Market Analysis Tools — Fundamental vs Technical Analysis

In the second lesson of this series, we'll dive into two core market analysis methods: fundamental analysis and technical analysis. You'll learn their definitions, key elements, respective strengths and weaknesses, and how to combine them for more comprehensive investment/trading judgments. This lesson will lay a solid foundation for future strategy design and practical operations.

What is Fundamental Analysis?

Fundamental Analysis evaluates an asset’s or company’s true value or long-term potential by examining “intrinsic value factors”, such as the macroeconomic environment, industry trends, and corporate financial statements.

Key elements of fundamental analysis include:

Macroeconomic indicators

- GDP growth rate, inflation rate, unemployment rate, interest rates

- Government policies, monetary policies (e.g., interest rate adjustments, quantitative easing)

Industry prospects and competitive landscape

- Supply-demand dynamics, technological trends, and the threat of new entrants within the industry

- Market growth potential, entry barriers, and competitive moats

Corporate financial health

- Income statement (revenue, net profit, gross margin, etc.)

- Balance sheet (assets, liabilities, net assets, etc.)

- Cash flow statement (operating cash flow, free cash flow)

Management and business strategy

- Experience and integrity of the leadership team

- Company strategy, operational efficiency, and innovation capability

The goal of fundamental analysis is to determine if an asset is undervalued or overvalued by the market, and predict its medium-to-long-term value appreciation potential.

What is Technical Analysis?

Technical Analysis focuses on “historical behavior” data such as market prices, trading volume, chart patterns, and technical indicators to identify price trends, buy/sell signals, and market sentiment.

Main tools and methods of technical analysis include:

- Price trend charts and candlestick charts

- Candlesticks: body, upper shadow, lower shadow

- Moving averages: short-term/medium-term/long-term moving averages

- Trends and support/resistance

- Trend lines, channels, and Fibonacci retracement lines

- Support and resistance lines as important references for buying/selling

- Technical indicators

- Relative Strength Index (RSI), Stochastic Oscillator

- MACD, Bollinger Bands, volume indicators

- Pattern recognition and pattern signals

- Classic patterns: head and shoulders top/bottom, double top/bottom, triangles, flags, etc.

- Reversal or continuation patterns to identify trend direction

The advantage of technical analysis is its ability to respond quickly to price changes, making it ideal for short-to-medium-term traders seeking opportunities.

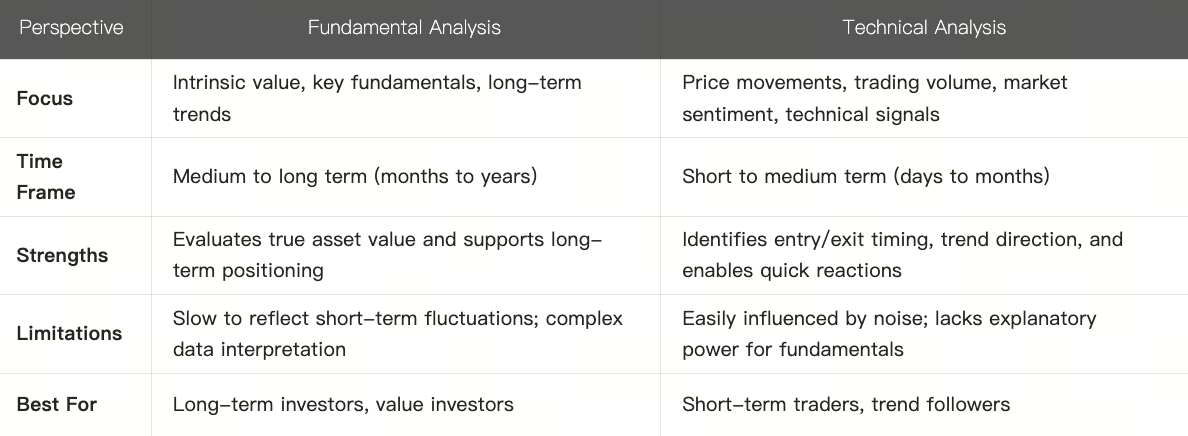

Fundamental vs. Technical: Comparison and Limitations

Relying solely on fundamentals may cause you to miss short-term opportunities; relying purely on technicals may lead you to overlook an asset’s inherent risks.

How to Combine the Two Approaches?

For more comprehensive, robust market decisions, adopt a “hybrid analysis” approach that integrates the strengths of both methods. Below are common integration strategies:

Use fundamentals for underlying judgment + technicals for timing entry points

First, use fundamentals to assess valuation and long-term trends. If the asset shows potential, use technical indicators to pinpoint exact entry/exit points.Trend confirmation + Valuation safety margin

After identifying a trend with technicals, verify the asset’s valuation safety margin through fundamental analysis.Staged position strategy

Enter and exit positions in batches: Establish long-term positions for fundamentally sound assets; add or reduce positions when technical trends emerge.Hedging and risk control

Allocate core assets based on fundamentals, while using technical tools to hedge or trade short-term volatile portions.

Practical Demonstration (Case Study)

Suppose we observe the following scenario in a stock/crypto asset:

- Fundamental analysis: The company has a 3-year revenue CAGR of 18%, with a stable net profit margin around 15%; a debt-to-asset ratio below 40%, healthy cash flow. The industry is expected to grow at an average rate of 10% over the next two years.

- Technical trends: Price has formed an ascending triangle pattern over the past three months, breaking out with increased volume above a long-term resistance level (e.g., $50). Trading volume increased 2.5 times compared to the previous week’s average; RSI rose from 45 to 65, entering an upward channel but not yet overbought.

In this scenario, the asset may be entering a new uptrend. Here’s a plan:

- Buy on dips near the breakout point ($49 - $50 range), setting a stop-loss about 5% below the previous support level ($47.5);

- If the price stabilizes above $50 with sustained volume, add to the position in batches every 5% - 8% price increase;

- When technical indicators show divergence (e.g., RSI making lower highs while price makes higher highs) or MACD shows a death cross, gradually reduce positions, selling in stages (25% each time).

This case shows how combining fundamental data (growth rates, debt ratios) with technical indicators (volume, RSI, support/resistance) creates a quantifiable trading decision system in practice.

Fundamental analysis focuses on an asset’s intrinsic value and future trends; technical analysis captures price movements and entry/exit signals. Using them together enhances judgment accuracy and risk control capabilities.