MasterZhao'sDiscourseOnPower

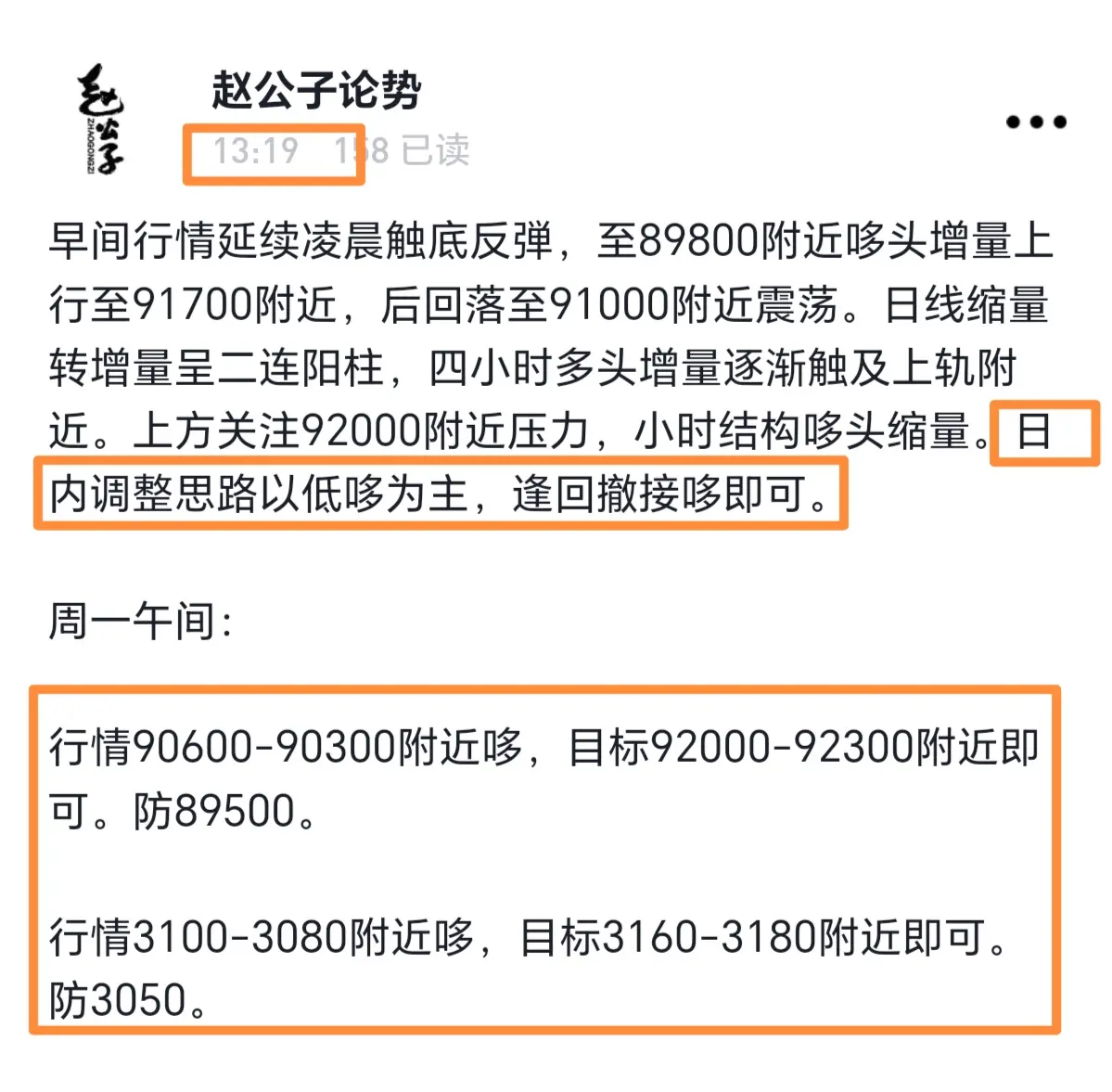

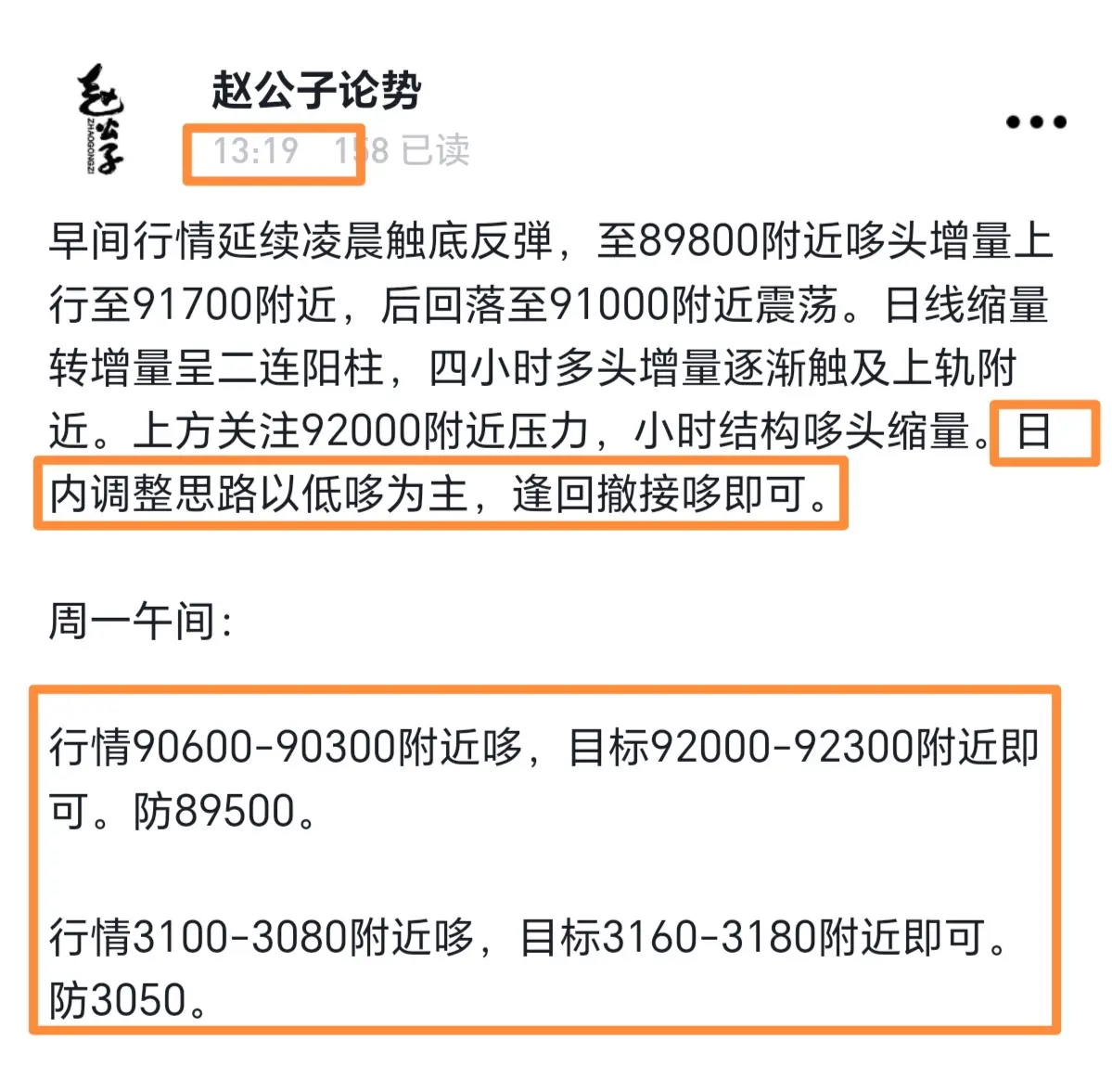

Morning market trend around 91200, rallying to around 92700 then pulling back to around 92100 with fluctuations, overall market showing a wide-range oscillation. Moving averages gradually rise, four-hour structure shows increased divergence with a bearish trend, hourly structure shows reduced volume correction, with an upward trend in operation, short-term short positions show increasing downward movement. During the day, maintain a low-thought approach, buy on dips accordingly.

Friday midday:

Market around 91800-91500, target around 92800-93100. Protect at 90800.

Market around 3220-3200, targ

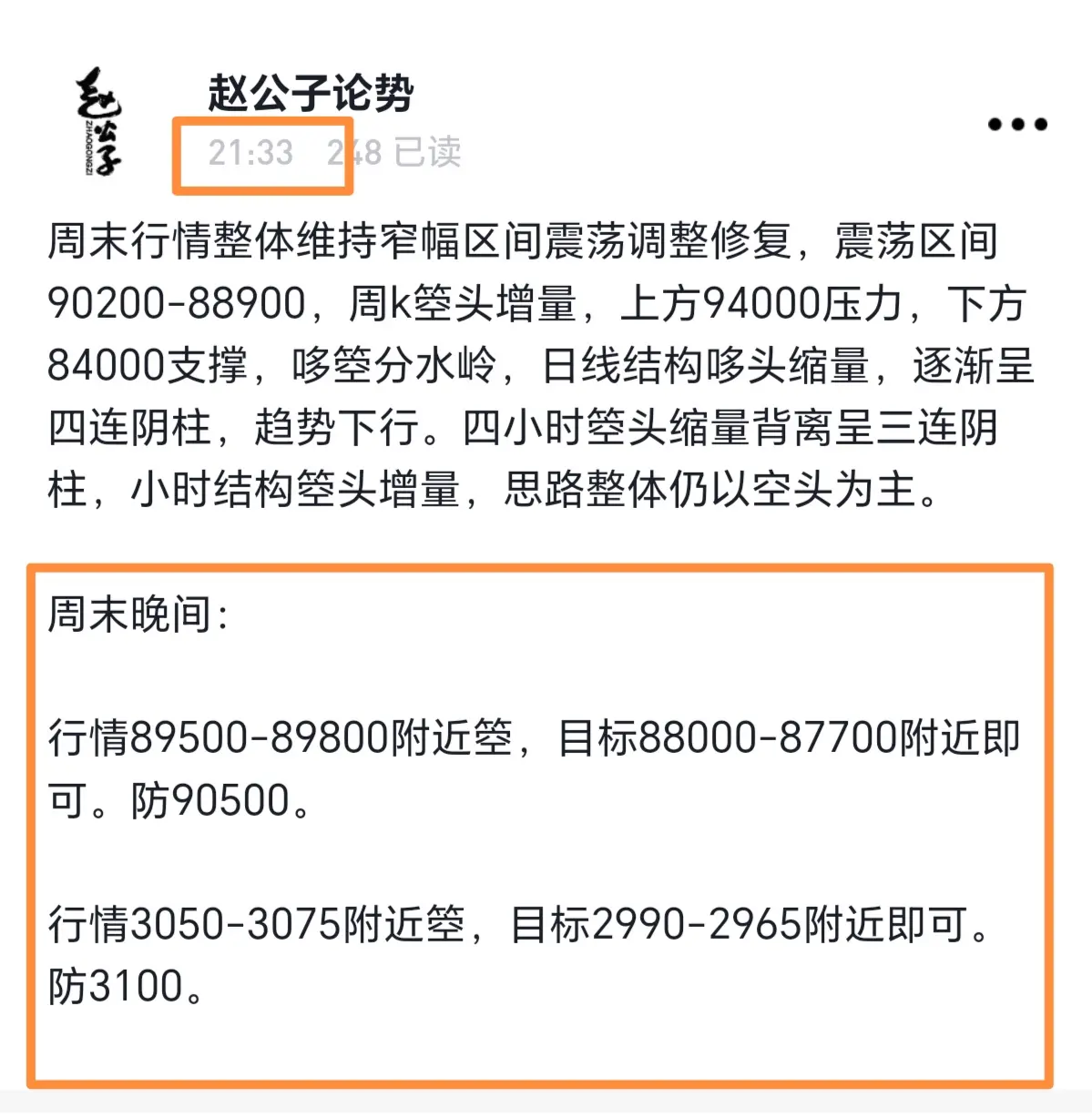

View OriginalFriday midday:

Market around 91800-91500, target around 92800-93100. Protect at 90800.

Market around 3220-3200, targ