Cryptohakan

No content yet

Pin

Cryptohakan

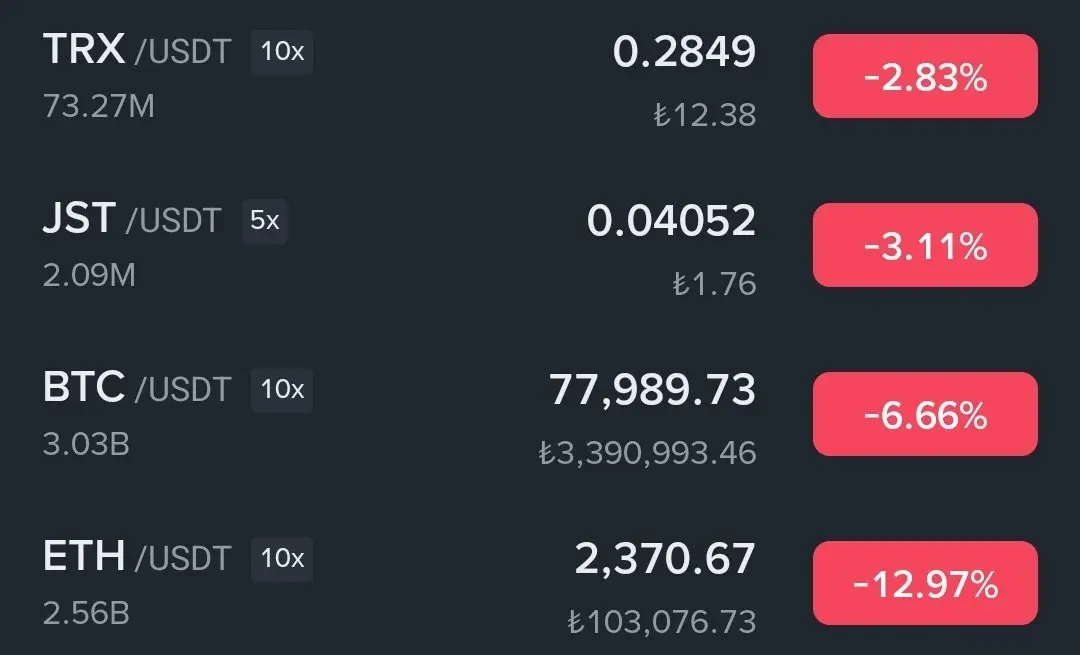

The 100x Supercycle Project Everyone Is Overlooking: $JST 🚀

JustLend is the #1 DeFi project within the TRON ecosystem — the same ecosystem that has made more money than almost any other network after Bitcoin and Ethereum. And it continues to print.

Now let’s take a moment to understand the man who tweeted that JST could be the next 100x — Justin Sun. And then you decide whether he can actually make this happen.

Justin Sun acquired BitTorrent for $140M.

Justin Sun purchased the crypto exchange Poloniex (exact amount undisclosed, estimated in the tens of millions).

Justin Sun took a major stake

JustLend is the #1 DeFi project within the TRON ecosystem — the same ecosystem that has made more money than almost any other network after Bitcoin and Ethereum. And it continues to print.

Now let’s take a moment to understand the man who tweeted that JST could be the next 100x — Justin Sun. And then you decide whether he can actually make this happen.

Justin Sun acquired BitTorrent for $140M.

Justin Sun purchased the crypto exchange Poloniex (exact amount undisclosed, estimated in the tens of millions).

Justin Sun took a major stake

JST5,93%

- Reward

- 2

- Comment

- Repost

- Share

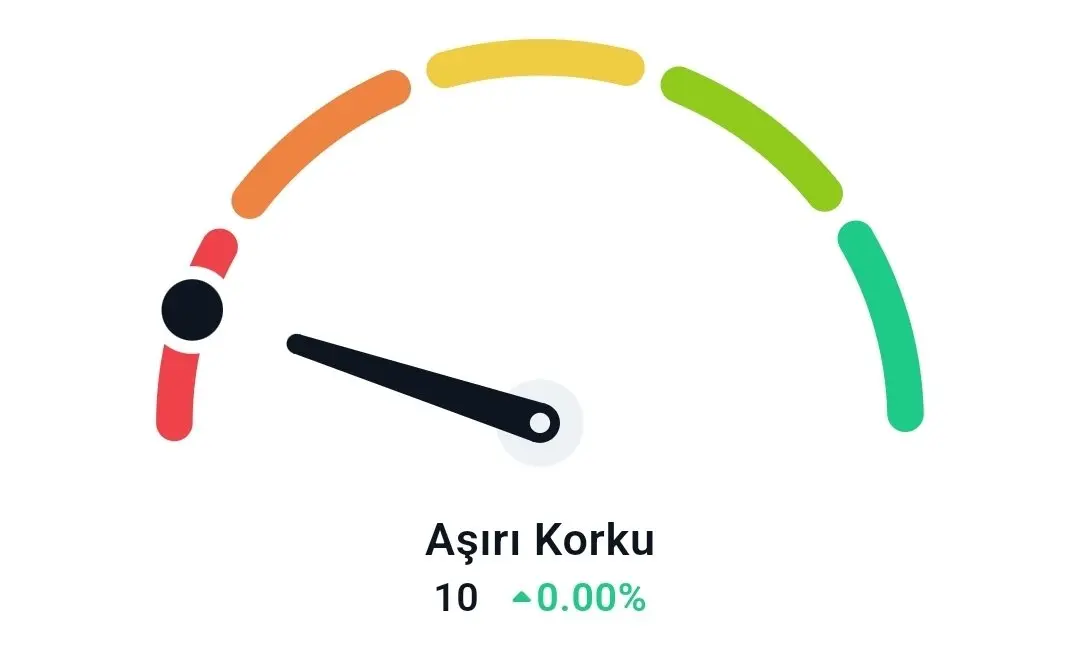

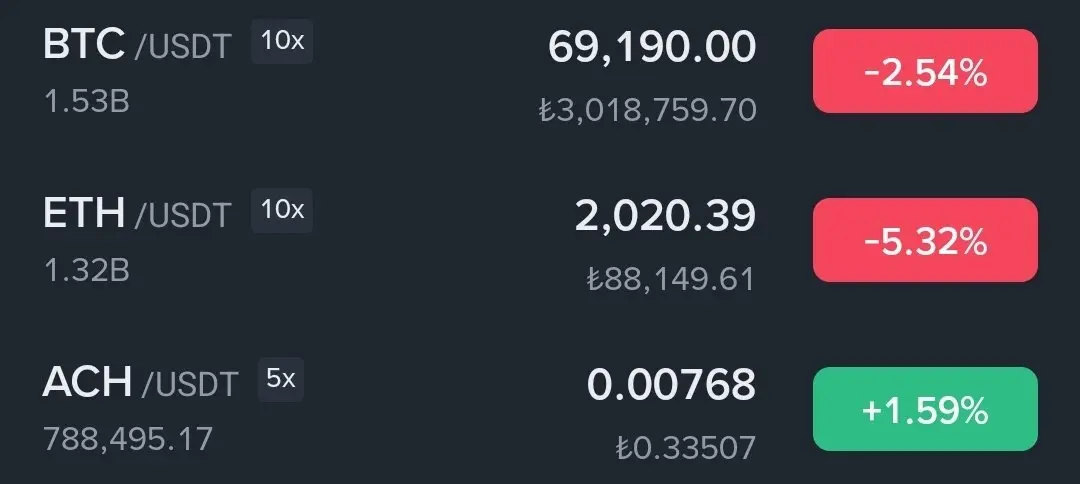

We are still in an extreme fear phase in the crypto market.

Like all markets, this market is two-sided.

Accumulate during fear, sell during euphoria.

The most psychologically important support for Bitcoin is now clearly $50,000.

We will likely stay around these levels for a while longer.

They won't fully ramp up until they reset the futures.

Prices have become extremely cheap, and they don't want to give away 2x or 3x longs at free prices.

Once the cleanup is complete and the global agenda eases a bit, I believe we will enter the summer months comfortably.

During this process, please choose yo

Like all markets, this market is two-sided.

Accumulate during fear, sell during euphoria.

The most psychologically important support for Bitcoin is now clearly $50,000.

We will likely stay around these levels for a while longer.

They won't fully ramp up until they reset the futures.

Prices have become extremely cheap, and they don't want to give away 2x or 3x longs at free prices.

Once the cleanup is complete and the global agenda eases a bit, I believe we will enter the summer months comfortably.

During this process, please choose yo

BTC-2,17%

- Reward

- 1

- Comment

- Repost

- Share

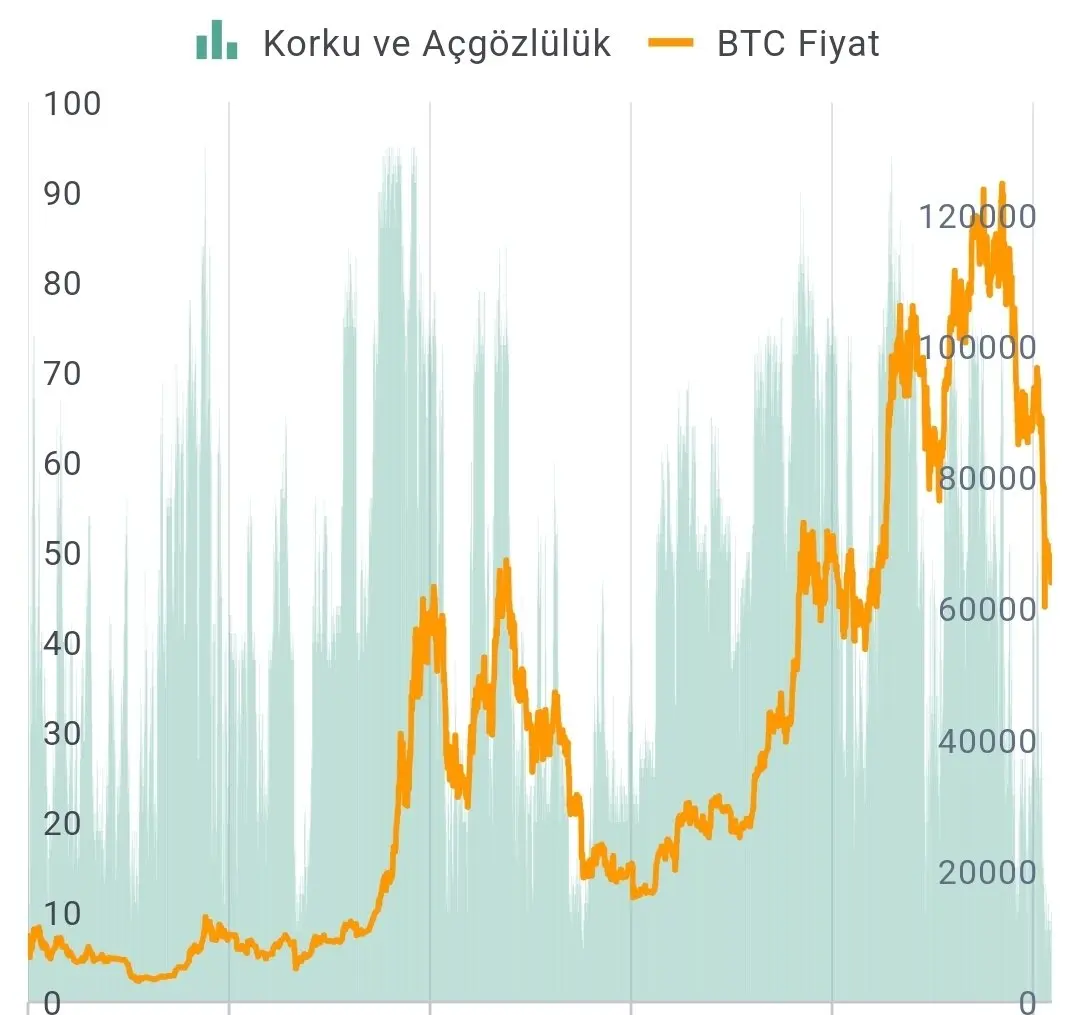

3.6 million ETH is in the staking queue.

Funds are locked.

Demand has surged. There is a 63-day wait.

But the $LDO chart looks like a graveyard.

With data like this, the pricing is irrational.

The market is either not aware of something right now

or leaving a big opportunity.

Time will tell which one it is.

View OriginalFunds are locked.

Demand has surged. There is a 63-day wait.

But the $LDO chart looks like a graveyard.

With data like this, the pricing is irrational.

The market is either not aware of something right now

or leaving a big opportunity.

Time will tell which one it is.

- Reward

- like

- Comment

- Repost

- Share

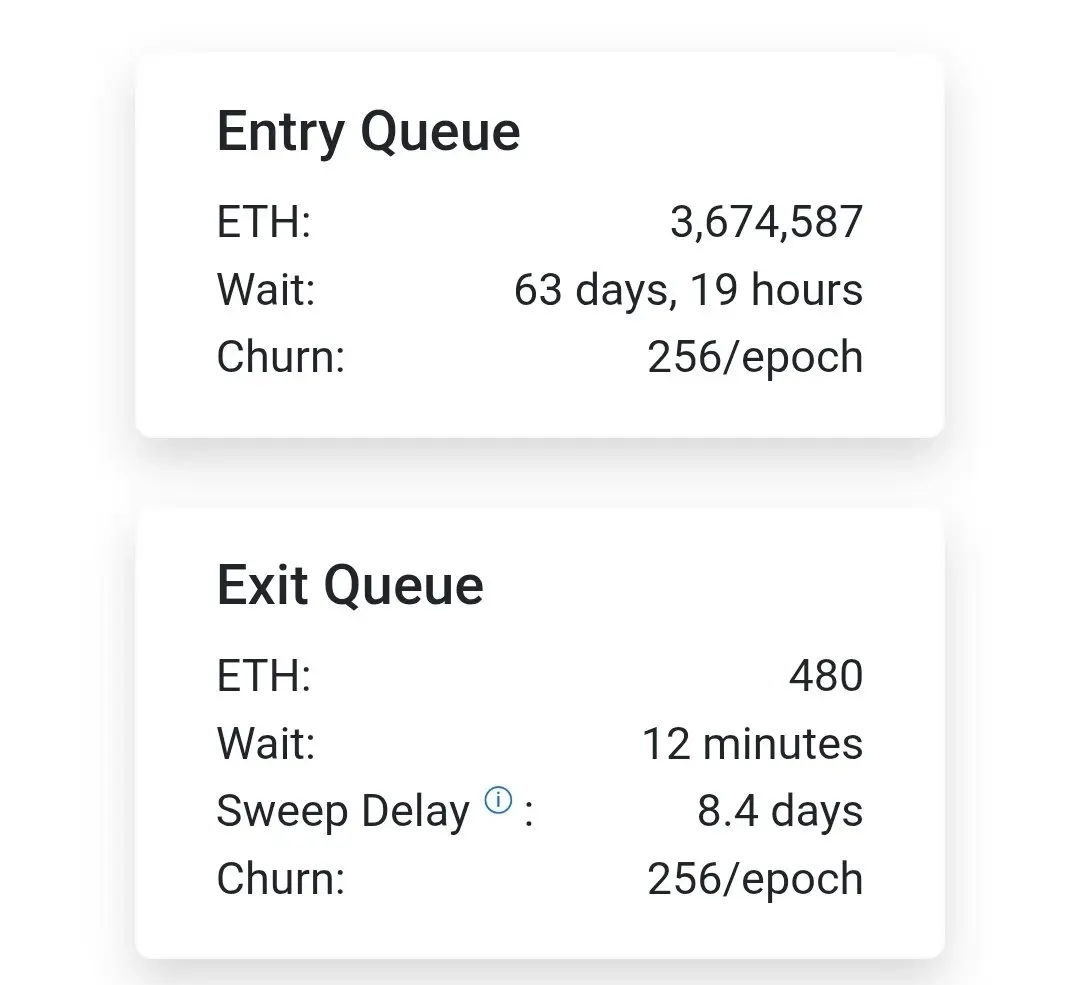

Every time we think about buying fear and selling greed, they scare us even more...

While there are extremely positive developments happening, we are also experiencing an uncertain and negative crypto market environment for the first time with this atmosphere of fear.

I believe that once we get through this process safely, those who survive will be able to accumulate wealth in the right assets.

My coin holdings have dropped significantly; I think this won't come back. If you don't get caught up in the idea of selling and going 3x long in futures, your chances of winning are high.

Without falli

View OriginalWhile there are extremely positive developments happening, we are also experiencing an uncertain and negative crypto market environment for the first time with this atmosphere of fear.

I believe that once we get through this process safely, those who survive will be able to accumulate wealth in the right assets.

My coin holdings have dropped significantly; I think this won't come back. If you don't get caught up in the idea of selling and going 3x long in futures, your chances of winning are high.

Without falli

- Reward

- like

- Comment

- Repost

- Share

Silver, which was $20 at the beginning of 2024, has surpassed $100.

In an environment where even silver is doing this, don't expect mediocre performance from altcoins.

While cryptocurrencies continue to hit historic lows, cut all extra expenses and gradually add to quality altcoins from the bottom.

But be careful!

Make sure you're adding to projects that have been built for many years without VC pressure and have a story.

It's almost our turn.

Don't worry, this cycle will turn.

View OriginalIn an environment where even silver is doing this, don't expect mediocre performance from altcoins.

While cryptocurrencies continue to hit historic lows, cut all extra expenses and gradually add to quality altcoins from the bottom.

But be careful!

Make sure you're adding to projects that have been built for many years without VC pressure and have a story.

It's almost our turn.

Don't worry, this cycle will turn.

- Reward

- like

- Comment

- Repost

- Share

China has fully regulated RWA without a complete ban 🚨

CSRC has released an official framework for tokenized RWA.

Domestic issuances are subject to licensing. Offshore issuances require strict reporting.

The crypto ban is still in effect.

This is essentially a transition to a state-controlled model. In the short term, there is uncertainty, but in the long term, the narrative of institutional RWA is strengthening. Recognizing the huge potential in this area, China has already begun tightening oversight. RWA is now part of the global financial system. Regulated, bank-integrated, real-asset-back

CSRC has released an official framework for tokenized RWA.

Domestic issuances are subject to licensing. Offshore issuances require strict reporting.

The crypto ban is still in effect.

This is essentially a transition to a state-controlled model. In the short term, there is uncertainty, but in the long term, the narrative of institutional RWA is strengthening. Recognizing the huge potential in this area, China has already begun tightening oversight. RWA is now part of the global financial system. Regulated, bank-integrated, real-asset-back

RWA-1,82%

- Reward

- like

- Comment

- Repost

- Share

0.10$ - 0.30$ levels, what did investors buy when XRP was ignored and it reached 3.5$?

Today, when gold prices are stagnating and people are getting excited, you'll be shocked to see at what prices people bought.

The veterans know the story, but the newcomers don't, friends.

The market has turned; now with the perception that everything will rise, new crowds are rushing in, and there will definitely be buyers for every asset.

Just be patient until the trigger for the reversal is fired and protect your spot investments.

Today, when gold prices are stagnating and people are getting excited, you'll be shocked to see at what prices people bought.

The veterans know the story, but the newcomers don't, friends.

The market has turned; now with the perception that everything will rise, new crowds are rushing in, and there will definitely be buyers for every asset.

Just be patient until the trigger for the reversal is fired and protect your spot investments.

XRP-5,35%

- Reward

- like

- Comment

- Repost

- Share

Every stablecoin issued today signifies a demand for U.S. Treasuries behind the scenes.

And do you really think the U.S. will give this up?

As stablecoins grow, bond demand increases. As bond demand grows, the system strengthens.

Even if gold only rises 2x, the U.S. Treasury is strengthening.

Even Turkey’s treasury is strengthening.

So in a scenario where the U.S. aggressively accumulates Bitcoin, do you think it will not strengthen through crypto in the future?

Preparations are underway.

Infrastructure is being built.

But at the same time, bad news is being pumped.

Perception management is in

And do you really think the U.S. will give this up?

As stablecoins grow, bond demand increases. As bond demand grows, the system strengthens.

Even if gold only rises 2x, the U.S. Treasury is strengthening.

Even Turkey’s treasury is strengthening.

So in a scenario where the U.S. aggressively accumulates Bitcoin, do you think it will not strengthen through crypto in the future?

Preparations are underway.

Infrastructure is being built.

But at the same time, bad news is being pumped.

Perception management is in

BTC-2,17%

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊Did you ever look at the state of some projects that everyone was talking about during the 2021 altcoin rally before they became popular and how they withstood the test of patience?

Back then, so-called altcoins were about to be wiped out, and people sold at prices close to zero out of fear.

Friends, if there is a story and the fundamental strength is solid, the price will react when the time comes.

A single true story can change your entire life.

Of course, we've seen this happen many times in this market where 10x, 20x, 50x, or even higher gains are discussed, but let's also understa

View OriginalBack then, so-called altcoins were about to be wiped out, and people sold at prices close to zero out of fear.

Friends, if there is a story and the fundamental strength is solid, the price will react when the time comes.

A single true story can change your entire life.

Of course, we've seen this happen many times in this market where 10x, 20x, 50x, or even higher gains are discussed, but let's also understa

- Reward

- like

- Comment

- Repost

- Share

Alchemy Chain testnet launches on February 23 🚨

Alchemy Chain is designed with a focus on payments and will facilitate stablecoin transactions with fast and fixed fees.

5-second block time.

Almost instant transaction confirmation.

Fixed and upfront fees.

The most important part is that ACH will be used to pay transaction fees on this network...

So ACH is not just a payment tool,

it will be the token needed for the network to operate.

As usage increases:

More transactions.

More ACH usage.

Increased on-chain demand.

You will understand very well why ACH is included in Citi Group's report.

Just

Alchemy Chain is designed with a focus on payments and will facilitate stablecoin transactions with fast and fixed fees.

5-second block time.

Almost instant transaction confirmation.

Fixed and upfront fees.

The most important part is that ACH will be used to pay transaction fees on this network...

So ACH is not just a payment tool,

it will be the token needed for the network to operate.

As usage increases:

More transactions.

More ACH usage.

Increased on-chain demand.

You will understand very well why ACH is included in Citi Group's report.

Just

ACH-5,46%

- Reward

- like

- Comment

- Repost

- Share

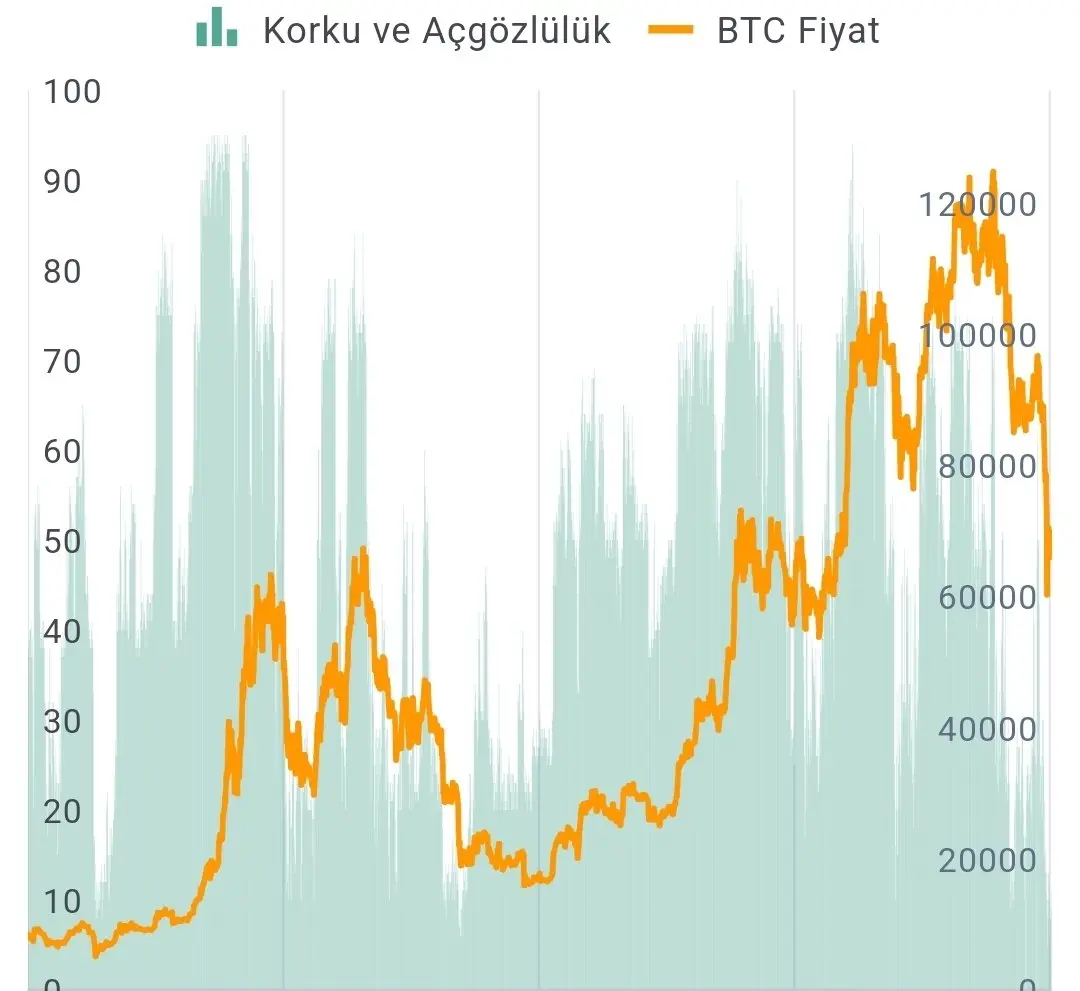

Fear & Greed: 11 🚨

Take a good look at the chart.

When the index drops to every 10–15 zone,

we say the market is dead.

But history has always told us something different.

Extreme fear followed by a big reset.

Big reset followed by a strong rally.

How many times have we watched the same movie?

The most money in the market is made when there's the most fear.

Even those mining Bitcoin now are losing money, and historically, this pattern shouldn't continue.

Those who are positioned in the right altcoins at reasonable entry prices should calmly watch the process and focus on their targets. Those w

Take a good look at the chart.

When the index drops to every 10–15 zone,

we say the market is dead.

But history has always told us something different.

Extreme fear followed by a big reset.

Big reset followed by a strong rally.

How many times have we watched the same movie?

The most money in the market is made when there's the most fear.

Even those mining Bitcoin now are losing money, and historically, this pattern shouldn't continue.

Those who are positioned in the right altcoins at reasonable entry prices should calmly watch the process and focus on their targets. Those w

BTC-2,17%

- Reward

- like

- Comment

- Repost

- Share

X is Transforming into a Financial Interface 🚨

With a post from X's product head Nikita Bier:

Smart Cashtags are coming soon.

The $BTC, $ETH , or stock symbols we use while composing tweets and see while browsing will no longer be just tags but will be integrated with real-time prices, charts, and data.

The concept visuals show Buy and Sell buttons. But there is no official announcement about this yet.

But I think the direction is clear.

Elon Musk's vision of turning X into an all-in-one app is exactly this.

Social feed + financial data + potential trading infrastructure could be a huge revol

View OriginalWith a post from X's product head Nikita Bier:

Smart Cashtags are coming soon.

The $BTC, $ETH , or stock symbols we use while composing tweets and see while browsing will no longer be just tags but will be integrated with real-time prices, charts, and data.

The concept visuals show Buy and Sell buttons. But there is no official announcement about this yet.

But I think the direction is clear.

Elon Musk's vision of turning X into an all-in-one app is exactly this.

Social feed + financial data + potential trading infrastructure could be a huge revol

- Reward

- 1

- Comment

- Repost

- Share

You will realize the value of $ACH once it exceeds $0.10. Just like how no one cared about silver at $10, but when it jumped over $100, the world rushed in, a similar event will happen with ACH. That's how these things work.

Those who buy when it's cheap are making a fortune.

Those who bought silver at $10 have already made a profit.

Just my personal opinion. YTD 😃

Those who buy when it's cheap are making a fortune.

Those who bought silver at $10 have already made a profit.

Just my personal opinion. YTD 😃

ACH-5,46%

- Reward

- like

- Comment

- Repost

- Share

100,000 ACH = $730

100,000 PLUME = $1,100

250,000 REZ = $740

Total cost $2,570

Now, let's look at the potential profit based on the supply of these coins and the minimum targets they need to reach during a rally:

ACH at $0.10 would yield a $10K profit

PLUME at $0.10 would yield a $10K profit

REZ at $0.05 would yield a $12,500 profit

With a $2,570 investment, the most likely target would be a $32,500 profit.

This game is two-sided.

Harsh in downturns, explosive in upswings.

This is crypto.

View Original100,000 PLUME = $1,100

250,000 REZ = $740

Total cost $2,570

Now, let's look at the potential profit based on the supply of these coins and the minimum targets they need to reach during a rally:

ACH at $0.10 would yield a $10K profit

PLUME at $0.10 would yield a $10K profit

REZ at $0.05 would yield a $12,500 profit

With a $2,570 investment, the most likely target would be a $32,500 profit.

This game is two-sided.

Harsh in downturns, explosive in upswings.

This is crypto.

- Reward

- like

- Comment

- Repost

- Share

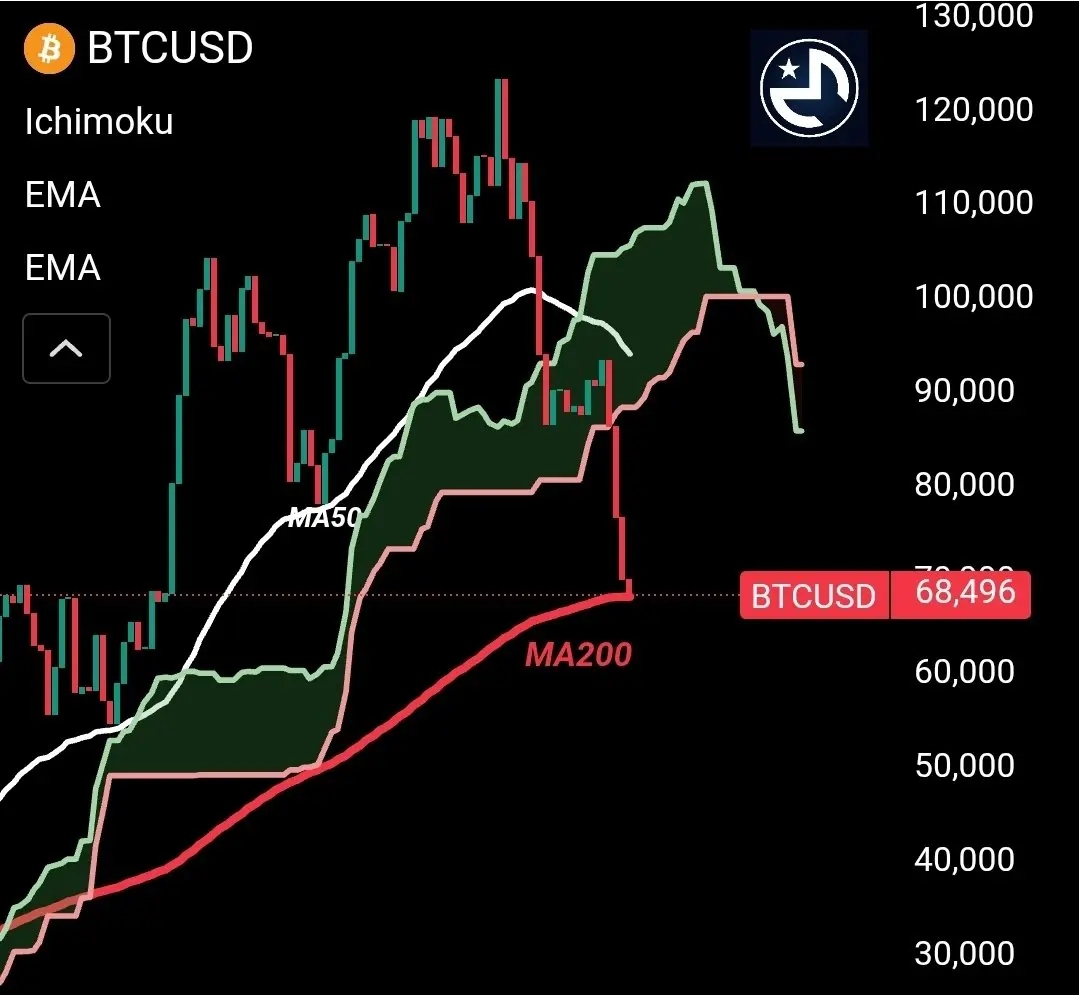

Bitcoin is within the MA200 framework zone.

Normally, since we closed above it last night, the market should breathe and turn positive.

If we close below it, as crypto enthusiasts, we will continue to be the subject of ridicule for a while longer.

Normally, since we closed above it last night, the market should breathe and turn positive.

If we close below it, as crypto enthusiasts, we will continue to be the subject of ridicule for a while longer.

BTC-2,17%

- Reward

- like

- Comment

- Repost

- Share

FIDELITY STABLECOIN is launched on the $FIDD Ethereum network, opening up to institutional and individual investors. Institutional adoption has begun. Although the changing balances in the testnet market are a bit annoying, I am confident in my goals, so I am focusing on the super cycle with my spot investments.

ETH-3,42%

- Reward

- like

- Comment

- Repost

- Share

As the market collapses, TRX and its partner JST, as we know, are also affected.

TRX-0,23%

- Reward

- like

- Comment

- Repost

- Share

The flow from precious metals to crypto will surely begin. Investors positioned in the right altcoins are looking at a fantastic future.

View Original

- Reward

- like

- Comment

- Repost

- Share

Good luck to our GALATASARAY 🇹🇷 I will give a gift of 1000 TL to 1 follower who predicts the correct score ❤️

View Original

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More289.18K Popularity

21.9K Popularity

34.94K Popularity

11.66K Popularity

448.3K Popularity

Pin