DanielRomero

No content yet

DanielRomero

$NBIS's Tavily has achieved over one million downloads, and its customers include Cohere and Groq

I wonder whether Groq is still a customer under $NVDA

I wonder whether Groq is still a customer under $NVDA

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$NBIS acquisition of Tavily for $275 million is a key piece of its software stack

We recently learned that Goldman Sachs has a team from Anthropic helping automate workloads

Not everyone has Goldman Sachs-level money

Many companies will need an affordable and reliable cloud to develop AI agents

$NBIS is already used by $SHOP, $NET, and Revolut

With these offerings, more companies will be drawn into the $NBIS cloud

If you’re an SMB, there is no reason to go with AWS, Azure, or Google Cloud

The UI and customer support at $NBIS are in another league

Although this is just the beginning, these inve

We recently learned that Goldman Sachs has a team from Anthropic helping automate workloads

Not everyone has Goldman Sachs-level money

Many companies will need an affordable and reliable cloud to develop AI agents

$NBIS is already used by $SHOP, $NET, and Revolut

With these offerings, more companies will be drawn into the $NBIS cloud

If you’re an SMB, there is no reason to go with AWS, Azure, or Google Cloud

The UI and customer support at $NBIS are in another league

Although this is just the beginning, these inve

- Reward

- like

- Comment

- Repost

- Share

What data center is $NBIS planning in Philadelphia?

- Reward

- like

- Comment

- Repost

- Share

Could this be $NBIS's new colocation data center?

Based on recent job postings, $NBIS is hiring a Data Center IT Manager in Béthune, France

In 2025, Azur Datacenter announced a €1.5B retrofit investment, expected to be operational for AI workloads by early 2026

The site would have 26,000 m², compared to 241,000 m² for the Vineland site

Based on recent job postings, $NBIS is hiring a Data Center IT Manager in Béthune, France

In 2025, Azur Datacenter announced a €1.5B retrofit investment, expected to be operational for AI workloads by early 2026

The site would have 26,000 m², compared to 241,000 m² for the Vineland site

- Reward

- like

- Comment

- Repost

- Share

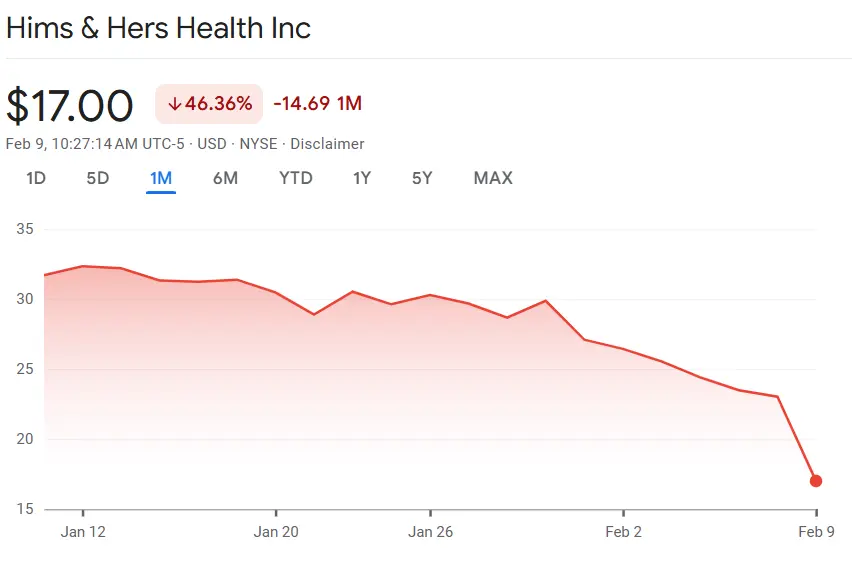

I’ve been told that $HIMS is fighting Big Pharma

If that were the case, why would they pull oral GLP-1?

If they were in the right, why not keep it?

The answer is simple. If things went wrong, it could not only hit the company, it could hit management personally

Once a consumer uses a pill that is later proven to be ineffective, management can be sued for consumer fraud

Anyone involved in deceptive marketing is potentially liable under FTC law

The FTC has taken action not only against product marketers, but also, in certain cases, against individual owners and corporate officers

That means fine

If that were the case, why would they pull oral GLP-1?

If they were in the right, why not keep it?

The answer is simple. If things went wrong, it could not only hit the company, it could hit management personally

Once a consumer uses a pill that is later proven to be ineffective, management can be sued for consumer fraud

Anyone involved in deceptive marketing is potentially liable under FTC law

The FTC has taken action not only against product marketers, but also, in certain cases, against individual owners and corporate officers

That means fine

- Reward

- like

- Comment

- Repost

- Share

Bulls have been preaching for months that $HIMS is much more than a GLP-1 company

$HIMS management is willing to risk it all to keep offering GLP-1

What does that tell you?

$HIMS management is willing to risk it all to keep offering GLP-1

What does that tell you?

- Reward

- like

- Comment

- Repost

- Share

$HIMS is now down 46% over the last month

$3.8B market cap

Now significantly below Ro’s $7B valuation

$3.8B market cap

Now significantly below Ro’s $7B valuation

- Reward

- 1

- 1

- Repost

- Share

Lions_Lionish :

:

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵“So RAM costs 15x more than a year ago”

“Yes, Dave”

“And you sold $MU at single-digit forward earnings?”

“Yes, I did, Dave”

“Why would you do that?”

“Because that’s what X told me I should do, Dave”

“Yes, Dave”

“And you sold $MU at single-digit forward earnings?”

“Yes, I did, Dave”

“Why would you do that?”

“Because that’s what X told me I should do, Dave”

- Reward

- like

- Comment

- Repost

- Share

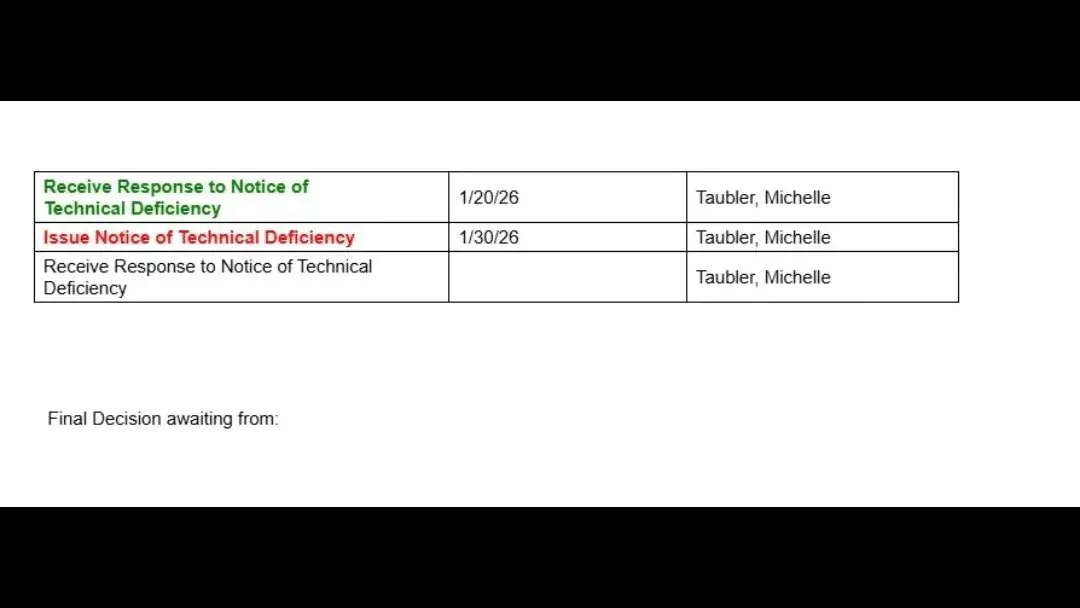

$NBISDataOne has still not received the air permit for its gas engines at the Vineland data centerThe permit covers 36 Bergen engines, with a combined 403 MW of power generation potentialUntil they stop triggering deficiencies, the engines cannot be installed

- Reward

- 1

- Comment

- Repost

- Share

$HIMS could’ve partnered with NovoSell oral Wegovy legallyTurn it into a funnel for their other productsSacrifice high-margin GLP-1 revenue to reduce CACBuild a health platform beyond GLP-1But they chose to be greedy

- Reward

- like

- Comment

- Repost

- Share

$HIMS deciding to double down on something that was obviously going to cause legal repercussions, just as they were starting to show success in their transition from product to platform, is a choice.

- Reward

- like

- Comment

- Repost

- Share

At this point, it’s obvious who the AI winners are$META should just partner with Anthropic for frontier models

- Reward

- like

- Comment

- Repost

- Share

$GLXY Announces $200 Million Share Repurchase Program

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More222.5K Popularity

29.97K Popularity

16.96K Popularity

14.51K Popularity

7.63K Popularity

Pin