MarkETH

No content yet

MarkEth

🔥 $RENDER is loading up for Wave 2.

The 4H chart is flashing signals price is squeezing inside a falling wedge, and pressure is building fast.

This setup usually doesn’t stay quiet for long.

Breakout looks imminent.

Momentum is shifting.

Targeting up to 50% upside if confirmation hits.

Smart money watches these structures before the move not after.

Keep $RENDER on your radar… this one could move quickly 🚀

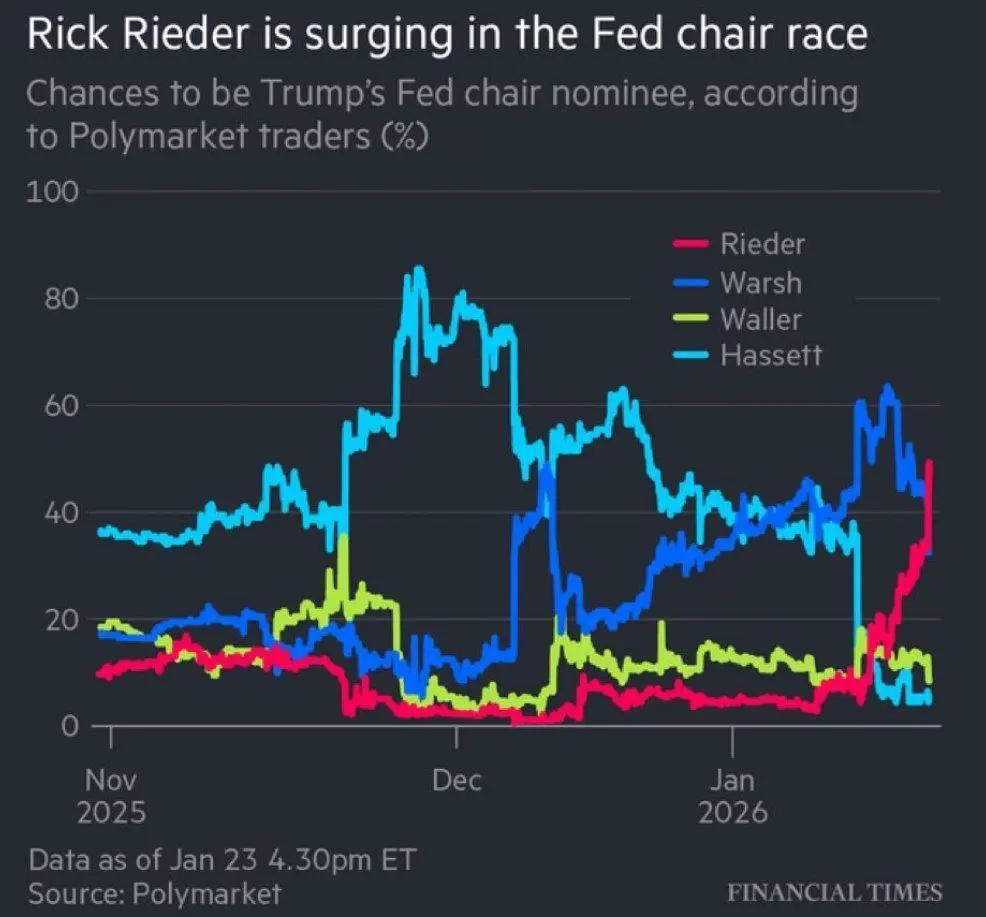

#CryptoRegulationNewProgress #FedRateDecisionApproaches

The 4H chart is flashing signals price is squeezing inside a falling wedge, and pressure is building fast.

This setup usually doesn’t stay quiet for long.

Breakout looks imminent.

Momentum is shifting.

Targeting up to 50% upside if confirmation hits.

Smart money watches these structures before the move not after.

Keep $RENDER on your radar… this one could move quickly 🚀

#CryptoRegulationNewProgress #FedRateDecisionApproaches

RENDER-10,86%

- Reward

- 1

- Comment

- 1

- Share

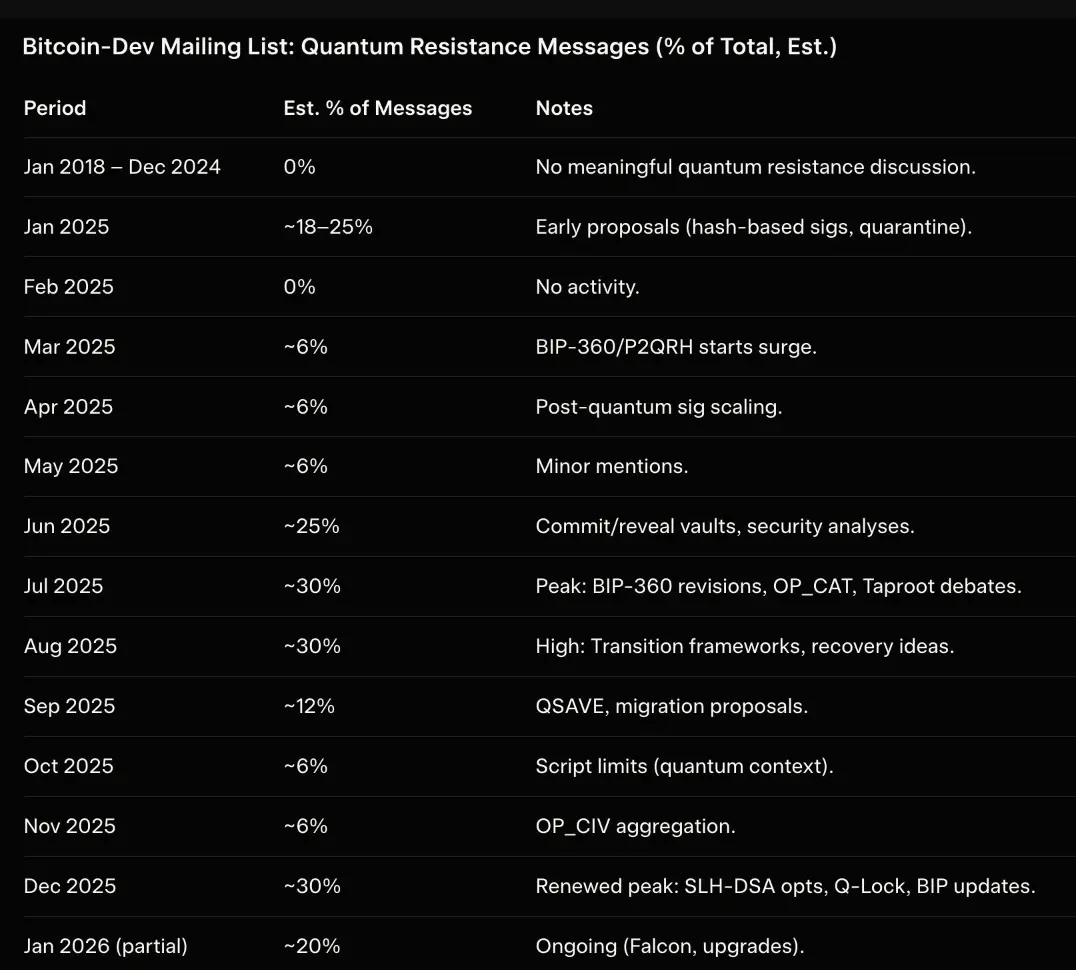

Bitcoin’s quantum debate is heating up.

While Solana and Ethereum are already moving toward post-quantum security, $BTC is still stuck between not yet and we’ll handle it later.

Some OGs say quantum is decades away. Others think it’s already impacting BTC vs gold.

Willy Woo notes progress is finally accelerating but it’s late.

Nic Carter drops the real alpha: if Bitcoin drags its feet on post-quantum upgrades, $ETH could take the lead in investor returns.

Quantum readiness won’t be optional.

#ContentMiningRevampPublicBeta #MiddleEastTensionsEscalate

While Solana and Ethereum are already moving toward post-quantum security, $BTC is still stuck between not yet and we’ll handle it later.

Some OGs say quantum is decades away. Others think it’s already impacting BTC vs gold.

Willy Woo notes progress is finally accelerating but it’s late.

Nic Carter drops the real alpha: if Bitcoin drags its feet on post-quantum upgrades, $ETH could take the lead in investor returns.

Quantum readiness won’t be optional.

#ContentMiningRevampPublicBeta #MiddleEastTensionsEscalate

- Reward

- like

- Comment

- Repost

- Share

$ETHFI is compressing inside a falling wedge on the Daily, and price looks close to forming a base.

Risk is tightening here if this structure plays out, I’m eyeing a potential 30% upside in the short term.

Not financial advice. Watching for confirmation.

#ETHTrendWatch #TheWorldEconomicForum

Risk is tightening here if this structure plays out, I’m eyeing a potential 30% upside in the short term.

Not financial advice. Watching for confirmation.

#ETHTrendWatch #TheWorldEconomicForum

ETHFI-7,35%

- Reward

- like

- Comment

- Repost

- Share

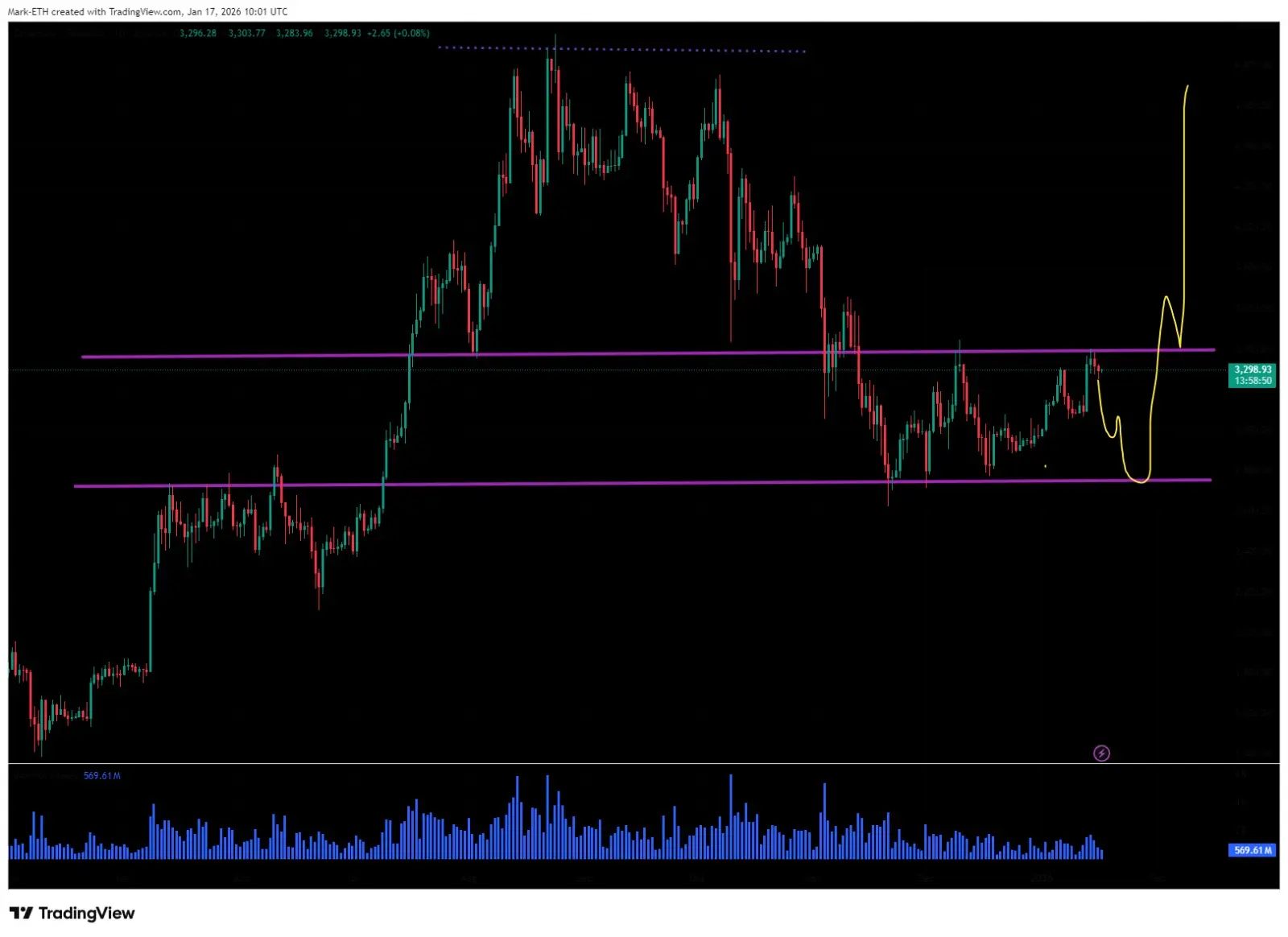

Ethereum is starting to roll over from a classic bearish flag setup on the daily chart. Price action is losing strength, and the structure suggests sellers may be stepping back in.

If this breakdown confirms, we could see a sharp move to the downside. I’m positioning for a potential ~21% move in the short term.

Momentum is shifting manage risk and stay sharp. 👀📉

$ETH

#ContentMiningRevampPublicBeta #GoldandSilverHitNewHighs

If this breakdown confirms, we could see a sharp move to the downside. I’m positioning for a potential ~21% move in the short term.

Momentum is shifting manage risk and stay sharp. 👀📉

$ETH

#ContentMiningRevampPublicBeta #GoldandSilverHitNewHighs

ETH-5,15%

- Reward

- like

- Comment

- Repost

- Share

$RVN looks like it’s carving out a classic falling wedge on the macro chart a structure that usually signals exhaustion on the downside.

Weekly price action suggests the bottom may already be in. Momentum is quietly shifting, and if this setup plays out, a solid reversal could be next.

I’m eyeing a potential 50%–100% upside from these levels. Definitely one to keep on your radar. 👀📈

#GateWeb3UpgradestoGateDEX #BitcoinWeakensVsGold

Weekly price action suggests the bottom may already be in. Momentum is quietly shifting, and if this setup plays out, a solid reversal could be next.

I’m eyeing a potential 50%–100% upside from these levels. Definitely one to keep on your radar. 👀📈

#GateWeb3UpgradestoGateDEX #BitcoinWeakensVsGold

RVN-6,77%

- Reward

- like

- Comment

- Repost

- Share

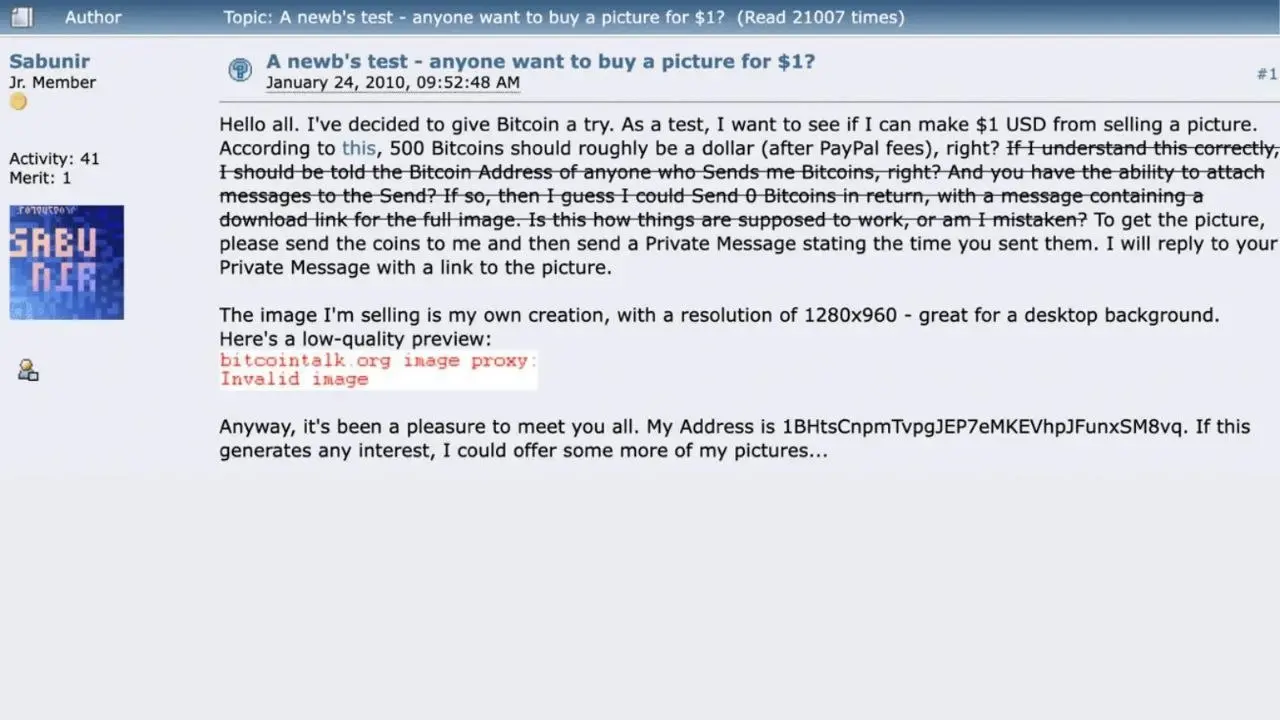

🔥 THROWBACK:

16 years ago today, someone offered to sell digital art for 500 $BTC worth $1 at the time.

Was this the first NFT?

#GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats

16 years ago today, someone offered to sell digital art for 500 $BTC worth $1 at the time.

Was this the first NFT?

#GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats

BTC-3,43%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊$AAVE looks primed right now 👀

It’s compressing inside a falling wedge on the daily, and pressure is clearly building for a breakout 📈

This one’s moving straight to the top of my watchlist structure says the move could come fast once it clears.

If it breaks clean, a 30% run in a short window isn’t unrealistic 💰

Definitely one to keep eyes on.

#ETHTrendWatch #GoldandSilverHitNewHighs

It’s compressing inside a falling wedge on the daily, and pressure is clearly building for a breakout 📈

This one’s moving straight to the top of my watchlist structure says the move could come fast once it clears.

If it breaks clean, a 30% run in a short window isn’t unrealistic 💰

Definitely one to keep eyes on.

#ETHTrendWatch #GoldandSilverHitNewHighs

AAVE-7,81%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 3

- Comment

- Repost

- Share

Whenever hype being made with crypto and $BTC this happened again and again.

That's probably the 5 th time altcoins Doe's the same trick.

I'm amazed that who don't want to, for Bitcoin to cross $100k .

Always top buyers sell their bags.

I'm seeing from weeks only Michael saylor buying while Black Rock only selling in this situation.

CZ calls for crypto super cycle. Sorry but not like the way 😂

So keep yourself safe and hate leverage currently.

spend time with your family currently 🤝

#Gate1gGoldGiveaway #TariffTensionsHitCryptoMarket

That's probably the 5 th time altcoins Doe's the same trick.

I'm amazed that who don't want to, for Bitcoin to cross $100k .

Always top buyers sell their bags.

I'm seeing from weeks only Michael saylor buying while Black Rock only selling in this situation.

CZ calls for crypto super cycle. Sorry but not like the way 😂

So keep yourself safe and hate leverage currently.

spend time with your family currently 🤝

#Gate1gGoldGiveaway #TariffTensionsHitCryptoMarket

BTC-3,43%

- Reward

- like

- Comment

- Repost

- Share

$AR about to breakout from falling wedge pattern.

If breakout here, retest to trend zone will send it much higher.

See you at double figures.

#TariffTensionsHitCryptoMarket #CryptoMarketPullback

If breakout here, retest to trend zone will send it much higher.

See you at double figures.

#TariffTensionsHitCryptoMarket #CryptoMarketPullback

AR-8,34%

- Reward

- like

- Comment

- Repost

- Share

$ETH making clean structure than ever in this demand zone.

You've seen previous rally from $XMR & $ZEC but eth will make higher impact i think.

So keep you high mc gems in your wallet and stay away from leverage currently.

#WeekendMarketAnalysis #ChineseMemecoinBoom

You've seen previous rally from $XMR & $ZEC but eth will make higher impact i think.

So keep you high mc gems in your wallet and stay away from leverage currently.

#WeekendMarketAnalysis #ChineseMemecoinBoom

- Reward

- like

- Comment

- Repost

- Share

I was right about recent year bear dominance

Now I'm seeing $ETH will outperform $BTC and first large mc altcoins will dominate

and then small caps like $ASTER will do wonders.

#IstheMarketBottoming? #GateFun马勒戈币Surges1251.09%

Now I'm seeing $ETH will outperform $BTC and first large mc altcoins will dominate

and then small caps like $ASTER will do wonders.

#IstheMarketBottoming? #GateFun马勒戈币Surges1251.09%

- Reward

- like

- Comment

- Repost

- Share

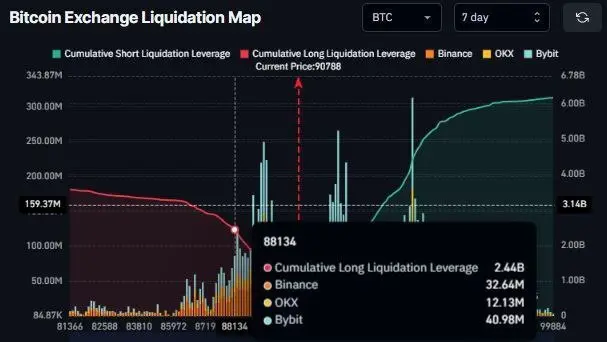

$BTC still has that unfilled CME gap from New Year’s Eve sitting near $88K and it matters.

If price slides down to close it, we could see over $2.4B in leveraged longs get wiped out, triggering a fast flush lower.

It’s a level traders should keep on their radar one dip in that direction and volatility could explode in both directions.

#AreYouBullishOrBearishToday? #BTCMarketAnalysis

If price slides down to close it, we could see over $2.4B in leveraged longs get wiped out, triggering a fast flush lower.

It’s a level traders should keep on their radar one dip in that direction and volatility could explode in both directions.

#AreYouBullishOrBearishToday? #BTCMarketAnalysis

BTC-3,43%

- Reward

- like

- Comment

- Repost

- Share

Basically $MSCI had the option to remove Bitcoin-holding companies from their indexes in the February review, but chose not to.

Some people wanted firms with big $BTC treasuries kicked out because “it’s too risky.”

MSCI instead said, no these companies are legitimate parts of the market.

That keeps them in major indexes that big investors track.

It also recognizes that holding digital assets is now a normal treasury choice, not a fringe activity.

#GMTokenLaunchAndPromotion #BitcoinSix-DayRally

Some people wanted firms with big $BTC treasuries kicked out because “it’s too risky.”

MSCI instead said, no these companies are legitimate parts of the market.

That keeps them in major indexes that big investors track.

It also recognizes that holding digital assets is now a normal treasury choice, not a fringe activity.

#GMTokenLaunchAndPromotion #BitcoinSix-DayRally

BTC-3,43%

- Reward

- like

- Comment

- Repost

- Share

Hello Happy new year guys

$BNB just strike best candle in new year.

Better days ahead

#Gate2025AnnualReport #CryptoMarketRebound

$BNB just strike best candle in new year.

Better days ahead

#Gate2025AnnualReport #CryptoMarketRebound

BNB-2,9%

- Reward

- like

- Comment

- Repost

- Share

$BTC hits $90K mark and $ETH crossed $3100 barrier.

I wouldn't be surprised to see another manipulation tomorrow morning.

what you think?

#GateCEO2025YearEndOpenLetter #My2026FirstPost

I wouldn't be surprised to see another manipulation tomorrow morning.

what you think?

#GateCEO2025YearEndOpenLetter #My2026FirstPost

- Reward

- like

- Comment

- Repost

- Share

🇸🇻 El Salvador is doubling down on its future.

In 2026, the country plans to fully commit to Bitcoin and AI as core pillars of its economic strategy. It’s not just about holding $BTC anymore it’s about building infrastructure, innovation, and intelligence around it.

While others debate regulation and hesitation, El Salvador is choosing execution.

Crypto-native finance + AI-driven systems could redefine how a nation competes in the digital era.

Bold move. High conviction. The world will be watching.

#DrHan2025YearEndOpenLetter #My2026FirstPost

In 2026, the country plans to fully commit to Bitcoin and AI as core pillars of its economic strategy. It’s not just about holding $BTC anymore it’s about building infrastructure, innovation, and intelligence around it.

While others debate regulation and hesitation, El Salvador is choosing execution.

Crypto-native finance + AI-driven systems could redefine how a nation competes in the digital era.

Bold move. High conviction. The world will be watching.

#DrHan2025YearEndOpenLetter #My2026FirstPost

BTC-3,43%

- Reward

- like

- Comment

- Repost

- Share