Fundamental Concepts and Differences Between Trading and Investing

Welcome to the first lesson of this course series. In this lesson, we'll break down what trading and investing truly mean, and help you grasp their core differences in goals, time frames, strategies, and risk profiles. By the end of this lesson, you'll be able to determine if you're better suited for short-term trading or long-term holding — and lay a clear foundation for your future investment and financial planning journey.

⚠️ Educational Disclaimer: This course is for educational purposes only and does not constitute investment advice. Always conduct your own research before making financial decisions.

What is “Investing”?

• Goal-oriented: Focuses on long-term asset growth and returns, including not just capital gains from price appreciation, but also passive income like dividends, interest, or rent.

• Long time horizon: Investors typically hold assets for months, years, or even longer, leveraging time to pursue growth and compound returns.

• Risk & return: Emphasizes “risk diversification” and “patient holding,” aiming to offset short-term volatility with long-term gains.

• Analysis method: Relies primarily on fundamental analysis, such as company financial reports, industry trends, and economic conditions.

What is “Trading”?

• The goal is to capture opportunities: Traders focus more on short-term price fluctuations, seeking to profit by buying high and selling low or buying low and selling high.

• Short time horizon: Positions may be held for minutes, hours, days, or weeks.

• High risk tolerance: Accepts frequent market volatility, often using leverage or short-term strategies to boost profit potential.

• Analysis method: Relies primarily on technical analysis, such as company financial reports, industry trends, and economic conditions.

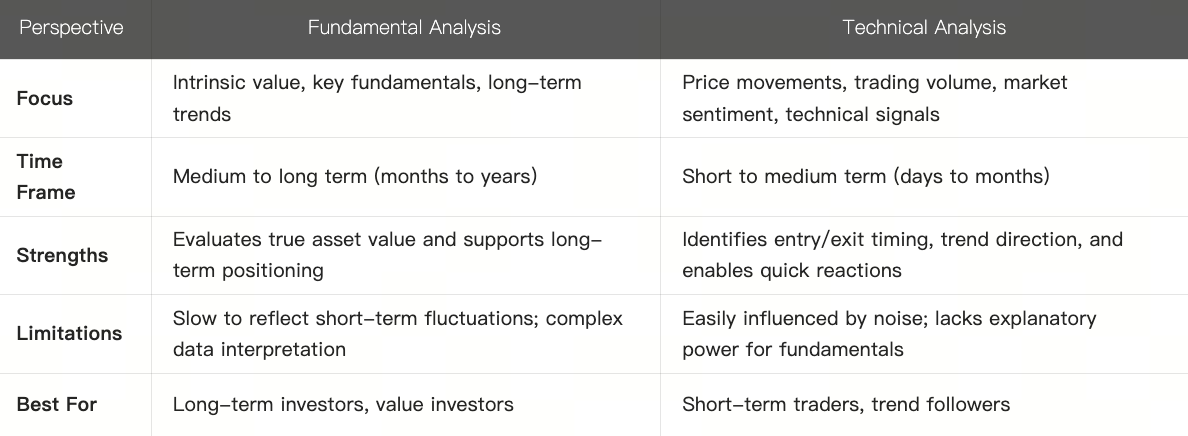

Main Differences between Trading and Investing

How They Coexist and Complement Each Other

Trading and investing are not mutually exclusive; they can be combined to create a more flexible asset strategy:

• Some investors engage in short-term trading alongside long-term holdings to enhance returns or hedge risks.

• Traders may allocate part of their funds to long-term positions to stabilize overall asset volatility.

• For fund management, separate “investment funds” from “trading funds” and implement distinct risk control strategies for each.

Why Understand These Concepts First?

• For beginners, lacking clear goals and style can lead to being swayed by market trends.

• Clarifying your direction helps you choose appropriate tools and strategies, and control risks effectively.

• Understanding the basic logic of trading and investing makes subsequent learning (e.g., risk management, psychological discipline, asset allocation) more meaningful.

Investing prioritizes long-term value and compound growth; trading focuses on short-term fluctuations and market opportunities. Neither is superior to the other; the key is whether it aligns with your personality and goals.