Diznifigo

No content yet

diznifigo

🚨 BUFFETT SOUNDS THE ALARM

WARREN BUFFETT SAYS HISTORY SHOWS ONE CLEAR PATTERN:

GOVERNMENTS EVENTUALLY ERODE THE VALUE OF THEIR OWN MONEY — AND WHAT HE’S SEEING IN U.S. POLICY RIGHT NOW MAKES HIM UNCOMFORTABLE.

WHEN EVEN THE MOST PATIENT INVESTOR STARTS POSITIONING FOR A SOFTER DOLLAR…

THAT’S NOT NOISE. THAT’S A SIGNAL. 👀

WARREN BUFFETT SAYS HISTORY SHOWS ONE CLEAR PATTERN:

GOVERNMENTS EVENTUALLY ERODE THE VALUE OF THEIR OWN MONEY — AND WHAT HE’S SEEING IN U.S. POLICY RIGHT NOW MAKES HIM UNCOMFORTABLE.

WHEN EVEN THE MOST PATIENT INVESTOR STARTS POSITIONING FOR A SOFTER DOLLAR…

THAT’S NOT NOISE. THAT’S A SIGNAL. 👀

- Reward

- 2

- 1

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊🚨CNBC reported: “Capital is flowing into #XRP for three major reasons.”

Global capital is pouring into XRPL following confirmation that Walmart — an $800B retail giant — is now integrated via RealFi. With Walmart handling over $650B in annual transaction volume, substantial payment flows could be routed through REAL on the XRP Ledger, potentially creating a powerful supply–demand imbalance.

REAL Token, built natively on the XRP Ledger, enables value transfer across a $654.39 trillion global market. A fixed supply combined with accelerating real-world adoption positions REAL for a possible sup

Global capital is pouring into XRPL following confirmation that Walmart — an $800B retail giant — is now integrated via RealFi. With Walmart handling over $650B in annual transaction volume, substantial payment flows could be routed through REAL on the XRP Ledger, potentially creating a powerful supply–demand imbalance.

REAL Token, built natively on the XRP Ledger, enables value transfer across a $654.39 trillion global market. A fixed supply combined with accelerating real-world adoption positions REAL for a possible sup

XRP-4,37%

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊So in 72 hours we get:

• Trump speech

• Fed decision + Powell speech

• Tesla, Meta, and Microsoft earnings

• PPI inflation

• Apple earnings

• US government Shutdown deadline

If any of these goes against the market, red candles will be all over again.

• Trump speech

• Fed decision + Powell speech

• Tesla, Meta, and Microsoft earnings

• PPI inflation

• Apple earnings

• US government Shutdown deadline

If any of these goes against the market, red candles will be all over again.

- Reward

- like

- Comment

- Repost

- Share

YEN INTERVENTION COULD CRASH THE CRYPTO MARKET🚨

A few days ago, I talked about the Fed's possible "Yen Intervention."

This is planned to be done via USD devaluation, as a weak dollar is beneficial for the US government.

Now you must ask, Isn't a weak dollar bullish for BTC and alts?

Yes, but not in the short term.

We all know that weak Yen was a major liquidity source for decades.

If the Yen suddenly becomes stronger, investors will have to panic dump their assets.

This will be very similar to what happened in Q3 2024 when Yen pumped nearly 15% against the USD.

During that timeframe, BTC and

A few days ago, I talked about the Fed's possible "Yen Intervention."

This is planned to be done via USD devaluation, as a weak dollar is beneficial for the US government.

Now you must ask, Isn't a weak dollar bullish for BTC and alts?

Yes, but not in the short term.

We all know that weak Yen was a major liquidity source for decades.

If the Yen suddenly becomes stronger, investors will have to panic dump their assets.

This will be very similar to what happened in Q3 2024 when Yen pumped nearly 15% against the USD.

During that timeframe, BTC and

BTC-6,32%

- Reward

- like

- Comment

- Repost

- Share

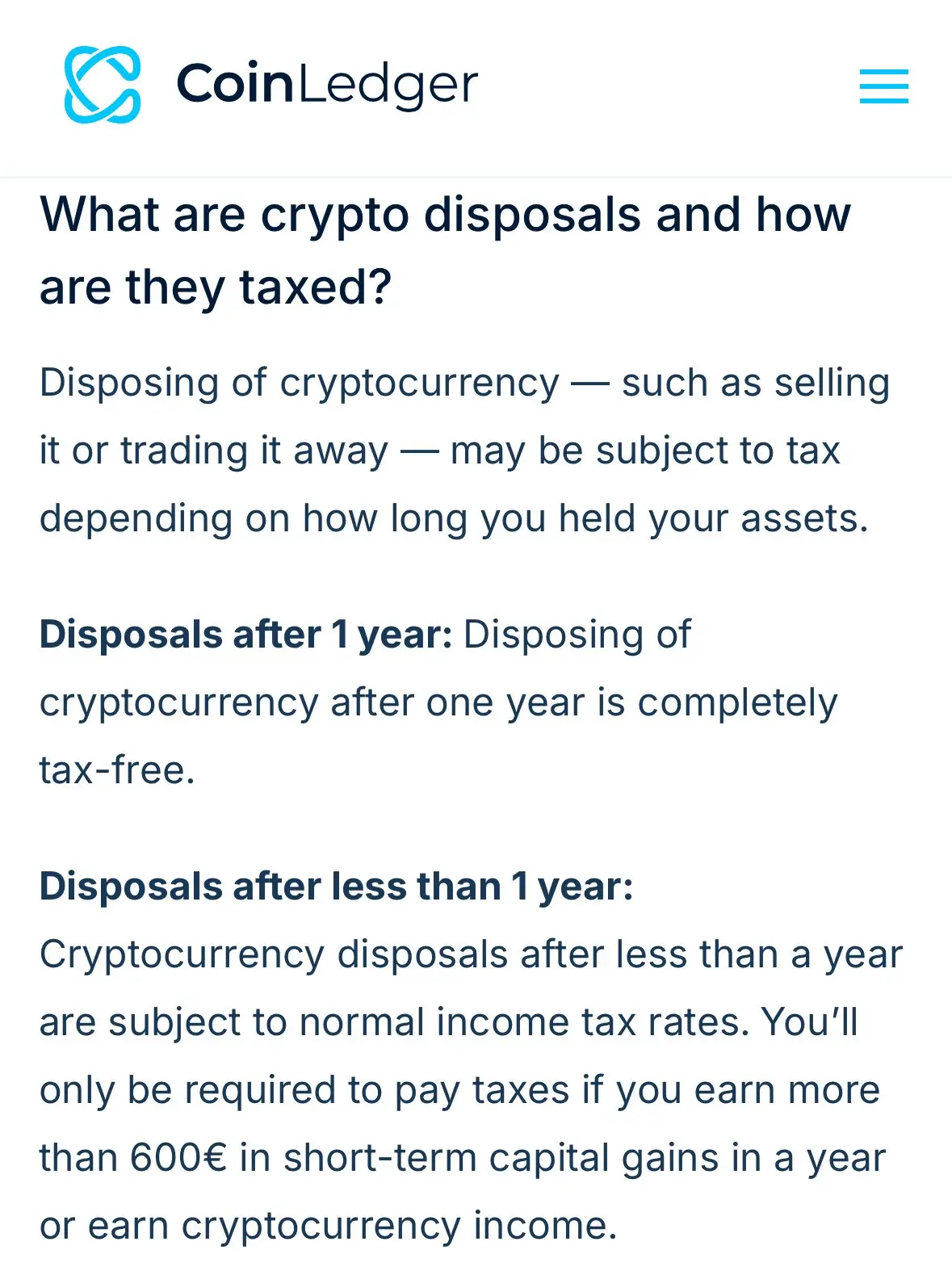

🚨BREAKING: Germany Confirms 0% Capital Gains Tax on $XRP (If You Hold 1+ Year) 🇩🇪💥

Germany treats crypto like private property, which means:

👉 Hold your $XRP for over 12 months = ZERO capital gains tax

👉 No minimum amount required

👉 Profit size doesn’t matter — 100% tax-free after one year

Short-term holders still pay income tax.

Tax haven for $XRP investors. 🤑🚀

Germany treats crypto like private property, which means:

👉 Hold your $XRP for over 12 months = ZERO capital gains tax

👉 No minimum amount required

👉 Profit size doesn’t matter — 100% tax-free after one year

Short-term holders still pay income tax.

Tax haven for $XRP investors. 🤑🚀

XRP-4,37%

- Reward

- 1

- Comment

- Repost

- Share

HUGE: 🇺🇸 US Senate will vote on the Crypto Markey Structure bill today at 3:00 PM ET.

BIG BIG BIG BIG BIG BIG BIG BIG 2026 .

BIG BIG BIG BIG BIG BIG BIG BIG 2026 .

- Reward

- like

- Comment

- Repost

- Share

THE US DOLLAR INDEX DXY IS ABOUT TO CRASH REALLY HARD 🚨

And here’s why:

For the first time this century, the Fed is planning to stop the Japanese yen from going down.

This is what we call “yen intervention.”

To do this, the Fed first needs to create new dollars and then use them to buy yen.

This causes the yen to strengthen and the USD to dump.

And the US government benefits from a weaker USD.

• Future debt gets inflated away

• Exports get a boost due to a cheaper dollar

• The deficit goes down

And for those holding assets, this intervention can result in a huge rally.

Back in July 2024, Japa

And here’s why:

For the first time this century, the Fed is planning to stop the Japanese yen from going down.

This is what we call “yen intervention.”

To do this, the Fed first needs to create new dollars and then use them to buy yen.

This causes the yen to strengthen and the USD to dump.

And the US government benefits from a weaker USD.

• Future debt gets inflated away

• Exports get a boost due to a cheaper dollar

• The deficit goes down

And for those holding assets, this intervention can result in a huge rally.

Back in July 2024, Japa

BTC-6,32%

- Reward

- 1

- 2

- Repost

- Share

🚨 NEXT WEEK’S SCHEDULE IS INSANE FOR THE MARKETS!

MONDAY → FED GDP REPORT

TUESDAY → LIQUIDITY INJECTION ($8.3B)

WEDNESDAY → FED INTEREST RATE DECISION

THURSDAY → U.S. BALANCE SHEET

FRIDAY → FOMC PRESIDENT SPEECH

THE BIGGEST BULL RUN IN HISTORY STARTS TOMORROW ? 🔥

MONDAY → FED GDP REPORT

TUESDAY → LIQUIDITY INJECTION ($8.3B)

WEDNESDAY → FED INTEREST RATE DECISION

THURSDAY → U.S. BALANCE SHEET

FRIDAY → FOMC PRESIDENT SPEECH

THE BIGGEST BULL RUN IN HISTORY STARTS TOMORROW ? 🔥

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 JUST IN: A NEW STRATEGIC BITCOIN RESERVE BILL HAS BEEN INTRODUCED IN CONGRESS.

THE PROPOSAL WOULD ALLOW TAXES TO BE PAID IN BITCOIN AND ELIMINATE CAPITAL GAINS TAX ON BTC.

A MAJOR STEP TOWARD MAINSTREAM ADOPTION — AND A POTENTIALLY GAME-CHANGING MOMENT FOR CRYPTO.

THE PROPOSAL WOULD ALLOW TAXES TO BE PAID IN BITCOIN AND ELIMINATE CAPITAL GAINS TAX ON BTC.

A MAJOR STEP TOWARD MAINSTREAM ADOPTION — AND A POTENTIALLY GAME-CHANGING MOMENT FOR CRYPTO.

BTC-6,32%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin Regret Comes to Anyone Ignoring Coinbase CEO's 5% Rule as Banks Struggle to Limit Gains Advisers are building caps, rebalancing rules and the math of the decline in value, while crypto executives are selling avoiding regret as the new thesis. Coinbase CEO Brian Armstrong told Bloomberg in Davos that investors who don't have at least 5% of their net worth in Bitcoin are "probably going to be pretty sad" by 2030. Recently, Morgan Stanley's asset management division released portfolio guidelines that limit cryptocurrency exposure to a maximum of 4% for even their most aggressive growth mo

BTC-6,32%

- Reward

- like

- Comment

- Repost

- Share

BRAD GARLINGHOUSE SAYS ‼️

“THE BITCOIN EXPERIMENT IS OVER.”

🔥 #XRP IS THE FUTURE OF GLOBAL VALUE TRANSFER — engineered for $10,000+ per coin utility 🚀🌗

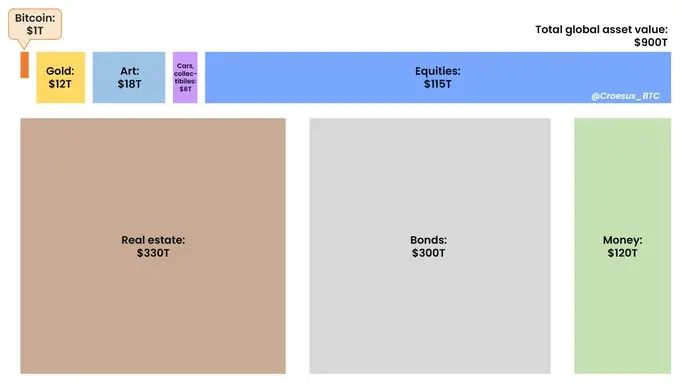

Trillions in global capital are positioning to enter the XRP Ledger, with momentum accelerating ahead of the REAL Token launch on January 26.

💥 Estimates suggest up to $800B could rotate into REAL on XRPL, setting the stage for a historic supply shock.

REAL is built natively on the XRP Ledger to move value across a $654.39 TRILLION global market.

With an extremely limited supply, the conditions align for a potentially massive supply squeeze

“THE BITCOIN EXPERIMENT IS OVER.”

🔥 #XRP IS THE FUTURE OF GLOBAL VALUE TRANSFER — engineered for $10,000+ per coin utility 🚀🌗

Trillions in global capital are positioning to enter the XRP Ledger, with momentum accelerating ahead of the REAL Token launch on January 26.

💥 Estimates suggest up to $800B could rotate into REAL on XRPL, setting the stage for a historic supply shock.

REAL is built natively on the XRP Ledger to move value across a $654.39 TRILLION global market.

With an extremely limited supply, the conditions align for a potentially massive supply squeeze

- Reward

- like

- Comment

- Repost

- Share

Bitcoin will soon pass the Federal Reserve's stress tests in 2026, creating a huge capital risk for regulated banks.

With IBIT close to $70 billion and G-SIB broker-dealers acting as authorized participants, margin and liquidity shocks are getting harder to ignore. Pierre Rochard's call for the Federal Reserve to integrate Bitcoin into its stress tests came at an unusual time: The Fed is seeking public comment on its 2026 scenarios while also proposing new transparency requirements in how it builds and updates those models.

With IBIT close to $70 billion and G-SIB broker-dealers acting as authorized participants, margin and liquidity shocks are getting harder to ignore. Pierre Rochard's call for the Federal Reserve to integrate Bitcoin into its stress tests came at an unusual time: The Fed is seeking public comment on its 2026 scenarios while also proposing new transparency requirements in how it builds and updates those models.

BTC-6,32%

- Reward

- 2

- Comment

- Repost

- Share

COINBASE CEO REVEALS :

MAJOR BANKS ARE QUIETLY PUSHING BACK AGAINST THE PRESIDENT’S PRO-CRYPTO PUSH.

THEY’RE TRYING TO DRAG THEIR FEET ON ADOPTION.

THEY WANT TO KEEP THEIR GRIP ON THE FINANCIAL SYSTEM.

THEY SEE CRYPTO AS A THREAT.

THIS BATTLE IS JUST GETTING STARTED. 👀🔥

MAJOR BANKS ARE QUIETLY PUSHING BACK AGAINST THE PRESIDENT’S PRO-CRYPTO PUSH.

THEY’RE TRYING TO DRAG THEIR FEET ON ADOPTION.

THEY WANT TO KEEP THEIR GRIP ON THE FINANCIAL SYSTEM.

THEY SEE CRYPTO AS A THREAT.

THIS BATTLE IS JUST GETTING STARTED. 👀🔥

- Reward

- like

- Comment

- Repost

- Share

⚠️ MAJOR SIGNAL FROM INSTITUTIONAL CAPITAL ‼️

The world’s largest fund has issued a bold projection: #XRP at $50,000, driven by $32 trillion in U.S. debt migrating into digital financial infrastructure and accelerating global institutional adoption.

This isn’t speculation anymore. It’s already beginning‼️

January 26

RealFi is set to approve a retailer valued at $800 billion, utilizing the REAL token built on the XRP Ledger

The world’s largest fund has issued a bold projection: #XRP at $50,000, driven by $32 trillion in U.S. debt migrating into digital financial infrastructure and accelerating global institutional adoption.

This isn’t speculation anymore. It’s already beginning‼️

January 26

RealFi is set to approve a retailer valued at $800 billion, utilizing the REAL token built on the XRP Ledger

XRP-4,37%

- Reward

- 1

- 1

- Repost

- Share

GateUser-ab6eaf01 :

:

GreatThe European timelines and the draft BIS define the regulated end goal Policy timelines in Europe determine the dates for how quickly a regulated approach can be put into practice.

The European Commission's Markets in Crypto Assets (MiCA) Regulation was fully applicable on December 30, 2024, and the provisions on stablecoins came into force on June 30, 2024. The Digital Operational Resilience Act (DORA) applies from 17 January 2025. Own market figures for future prices are also determined in an institutional sense.

Citi's Crypto Stable Report predicts issuance of $1.9 trillion in the base sc

The European Commission's Markets in Crypto Assets (MiCA) Regulation was fully applicable on December 30, 2024, and the provisions on stablecoins came into force on June 30, 2024. The Digital Operational Resilience Act (DORA) applies from 17 January 2025. Own market figures for future prices are also determined in an institutional sense.

Citi's Crypto Stable Report predicts issuance of $1.9 trillion in the base sc

- Reward

- like

- Comment

- Repost

- Share

How TradFi is devouring cryptocurrencies, killing Satoshi's dream by rewarding centralization

Bitcoin is being quietly hijacked by "broken" financial systems, creating a surveillance trap disguised as massive market growth. The price of Bitcoin, and thus the entire crypto market, is increasingly anchored by flows through regulated envelopes. Cryptocurrencies are increasingly being absorbed by TradFi instead of offering an alternative to the broken system that Satoshi criticized. Subscriptions and redemptions of US spot ETFs now record daily swings that increasingly dominate daily reports. In

Bitcoin is being quietly hijacked by "broken" financial systems, creating a surveillance trap disguised as massive market growth. The price of Bitcoin, and thus the entire crypto market, is increasingly anchored by flows through regulated envelopes. Cryptocurrencies are increasingly being absorbed by TradFi instead of offering an alternative to the broken system that Satoshi criticized. Subscriptions and redemptions of US spot ETFs now record daily swings that increasingly dominate daily reports. In

BTC-6,32%

- Reward

- like

- Comment

- Repost

- Share

🚨 BIG SIGNAL

WARREN BUFFETT WARNS: “GOVERNMENTS ALWAYS DESTROY THEIR OWN MONEY.”

BERKSHIRE MOVES $348B INTO JAPANESE YEN.

THIS ISN’T A TRADE — IT’S A WARNING.

DOLLAR RISK IS RISING.

SMART MONEY IS REPOSITIONING.

WARREN BUFFETT WARNS: “GOVERNMENTS ALWAYS DESTROY THEIR OWN MONEY.”

BERKSHIRE MOVES $348B INTO JAPANESE YEN.

THIS ISN’T A TRADE — IT’S A WARNING.

DOLLAR RISK IS RISING.

SMART MONEY IS REPOSITIONING.

- Reward

- like

- Comment

- Repost

- Share

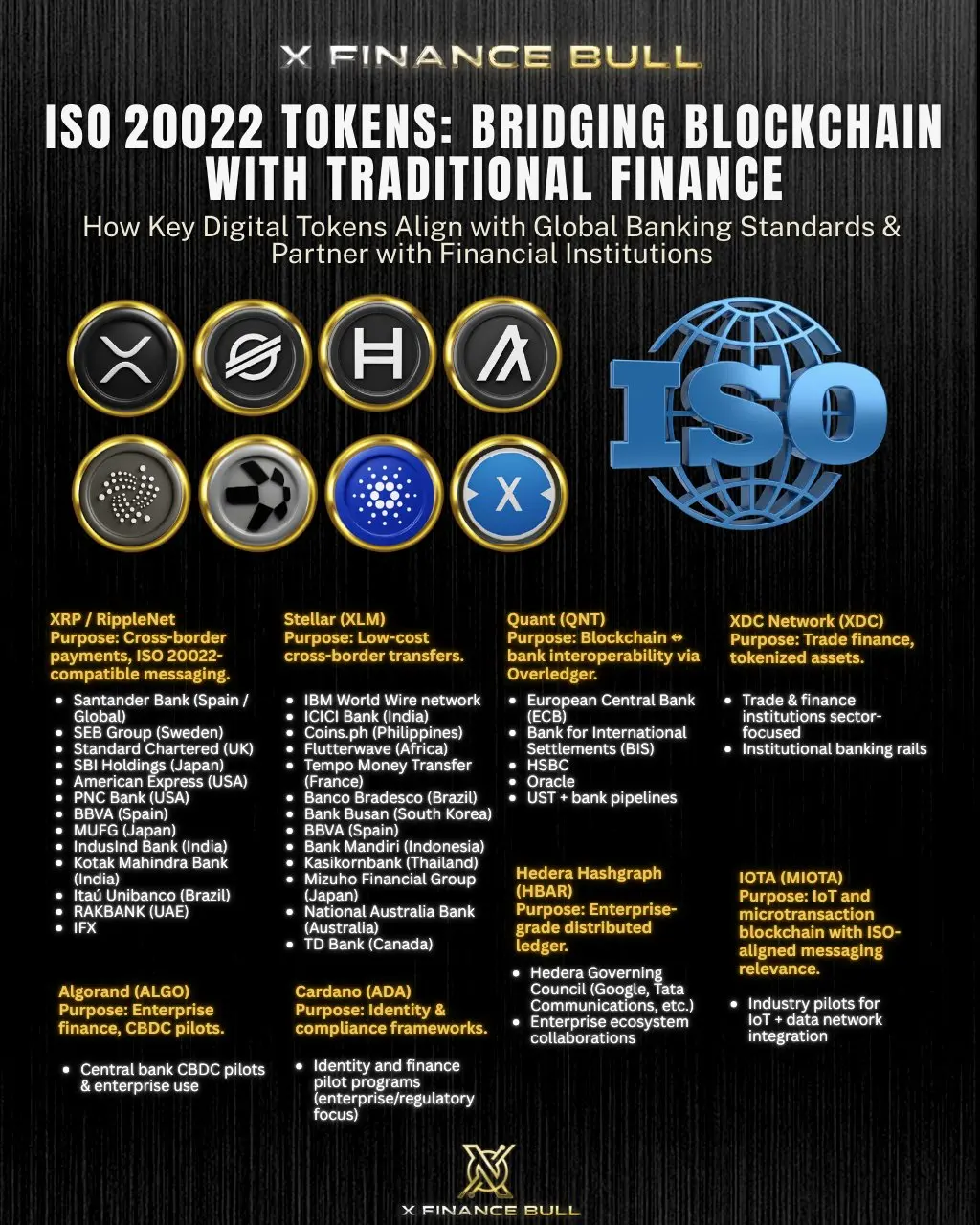

CME legitimizes crypto futures with the addition of Cardana, Chainlink and Stellar, but retail traders face a big catch With ADA, LINK and XLM futures contracts

CME puts cryptocurrencies into a diversified asset class, signaling new opportunities for investors. On January 15, CME Group announced plans to launch Cardano (ADA), Chainlink (LINK) and Stellar (XLM) futures on February 9, pending regulatory review. The move represents a calculated signal from the Chicago-based stock market giant that the digital asset market has matured beyond the gravitational pull of Bitcoin and Ethereum into a di

CME puts cryptocurrencies into a diversified asset class, signaling new opportunities for investors. On January 15, CME Group announced plans to launch Cardano (ADA), Chainlink (LINK) and Stellar (XLM) futures on February 9, pending regulatory review. The move represents a calculated signal from the Chicago-based stock market giant that the digital asset market has matured beyond the gravitational pull of Bitcoin and Ethereum into a di

- Reward

- like

- Comment

- Repost

- Share