@Mayacrypt @Zircuit Wow Maya, this breakdown hits different pure signal, no noise

GateUser-df796f3c

No content yet

GateUser-df796f3c

$BTC.b becoming the primary $BTC standard on @stable is a collateral re-rating event, and it’s being driven by @Lombard_Finance.

This is the first time $BTC leverage on this surface is anchored to:

• validator-secured issuance

• protocol-native minting

• deterministic stablecoin conversion

That trifecta removes what traders usually overpay for in $BTC leverage: uncertain failure modes.

Once collateral loss becomes mathematically bounded instead of issuer-dependent, three risk dynamics reprice:

1️⃣ Liquidation topology simplifies:

Multiple wrappers create feedback spirals across venues. A singl

This is the first time $BTC leverage on this surface is anchored to:

• validator-secured issuance

• protocol-native minting

• deterministic stablecoin conversion

That trifecta removes what traders usually overpay for in $BTC leverage: uncertain failure modes.

Once collateral loss becomes mathematically bounded instead of issuer-dependent, three risk dynamics reprice:

1️⃣ Liquidation topology simplifies:

Multiple wrappers create feedback spirals across venues. A singl

BTC-1.9%

- Reward

- like

- Comment

- Repost

- Share

Perps charge more per trade. DEXs make more money.

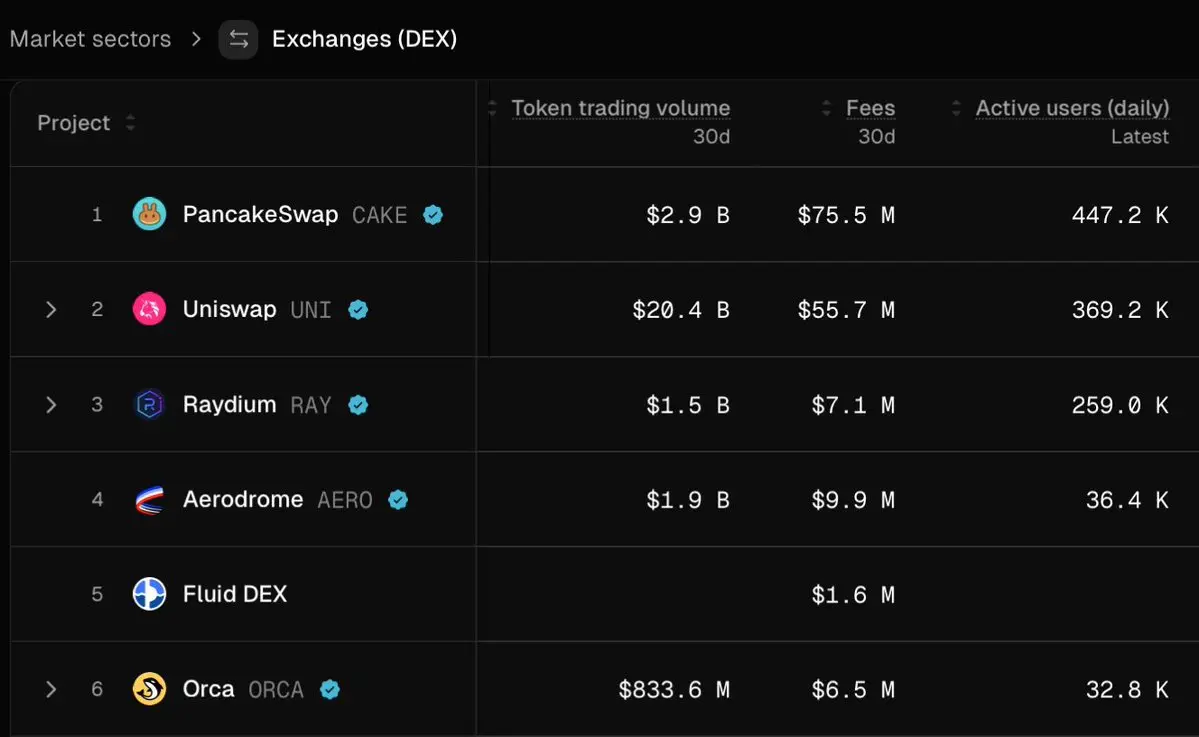

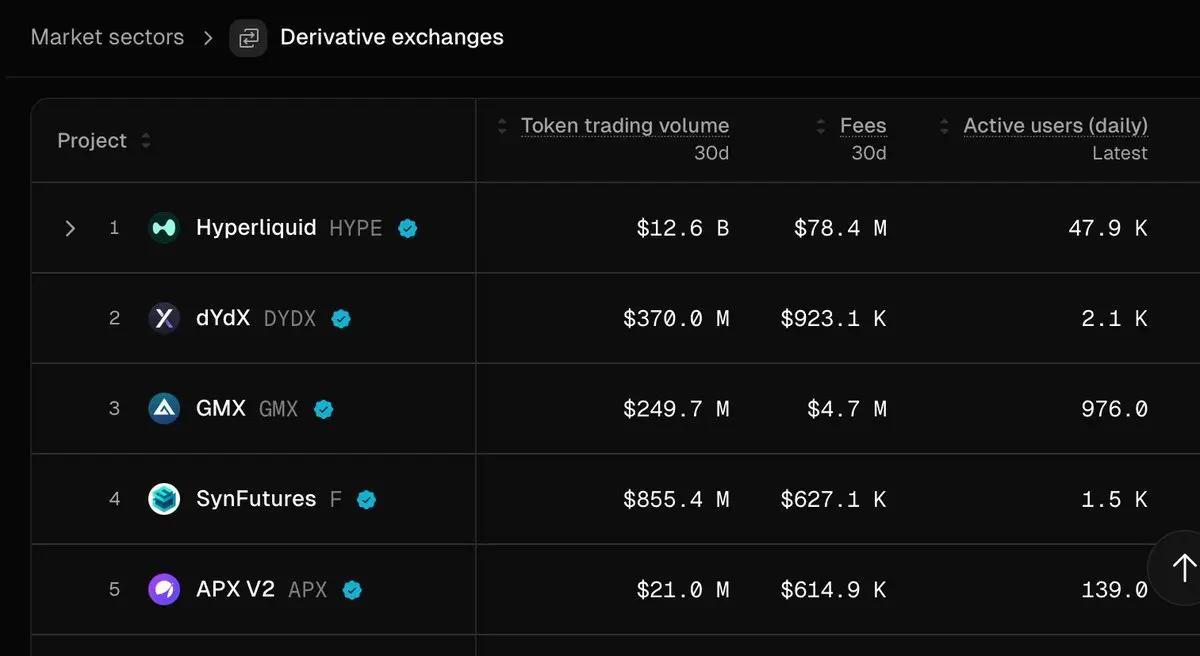

Over the last 30 days:

-> Perpetual futures platforms processed $19.1B of trading activity and earned $87.3M in fees.

-> DEXs processed $228.8B of spot trading activity and earned $224.4M in fees.

Perps monetize harder per dollar.

DEXs monetize at far greater scale.

On fee efficiency alone, perps win:

• 0.46% per dollar traded on perps

• 0.10% per dollar traded on DEXs

But on absolute cash flow, DEXs still dominate:

DEXs earn ~2.6× more total fees than perps

That gap is structural.

Perps compete on leverage, rebates, and tight spreads. They mu

Over the last 30 days:

-> Perpetual futures platforms processed $19.1B of trading activity and earned $87.3M in fees.

-> DEXs processed $228.8B of spot trading activity and earned $224.4M in fees.

Perps monetize harder per dollar.

DEXs monetize at far greater scale.

On fee efficiency alone, perps win:

• 0.46% per dollar traded on perps

• 0.10% per dollar traded on DEXs

But on absolute cash flow, DEXs still dominate:

DEXs earn ~2.6× more total fees than perps

That gap is structural.

Perps compete on leverage, rebates, and tight spreads. They mu

- Reward

- like

- Comment

- Repost

- Share

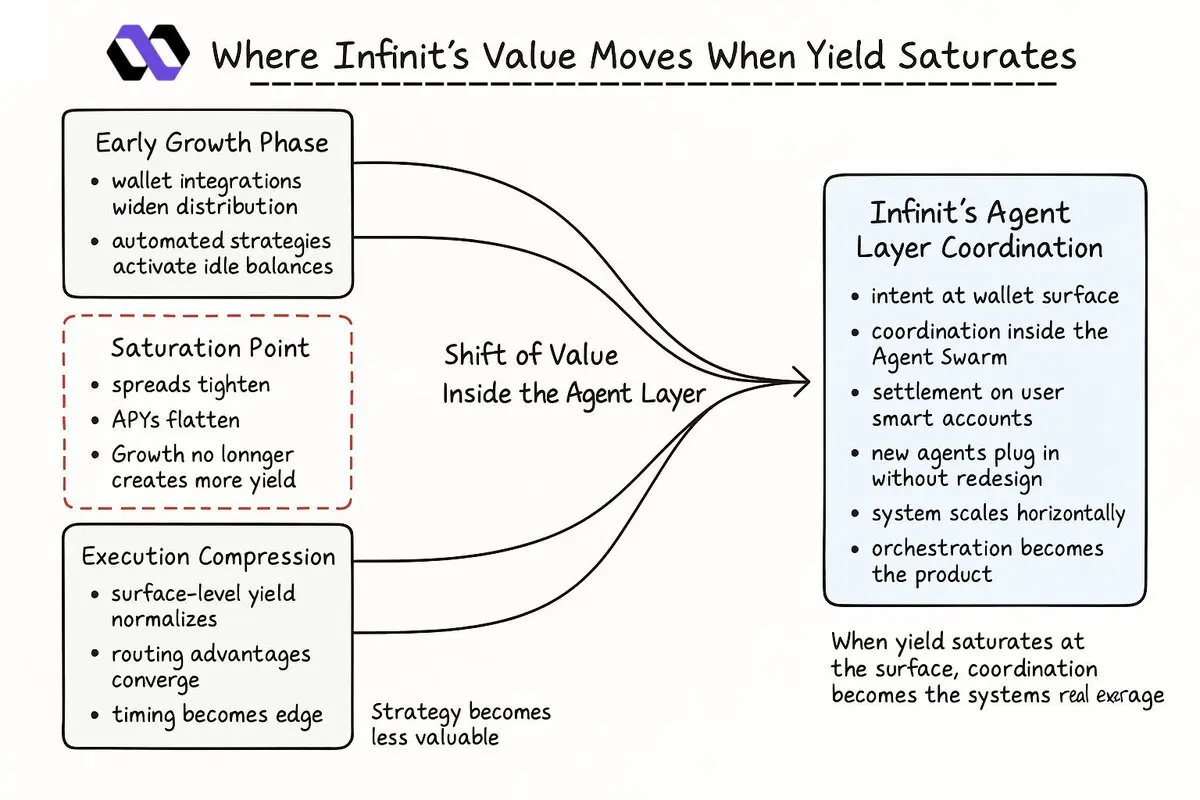

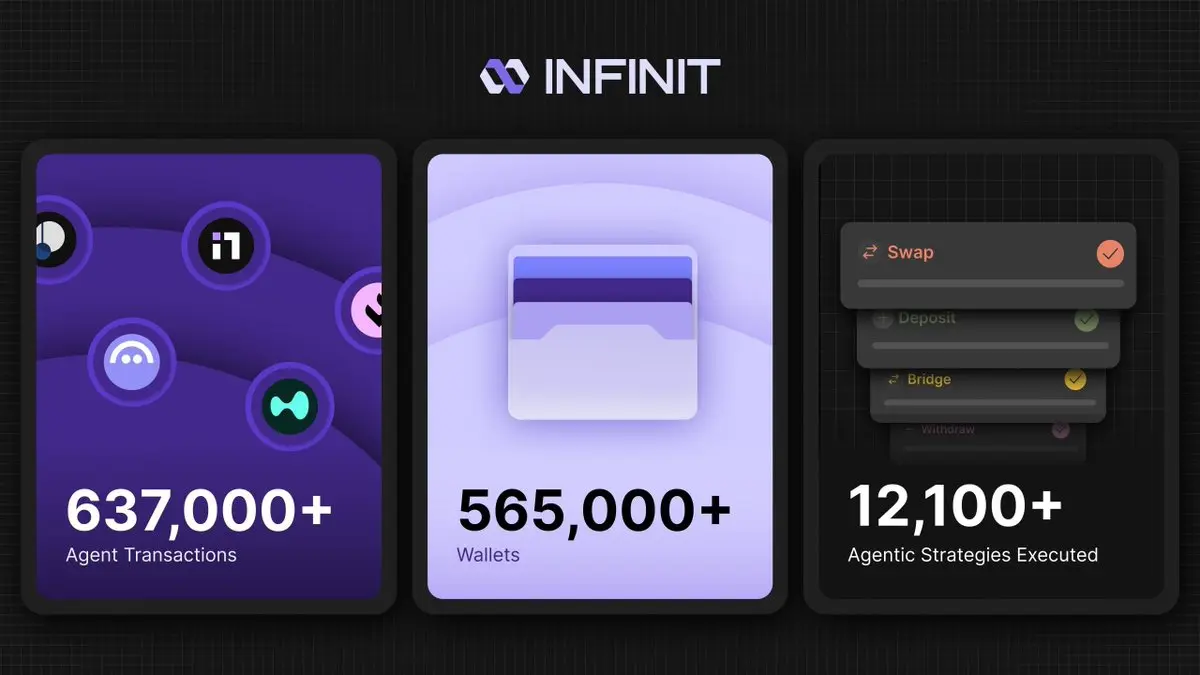

Early adoption for @Infinit_Labs follows a clear arc:

• wallet integrations widen distribution

• automated strategies wake up idle balances

• yield-routing agents capture cross-chain inefficiencies.

In the early phase, every new user helps because the market still has slack.

But that slack eventually disappears. As one-click execution scales, spreads tighten, yields compress, and the system starts to look like any market where too much capital chases the same opportunities. The marginal value of one more wallet falls.

— The Point Where Growth No Longer Helps

This phase is the saturation point:

• wallet integrations widen distribution

• automated strategies wake up idle balances

• yield-routing agents capture cross-chain inefficiencies.

In the early phase, every new user helps because the market still has slack.

But that slack eventually disappears. As one-click execution scales, spreads tighten, yields compress, and the system starts to look like any market where too much capital chases the same opportunities. The marginal value of one more wallet falls.

— The Point Where Growth No Longer Helps

This phase is the saturation point:

IN-1.52%

- Reward

- like

- Comment

- Repost

- Share

The misunderstanding around yield is structural.

Most people still see it as something you “pick,” when the real determinant of performance is how efficiently your capital gets where it needs to be.

APR tables suggest simplicity.

The market does not.

Liquidity now lives across L1s, L2s, appchains, intent routers, and timing-sensitive execution surfaces.

That fragmentation breaks the old model where “highest APR” translated into highest returns.

@Infinit_Labs' value comes from understanding why that break happened and building for the environment that replaced it.

When execution becomes the pro

Most people still see it as something you “pick,” when the real determinant of performance is how efficiently your capital gets where it needs to be.

APR tables suggest simplicity.

The market does not.

Liquidity now lives across L1s, L2s, appchains, intent routers, and timing-sensitive execution surfaces.

That fragmentation breaks the old model where “highest APR” translated into highest returns.

@Infinit_Labs' value comes from understanding why that break happened and building for the environment that replaced it.

When execution becomes the pro

- Reward

- like

- Comment

- Repost

- Share

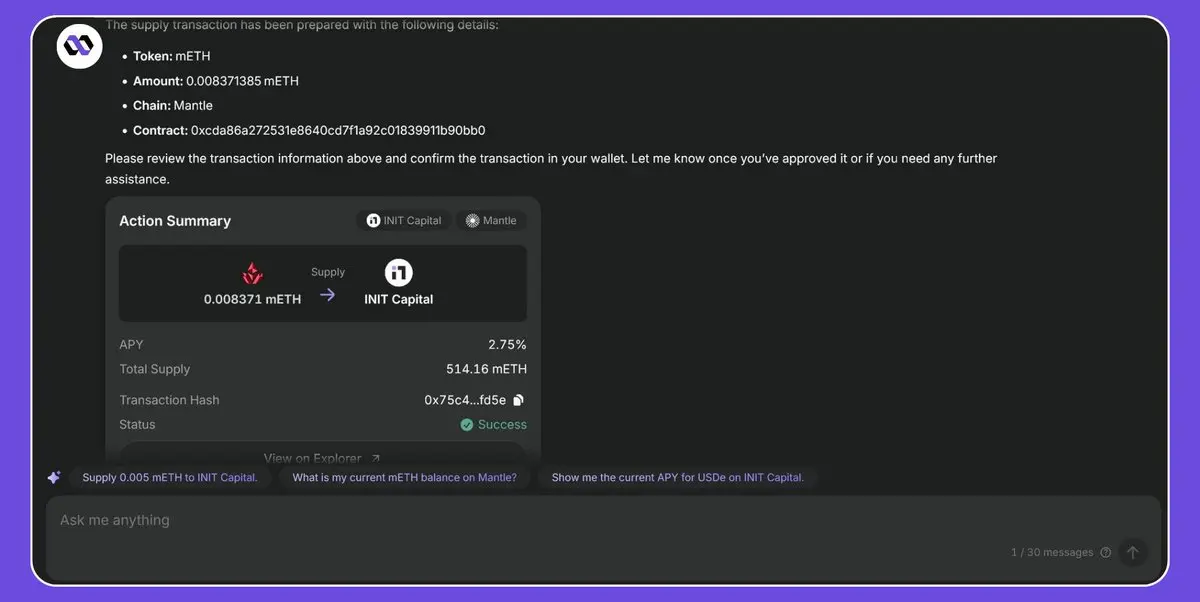

STRATEGY: The Dual-Surface Yield Engine

This strategy uses the two strongest, most stable yield planes on @Mantle_Official that @Infinit_Labs agents can actually execute:

$mETH supply APY and $USDe supply APY inside @InitCapital_.

These two surfaces consistently diverge, because borrower demand pushes $USDe yields up while $mETH stays predictable around 2.7%.

By splitting your position between both, you build a yield engine that captures the higher of the two over time without leverage, LP risk, or restaking.

No loops.

No liquidation risk.

Only the two operations INFINIT supports: Kyber swaps

This strategy uses the two strongest, most stable yield planes on @Mantle_Official that @Infinit_Labs agents can actually execute:

$mETH supply APY and $USDe supply APY inside @InitCapital_.

These two surfaces consistently diverge, because borrower demand pushes $USDe yields up while $mETH stays predictable around 2.7%.

By splitting your position between both, you build a yield engine that captures the higher of the two over time without leverage, LP risk, or restaking.

No loops.

No liquidation risk.

Only the two operations INFINIT supports: Kyber swaps

USDE0.02%

- Reward

- like

- Comment

- Repost

- Share

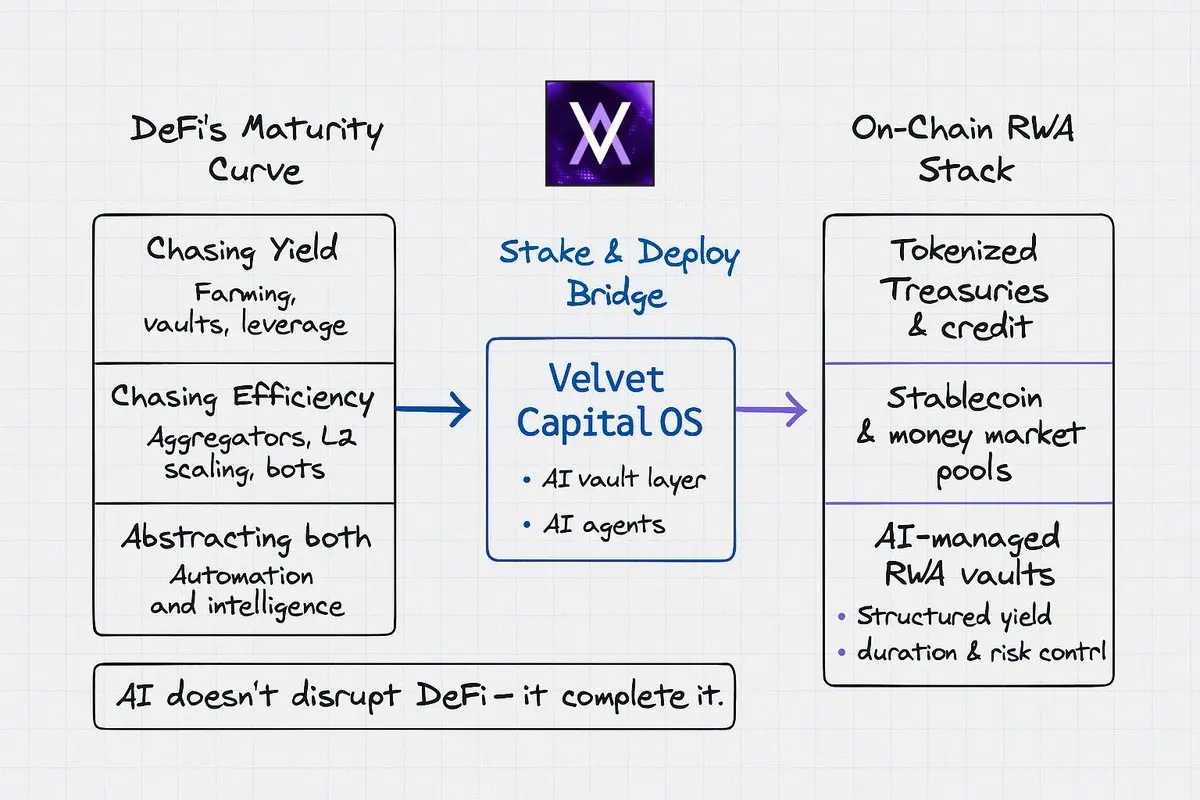

A fort that stores gold grows slowly.

A port that moves goods grows endlessly.

DeFi vaults are forts. DeFi orchestration is the port.

That distinction captures the structural shift already underway in DeFi.

Capital is moving from static allocation toward dynamic orchestration.

Protocols still built around fixed strategies are effectively pricing yesterday’s market, not the one we trade in today.

@Velvet_Capital is building for the real environment; one defined by constant rotation and unstable edges:

• fragmented liquidity

• shifting yield curves

• MEV-sensitive execution

• cross-chain arbitra

A port that moves goods grows endlessly.

DeFi vaults are forts. DeFi orchestration is the port.

That distinction captures the structural shift already underway in DeFi.

Capital is moving from static allocation toward dynamic orchestration.

Protocols still built around fixed strategies are effectively pricing yesterday’s market, not the one we trade in today.

@Velvet_Capital is building for the real environment; one defined by constant rotation and unstable edges:

• fragmented liquidity

• shifting yield curves

• MEV-sensitive execution

• cross-chain arbitra

VELVET0.51%

- Reward

- like

- Comment

- Repost

- Share

.@Infinit_Labs is small-cap on paper ( $IN = $21M market cap), but it’s building what DeFi actually needs: an execution layer that scales intent.

Most protocols optimize where liquidity sits. Infinit optimizes how it moves using deterministic AI agents that execute multi-protocol operations in a single transaction.

Proof of usage:

• 637K+ agent transactions processed

• 565K+ wallets connected

• 12K+ strategies executed across seven networks

No yield farming. No bribes. Pure product demand.

It’s not a vault or a dashboard. It’s the engine under both.

Sommelier coordinates validators.

Instadapp

Most protocols optimize where liquidity sits. Infinit optimizes how it moves using deterministic AI agents that execute multi-protocol operations in a single transaction.

Proof of usage:

• 637K+ agent transactions processed

• 565K+ wallets connected

• 12K+ strategies executed across seven networks

No yield farming. No bribes. Pure product demand.

It’s not a vault or a dashboard. It’s the engine under both.

Sommelier coordinates validators.

Instadapp

IN-1.52%

- Reward

- like

- Comment

- Repost

- Share

Every DeFi cycle runs the same script.

> First, they chase yield.

> Then, they chase efficiency.

> Finally, they abstract both.

@Velvet_Capital sits at that third phase; where capital stops being moved and starts moving itself.

Its DeFAI OS already runs autonomous vaults that trade, rebalance, and deploy liquidity through AI agents.

The next step is obvious: extend that logic to tokenized real-world assets.

Think about it, RWAs behave like DeFi instruments; yield-bearing, composable, rule-based.

Once those assets live on-chain, AI agents can manage them directly.

@Velvet_Capital's modular vaul

> First, they chase yield.

> Then, they chase efficiency.

> Finally, they abstract both.

@Velvet_Capital sits at that third phase; where capital stops being moved and starts moving itself.

Its DeFAI OS already runs autonomous vaults that trade, rebalance, and deploy liquidity through AI agents.

The next step is obvious: extend that logic to tokenized real-world assets.

Think about it, RWAs behave like DeFi instruments; yield-bearing, composable, rule-based.

Once those assets live on-chain, AI agents can manage them directly.

@Velvet_Capital's modular vaul

VELVET0.51%

- Reward

- like

- Comment

- Repost

- Share

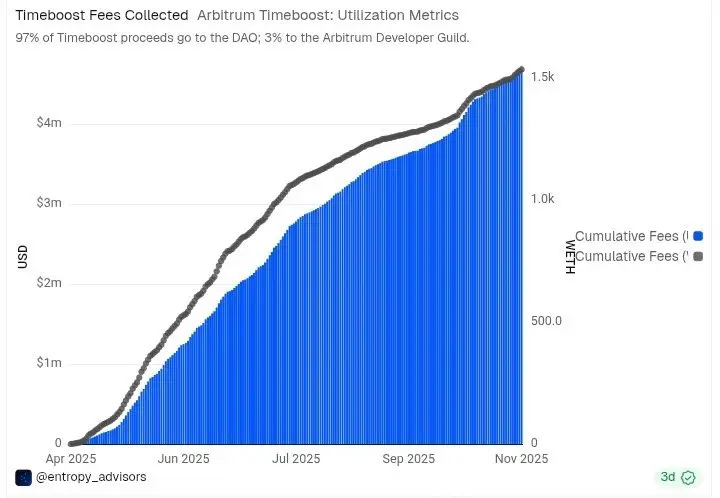

Arbitrum just proved blockspace can pay its own bills.

Since April, TimeBoost; @arbitrum's MEV auction system has redirected 1,500 ETH (~$4.6M) straight into the DAO treasury.

What used to leak out as silent arbitrage now flows back as yield.

That’s a big shift: MEV isn’t a tax anymore. It’s income.

Every block priority bid now funds the network that made it possible.

And that loop: usage → auction → treasury → grants → more usage, quietly turned Arbitrum into one of the first self-financing rollups.

This isn't emissions. This is sustainable yield baked into the protocol.

MEV used to extract v

Since April, TimeBoost; @arbitrum's MEV auction system has redirected 1,500 ETH (~$4.6M) straight into the DAO treasury.

What used to leak out as silent arbitrage now flows back as yield.

That’s a big shift: MEV isn’t a tax anymore. It’s income.

Every block priority bid now funds the network that made it possible.

And that loop: usage → auction → treasury → grants → more usage, quietly turned Arbitrum into one of the first self-financing rollups.

This isn't emissions. This is sustainable yield baked into the protocol.

MEV used to extract v

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

While most of the market chops sideways, $BARD is up +13% this week, trading at $0.72 with $26.8M in 24h volume.

Market cap sits at $162.9M.

That’s still tiny compared to what it underwrites.

✅ Restaking

✅ Institutional credit

✅ Synthetic money markets (lend, borrow, and trade)

These are all being built on @Lombard_Finance infrastructure. And $BARD backs the whole stack.

Flows create trust. Trust creates value.

That loop now runs through $BARD.

Market cap sits at $162.9M.

That’s still tiny compared to what it underwrites.

✅ Restaking

✅ Institutional credit

✅ Synthetic money markets (lend, borrow, and trade)

These are all being built on @Lombard_Finance infrastructure. And $BARD backs the whole stack.

Flows create trust. Trust creates value.

That loop now runs through $BARD.

BARD-11.36%

- Reward

- like

- Comment

- Repost

- Share