ShafynKhan

No content yet

ShafynKhan

- Reward

- 1

- 1

- Repost

- Share

PumpSpreeLive :

:

HODL Tight 💪- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

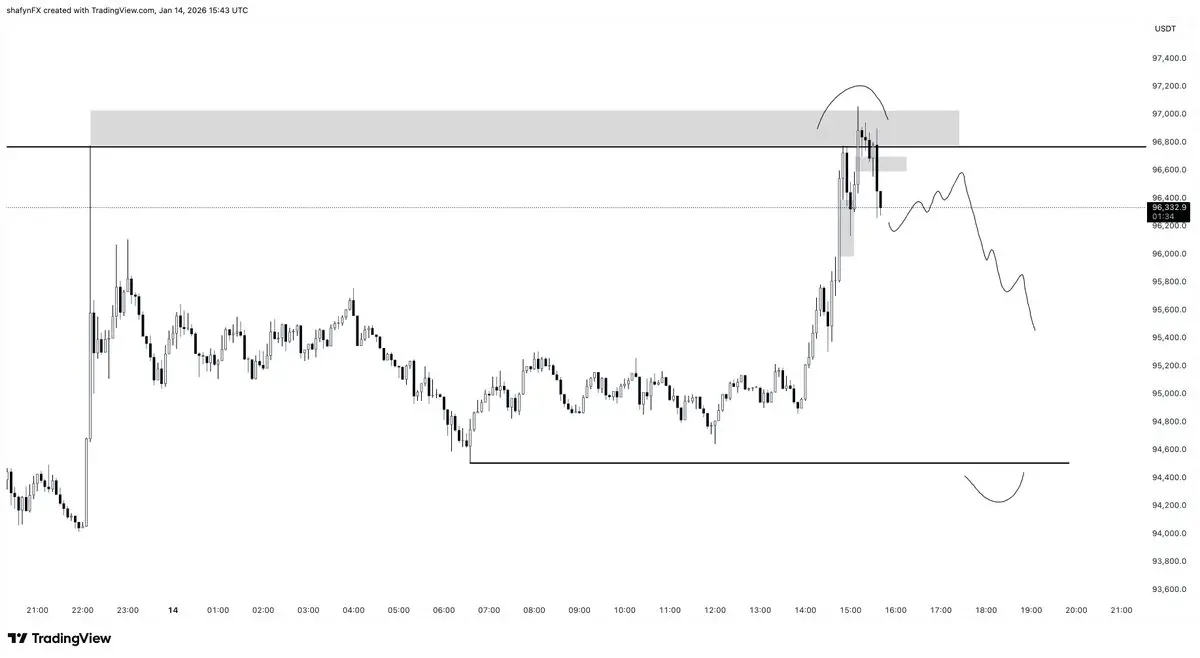

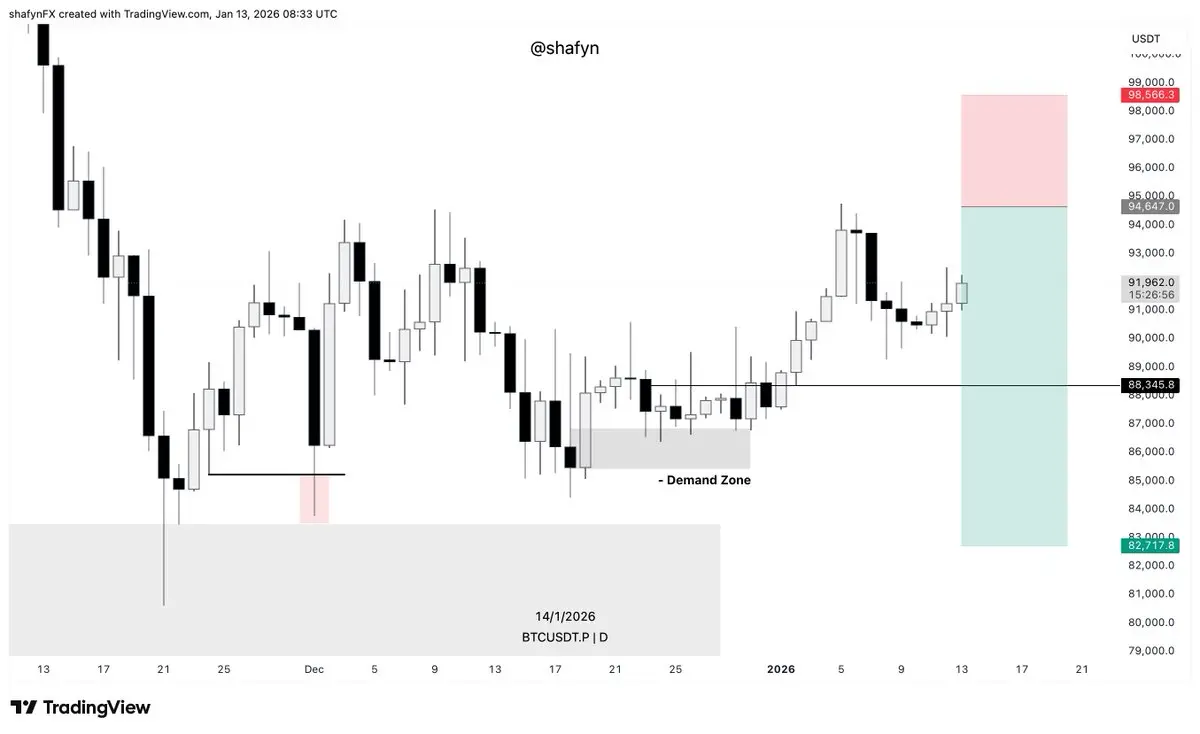

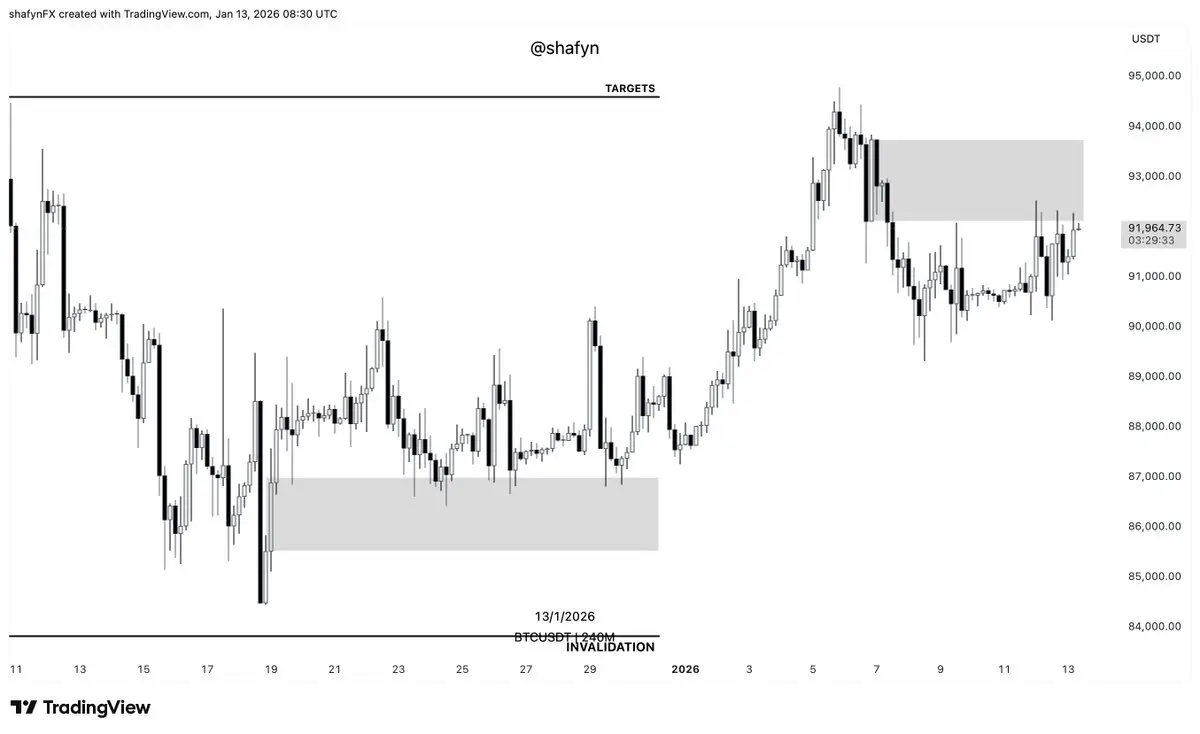

$BTC HTF update:

Currently pushing into a key resistance zone here.

My base case is a rejection from this area, keeping the short-side idea valid, especially if we see liquidity taken above highs, but spot buying fails, CVD diverges, and OI builds without real follow-through (late longs getting trapped).

That said, everything depends on how pthe ice behaves around the grey zone.

If we flip and hold above it with real demand. Strong spot volume, clean CVD continuation, then the bearish idea is off the table, and I’ll shift bullish toward 109K, which becomes the next area of interest.

For now,

Currently pushing into a key resistance zone here.

My base case is a rejection from this area, keeping the short-side idea valid, especially if we see liquidity taken above highs, but spot buying fails, CVD diverges, and OI builds without real follow-through (late longs getting trapped).

That said, everything depends on how pthe ice behaves around the grey zone.

If we flip and hold above it with real demand. Strong spot volume, clean CVD continuation, then the bearish idea is off the table, and I’ll shift bullish toward 109K, which becomes the next area of interest.

For now,

BTC0,42%

- Reward

- like

- Comment

- Repost

- Share

GM.

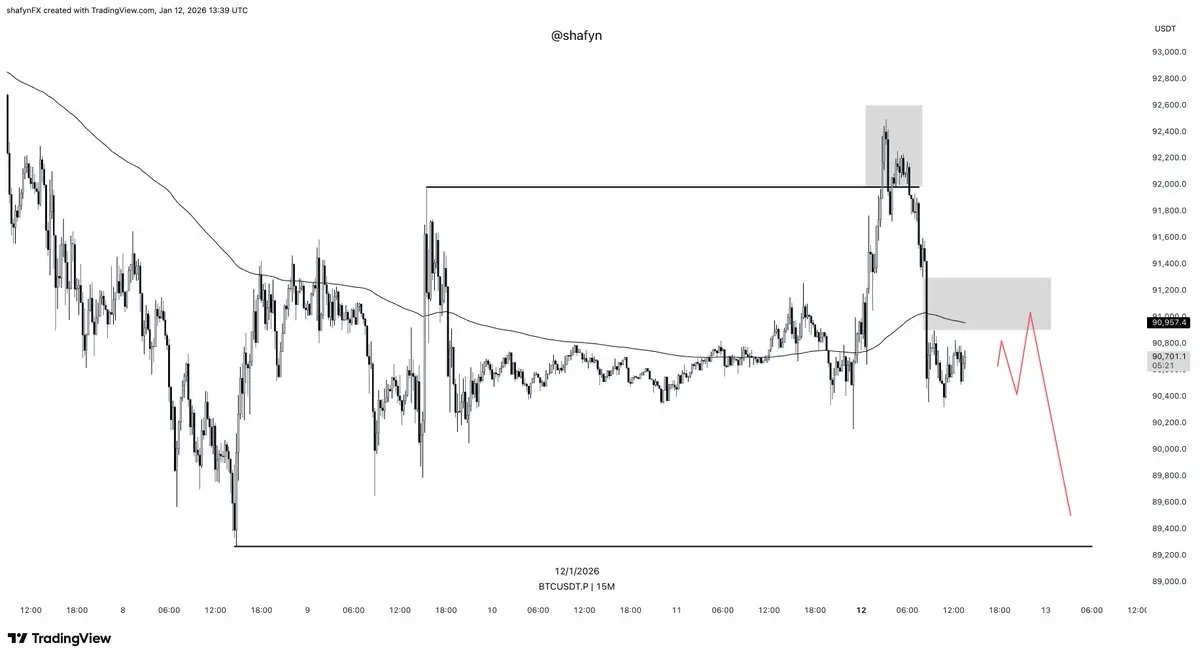

I was wrong on the move from 92–96K.

Caught the upside from the early 80Ks to 91K with longs shared on X, but gave back part of those profits by shorting 93–94K. Still holding a short with stops above 98K.

The mistake was a rookie one, "marrying a bias".

Trades must stay liquid and flexible. I gave back some profits, but accountability matters.

Coming back stronger.

I was wrong on the move from 92–96K.

Caught the upside from the early 80Ks to 91K with longs shared on X, but gave back part of those profits by shorting 93–94K. Still holding a short with stops above 98K.

The mistake was a rookie one, "marrying a bias".

Trades must stay liquid and flexible. I gave back some profits, but accountability matters.

Coming back stronger.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Diabolical day for CT

- Bears got rekt (Me)

- Bulls got stopped breakeven

- Bulls making fun of bears

Classical day at CT

GN

- Bears got rekt (Me)

- Bulls got stopped breakeven

- Bulls making fun of bears

Classical day at CT

GN

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

LittleQueen :

:

good information$BTC

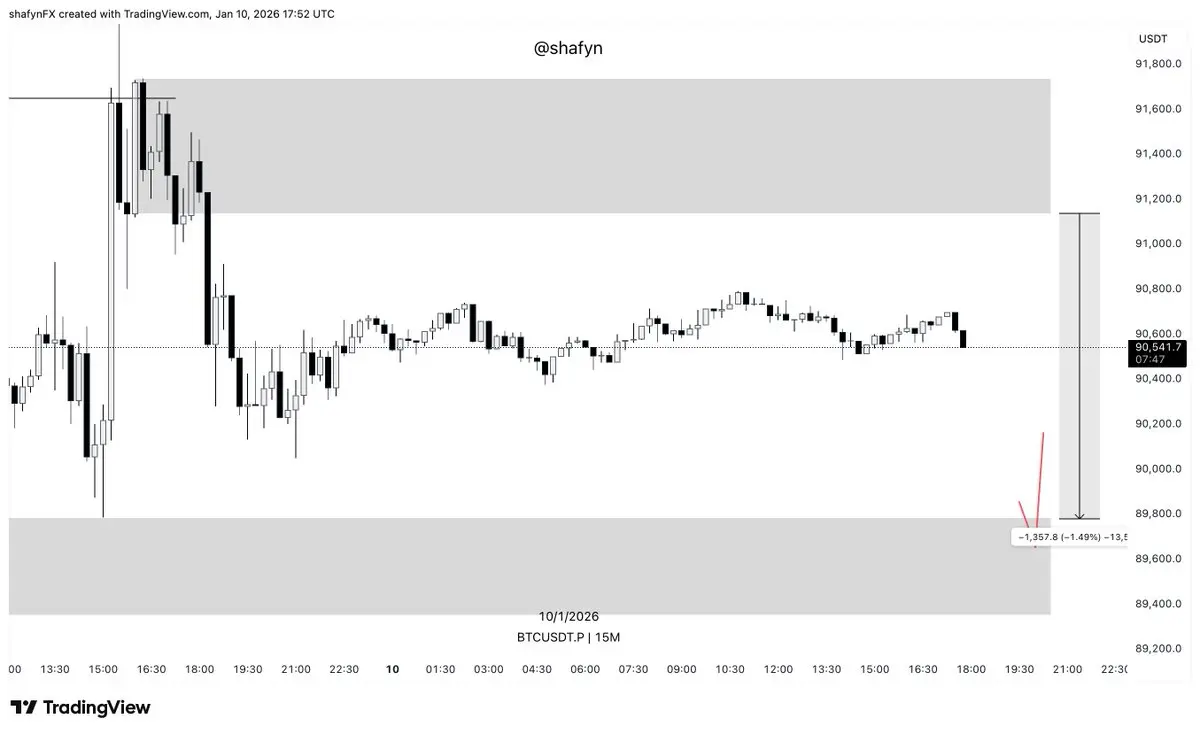

Price is currently trading inside a key order block, making this a critical decision area going into CPI.

Markets are positioned for continued disinflation, with risk assets already extended and longs crowded. Financial conditions remain loose, while services and shelter inflation stay sticky.

Historically, when CPI prints inline or slightly hot in this setup, initial volatility fades into selling pressure as positioning unwinds.

For CPI, I’m looking for bearish acceptance after the first reaction, especially if upside fails to hold and volume confirms.

Bias: sell the reaction.

Price is currently trading inside a key order block, making this a critical decision area going into CPI.

Markets are positioned for continued disinflation, with risk assets already extended and longs crowded. Financial conditions remain loose, while services and shelter inflation stay sticky.

Historically, when CPI prints inline or slightly hot in this setup, initial volatility fades into selling pressure as positioning unwinds.

For CPI, I’m looking for bearish acceptance after the first reaction, especially if upside fails to hold and volume confirms.

Bias: sell the reaction.

BTC0,42%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Shorts or longs??

Who will be eating the other one today????

Who will be eating the other one today????

- Reward

- like

- Comment

- Repost

- Share

Always set you goals realistically

You don't need 10rr trade to be profitable

You just need some small changes to get profitable

- Risk the amount that doesn't effect your psychology

- Take max 2 trades a day in the beginning

- Never over-trade and over-risk

It is simple.

You don't need 10rr trade to be profitable

You just need some small changes to get profitable

- Risk the amount that doesn't effect your psychology

- Take max 2 trades a day in the beginning

- Never over-trade and over-risk

It is simple.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

50 spots will be opened tonight,

Slots will be closed before Monday's open.

LFG!

Slots will be closed before Monday's open.

LFG!

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share