NekoZz

No content yet

NekoZz

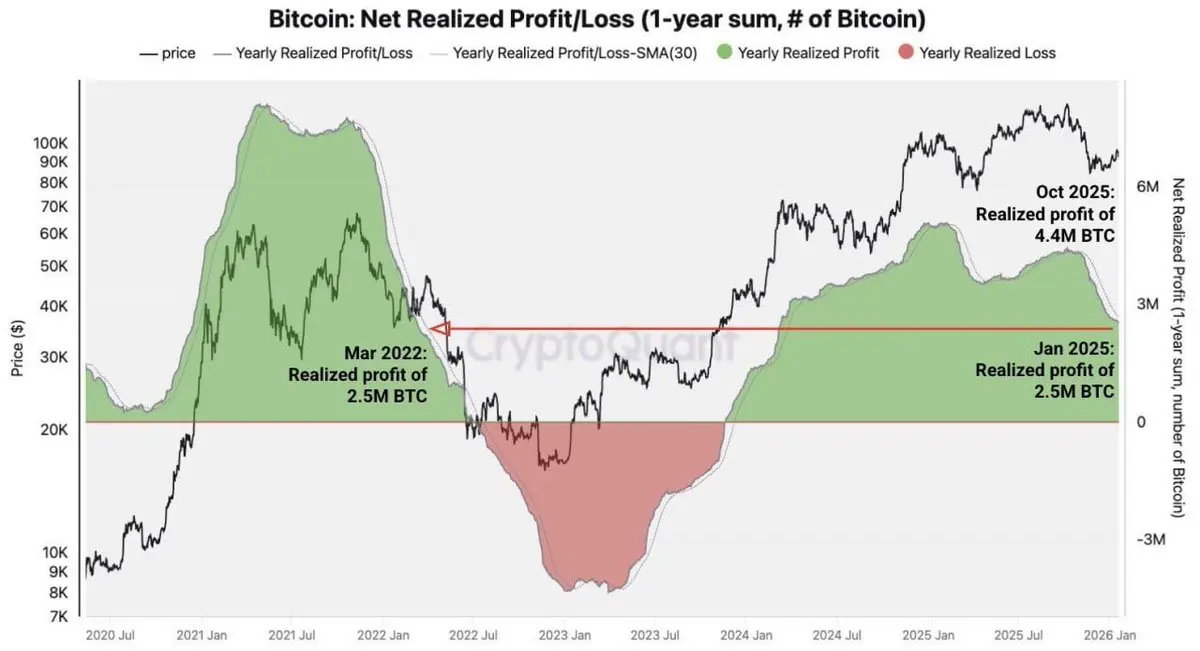

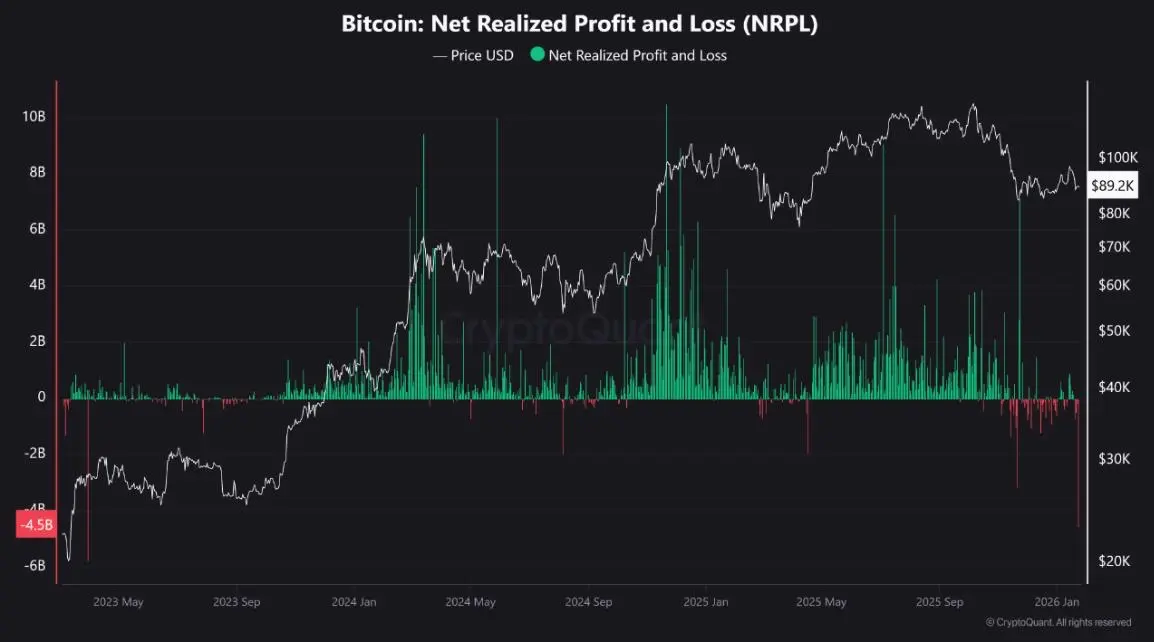

$4.5 Billion in Realized Loss on BitcoinThe highest amount of realized losses in three years occurred recently. The last time this happened with Bitcoin, the price was trading at $28,000 after a brief correction period that lasted about a year.

BTC-0,97%

- Reward

- 1

- Comment

- Repost

- Share

Second substack article is out!

- Reward

- like

- Comment

- Repost

- Share

We’re closer to the bottom than the top.Good. This is where the tourists quit and the real builders get to work.Buy the silence.

- Reward

- like

- Comment

- Repost

- Share

Liquidity is a tide, not a light switch.Gold/Silver are front-running the debasement. Stocks are at the ceiling. Crypto is the last to get the memo, as usual. The divergence is disgusting, but the math eventually wins.

- Reward

- like

- Comment

- Repost

- Share

BREAKING: Bank of America sees Gold hitting $6,000/oz by Spring 2026. That’s a 2x+ move from here. The macro shift is accelerating. If you aren\'t watching the charts, you\'re missing the move of the decade.Gold to the moon.

- Reward

- like

- Comment

- Repost

- Share

Sentora: Key #DeFi metrics this weekThe key shift is rising stablecoin borrowing costs, driven by shrinking liquidity across the market.

- Reward

- like

- Comment

- Repost

- Share

Tokenized Treasuries has surpassed $10 billionCircle’s $USYC deployed on BNB Chain tipped the asset class into next stage of scale.

BNB-0,77%

- Reward

- like

- 1

- Repost

- Share

Dx888 :

:

Today is a new opportunity to step forward more boldly. Don't let fear stop you, because every small effort you make is building a great future.Whale Factor #1: 3 Altcoins Whales Are Quietly Accumulating

- Reward

- like

- Comment

- Repost

- Share

You only get one life. Don’t waste it playing defense. Make the attempt.

- Reward

- like

- Comment

- Repost

- Share

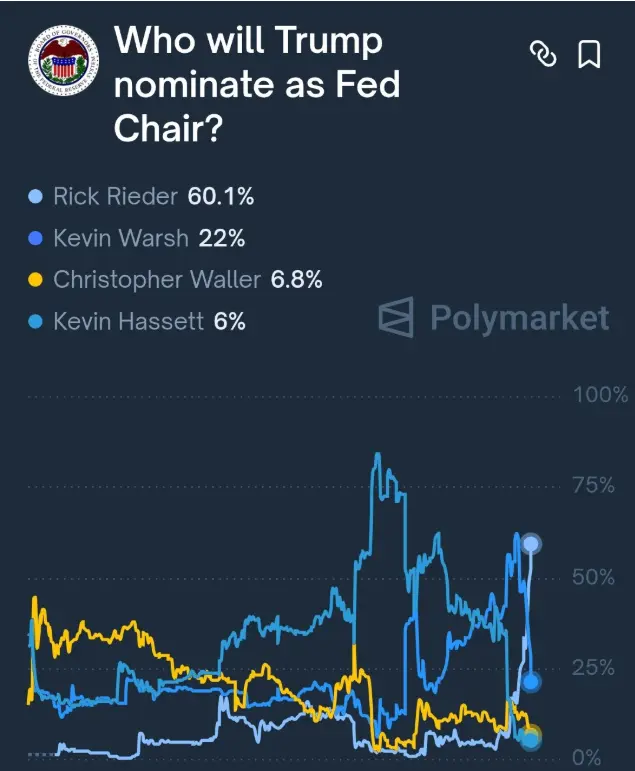

Polymarket betting on Rick Rieder for Fed Chair.Massive for crypto.A Fed chief who actually understands liquidity and digital gold. The pivot is coming.Study the rotation.

- Reward

- like

- Comment

- Repost

- Share

Inflation outlook at a 1-year low. Why are we still at these levels? Powell is a "total stiff" playing defense while the administration tries to move the needle. "Too Late Powell" is the anchor dragging on the recovery. Big rate cut or bust.

- Reward

- like

- Comment

- Repost

- Share