Amarylliss_14

No content yet

Amarylliss_14

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊$BTC

$60K wasn’t just another bounce.

That level absorbed panic, forced sellers out, and flipped momentum when the market least expected it. Same zone that kick-started the 2025 run is still doing its job.

Momentum isn’t clean yet — hesitation remains — but value buyers are clearly stepping in while fear is loud.

Bitcoin doesn’t bottom when confidence is high. It bottoms when selling stops working

$60K wasn’t just another bounce.

That level absorbed panic, forced sellers out, and flipped momentum when the market least expected it. Same zone that kick-started the 2025 run is still doing its job.

Momentum isn’t clean yet — hesitation remains — but value buyers are clearly stepping in while fear is loud.

Bitcoin doesn’t bottom when confidence is high. It bottoms when selling stops working

BTC2,1%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$XRP $XRP keeps printing lower highs, sliding from $3.50 toward $1.50 — yet Open Interest is up ~12%.

That’s a classic divergence.

Rising OI into a falling price usually isn’t accumulation.

It’s leverage building:

• shorts leaning into weakness

• late longs chasing dip entries

ETF desk activity and hedging flows point to positioning, not spot demand.

As leverage thickens and price compresses, fragility increases.

These setups tend to lead to volatility expansion, not a clean reversal.

Watch positioning. Not narratives.

That’s a classic divergence.

Rising OI into a falling price usually isn’t accumulation.

It’s leverage building:

• shorts leaning into weakness

• late longs chasing dip entries

ETF desk activity and hedging flows point to positioning, not spot demand.

As leverage thickens and price compresses, fragility increases.

These setups tend to lead to volatility expansion, not a clean reversal.

Watch positioning. Not narratives.

XRP0,34%

- Reward

- 1

- Comment

- Repost

- Share

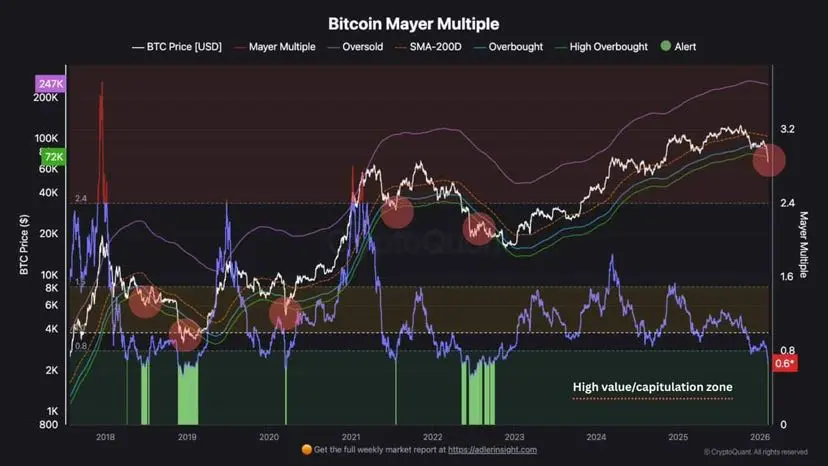

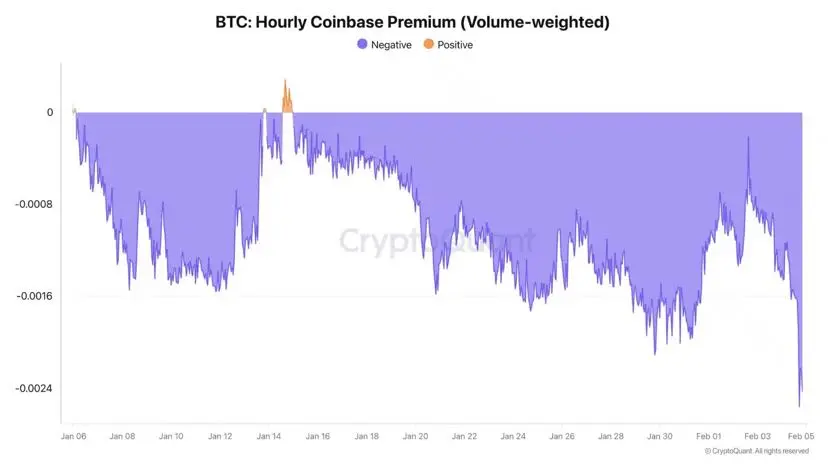

Bitcoin is flashing stress signals.

• $BTC trading well below realized price ($79.1k)

• 14-month low as correlation with U.S. tech tightens

• CLARITY Act delays adding to sell pressure

More concerning:

Coinbase Premium (VWAP) just hit its most negative level of 2026 Darkfost.

That’s heavy selling from large U.S. players.

$74.5k weekly support is gone.

A sweep to $60k now opens the door for a deeper retrace.

High uncertainty. Volatility ahead.

This is not a comfort zone for bulls.

• $BTC trading well below realized price ($79.1k)

• 14-month low as correlation with U.S. tech tightens

• CLARITY Act delays adding to sell pressure

More concerning:

Coinbase Premium (VWAP) just hit its most negative level of 2026 Darkfost.

That’s heavy selling from large U.S. players.

$74.5k weekly support is gone.

A sweep to $60k now opens the door for a deeper retrace.

High uncertainty. Volatility ahead.

This is not a comfort zone for bulls.

BTC2,1%

- Reward

- like

- Comment

- Repost

- Share

Whales are accumulating $ZEC hard big withdrawals, steady exchange outflows, real money moving in.

Yet price keeps sliding and structure stays weak.

Feels like positioning ahead of something, not demand taking control yet.

Share via @coinexcom

#CoinEx #CoinExCreator

Yet price keeps sliding and structure stays weak.

Feels like positioning ahead of something, not demand taking control yet.

Share via @coinexcom

#CoinEx #CoinExCreator

- Reward

- like

- Comment

- Repost

- Share

$MIL is officially live on Solana

Built for the Millionero ecosystem with a clear focus on long-term utility, not short-term hype.

Official CA: 6Tk3uHQpLDtd4Qob5fduLjfhXxAasWgvdo8hYeswxMiL

For more updates @MillioneroEx

Built for the Millionero ecosystem with a clear focus on long-term utility, not short-term hype.

Official CA: 6Tk3uHQpLDtd4Qob5fduLjfhXxAasWgvdo8hYeswxMiL

For more updates @MillioneroEx

SOL-1,87%

- Reward

- like

- Comment

- Repost

- Share

$BTC shook out weak hands.

STH unrealized losses peaked near $110B and have now dropped to $65B as price reclaimed $95K–$97K.

Sell-side risk from short-term holders is near cycle lows.

Most panic selling already happened.

With STH stress easing and price reclaiming key EMAs, it won’t take much demand to push BTC toward $99K+.

Market feels lighter here.

Share via @coinexcom

#coinex

STH unrealized losses peaked near $110B and have now dropped to $65B as price reclaimed $95K–$97K.

Sell-side risk from short-term holders is near cycle lows.

Most panic selling already happened.

With STH stress easing and price reclaiming key EMAs, it won’t take much demand to push BTC toward $99K+.

Market feels lighter here.

Share via @coinexcom

#coinex

- Reward

- like

- Comment

- Repost

- Share

Just joined #ChainersParty

Prize pool $5,000+ with $2,000 USDT split across the leaderboard.

Top 250 get rewards, and there’s also a 10,000 CFB raffle for everyone else.

Just doing quests, stacking CP, and letting it play out. Hard to ignore a pool like this tbh.

Prize pool $5,000+ with $2,000 USDT split across the leaderboard.

Top 250 get rewards, and there’s also a 10,000 CFB raffle for everyone else.

Just doing quests, stacking CP, and letting it play out. Hard to ignore a pool like this tbh.

- Reward

- like

- Comment

- Repost

- Share

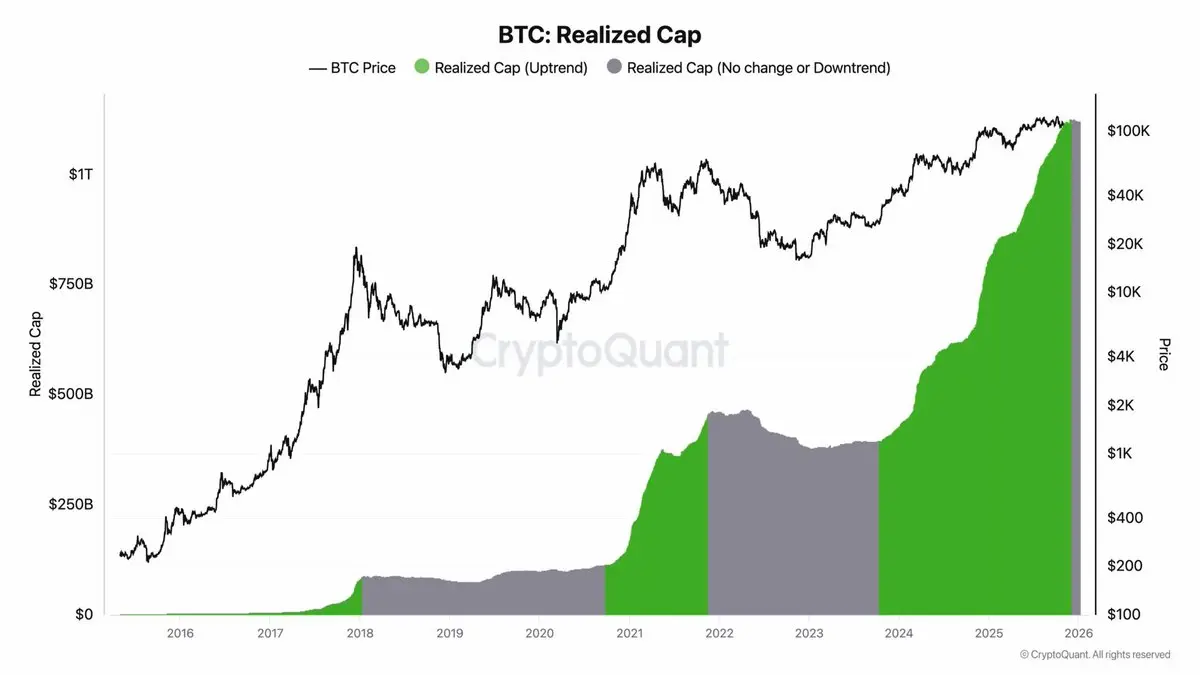

$BTC is pressing up against a critical inflection zone.

Price is hovering near $97K, just below the Short-Term Holder cost basis at $98.4K a level that often determines whether momentum accelerates or stalls. When recent buyers are underwater, supply tends to lean on price.

Zoom out and the picture looks far healthier $BTC is holding comfortably above long-term benchmarks

Active Investor Mean ($87.8K), True Market Mean ($81.1K), and Realized Price ($56.2K).

That’s not what structural weakness looks like.

This is a tactical fight, not a trend reversal.

A clean reclaim of $98.4K would flip short

Price is hovering near $97K, just below the Short-Term Holder cost basis at $98.4K a level that often determines whether momentum accelerates or stalls. When recent buyers are underwater, supply tends to lean on price.

Zoom out and the picture looks far healthier $BTC is holding comfortably above long-term benchmarks

Active Investor Mean ($87.8K), True Market Mean ($81.1K), and Realized Price ($56.2K).

That’s not what structural weakness looks like.

This is a tactical fight, not a trend reversal.

A clean reclaim of $98.4K would flip short

- Reward

- like

- Comment

- Repost

- Share

$BTC is pressing up against a critical inflection zone.

Price is hovering near $97K, just below the Short-Term Holder cost basis at $98.4K a level that often determines whether momentum accelerates or stalls. When recent buyers are underwater, supply tends to lean on price.

Zoom out and the picture looks far healthier.

BTC is holding comfortably above long-term benchmarks:

Active Investor Mean ($87.8K), True Market Mean ($81.1K), and Realized Price ($56.2K).

That’s not what structural weakness looks like.

This is a tactical fight, not a trend reversal.

A clean reclaim of $98.4K would flip shor

Price is hovering near $97K, just below the Short-Term Holder cost basis at $98.4K a level that often determines whether momentum accelerates or stalls. When recent buyers are underwater, supply tends to lean on price.

Zoom out and the picture looks far healthier.

BTC is holding comfortably above long-term benchmarks:

Active Investor Mean ($87.8K), True Market Mean ($81.1K), and Realized Price ($56.2K).

That’s not what structural weakness looks like.

This is a tactical fight, not a trend reversal.

A clean reclaim of $98.4K would flip shor

- Reward

- like

- Comment

- Repost

- Share

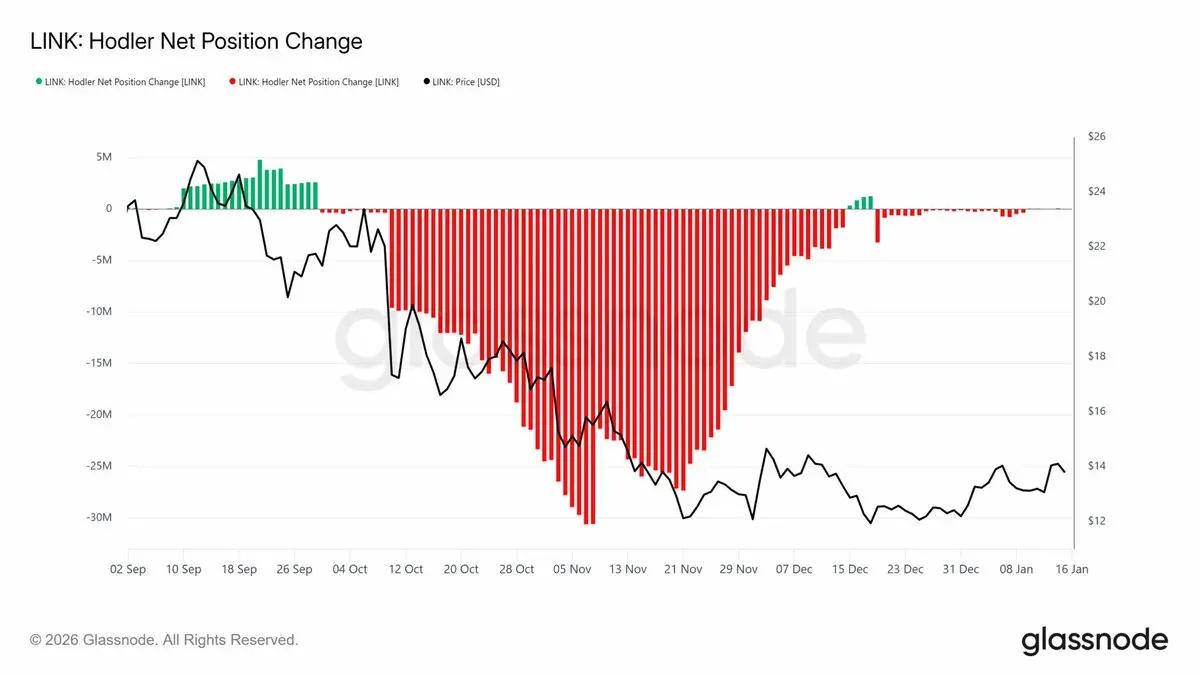

Chainlink is quietly flashing strength.

$LINK now leads ecosystem development on Solana, driven by CCIP and oracle demand. On-chain data shows holders have stopped heavy selling, supply in profit is near cycle lows, and accumulation may be starting.

With CME futures live and ETF inflows coming in, $LINK is setting up again just watch $BTC for confirmation.

Share via @coinexcreators

#coinex

$LINK now leads ecosystem development on Solana, driven by CCIP and oracle demand. On-chain data shows holders have stopped heavy selling, supply in profit is near cycle lows, and accumulation may be starting.

With CME futures live and ETF inflows coming in, $LINK is setting up again just watch $BTC for confirmation.

Share via @coinexcreators

#coinex

- Reward

- like

- Comment

- Repost

- Share

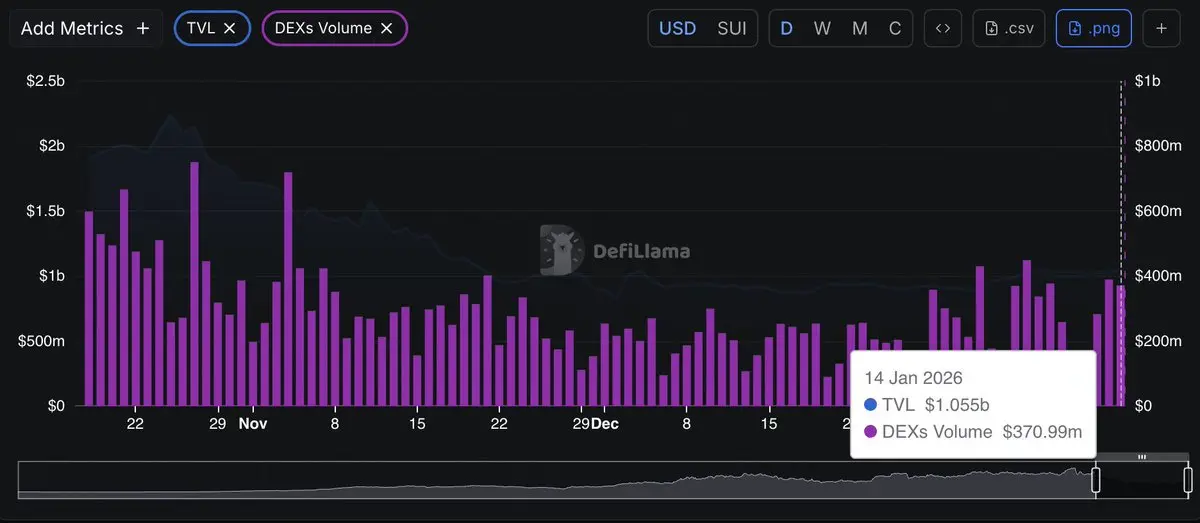

$SUI is quietly rebuilding strength.

TVL bounced back to $1.05B, up from $900M in late December, even before the recent disruption.

DEX volume hit $371M in a single day.

Capital is rotating back into Sui DeFi while the broader market stays shaky.

That’s not noise that’s positioning.

Share via @coinexcom

#coinex #coinexcreator

TVL bounced back to $1.05B, up from $900M in late December, even before the recent disruption.

DEX volume hit $371M in a single day.

Capital is rotating back into Sui DeFi while the broader market stays shaky.

That’s not noise that’s positioning.

Share via @coinexcom

#coinex #coinexcreator

- Reward

- like

- Comment

- Repost

- Share

Japan just set the tone 🇯🇵

Nikkei 225 surged 3.6% to a fresh ATH (53,814) as traders rushed back post-holiday, backed by election hopes, fiscal support expectations, and a weaker yen boosting exporters.

Meanwhile in crypto:

• STHs flipped to net selling

• $BTC trades below STH realized price ($98,450)

• New buyers sit on unrealized losses → near-term pressure builds

$BTC holds above $92K for now, but with macro running hot, the next shock could decide whether this range holds… or breaks.

Share via @coinexcom

#CoinExCreator

Nikkei 225 surged 3.6% to a fresh ATH (53,814) as traders rushed back post-holiday, backed by election hopes, fiscal support expectations, and a weaker yen boosting exporters.

Meanwhile in crypto:

• STHs flipped to net selling

• $BTC trades below STH realized price ($98,450)

• New buyers sit on unrealized losses → near-term pressure builds

$BTC holds above $92K for now, but with macro running hot, the next shock could decide whether this range holds… or breaks.

Share via @coinexcom

#CoinExCreator

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

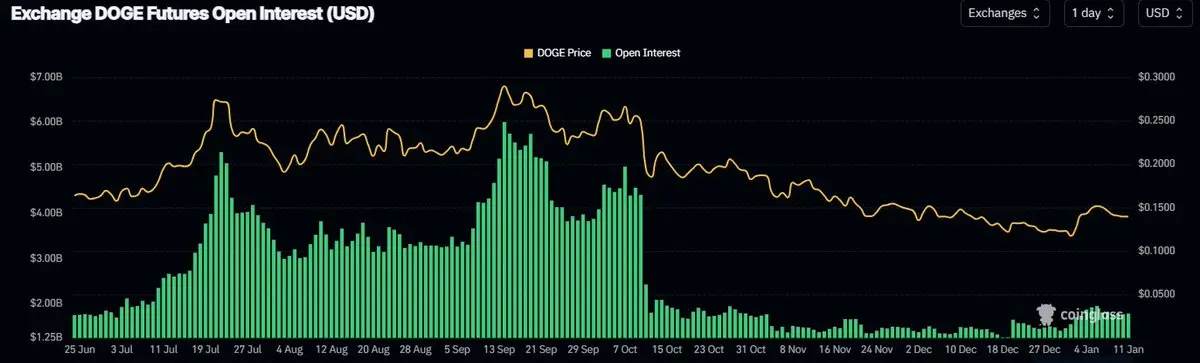

ETF hype pulled leverage into $DOGE fast, but it didn’t stick.

Open interest surged from $1.5B to $6B while price went nowhere.

Post-ETF, leverage flushed hard.

OI now sits near cycle lows, with Binance participation crushed.

This is a thin liquidity market.

Next volatility move won’t be gentle.

Share via @coinexcom

Open interest surged from $1.5B to $6B while price went nowhere.

Post-ETF, leverage flushed hard.

OI now sits near cycle lows, with Binance participation crushed.

This is a thin liquidity market.

Next volatility move won’t be gentle.

Share via @coinexcom

- Reward

- like

- Comment

- Repost

- Share

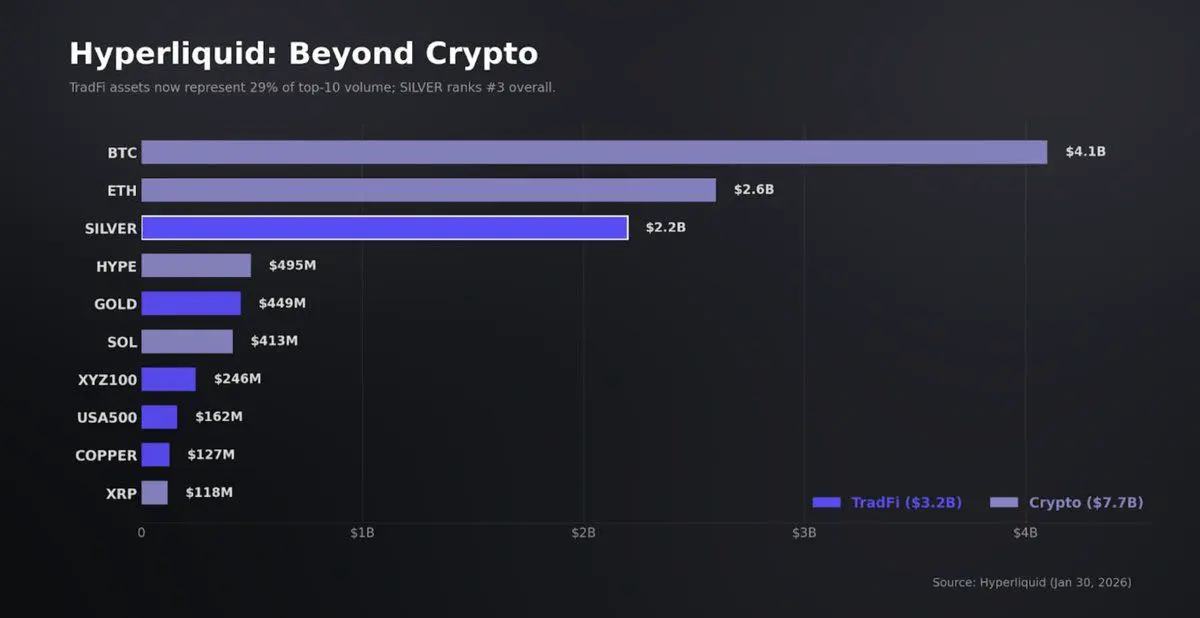

Tokenization is shaping up as the defining theme for 2026.

Analysts increasingly see on-chain stocks and ETFs as the next major wave, with U.S. regulators pushing capital markets toward blockchain rails.

It’s a $1B market today, but once rules are clear, growth could be exponential.

Share via @coinexcom

#coinex

Analysts increasingly see on-chain stocks and ETFs as the next major wave, with U.S. regulators pushing capital markets toward blockchain rails.

It’s a $1B market today, but once rules are clear, growth could be exponential.

Share via @coinexcom

#coinex

- Reward

- like

- Comment

- Repost

- Share

WAHA power economics show the real squeeze on miners.

Efficient rigs can survive short term, but once capex, downtime, and taxes are counted, margins get thin fast at current $BTC prices.

That’s why hashrate growth has stalled, not collapsed.

Miners aren’t exiting, they’re waiting.

Share via @coinexcom

#coinex #coinexcreator

Efficient rigs can survive short term, but once capex, downtime, and taxes are counted, margins get thin fast at current $BTC prices.

That’s why hashrate growth has stalled, not collapsed.

Miners aren’t exiting, they’re waiting.

Share via @coinexcom

#coinex #coinexcreator

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

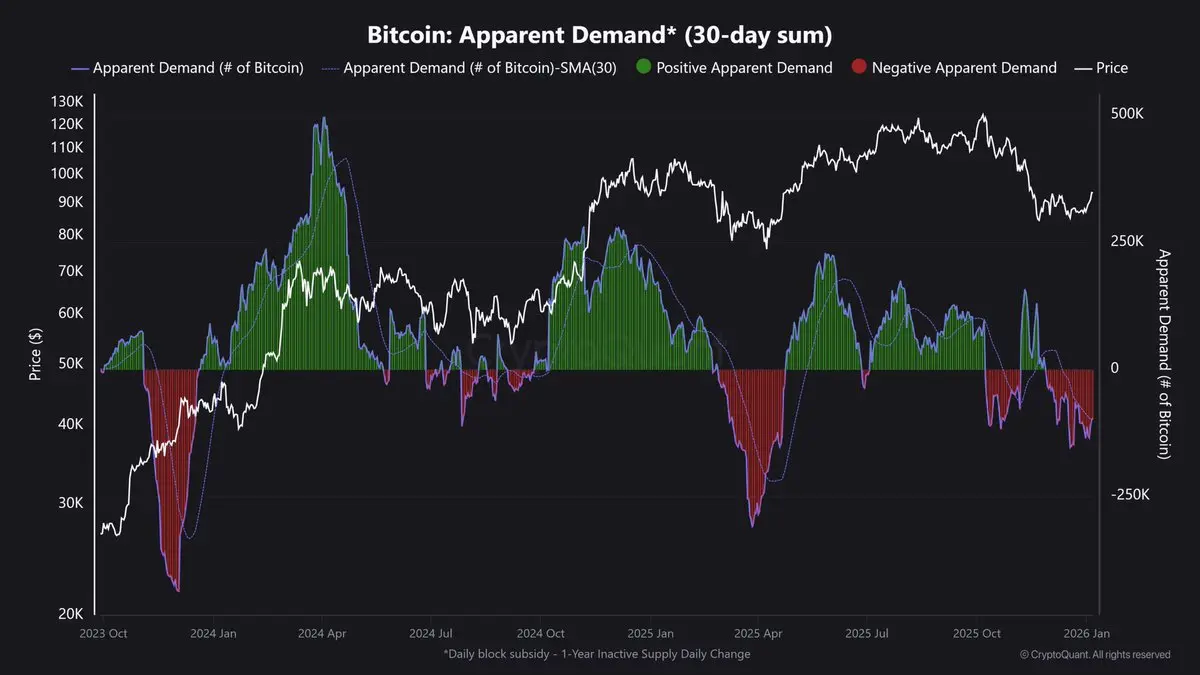

Bitcoin ETFs are roaring into 2026 🦁

$1.2B inflows in just 2 days = $150B annualized, showing strong institutional conviction.

But there’s a catch

On-chain data still shows overall BTC demand is negative, and price keeps stalling near $94K–$96K.

Sustainable rally to $100K needs demand to flip positive, not just ETF hype.

Share in collab with @coinexcreators

#CoinEx #CoinExCreator

$1.2B inflows in just 2 days = $150B annualized, showing strong institutional conviction.

But there’s a catch

On-chain data still shows overall BTC demand is negative, and price keeps stalling near $94K–$96K.

Sustainable rally to $100K needs demand to flip positive, not just ETF hype.

Share in collab with @coinexcreators

#CoinEx #CoinExCreator

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More167.11K Popularity

19.28K Popularity

395.8K Popularity

8.47K Popularity

19.24K Popularity

Pin