How to Apply Fundamental and Technical Analysis to Decision Making

In the first two lessons, we’ve covered the core differences between “trading vs. investing” and the unique methods/characteristics of “fundamental vs. technical analysis.” This lesson focuses on integrating these two approaches in real-world operations, teaching you to judge entry/exit timing from multiple angles and combine risk control techniques to boost decision accuracy and stability.

Why integrate the two types of analysis?

• Relying solely on fundamentals may fail to respond promptly to short-term market fluctuations.

• Relying solely on technicals may overlook an asset’s intrinsic value and fundamental risks.

• Integrated analysis complements strengths and offsets weaknesses, making decisions more comprehensive and evidence-based.

Thought Process and Steps for Integrated Analysis

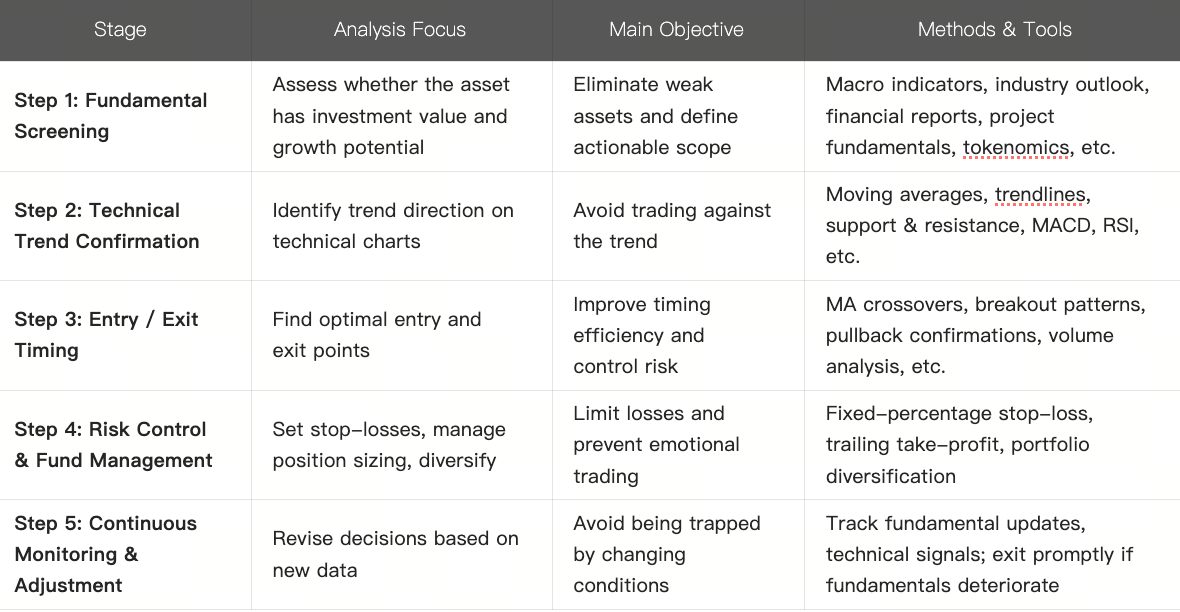

Below is a common, effective integration framework for reference:

Typical Integrated Strategy Examples

Example 1: Quality Asset + Trend Breakout Entry

• Fundamental Analysis: The asset holds a leading position in its industry with healthy financials/token economics.

• Technical Confirmation: Price breaks above a long-term resistance zone with expanded volume, and technical indicators show confirmation signals.

• Execution: Build a position near the breakout point, set a stop-loss below the support zone. Add positions in batches if the trend persists; exit promptly if reversal signals emerge.

Example 2: Technical Trend Direction as Primary + Fundamental Verification

• Technical Judgment: The market is in a clear uptrend, with prices making higher highs and a solid support line.

• Fundamental Assistance: After confirming the trend technically, assess whether the asset’s valuation is reasonable and identify potential risks from a fundamental perspective.

• Execution: Use technicals to guide entry direction; rely on fundamentals to determine position size or whether to add positions.

Example 3: Short-Term Trading in Sideways Markets + Fundamental Backing

• Use technical analysis for short-term swing trading when the market is range-bound with no clear trend.

• Only select assets with strong fundamentals and high project sustainability to avoid low-quality assets getting trapped in volatility.

• This strategy works well for selectively capitalizing on opportunities in choppy markets.

Special Considerations for Crypto Asset Integrated Analysis

Crypto markets have unique traits. Here are key points to prioritize:

- On-chain Metrics: Active addresses, transaction volume, Gas fees, and network fee revenue can reinforce fundamental analysis.

- Token Economics & Inflation: Issuance, burning, and lock-up mechanisms may impact long-term value.

- Community Activity & Developer Contributions: Is the project community consistently active? Is the code repository updated frequently?

- Market Sentiment & News: Crypto markets are sensitive to information; news, regulatory policies, and institutional movements may cause strong short-term fluctuations.

- False Breakout Risks: Low-liquidity assets are prone to manipulation; technical breakout signals may be false and require confirmation via fundamentals and volume.

How to Evaluate Integrated Strategy Effectiveness?

• Win Rate & Risk-Reward Ratio: Focus not just on the number of successful trades, but whether profits from wins cover losses from failures.

• Drawdowns: Even profitable strategies can lead to psychological and financial strain if drawdowns are excessive.

• Strategy Stability: Does it perform consistently across different market environments (bull, sideways, bear)?

• Transaction Cost & Slippage Control: In crypto markets, fees, slippage, and execution efficiency can erode profits significantly.

Through phased processes and strategy examples, we’ve explored how to integrate fundamental and technical analysis into practice. You’ll now be able to apply both methods to real trading/investment decisions while using risk control to enhance stability.