# ETHEREUM

610.09K

Mosfick

Bitcoin is knocking on $70K's door and I'm not going to lie, this feels good. 👀

After weeks of bleeding below $63K with all that tariff drama and risk-off panic, BTC just posted an 8.5% intraday gain, its biggest single-session move since early February, climbing to $69,500. The $70K level is right there and the market can smell it.

And it's not just Bitcoin either. ETH is up around 12% to $2,085, SOL gained 13%, and DOGE plus XRP are both flashing strong double-digit gains. This is a broad relief rally, not just one coin having a moment.

What's driving it? Honestly, a mix of things. Short sq

After weeks of bleeding below $63K with all that tariff drama and risk-off panic, BTC just posted an 8.5% intraday gain, its biggest single-session move since early February, climbing to $69,500. The $70K level is right there and the market can smell it.

And it's not just Bitcoin either. ETH is up around 12% to $2,085, SOL gained 13%, and DOGE plus XRP are both flashing strong double-digit gains. This is a broad relief rally, not just one coin having a moment.

What's driving it? Honestly, a mix of things. Short sq

- Reward

- 4

- 1

- Repost

- Share

Discovery :

:

To The Moon 🌕$ETH

Bullish Reversal

Strong recovery from the 1,800 local bottom → impulsive 11.98% surge reclaiming major resistance → price currently consolidating near 2,068 after testing a daily high of 2,086.

Momentum has flipped bullish on the 4H timeframe with significant volume expansion.

Long Setup

2,020 – 2,045

Targets:

2,125

2,240

2,350

Stop loss:

1,940

Healthy breakout structure → looking for a successful retest of the psychological 2,000 zone before targeting higher liquidity levels.

#ETH #Ethereum #Crypto

Bullish Reversal

Strong recovery from the 1,800 local bottom → impulsive 11.98% surge reclaiming major resistance → price currently consolidating near 2,068 after testing a daily high of 2,086.

Momentum has flipped bullish on the 4H timeframe with significant volume expansion.

Long Setup

2,020 – 2,045

Targets:

2,125

2,240

2,350

Stop loss:

1,940

Healthy breakout structure → looking for a successful retest of the psychological 2,000 zone before targeting higher liquidity levels.

#ETH #Ethereum #Crypto

ETH11,99%

- Reward

- 2

- Comment

- Repost

- Share

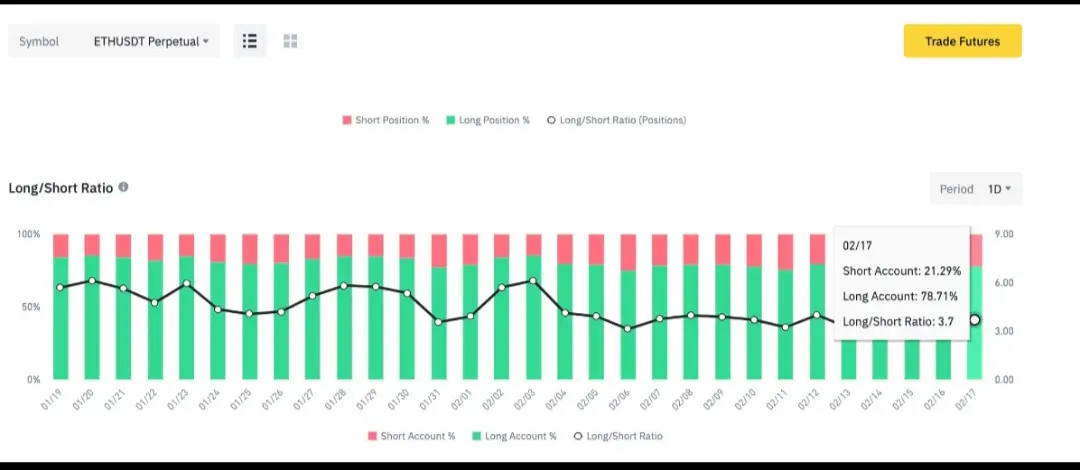

#ETH多空对决 ⚔️📊

Ethereum (ETH) is stepping into a decisive phase where bulls and bears are locked in a high-stakes battle. At the current price zone, we’re seeing repeated tests of critical support and resistance — a clear sign that conviction on both sides is strong.

From a technical standpoint, volatility compression within key levels often precedes expansion. Trading volume fluctuations and shifting funding rates show that sentiment remains deeply divided.

🟢 Bulls are leaning on ecosystem growth, network upgrades, ETF flows, and long-term capital accumulation.

🔴 Bears are focused on macro u

Ethereum (ETH) is stepping into a decisive phase where bulls and bears are locked in a high-stakes battle. At the current price zone, we’re seeing repeated tests of critical support and resistance — a clear sign that conviction on both sides is strong.

From a technical standpoint, volatility compression within key levels often precedes expansion. Trading volume fluctuations and shifting funding rates show that sentiment remains deeply divided.

🟢 Bulls are leaning on ecosystem growth, network upgrades, ETF flows, and long-term capital accumulation.

🔴 Bears are focused on macro u

ETH11,99%

- Reward

- 4

- 4

- Repost

- Share

ybaser :

:

thanks for shairing the true crypto market insightView More

🔵 Ethereum Foundation Begins Staking Part Of Ether Treasury Amid Buterin’s ETH Selloff

The Ethereum Foundation has started staking part of its ether holdings. On Feb.24, the nonprofit announced an initial deposit of 2,016 ETH (worth around $3.8 million). Over time, the Foundation plans to stake approximately 70,000 ETH — valued at roughly $127 million — through solo staking. The resulting native ETH rewards will be funneled to the organization’s treasury to support upcoming initiatives.

“By participating directly in consensus through solo staking, the Ethereum Foundation generates native, ETH

The Ethereum Foundation has started staking part of its ether holdings. On Feb.24, the nonprofit announced an initial deposit of 2,016 ETH (worth around $3.8 million). Over time, the Foundation plans to stake approximately 70,000 ETH — valued at roughly $127 million — through solo staking. The resulting native ETH rewards will be funneled to the organization’s treasury to support upcoming initiatives.

“By participating directly in consensus through solo staking, the Ethereum Foundation generates native, ETH

ETH11,99%

- Reward

- 2

- Comment

- Repost

- Share

#ETH多空对决

⚔️ ETH Battle Update – Bulls Push Back Above $1.9K

February 25, 2026 — and the momentum just shifted. Ethereum is trading around $1,917, up roughly 4–5% on the day, and short pressure is starting to unwind.

📊 What Just Happened?

🩸 Short Liquidations:

Over $120M in short positions cleared in just a few hours. When positioning gets crowded on one side, the market usually punishes it fast.

🏛️ Foundation Signal:

The Ethereum Foundation allocating 70,000 ETH to staking is not a sell signal — it’s a long-term alignment signal. That reduces circulating supply pressure rather than increasi

⚔️ ETH Battle Update – Bulls Push Back Above $1.9K

February 25, 2026 — and the momentum just shifted. Ethereum is trading around $1,917, up roughly 4–5% on the day, and short pressure is starting to unwind.

📊 What Just Happened?

🩸 Short Liquidations:

Over $120M in short positions cleared in just a few hours. When positioning gets crowded on one side, the market usually punishes it fast.

🏛️ Foundation Signal:

The Ethereum Foundation allocating 70,000 ETH to staking is not a sell signal — it’s a long-term alignment signal. That reduces circulating supply pressure rather than increasi

ETH11,99%

- Reward

- 13

- 19

- Repost

- Share

ybaser :

:

To The Moon 🌕View More

ETH多空博弈进入关键时刻 ⚖️📉📈

Right now, Ethereum (ETH) is trading in a zone that feels less like a trend and more like a battlefield. Price is hovering around critical levels where neither bulls nor bears are willing to step back — and that tension is visible in every candle.

Instead of a clean breakout, we’re seeing hesitation. Volume spikes fade quickly. Breakouts struggle to follow through. Funding rates fluctuate. This tells us one thing: the market is uncertain — and divided.

What’s Driving Both Sides?

🟢 Bullish case:

Continued ecosystem development and network strength

Institutional interest an

Right now, Ethereum (ETH) is trading in a zone that feels less like a trend and more like a battlefield. Price is hovering around critical levels where neither bulls nor bears are willing to step back — and that tension is visible in every candle.

Instead of a clean breakout, we’re seeing hesitation. Volume spikes fade quickly. Breakouts struggle to follow through. Funding rates fluctuate. This tells us one thing: the market is uncertain — and divided.

What’s Driving Both Sides?

🟢 Bullish case:

Continued ecosystem development and network strength

Institutional interest an

ETH11,99%

- Reward

- 2

- 3

- Repost

- Share

NovaCryptoGirl :

:

LFG 🔥View More

🛑 HOW TO AVOID SCAMS IN CRYPTO 🛑

🔐 Never share your Private Key / Seed Phrase

🌐 Use only official websites

💰 Avoid “Guaranteed Profit” schemes

📊 Research before investing

🛡️ Use hardware wallet for big funds

🪙 Stick with Strong Projects:

$BTC | $ETH | $SOL

Even with trusted coins, beware of:

⚠️ Fake giveaways

⚠️ Phishing links

⚠️ DM investment offers

✅ If it sounds too good to be true…

It’s probably a scam.

#Crypto #Bitcoin #Ethereum #Solana #CryptoSafety

🔐 Never share your Private Key / Seed Phrase

🌐 Use only official websites

💰 Avoid “Guaranteed Profit” schemes

📊 Research before investing

🛡️ Use hardware wallet for big funds

🪙 Stick with Strong Projects:

$BTC | $ETH | $SOL

Even with trusted coins, beware of:

⚠️ Fake giveaways

⚠️ Phishing links

⚠️ DM investment offers

✅ If it sounds too good to be true…

It’s probably a scam.

#Crypto #Bitcoin #Ethereum #Solana #CryptoSafety

- Reward

- like

- Comment

- Repost

- Share

#ETHLongShortBattle

🚨 #ETHLongShortBattle – Who’s Winning the War? ⚔️

📊 Market Structure

Price is reacting near a key support/resistance flip zone.

Lower timeframes show volatility expansion.

Higher timeframe trend remains cautiously bullish unless major support breaks.

📈 Long Positions (Bulls)

Buyers are defending strong support levels.

RSI holding above midline suggests underlying strength.

Any breakout above immediate resistance could trigger short liquidation.

📉 Short Positions (Bears)

Sellers are active near resistance zones.

Volume spikes on red candles show distribution attempts.

I

🚨 #ETHLongShortBattle – Who’s Winning the War? ⚔️

📊 Market Structure

Price is reacting near a key support/resistance flip zone.

Lower timeframes show volatility expansion.

Higher timeframe trend remains cautiously bullish unless major support breaks.

📈 Long Positions (Bulls)

Buyers are defending strong support levels.

RSI holding above midline suggests underlying strength.

Any breakout above immediate resistance could trigger short liquidation.

📉 Short Positions (Bears)

Sellers are active near resistance zones.

Volume spikes on red candles show distribution attempts.

I

ETH11,99%

- Reward

- 4

- 1

- Repost

- Share

ybaser :

:

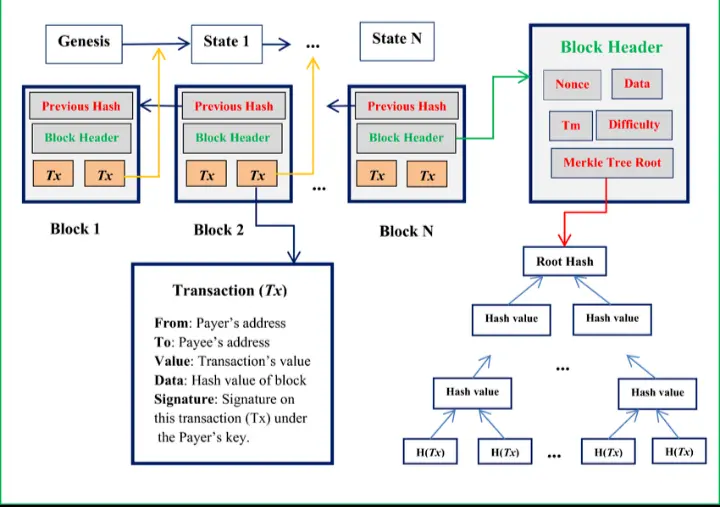

To The Moon 🌕$ETH is not just a cryptocurrency — it’s a complete blockchain ecosystem where the future of finance, gaming, NFTs, and Web3 is being built.

✨ Why is Ethereum so powerful?

🔹 Smart contract technology – automated and secure transactions

🔹 The foundation of DeFi platforms

🔹 The leading network for NFT marketplaces

🔹 Ethereum 2.0 upgrade – lower gas fees and greater scalability

Thousands of developers around the world work on the Ethereum network every day — and that is its greatest strength.

#Ethereum #Crypto #Web3 #FutureFinance

✨ Why is Ethereum so powerful?

🔹 Smart contract technology – automated and secure transactions

🔹 The foundation of DeFi platforms

🔹 The leading network for NFT marketplaces

🔹 Ethereum 2.0 upgrade – lower gas fees and greater scalability

Thousands of developers around the world work on the Ethereum network every day — and that is its greatest strength.

#Ethereum #Crypto #Web3 #FutureFinance

ETH11,99%

- Reward

- like

- Comment

- Repost

- Share

The $ETH setup is asymmetric right now.

• $2,000 is clearly a liquidity magnet. With $2B+ in shorts stacked there, a squeeze is structurally possible — but only if spot demand absorbs supply first. Without real bid strength, that level becomes resistance, not fuel.

• Whale distribution vs accumulation wallets adding 2.5M ETH tells me this isn’t consensus — it’s positioning divergence. Near $1,800, I lean cautiously constructive, but only if structure holds.

• $1,600 is the real invalidation. Lose that and liquidation cascades accelerate.

TP: Into liquidity above $2,000–$2,200

SL: Below $1,5

• $2,000 is clearly a liquidity magnet. With $2B+ in shorts stacked there, a squeeze is structurally possible — but only if spot demand absorbs supply first. Without real bid strength, that level becomes resistance, not fuel.

• Whale distribution vs accumulation wallets adding 2.5M ETH tells me this isn’t consensus — it’s positioning divergence. Near $1,800, I lean cautiously constructive, but only if structure holds.

• $1,600 is the real invalidation. Lose that and liquidation cascades accelerate.

TP: Into liquidity above $2,000–$2,200

SL: Below $1,5

ETH11,99%

- Reward

- 10

- 11

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

86.34K Popularity

175.86K Popularity

41.34K Popularity

9.46K Popularity

432.8K Popularity

339.72K Popularity

49.2K Popularity

60.34K Popularity

3.35K Popularity

7.59K Popularity

10.44K Popularity

7.85K Popularity

1.94K Popularity

2.79K Popularity

35.63K Popularity

News

View MoreThe $100 million cryptocurrency political donation committee Fellowship PAC has no actual funds, and Tether denies any association.

1 m

Vitalik's sale plan is 94% complete, with 15,500 ETH sold since February 2.

4 m

Data: If BTC drops below $64,982, the total long liquidation strength on mainstream CEXs will reach $1.498 billion.

5 m

Today, the Fear & Greed Index remains at 11, indicating the market is in an "extreme fear" state.

6 m

An American politician was banned from using the Kalshi platform and fined for insider trading.

12 m

Pin