Cuộc chiến TradFi giữa Eastern HashKey Chain và Western Base dưới xu hướng tuân thủ quy định

Vào tháng 1 năm 2025, Coinbase và EY-Parthenon đã tiến hành khảo sát 352 người quyết định cấp bách tại các tổ chức. Kết quả rõ ràng: 83% số người tham gia khảo sát dự định tăng phân bổ tài sản tiền điện tử trong năm nay, và 59% dự định phân bổ hơn 5% tổng tài sản quản lý (AUM) cho tài sản tiền điện tử vào năm 2025.

Một tín hiệu mạnh mẽ đã nổi lên: với các quy định rõ ràng hơn và các trường hợp sử dụng rộng rãi hơn, sự tin tưởng của các tổ chức trong tài sản tiền điện tử đang tăng lên. Khi sự tham gia của các tổ chức đạt đến mức chưa từng có, năm 2025 đánh dấu một điểm quyết định quan trọng cho tài chính trên chuỗi.

Là cơ sở hạ tầng cơ bản cho sự biến đổi này, làm thế nào các chuỗi khối có thể hỗ trợ tốt hơn cho sự tiến hóa của tài chính trên chuỗi - hấp thụ vốn, người dùng và các công cụ tài chính phức tạp theo quy mô?

Đây là một cuộc thi thật sự về sức mạnh, và những người khổng lồ tiền điện tử đã sẵn sàng.

Ở phương Tây, chính sách ngày càng thân thiện với tiền điện tử của chính phủ Mỹ và sự hiện diện truyền thông của một tổng thống ủng hộ tiền điện tử đã đưa sự chú ý và lưu lượng chưa từng có đến ngành này. Là một trong những công ty tiền điện tử nổi bật nhất tại Hoa Kỳ, Coinbase không chỉ là một khách mời thường xuyên tại các Hội nghị Tài sản Kỹ thuật số của Nhà Trắng mà còn thúc đẩy sự phát triển nhanh chóng của tài chính onchain thông qua mạng lưới Layer 2 hiệu suất cao của mình, Base, tirợa sự hỗ trợ chính của stablecoin USDC tuân thủ.

Trong khi đó, ở phía Đông, một phong trào biểu tượng hóa tài chính đang âm thầm phát triển mạnh mẽ.

HashKey, nhóm tài chính tài sản kỹ thuật số hàng đầu Châu Á, đã chính thức ra mắt mainnet của chuỗi khối được xây dựng với mục đích cho tài chính và RWA của mình: Chuỗi HashKey. Mạng được thiết kế để an toàn, tuân thủ và hiệu quả, nhằm mở rộng DeFi và TradFi bằng cách cho phép mã hóa sản phẩm tài chính.

2025: Tài chính trên chuỗi sắp đến thời điểm bùng nổ

Lịch sử tài chính phản ánh sự tiến bộ của nền văn minh nhân loại - từ Ý thời Phục hưng sinh ra ngân hàng hiện đại, đến Wall Street phồn thịnh dưới chuẩn vàng sau Chiến tranh thế giới thứ hai. Mỗi bước nhảy trong đổi mới tài chính đều nhằm mục tiêu tạo điều kiện cho dòng vốn và phân bổ tài nguyên hiệu quả hơn.

Bây giờ, blockchain cung cấp bước nhảy tiếp theo. Với các tính chất phi tập trung, không cần phép màu, minh bạch và tiết kiệm vốn, nó hứa hẹn sẽ phá vỡ các hiệu suất kế thừa. Tài chính trên chuỗi có thể trở thành động cơ mới của sự di chuyển vốn, đưa chúng ta đến một tương lai tài chính hiệu quả, công bằng và bền vững hơn.

Và vào năm 2025, dưới tín hiệu quy định rõ ràng và sự quan tâm tăng của các tổ chức, ngành này sẵn sàng bùng nổ.

Vào tháng 1 năm 2024, chúng tôi chứng kiến sự phê duyệt lịch sử của các quỹ ETF Bitcoin. Sự kiện địa danh này đã loại bỏ sự phức tạp và rào cản kỹ thuật của việc mua, lưu trữ và quản lý Bitcoin trực tiếp, mở cửa cho việc thông dụng rộng rãi và thu hút một làn sóng vốn hóa tự doanh.

Theo dữ liệu từ Coinglass, tổng giá trị tài sản ròng (NAV) của các quỹ ETF Bitcoin trên chốt hiện đang ở mức khoảng 100 tỷ đô la. Trong số đó, IBIT của BlackRock nắm giữ khoảng 46,3 tỷ đô la, FBTC của Fidelity nắm giữ 16,2 tỷ đô la, và GBTC của Grayscale nắm giữ khoảng 15,8 tỷ đô la.

Vượt ra ngoài ETF, một số lĩnh vực liên quan đến tài chính trên chuỗi khối như RWA (Tài sản Thế giới Thực) và stablecoin đã trải qua sự tăng trưởng bùng nổ, xây dựng những cây cầu quan trọng giữa tài chính truyền thống và trên chuỗi khối.

Vào năm 2024, ngành RWA trải qua một đợt bùng nổ, với tổng giá trị vượt qua 19 tỷ đô la (không tính stablecoins), đánh dấu mức tăng trưởng so với cùng kỳ năm trước là hơn 85%. Tín dụng được mã hóa, trái phiếu chính phủ và bất động sản đã nổi lên như những người đẩy chính.

Trong khi đó, dữ liệu từ Coinglass cho thấy khối lượng giao dịch stablecoin vào năm 2024 đã vượt qua 8,3 nghìn tỷ đô la, với tổng vốn hóa thị trường hơn 210 tỷ đô la. Các ông lớn truyền thống như Stripe, PayPal, và thậm chí cả SpaceX cũng đã tham gia vào lĩnh vực stablecoin.

Cùng lúc đó, chiến thắng của Donald Trump trong cuộc bầu cử Tổng thống Mỹ vào tháng 11 năm 2024 đã tạo ra kỳ vọng tăng cao về một môi trường quản lý thuận lợi đối với tiền điện tử và một làn sóng tài chính trên chuỗi.

Ngay cả trước khi nhậm chức, Trump đã làm rõ quan điểm ủng hộ tiền điện tử của mình - phát biểu chính tại Bitcoin 2024 và truyền cảm hứng cho sự tăng vọt phi thường của đồng tiền mã $TRUMP.

Chỉ hai tháng sau khi nhậm chức, đã có hơn mười chính sách ủng hộ tiền điện tử được ký kết, bao gồm một sắc lệnh điều hành mang tên “Nâng cao Vai trò Lãnh đạo của Hoa Kỳ trong Công nghệ Tài chính Kỹ thuật Số,” việc bãi bỏ quy định môi giới DeFi của Cục Thuế Liên bang, và việc chỉ định BTC, ETH, XRP, SOL và ADA làm dự trữ tiền điện tử chiến lược. Đồng thời, Ủy ban giao dịch Chứng khoán (SEC) đã thành lập một đội nhiệm vụ chuyên biệt về tiền điện tử và rút lại các vụ kiện chống lại một số công ty blockchain.

Dưới bảng kêu gọi “Make America Great Again,” rõ ràng hơn và hơn rằng tiền điện tử đang được định vị như một công cụ để củng cố vai trò của Mỹ là trái tim đập của tài chính toàn cầu.

Hơn nữa, sự chuyển đổi thân thiện với tiền điện tử của Mỹ không xảy ra độc lập.

Với tài chính trên chuỗi ngày càng thu hút sự chú ý toàn cầu và các cơ quan quản lý trên thế giới đang bị ép buộc phải phản ứng, khuôn khổ của Mỹ đang sẵn sàng trở thành một điểm tham khảo — có thể kích hoạt các động thái theo sau ở các khu vực và thúc đẩy việc tạo ra các tiêu chuẩn quản lý toàn cầu rõ ràng hơn. Tại châu Âu, quy định MiCA (Thị trường trong Tài sản Mật mã) đã chính thức có hiệu lực, cung cấp môi trường có cấu trúc và được mã hoá cho việc phát triển tiền mật mã trên các quốc gia EU.

So với thế giới phương Tây do Mỹ dẫn đầu, các khu vực Đông đã thể hiện sự cạnh tranh gay gắt hơn trong việc đẩy mạnh sự rõ ràng về quy định và đảm bảo một vị thế vững chắc trong tài chính trên chuỗi.

Các quốc gia và khu vực như Hồng Kông, Hàn Quốc, Nhật Bản, Singapore, Thái Lan, Ấn Độ và Dubai đều đã triển khai chính sách để hướng dẫn phát triển tiền điện tử, trong đó Hồng Kông đang đóng vai trò hàng đầu. Gần đây, Ủy ban Chứng khoán và Tương lai Hồng Kông (SFC) đã phát hành một lộ trình 12 điểm được đặt tên là “A-S-P-I-Re” để thu hút thêm các nhà đầu tư tổ chức vào thị trường tài sản ảo.

Nếu hiệu suất lưu thông vốn trên chuỗi là điểm hấp dẫn ban đầu để tài chính truyền thống chuyển sang chuỗi, thì sự quy định rõ ràng, minh bạch và bao dung chính là chìa khóa để loại bỏ sự do dự của các tổ chức, mở đường cho các chiến lược táo bạo hơn đối với tích hợp trên chuỗi.

Xu hướng này đã rõ ràng: Ở mặt trận phía Tây, các ông lớn tài chính như JPMorgan, Goldman Sachs, BlackRock và MicroStrategy đã thực hiện những bước đi cụ thể vào blockchain. Trong khi đó, ở phía Đông, những người chơi lớn như Sony, Samsung và HSBC cũng đang tích cực tham gia cuộc chiến.

Một chỉ báo mạnh mẽ khác về xu hướng này là sự tăng mạnh về các đơn đăng ký ETF. Nhiều tổ chức đã nộp hồ sơ cho SEC để ETFs liên quan đến các mã thông báo như Ripple (XRP), Solana (SOL), Litecoin (LTC), Cardano (ADA), Hedera (HBAR), Polkadot (DOT) và Dogecoin (DOGE).

Khi các tổ chức mang theo vốn và người dùng hơn, năm 2025 đang hình thành thành một điểm quay quan trọng cho tài chính trên chuỗi.

Câu hỏi then chốt bây giờ là: làm thế nào các nền tảng có thể trở thành những người chơi chiến lược tại bàn tài chính on-chain?

Lời giải đáp nằm ở việc vận dụng cả sự phối hợp bên ngoài và khả năng nội tại:

Bên ngoài: Chào đón sự tuân thủ. Quy định sẽ trở thành tiêu chuẩn cốt lõi cho sự tham gia cơ sở tài chính trên chuỗi của các tổ chức. Điều chỉnh một cách tích cực với cơ quan quản lý sẽ giúp giảm bớt lo ngại của các tổ chức và tạo ra một môi trường phát triển lành mạnh, ổn định hơn.

Nội bộ: Nâng cấp cơ sở hạ tầng. Việc cải tiến liên tục về tốc độ giao dịch, hiệu quả chi phí, trải nghiệm người dùng và bảo mật sẽ nâng cao vai trò của blockchain như là cơ sở hạ tầng tài chính mạnh mẽ, có khả năng xử lý các luồng quy mô cơ quan.

Với hai con đường này, hiện nay đối thủ chính đang thể hiện như thế nào?

Sự tuân thủ: Sự Gặp Gỡ Giữa Đông và Tây - Người Có Kiến Thức Rõ Về Nhà Trắng So Với Đội Tiên Phong Quản Lý Ở Hồng Kông

Coinbase ở phương Tây, HashKey ở phương Đông.

Bức phân tích phổ biến này trong cộng đồng tiền điện tử không chỉ xuất phát từ các đế chế kinh doanh mở rộ của họ mà còn từ cam kết chung của họ đối với sự tuân thủ quy định và các quỹ đạo tương tự nổi bật.

Là công ty tiền điện tử đầu tiên niêm yết công khai tại Hoa Kỳ, Coinbase đã từng bước đảm bảo được giấy phép chuyển tiền cho các tiểu bang khác nhau, cùng với sự chấp thuận quy định để hoạt động tại các khu vực như Vương quốc Anh, Liên minh châu Âu, Singapore và Nhật Bản.

Mặc dù con đường của nó đã trải qua sóng gió - đặc biệt là do sự giám sát liên tục từ SEC - Coinbase hiện đang trải qua bầu trời trong xanh hơn dưới một chính phủ ủng hộ tiền điện tử. Sau khi bị từ chối đơn kiện của SEC, và với sự trở lại của Trump trên đài chính trị, Coinbase đã thấy mình trong một môi trường quản lý thuận lợi hơn.

Tại Hội nghị Tài sản kỹ thuật số tại Nhà Trắng lần đầu tiên, Giám đốc điều hành Coinbase Brian Armstrong ngồi cách Trump chỉ ba ghế - một sự gợi ý tượng trưng về vai trò trung tâm của công ty. Trong cuộc phỏng vấn truyền thông, Armstrong thể hiện sẵn sàng của Coinbase để phục vụ như một người giám hộ cho dự trữ tiền điện tử quốc gia, tiết lộ rằng sàn giao dịch này đã làm việc với các bộ phận chính phủ về việc giữ và giao dịch tài sản. Hơn nữa, Coinbase đang tích cực tương tác với các nhà lập pháp để đẩy nhanh quá trình lập pháp xung quanh stablecoins và cải cách cơ cấu thị trường.

Trên mặt trận phía Đông, HashKey có trụ sở tại Hong Kong đã trở thành một nhà tuân thủ nổi bật trong mắt nhiều thành viên cộng đồng.

Hồng Kông, trước đây là một trong “Bốn con Rồng Nhỏ của châu Á,” sở hữu những lợi thế địa lý và chiến lược không ai sánh kịp, đóng vai trò như một cây cầu nối giữa Trung Quốc, Nhật Bản, Hàn Quốc và Đông Nam Á. Với cơ sở hạ tầng tài chính chín chắn, hệ sinh thái sáng tạo sôi động và nguồn nhân tài sâu rộng bao gồm tài chính, công nghệ và pháp luật, thành phố vẫn luôn là trung tâm tài chính hàng đầu tại khu vực châu Á-Thái Bình Dương.

Đất màu mỡ này đã từng sinh ra các tổ chức tiền điện tử lớn như FTX, Amber Group, Crypto.com và BitMEX. Theo một báo cáo từ InvestHK, hiện có hơn 1.100 công ty fintech hoạt động tại Hong Kong, bao gồm 175 công ty ứng dụng blockchain và 111 công ty tài sản kỹ thuật số.

Năm 2023, Hồng Kông đã củng cố thêm hoài bão về blockchain bằng việc ưu tiên ngành này trong chính sách nghị quyết của mình. Với việc giới thiệu rẹgime cấp phép cho các Nhà cung cấp Dịch vụ Tài sản Ảo (VASP), cũng như các sáng kiến mở cửa ETFs và quỹ đầu tư tiền điện tử cho nhà đầu tư bán lẻ, Hồng Kông đang định vị chính mình là trung tâm toàn cầu cho sự đổi mới tài chính trên chuỗi.

Là một trong những công ty đầu tiên xin và nhận được giấy phép VASP, HashKey đã là một lực lượng đẩy mạnh đằng sau sự biến đổi này. Hiện tại, công ty này đang giữ các giấy phép Loại 1, Loại 4 và Loại 9 từ Ủy ban Chứng khoán và Tương lai (SFC), mở rộng phạm vi tuân thủ và khả năng phục vụ dưới sự giám sát chính thức.

Chỉ trong một năm, HashKey đã tăng tốc chiến lược tuân thủ toàn cầu của mình, đảm bảo được sự chấp thuận của các cơ quan quản lý lớn tại các lãnh thổ chính:

- Một Giấy phép Tổ chức Thanh toán Chính từ Cơ quan Quản lý Tiền tệ Singapore (MAS)

- Một giấy phép sàn giao dịch tiền điện tử tại Nhật Bản

- Một giấy phép lớp F từ Cơ quan Tiền tệ Bermuda (BMA)

- Một Sự Phê Duyệt Nguyên Tắc (IPA) cho một giấy phép VASP từ Cơ quan Quản lý Tài sản Ảo của Dubai (VARA)

Nhìn vào tương lai, Nhóm HashKey đã cam kết mở rộng danh mục giấy phép toàn cầu của mình trong vòng năm năm tới, với mục tiêu mở rộng được đặt tại Trung Đông và Châu Âu.

Blockchain độc quyền của họ, HashKey Chain, được xây dựng đặc biệt cho tài chính trên chuỗi và tài sản thế giới thực (RWA), sẽ tiếp tục mang theo DNA tuân thủ hàng đầu của mình. Chuỗi này được thiết kế để là một giải pháp toàn diện nối kết Web2 và Web3 thông qua cơ sở hạ tầng tuân thủ quy định.

Lợi thế về quy định này đang dịch thành đà tăng trưởng kinh doanh mạnh mẽ—đặc biệt là trong việc áp dụng cơ sở chuyên nghiệp:

Vào năm 2024, HashKey đã ra mắt Bosera HashKey BTC ETF và Bosera HashKey ETH ETF, và thiết lập các đối tác chặt chẽ với các tổ chức tài chính lớn như Futu Securities, Tiger Brokers, Quản lý tài sản Quốc tế Cinda và Ngân hàng ZA.

Nền tảng hiện có hơn 250.000 người dùng, với hơn 4,5 tỷ HKD được gửi tiền trên chuỗi và hơn 500 tỷ HKD trong khối lượng giao dịch tích luỹ.

Ngoài việc tập trung chung vào sự tuân thủ quy định, blockchain chính là cơ sở hạ tầng cơ bản cho tài chính onchain. Khi cả Coinbase và HashKey đều đã ra mắt các giải pháp Layer 2 riêng của họ như một phần của các nhóm quản lý tài sản tiền điện tử, việc chú ý dần chuyển sang Base và HashKey Chain là điều hoàn toàn tự nhiên.

Cơ sở hạ tầng tài chính On-Chain: Cuộc chiến kéo co giữa Stablecoins Tuân thủ và Sản phẩm Tài chính Tokenized

Chúng ta có thể quan sát nhiều điểm tương đồng giữa Base và HashKey Chain.

Cả hai đều đang trỗi dậy như là các lớp nền tảng thế hệ tiếp theo cho tài chính trên chuỗi, ưu tiên tối ưu hóa hiệu suất để phục vụ tốt hơn cho vốn lớn và hoạt động của người dùng quy mô lớn.

Base ra mắt mainnet vào năm 2023 và nhanh chóng trở thành một trong những L2 nổi bật nhất trong thời gian chưa đầy hai năm. Theo dữ liệu từ Artemis, Base đã ghi nhận một lưu lượng vốn ròng vượt quá 2,5 tỷ đô la vào Q4 2024, với một trung bình 11,1 triệu giao dịch hàng ngày. Trở lên mạnh mẽ trong bối cảnh bùng nổ token AI Agent và meme vào năm 2024, Base đã thể hiện sức mạnh thu hút vốn mạnh mẽ và khả năng xử lý cao để hỗ trợ các tương tác trên chuỗi thường xuyên từ một cơ sở người dùng lớn.

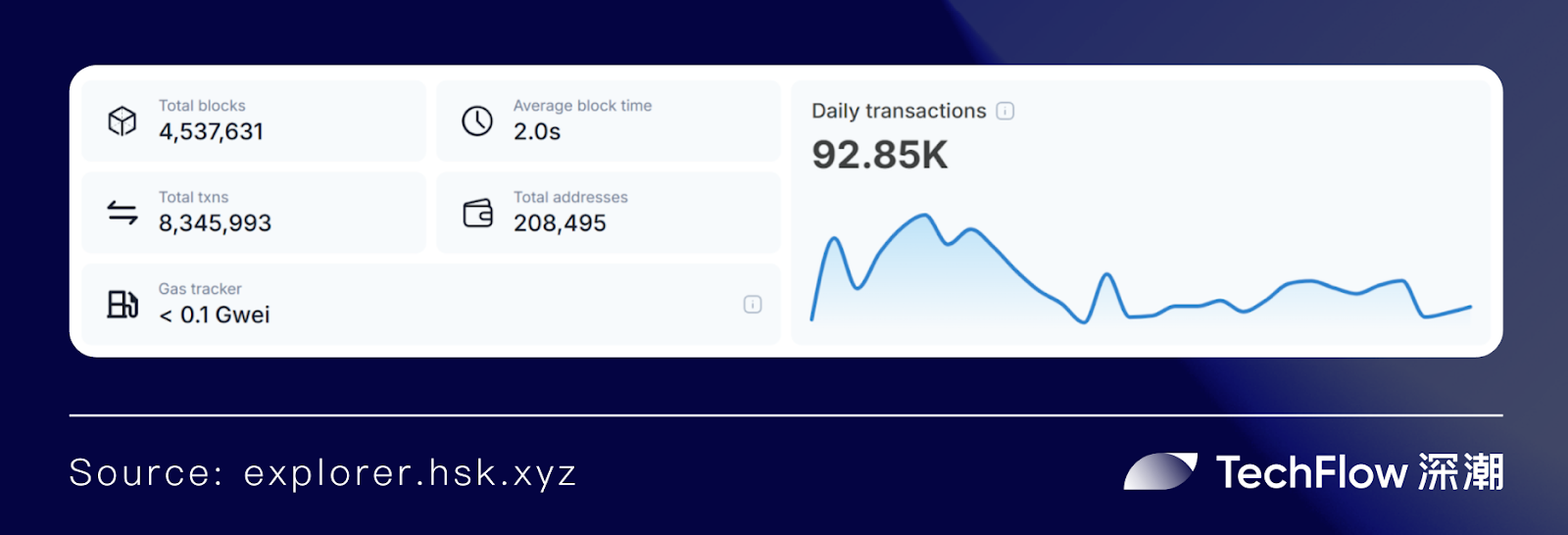

So với đó, HashKey Chain chỉ mới hoạt động được hơn hai tháng, nhưng cả hai chỉ số trên chuỗi tăng nhanh và các tính năng tập trung vào tổ chức của nó nhấn mạnh sự quyết tâm trở thành blockchain hàng đầu cho tài chính và Tài sản Thế giới Thực (RWAs).

Xây dựng như một Ethereum Layer 2 trên OP Stack, HashKey Chain cung cấp khả năng tương thích với EVM, công suất cao và khả năng mở rộng mạnh mẽ. Dữ liệu công khai cho thấy nó tự hào với thời gian khối trung bình 2 giây, phí gas thấp như 0.1 Gwei, và TPS lên đến 400—mang lại trải nghiệm người dùng hiệu suất cao cho các tương tác tài chính on-chain.

Trong giai đoạn testnet của mình, HashKey Chain đã xử lý hơn 25,8 triệu giao dịch, đăng ký hơn 870.000 địa chỉ ví và thu hút hơn 300.000 thành viên cộng đồng. Kể từ khi ra mắt mainnet, nó đã vượt qua 8,34 triệu giao dịch và 208.000 địa chỉ ví, theo dữ liệu từ hashkey.blockscout.

Đối với các tổ chức quản lý số lượng vốn lớn, an ninh là rất quan trọng—và HashKey Chain được xây dựng với điều này trong tâm trí:

Cơ chế “Smart Escape Pod” của nó đồng bộ hóa các bản chụp trạng thái cây Merkle đến Layer 1 tại các khoảng cố định, cung cấp sự an toàn tài sản tối đa.

Trong khi đó, một cấu trúc quản trị DAO đa tầng cung cấp sự củng cố cho điều này—nơi một DAO Hội đồng An ninh được giao nhiệm vụ phản ứng nhanh chóng đối với các mối đe dọa, và một DAO Kiểm toán Kỹ thuật tập trung vào phân tích sâu và xác minh, nâng cao bảo mật tổng thể của giao thức.

HashKey Chain cũng hợp tác với Chainlink để tăng cường khả năng giao tiếp qua chuỗi. Chainlink CCIP (Cross-Chain Interoperability Protocol) phục vụ như cơ sở hạ tầng giao tiếp qua chuỗi tiêu chuẩn, giảm thiểu các lỗ hổng phổ biến như double-spending và cuộc tấn công reentrancy. Ngoài ra, Chainlink Data Streams cung cấp dữ liệu thị trường thời gian thực, thấp độ trễ, chống thay đổi—cho phép sáng tạo trong giao dịch tần suất cao và sản phẩm phái sinh trên HashKey Chain.

Tất nhiên, trong cuộc chạy đua vũ trang của cơ sở hạ tầng blockchain công cộng, hiệu suất chỉ là một nửa câu chuyện. Phát triển hệ sinh thái - “sức mạnh mềm” - cũng quan trọng không kém.

Trong bối cảnh này, cả Base và HashKey Chain đều đang vị trí để nắm bắt cơ hội tài chính trên chuỗi vào năm 2025, mặc dù với các điểm vào hệ sinh thái khác nhau.

Base đang tăng cường về stablecoin tuân thủ, đặc biệt là USDC.

Mối quan hệ của Base với stablecoin tuân thủ ngày trở về năm 2018, khi Circle và Coinbase cùng phát hành USDC - stablecoin đầu tiên được hỗ trợ bởi một sàn giao dịch tập trung. Với sự tuân thủ quy định là một lợi thế cốt lõi, Circle sở hữu giấy phép đầy đủ tại Hoa Kỳ, Vương quốc Anh và Liên minh châu Âu, và vào tháng 7 năm 2023, đã được ủy quyền phát hành USDC và EURC dưới khung pháp lý MiCA. Gần đây nhất, Circle đã nộp đơn S-1 với SEC Hoa Kỳ để đề xuất IPO.

Các loại stablecoin tuân thủ như USDC không chỉ phục vụ như một phương tiện trao đổi ổn định mà còn cung cấp một cầu nối được quy định cho việc chuyển đổi tài sản nhanh chóng và thanh khoản - mở đường cho tài chính truyền thống chuyển sang chuỗi khối một cách tuân thủ.

Bằng việc cố định vào USDC, Base không chỉ xây dựng một lớp tài chính trên chuỗi mạnh mẽ mà còn thúc đẩy sự đổi mới trong các lĩnh vực như thanh toán và RWAs. Hệ sinh thái Base đã tạo ra một số ứng dụng thanh toán stablecoin bản địa như Peanut và LlamaPay.

Mặt khác, HashKey Chain tận dụng quan hệ đối tác thể chế của mình để tập trung vào việc mã hóa các sản phẩm tài chính, nhằm mục đích trở thành chuỗi hàng đầu cho tài chính và RWA.

Các tổ chức quản lý tài sản và cơ sở người dùng khổng lồ. Sự tham gia của họ mang lại cả luồng vốn và sự chấp nhận người dùng mới — những yếu tố chính để phát triển và mở rộng tài chính on-chain. HashKey Chain cố gắng loại bỏ các rào cản kỹ thuật và quy định cho các tổ chức thông qua các giải pháp token hóa hiệu quả và tuân thủ.

Một trường hợp nổi bật là việc triển khai thành công của quỹ thị trường tiền tệ USD được mã hóa ‘CPIC Estable MMF’ trên HashKey Chain, do bộ phận quản lý tài sản của Bảo hiểm Thái Bình Dương Trung Quốc triển khai tại Hong Kong. Điều này chứng minh rằng việc mã hóa sản phẩm tài chính là trung tâm của sứ mệnh của HashKey Chain để trở thành nền tảng hàng đầu cho tài chính và RWAs.

Đối với các tổ chức, HashKey Chain cung cấp cơ sở hạ tầng tuân thủ pháp lý, an toàn và hiệu suất với chi phí thấp và một hệ sinh thái DeFi phát triển mạnh mẽ - giảm ngưỡng cho triển khai sản phẩm tài chính on-chain. Kết quả là, CPIC Estable MMF trở thành một công cụ phân bổ tài sản kỹ thuật số mạnh mẽ, cho phép quản lý quỹ minh bạch, hiệu quả và chính xác trên chuỗi.

Đối với người dùng DeFi, việc token hóa theo hình thức tổ chức mang lại tài sản tạo ra lợi suất chất lượng cao cho hệ sinh thái—mang đến cơ hội sinh lợi đa dạng.

Và đối với tài chính trên chuỗi nói chung, sự hiện diện ngày càng tăng của tài sản cấp tổ chức trên HashKey Chain đẩy nhanh sự hội tụ giữa tài chính truyền thống và phi tập trung, đặt tài chính trên chuỗi là một trụ cột quan trọng của hệ thống tài chính toàn cầu.

Theo HashKey, CPIC Estable MMF vượt mức 100 triệu đô la trong ngày đầu tiên - nhấn mạnh nhu cầu thị trường cực kỳ lớn cho việc biến đổi tài sản cơ sở của tổ chức. Khi chuỗi HashKey đang verd nhanh hợp tác cơ sở của tổ chức, nó đang trở thành nền tảng lựa chọn cho các sản phẩm tài chính được mã hóa như trái phiếu, quỹ và stablecoin - thúc đẩy sự tăng trưởng mũi nhọn cả trong tài chính trên chuỗi và sự áp dụng RWA.

Hai con đường, mỗi con đều có điểm mạnh riêng, nhưng lại được đoàn kết bởi một tầm nhìn chung - kích thích sự bùng nổ trong tài chính on-chain. Base và HashKey Chain đã đạt được những bước tiến quan trọng trong hướng đã chọn của họ.

Tuy nhiên, vì tài chính trên chuỗi vẫn còn ở giai đoạn đầu của nó, bài kiểm tra thực sự nằm ở việc phát triển tích hợp sâu hơn với thế giới thực—kết hợp cơ sở hạ tầng trên chuỗi với các trường hợp sử dụng tài chính ngoại chuỗi. Cần có một cái nhìn chiều dài hơn và có thể định hướng 2025 vừa được phát hành sẽ cung cấp nhiều gợi ý hơn về những gì phía trước.

Chiến lược Đa chiều: Tiếp nhận Kỷ nguyên Vàng của Tài chính On-Chain

Lộ trình đường sắt năm 2025 của Base đặt ra một hướng tiếp cận song song rõ ràng: một tập trung vào công nghệ, và một tập trung vào sự phát triển của hệ sinh thái.

Trên mặt kỹ thuật, Base đang ưu tiên phát triển OnchainKit, Paymaster và Layer 3 (L3) để nâng cao trải nghiệm người dùng.

Về mặt hệ sinh thái, Base nhằm tích hợp hơn 25 lối vào tiền tệ, thuê được 25 triệu người dùng và 25.000 nhà phát triển, và đạt được 100 tỷ đô la trong tài sản trên chuỗi trong năm nay.

Khác với những hoài bão dựa trên dữ liệu của Base, lộ trình đến năm 2025 của HashKey Chain tập trung vào BTCFi, PayFi, RWA và stablecoin. Với việc tập trung rõ ràng vào tài chính trên chuỗi cấp độ tổ chức, HashKey Chain đề ra các sáng kiến cụ thể để mở rộng cơ sở nhà phát triển của mình, thu hút dòng vốn với quy mô lớn và xây dựng cơ sở hạ tầng tuân thủ, hướng tới tài chính.

Một sáng kiến lớn sắp tới là HashKey BTC (HBTC) — một tài sản BTC bọc bởi HashKey Chain:

Nhắm vào thị trường BTCFi triệu tỷ đô la, HBTC được thiết kế để cung cấp cho người dùng lợi suất on-chain an toàn, tuân thủ và bền vững, bao gồm lợi suất cho vay, khai thác thanh khoản, phần thưởng restaking và điểm HashKey.

Trong khi đó, tiếp tục giữ vững tầm nhìn trở thành “blockchain cho tài chính và RWAs,” HashKey Chain tiếp tục mở rộng sự hiện diện trong việc token hóa tài sản thế giới thực:

Trước đây, Nhóm HashKey đã hợp tác với Công ty Cinda International để phát hành STBL, đó là ST (chứng khoán bảo đảm) đầu tiên do một cơ quan tài chính Hong Kong có giấy phép phát hành. STBL được bảo đảm bằng một danh mục các quỹ thị trường tiền tệ (MMFs) được xếp hạng AAA, mỗi token được gắn với 1 USD. Có thể chuyển nhượng 24/7, STBL sẽ phân phối lãi suất tích luỹ hàng tháng dưới dạng token mới được phát hành trực tiếp vào ví của các nhà đầu tư. Cùng nhìn vào tương lai, việc phát hành STBL sẽ mở rộng ra Mạng lưới HashKey.

Ngoài MMFs, HashKey Chain cũng dự định mã hóa tài sản truyền thống như bất động sản, hàng hoá và nghệ thuật tinh tế — mở khóa thanh khoản và tăng cường sự minh bạch trên thị trường.

Quan trọng hơn, một loại tiền ổn định bám chặt vào HKD được hỗ trợ bởi sự hợp tác chặt chẽ với các tổ chức cơ sở đang được phát triển:

Sàn giao dịch HashKey đã hợp tác với các đối tác như Công nghệ RD và Allinpay International. Đồng stablecoin HKD sẽ sớm ra mắt trên HashKey Chain, tạo nền tảng cho một hệ sinh thái dựa trên stablecoin hỗ trợ thanh toán xuyên biên giới và giải pháp DeFi - tăng tốc quá trình chuyển đổi trên chuỗi của tài chính toàn cầu.

Trên phía phát triển, cam kết của HashKey Chain trong việc xây dựng một hệ sinh thái tài chính trên chuỗi phát triển mạnh mẽ được phản ánh trong một loạt các chương trình khuyến khích:

Khi ra mắt mainnet, HashKey Chain đã công bố Chương trình tài trợ Atlas trị giá 50 triệu đô la, nhằm tăng cường sức mạnh cho các dự án Web3 tiềm năng cao và thúc đẩy sự phát triển vượt bậc trong số người dùng và ứng dụng. Giai đoạn I kết thúc vào ngày 20 tháng 1 năm 2025, với các Giai đoạn II-V sẽ được triển khai trong Q2, Q3 và Q4 của năm đó.

Bổ sung vào đó, một loạt các HashKey Hacker Houses và Hackathons sẽ sớm được khởi đầu tại các thành phố chính như Hàn Quốc, Đài Loan, Nhật Bản và Thái Lan — cung cấp cho các nhà phát triển quyền truy cập trực tiếp vào nhóm chính của HashKey Chain, tài nguyên và hỗ trợ.

Từ việc tuân thủ đến tận dụng các câu chuyện then chốt như BTCFi, RWA và stablecoins, HashKey Chain đang nổi lên như một lực lượng then chốt nối liền tài chính truyền thống và trên chuỗi.

Một bên, chúng ta có Coinbase và mạng lưới Layer 2 hiệu suất cao Base của họ; mặt khác, HashKey với chuỗi blockchain HashKey đầu tiên với RWA của họ. Cả hai đều đang đẩy mạnh chương trình tài chính trên chuỗi theo cách của riêng họ. Sự động viên Đông gặp Tây này không chỉ thể hiện sự đa dạng của các con đường trong tài chính trên chuỗi, mà còn tín hiệu về một sự chuyển đổi sâu hơn, toàn cầu trong cơ sở hạ tầng tài chính.

Như cộng đồng nói:

Coinbase ở phương Tây, HashKey ở phương Đông

Cơ sở ở phía Tây, Chuỗi HashKey ở phía Đông

Trong một thời đại mà sự rõ ràng về quy định và sự áp dụng cơ sở hạ tầng gần như không thể tránh khỏi, có lẽ điều quan trọng không phải là cạnh tranh mà là sự cùng tạo ra cùng nhau.

Với San Francisco và Hong Kong là hai trung tâm song sinh, và với hệ sinh thái stablecoin sẵn sàng tuân thủ của Base và ngăn xếp tài chính mã hóa cấp cơ sở của HashKey Chain, chúng ta có thể đang bước vào một thời đại vàng - một thời đại mà cả Base và HashKey Chain hoạt động cùng nhau để định hình một trật tự tài chính trên chuỗi mới, toàn cầu.

Miễn trừ trách nhiệm:

- Bài viết này được tái bản từ [ TechFlow], and bản quyền thuộc về tác giả ban đầu [TechFlow]. Nếu bạn có bất kỳ ý kiến nào về việc tái in, vui lòng liên hệ với Cổng Họcđội, và đội sẽ xử lý nó càng sớm càng tốt theo các thủ tục liên quan.

- Tuyên bố từ chối trách nhiệm: Các quan điểm và ý kiến được thể hiện trong bài viết này chỉ đại diện cho quan điểm cá nhân của tác giả và không cung cấp bất kỳ lời khuyên đầu tư nào.

- Các phiên bản ngôn ngữ khác của bài viết được dịch bởi nhóm Gate Learn và không được đề cập trong Gate.com, bài viết dịch có thể không được sao chép, phân phối hoặc đạo văn.

Bài viết liên quan

Tronscan là gì và Bạn có thể sử dụng nó như thế nào vào năm 2025?

Coti là gì? Tất cả những gì bạn cần biết về COTI

Stablecoin là gì?

Mọi thứ bạn cần biết về Blockchain

HODL là gì