Amelia1231

No content yet

Amelia1231

Regarding the current $BTC long-term outlook

Whether for defensive investors or aggressive investors, caution is advised. The current bear market rhythm is very prominent and obvious.

First, the impact of the Bitcoin halving bull market has diminished; secondly, the bull markets driven by AI, non-ferrous metals, and US tech stocks have not yet experienced a major cycle correction, and capital remains enthusiastic, which further affects the heat in the crypto space. Third, political, war, and policy factors are unfavorable to the crypto market. Fourth, most central banks, including the Federal

Whether for defensive investors or aggressive investors, caution is advised. The current bear market rhythm is very prominent and obvious.

First, the impact of the Bitcoin halving bull market has diminished; secondly, the bull markets driven by AI, non-ferrous metals, and US tech stocks have not yet experienced a major cycle correction, and capital remains enthusiastic, which further affects the heat in the crypto space. Third, political, war, and policy factors are unfavorable to the crypto market. Fourth, most central banks, including the Federal

BTC2,92%

- Reward

- 4

- 2

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Although the current performance $BTC garbage, it is still optimistic

No matter what metal, stock, or fund, it is still impossible to surpass Bitcoin in terms of potential yield and safety for a long time.

Bitcoin currently has the highest potential yield among the varieties that can be relieved of studs.

Even if it falls from $126,000 to $50,000, it only means a windfall from the sky, giving people who don't stock up enough more opportunities.

Bitcoin also has unique advantages in terms of ease of understanding.

Compared with A-shares, the companies in the U.S. stock market are relatively ea

No matter what metal, stock, or fund, it is still impossible to surpass Bitcoin in terms of potential yield and safety for a long time.

Bitcoin currently has the highest potential yield among the varieties that can be relieved of studs.

Even if it falls from $126,000 to $50,000, it only means a windfall from the sky, giving people who don't stock up enough more opportunities.

Bitcoin also has unique advantages in terms of ease of understanding.

Compared with A-shares, the companies in the U.S. stock market are relatively ea

BTC2,92%

- Reward

- 8

- 2

- Repost

- Share

Discovery :

:

Watching Closely 🔍️View More

Today, the gold market has once again refreshed everyone's understanding. Under the bearish pressure of the Federal Reserve's clear announcement yesterday not to cut interest rates and to maintain high rates, gold prices not only did not fall but directly broke through $5,500. Generally speaking, with high US dollar interest rates, assets like gold that do not generate interest should be out of favor, but the current market trend is completely opposite.

1. Why did the "no rate cut" policy fail?

In the past, gold prices feared rate hikes because everyone thought holding dollars was more profita

1. Why did the "no rate cut" policy fail?

In the past, gold prices feared rate hikes because everyone thought holding dollars was more profita

PAXG-5,43%

- Reward

- 6

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

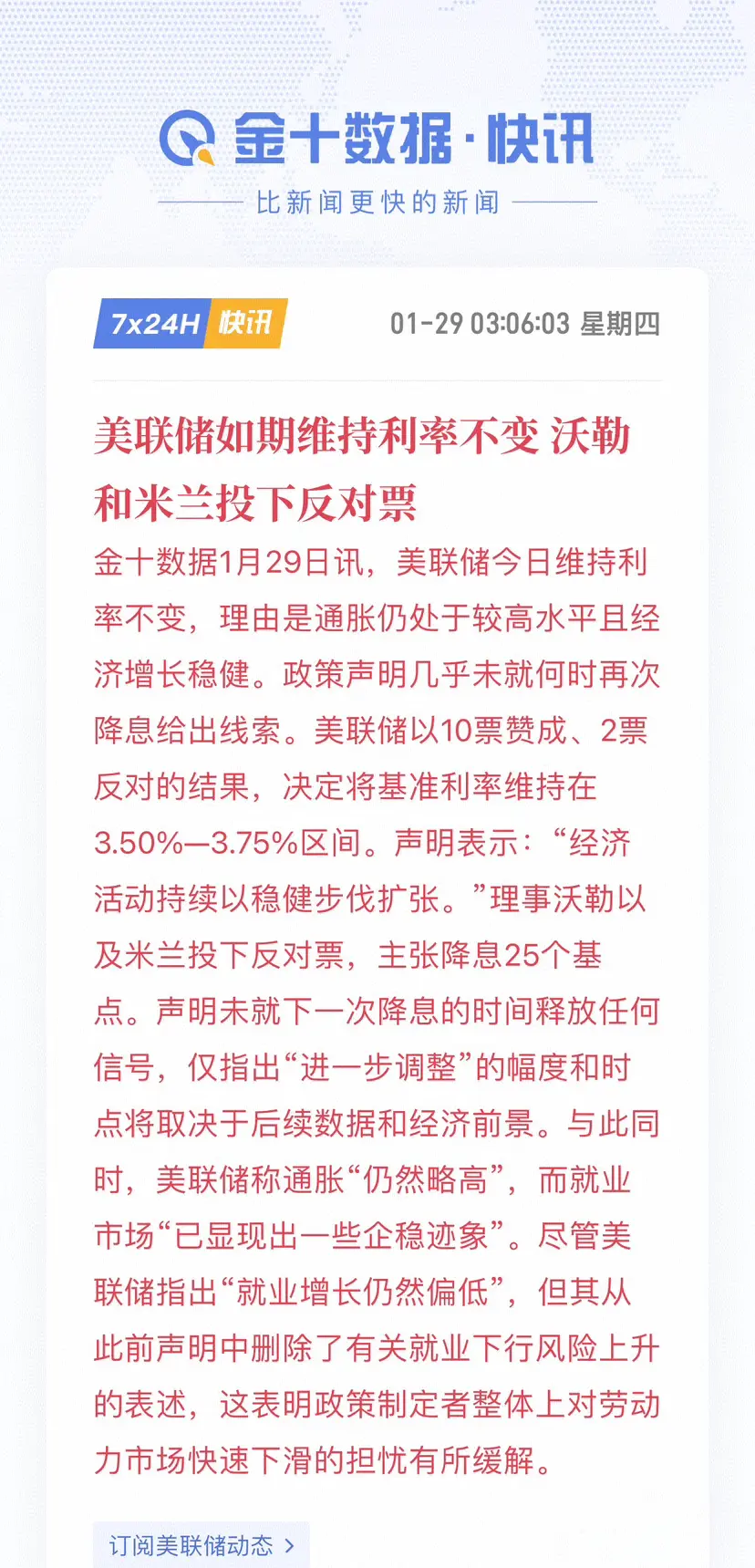

Listening to Powell's live broadcast, it was much more dovish than expected.

During the Q&A, Powell directly refused to answer sensitive questions unrelated to the Federal Reserve's duties, indicating a retreat before stepping down.

But he also emphasized two points:

1. Interest rates are at the upper end of the neutral zone

2. Tariffs are very likely a one-time price increase, and the core PCE excluding the impact of tariffs is slightly above 2%, which is very healthy

All of this leaves room for rate cuts in the future.

The current market has already priced in no rate cuts before May( Powell

View OriginalDuring the Q&A, Powell directly refused to answer sensitive questions unrelated to the Federal Reserve's duties, indicating a retreat before stepping down.

But he also emphasized two points:

1. Interest rates are at the upper end of the neutral zone

2. Tariffs are very likely a one-time price increase, and the core PCE excluding the impact of tariffs is slightly above 2%, which is very healthy

All of this leaves room for rate cuts in the future.

The current market has already priced in no rate cuts before May( Powell

- Reward

- 5

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Gold has experienced an epic rally, and silver is following suit, but $BTC continues to decline steadily. This wave of gains seems to be supported by fundamentals, but in reality, it's all just a frenzy of speculative capital. The ending will likely be more brutal than previous cycles. The London gold leasing rate has soared, and short sellers can't borrow gold, pushing the short squeeze to the extreme. Exchanges will inevitably raise costs and limit positions, directly cutting off market liquidity. After the bulls' collective rally turns into a stampede and escapes, funds will eventually lea

BTC2,92%

- Reward

- 4

- 3

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

$BTC

The total market capitalization of altcoins has fallen to a ten-year low, with remaining volume only about $119.5 billion. This figure is lower than the bear market of 2018, below the 2020 312 black swan event, and also below the bottom after the FTX collapse in 2022. From a historical perspective, this is a very high level of compression.

Historically, genuine altcoin rallies often do not occur when everyone is optimistic about them, but rather after they have been long ignored, continuously suppressed, and almost abandoned, followed by a reflow of liquidity. Currently, this stage resem

The total market capitalization of altcoins has fallen to a ten-year low, with remaining volume only about $119.5 billion. This figure is lower than the bear market of 2018, below the 2020 312 black swan event, and also below the bottom after the FTX collapse in 2022. From a historical perspective, this is a very high level of compression.

Historically, genuine altcoin rallies often do not occur when everyone is optimistic about them, but rather after they have been long ignored, continuously suppressed, and almost abandoned, followed by a reflow of liquidity. Currently, this stage resem

BTC2,92%

- Reward

- 5

- 2

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

- Reward

- 5

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

What is the bottom of this round of Bitcoin bear market?

Last year, Bitcoin peaked at 126,000, and this year it has already entered a bear market. If you still insist that this is a bull market, a super cycle, then there's no need to read further.

There are only two core questions in a bear market: where will BTC price fall to? When will the bottom be reached?

The first approach is to look at the "decreasing law" of historical bear market declines. In each Bitcoin bear market, the maximum decline gets smaller, gradually converging overall, rather than repeatedly dropping 70%+.

The top structur

Last year, Bitcoin peaked at 126,000, and this year it has already entered a bear market. If you still insist that this is a bull market, a super cycle, then there's no need to read further.

There are only two core questions in a bear market: where will BTC price fall to? When will the bottom be reached?

The first approach is to look at the "decreasing law" of historical bear market declines. In each Bitcoin bear market, the maximum decline gets smaller, gradually converging overall, rather than repeatedly dropping 70%+.

The top structur

BTC2,92%

- Reward

- 10

- 8

- Repost

- Share

SpeciallyTargetingChildren's :

:

2026 Go Go Go 👊View More

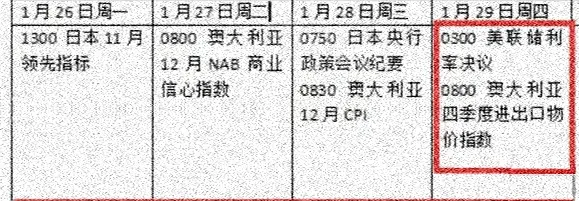

The upcoming week will be a crucial one for the cryptocurrency market

January 26: The probability of a US government shutdown skyrockets to 80%

January 28: Federal Reserve interest rate decision, Powell press conference, earnings reports from Microsoft, Meta, and Tesla

January 29: Initial jobless claims, Apple earnings report

January 30: US PPI inflation data, the final deadline for the US government shutdown

Market volatility is expected to be very intense. Are you panicking😄

In the short-term trend, if the price continues to fall, I think it might actually be a short-term rebound opportunit

January 26: The probability of a US government shutdown skyrockets to 80%

January 28: Federal Reserve interest rate decision, Powell press conference, earnings reports from Microsoft, Meta, and Tesla

January 29: Initial jobless claims, Apple earnings report

January 30: US PPI inflation data, the final deadline for the US government shutdown

Market volatility is expected to be very intense. Are you panicking😄

In the short-term trend, if the price continues to fall, I think it might actually be a short-term rebound opportunit

BTC2,92%

- Reward

- 5

- 9

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

The next bull market will definitely see a focus on stablecoins. Stablecoins are currently the most successful real-world applications of blockchain, and the market won't be limited to just USDT and USDC.

$WLFI 's exit with USD1 and $ENA 's launch of USDE

Currently, it seems both of these stablecoins are unlikely to fail.

If you want to get involved in the stablecoin sector, those with a US stock account can directly buy CRCL, while those without a US stock account can choose between WLFI and ENA to position themselves for the next bull market. Personally, I lean more towards WLFI.

#Ga

View Original$WLFI 's exit with USD1 and $ENA 's launch of USDE

Currently, it seems both of these stablecoins are unlikely to fail.

If you want to get involved in the stablecoin sector, those with a US stock account can directly buy CRCL, while those without a US stock account can choose between WLFI and ENA to position themselves for the next bull market. Personally, I lean more towards WLFI.

#Ga

- Reward

- 5

- 4

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

The current round of TAO has actually completed a full cycle. It started with a rapid rise driven by sentiment, followed by distribution at high levels, then entered a more rhythmic decline. The subsequent rebound only stopped near the downward pressure, and the pullback itself was part of the script.

Now, this position is neither good nor bad. Ideally, it would slowly form a bottom here; a less ideal scenario is to continue downward along the original trend. Anyway, it's not something that can be figured out in a day or two.

So at this stage, the price is less important, and time is more

Now, this position is neither good nor bad. Ideally, it would slowly form a bottom here; a less ideal scenario is to continue downward along the original trend. Anyway, it's not something that can be figured out in a day or two.

So at this stage, the price is less important, and time is more

TAO0,98%

- Reward

- 8

- 6

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Bitcoin - Ethereum Next Week Focus

The Federal Reserve decision is approaching, and Trump has revoked the threat of tariffs on Europe over Greenland!

The key level for Bitcoin at 90,000 and the main trend for Ethereum at 3000—will the market bring new declines?

Similarly, after three consecutive rate cuts, the pause appears to be temporary. According to LSEG data, the money market is now fully considering future rate cut points. In reality, these are just gimmicks. The volatility that should occur in crypto won't be affected by the current situation. Excluding certainty (positive or negative),

View OriginalThe Federal Reserve decision is approaching, and Trump has revoked the threat of tariffs on Europe over Greenland!

The key level for Bitcoin at 90,000 and the main trend for Ethereum at 3000—will the market bring new declines?

Similarly, after three consecutive rate cuts, the pause appears to be temporary. According to LSEG data, the money market is now fully considering future rate cut points. In reality, these are just gimmicks. The volatility that should occur in crypto won't be affected by the current situation. Excluding certainty (positive or negative),

- Reward

- 5

- 4

- Repost

- Share

Ryakpanda :

:

Just go for it💪View More

Can gold break through $5000?

Currently, spot gold is fluctuating above $4900, just one step away from the $5000 threshold. Considering core drivers and potential risks, the probability of breaking through is high, but short-term pullback interference should be watched.

The logic supporting a breakthrough of $5000 is clear. On the geopolitical front, escalating Middle East tensions and intensified global geopolitical games continue to drive safe-haven buying, becoming the core catalyst for gold prices. On the funding and policy side, the Fed's easing expectations have increased, lowering the c

View OriginalCurrently, spot gold is fluctuating above $4900, just one step away from the $5000 threshold. Considering core drivers and potential risks, the probability of breaking through is high, but short-term pullback interference should be watched.

The logic supporting a breakthrough of $5000 is clear. On the geopolitical front, escalating Middle East tensions and intensified global geopolitical games continue to drive safe-haven buying, becoming the core catalyst for gold prices. On the funding and policy side, the Fed's easing expectations have increased, lowering the c

- Reward

- 4

- 3

- Repost

- Share

Ryakpanda :

:

Hold on tight, we're about to take off 🛫View More

Blockchain symptoms, see how many you have?

1. Can't bring yourself to spend hundreds on clothes and shoes, but spend thousands of dollars on dog coins.

2. Every day looking at K-line charts on your phone, losing hobbies, losing the joy of playing ball, shopping, and traveling.

3. Fewer friends in real life, more crypto friends; unwilling to lend hundreds of friends, but when crypto friends shout, it's tens of thousands of dollars.

4. Currency units are different from those around you, using dollars as the unit.

5. Dreaming more easily about the red big bearish line of the whale market, waking

View Original1. Can't bring yourself to spend hundreds on clothes and shoes, but spend thousands of dollars on dog coins.

2. Every day looking at K-line charts on your phone, losing hobbies, losing the joy of playing ball, shopping, and traveling.

3. Fewer friends in real life, more crypto friends; unwilling to lend hundreds of friends, but when crypto friends shout, it's tens of thousands of dollars.

4. Currency units are different from those around you, using dollars as the unit.

5. Dreaming more easily about the red big bearish line of the whale market, waking

MC:$25.14KHolders:396

100.00%

- Reward

- 5

- 3

- Repost

- Share

ChanganBloom :

:

Just do it.View More

Short-term boring market, stay patient and wait for the rebound

$BTC In the short term, the market is oscillating back and forth between 88,000 and 90,000. Many people in the market have lost half of their confidence, and the more timid have already liquidated and left. Actually, I think most retail investors want to run away from this market right now, but many are trapped in their positions and can't exit, so they have to endure and hold on.

In the short term, as long as BTC does not effectively break below 87,000, the structure remains intact. What we are waiting for is still a rebound, wit

View Original$BTC In the short term, the market is oscillating back and forth between 88,000 and 90,000. Many people in the market have lost half of their confidence, and the more timid have already liquidated and left. Actually, I think most retail investors want to run away from this market right now, but many are trapped in their positions and can't exit, so they have to endure and hold on.

In the short term, as long as BTC does not effectively break below 87,000, the structure remains intact. What we are waiting for is still a rebound, wit

- Reward

- 4

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Market is another boring day. I looked at the news in the cryptocurrency market today, and it's either GameStop suspected to transfer all on-chain BTC to Coinbase for selling, or HexTrust deposited 6230 AAVE into exchanges for selling in the past 4 hours, or BlackRock deposited 15112 ETH and 249.5 BTC into Coinbase for selling. Why are all major institutions selling? It gives the impression that the crypto boom is over😂😂😂

#Gate广场创作者新春激励

View Original#Gate广场创作者新春激励

- Reward

- 4

- 5

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

The market cap of hundreds of trillions of dollars in gold can double, imagining the future of $BTC . As Wall Street institutions exit, major countries are beginning to allocate BTC as strategic reserves. Therefore, in this round of bear market, BTC prices will be kept above $60,000 and below $120,000 for institutional long-term holders.

Currently, Bitcoin is mimicking the 2020 spot gold trend, entering a three-year long "super cycle" consolidation phase at the top. By 2028, BTC will enter another major upward wave, heading straight for $500,000 or more.

So, this bear market will be the la

Currently, Bitcoin is mimicking the 2020 spot gold trend, entering a three-year long "super cycle" consolidation phase at the top. By 2028, BTC will enter another major upward wave, heading straight for $500,000 or more.

So, this bear market will be the la

BTC2,92%

- Reward

- 6

- 5

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

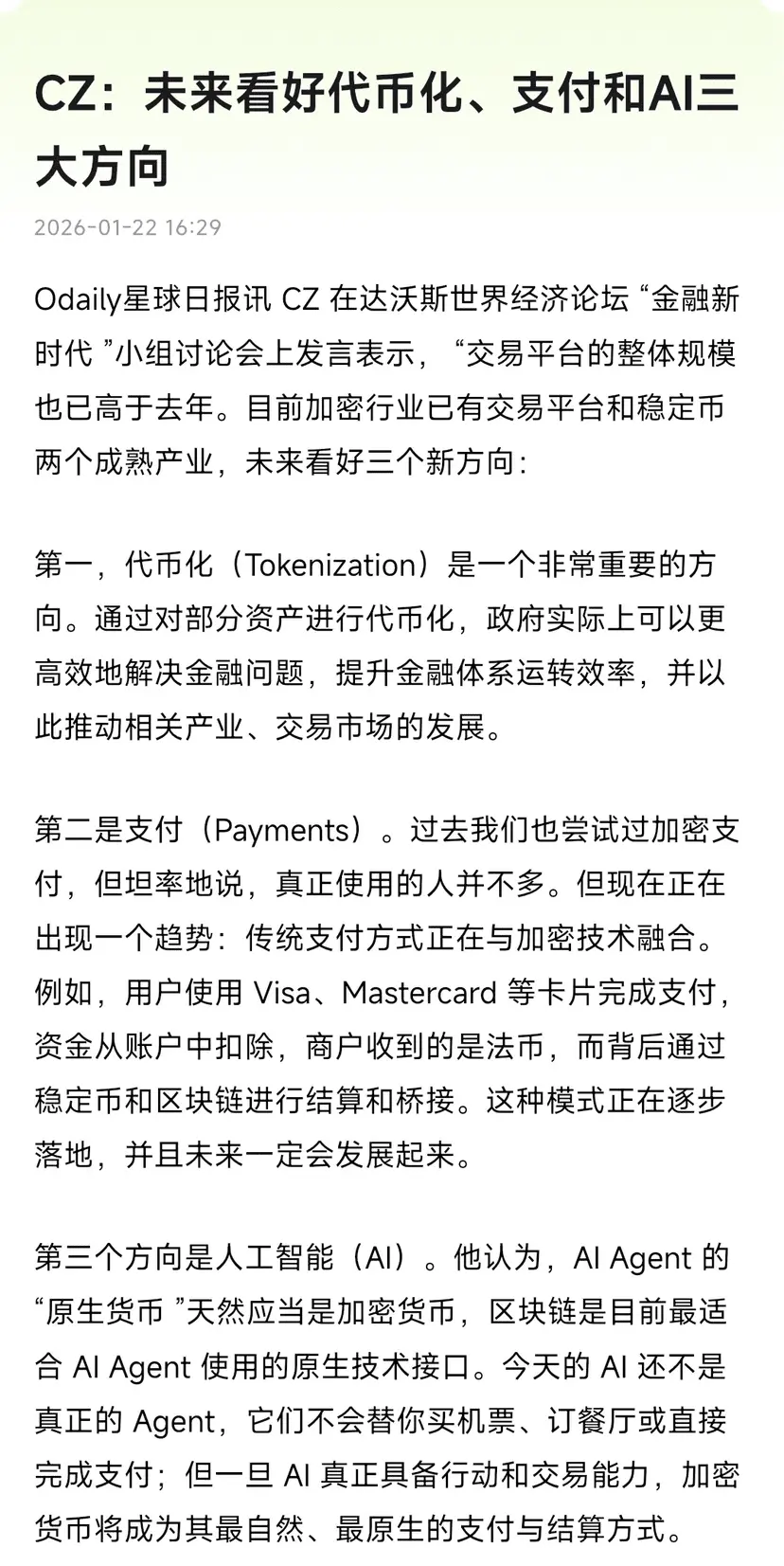

CZ: Looking forward to three major directions in the future: tokenization, payments, and AI

Although CZ's indicator is often joked about—that whenever CZ comes out to express optimism about the upcoming market, the short-term market will crash—CZ's overall view on the big trends in the crypto world is still quite accurate. Let's analyze which specific coins belong to these three directions, so you can add them to your watchlist and consider them as bottom-fishing targets during the bear market.

1: Tokenization, which we know as RWA, is the first recommended project ONDO, followed by SYRUP, wit

View OriginalAlthough CZ's indicator is often joked about—that whenever CZ comes out to express optimism about the upcoming market, the short-term market will crash—CZ's overall view on the big trends in the crypto world is still quite accurate. Let's analyze which specific coins belong to these three directions, so you can add them to your watchlist and consider them as bottom-fishing targets during the bear market.

1: Tokenization, which we know as RWA, is the first recommended project ONDO, followed by SYRUP, wit

- Reward

- 4

- 3

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

The only altcoins still playable in the crypto world now

The 2026 US-Canada-Mexico World Cup will be held from June 11 to July 19, 2026.

Fan coins also follow a four-year cycle. Regardless of the market trend each year, fan coins will have their own independent market. At this stage, it’s almost time to buy spot holdings in batches.

From the perspective of liquidity and market consensus, I still recommend leading $CHZ and the $SANTOS of the coin series. Other fan coins can also be bought, but they should only be considered as lottery tickets.

Looking at the trading volume of fan coins, it’s

View OriginalThe 2026 US-Canada-Mexico World Cup will be held from June 11 to July 19, 2026.

Fan coins also follow a four-year cycle. Regardless of the market trend each year, fan coins will have their own independent market. At this stage, it’s almost time to buy spot holdings in batches.

From the perspective of liquidity and market consensus, I still recommend leading $CHZ and the $SANTOS of the coin series. Other fan coins can also be bought, but they should only be considered as lottery tickets.

Looking at the trading volume of fan coins, it’s

- Reward

- 9

- 11

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

Grayscale submits S-1 filing for ETH, prepares to launch NEAR Trust, effectively packaging NEAR tokens into a "quasi-ETF"—once approved by the SEC, it can be publicly traded on the US OTC market. For the NEAR blockchain, this means three things:

1. Compliance "Gold Plating"

Assets selected by Grayscale have traditionally been regarded as "mainstream assets" by traditional funds. The SEC's S-1 review process will give NEAR a comprehensive compliance check, and passing it will grant a Wall Street pass.

2. Opening the Gate for Incremental Funds

Trust shares can be bought and sold directly i

1. Compliance "Gold Plating"

Assets selected by Grayscale have traditionally been regarded as "mainstream assets" by traditional funds. The SEC's S-1 review process will give NEAR a comprehensive compliance check, and passing it will grant a Wall Street pass.

2. Opening the Gate for Incremental Funds

Trust shares can be bought and sold directly i

ETH-0,91%

- Reward

- 6

- 5

- Repost

- Share

ybaser :

:

New Year Wealth Explosion 🤑View More

Trending Topics

View More25.47K Popularity

38.41K Popularity

358.08K Popularity

35.29K Popularity

53.28K Popularity

Pin