What is Sky (SKY)?

Introduction

Sky (SKY) is a decentralized financial protocol built as the successor to MakerDAO. It represents a major shift in how decentralized governance, stablecoins, and DeFi incentives are structured. Sky was introduced through a long-term transformation plan known as Endgame, led by the original MakerDAO community and core contributors. The protocol introduces two key tokens:

- USDS: a collateral-backed stablecoin

- SKY: a governance and utility token, replacing MKR

Sky simplifies access to decentralized finance through its core platform, Sky.money, which is a non-custodial interface where users can mint, save, upgrade, stake, and vote using their tokens. This rebrand is not just cosmetic, but a structural upgrade. Sky introduces new incentive systems, staking models, and modular sub-ecosystems (“Stars”) designed for scale, autonomy, and long-term resilience.

What is Sky?

Sky is a decentralized financial protocol that emerged from the restructuring of MakerDAO, one of the oldest and most trusted projects in DeFi. It was launched as part of a broader upgrade strategy called Endgame, which aimed to make the system more scalable, autonomous, and user-friendly. Sky introduces a new dual-token system:

- USDS: a collateral-backed stablecoin that is soft-pegged to the U.S. dollar.

- SKY: a governance and utility token that replaces MKR at a fixed conversion rate of 1 MKR = 24,000 SKY.

The protocol is accessed through Sky.money, a non-custodial, all-in-one interface that allows users to interact with the Sky ecosystem. It includes tools for saving, staking, upgrading tokens, and participating in on-chain governance.

Sky separates itself from traditional DeFi models by implementing modular substructures called Stars, which operate like sub-DAOs. These Stars focus on specific areas such as lending, real-world assets, and growth, while maintaining interoperability with the main protocol.

Sky also integrates a cross-chain bridge mechanism called SkyLink, allowing users to move USDS and SKY across supported blockchains like Arbitrum, Optimism, and Base.

Key Differences Between Sky and MakerDAO

- Decentralized Governance**Sky introduces a more dynamic and scalable governance structure compared to MakerDAO**. While MakerDAO’s MKR token provided governance rights primarily through voting power, Sky’s governance system is more modular, allowing for increased decentralization and a broader community-driven decision-making process.

Tokens and Utility In contrast to MakerDAO, which used MKR for both governance and as a utility token, Sky divides these functions into two distinct tokens:

USDS: A collateral-backed stablecoin that acts as the foundation of Sky’s financial system.

- SKY: A governance and utility token that replaces MKR, but with an enhanced focus on incentivizing users within the broader Sky ecosystem, including governance, staking, and participating in sub-ecosystems (“Stars”).

- Incentive Systems and Staking Models**Sky simplifies access to decentralized finance while introducing more sophisticated incentive systems and staking models. Unlike MakerDAO, which relied heavily on passive staking and governance rewards, Sky’s models are designed to actively engage users and encourage long-term participation. Its innovative approach includes modular sub-ecosystems** that operate autonomously, offering greater flexibility and scalability for both users and developers.

- Platform: Sky.money At the heart of Sky’s ecosystem is Sky.money, a non-custodial platform where users can engage with the protocol directly. Unlike MakerDAO, which primarily operated via governance interactions and limited user interfaces, Sky.money offers a complete experience where users can mint stablecoins, stake, upgrade, and vote seamlessly using their tokens. It simplifies the DeFi journey, making it more user-friendly and accessible.

- Long-term Transformation: Endgame Plan**Sky is not just a rebrand—it’s part of a long-term transformation plan known as Endgame, which was spearheaded by the original MakerDAO community. This plan was carefully crafted to address gaps in MakerDAO’s initial framework and to build a more resilient and autonomous DeFi infrastructure that can thrive in the long term. Sky** builds upon MakerDAO’s legacy but upgrades its core structural elements, ensuring scalability, user autonomy, and better alignment with the rapidly evolving DeFi ecosystem.

History of Sky, Origins, and Key Persons

Sky has a rich history rooted in one of DeFi’s earliest and most influential protocols:

Origins & “Endgame” Restructure

October 2022: MakerDAO community approved the Endgame roadmap, which was an ambitious plan to move from a monolithic model to a modular, scalable ecosystem with sub-DAOs for specialized functions. Over the following two years, development focused on launching new tokens (USDS & SKY), a user-focused interface (Sky.money), and incentive systems tied to this modular structure.

Rebrand Rollout

August 27, 2024: MakerDAO officially announced its transition to Sky, with a scheduled launch for September 18, 2024.

September 18, 2024: The protocol formally rebranded MKR → SKY at a fixed conversion rate of 1 MKR = 24,000 SKY, and DAI → USDS on a 1:1 basis. Users retain full option to reverse the swap back to MKR/DAI.

Key Figures Behind Sky

The project remains deeply rooted in MakerDAO’s original leadership, guided by Rune Christensen, co-founder of MakerDAO. The Grove subDAO, part of the Stars framework, launched in June 2025 with leadership from Mark Phillips, Kevin Chan, and Sam Paderewski, focusing on tokenized asset programs.

Investments & Ecosystem Projects

The Grove entity received a $1 billion allocation to deploy capital into a tokenized, institutional-grade CLO strategy alongside Janus Henderson and Centrifuge. Other Stars include Spark, focused on real-world assets integration, and Grove, focusing on credit markets.

How Does Sky Work?

Sky functions as a decentralized protocol built around two main tokens: USDS, a stablecoin, and SKY, a governance and utility token.

Users can mint USDS by depositing accepted collateral like DAI or USDC at a 1:1 ratio. To earn yield, they can deposit USDS into the protocol’s Sky Savings Rate (SSR) and receive sUSDS, which accrues interest automatically.

The SKY token gives holders governance rights and access to future staking rewards. Participation across the ecosystem, such as saving, voting, or using the protocol’s cross-chain bridge, earns additional SKY through the Sky Token Rewards (STR) system.

Sky also includes SkyLink, a built-in bridge that allows users to move USDS, sUSDS, and SKY across multiple blockchains like Ethereum, Solana, and Arbitrum.

All core functions, such as minting, saving, rewards, and governance are accessible through the official, non-custodial interface at Sky.money.

Key Features of Sky

Upgrade

Sky introduces a unique “Upgrade” mechanism that allows users to convert their DAI and MKR tokens into USDS and SKY, respectively. The upgrade is optional and reversible, meaning users can switch back to their original tokens if needed. The conversion rate is fixed—1 DAI equals 1 USDS, and 1 MKR equals 24,000 SKY. This feature was designed to ensure a smooth transition from MakerDAO to Sky without excluding long-term users. By upgrading, users gain access to the full set of features offered within the Sky ecosystem, including advanced yield options and governance tools.

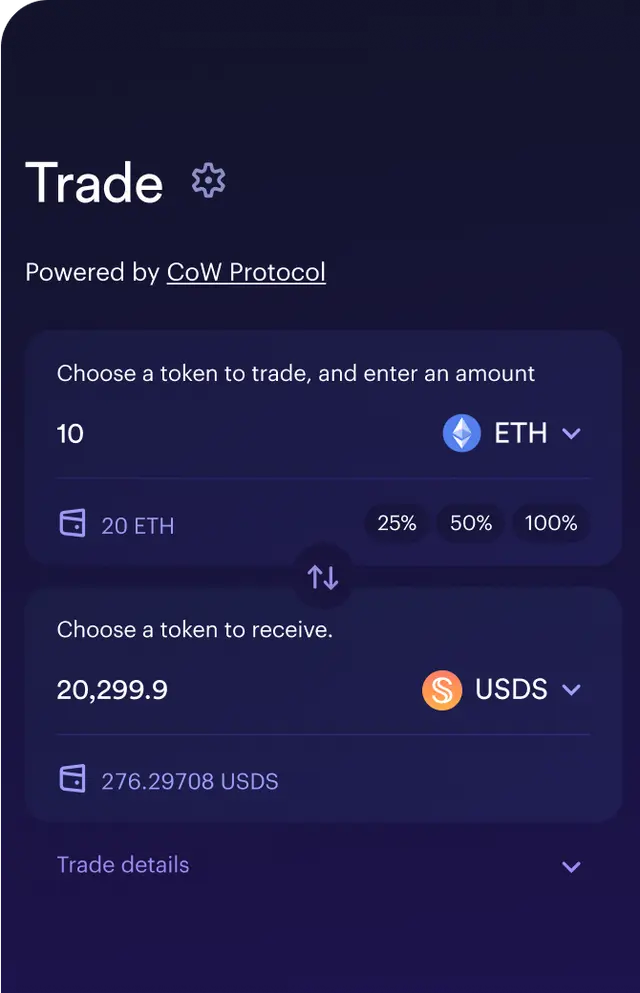

Trade

Sky provides a built-in, non-custodial trading interface through Sky.money, where users can buy, sell, and swap between SKY, USDS, and sUSDS directly. The platform integrates with on-chain liquidity pools and external bridges to make token movement efficient and low-cost. Because Sky supports cross-chain activity, users can also move assets across Ethereum, Solana, Arbitrum, Optimism, and other supported chains through SkyLink (covered below). This makes Sky not just a DeFi protocol, but a fully functional trading gateway for stablecoins and governance tokens.

Rewards

Sky uses a reward system called Sky Token Rewards (STR) to incentivize participation across the platform. Users earn SKY tokens for actions like minting USDS, saving through SSR, voting on proposals, or using the SkyLink bridge. Rewards are automatically calculated and distributed based on protocol usage, encouraging users to stay active within the system. This aligns user activity with the growth and decentralization of the protocol, while avoiding lock-in or unnecessary staking requirements.

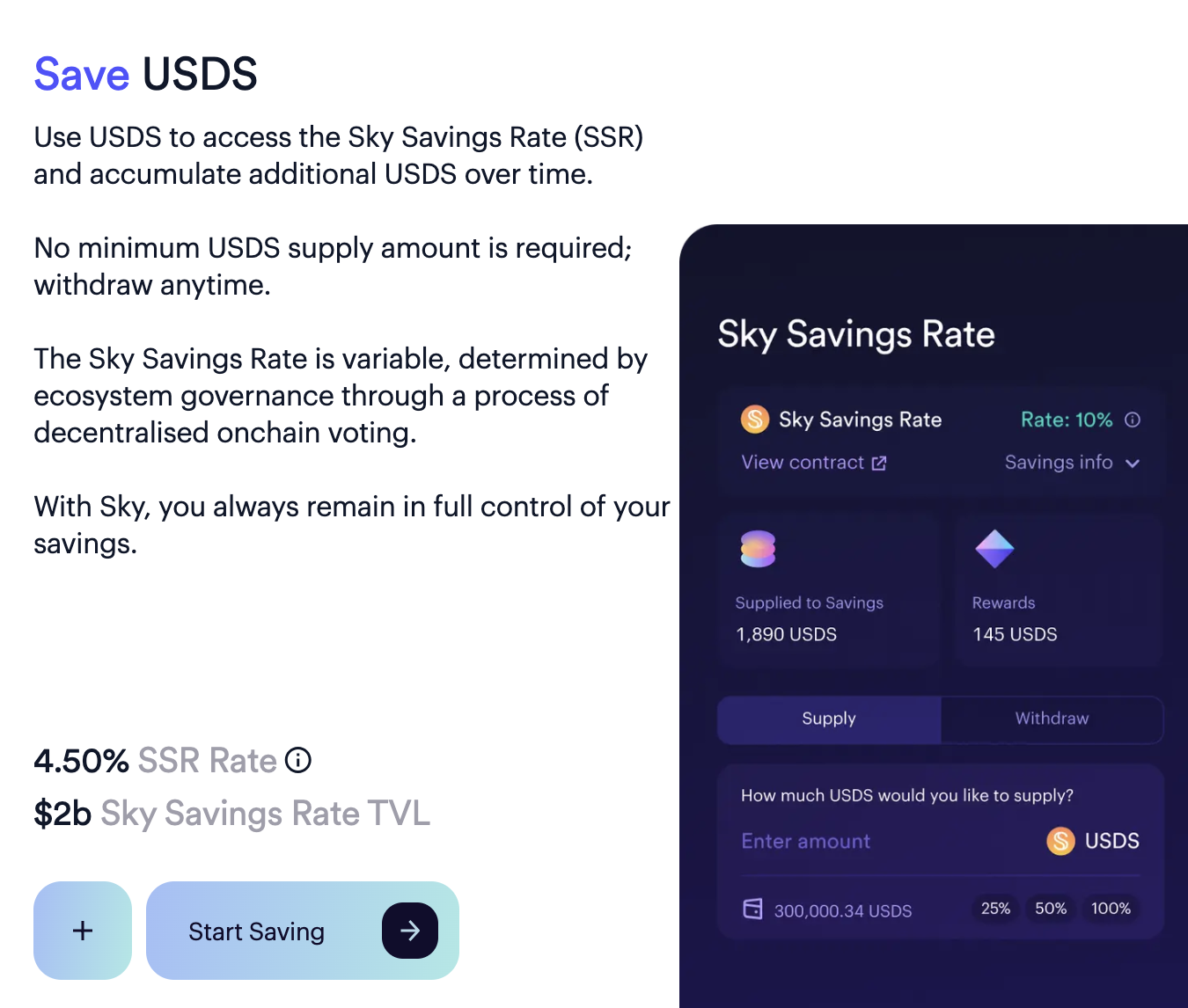

Savings

Sky offers a savings feature through the Sky Savings Rate (SSR), allowing USDS holders to earn passive income. When users deposit USDS into the SSR, they receive sUSDS, an interest-bearing version of the stablecoin. The value of sUSDS grows over time as interest is automatically accrued. Yield is generated from fees collected by the protocol and returns on real-world assets like tokenized bonds. There’s no minimum deposit or lock-up period, and users can redeem their sUSDS back into USDS at any time. This makes the savings mechanism flexible and easy to use for both casual and experienced DeFi users.

Staking Engine

Sky plans to introduce a staking engine that allows holders to “activate” their SKY tokens for additional benefits. While this feature is still under development, it will enable users to lock SKY to earn higher-tier governance rights or access special rewards. The system is expected to include different activation levels with varying rewards and commitment terms. This approach is meant to balance participation incentives with governance responsibility, helping filter out passive holders from high-impact decision-making processes.

SkyLink

SkyLink is Sky’s built-in cross-chain bridge that lets users move SKY, USDS, and sUSDS between multiple networks. Supported chains include Ethereum, Base, Arbitrum, Optimism, Polygon, Avalanche, and Solana. Unlike third-party bridges, SkyLink is permissionless and directly integrated into the Sky.money interface. This ensures a seamless experience where users can transfer their assets across chains while preserving staking rewards and governance rights. It also helps reduce gas costs and unlocks access to yield opportunities on faster, low-fee networks.

Is Sky a Good Investment?

Sky builds directly on MakerDAO, leveraging over a decade of development and billions in stablecoin circulation. This long history brings trust and resilience.

Multi-Channel Passive & Active Returns

- Sky Savings Rate (SSR) offers yield on USDS via sUSDS with no lock-up. Returns stem from protocol fees and real-world asset allocations like bonds and CLOs.

- Sky Token Rewards (STR) reward active participants—minting, voting, bridge usage—aligned with ecosystem growth.

- Upcoming staking mechanisms allow SKY holders to earn additional USDS and future rewards through the staking engine announced in May 2025.

SkyLink makes USDS, sUSDS, and SKY bridgeable across Ethereum, Arbitrum, Solana, Base, Optimism, Polygon, and Avalanche. This unlocks diverse yield opportunities and lowers costs. The Grove Star received a $1 billion allocation to deploy AAA-rated tokenized credit via Janus Henderson and Centrifuge, signaling strengthened real-world yield prospects.

All DeFi protocols carry risks of bugs or exploits. Sky’s multiple new modules may add complexity and attack surfaces. Governance proposals carry approval risks—users may miss out or commit to unfavorable changes. Return rates (SSR, STR, staking yields) depend heavily on platform usage. If user activity slows, so do rewards. SKY token price is also sensitive to broader crypto market trends. Sky’s use of tokenized real-world assets and stablecoins could attract regulatory scrutiny from entities like the SEC or CFTC.

The final shift from MKR to SKY occurred in May 2025, ending the ability to revert. Delays in staking, reward enhancement, or protocol upgrades may influence returns.

How Can You Own SKY

SKY is listed on various centralized and decentralized exchanges. You can purchase it using USDT, USDC, or other trading pairs, depending on the platform. Supported networks include Ethereum, Arbitrum, Optimism, Solana, and more, accessible through both native wallets and the Sky.money bridge.

Tokenomics

Sky uses a structured, transparent token model:

- Annual Emission Cap: Capped at 1 billion SKY per year. Emissions are non-inflationary and based on DAO-set budgets.

- Sky Token Rewards (STR): A portion of annual emissions is allocated to reward users who actively mint, save, vote, or use SkyLink.

- Smart Burn Engine: Protocol profits can be used to burn SKY, reducing total supply and maintaining long-term value.

- Treasury & Budgeting: SKY is distributed via decentralized budgeting proposals. Each proposal is published and tracked on the Sky Fusion dashboard.

- Governance Participation: SKY is required to vote on protocol upgrades, budget approvals, emission policies, and Star launches. Additional governance weight may be introduced through staking and activation.

Roadmap of Sky

The roadmap is built around modular releases and is governed directly by community votes:

2024

- September: Sky officially launched, replacing MakerDAO branding

- USDS and SKY token deployment

- Sky.money platform went live

2025 (In Progress)

- Q1: Rollout of Sky Token Rewards (STR) system and SSR onboarding

- Q2: Launch of Grove Star with $1B RWA deployment

- Q3: Release of Staking Engine and Activation rewards

- Q4: Expansion of Stars model, new subDAOs announced

2026 and Beyond

- Implementation of AI-assisted governance tooling

- Expansion of SkyLink to additional chains and rollups

- Smart Burn Engine optimization based on treasury surplus

- Introduction of custom Stars by third-party developers

Conclusion

Sky is the next evolution of MakerDAO, redesigned to address scalability, governance complexity, and long-term sustainability in decentralized finance. With its dual-token model, USDS as a stablecoin and SKY as a governance and incentive token, Sky offers users a complete, non-custodial financial platform that includes savings, rewards, staking, and cross-chain functionality.

The protocol’s architecture introduces modular subDAOs (Stars), a structured governance system (Sky Atlas), and an incentive model (STR + SSR) that encourages both passive participation and active governance. By launching its own gateway at Sky.money, the protocol simplifies DeFi access without compromising decentralization.

For users and investors, Sky provides multiple ways to engage: earning yield through sUSDS, participating in protocol decisions through SKY, and exploring new utility through Stars. However, like all DeFi projects, it carries risks, especially around market volatility and governance outcomes.

Related Articles

The MakerDAO Endgame Plan

Unveiling MakerDAO RWA: Governance Systems and Trading Architecture for Capturing Off-Chain Assets in DeFi

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?