Market Psychology and Emotion-Driven Dynamics

In this final lesson, we'll focus on psychological factors - how the emotions, cognitive biases, and collective mentality of market participants invisibly drive price fluctuations and distort judgment. Through this lesson, you'll better understand why markets often behave more irrationally than logical reasoning would suggest, and develop the ability to resist emotional traps.

Why is psychology so crucial in markets?

Markets are not just a pile of numbers and charts; behind them are thousands of “people” taking action, their emotions, fears, greed, anxiety, and hopes all influencing buying and selling decisions.

When most people’s emotions converge (e.g., panic or euphoria), it often leads to extreme price fluctuations far from fundamental values.

Even when technical indicators and fundamentals point in one direction, if market sentiment diverges, “false breakouts,” “reversals,” and “sharp drops” often occur.

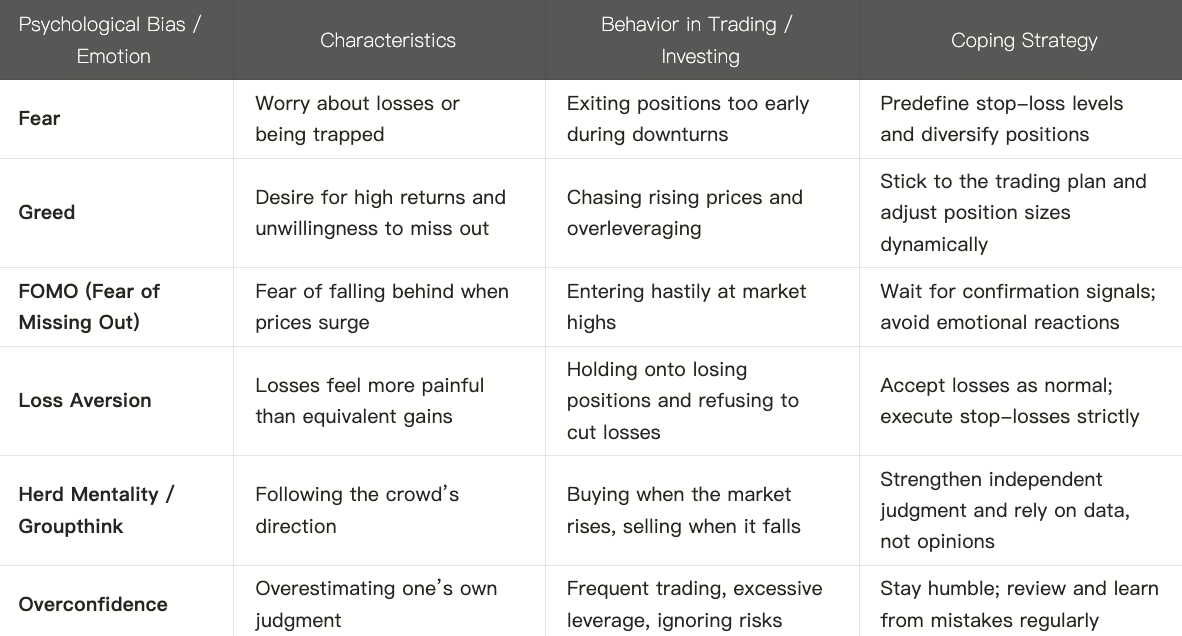

Common Psychological Biases and Emotional Traps

These psychological biases are very common in real trading, especially amplified in high volatile markets.

Market Psychology Stages: How Emotions Drive Cyclical Fluctuations

Market psychology often evolves emotionally with the cycle. It can be simplified into the following stages:

Hope / Optimism Phase

The market strengthens, more participants enter, and confidence gradually builds.Excitement / Greed Phase

Returns rise rapidly, many investors “chase the rally” to enter positions, and prices are pushed to excessive levels.Euphoria / Peak

Emotions run high, it’s widely believed this time is different, and the rally seems endless. Risk is extremely high at this point.Alertness / Anxiety

The rally slows down, doubts emerge, and volatility increases. Investors start looking to sell or take profits.Panic / Denial

The decline accelerates; fear spreads, and many investors “cut losses” or exit the market entirely.Despair / Capitulation

Most investors exit at a loss, and market confidence hits rock bottom.Pessimism / Confusion

Trading activity turns tepid, and the general public loses interest in or stops participating in the market.Recovery / Hope Rekindled

At low price levels, insightful or patient investors begin to build positions, and the market gradually rebounds.

This emotional cycle repeats in bull and bear markets. Understanding this process helps you stay alert at key levels and judge trend reversal timings accurately.

How Market Sentiment Affects Price Action

Price Extremes and Reversals: When most people are in extreme emotions (euphoria or panic), it’s often a sign of trend reversal.

Volume Anomalies: Emotional highs or lows often accompany volume spikes or rapid contractions.

Psychological Levels / Round Numbers Effect: Many traders set orders at round numbers (e.g., 1,000, 10,000); these “psychological levels” often become support or resistance zones.

News / Public Opinion Amplifier: When group emotions are fragile, a news item or tweet can trigger violent fluctuations.

False Breakouts and Shakeouts: Some traders or funds may intentionally guide prices to break certain levels, trigger stop losses, then pull back, forming a shakeout.

How to Control Psychological and Emotional Influences in Trading

Develop and strictly follow a trading/investment plan

Include clear rules for entry, exit, and stop-loss. This allows you to act on logic rather than emotion when pressure hits.Enter and exit positions in batches

Avoid all-in or all-out moves to reduce the impact of emotional impulses on your operations.Set stop-loss and take-profit mechanisms

mate these processes to minimize interference from subjective emotions.Regularly review trades and record your emotions

Document your psychological state, motivations, and any deviations from your plan for each trade. This helps improve self-awareness.Maintain rationality and patience

Avoid rushing for quick profits or acting on impulse; always aim to trade in a calm state of mind.Divert attention or pause trading

If you face consecutive losses or feel overexcited, step away from the market temporarily to cool down.Monitor macro information and sentiment indicators

Track metrics like market fear indexes, community sentiment scores, and public opinion trends as references for market psychology.

Markets are driven not only by supply, demand, and intrinsic value but also deeply influenced by participants’ emotions. Common psychological biases such as fear, greed, FOMO, and loss aversion often lead to poor trading decisions. Market sentiment fluctuates with cycles, manifesting in price behaviors like extreme volatility, false breakouts, and reactions to psychological levels. Therefore, investors need to design mechanisms and mental strategies to control emotional influences, ultimately improving the stability of their trading performance.