Alexx0

No content yet

Alexx0

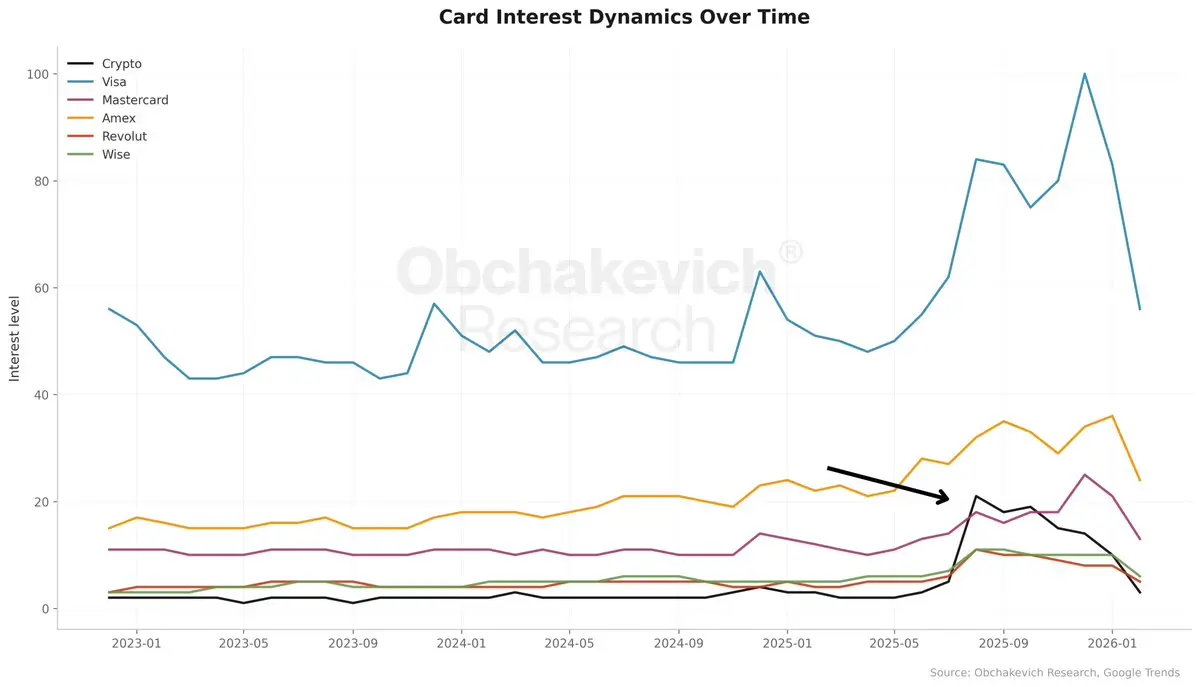

An interesting fact about crypto cards.

Between August and October 2025, the number of search queries for crypto cards exceeded those for traditional cards such as Mastercard, Revolut, and Wise.

Between August and October 2025, the number of search queries for crypto cards exceeded those for traditional cards such as Mastercard, Revolut, and Wise.

- Reward

- like

- Comment

- Repost

- Share

. @0xPolygon demonstrated accelerated payment dynamics in 2025.

The December volume reached $1.81B, which is the peak of the year, and from January to December, the growth was +365%.

The strongest momentum was recorded in October at $147M, while the largest monthly jump occurred in December at $490M.

The Payment Growth Velocity metric confirms the strengthening of real network usage and a steady upward trend.

The December volume reached $1.81B, which is the peak of the year, and from January to December, the growth was +365%.

The strongest momentum was recorded in October at $147M, while the largest monthly jump occurred in December at $490M.

The Payment Growth Velocity metric confirms the strengthening of real network usage and a steady upward trend.

- Reward

- 1

- 1

- Repost

- Share

Unoshi :

:

Thanks for the AnalysisThe sanctioned stablecoin A7A5 has a 24-hour volume of $591 and a “capitalization” of $500M LOL.

It is clear that the main volumes of this stablecoin pass through the black sanctioned exchanges Grinex and Garantex.

But analytical services continue to rank it first in the rating of non-USD stablecoins, above EURC and EURe 👀

It is clear that the main volumes of this stablecoin pass through the black sanctioned exchanges Grinex and Garantex.

But analytical services continue to rank it first in the rating of non-USD stablecoins, above EURC and EURe 👀

- Reward

- like

- Comment

- Repost

- Share

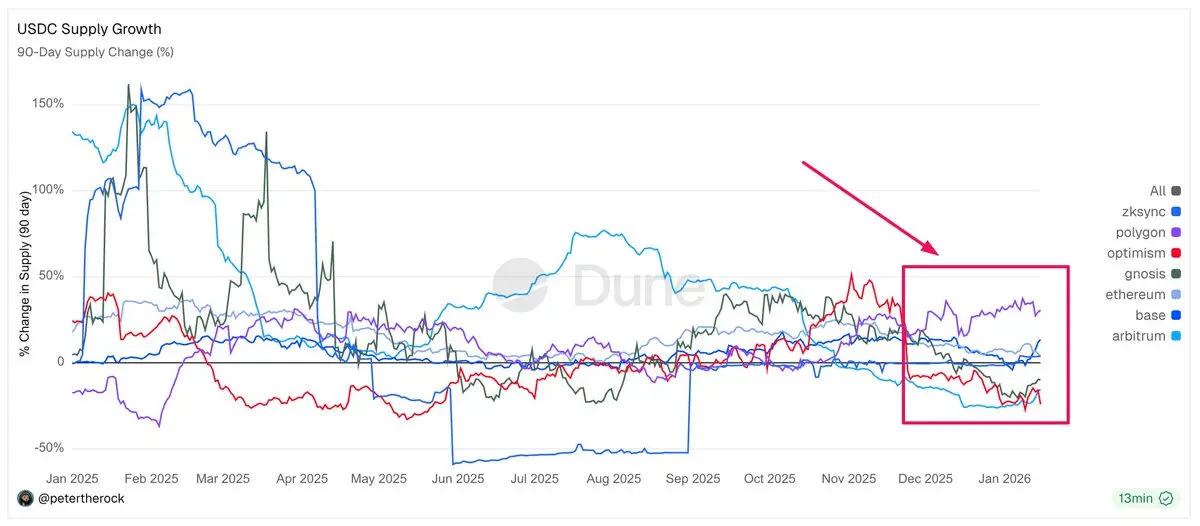

Since the end of November 2025, @0xPolygon has shown the largest increase in USDC supply in terms of percentage growth.

This is due to the fact that more and more projects, companies, and merchants are choosing Polygon for payments, as well as the development of the payment direction on the part of Polygon Labs.

data/@petertherock by @Dune

This is due to the fact that more and more projects, companies, and merchants are choosing Polygon for payments, as well as the development of the payment direction on the part of Polygon Labs.

data/@petertherock by @Dune

- Reward

- like

- Comment

- Repost

- Share

one of the common problems of early fintech companies entering the crypto market is that they prioritize marketing over the product.

this is especially true for companies that have received funding from investors and funds.

they want to onboard as many people as possible as quickly as possible in order to include these results in their reports to investors.

as a result, the company faces the problem of negative feedback from the audience because the product is not fully developed.

this is especially true for companies that have received funding from investors and funds.

they want to onboard as many people as possible as quickly as possible in order to include these results in their reports to investors.

as a result, the company faces the problem of negative feedback from the audience because the product is not fully developed.

- Reward

- like

- Comment

- Repost

- Share

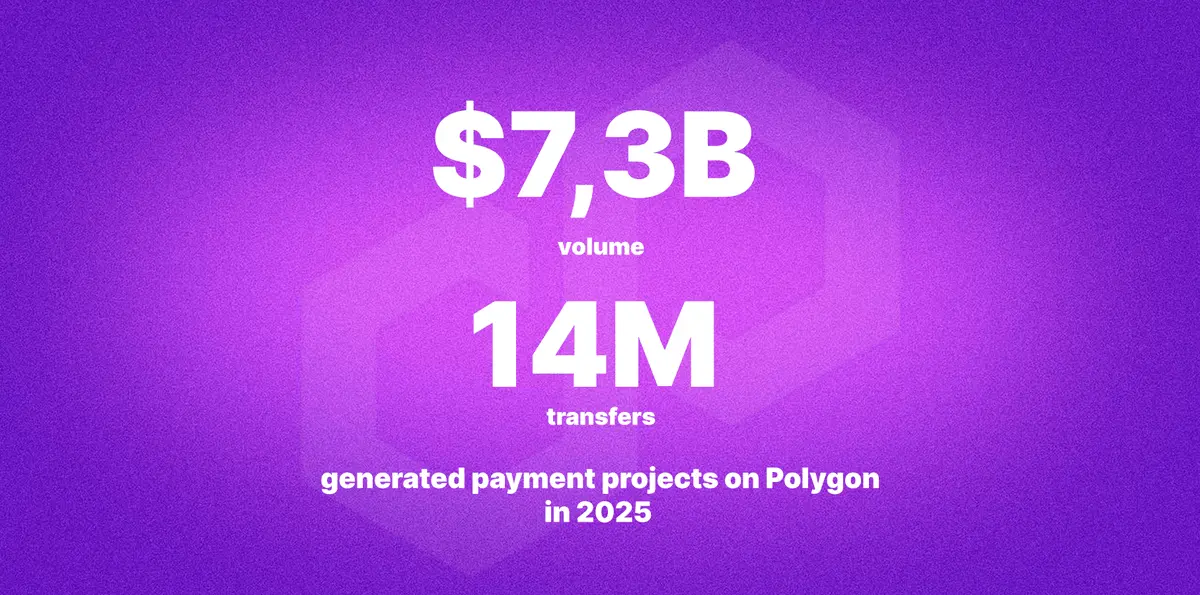

In 2025, payment projects generated $7.3B in transfer volume and 14M transfers on @0xPolygon.

Interesting cases:

@Revolut - $856M

@blindpaylabs - $450M

@raincards - $210M

@monerium - $188M

@stripe - $70M

Polygon has established itself as one of the leaders promoting crypto payments, and in 2026 it will continue to move in this direction by increasing volumes and adding hundreds of new payment projects to the ecosystem.

Interesting cases:

@Revolut - $856M

@blindpaylabs - $450M

@raincards - $210M

@monerium - $188M

@stripe - $70M

Polygon has established itself as one of the leaders promoting crypto payments, and in 2026 it will continue to move in this direction by increasing volumes and adding hundreds of new payment projects to the ecosystem.

- Reward

- like

- Comment

- Repost

- Share

Which crypto card would you like to see in the tracking list in the my analytics dashboard on @Dune ?

*Your version in the comments 👇

*Your version in the comments 👇

- Reward

- like

- Comment

- Repost

- Share

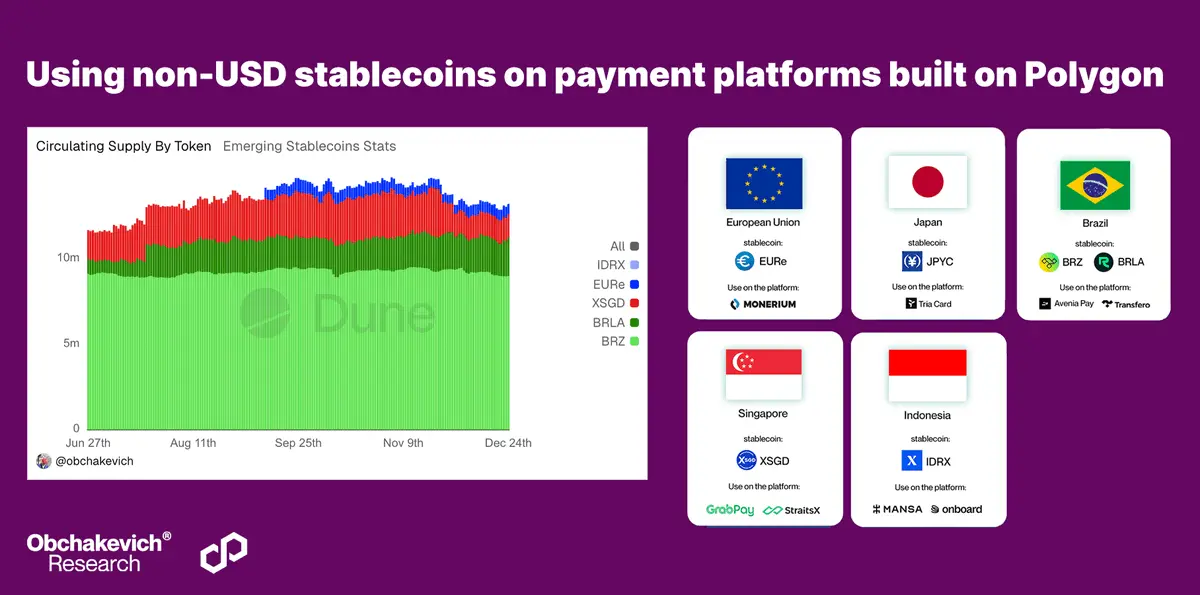

Using non-USD stablecoins on payment platforms built on @0xPolygon

🇪🇺 EU → $EURe on @monerium

🇯🇵 Japan → $JPYC on @useTria Card

🇧🇷 Brazil → $BRZ and $BRLA on @transferogroup, @aveniaio pay

🇸🇬 Singapore → $XSGD on @StraitsX and @GrabSG

🇮🇩 Indonesia → $IDRX on @MANSA_FI and @OnboardGlobal

#Payments

🇪🇺 EU → $EURe on @monerium

🇯🇵 Japan → $JPYC on @useTria Card

🇧🇷 Brazil → $BRZ and $BRLA on @transferogroup, @aveniaio pay

🇸🇬 Singapore → $XSGD on @StraitsX and @GrabSG

🇮🇩 Indonesia → $IDRX on @MANSA_FI and @OnboardGlobal

#Payments

- Reward

- like

- Comment

- Repost

- Share