AylaShinex

No content yet

AylaShinex

#CryptoMarketPullback

💭 I think the real deciding factor right now is macro — not rumors.

Government shutdown headlines and noise can shake sentiment, but what truly moves this market is liquidity and Fed direction.

If rate cuts get delayed, risk assets stay under pressure.

If liquidity improves, crypto rebounds fast.

Right now BTC below $76K isn’t panic — it’s positioning.

Smart traders watch policy, not drama.

What’s your view? Macro shift or just temporary fear? 👇

#MarketUpdate #BTC #MacroImpact

💭 I think the real deciding factor right now is macro — not rumors.

Government shutdown headlines and noise can shake sentiment, but what truly moves this market is liquidity and Fed direction.

If rate cuts get delayed, risk assets stay under pressure.

If liquidity improves, crypto rebounds fast.

Right now BTC below $76K isn’t panic — it’s positioning.

Smart traders watch policy, not drama.

What’s your view? Macro shift or just temporary fear? 👇

#MarketUpdate #BTC #MacroImpact

BTC0,57%

- Reward

- 4

- 5

- Repost

- Share

HanssiMazak :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback 📉🔥

The leverage flush is here.

BTC lost $76K. ETH and SOL followed. Liquidations wiped out overconfident longs — and volatility is back on the table.

But this isn’t chaos.

This is market structure resetting.

💡 My Positioning This Week:

I’m protecting capital first. Partial cash, selective exposure. In high-volatility phases, survival > aggression.

🎯 Down-Market Playbook:

• Reduce leverage — volatility kills overexposed traders

• Hedge using partial futures shorts against spot holdings

• Scale into key support zones instead of chasing candles

• Follow liquidity, not em

The leverage flush is here.

BTC lost $76K. ETH and SOL followed. Liquidations wiped out overconfident longs — and volatility is back on the table.

But this isn’t chaos.

This is market structure resetting.

💡 My Positioning This Week:

I’m protecting capital first. Partial cash, selective exposure. In high-volatility phases, survival > aggression.

🎯 Down-Market Playbook:

• Reduce leverage — volatility kills overexposed traders

• Hedge using partial futures shorts against spot holdings

• Scale into key support zones instead of chasing candles

• Follow liquidity, not em

- Reward

- 4

- 5

- Repost

- Share

HanssiMazak :

:

2026 GOGOGO 👊View More

Gate Plaza|2/2 Today's Hot Topics: #加密市场回调

🎁【Fan Appreciation Giveaway】Post with a topic, 5 lucky winners * each receive an $100 position experience voucher!

In the past 24 hours, the market has undergone a hardcore “deleveraging.” BTC broke below $76,000, and mainstream assets like ETH, SOL, and others declined simultaneously. When volatility suddenly amplifies, how do you operate now?

💬 This week's hot discussion topics:

1️⃣ Position Management: Facing continuous declines, do you choose to “lighten your position and wait for change” or “hold your full position and stand firm”?

2️⃣ Profit

🎁【Fan Appreciation Giveaway】Post with a topic, 5 lucky winners * each receive an $100 position experience voucher!

In the past 24 hours, the market has undergone a hardcore “deleveraging.” BTC broke below $76,000, and mainstream assets like ETH, SOL, and others declined simultaneously. When volatility suddenly amplifies, how do you operate now?

💬 This week's hot discussion topics:

1️⃣ Position Management: Facing continuous declines, do you choose to “lighten your position and wait for change” or “hold your full position and stand firm”?

2️⃣ Profit

- Reward

- 2

- 2

- Repost

- Share

HanssiMazak :

:

2026 GOGOGO 👊View More

#PreciousMetalsPullBack 🟡📉

After an explosive rally, precious metals are finally cooling off. Gold and silver — which had been leading the safe-haven trade — are now facing controlled profit-taking.

But this isn’t panic.

It’s recalibration.

When assets rally aggressively, pullbacks are part of trend structure. Strong trends breathe before continuing.

What to watch now:

🔹 Gold holding above major support zones

🔹 Silver’s higher volatility vs gold

🔹 Dollar strength and Treasury yields

🔹 Risk appetite returning to equities & crypto

If gold stabilizes above key levels, the macro safe-haven n

After an explosive rally, precious metals are finally cooling off. Gold and silver — which had been leading the safe-haven trade — are now facing controlled profit-taking.

But this isn’t panic.

It’s recalibration.

When assets rally aggressively, pullbacks are part of trend structure. Strong trends breathe before continuing.

What to watch now:

🔹 Gold holding above major support zones

🔹 Silver’s higher volatility vs gold

🔹 Dollar strength and Treasury yields

🔹 Risk appetite returning to equities & crypto

If gold stabilizes above key levels, the macro safe-haven n

- Reward

- 3

- 5

- Repost

- Share

HanssiMazak :

:

2026 GOGOGO 👊View More

#AltcoinDivergence 📊🔥

interesting is happening beneath the surface.

While Bitcoin consolidates and struggles near key levels, selective altcoins are showing relative strength. That’s called divergence — and smart traders pay attention to it.

Here’s what it signals:

🔹 Capital rotating, not leaving the market

🔹 Early positioning before broader momentum shift

🔹 Sector-specific strength (AI, RWA, L2s, memes)

🔹 BTC dominance potentially nearing short-term exhaustion

But caution — not all divergence leads to an altseason. Sometimes it’s just temporary liquidity rotation before another BTC mov

interesting is happening beneath the surface.

While Bitcoin consolidates and struggles near key levels, selective altcoins are showing relative strength. That’s called divergence — and smart traders pay attention to it.

Here’s what it signals:

🔹 Capital rotating, not leaving the market

🔹 Early positioning before broader momentum shift

🔹 Sector-specific strength (AI, RWA, L2s, memes)

🔹 BTC dominance potentially nearing short-term exhaustion

But caution — not all divergence leads to an altseason. Sometimes it’s just temporary liquidity rotation before another BTC mov

- Reward

- 4

- 3

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#ETHUnderPressure #ETHUnderPressure ⚡📉

Ethereum is testing patience.

After losing key momentum near the $2,700 zone, ETH is now trading under pressure around critical support levels. The $2,400 area is acting as a psychological battlefield — and structure here matters.

What’s happening?

🔹 Weak macro environment

🔹 Risk-off sentiment across crypto

🔹 Liquidations accelerating downside moves

🔹 BTC dominance rising

If ETH fails to hold this demand zone, deeper consolidation toward $2,100 can’t be ruled out. But if buyers step in aggressively and reclaim higher resistance levels, this could tur

Ethereum is testing patience.

After losing key momentum near the $2,700 zone, ETH is now trading under pressure around critical support levels. The $2,400 area is acting as a psychological battlefield — and structure here matters.

What’s happening?

🔹 Weak macro environment

🔹 Risk-off sentiment across crypto

🔹 Liquidations accelerating downside moves

🔹 BTC dominance rising

If ETH fails to hold this demand zone, deeper consolidation toward $2,100 can’t be ruled out. But if buyers step in aggressively and reclaim higher resistance levels, this could tur

- Reward

- 4

- 3

- Repost

- Share

xxx40xxx :

:

Buy To Earn 💎View More

#WhaleActivityWatch #WhaleActivityWatch 🐋📊

When whales move, markets listen.

Large wallet transfers have started increasing — and that’s never random. Whether it’s accumulation, distribution, or strategic repositioning, whale activity often precedes major volatility.

Here’s what smart traders monitor:

🔹 Exchange inflows → Possible selling pressure

🔹 Exchange outflows → Accumulation signal

🔹 Large stablecoin movements → Preparing for deployment

🔹 Sudden spikes in open interest → High-leverage positioning

Retail reacts to candles.

Whales position before the candles print.

If big players ar

When whales move, markets listen.

Large wallet transfers have started increasing — and that’s never random. Whether it’s accumulation, distribution, or strategic repositioning, whale activity often precedes major volatility.

Here’s what smart traders monitor:

🔹 Exchange inflows → Possible selling pressure

🔹 Exchange outflows → Accumulation signal

🔹 Large stablecoin movements → Preparing for deployment

🔹 Sudden spikes in open interest → High-leverage positioning

Retail reacts to candles.

Whales position before the candles print.

If big players ar

BTC0,57%

- Reward

- 4

- 3

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#BTCKeyLevelBreak #BTCKeyLevelBreak 🚨📉

Bitcoin just lost a level that mattered.

When a key support breaks, it’s not just a price move — it’s a shift in market structure and psychology. The $80K zone was holding momentum. Losing it opens the door to deeper liquidity hunts.

What this means:

🔹 Stop-loss clusters get triggered

🔹 Short-term sentiment flips bearish

🔹 Volatility expands rapidly

🔹 Weak hands exit, strong hands observe

Now the focus shifts to the next demand zone. If BTC stabilizes and reclaims the broken level quickly, this becomes a fake breakdown. If not, consolidation or furt

Bitcoin just lost a level that mattered.

When a key support breaks, it’s not just a price move — it’s a shift in market structure and psychology. The $80K zone was holding momentum. Losing it opens the door to deeper liquidity hunts.

What this means:

🔹 Stop-loss clusters get triggered

🔹 Short-term sentiment flips bearish

🔹 Volatility expands rapidly

🔹 Weak hands exit, strong hands observe

Now the focus shifts to the next demand zone. If BTC stabilizes and reclaims the broken level quickly, this becomes a fake breakdown. If not, consolidation or furt

BTC0,57%

- Reward

- 4

- 3

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#FedLeadershipImpact #FedLeadershipImpact 🏦⚡

When Fed leadership shifts, markets don’t just react — they reprice the future.

2026 is proving that monetary tone matters more than ever. A hawkish stance strengthens the dollar, pressures risk assets, and tightens liquidity. A dovish pivot injects confidence, fuels equities, and often reignites crypto momentum.

Bitcoin and Ethereum are no longer isolated from macro. They move with yields, inflation expectations, and policy guidance.

Here’s what traders should watch:

🔹 Forward guidance on rate cuts or pauses

🔹 Treasury yield movement (10Y is key

When Fed leadership shifts, markets don’t just react — they reprice the future.

2026 is proving that monetary tone matters more than ever. A hawkish stance strengthens the dollar, pressures risk assets, and tightens liquidity. A dovish pivot injects confidence, fuels equities, and often reignites crypto momentum.

Bitcoin and Ethereum are no longer isolated from macro. They move with yields, inflation expectations, and policy guidance.

Here’s what traders should watch:

🔹 Forward guidance on rate cuts or pauses

🔹 Treasury yield movement (10Y is key

- Reward

- 3

- 3

- Repost

- Share

xxx40xxx :

:

Buy To Earn 💎View More

#Web3FebruaryFocus #Web3FebruaryFocus 🌐🔥

February isn’t just another month in crypto — it’s a positioning window.

While price action remains volatile, the real story is happening beneath the surface: infrastructure upgrades, regulatory clarity, tokenization expansion, and creator monetization systems going live.

This is what smart capital watches.

🔹 RWA Acceleration: Tokenized commodities, securities, and yield products are gaining institutional traction.

🔹 On-Chain Activity: Engagement-driven ecosystems are outperforming passive platforms.

🔹 AI + Web3 Integration: Automation and data int

February isn’t just another month in crypto — it’s a positioning window.

While price action remains volatile, the real story is happening beneath the surface: infrastructure upgrades, regulatory clarity, tokenization expansion, and creator monetization systems going live.

This is what smart capital watches.

🔹 RWA Acceleration: Tokenized commodities, securities, and yield products are gaining institutional traction.

🔹 On-Chain Activity: Engagement-driven ecosystems are outperforming passive platforms.

🔹 AI + Web3 Integration: Automation and data int

- Reward

- 3

- 3

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#FedLeadershipImpact #FedLeadershipImpact 🏦⚡

The Fed isn’t just setting rates — it’s shaping market psychology. Leadership changes in 2026 are sending shockwaves through crypto, equities, and commodities alike.

Why it matters:

🔹 Policy Tone Shift: New leadership could redefine liquidity expectations and interest rate paths.

🔹 Market Sentiment: BTC, ETH, and tech stocks respond faster than ever to Fed signals — risk-on or risk-off flows are amplified.

🔹 Macro Dominoes: Dollar strength, Treasury yields, and global capital rotation hinge on who’s at the helm.

Traders and investors: this isn’t

The Fed isn’t just setting rates — it’s shaping market psychology. Leadership changes in 2026 are sending shockwaves through crypto, equities, and commodities alike.

Why it matters:

🔹 Policy Tone Shift: New leadership could redefine liquidity expectations and interest rate paths.

🔹 Market Sentiment: BTC, ETH, and tech stocks respond faster than ever to Fed signals — risk-on or risk-off flows are amplified.

🔹 Macro Dominoes: Dollar strength, Treasury yields, and global capital rotation hinge on who’s at the helm.

Traders and investors: this isn’t

- Reward

- 5

- 7

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#Web3FebruaryFocus #Web3FebruaryFocus 🚀🌐

February 2026 is shaping up as a pivotal month for Web3 adoption. The ecosystem isn’t just growing — it’s maturing and integrating into real-world utility.

Here’s the pulse:

🔹 On-Chain Engagement: Platforms are designing gamified experiences that reward users for interaction, not just trading.

🔹 Tokenized Assets: Real-world assets like commodities, securities, and collectibles are going digital — bridging TradFi and DeFi.

🔹 Cross-Chain Expansion: Interoperability solutions are gaining traction, allowing users to move seamlessly across ecosystems.

�

February 2026 is shaping up as a pivotal month for Web3 adoption. The ecosystem isn’t just growing — it’s maturing and integrating into real-world utility.

Here’s the pulse:

🔹 On-Chain Engagement: Platforms are designing gamified experiences that reward users for interaction, not just trading.

🔹 Tokenized Assets: Real-world assets like commodities, securities, and collectibles are going digital — bridging TradFi and DeFi.

🔹 Cross-Chain Expansion: Interoperability solutions are gaining traction, allowing users to move seamlessly across ecosystems.

�

- Reward

- 4

- 6

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback BTC is showing strong momentum on the charts and the long-term trend is bullish.

Even after minor corrections, buyers are stepping in aggressively, holding key support zones.

Key Points:

✅ Support holding around $74K – $75K

✅ Moving averages showing bullish bias

✅ Strong buying volume indicating potential continuation

Traders can consider long positions with proper risk management while waiting for clear breakout signals.

💡 Remember: Patience is key — BTC rewards disciplined traders!

#BTC #Bitcoin #Crypto #CryptoTrading$BTC

Even after minor corrections, buyers are stepping in aggressively, holding key support zones.

Key Points:

✅ Support holding around $74K – $75K

✅ Moving averages showing bullish bias

✅ Strong buying volume indicating potential continuation

Traders can consider long positions with proper risk management while waiting for clear breakout signals.

💡 Remember: Patience is key — BTC rewards disciplined traders!

#BTC #Bitcoin #Crypto #CryptoTrading$BTC

BTC0,57%

- Reward

- 4

- 6

- Repost

- Share

xxx40xxx :

:

Buy To Earn 💎View More

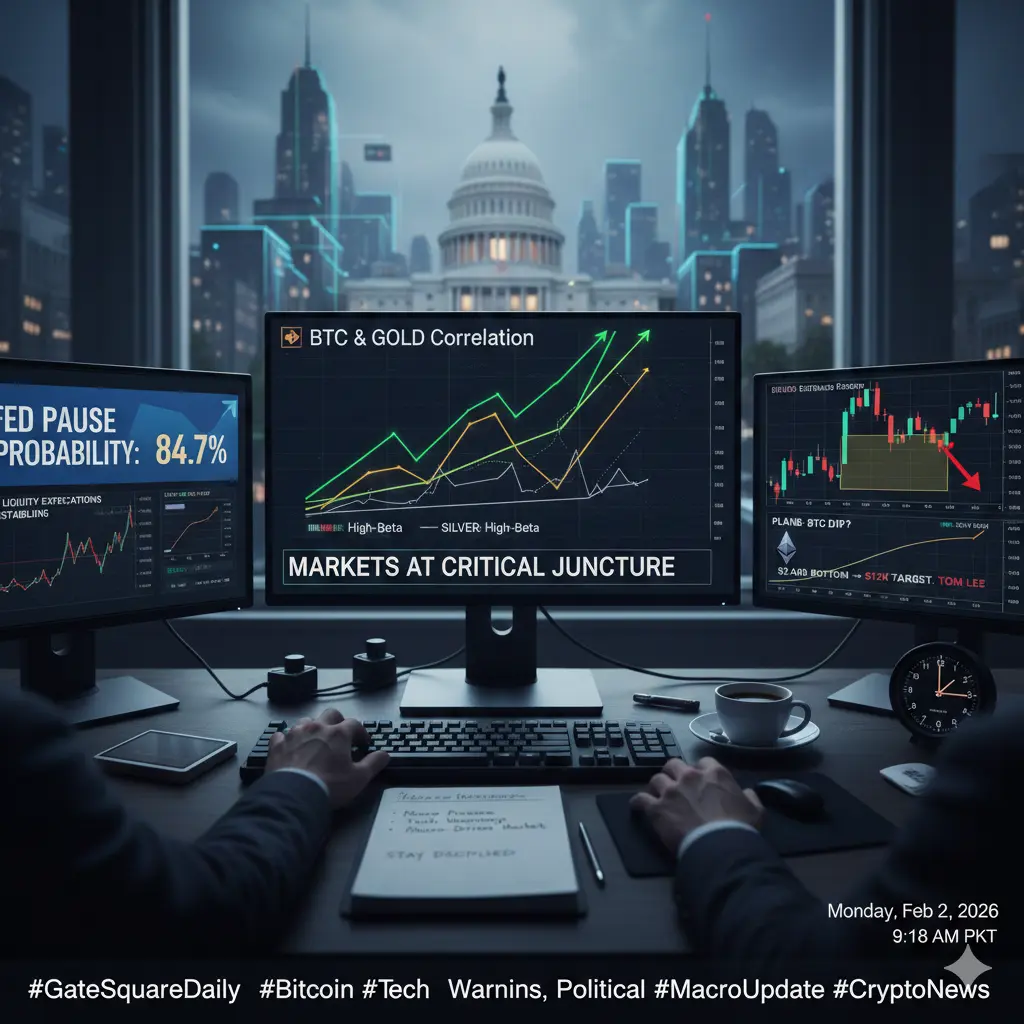

#CryptoMarketPullback Markets are entering a critical decision phase. Macro pressure, technical warnings, and political uncertainty are all colliding at once.

Here’s what matters today 👇

1️⃣ Macro Update:

Fed March pause probability jumps to 84.7%. Liquidity expectations are stabilizing — but markets are still cautious.

2️⃣ Correlation Shift:

BTC and Gold are moving in sync again, while Silver is behaving like a high-beta “meme stock.” Risk appetite is rotating, not disappearing.

3️⃣ Technical Warning:

PlanB suggests a possible BTC dip toward $55K–$58K in a shallow bear scenario. That zone wo

Here’s what matters today 👇

1️⃣ Macro Update:

Fed March pause probability jumps to 84.7%. Liquidity expectations are stabilizing — but markets are still cautious.

2️⃣ Correlation Shift:

BTC and Gold are moving in sync again, while Silver is behaving like a high-beta “meme stock.” Risk appetite is rotating, not disappearing.

3️⃣ Technical Warning:

PlanB suggests a possible BTC dip toward $55K–$58K in a shallow bear scenario. That zone wo

- Reward

- 8

- 15

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

- Reward

- 11

- 19

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

Share content from Moments to earn commission effortlessly!https://www.gate.com/live/video/2565059c64444340a9c2ab8c553ee40f?type=live&ref=VLRFB1TBBQ&ref_type=105

- Reward

- 10

- 12

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

#CryptoRegulationNewProgress 🚨⚖️

The narrative around crypto regulation is shifting — not slowly, but meaningfully.

2026 is proving to be a year where policy clarity isn’t just talked about… it’s being acted on. And this matters to every trader, investor, and builder in the space.

Regulation used to be the wildcard that intimidated markets.

Now it’s becoming the framework that enables long-term capital to enter confidently.

Here’s what’s changing:

🔹 Clear Definitions: Tokenized securities, RWAs, and digital assets are no longer in regulatory limbo — frameworks are emerging.

🔹 Institutional

The narrative around crypto regulation is shifting — not slowly, but meaningfully.

2026 is proving to be a year where policy clarity isn’t just talked about… it’s being acted on. And this matters to every trader, investor, and builder in the space.

Regulation used to be the wildcard that intimidated markets.

Now it’s becoming the framework that enables long-term capital to enter confidently.

Here’s what’s changing:

🔹 Clear Definitions: Tokenized securities, RWAs, and digital assets are no longer in regulatory limbo — frameworks are emerging.

🔹 Institutional

- Reward

- 10

- 15

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More