MrFlower_XingChen

No content yet

MrFlower_XingChen

#VanEckLaunchesAVAXSpotETF The cryptocurrency market has entered another defining chapter as VanEck officially announces the launch of its AVAX Spot ETF. This development extends far beyond a single asset listing — it reflects the accelerating integration of digital assets into traditional financial architecture. With each new spot-based product, the boundary between crypto-native markets and institutional capital continues to narrow.

Unlike futures-based instruments, a spot ETF represents direct exposure to the underlying asset. For investors, this distinction is critical. It removes the comp

Unlike futures-based instruments, a spot ETF represents direct exposure to the underlying asset. For investors, this distinction is critical. It removes the comp

- Reward

- 9

- 12

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#AIBotClawdbotGoesViral The viral rise of Clawdbot in late January 2026 marks a rare intersection where genuine AI utility collides directly with speculative crypto behavior. Unlike previous “AI narrative” waves that relied largely on abstraction and imagination, Clawdbot represents something materially different: a functioning open-source AI agent with real-world usage spreading organically among developers and productivity-focused users.

This convergence has created a uniquely complex market dynamic. On one side sits authentic technological momentum driven by experimentation and adoption. On

This convergence has created a uniquely complex market dynamic. On one side sits authentic technological momentum driven by experimentation and adoption. On

- Reward

- 8

- 10

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#SolanaMemeHypeReturns The January 2026 Solana meme season marks a decisive transformation in speculative behavior. What began earlier in the cycle as AI-driven narrative trading has evolved into something far more aggressive, compressed, and reactive. Capital is no longer waiting for whitepapers, product demos, or influencer validation. Instead, it is front-running real-time political imagery, social media mistakes, and global optics — turning attention itself into the primary asset.

This shift represents a new phase of meme speculation: high-velocity political virality. Entire hype cycles ar

This shift represents a new phase of meme speculation: high-velocity political virality. Entire hype cycles ar

- Reward

- 9

- 23

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#FedRateDecisionApproaches The Federal Reserve’s upcoming rate decision has once again become the central axis of global financial attention. Markets are not merely reacting to the possibility of a rate change, but to the deeper message embedded within the Federal Reserve’s communication strategy. In the current environment, perception often matters more than policy itself.

With inflation showing mixed signals and economic momentum slowing unevenly, the Fed finds itself walking a narrow path. On one side lies the risk of reigniting inflation through premature easing, and on the other, the dang

With inflation showing mixed signals and economic momentum slowing unevenly, the Fed finds itself walking a narrow path. On one side lies the risk of reigniting inflation through premature easing, and on the other, the dang

- Reward

- 8

- 6

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#GameFiSeesaStrongRebound 1️⃣ After one of the deepest collapses in crypto history, GameFi is finally showing signs of structural recovery$GT in early 2026. Following a brutal 75% sector-wide drawdown during 2025, capital rotation is slowly returning as investors reassess undervalued gaming ecosystems. Unlike previous hype cycles, this rebound is not purely price-driven — it is being supported by visible improvements in design, infrastructure, and real user engagement.

2️⃣ The recent 14% week-over-week increase in GameFi market capitalization marks a psychological turning point. While overa

2️⃣ The recent 14% week-over-week increase in GameFi market capitalization marks a psychological turning point. While overa

GT1,01%

- Reward

- 11

- 7

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#CryptoRegulationNewProgress 1️⃣ Global crypto regulation has officially moved into its execution phase, marking a historic transition from $BTC $ETH experimentation to enforcement. After more than a decade of regulatory uncertainty, governments are no longer debating whether crypto should exist — they are now deciding how it must operate. This structural shift is transforming crypto from a speculative frontier market into a regulated financial sector that increasingly mirrors traditional banking and capital markets.

2️⃣ The most important change is the global alignment of compliance stand

2️⃣ The most important change is the global alignment of compliance stand

- Reward

- 9

- 9

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate The current geopolitical escalation in the Middle East is casting a heavy shadow over the global financial landscape, and the cryptocurrency market is not immune to its effects. With rising tensions in the region, crypto markets are grappling with heightened volatility, erratic liquidity flows, and drastic swings in investor sentiment. In particular, we are seeing a marked shift in the behavior of both institutional and retail investors, as they navigate this uncertain environment. The intersection of geopolitical risks and financial markets has pushed cryptocurrenc

- Reward

- 7

- 9

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#CLARITYBillDelayed Regulatory Uncertainty and the Path Forward

1️⃣ The recent delay of the CLARITY Act marks another pivotal moment in U.S. crypto regulation. Originally envisioned as a comprehensive framework for federal oversight, its postponement leaves the market navigating uncharted legal territory. Stakeholders are facing an environment where uncertainty has become the default state.

2️⃣ At the heart of the issue are competing priorities. Lawmakers, regulators, and industry participants all recognize the need for clarity, yet disagreements over jurisdiction, innovation, and investor pro

1️⃣ The recent delay of the CLARITY Act marks another pivotal moment in U.S. crypto regulation. Originally envisioned as a comprehensive framework for federal oversight, its postponement leaves the market navigating uncharted legal territory. Stakeholders are facing an environment where uncertainty has become the default state.

2️⃣ At the heart of the issue are competing priorities. Lawmakers, regulators, and industry participants all recognize the need for clarity, yet disagreements over jurisdiction, innovation, and investor pro

- Reward

- 24

- 102

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

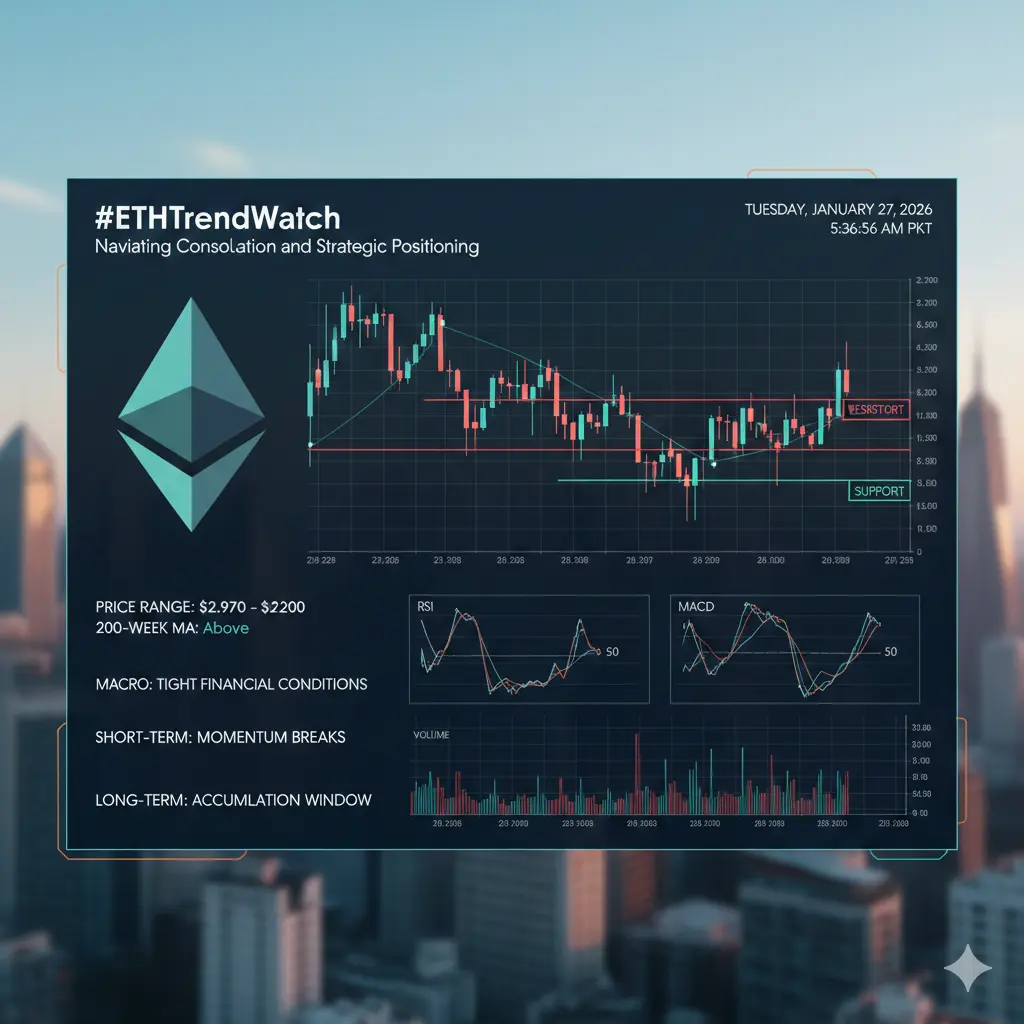

#ETHTrendWatch Ethereum Trend Watch: Navigating Consolidation and Strategic Positioning

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a consolidation phase marked by elevated volatility and cautious market participation. Price action remains confined within the $2,970–$3,200 zone, reflecting a market balancing accumulation interest with broader macro uncertainty. Traders and community participants are closely observing these ranges for actionable opportunities.

Demand consistently appears near the $3,100–$3,200 level, supported by short-term moving averages

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a consolidation phase marked by elevated volatility and cautious market participation. Price action remains confined within the $2,970–$3,200 zone, reflecting a market balancing accumulation interest with broader macro uncertainty. Traders and community participants are closely observing these ranges for actionable opportunities.

Demand consistently appears near the $3,100–$3,200 level, supported by short-term moving averages

- Reward

- 20

- 95

- 1

- Share

GateUser-0647c8a9 :

:

Paying Close Attention🔍View More

#TheWorldEconomicForum A Turning Point for Global Governance, AI, and Geopolitics

The 56th Annual Meeting of the World Economic Forum (WEF) concluded in Davos, Switzerland, from January 19–23, 2026, drawing an unprecedented assembly of world leaders, CEOs, policymakers, and civil society figures. With nearly 3,000 participants from over 130 countries, including record representation from major economies, Davos 2026 reflected the complex geopolitical and economic crossroads shaping the world today.

Geopolitical Strains and Trade Tensions

The forum was dominated by discussions around renewed tar

The 56th Annual Meeting of the World Economic Forum (WEF) concluded in Davos, Switzerland, from January 19–23, 2026, drawing an unprecedented assembly of world leaders, CEOs, policymakers, and civil society figures. With nearly 3,000 participants from over 130 countries, including record representation from major economies, Davos 2026 reflected the complex geopolitical and economic crossroads shaping the world today.

Geopolitical Strains and Trade Tensions

The forum was dominated by discussions around renewed tar

- Reward

- 19

- 136

- Repost

- Share

xiaoXiao :

:

2026 Go Go Go 👊View More

#NextFedChairPredictions The Decision That Could Define the Direction of Global Markets

As 2026 unfolds, global financial markets are increasingly focused on one central question: who will become the next Chair of the Federal Reserve, and what direction will that leadership impose on global liquidity? This is far more than a political appointment — it represents control over the world’s most influential central bank, with the power to shape capital flows across every asset class.

From U.S. Treasuries to emerging markets and cryptocurrencies, investors are positioning not around today’s data, b

As 2026 unfolds, global financial markets are increasingly focused on one central question: who will become the next Chair of the Federal Reserve, and what direction will that leadership impose on global liquidity? This is far more than a political appointment — it represents control over the world’s most influential central bank, with the power to shape capital flows across every asset class.

From U.S. Treasuries to emerging markets and cryptocurrencies, investors are positioning not around today’s data, b

- Reward

- 16

- 129

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#JapanBondMarketSell-Off A Silent Macro Shift With Global Consequences

The recent surge in Japanese government bond yields — particularly the sharp move of over 25 basis points in 30-year and 40-year maturities — is emerging as one of the most underappreciated macro developments of early 2026. While it may seem like a domestic policy adjustment, global investors increasingly interpret this as a potential turning point in one of the world’s most influential financial anchors.

For decades, Japan has maintained an ultra-low-yield framework, shaping global liquidity behavior. Japanese bonds acted

The recent surge in Japanese government bond yields — particularly the sharp move of over 25 basis points in 30-year and 40-year maturities — is emerging as one of the most underappreciated macro developments of early 2026. While it may seem like a domestic policy adjustment, global investors increasingly interpret this as a potential turning point in one of the world’s most influential financial anchors.

For decades, Japan has maintained an ultra-low-yield framework, shaping global liquidity behavior. Japanese bonds acted

- Reward

- 15

- 84

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#GrowthPointsDrawRound16 Where Community Power Turns Activity Into Opportunity

With the arrival of 2026, Gate.io has ushered in the new year with renewed momentum by launching the 16th edition of the Growth Value New Year Lottery — Growth Points Draw Round 16. This campaign reflects a strategic evolution: it is no longer just a giveaway, but a framework that transforms community participation into tangible opportunity.

Rather than measuring success solely by trading volume, the event emphasizes active engagement. Users earn Growth Points by contributing to Gate Square — posting content, commen

With the arrival of 2026, Gate.io has ushered in the new year with renewed momentum by launching the 16th edition of the Growth Value New Year Lottery — Growth Points Draw Round 16. This campaign reflects a strategic evolution: it is no longer just a giveaway, but a framework that transforms community participation into tangible opportunity.

Rather than measuring success solely by trading volume, the event emphasizes active engagement. Users earn Growth Points by contributing to Gate Square — posting content, commen

- Reward

- 14

- 110

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#GateTradFi1gGoldGiveaway Where Digital Commitment Shapes the Future of Value

As 2026 progresses, the intersection of digital finance and tangible assets is entering a decisive new phase. Gate TradFi’s 1g Gold Giveaway exemplifies this shift. It is no longer merely a promotional campaign — it is emerging as a blueprint for how next-generation platforms reward participation, loyalty, and disciplined engagement.

Unlike conventional reward structures that rely on volatile tokens or fleeting incentives, this initiative anchors digital activity to a universally recognized asset: physical gold. Gold

As 2026 progresses, the intersection of digital finance and tangible assets is entering a decisive new phase. Gate TradFi’s 1g Gold Giveaway exemplifies this shift. It is no longer merely a promotional campaign — it is emerging as a blueprint for how next-generation platforms reward participation, loyalty, and disciplined engagement.

Unlike conventional reward structures that rely on volatile tokens or fleeting incentives, this initiative anchors digital activity to a universally recognized asset: physical gold. Gold

- Reward

- 14

- 118

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#IranTradeSanctions Trade at a Crossroads — When Geopolitics Becomes Global Economics

In early 2026, Iran-related sanctions have expanded far beyond their original scope. What once functioned as a targeted geopolitical instrument has evolved into a system-wide pressure mechanism reshaping trade behavior, diplomatic alignment, and global market confidence.

The sanctions framework now reaches far outside Iran itself. By restricting access to capital, technology, logistics, and financial infrastructure, the measures increasingly affect not only Tehran — but every economy connected to its trade ne

In early 2026, Iran-related sanctions have expanded far beyond their original scope. What once functioned as a targeted geopolitical instrument has evolved into a system-wide pressure mechanism reshaping trade behavior, diplomatic alignment, and global market confidence.

The sanctions framework now reaches far outside Iran itself. By restricting access to capital, technology, logistics, and financial infrastructure, the measures increasingly affect not only Tehran — but every economy connected to its trade ne

- Reward

- 14

- 77

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#DOGEETFListsonNasdaq Dogecoin Enters Wall Street — From Internet Culture to Regulated Capital

A symbolic line was crossed in early 2026 as Dogecoin officially entered traditional financial markets. The listing of a Dogecoin exchange-traded fund on Nasdaq marked a historic moment — not only for DOGE, but for the broader evolution of digital assets.

For the first time, investors gained regulated exposure to Dogecoin through a spot-based ETF structure, allowing participation without wallets, private keys, or on-chain complexity. What began as internet humor has now reached institutional infrastr

A symbolic line was crossed in early 2026 as Dogecoin officially entered traditional financial markets. The listing of a Dogecoin exchange-traded fund on Nasdaq marked a historic moment — not only for DOGE, but for the broader evolution of digital assets.

For the first time, investors gained regulated exposure to Dogecoin through a spot-based ETF structure, allowing participation without wallets, private keys, or on-chain complexity. What began as internet humor has now reached institutional infrastr

DOGE0,65%

- Reward

- 17

- 98

- Repost

- Share

Ryky :

:

Paying Close Attention🔍View More

#RIVERUp50xinOneMonth The New Route of Digital Liquidity

As Bitcoin enters a consolidation phase near its upper valuation zone, market attention has quietly shifted toward a new source of momentum. While majors stabilize, capital has begun searching for velocity — and that search has brought River protocol into focus.

Over the past month, RIVER has transformed from a low-visibility asset into one of the most discussed names across on-chain analytics dashboards. The move has not been driven by memes or short-term excitement alone, but by a convergence of narrative alignment, liquidity access, a

As Bitcoin enters a consolidation phase near its upper valuation zone, market attention has quietly shifted toward a new source of momentum. While majors stabilize, capital has begun searching for velocity — and that search has brought River protocol into focus.

Over the past month, RIVER has transformed from a low-visibility asset into one of the most discussed names across on-chain analytics dashboards. The move has not been driven by memes or short-term excitement alone, but by a convergence of narrative alignment, liquidity access, a

BTC-0,36%

- Reward

- 11

- 98

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊2026 GOGOGO 👊2026 GOGOGO 👊View More

#BitcoinFallsBehindGold When Protection Outranks Innovation

Global financial markets are quietly delivering a powerful message. The hierarchy of safe-haven assets is shifting once again. Recent price behavior reveals a growing divergence between Bitcoin and Gold — one that reflects a deeper change in investor psychology.

As geopolitical tension intensifies and monetary visibility weakens, capital is no longer chasing transformation. It is prioritizing preservation.

Gold’s advance is neither emotional nor speculative. Its movement toward the upper valuation bands reflects deliberate allocation

Global financial markets are quietly delivering a powerful message. The hierarchy of safe-haven assets is shifting once again. Recent price behavior reveals a growing divergence between Bitcoin and Gold — one that reflects a deeper change in investor psychology.

As geopolitical tension intensifies and monetary visibility weakens, capital is no longer chasing transformation. It is prioritizing preservation.

Gold’s advance is neither emotional nor speculative. Its movement toward the upper valuation bands reflects deliberate allocation

BTC-0,36%

- Reward

- 11

- 106

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#TrumpWithdrawsEUTariffThreats From Confrontation to Calculation: A Strategic Reset in 2026

The opening phase of 2026 delivered a familiar reminder to global markets: political signaling still moves capital faster than economic data. When the United States administration floated the possibility of new customs tariffs on several European nations, market sentiment shifted instantly. The scale of the proposal mattered less than the uncertainty it introduced.

Within hours, investors began repricing geopolitical risk. Equities weakened, crypto markets corrected sharply, and capital rotated toward t

The opening phase of 2026 delivered a familiar reminder to global markets: political signaling still moves capital faster than economic data. When the United States administration floated the possibility of new customs tariffs on several European nations, market sentiment shifted instantly. The scale of the proposal mattered less than the uncertainty it introduced.

Within hours, investors began repricing geopolitical risk. Equities weakened, crypto markets corrected sharply, and capital rotated toward t

- Reward

- 14

- 108

- Repost

- Share

GateUser-3ae550c6 :

:

Honesty is the best policyView More