Omimi

No content yet

Omimi

I still can’t believe how wildly inefficient traditional finance actually is. We have trillions tied up in slow-moving credit structures, but the shift to liquid on-chain markets is accelerating fast.

The future of finance goes beyond tokenizing an asset, it's what you actually do with it afterward.

Turning idle debt into tradeable cpTokens changes the math completely.

1. You aren't rotting in a static contract anymore.

2. Your yield-bearing asset unlocks new value across DeFi.

3. Credit becomes a portable financial primitive.

It’s a massive upgrade to the operating system of global credit. M

The future of finance goes beyond tokenizing an asset, it's what you actually do with it afterward.

Turning idle debt into tradeable cpTokens changes the math completely.

1. You aren't rotting in a static contract anymore.

2. Your yield-bearing asset unlocks new value across DeFi.

3. Credit becomes a portable financial primitive.

It’s a massive upgrade to the operating system of global credit. M

- Reward

- 1

- Comment

- Repost

- Share

Most technology fails simply because it speaks the wrong language.

@mwx_ai just brought AIDEN into their Base ecosystem, and it fixes the biggest blind spot in crypto right now. Data isn't power unless you can actually read and apply it instantly.

For the 400 million small businesses trying to survive, complex smart contracts are a brick wall.

MWX acts like a universal remote for business tools, and AIDEN acting as the IQ encyclopedia is the screen that makes the blockchain readable. ...I mean, you wouldn't hand a bakery a coding manual, right?

Here is how it practically works under the hood:

@mwx_ai just brought AIDEN into their Base ecosystem, and it fixes the biggest blind spot in crypto right now. Data isn't power unless you can actually read and apply it instantly.

For the 400 million small businesses trying to survive, complex smart contracts are a brick wall.

MWX acts like a universal remote for business tools, and AIDEN acting as the IQ encyclopedia is the screen that makes the blockchain readable. ...I mean, you wouldn't hand a bakery a coding manual, right?

Here is how it practically works under the hood:

IQ3,88%

- Reward

- like

- Comment

- Repost

- Share

The finish line is exactly where the amateurs get tired.

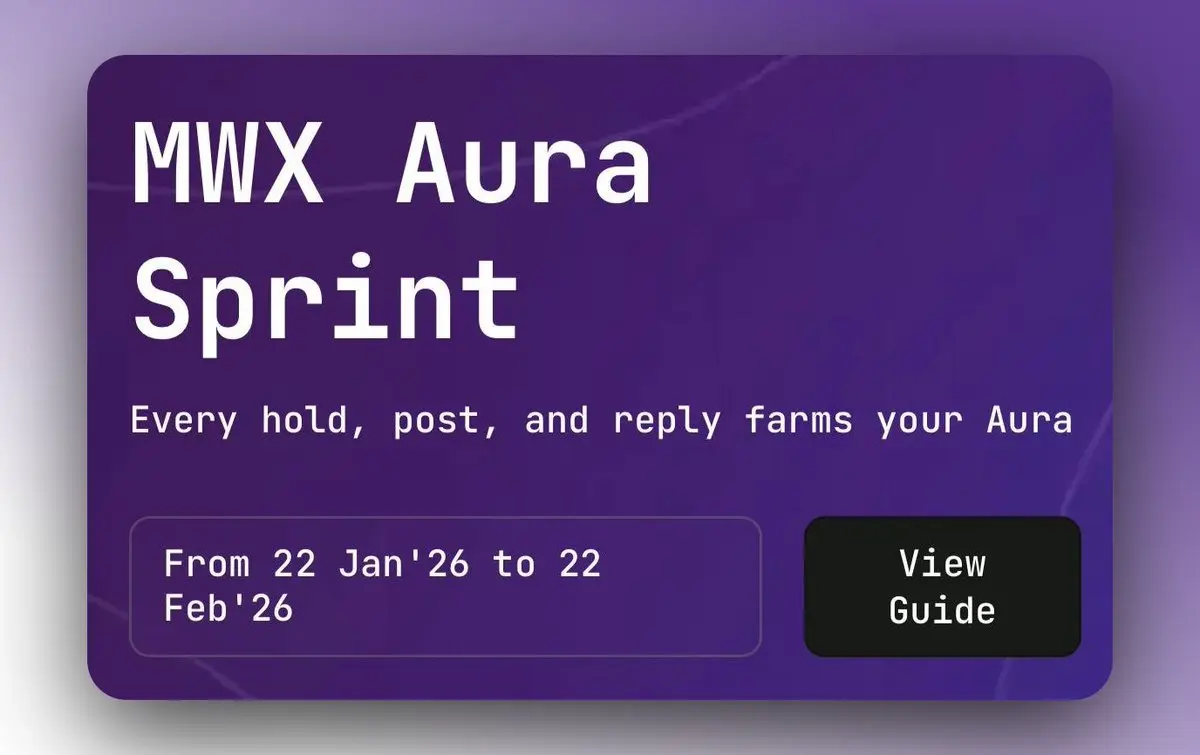

We are exactly five days away from the @mwx_ai Airaa cutoff, and the late-game strategy is getting intense.

Holding $MWXT on Base isn't just a suggestion; it is the bridge to the top tier.

Pure volume loses to calculated multipliers every single time. It's the only way to lock down that $30k USDC pool for the top 50.

Even if you miss, there's that 20-person random bailout in the 51-100 tier.

But let’s be real, the $100k loyalty program wrapping up March 12th is the real target anyway.

Position your bags where the odds actually favor

We are exactly five days away from the @mwx_ai Airaa cutoff, and the late-game strategy is getting intense.

Holding $MWXT on Base isn't just a suggestion; it is the bridge to the top tier.

Pure volume loses to calculated multipliers every single time. It's the only way to lock down that $30k USDC pool for the top 50.

Even if you miss, there's that 20-person random bailout in the 51-100 tier.

But let’s be real, the $100k loyalty program wrapping up March 12th is the real target anyway.

Position your bags where the odds actually favor

- Reward

- 2

- Comment

- Repost

- Share