CryptosBatman

No content yet

CryptosBatman

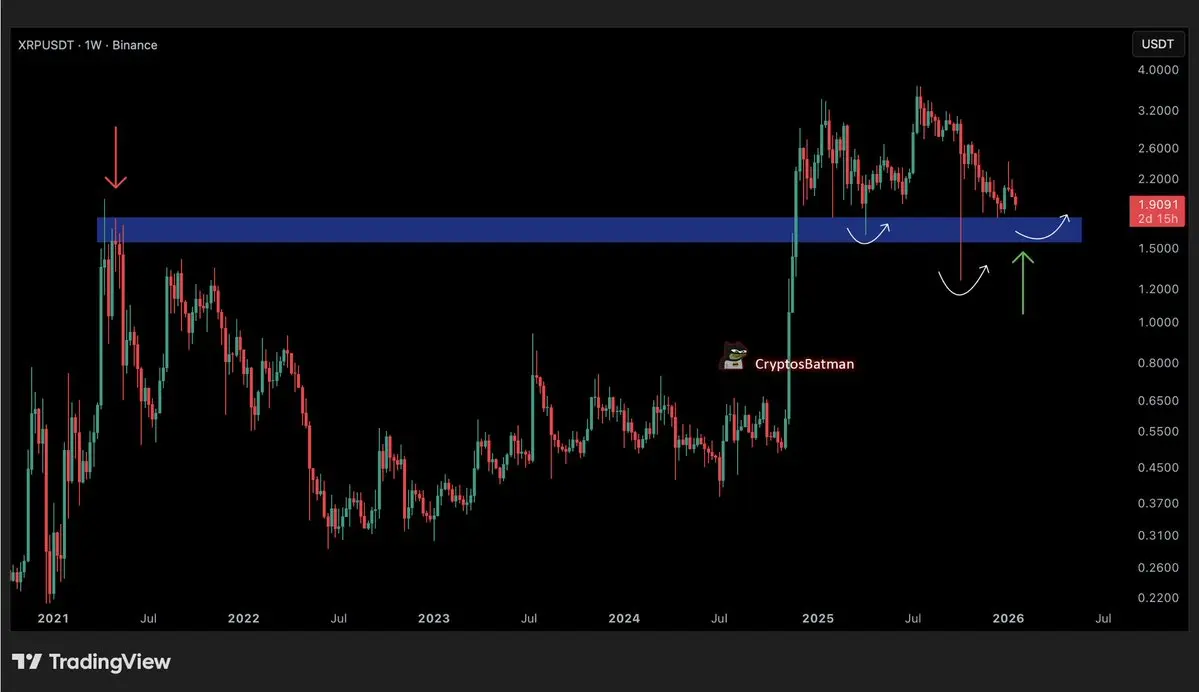

XRP analysts eye $4 target as it tests familiar channel patterns. Same setup occurred twice since 2021, triggering explosive moves after months sideways.Volume confirmation at $2.10 resistance is key. False breakouts without volume always sent us back to lows 👀

XRP-1,57%

- Reward

- like

- Comment

- Repost

- Share

Do you believe Bitcoin will be trading higher or lower in one year from now?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Watching Arsenal vs Man United. What a goal from Dorgu! So good!

- Reward

- like

- Comment

- Repost

- Share

Remember when we called $1000 ETH "expensive" in 2017? I was hesitant to buy more above $800 😅Now projects raise $50M+ on Ethereum without blinking. Gas fees alone cost more than whole transactions back then.Your "expensive" today becomes tomorrow\'s floor

ETH0,06%

- Reward

- like

- 1

- Repost

- Share

456BU :

:

2026 GOGOGO 👊One chart still worth watching? $XRP\n\nZoom out a bit, and you will see it\'s actually consolidating above the 2020 cycle high.\n\nAs long as this area holds, it\'s still a bullish consolidation, not a breakdown.

XRP-1,57%

- Reward

- like

- Comment

- Repost

- Share

BREAKING: Kansas issues a bill to create a strategic Bitcoin Reserve!

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

You know you\'re deep in crypto when your browser has 47 tabs open and 43 of them are different DEX interfaces you "might need later" 😂\n\nWe really turned FOMO into a tab management problem.

- Reward

- like

- Comment

- Repost

- Share

Let\'s zoom out a bit on $ETH\n\nIt\'s currently nearing its last line of defense, the support level that has held price for the past 3 months.\n\nIf there\'s an area for Ethereum to rebound, this is it. If not, it’s going to look bad.

ETH0,06%

- Reward

- 1

- Comment

- Repost

- Share

Gold crashing after Trump cancels EU tariffs and announces framework for Greenland deal

- Reward

- like

- Comment

- Repost

- Share

BREAKING: Bitcoin reclaims $90,000 with the announcement of Trump canceling EU tariffs after forming framework for a deal on Greenland.

- Reward

- like

- Comment

- Repost

- Share

Ark Invest put out a new $BTC forecast, saying it could go to $760,000 by 2030. They are betting on institutions and ETFs holding more.\n\nI agree with their goal, and see the same thing playing out. I\'m confident the price will reach $1M within 5-10 years from now.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

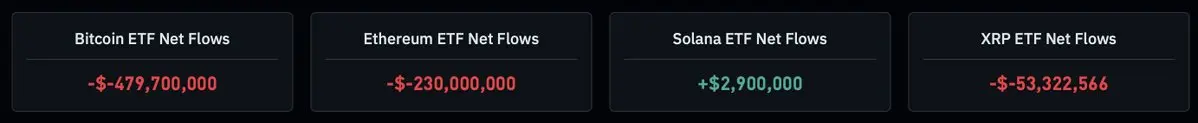

Wow, interesting.\n\nWhile the market bleeds left and right, with massive outflows from whales and institutions, Solana is the only one showing net ETF inflows right now.\n\nThere\'s something going on with $SOL that we don\'t know yet.

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Seeing $BTC drop under $90k was part of a market move. It tracked stocks lower.

The key point is Bitcoin's dominance rose to almost 60%. Funds consolidated into Bitcoin, not out of crypto.

This tells me Bitcoin is now the core asset for the space. In a pullback, capital moves to it from alts like $ETH. It shows a hierarchy forming.

The key point is Bitcoin's dominance rose to almost 60%. Funds consolidated into Bitcoin, not out of crypto.

This tells me Bitcoin is now the core asset for the space. In a pullback, capital moves to it from alts like $ETH. It shows a hierarchy forming.

ETH0,06%

- Reward

- like

- Comment

- Repost

- Share

Going to try out the CMC Community Feed after requests from many of my followers.

See you there soon!

See you there soon!

- Reward

- like

- Comment

- Repost

- Share

The US Dollar Index $DXY has just rejected a major resistance level, right at the 0.618 golden ratio.

And judging by the strength of that rejection, downside pressure should continue.

Just remember the basic rule: DXY down = risk assets like $BTC up.

And judging by the strength of that rejection, downside pressure should continue.

Just remember the basic rule: DXY down = risk assets like $BTC up.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More44.12K Popularity

5.89K Popularity

5.23K Popularity

2.82K Popularity

2.55K Popularity

Pin