Nghiên cứu Gate: Canada đã phê duyệt ETF Solana Giao ngay; Quỹ Tài sản số thấy tuần thứ ba liên tiếp có luồng tiền lớn rút ra

Tóm tắt

- Giá Bitcoin tăng 0,08% lên $85,284; Ethereum tăng 0,60% lên $1,641.76

- Quỹ tài sản kỹ thuật số đã trải qua sự rút lui quy mô lớn trong tuần thứ ba liên tiếp, tổng cộng là 7,2 tỷ đô la

- Ethereum chiếm ưu thế về doanh thu dAPP trong Q1 2025, tạo ra hơn 1 tỷ đô la

- Canada sẽ ra mắt các ETF Solana Giao ngay đầu tiên vào tuần này, với phần thưởng staking được kích hoạt

- JPMorgan giới thiệu một tài khoản blockchain dựa trên GBP, nâng cao khả năng thanh toán toàn cầu

- EigenLayer sẽ kích hoạt cơ chế cắt giảm trên mainnet, trừng phạt các nút vi phạm các quy tắc giao thức

Phân tích thị trường

- BTCTrong vòng 24 giờ qua, giá BTC đã tăng 0,08%, hiện đang ở mức $85,284. Từ biểu đồ, BTC giao dịch ngang trong khoảng từ $84,800 đến $85,300 sau một ngày hòa giữa, với sự dao động nhẹ xung quanh đường trung bình di chuyển 5 ngày và 10 ngày. Vẫn chưa có sự đột phá rõ ràng trong ngắn hạn. Khối lượng giao dịch vẫn thấp, cho thấy sự do dự mạnh mẽ của thị trường và dòng vốn yếu. Về chỉ báo MACD, các đường nhanh và chậm đang hội tụ gần trục zero, và biểu đồ cột chỉ cho thấy sự biến động tối thiểu, cho thấy đà đẳng phẳng và một hướng ngắn hạn không rõ ràng.

- ETH Giá ETH tăng 0,60% trong vòng 24 giờ qua, hiện đang ở mức $1,641.75. Biểu đồ cho thấy ETH cũng đang giao dịch trong một phạm vi hẹp, dao động xung quanh các đường trung bình di chuyển 5 ngày, 10 ngày và 30 ngày. Xu hướng ngắn hạn vẫn chưa rõ ràng. Hoạt động giao dịch nói chung là thấp, không có sự tăng trưởng đáng kể về khối lượng được quan sát gần đây. Tâm lý thị trường trông như là trung lập. Chỉ báo MACD cho thấy đường nhanh hơi cao hơn đường chậm, nhưng với đà yếu dần. Biểu đồ cột nằm gần trục zero, thiếu hướng dẫn mạnh mẽ trong ngắn hạn.

- ETF— Theo dữ liệu từ SoSoValue, vào ngày 14 tháng 4, tổng lưu lượng ròng vào các quỹ ETF spot Bitcoin tại Mỹ là 1,47 triệu USD, trong khi tổng lưu lượng ròng từ các quỹ ETF spot Ethereum tại Mỹ là 5,98 triệu USD. Dữ liệu tính đến ngày 15 tháng 4, 12:00 PM (UTC+8).

- Altcoins- Hệ sinh thái Pump.fun, AI Meme và các lĩnh vực Perpetuals đã có sự thay đổi lần lượt là +5.1%, +4.7% và +3.8%. [5]

- Chỉ số thị trường chứng khoán Mỹ— Vào ngày 7 tháng 4, chỉ số S&P 500 tăng 0,79%, Dow Jones tăng 0,78%, và Nasdaq tăng 0,64%.[6]

- Vàng Giao ngayGiá vàng giao ngay giảm 0,40% xuống 3.223,75 đô la mỗi ounce. Dữ liệu tính đến ngày 15 tháng 4, 10:00 AM (UTC+8). [7]

- Chỉ số Sợ hãi & Tham lamChỉ số đọc 38, cho thấy thị trường đang trong tình trạng sợ hãi. [8]

Top Performers

Theo dữ liệu thị trường của Gate.io[9], các loại altcoin có hiệu suất cao nhất trong vòng 24 giờ qua, dựa trên khối lượng giao dịch và biến động giá, như sau:

VTHO (VeThor)— Tăng khoảng 52.52% hàng ngày, vốn hóa thị trường lưu hành: $286 triệu

VeThor (VTHO) là mã token gas của chuỗi khối VeChainThor. Nó chủ yếu được sử dụng để thanh toán cho các giao dịch mạng và thực thi hợp đồng thông minh. VeChainThor là một chuỗi khối được thiết kế đặc biệt cho doanh nghiệp, tập trung mạnh vào quản lý chuỗi cung ứng và minh bạch dữ liệu. Nó áp dụng cơ chế đôi token trong đó VET được sử dụng cho việc lưu trữ giá trị và tạo ra VTHO, trong khi VTHO duy trì hoạt động của mạng. Thiết kế này giúp ổn định chi phí giao dịch và hỗ trợ triển khai các ứng dụng cấp doanh nghiệp.

Sự tăng giá gần đây của VTHO chủ yếu được thúc đẩy bởi một sự phát triển tích cực lớn. Tổng giám đốc UFC Dana White đã gia nhập VeChainThor với tư cách cố vấn. Là tổ chức võ thuật hỗn hợp lớn nhất thế giới, UFC có một đối tượng người xem toàn cầu rộng lớn và sở hữu sức ảnh hưởng mạnh mẽ. Đối tượng chính của UFC bao gồm những người trẻ tuổi, hiểu biết về công nghệ - một nhóm người mà phù hợp với đối tượng sử dụng hệ sinh thái blockchain. Tin tức này đã làm tăng niềm tin của nhà đầu tư và cộng đồng vào tiềm năng mở rộng của nền tảng, dẫn đến sự tăng đột ngột trong sự chú ý và hoạt động giao dịch cho VTHO.

ACH (Alchemy Pay) — Tăng khoảng 26.06% hàng ngày, Vốn hóa thị trường lưu hành: 135 triệu đô la

Alchemy Pay (ACH), thành lập vào năm 2018 và có trụ sở tại Singapore, là một nhà cung cấp giải pháp thanh toán tập trung vào việc nối kết khoảng cách giữa tiền tệ truyền thống và nền kinh tế tiền điện tử. Nền tảng cho phép cả các thương gia trực tuyến và ngoại tuyến chấp nhận thanh toán bằng tiền tệ và tiền điện tử. Token gốc của nó, ACH, dựa trên Ethereum và được sử dụng cho các khoản phí giao dịch, cơ chế khuyến khích và bỏ phiếu quản trị. Theo kế hoạch phát triển đến năm 2025 của mình, Alchemy Pay sẽ mở rộng hơn vào hệ sinh thái stablecoin và lĩnh vực tài sản thế giới thực (RWA).

Việc tăng giá chủ yếu được kích hoạt bởi việc công bố lộ trình chi tiết vào ngày 11/4/2025. Lộ trình vạch ra một số hướng phát triển chiến lược quan trọng, thúc đẩy đáng kể niềm tin của thị trường. Đầu tiên, nó nhấn mạnh chiến lược on-ramp fiat toàn cầu với cách tiếp cận "quy định đầu tiên". Điều này cho thấy ý định của dự án nhằm tăng cường tuân thủ ở nhiều khu vực pháp lý hơn, tăng sự chấp nhận của người dùng chính đối với các dịch vụ fiat của nó. Thứ hai, Alchemy Pay tuyên bố sẽ tích hợp các tính năng tài sản trong thế giới thực (RWA). Điều này sẽ cho phép người dùng truy cập các giao dịch trên chuỗi liên quan đến các tài sản truyền thống như bất động sản và hàng hóa. Bằng cách khai thác sự cường điệu hiện tại xung quanh RWA, sự phát triển này đã dẫn đến sự gia tăng mạnh mẽ về giá mã thông báo ACH. [11]

AQT (Alpha Quark)— Tăng khoảng 44,87% hàng ngày, Vốn hóa thị trường lưu hành: 50,55 triệu đô la

Alpha Quark (AQT) là một dự án blockchain tập trung vào việc số hóa tài sản sở hữu trí tuệ (IP). Sứ mệnh của nó là tăng cường tính sẵn có và hiệu quả giao dịch của tài sản IP thông qua việc sử dụng công nghệ NFT và thế giới ảo. Ý tưởng cốt lõi là biến tài sản không thanh khoản truyền thống như quyền sở hữu âm nhạc, sách, tác phẩm nghệ thuật và giấy phép thương hiệu thành NFT. Những token này sau đó có thể được trưng bày, giao dịch hoặc cấp phép trên một nền tảng dành riêng.

Sự tăng giá này chủ yếu được thúc đẩy bởi thông báo về việc tích hợp hệ sinh thái của Alpha Quark với House Party Protocol (HPP). Dự án tiết lộ kế hoạch tái cấu trúc tokenomics và theo đuổi việc sáp nhập token trong tương lai. Tuyên bố chính thức nhấn mạnh việc ưu tiên lợi ích của cộng đồng và người giữ token, điều này đã tăng cường niềm tin của các nhà đầu tư. Các kỳ vọng về hiệu quả kỹ thuật và sự mở rộng của hệ sinh thái từ việc tích hợp này đã kích thích hoạt động đầu cơ và tăng cường sự quan tâm giao dịch. Những yếu tố này kết hợp với nhau đã thúc đẩy sự tăng giá đột ngột trong giá của AQT trong thời gian ngắn.

Nổi bật dữ liệu

Quỹ Tài sản Kỹ thuật số Thấy tuần thứ ba liên tiếp của Sự rút lui lớn, Tổng cộng $7.2 Tỷ đô la

Sản phẩm đầu tư tài sản kỹ thuật số đã trải qua một vòng đồng tiền quan trọng khác trong tuần trước, với tổng cộng $795 triệu rút ra. Điều này đánh dấu tuần thứ ba liên tiếp của dòng tiền rút ra. Kể từ đầu đợt bán tháo vào đầu tháng 2, tổng số tiền rút ra đã đạt mức ấn tượng $7.2 tỷ, gần như xóa sạch tất cả dòng tiền ròng được ghi nhận từ đầu năm. Hiện tại, dòng tiền ròng kể từ đầu năm đến nay chỉ đạt $165 triệu.

Bitcoin dẫn đầu về luồng ra, với $751 triệu rút khỏi các sản phẩm liên quan chỉ trong tuần trước. Mặc dù vậy, Bitcoin vẫn duy trì luồng vào ròng từ đầu năm đến nay là $545 triệu. Đáng chú ý, là làn sóng rút tiền gần đây không chỉ ảnh hưởng đến các sản phẩm giao ngay, mà còn ảnh hưởng đến các công cụ đầu tư Bitcoin ngắn hạn, mà đã thấy $4.6 triệu rút ra—cho thấy tinh thần thị trường rộng lớn đang cảnh giác.

Ethereum cũng đã trải qua việc rút vốn tuần trước, tổng cộng $37.6 triệu. Các dự án lớn khác như Solana, Aave và Sui đã có số vốn rút nhỏ hơn lần lượt là $5.1 triệu, $780,000 và $580,000. Ngược lại với hiệu suất yếu tổng thể này, một số altcoins nhỏ vẫn thu hút được dòng vốn. XRP nổi bật với dòng vốn ròng là $3.5 triệu, trong khi Ondo, Algorand và Avalanche ghi nhận dòng vốn ròng lần lượt là $460,000, $250,000 và $250,000.

Tuy nhiên, có một phục hồi thị trường ngắn hạn vào cuối tuần trước, do tin tức về việc cựu Tổng thống Trump thông báo trì hoãn việc áp dụng thuế mới. Điều này giúp tài sản quản lý tổng cộng (AuM) tăng trở lại 8% từ mức thấp trong năm tháng vào ngày 8 tháng 4, quay trở lại mức 130 tỷ đô la và cung cấp cho thị trường một đợt tăng ngắn hạn.

Biến động ngầm của Bitcoin tăng mạnh khi thị trường bị nhầm lẫn bởi các tín hiệu chính sách thuế

Mặc dù các đường viền chính của chính sách tarif của Mỹ đã được làm rõ đáng kể, nhưng tín hiệu hỗn hợp liên tục từ chính phủ Trump vẫn tiếp tục gây ra sự không chắc chắn trên thị trường tiền điện tử. Như đã thấy, biến động ngụ ý một tuần của Bitcoin vẫn ở mức rất cao, phản ánh sự thiếu hướng rõ ràng của các nhà đầu tư về các biến động giá cả trong tương lai.

Các con số gần đây cho thấy rằng biến động ngụ ý của Bitcoin gần 20 điểm phần trăm so với mức thấp nhất trong lịch sử và ít nhất 10 điểm phần trăm cao hơn so với mức ổn định điển hình của nó. Biến động cao kéo dài thường được coi là một “chỉ số nỗi sợ” trên thị trường, cho thấy sự tăng đáng kể trong kỳ vọng của các nhà đầu tư về biến động giá.

Sự bùng nổ của biến động chủ yếu được đẩy mạnh bởi sự không chắc chắn về chính sách thương mại của Mỹ trong tương lai. Mặc dù Trump trước đó đã thông báo tạm ngừng thêm 90 ngày áp thuế đối với hầu hết các quốc gia, lo ngại từ thị trường vẫn chưa hoàn toàn được xoa dịu. Một số nhà giao dịch lo ngại rằng chính sách có thể đảo ngược lại một lần nữa, tiềm ẩn nguy cơ làm leo thang hơn nữa sự hỗn loạn trên toàn cầu đối với tài sản rủi ro.

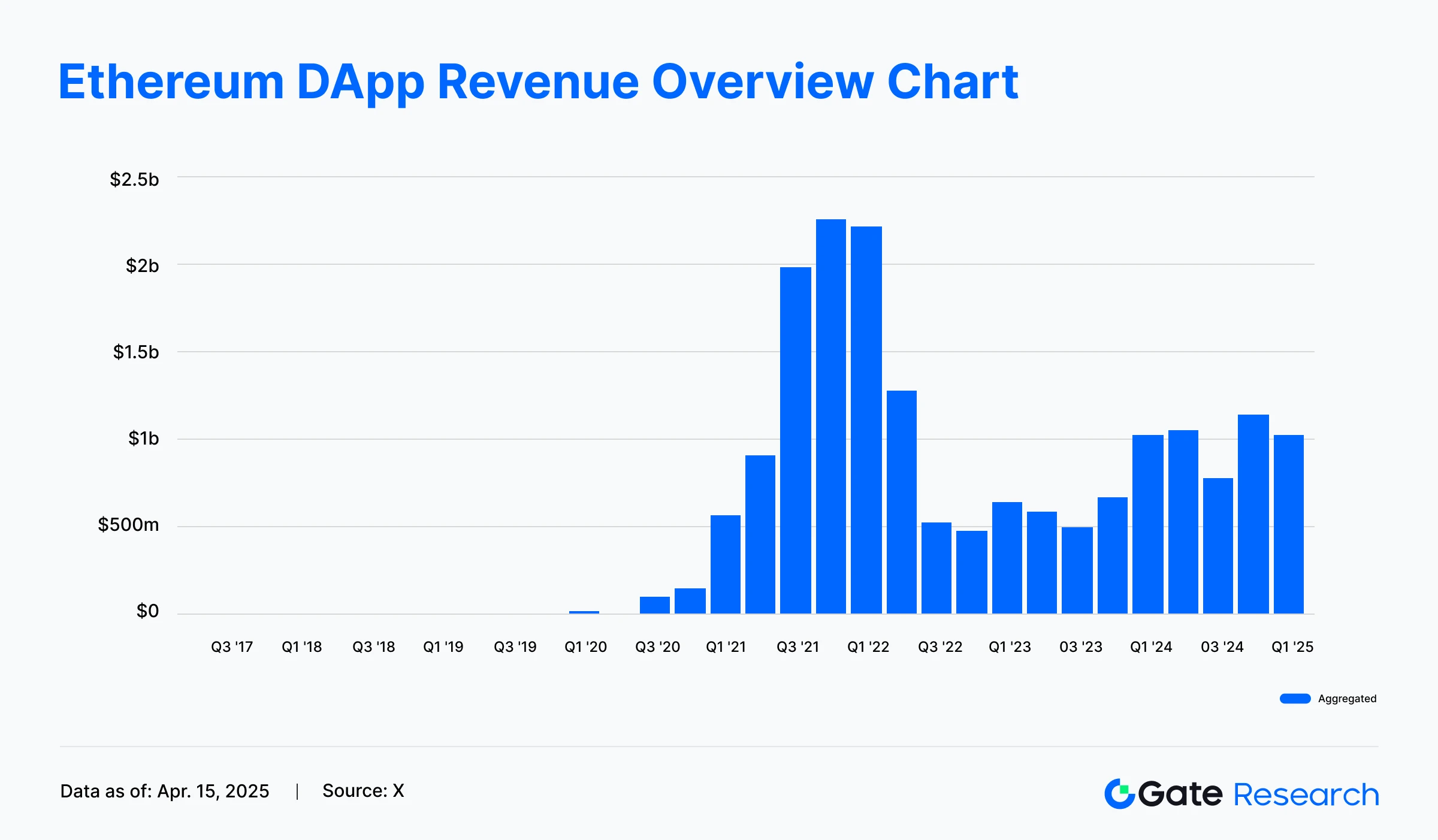

Ethereum dẫn đầu doanh thu dApp trong Quý 1 năm 2025 với hơn 1 tỷ đô la doanh thu

Theo dữ liệu từ Token Terminal, Ethereum đã duy trì sự ưu thế của mình trong các ứng dụng phi tập trung (dApps) trong quý 1 năm 2025, tạo ra tổng cộng 1.014 tỷ đô la Mỹ trong phí giao dịch - vượt xa tất cả các nền tảng blockchain khác.

Đứng sau là Mạng Layer 2 của Coinbase, Base, đã cho thấy sự tăng trưởng nhanh chóng nhưng vẫn đang đứng sau đáng kể với $193 triệu doanh thu từ dApp. BNB Chain và Arbitrum xếp thứ ba và thứ tư với lần lượt $170 triệu và $73.8 triệu. C-Chain của Avalanche đứng thứ năm với $27.68 triệu doanh thu.

Hiệu suất mạnh mẽ của Ethereum trong Q1 củng cố vai trò của nó là blockchain công cộng hàng đầu, thể hiện lợi ích của mạng lưới mạnh mẽ và hệ sinh thái phát triển. Trong khi các mạng Layer 2 mới nổi như Base đang phát triển nhanh chóng, khoảng cách doanh thu rộng lớn làm nổi bật ưu thế tiếp tục của Ethereum trong các giao dịch có giá trị cao và các kịch bản ứng dụng.

Phân tích Giao ngay

Canada sẽ ra mắt ETFs Solana Giao ngay đầu tiên tuần này, tính năng Staking được bao gồm

Canada sẽ ra mắt một số ETF Solana (SOL) giao ngay vào ngày 16 tháng 4 — đây là những sản phẩm đầu tiên trong loại hình này cung cấp việc gắn kết tiền điện tử để sinh lời. Những ETF này đã nhận được sự chấp thuận từ Ủy ban Chứng khoán Ontario (OSC), với các công ty quản lý tài sản như Purpose, Evolve, CI và 3iQ.

Không giống như khung pháp lý liên bang của Hoa Kỳ, việc giám sát chứng khoán của Canada được xử lý bởi các tỉnh và vùng lãnh thổ riêng lẻ. Sở giao dịch chứng khoán Toronto được quản lý bởi OSC. OSC tuyên bố rằng sự chấp thuận này dựa trên các sửa đổi quy định được ban hành vào tháng 1 năm 2024, cho phép các quỹ công nắm giữ và vận hành tài sản tiền điện tử, bao gồm cả việc đặt cọc chúng để kiếm thêm thu nhập. Trong khi tâm lý thị trường đối với các ETF altcoin có vẻ tích cực trên bề mặt, sự quan tâm thực tế của nhà đầu tư vẫn còn được nhìn thấy. Vào tháng 3 năm nay, công ty quản lý tài sản Mỹ Volatility Shares đã ra mắt quỹ ETF Solana dựa trên hợp đồng tương lai (SOLZ), nhưng đến giữa tháng 4, tài sản ròng của nó chỉ ở mức khoảng 5 triệu USD, phản ánh hiệu suất ảm đạm.

Việc Canada phê duyệt các ETF Solana giao ngay với chức năng staking tích hợp nhấn mạnh sự lãnh đạo của họ trong việc quy định tài sản tiền điện tử và đổi mới sản phẩm. Khác với Mỹ, nơi vẫn bị hạn chế chỉ là ETF dựa trên tương lai, bước đi của Canada mở rộng các lựa chọn đầu tư và cung cấp cho nhà đầu tư một nguồn thu nhập bổ sung. Trong khi các sản phẩm trước đó như SOLZ đã không đạt hiệu suất, việc bổ sung staking có thể trở thành yếu tố phân biệt chính thúc đẩy nhu cầu thực sự cho ETF altcoin.

JPMorgan ra mắt tài khoản tiền gửi Blockchain giao ngay được gắn với GBP để nâng cao khả năng thanh toán toàn cầu

Bộ phận blockchain của JPMorgan Kinexys (trước đây được biết đến với tên gọi Onyx) đã chính thức ra mắt các tài khoản tiền gửi dựa trên blockchain được định giá bằng đồng bảng Anh (GBP), cho phép khách hàng doanh nghiệp thực hiện thanh toán xuyên biên giới trong thời gian thực giữa GBP, EUR và USD, 24/7. Dịch vụ cũng hỗ trợ hoạt động vào cuối tuần và xử lý ngoại hối chậm, cải thiện tính thanh khoản và hiệu quả quản lý tiền mặt.

Các khách hàng ban đầu bao gồm SwapAgent của London Stock Exchange Group và công ty giao dịch hàng hóa Trafigura. Trafigura dự định sử dụng dịch vụ cho thanh toán thời gian thực trên khắp London, New York và Singapore, tận dụng các công cụ có thể lập trình để tự động hóa quản lý thanh khoản. Kể từ khi ra mắt vào năm 2019, Kinexys đã xử lý hơn 1,5 nghìn tỷ đô la trong tổng số giao dịch, với khối lượng hàng ngày đạt 2 tỷ đô la.

Với dịch vụ mới này, JPMorgan đang củng cố hệ thống cơ sở hạ tầng blockchain của mình trong lĩnh vực tài chính toàn cầu. Bằng việc hỗ trợ thanh toán xuyên biên giới ngay lập tức trong GBP, EUR và USD—bao gồm cả vào cuối tuần và ngoài giờ hành chính—dịch vụ này cải thiện đáng kể tính linh hoạt về thanh khoản cho các khách hàng tổ chức. Sự tham gia của các tổ chức lớn như LSEG và Trafigura là dấu hiệu của một bước tiến về phía tính thanh khoản cao hơn và tự động hóa, củng cố vai trò hàng đầu của Kinexys trong sự hội nhập giữa tài chính truyền thống và công nghệ blockchain.

EigenLayer để khởi chạy cơ chế cắt trên mainnet, nhắm mục tiêu các nút phá vỡ quy tắc

Giao ngay Ethereum’s restaking protocol EigenLayer đã thông báo rằng cơ chế cắt giảm của nó sẽ hoạt động trên mainnet vào ngày 17 tháng 4 năm 2025. Sự ra mắt này sẽ cho phép các Dịch vụ Xác minh Hoạt động (AVSs) xây dựng các ứng dụng phi tín nhiệm, phi tín nhiệm sử dụng EigenLayer trong khi tăng cường trách nhiệm cho các nhà điều hành và người cược.

Slashing là một cơ chế trừng phạt kinh tế thường được sử dụng trong các giao thức Proof-of-Stake (PoS) để trừng phạt các nút hoặc nhóm nút vi phạm các quy tắc giao thức. Cụ thể, nếu một nút tham gia vào hành vi độc hại có thể chứng minh được — như ký gửi hai lần hoặc thời gian chết máy kéo dài — tài sản được đặt cược của nó có thể bị tịch thu một phần hoặc toàn bộ. Việc giới thiệu slashing đánh dấu một bước tiến quan trọng trong sự tiến hóa của EigenLayer về mặt bảo mật và thiết kế động viên.

Việc kích hoạt cơ chế này được dự kiến sẽ tăng cường đáng kể tính bảo mật và đáng tin cậy của EigenLayer. Nó cũng có thể thu hút nhiều dự án AVS cấp tổ chức hơn để triển khai dịch vụ trên mạng, từ đó củng cố tính bền vững của hệ sinh thái restaking. Trong tương lai ngắn hạn, sự thay đổi này có thể thúc đẩy việc điều chỉnh chiến lược vận hành nút và thúc đẩy các nâng cấp kỹ thuật. Tổng thể, nó được định vị để phát triển thêm hệ sinh thái Ethereum về mặt bảo mật và sự cân đối động viên. Khi sự cân đối giữa lợi nhuận và rủi ro trở nên rõ ràng hơn, nhà đầu tư có thể áp dụng một cách tiếp cận cẩn thận hơn khi lựa chọn các nhà vận hành nút.

Tin tức vốn

Theo RootData, không có dự án nào công bố các vòng huy động vốn mới công khai trong vòng 24 giờ qua.[19]

Cơ hội nhận token miễn phí

Mint Blockchain

Mint Blockchain là một mạng lưới Layer 2 tập trung vào hệ sinh thái NFT. Xây dựng trên OP Stack, mục tiêu của nó là nâng cao trải nghiệm của việc tạo, giao dịch và quản lý NFT. Nền tảng được cấu trúc xung quanh ba module chính - MintID, GreenID và Mint Expedition - cung cấp xác thực danh tính, động lực dựa trên nhiệm vụ và theo dõi đóng góp của người dùng.

Hiện tại, Mint Blockchain đang tặng token $MINT riêng của mình thông qua airdrop. Airdrop chiếm 12% tổng cung cấp token (120 triệu token) và sẽ được phân phối cho người stake MintID, người sử dụng GreenID và những người tham gia Mint Expedition.

Cách tham gia:

1. Truy cập trang airdrop chính thức và kết nối ví của bạn để kiểm tra đủ điều kiện.

2. Lịch trình Đòi lại:

- Giai đoạn 1: 50% của airdrop có thể được yêu cầu tại Sự kiện Sinh ra Token (TGE).

- Giai đoạn 2: 25% mở khóa vào ngày 15 tháng 4 năm 2025.

- Giai đoạn 3: 25% còn lại sẽ được mở khóa vào ngày 31 tháng 5 năm 2025.

3. Người dùng có thể đòi lại token $MINT của họ trực tiếp hoặc chọn đặt cược chúng trong hệ sinh thái của nền tảng (ví dụ, để nhận phần thưởng đặt cược trong tương lai hoặc tính năng quản trị).

Lưu ý:

Kế hoạch và chi tiết tham gia airdrop có thể thay đổi bất cứ lúc nào. Người dùng được khuyến khích theo dõi các kênh chính thức của Mint Blockchain để cập nhật mới nhất. Việc tham gia nên được tiếp cận cẩn thận - hãy tìm hiểu kỹ và nhận thức về các rủi ro. Gate.io không đảm bảo việc phân phối airdrop trong tương lai.

Tham khảo:

- Gate.io,https://www.gate.io/trade/BTC_USDT

- Gate.https://www.gate.io/trade/ETH_USDT

- SoSoValue,https://sosovalue.xyz/assets/etf/us-btc-Spot

- SoSoValue,https://sosovalue.xyz/assets/etf/us-eth-Giao ngay

- CoinGecko,https://www.coingecko.com/en/categories

- Đầu tư,https://investing.com/indices/usa-indices

- Đầu tư,https://investing.com/currencies/xau-usd

- Gate.https://www.gate.io/bigdata

- Gate.io,https://www.gate.io/price

- X,https://x.com/vechainofficial/status/1911813884048007644

- X,https://x.com/AlchemyPay/status/1910637267649282103

- X,https://x.com/Alphaquark_/status/1910210362563289222

- Coinshares,https://blog.coinshares.com/volume-229-digital-asset-fund-flows-weekly-report-25662a68575a

- X,https://x.com/Matrixport_CN/status/1911700111580942672

- X,https://x.com/PANewsCN/status/1911947825090596910

- Cointelegraph,https://cointelegraph.com/news/Giao-ngay-Solana-ETFs-chuyên-nghiệp-phát-hành-tại-Canada-tuần-này

- Khối,https://www.theblock.co/post/350705/jpmorgan-gbp-blockchain-payments

- X,https://x.com/eigenlayer/status/1911923495673704782

- Roodata,https://www.rootdata.com/Fundraising

- X,https://x.com/MintFDN/status/1911689885804622207

Nghiên cứu Gate

Nghiên cứu Gate là một nền tảng nghiên cứu blockchain và tiền điện tử toàn diện cung cấp cho độc giả nội dung sâu rộng, bao gồm phân tích kỹ thuật, thông tin nóng hổi, đánh giá thị trường, nghiên cứu ngành, dự báo xu hướng và phân tích chính sách kinh tế toàn cầu.

Nhấn vàoLiên kếtđể biết thêm thông tin

Miễn trừ trách nhiệm

Việc đầu tư vào thị trường tiền điện tử mang lại rủi ro cao, và người dùng được khuyến khích thực hiện nghiên cứu độc lập và hiểu rõ bản chất của các tài sản và sản phẩm mà họ đang mua trước khi đưa ra bất kỳ quyết định đầu tư nào. Gate.io không chịu trách nhiệm về bất kỳ tổn thất hoặc thiệt hại nào do các quyết định đầu tư đó gây ra.

Bài viết liên quan

Cách thực hiện nghiên cứu của riêng bạn (DYOR)?

Cách đặt cược ETH?

Phân tích cơ bản là gì?

Phân tích kỹ thuật là gì?

Hướng dẫn giao dịch cho người mới bắt đầu