@ccjing_eth It is at the moment, but implementation will probably be quite difficult.

View OriginalAnsonAnson

No content yet

AnsonAnson

Vanishing T+1: How does Theo "cheat" time with quant code?

I don't know if you have a question: "Many RWAs always can't outperform the income and buy U.S. bonds directly?" "The common reason is not the handling fee, but the settlement delay!

The core of DeFi is atomicity, pursuing instant transactions of Block+0! Wall Street is still running on the ancient liquidation cycle, under TradFi's T+1 or even T+2 system, funds need to go through a 24-48 hour idle period to transfer funds from USDT to US bonds! This period of "funds in transit" will bring opportunity costs. This leads to a "spatio-temp

View OriginalI don't know if you have a question: "Many RWAs always can't outperform the income and buy U.S. bonds directly?" "The common reason is not the handling fee, but the settlement delay!

The core of DeFi is atomicity, pursuing instant transactions of Block+0! Wall Street is still running on the ancient liquidation cycle, under TradFi's T+1 or even T+2 system, funds need to go through a 24-48 hour idle period to transfer funds from USDT to US bonds! This period of "funds in transit" will bring opportunity costs. This leads to a "spatio-temp

- Reward

- like

- Comment

- Repost

- Share

Does the Brevis proof layer truly enable Ethereum to scale?

Ethereum’s current scalability pain point: it’s not bandwidth, it’s not storage, but “network-wide redundant execution”!

Current rule: every transaction must be fully executed from start to finish by every single validator node in the network to reach consensus!

→ Total computation = computation per transaction x total number of nodes

→ The more nodes there are, the greater the total computation! This is Ethereum’s “native scaling challenge”.

Traditional scaling solution: move 90%-99.9% of transaction computation to Layer 2 and have E

Ethereum’s current scalability pain point: it’s not bandwidth, it’s not storage, but “network-wide redundant execution”!

Current rule: every transaction must be fully executed from start to finish by every single validator node in the network to reach consensus!

→ Total computation = computation per transaction x total number of nodes

→ The more nodes there are, the greater the total computation! This is Ethereum’s “native scaling challenge”.

Traditional scaling solution: move 90%-99.9% of transaction computation to Layer 2 and have E

ETH-3.81%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Recently, many people have been discussing AI robots, but most are unaware of OpenMind.

To put it simply,

it's like the "Android for robots," designed to create a development platform that enables robots to think, learn, collaborate, and interact seamlessly with humans!

Its core components are:

1⃣ OM1: An open-source operating system, like the "brain" of a human

> Input Fusion: Collects sensor data in real time to form environmental awareness

> Decision Engine: Uses large language models (LLMs) to understand scenarios and plan intentions

> Action Execution: Modular output such as navigation, o

View OriginalTo put it simply,

it's like the "Android for robots," designed to create a development platform that enables robots to think, learn, collaborate, and interact seamlessly with humans!

Its core components are:

1⃣ OM1: An open-source operating system, like the "brain" of a human

> Input Fusion: Collects sensor data in real time to form environmental awareness

> Decision Engine: Uses large language models (LLMs) to understand scenarios and plan intentions

> Action Execution: Modular output such as navigation, o

- Reward

- like

- Comment

- Repost

- Share

In every bull market, there are projects that change the landscape, and HyperSui is likely to be the next ⚡️

Funds are rapidly flowing into the DEX sector, with Sui ecosystem trading volume surpassing $100M/day and market sentiment extremely optimistic!

At this moment, the native perpetual DEX HyperSui is in its token sale phase, having already raised over $2,000,000+, and its popularity continues to climb 🔥

🔥 Why it could explode

> Explosive growth in demand for perpetual trading

> Accelerating inflow of funds and users into the Sui ecosystem

> First-mover DEX + Certik security backing

> 30

View OriginalFunds are rapidly flowing into the DEX sector, with Sui ecosystem trading volume surpassing $100M/day and market sentiment extremely optimistic!

At this moment, the native perpetual DEX HyperSui is in its token sale phase, having already raised over $2,000,000+, and its popularity continues to climb 🔥

🔥 Why it could explode

> Explosive growth in demand for perpetual trading

> Accelerating inflow of funds and users into the Sui ecosystem

> First-mover DEX + Certik security backing

> 30

- Reward

- like

- Comment

- Repost

- Share

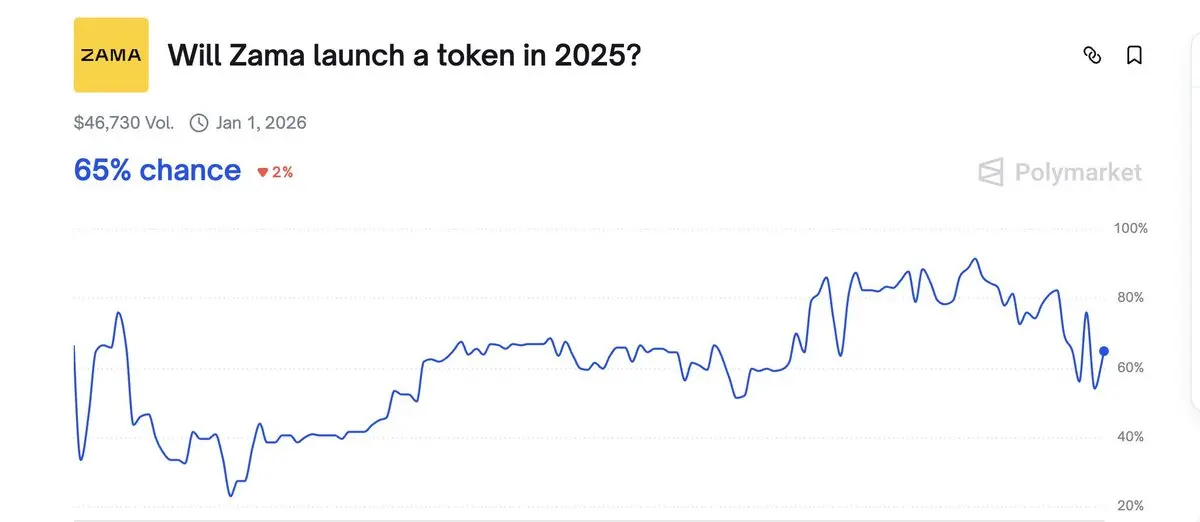

Crazy news!!! Polymarket predicts whether Zama will launch this year.

65% of the market is biased towards the belief that $ZAMA will be released within this year, 2025!

Clue:

> The project is basically mature and has started collaborating with numerous projects in various fields, such as self-custody wallets, on-chain decentralized auction locks, etc.

> The Zama creator program will also end on December 1!

> The official has announced the token code $ZAMA

> Recently, there have been many offline activities.

In summary, these are all actions before the TGE!

Will Zama launch a token in 2025? M

View Original65% of the market is biased towards the belief that $ZAMA will be released within this year, 2025!

Clue:

> The project is basically mature and has started collaborating with numerous projects in various fields, such as self-custody wallets, on-chain decentralized auction locks, etc.

> The Zama creator program will also end on December 1!

> The official has announced the token code $ZAMA

> Recently, there have been many offline activities.

In summary, these are all actions before the TGE!

Will Zama launch a token in 2025? M

- Reward

- like

- Comment

- Repost

- Share

Recently, many people are discussing DeFi, but most people do not know about INFINIT.

Understand in the simplest way

INFINIT is the "ChatGPT + LEGO of the DeFi world": tell the AI in one sentence what you want to earn, and it will automatically build all the blocks and help you get it done across protocols!

In the past, traditional DeFi was like manually assembling building blocks as an engineer: go to Uniswap to swap coins → go to Aave to borrow and lend → go to Pendle to sell yields... each step involved repetitive and cumbersome authorizations and confirmations.

Now, INFINIT: You just say "

View OriginalUnderstand in the simplest way

INFINIT is the "ChatGPT + LEGO of the DeFi world": tell the AI in one sentence what you want to earn, and it will automatically build all the blocks and help you get it done across protocols!

In the past, traditional DeFi was like manually assembling building blocks as an engineer: go to Uniswap to swap coins → go to Aave to borrow and lend → go to Pendle to sell yields... each step involved repetitive and cumbersome authorizations and confirmations.

Now, INFINIT: You just say "

- Reward

- like

- Comment

- Repost

- Share

Recently, many people are discussing RWA, but most people do not know KAI— the first protocol specifically designed for RWA.

Unlike traditional RWA, KAI does not aim to create an RWA project, but rather to help institutions transition their operations by providing a comprehensive one-stop RWA solution. The most remarkable aspect of this solution is: security + compliance!

What are the advantages of this RWA solution?

Traditional institutions do not need to build their own teams, worry about regulation, or sacrifice liquidity. With one click, real assets such as offline funds, bonds, and privat

View OriginalUnlike traditional RWA, KAI does not aim to create an RWA project, but rather to help institutions transition their operations by providing a comprehensive one-stop RWA solution. The most remarkable aspect of this solution is: security + compliance!

What are the advantages of this RWA solution?

Traditional institutions do not need to build their own teams, worry about regulation, or sacrifice liquidity. With one click, real assets such as offline funds, bonds, and privat

- Reward

- like

- Comment

- Repost

- Share

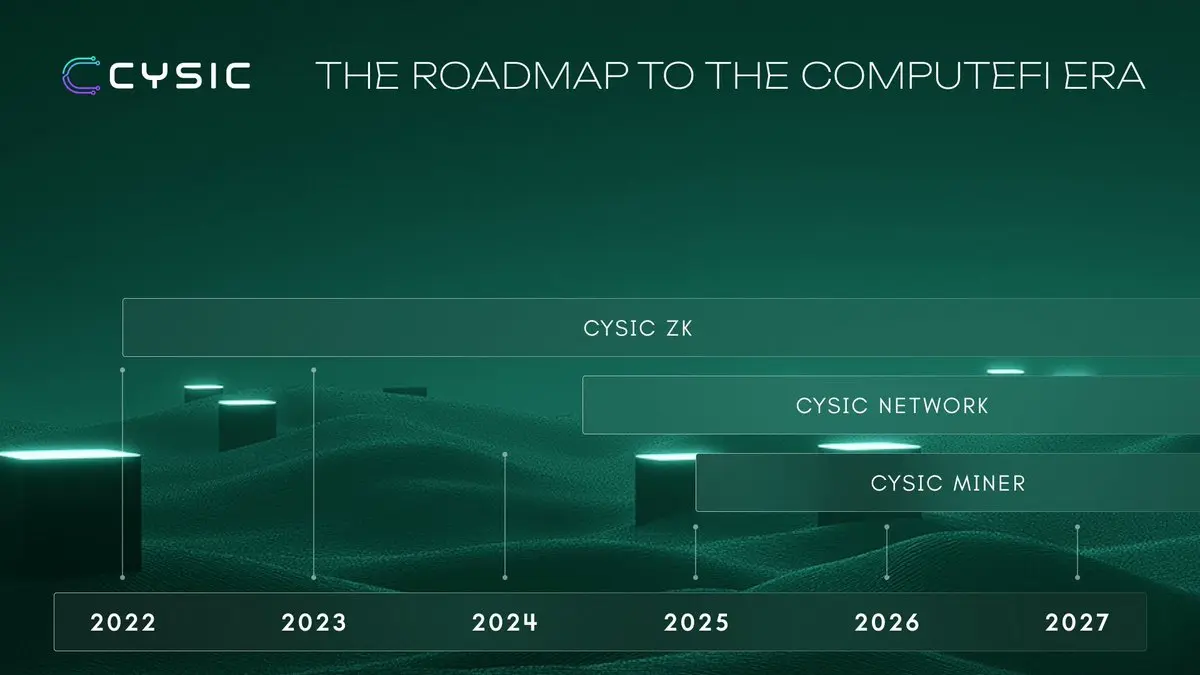

Recently, many people are discussing Cysic, but most people do not know the three major "killer moves" of Cysic.

The first major "killer move": ZK acceleration⚡️

In the past, traditional ZK proofs: a block takes 3 minutes.

Currently, Cysic ZK acceleration proof: a block only takes 4.2 seconds.

Traditional ZK is "can prove", while ZK acceleration is "can prove anytime"

It's like upgrading from "dial-up internet" to "5G".

The second biggest "killer move": Cysic Network coordination ⛓️

In the past, traditional ZK proofs were like: driving yourself, running the proof yourself.

Currently, Cysic

The first major "killer move": ZK acceleration⚡️

In the past, traditional ZK proofs: a block takes 3 minutes.

Currently, Cysic ZK acceleration proof: a block only takes 4.2 seconds.

Traditional ZK is "can prove", while ZK acceleration is "can prove anytime"

It's like upgrading from "dial-up internet" to "5G".

The second biggest "killer move": Cysic Network coordination ⛓️

In the past, traditional ZK proofs were like: driving yourself, running the proof yourself.

Currently, Cysic

CYS-11.89%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

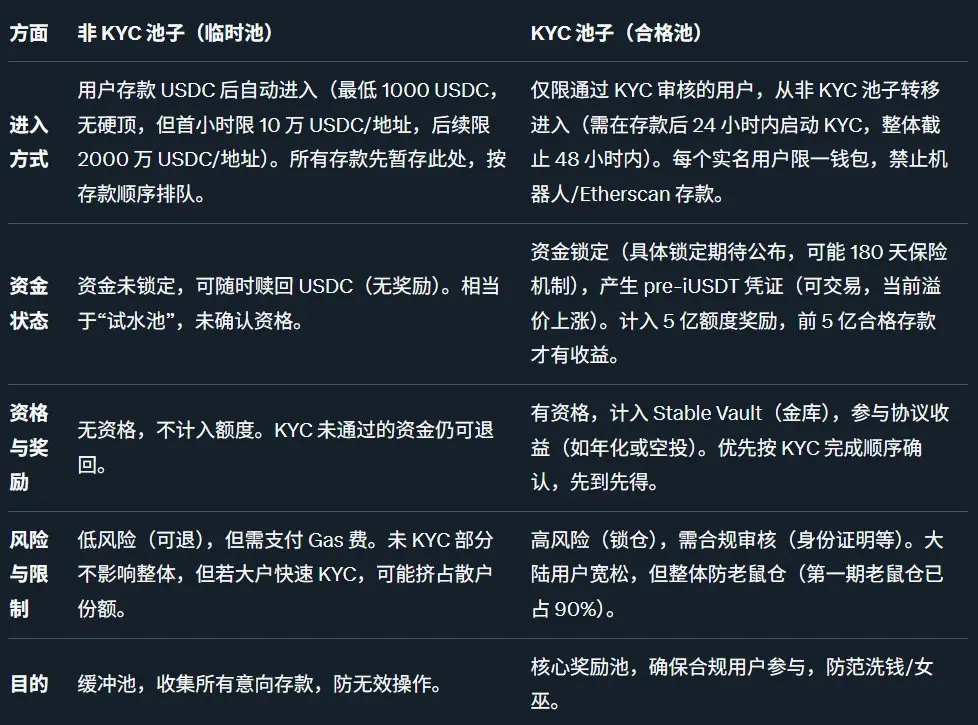

Know it well! Hot topic @stable deposit details

Today’s hottest topic: The second round of Stable deposit activities! This time, the deposit is officially revealed to be arranged on @hourglasshg!

Deposit Details

>Time: November 6th at 10 PM ( UTC+8 )

> No deposit limit → 500 million quota on a first-come, first-served basis

> Deposit Assets: Mainnet USDC

> Non-KYC deposit mechanism: Minimum $1000, maximum $100,000 in the first hour, then a maximum of $20 million.

> Save money first and then qualify through KYC certification (automatically enter the KYC pool through KYC)

>KYC needs to be comple

Today’s hottest topic: The second round of Stable deposit activities! This time, the deposit is officially revealed to be arranged on @hourglasshg!

Deposit Details

>Time: November 6th at 10 PM ( UTC+8 )

> No deposit limit → 500 million quota on a first-come, first-served basis

> Deposit Assets: Mainnet USDC

> Non-KYC deposit mechanism: Minimum $1000, maximum $100,000 in the first hour, then a maximum of $20 million.

> Save money first and then qualify through KYC certification (automatically enter the KYC pool through KYC)

>KYC needs to be comple

View Original

- Reward

- like

- Comment

- Repost

- Share

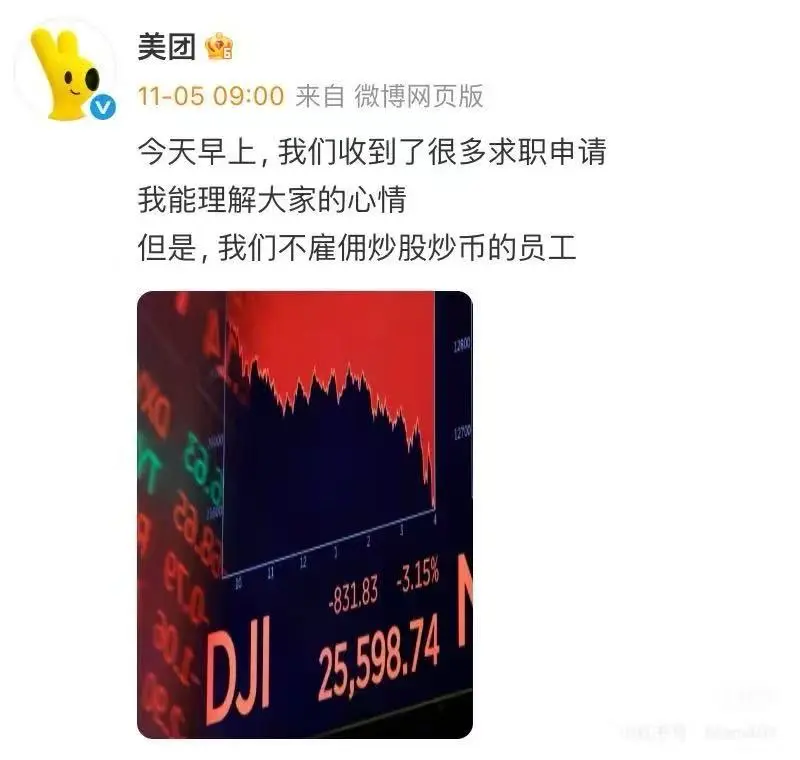

The sky has fallen! The crypto world is over, and I might lose my job.

Is there love in the crypto world? If not, I can only quit and return to the countryside...

View OriginalIs there love in the crypto world? If not, I can only quit and return to the countryside...

- Reward

- like

- Comment

- Repost

- Share

@zkgoudan @irys_xyz hirys! Let's build together.

View Original- Reward

- like

- Comment

- Repost

- Share

@HM010169 @SeiNetwork gsei! Let's build together.

View Original- Reward

- like

- Comment

- Repost

- Share