ArenarIntel

No content yet

ArenarIntel

🚨 BREAKING: Donald Trump has set a new record for the longest State of the Union address in US history.

#BreakingNews #Trump #SOTU #USPolitics

#BreakingNews #Trump #SOTU #USPolitics

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: Jamie Dimon says he is “starting to see parallels to the era before the 2008 financial crisis” in the current US economy.

#BreakingNews #Finance #JamieDimon #USMarkets

#BreakingNews #Finance #JamieDimon #USMarkets

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: Surveillance footage shows a coyote chasing a 3 year old boy through the front gate of his family’s home in Pasadena.

#BreakingNews #Pasadena #Wildlife #USA

#BreakingNews #Pasadena #Wildlife #USA

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: Turkey is considering sending forces into Iran to stop large numbers of refugees from crossing its border if the US attacks Iran.

#BreakingNews #Turkey #Iran #Geopolitics

#BreakingNews #Turkey #Iran #Geopolitics

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: Curtis Priem sold his 12.8 percent stake in Nvidia in 2006, which would be worth nearly $600 billion today if he had held on.

#BreakingNews #Nvidia #Business #Tech

#BreakingNews #Nvidia #Business #Tech

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: Stripe is reportedly in talks to acquire PayPal in a potential major fintech deal.

#BreakingNews #Stripe #PayPal #Fintech

#BreakingNews #Stripe #PayPal #Fintech

- Reward

- like

- Comment

- Repost

- Share

🚨 WILD: Elon Musk believes coding dies this year not evolves. Dies!

- Reward

- like

- Comment

- Repost

- Share

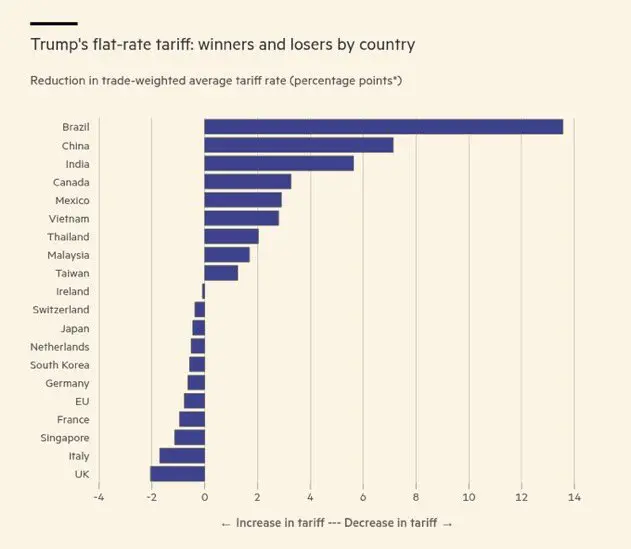

🚨 BREAKING: Donald Trump has proposed flat rate tariffs targeting multiple countries as part of a new global trade strategy.

#BreakingNews #Trump #Tariffs #Trade

#BreakingNews #Trump #Tariffs #Trade

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: Anthropic says Chinese AI firms, including DeepSeek, launched “industrial scale” attacks targeting its Claude AI model.

#BreakingNews #AI #Anthropic #DeepSeek

#BreakingNews #AI #Anthropic #DeepSeek

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: Chuck Schumer says Senate Democrats will try to block President Donald Trump’s plan to extend tariff measures, opposing further unilateral trade actions by the administration.

#BreakingNews #USPolitics #Tariffs #Economy

#BreakingNews #USPolitics #Tariffs #Economy

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: Peter Mandelson has reportedly been arrested by the Metropolitan Police Service on suspicion of misconduct in public office linked to files related to Jeffrey Epstein.

#BreakingNews #UK #PeterMandelson #Epstein

#BreakingNews #UK #PeterMandelson #Epstein

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: 🇮🇳 India has urged all its citizens and persons of Indian origin currently in Iran to leave the country immediately by available means of transport amid escalating security concerns and rising regional tensions, according to a fresh advisory from the Indian Embassy in Tehran.

#BreakingNews #India #Iran #TravelAdvisory

#BreakingNews #India #Iran #TravelAdvisory

- Reward

- like

- Comment

- Repost

- Share

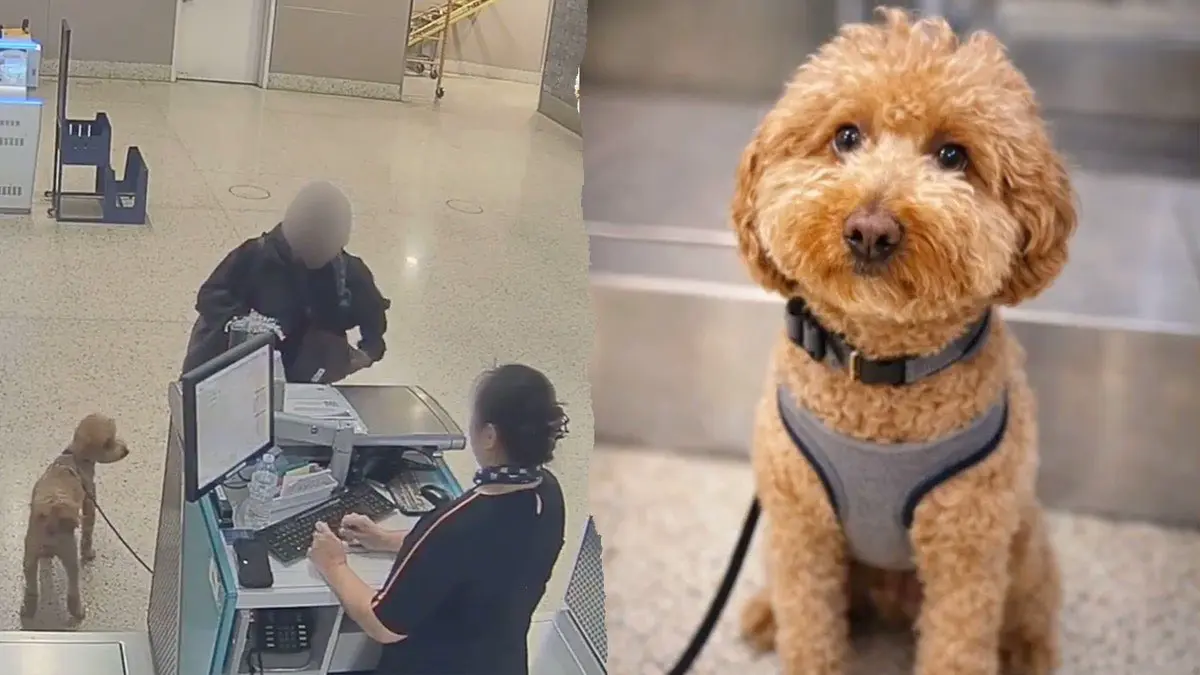

🚨 BREAKING: A woman has been charged with animal abandonment after leaving her dog tied at a JetBlue counter at Las Vegas Airport.

#BreakingNews #LasVegas #Animals #JetBlue

#BreakingNews #LasVegas #Animals #JetBlue

- Reward

- 1

- Comment

- Repost

- Share

🚨 JUST IN: Dead Mexican troops piled up on streets.

#cartel #mexico

#cartel #mexico

- Reward

- 1

- Comment

- Repost

- Share

🚨 BREAKING: Bank of Ghana and Securities and Exchange Commission have ordered crypto billboards to be removed by Sunday, warning of sanctions for non compliance.

#BreakingNews #Crypto #Ghana #Regulation

#BreakingNews #Crypto #Ghana #Regulation

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: Heavy clashes have been reported in Zacapu as armored vehicles linked to the Jalisco New Generation Cartel were seen entering the town.

#BreakingNews #Mexico #Cartel #Security

#BreakingNews #Mexico #Cartel #Security

- Reward

- 2

- Comment

- Repost

- Share

🚨 BREAKING: Calls are growing to cancel 2026 World Cup matches in Mexico amid clashes between the Jalisco New Generation Cartel and Mexican armed forces.

#BreakingNews #Mexico #WorldCup #Security

#BreakingNews #Mexico #WorldCup #Security

- Reward

- 1

- 1

- Repost

- Share

TheWaiter :

:

Good luck and prosperity 🧧Trending Topics

View More69.92K Popularity

163.64K Popularity

40.81K Popularity

7.57K Popularity

417.01K Popularity

Pin