Tiezhu

No content yet

Tiezhu

Claude Opus4.6 is incredibly powerful, truly outstanding.

The chart below shows the metrics analysis over the past few months that I provided via link, which it automatically analyzed for me, and it even provided its own key insights.

View OriginalThe chart below shows the metrics analysis over the past few months that I provided via link, which it automatically analyzed for me, and it even provided its own key insights.

- Reward

- like

- Comment

- Repost

- Share

Just reviewed the ETFs with over 20% YTD performance this year, which are quite informative and basically show what the market is buying.

1. Alternative Energy

NLR VanEck Uranium and Nuclear ETF - Nuclear Energy

FAN First Trust Global Wind Energy ETF - Wind Power

2. Energy Sector

Most perform well, but two stand out significantly

PXJ Invesco Oil & Gas Services ETF - Oil & Gas Services

URA Global X Uranium ETF - Uranium

3. Industrial Infrastructure

Mostly positive returns, but one is far ahead

SEA US Global Sea to Sky Cargo ETF - Global Sea and Air Cargo. The largest holding here is COSCO

1. Alternative Energy

NLR VanEck Uranium and Nuclear ETF - Nuclear Energy

FAN First Trust Global Wind Energy ETF - Wind Power

2. Energy Sector

Most perform well, but two stand out significantly

PXJ Invesco Oil & Gas Services ETF - Oil & Gas Services

URA Global X Uranium ETF - Uranium

3. Industrial Infrastructure

Mostly positive returns, but one is far ahead

SEA US Global Sea to Sky Cargo ETF - Global Sea and Air Cargo. The largest holding here is COSCO

BTC-6,6%

- Reward

- like

- Comment

- Repost

- Share

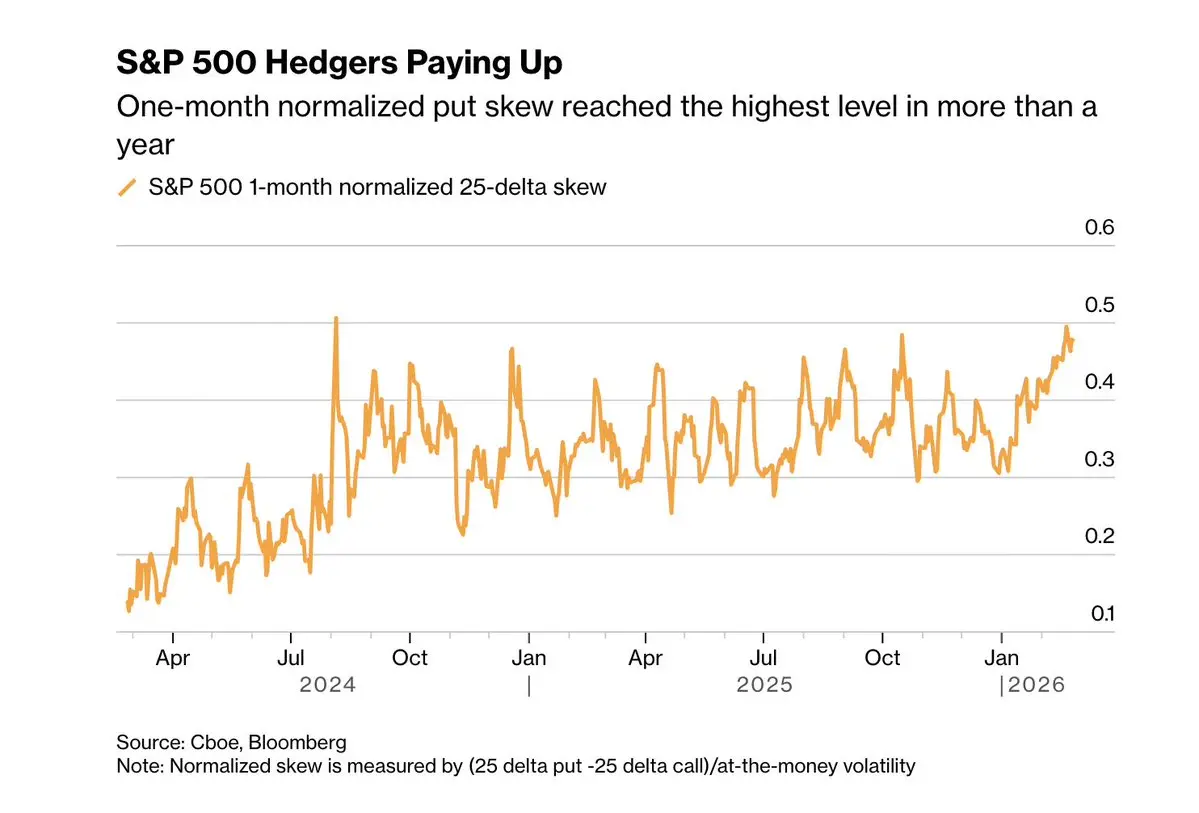

The chart is from Bloomberg. In simple terms, market participants are offering higher premiums for downside protection. The peak in July 2024 corresponds to the closing of yen arbitrage trades.

View Original

- Reward

- like

- Comment

- Repost

- Share

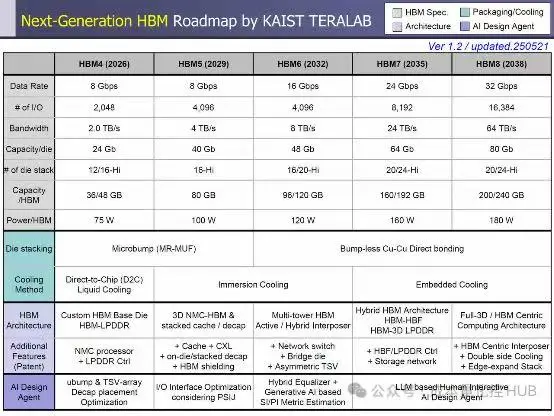

Semiconductors are the coolest kids on the block. Koreans are aggressively pushing the market.

By the time all of SK Hynix and Samsung's production capacities are built, it will still be possible to consider retreating. But that will be after 1.5 years.

Current bottlenecks: TSMC's CoWoS advanced packaging capacity, and the capacities of several memory suppliers.

Especially after the advent of HBM4, the Base Die will all rely on TSMC.

View OriginalBy the time all of SK Hynix and Samsung's production capacities are built, it will still be possible to consider retreating. But that will be after 1.5 years.

Current bottlenecks: TSMC's CoWoS advanced packaging capacity, and the capacities of several memory suppliers.

Especially after the advent of HBM4, the Base Die will all rely on TSMC.

- Reward

- 1

- Comment

- Repost

- Share

Google's century bond is surprising, with a few points:

1. Oversubscribed by more than 5 times, originally aiming for $15 billion, but ultimately raising $20 billion, with many long-term investors like pension and sovereign funds participating.

2. The three-year tranche was the strongest, with only a 0.27 percentage point premium over government bonds.

It seems that the entire AI CapEx will be a major infrastructure-driven boom unique to the U.S.. I believe this will have some crowding-out effects on other markets. In the future, if yields from similar DeFi or staking products are lower than G

View Original1. Oversubscribed by more than 5 times, originally aiming for $15 billion, but ultimately raising $20 billion, with many long-term investors like pension and sovereign funds participating.

2. The three-year tranche was the strongest, with only a 0.27 percentage point premium over government bonds.

It seems that the entire AI CapEx will be a major infrastructure-driven boom unique to the U.S.. I believe this will have some crowding-out effects on other markets. In the future, if yields from similar DeFi or staking products are lower than G

- Reward

- like

- Comment

- Repost

- Share

This article from Bloomberg has sparked widespread discussion in the English-speaking community, especially regarding where the Federal Reserve and the Treasury Department's agreement will ultimately land. What exactly is the market worried about? Here are my thoughts:

1. The core idea of the article is that Waller hopes to reform the relationship between the two agencies through a new version of the Fed-Treasury agreement, essentially reshaping the 1951 agreement. The 1951 agreement's core is that it established the Fed's independence by preventing it from restricting yields to lower governme

View Original1. The core idea of the article is that Waller hopes to reform the relationship between the two agencies through a new version of the Fed-Treasury agreement, essentially reshaping the 1951 agreement. The 1951 agreement's core is that it established the Fed's independence by preventing it from restricting yields to lower governme

- Reward

- like

- Comment

- Repost

- Share

I looked at the eight ministries' document, but there is one document that everyone has overlooked. The CSRC issued the "Regulatory Guidelines on the Offshore Issuance of Asset-Backed Securities Tokenized on Domestic Assets." This guideline has several significant implications: 1. No matter how difficult regulation may be, RWA at least opens a door. 2. It basically means that traditional ABS-type products similar to those domestically can try to develop RWA. For example, accounts receivable between enterprises, financial leasing, REIT-like products (such as highway toll rights), and photovolta

View Original- Reward

- like

- Comment

- Repost

- Share

I have an absurd hypothesis: the market downturn is all because of Epstein. Anyway, only bombs and crashes can divert people's attention from Epstein scandals. Top-tier PR.

View Original- Reward

- like

- Comment

- Repost

- Share

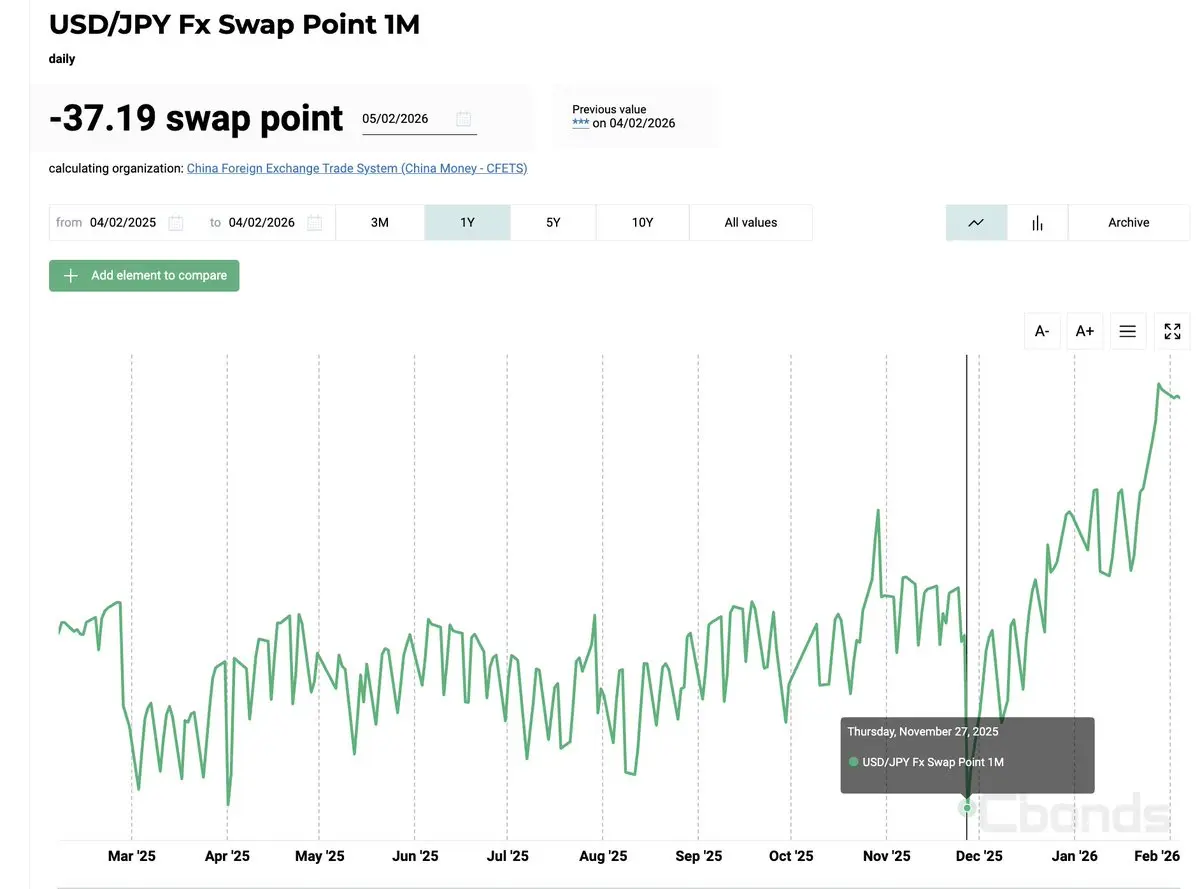

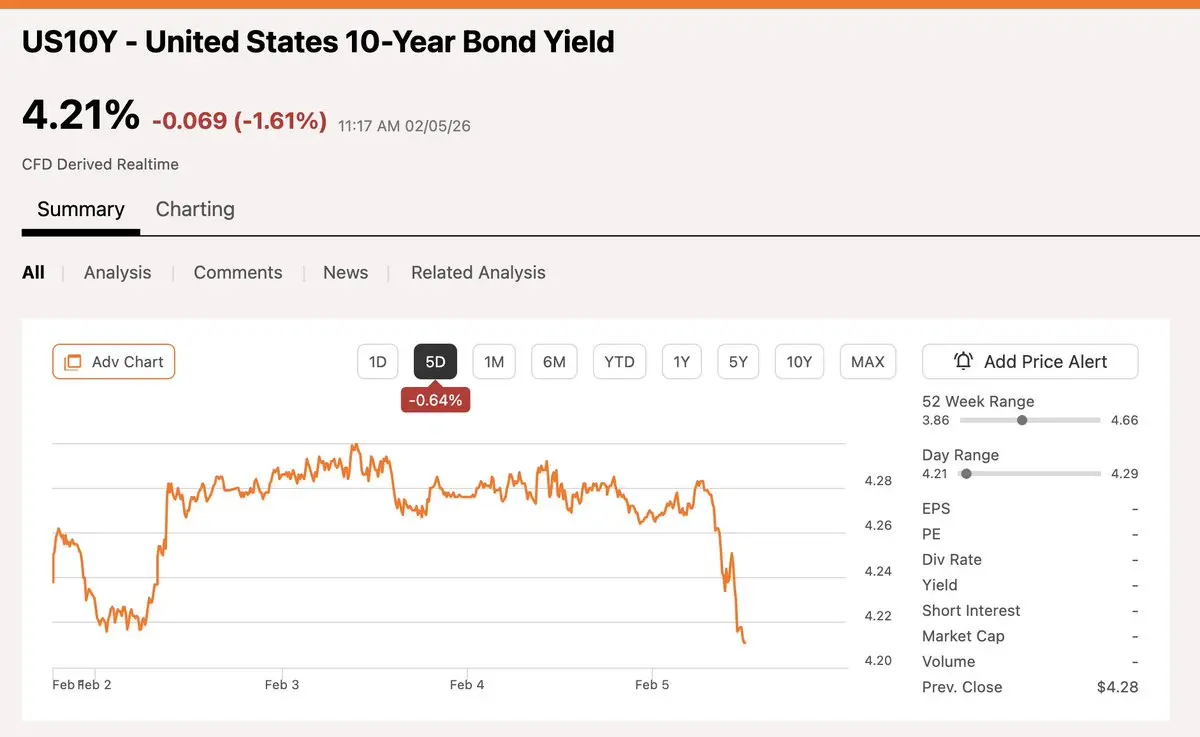

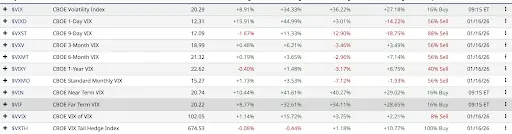

A few days ago, it was indicated that the risk clearance has not ended. The following four charts can explain this. 1. USD/JPY swap points have skyrocketed since December 27. 2. Capital has flooded into the bond market. 3. The VIX structure is also pricing forward uncertainty.

View Original

- Reward

- like

- Comment

- Repost

- Share

The following two charts basically reflect why the sharp decline in gold and silver occurred. Additionally, although gold and silver plunged, the CME's new margin requirements will still be adjusted after February 2nd. Especially since the margin requirements are based on the nominal value. In other words, this crash will cause the actual margin ratio to far exceed the current level. Put simply, it’s roughly equivalent to saying: those without sufficient capital should not play in the commodity markets. The consensus of crowded trades combined with changes in leverage margin requirements means

View Original

- Reward

- like

- Comment

- Repost

- Share

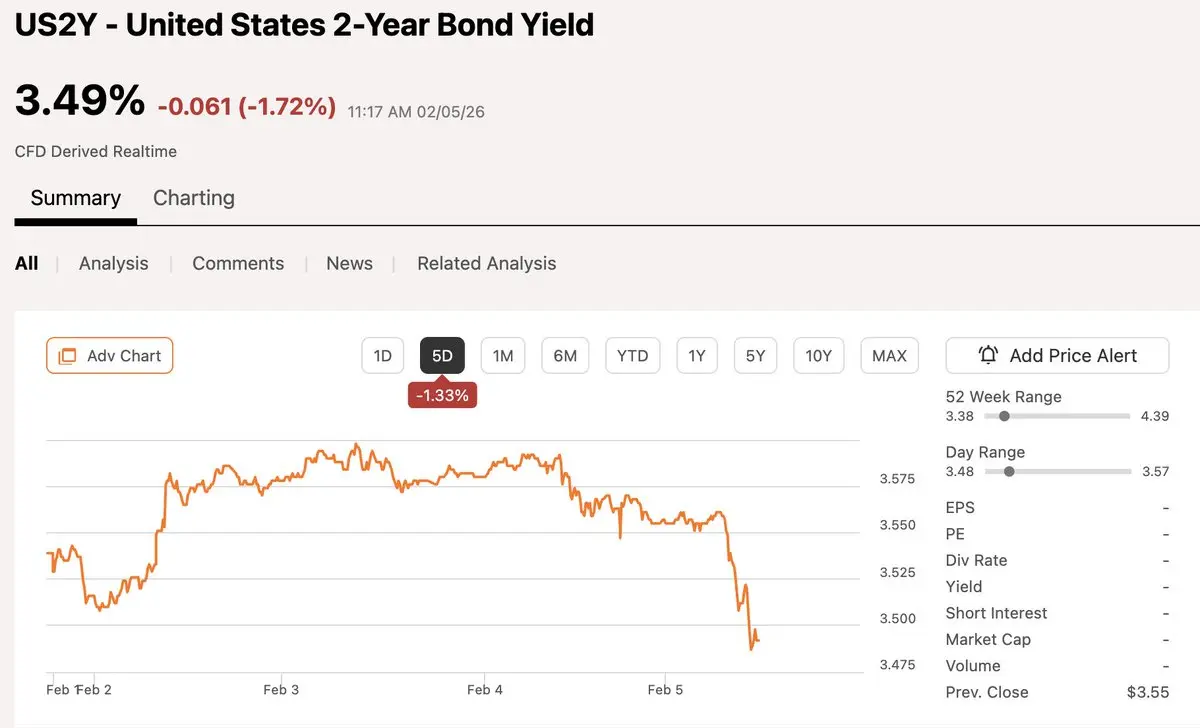

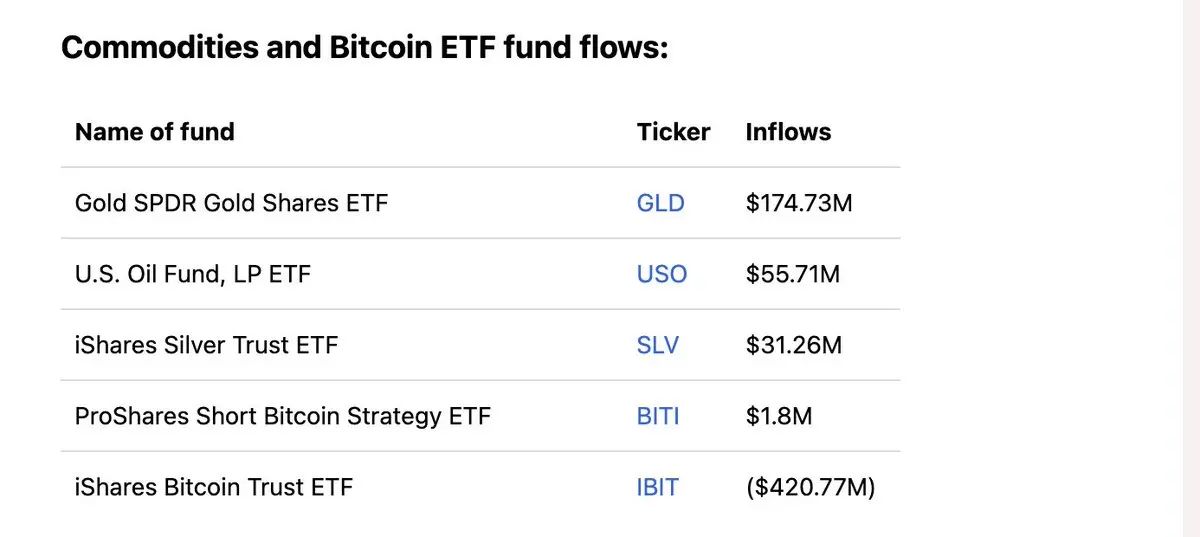

Last week ETF data: Gold net inflow of $174 million, oil net inflow of $55 million, silver net inflow of $31 million, Bitcoin short ETF net inflow of $1.8 million, Bitcoin ETF net outflow of $420 million.

View Original

- Reward

- like

- Comment

- Repost

- Share

ARK can be considered the fund with the highest risk appetite. It can be compared with the Nasdaq and S&P 500 to observe how the market's funds are currently viewing the situation.

View Original

- Reward

- like

- Comment

- Repost

- Share

What's going on? Are they now starting to promote the Mac Mini? The information gap between the English and Chinese communities is indeed quite significant.

View Original- Reward

- like

- Comment

- Repost

- Share

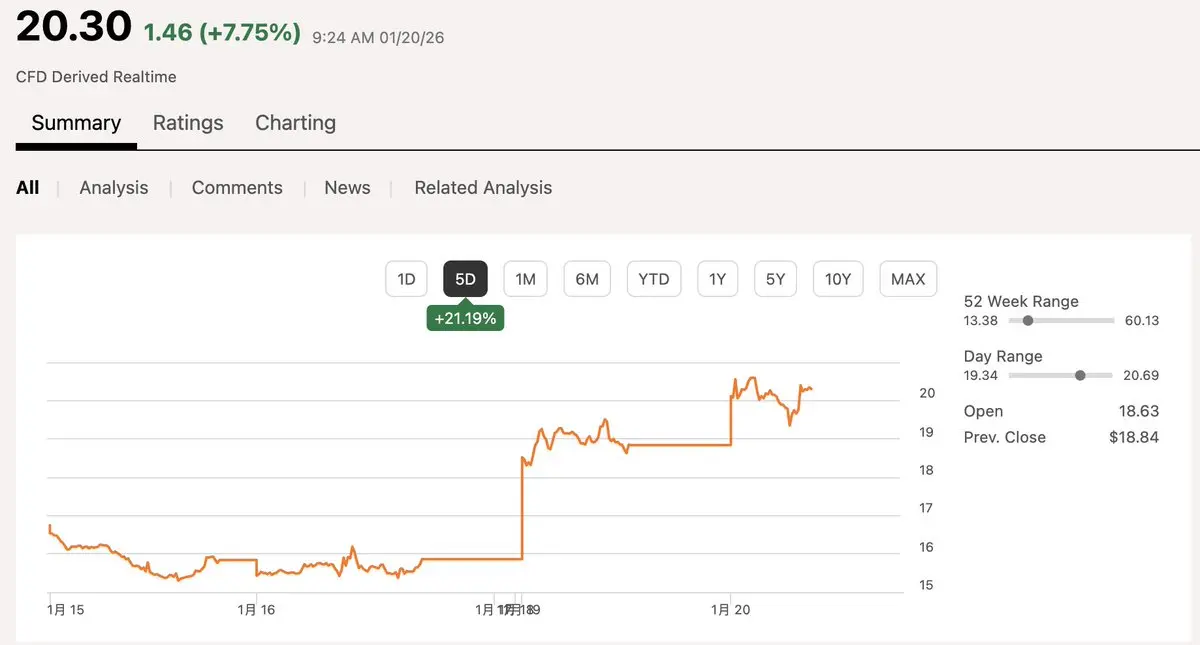

VIX has once again broken above 20. The market has clearly entered a short-term risk-averse mode rather than a long-term uncertain rally.

It will come back.

View OriginalIt will come back.

- Reward

- like

- Comment

- Repost

- Share

Google will be very impressive; the earnings report will be announced in early February.

Previously, Gemini2.5 was profitable (excluding basic model development), so 3 should also be positive. These are under the assumption of not considering the partnership with Apple.

View OriginalPreviously, Gemini2.5 was profitable (excluding basic model development), so 3 should also be positive. These are under the assumption of not considering the partnership with Apple.

- Reward

- like

- Comment

- Repost

- Share

I don't necessarily think it's Europe's retaliatory tariffs. The main reason might still be the overall market expectations of rate cuts and concerns about increasing uncertainty.

1. The US Treasury yield curve has become steeper. The primary reason is that dovish Harker has explicitly not participated in the Federal Reserve Chair race, increasing the probability of hawkish Waller. Another piece of news is that the Treasury Department plans to reopen the 7-year Treasury auction. The concern in the bond market is that this could be a signal that the Treasury Department may increase long-term de

View Original1. The US Treasury yield curve has become steeper. The primary reason is that dovish Harker has explicitly not participated in the Federal Reserve Chair race, increasing the probability of hawkish Waller. Another piece of news is that the Treasury Department plans to reopen the 7-year Treasury auction. The concern in the bond market is that this could be a signal that the Treasury Department may increase long-term de

- Reward

- like

- Comment

- Repost

- Share

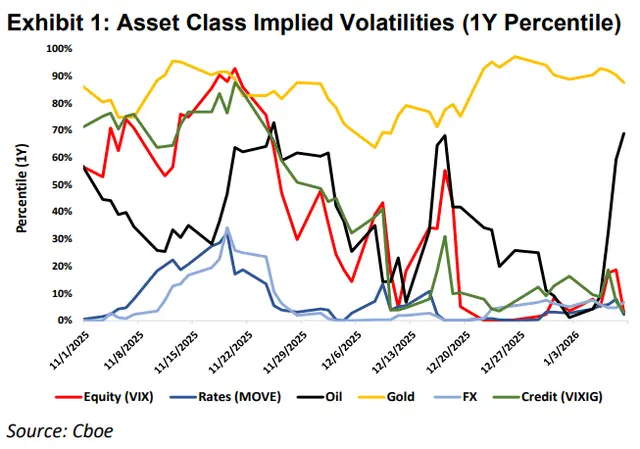

An article published today by CBOE. About volatility. Here's a summary:

1. From a cross-asset perspective, most are at lows, with crude oil volatility rising significantly and being extremely bullish.

2. The VIX index measuring stocks, despite its low reading, has undergone structural changes, with more puts being bought, and defensive positions still trending upward. The gap between index volatility and individual stock volatility exceeds the 90% percentile. In other words, as earnings season approaches, the market remains more focused on fundamentals rather than macro factors.

3. Despite Tru

View Original1. From a cross-asset perspective, most are at lows, with crude oil volatility rising significantly and being extremely bullish.

2. The VIX index measuring stocks, despite its low reading, has undergone structural changes, with more puts being bought, and defensive positions still trending upward. The gap between index volatility and individual stock volatility exceeds the 90% percentile. In other words, as earnings season approaches, the market remains more focused on fundamentals rather than macro factors.

3. Despite Tru

- Reward

- like

- Comment

- Repost

- Share

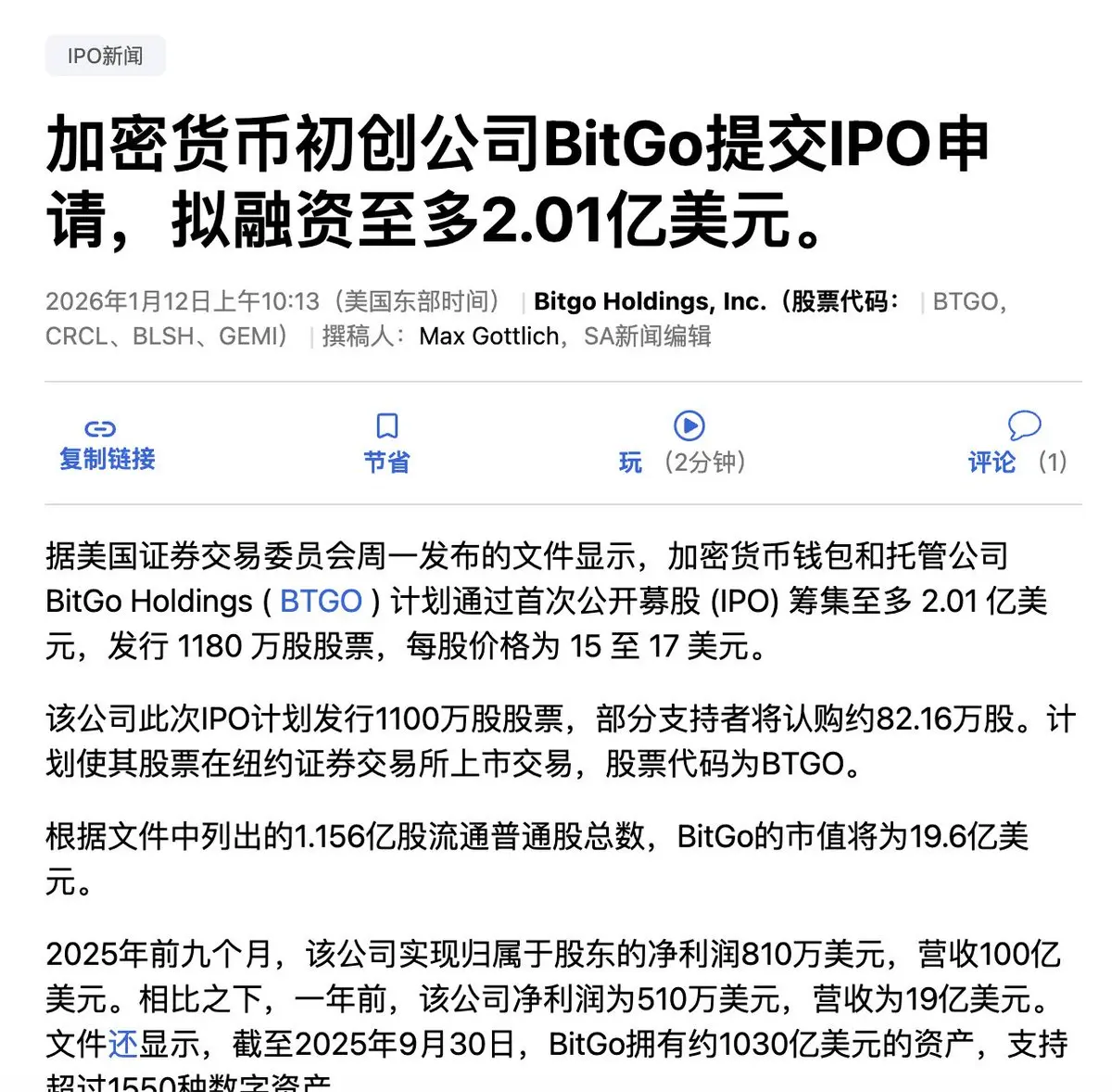

Is this the year of a big crypto IPO boom?

View Original

- Reward

- like

- Comment

- Repost

- Share

CPI is about to be announced, but overall, the impact is not significant. The main focus is on changes in food and housing.

View Original- Reward

- like

- Comment

- Repost

- Share

It looks like this year, the US stock market and real estate are probably going to see a surge.

View Original- Reward

- like

- Comment

- Repost

- Share