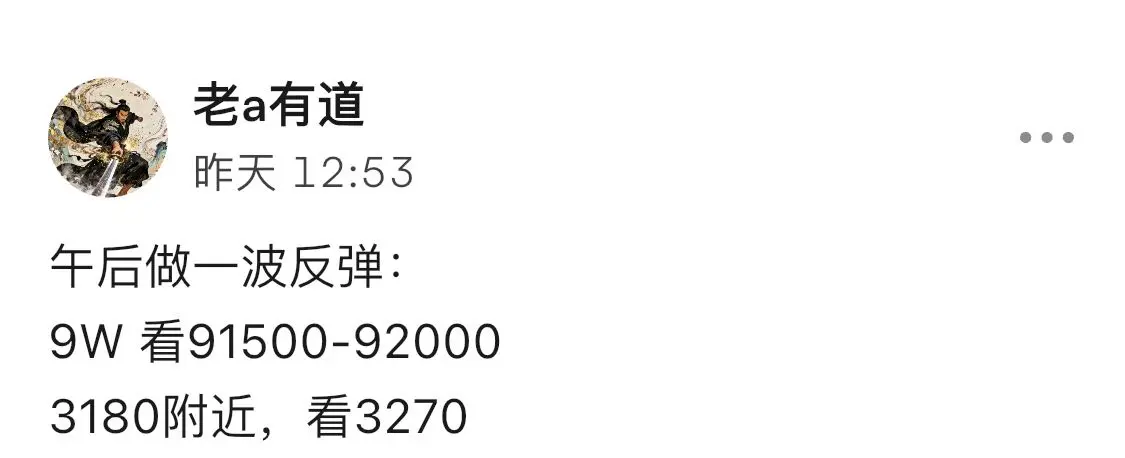

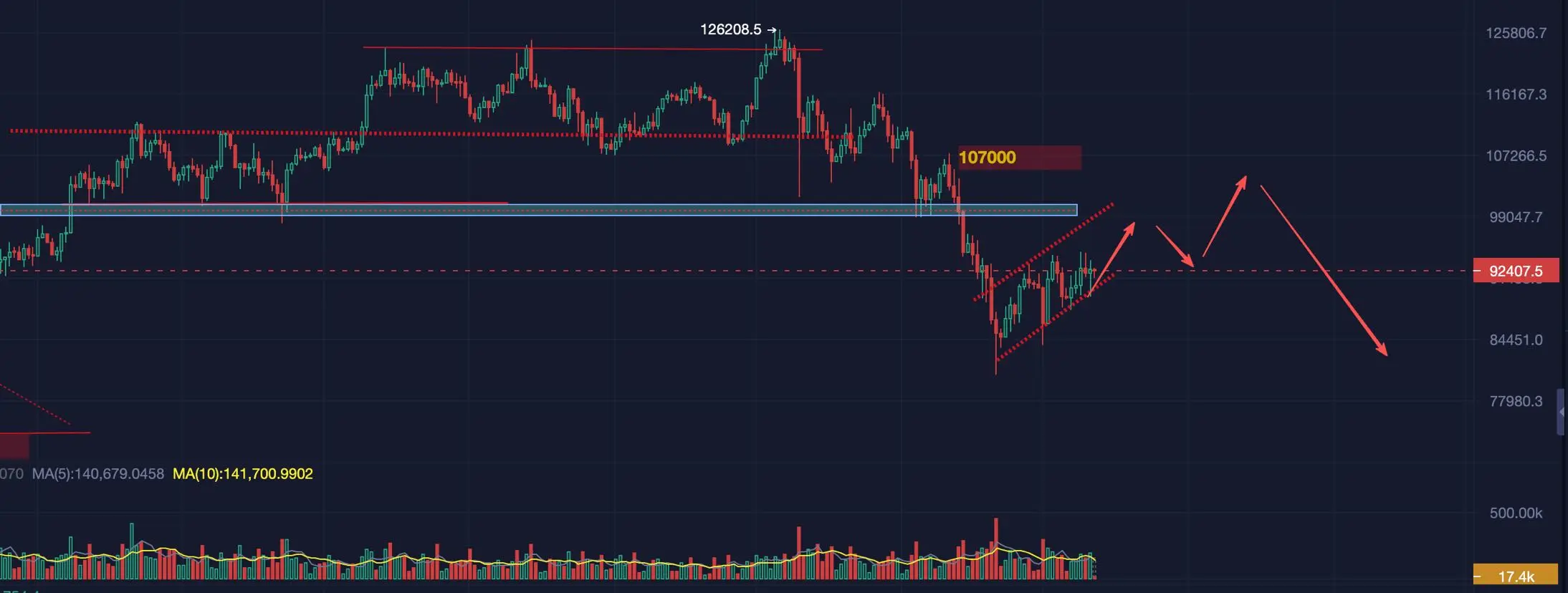

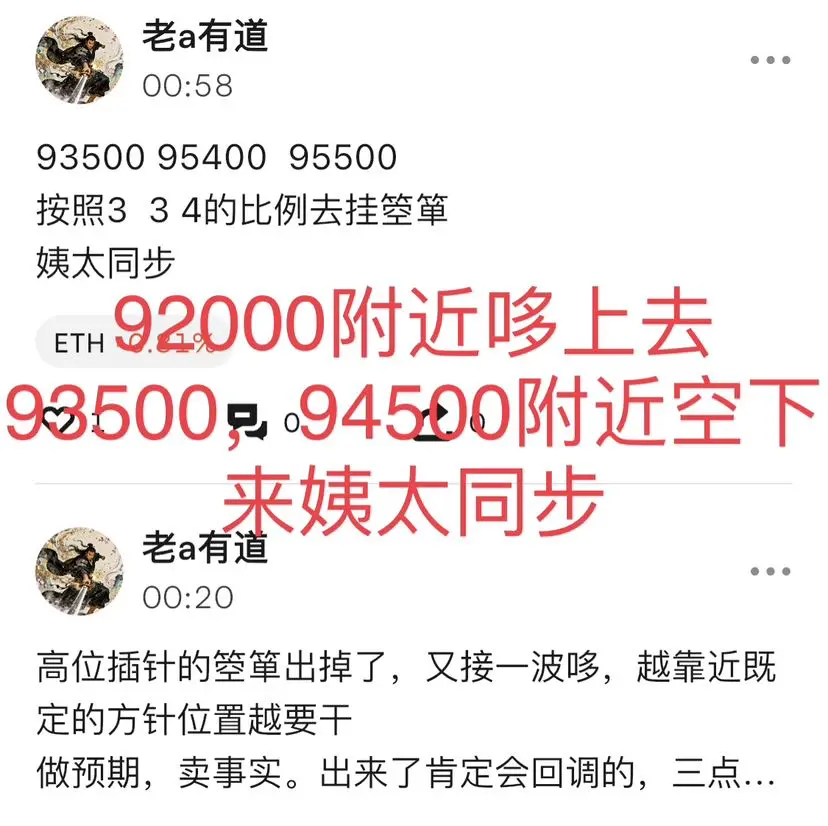

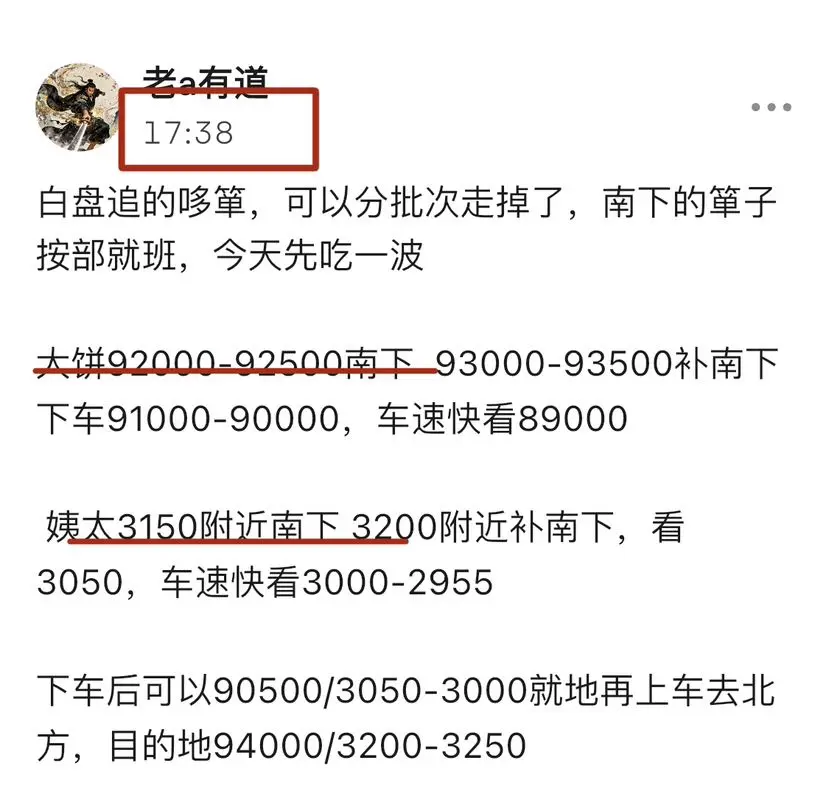

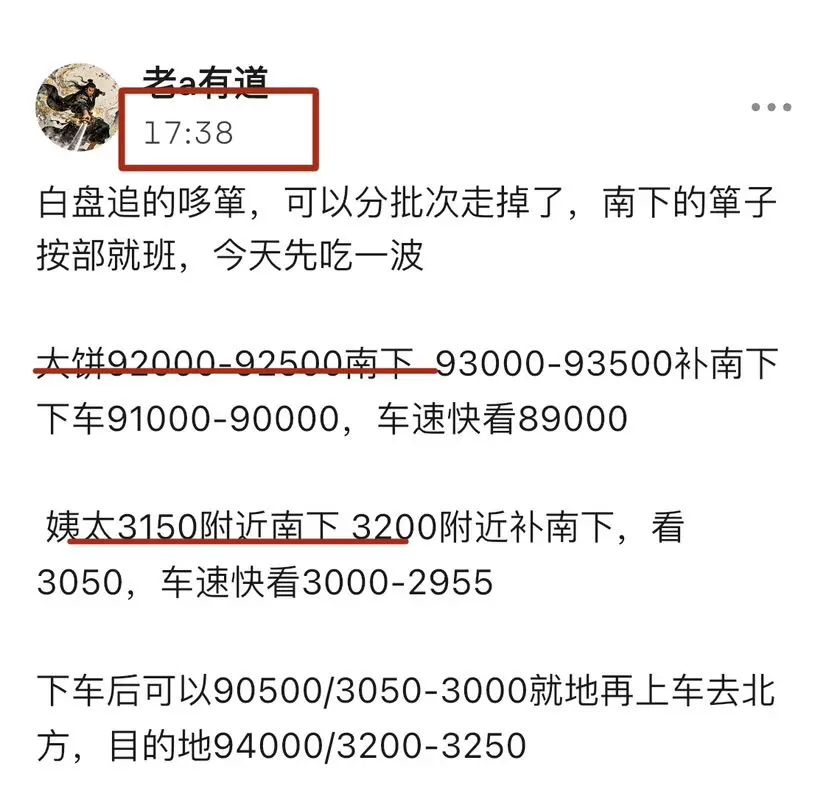

False breakout, waiting for the other shoe to drop. Yesterday, I made two short-term long trades during the pullback and managed to avoid the early morning spike—felt a bit lucky. However, looking at this morning's close, there's another long upper shadow. A direct breakout at this level to our previous first target of 99000 will be difficult; it may take three steps forward and two steps back, or even three steps back. Focus on short-term longs during intraday pullbacks, with support around 90500 and 91500. Pay close attention to the 3 a.m. decision tomorrow.

Go long near 91500, add more arou

View OriginalGo long near 91500, add more arou