Satoshitalks

No content yet

Satoshitalks

🚨 JUST IN: X is set to launch “Smart Cashtags” in the coming weeks.

Users will reportedly be able to trade stocks and crypto directly from the timeline.

Social media → Trading terminal.

The lines keep blurring.

Big move for fintech.

Users will reportedly be able to trade stocks and crypto directly from the timeline.

Social media → Trading terminal.

The lines keep blurring.

Big move for fintech.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Bitcoin Price on Valentine’s Day

2011: $1

2012: $5

2013: $20

2014: $600

2015: $300

2016: $450

2017: $1,200

2018: $10,000

2019: $3,631

2020: $10,000

2021: $45,000

2022: $42,500

2023: $22,000

2024: $75,000

2025: $95,000

2026: $70,000

2011: $1

2012: $5

2013: $20

2014: $600

2015: $300

2016: $450

2017: $1,200

2018: $10,000

2019: $3,631

2020: $10,000

2021: $45,000

2022: $42,500

2023: $22,000

2024: $75,000

2025: $95,000

2026: $70,000

BTC0,84%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: U.S. CPI comes in +2.4% YoY (vs. +2.5% expected).

Core CPI: +2.5% YoY (in line).

Takeaways:

Headline inflation slightly cooler

Core remains sticky

Fed path still data-dependent

Core CPI: +2.5% YoY (in line).

Takeaways:

Headline inflation slightly cooler

Core remains sticky

Fed path still data-dependent

- Reward

- like

- Comment

- Repost

- Share

🚨 Ledger co-founder incident (Jan 2025):

• David Balland and his partner abducted from their home

• Attackers demanded €10M

• Police rescued them after two days

A disturbing reminder of the personal security risks tied to crypto wealth.

• David Balland and his partner abducted from their home

• Attackers demanded €10M

• Police rescued them after two days

A disturbing reminder of the personal security risks tied to crypto wealth.

- Reward

- like

- Comment

- Repost

- Share

GM!

Happy Friday everyone

Happy Friday everyone

- Reward

- like

- Comment

- Repost

- Share

Brtw, they paid $25M for a single NFT

🚨 BREAKING: Coinbase $COIN reports a shock quarterly loss.

Key numbers:

• EPS: -$2.49 (vs $0.96 expected)

• Net loss: $667M

A massive miss — and Wall Street wasn’t positioned for it.

🚨 BREAKING: Coinbase $COIN reports a shock quarterly loss.

Key numbers:

• EPS: -$2.49 (vs $0.96 expected)

• Net loss: $667M

A massive miss — and Wall Street wasn’t positioned for it.

- Reward

- like

- Comment

- Repost

- Share

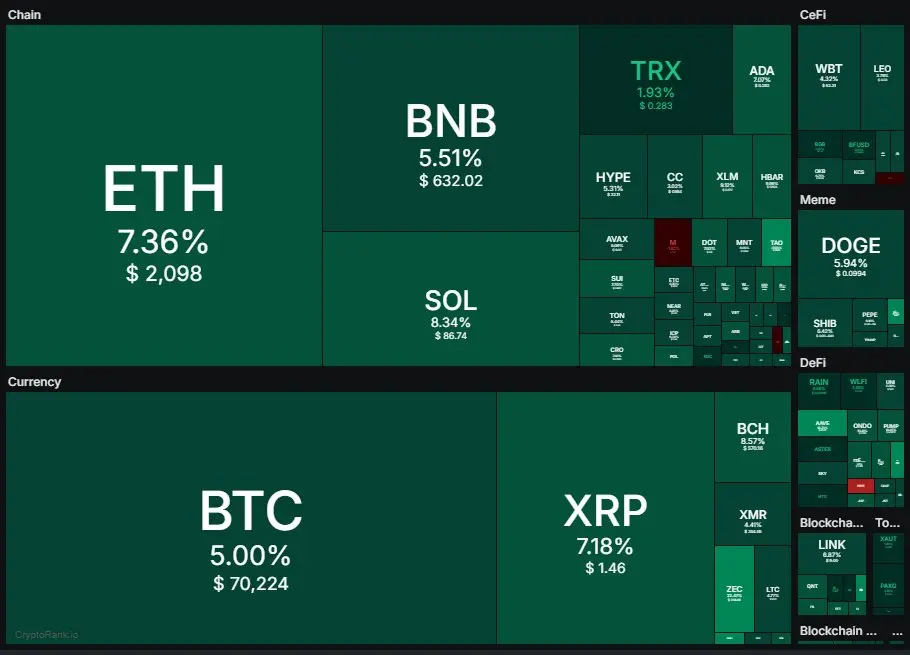

⏳ Timeline to watch:

• Next #Bitcoin halving: March 2028

• U.S. presidential term ends: Jan 2029

• 2027–2028 = potential new ATH cycle

Historically, halvings reshape supply dynamics.

But before that… how deep does BTC correct?

• Next #Bitcoin halving: March 2028

• U.S. presidential term ends: Jan 2029

• 2027–2028 = potential new ATH cycle

Historically, halvings reshape supply dynamics.

But before that… how deep does BTC correct?

BTC0,84%

- Reward

- like

- Comment

- Repost

- Share

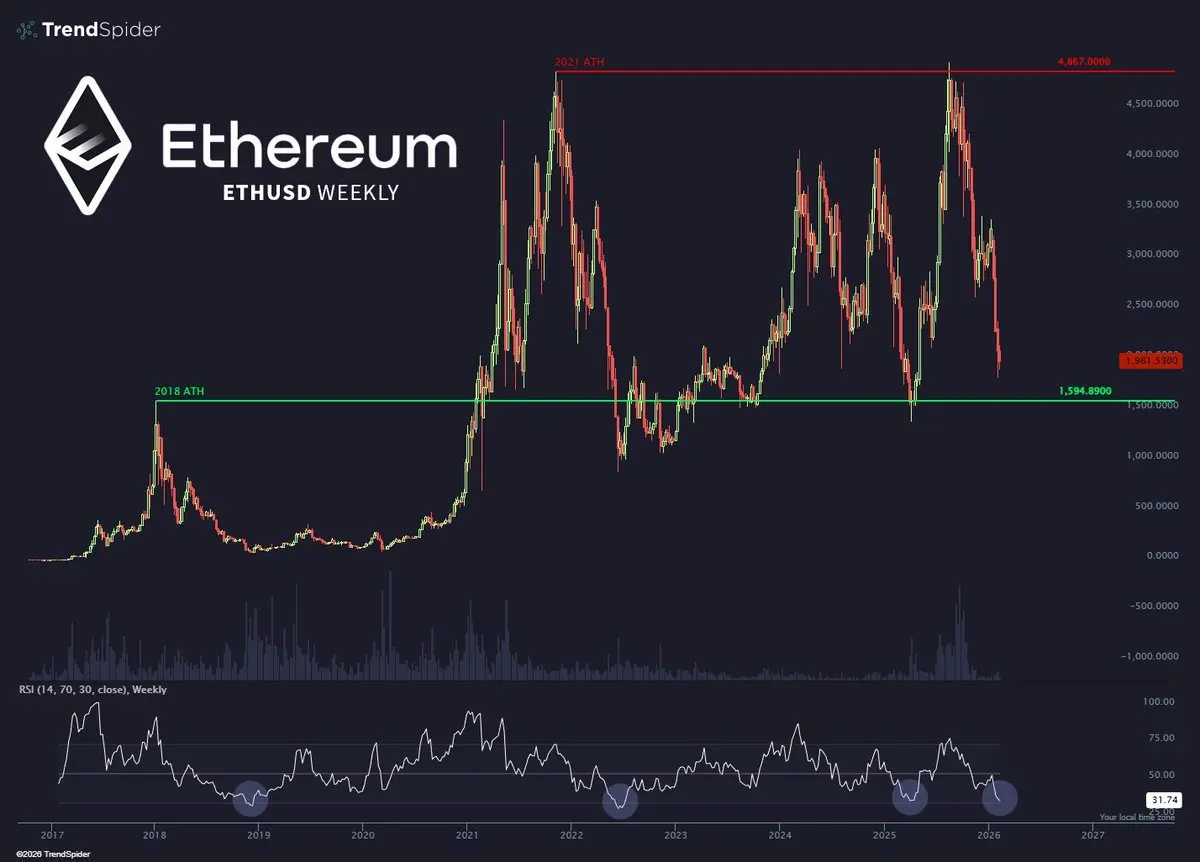

📉 Ethereum is testing a major floor at $1,594.

On the weekly chart:

• RSI just hit 31

• Every major bottom since 2018 formed near this level

Plan stays simple:

Buy the green. Sell the red.

On the weekly chart:

• RSI just hit 31

• Every major bottom since 2018 formed near this level

Plan stays simple:

Buy the green. Sell the red.

ETH0,87%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

🚨 JUST IN: Trump-backed World Liberty Financial is launching “World Swap,” a crypto-based FX & remittance platform.

Why this matters:

Stablecoins entering global FX

Faster cross-border settlements

Political capital meets crypto rails

Why this matters:

Stablecoins entering global FX

Faster cross-border settlements

Political capital meets crypto rails

- Reward

- like

- Comment

- Repost

- Share

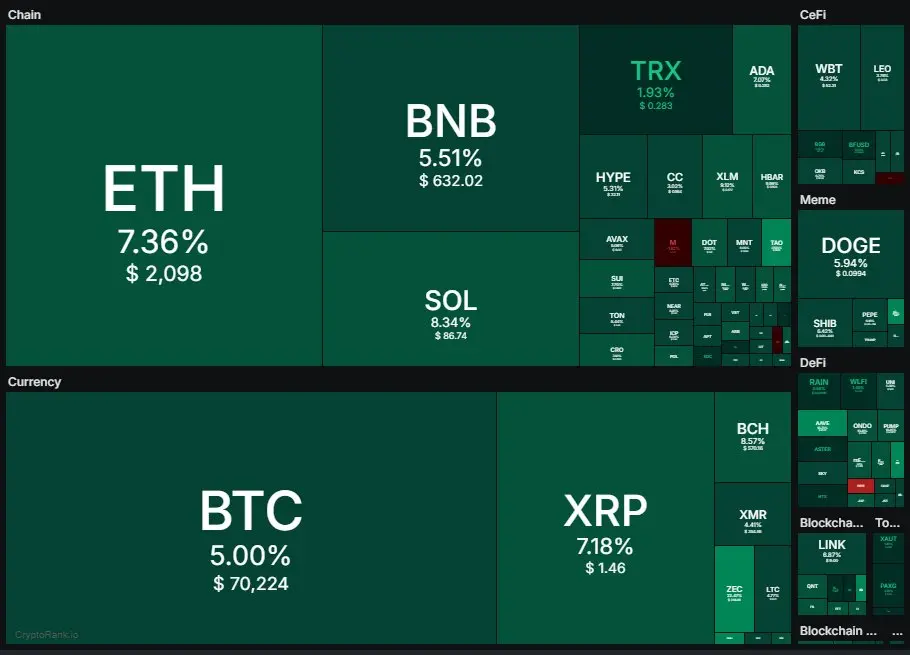

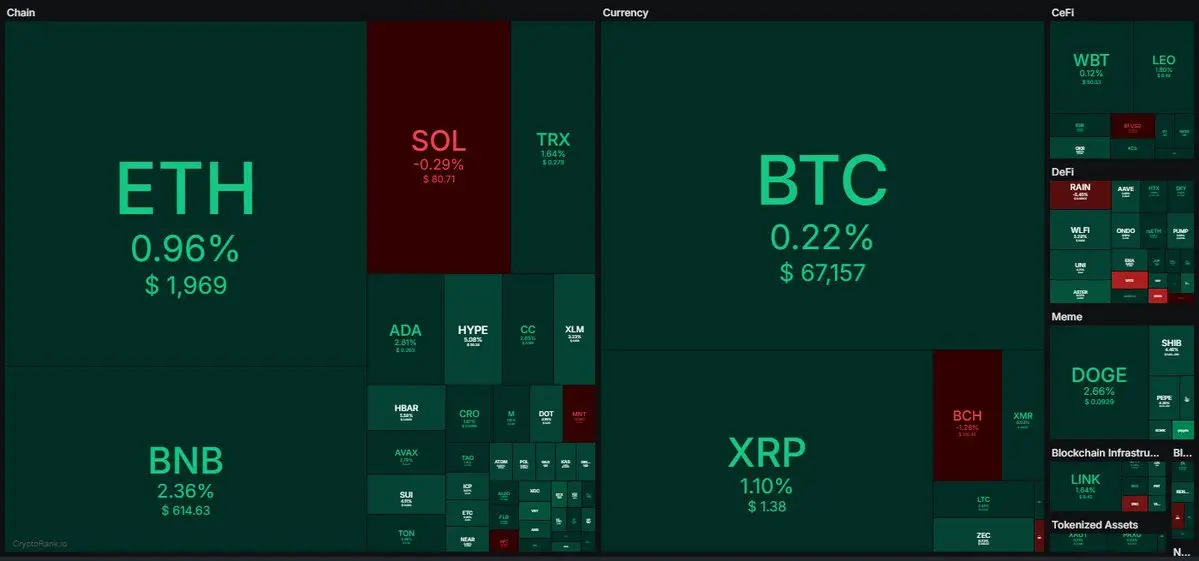

Happy Thursday 💚

Crypto is green.

Crypto is green.

- Reward

- like

- Comment

- Repost

- Share

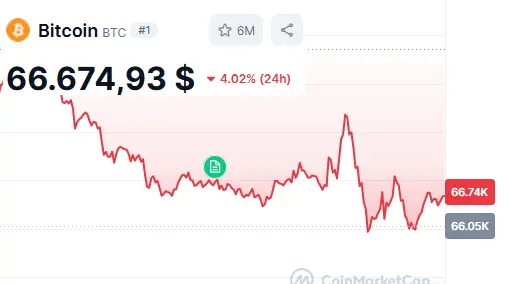

🚨 JUST IN: #Bitcoin falls below $67,000.

What to watch next:

Key support zone reaction

ETF flow data

Derivatives liquidations

Volatility is the price of admission.

What to watch next:

Key support zone reaction

ETF flow data

Derivatives liquidations

Volatility is the price of admission.

BTC0,84%

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: President Trump is reportedly weighing an exit from USMCA — the trade deal negotiated during his first term.

Why this matters:

North American trade disruption risk

Market & supply chain uncertainty

Political leverage ahead of elections

Why this matters:

North American trade disruption risk

Market & supply chain uncertainty

Political leverage ahead of elections

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More80.35K Popularity

6.7K Popularity

6.55K Popularity

52.98K Popularity

3.76K Popularity

Pin