MAB350

No content yet

MAB350

Key Details of the Bitcoin Bridge:Trust-Minimized Design: It enables users to move BTC directly onto Plasma wi

BTC-0,45%

- Reward

- like

- Comment

- Repost

- Share

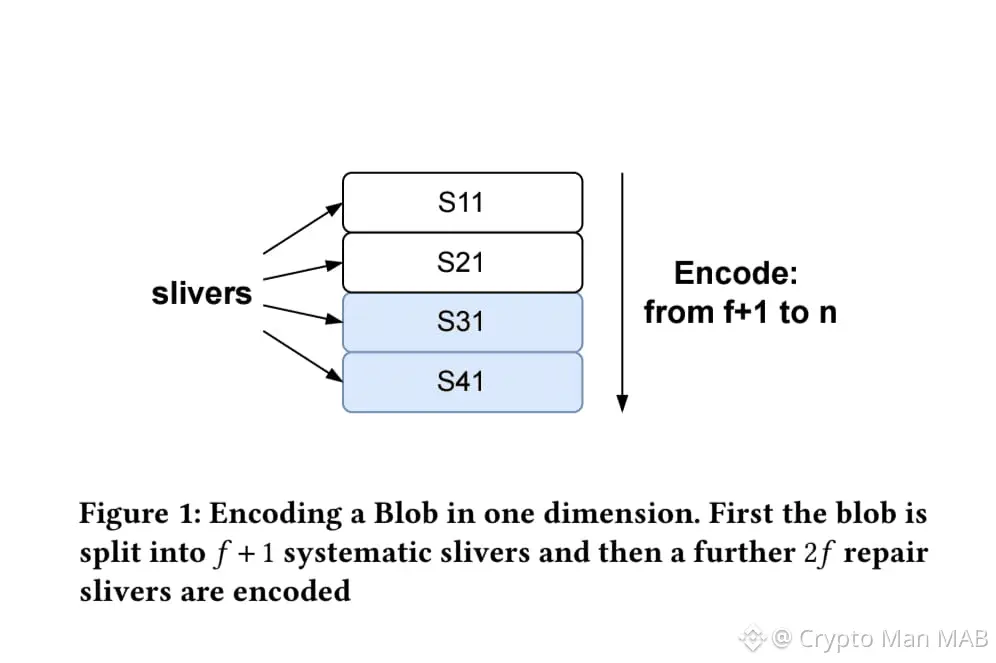

In an era where data is the new oil, especially with the explosive growth of AI and Web3 applications, secure and efficient storage solutions are more critical than ever. Enter Walrus – a groundbreaking decentralized storage protocol built on the Sui blockchain that\'s set to transform how we handle large-scale data. Imagine storing videos, images, datasets, and more without relying on centralized servers that could fail or censor content. Walrus makes this a reality, empowering developers, AI ag

- Reward

- like

- Comment

- Repost

- Share

Introduction to Liquidity FragmentationIn the world of finance, liquidity refers to how easily assets can be bought or sold without significantly affecting their price. However, one persistent challenge in traditional financial markets is liquidity fragmentation. This occurs when trading activity is spread across multiple exchanges, platforms, or venues, leading to dispersed liquidity pools. As a result, investors often face higher transaction costs, wider bid-ask spreads, slower execution tim

- Reward

- like

- Comment

- Repost

- Share

Why choose centralized cloud when you can go fully on-chain? delivers verifiable, persistent blob storage that\'s chain-agnostic but powered by Sui\'s speed. Store AI models, videos, or big data without worrying about availability. $WAL makes it affordable and rewarding. Bullish on this one!

- Reward

- like

- Comment

- Repost

- Share

Hello Crypto FAM! Hope you guys enjoying SUNDAY

- Reward

- like

- Comment

- Repost

- Share

👇DYOR, stay vigilant — chaos breeds opportunity🔥

- Reward

- like

- Comment

- Repost

- Share

In the rapidly evolving landscape of blockchain technology, few projects stand out as boldly forward-thinking as Vanar Chain. Launched as a purpose-built Layer 1 blockchain, Vanar isn\'t chasing fleeting trends--it\'s engineered from the ground up for genuine, scalable real-world adoption. With a team deeply rooted in gaming, entertainment, and major brand collaborations, Vanar focuses on onboarding the next 3 billion consumers into Web3 by making blockchain intuitive, useful, and integrated into

VANRY3,39%

- Reward

- like

- Comment

- Repost

- Share

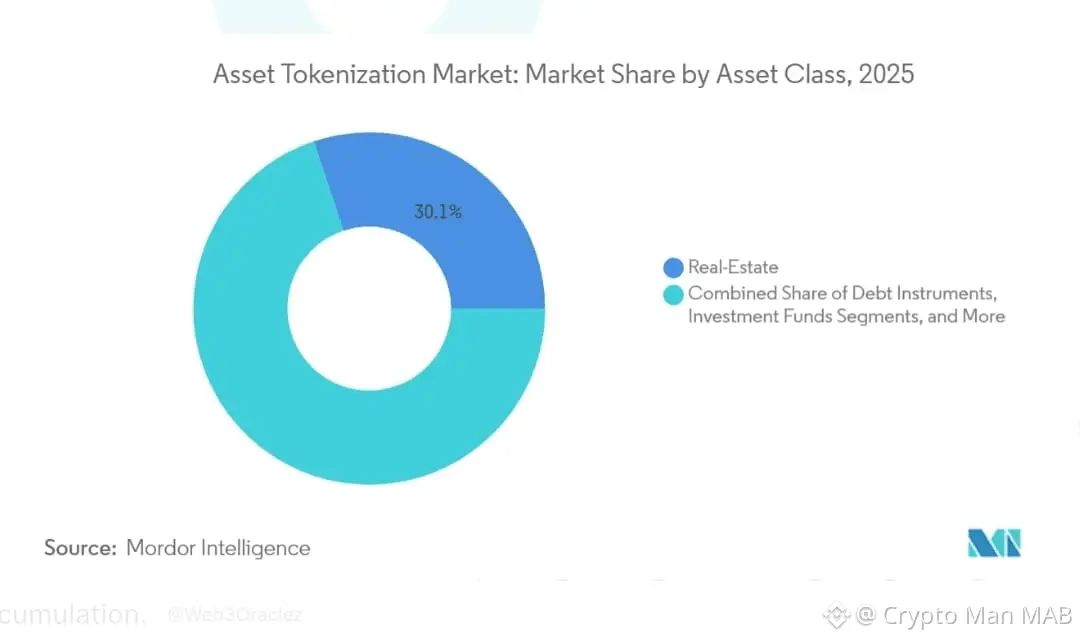

Market cap has hovered around $115–118 million, with exploding trading volumes signaling strong accumulation. Chainlink: Integration for reliable oracles and cross-chain interoperability, ensuring secure data feeds for RWA pricing and enabling multichain settlements.

LINK1,32%

- Reward

- 1

- Comment

- Repost

- Share

Consistency is the key

- Reward

- like

- Comment

- Repost

- Share

Decentralized storage isn\'t just about saving files it\'s infrastructure for AI data provenance, censorship-resistant social media, rollup DA, and programmable data markets. Walrus\'s willingness to publicly roast its own strawman designs shows serious engineering maturity. By fixing recovery and asynchrony pain points that have haunted the space for years, Walrus positions itself as a leader in making large-scale, reliable blob storage actually usable and affordable.If you\'re building on Sui, exploring DePIN, or just tired of centralized cloud bills, Walrus is worth watching closely. The st

- Reward

- 1

- Comment

- Repost

- Share

BREAKING: Silver reaches $100 for the first time in history.

- Reward

- like

- Comment

- Repost

- Share

One of the standout protocol customizations in Vanar Chain is its transaction ordering mechanism, which prioritizes simplicity, predictability,

- Reward

- like

- Comment

- Repost

- Share

My All Positions got liquidated 😭😭😭😭😭 I can Feel the pain of you guys just checkout my PNL

- Reward

- 1

- Comment

- Repost

- Share

Jummah Mubarak

- Reward

- like

- Comment

- Repost

- Share