#StrategyBitcoinPositionTurnsRed

Strategy Bitcoin Position Turns Red – Comprehensive Market Analysis (Feb 3, 2026)

The recent event of Strategy Inc. (formerly MicroStrategy, ticker: MSTR) temporarily seeing its massive BTC holdings move into unrealized losses (“red” on paper) has become a significant milestone in the Bitcoin and institutional investing landscape. Led by Executive Chairman Michael Saylor, this occurrence triggered sharp sentiment swings, debates, and FUD across crypto communities, X, finance forums, and trading desks.

1️⃣ Exact Trigger & Current Status

BTC Holdings: 713,502 BTC (latest 8-K filings, Feb 2, 2026).

Average Acquisition Cost: $76,052/BTC (blended, including fees; total cost basis ~$54.26B).

Recent Buys:

855 BTC at ~$87,974 each (Jan 26–Feb 1, 2026)

Prior week: 2,932 BTC at $90,061 average

Trigger Event: BTC briefly fell below $76,000 (lows ~$74,500–$75,500 during Feb 1–2 Asian session), dipping below Strategy’s cost basis and turning the position red.

Unrealized Loss Peak: ~$900M–$1B at the low (~1.3–1.5% underwater on average cost).

Recovery (Feb 3, 2026): BTC rebounded to ~$78,400–$78,900 (+3–5% from weekend lows), restoring slight unrealized gains (2.5–3% above cost). Treasury value: ~$55.8–$56.2B.

Takeaway: While brief, the red flip was a psychological milestone highlighting the inherent volatility of leveraged BTC proxies.

2️⃣ Price Action & Percentage Analysis

BTC Cycle Drawdown: Late-2025 ATH $126,000 → current $78,500 ≈ 37–38% correction

Recent Dip: $85,000–$90,000 → $74,500 ≈ 17–20% drop in days

Red Trigger: Breach below $76,052 (~1–2% further downside)

MSTR Amplification:

BTC proxy with 2–3x beta → $MSTR dropped 8–10%+ pre-market on red news

6-month drawdown ~55–61% from peaks

Post-dip, MSTR trades below NAV (<1x BTC value), vs. prior ~1.15x premium at $90k BTC

Recovery Bounce: BTC +4–6% intraday (Feb 2–3); MSTR likely +10–15% on green flip

3️⃣ Volume, Liquidity & Market Dynamics

Spot Volume: 30–40% below recent averages during dip → traders stepped back

Derivatives: Futures open interest declined; funding rates negative → classic deleveraging (~20–30% reduction in system leverage)

Liquidity Shifts:

BTC spot depth thinned 10–15%

Altcoins/mid-caps liquidity drained 30–50%

Defensive rotation favored BTC/large-caps

MSTR Equity Liquidity: Premium-to-NAV erosion makes future capital raises less efficient → slows aggressive BTC accumulation

Broader Crypto Impact: Total market cap fell 10–15% in the weekend leg; ~$590M longs liquidated, ~$230M shorts wiped out

4️⃣ Why It Matters: Psychological & Structural Angles

Sentiment Shock: “Even Saylor is red” narrative → extreme fear spike, amplified FUD

No Forced Selling: Strategy holds BTC without collateral calls; structure absorbs volatility

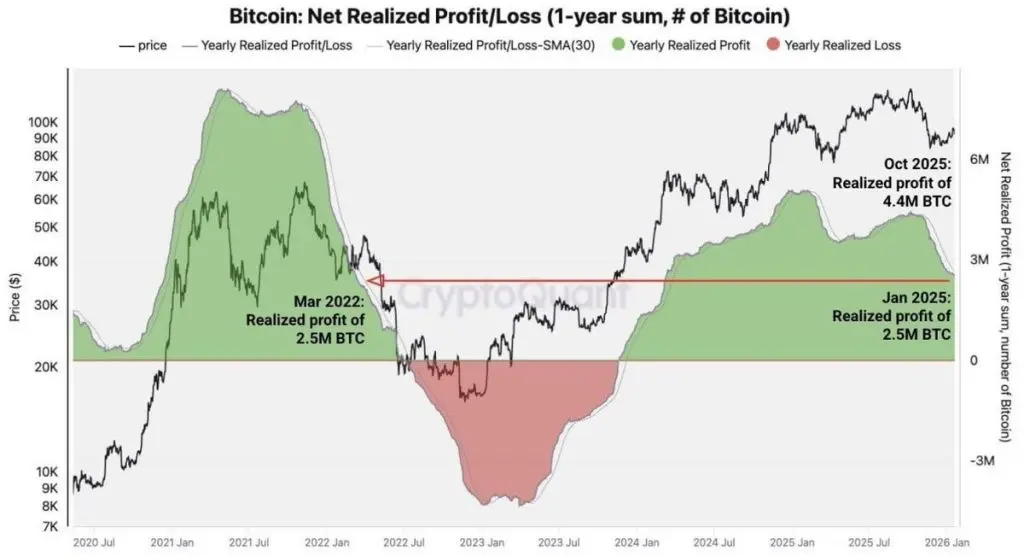

Historical Echo: Similar “reds” survived in 2022 bear market; BTC later multiplied in bull phases

ETF Comparison: Spot BTC ETFs (IBIT avg entry ~$85,360) also in unrealized losses → broader institutional pain

5️⃣ Macro & Fundamental Drivers

Hawkish Macro: USD strength, higher real yields, Fed chair uncertainty pressured risk assets

Cycle Timing: Post-halving volatility is normal; healthy correction/deleveraging, not end-of-bull

Adoption Tailwind: Corporate treasuries holding BTC through dips validate maturity & adoption narrative

6️⃣ Risks Amplified

Leverage Amplification: MSTR magnifies BTC moves → sharper equity drops

Dilution Trap: NAV discount slows aggressive buying; prolonged red could pressure asset sales (low probability)

Contagion: No immediate systemic threat, but sentiment fragile if BTC retests $70k–$72k

Persistent Volatility: Thin liquidity + headline sensitivity → choppy trading ranges

7️⃣ Opportunities & Bullish Case

Classic Dip-Buy Setup: Fear peaks often precede strong recoveries (2022 reds → 2023–2025 gains)

Saylor Conviction: Recent buys at highs signal long-term belief; “buy more” playbook

Reclaim Catalyst: BTC above $78k–$80k → rapid green flip, NAV premium return, sentiment reversal

Long-Term Validation: Corporate BTC holdings through drawdowns strengthen mainstream adoption

8️⃣ Tactical Takeaways for Traders/Investors

Short-Term: Expect high volatility; use stops below $74k–$75k for longs

Key Levels: BTC reclaim $80k = bullish; break below $72k = deeper 10–15% risk

Position Sizing: Small, measured bets; avoid blindly mirroring leveraged proxies

Broader Lesson: Paper losses ≠ realized pain; focus on fundamentals over viral headlines

✅ Bottom Line (Feb 3, 2026)

Strategy Inc.’s brief red position was a temporary but significant sentiment event. BTC’s 17–20% macro leg breached the company’s $76,052 cost basis, peaking at ~$1B unrealized loss, before rebounding to ~$78,500+. Volume compressed (~30–40%), liquidity rotated defensively, and MSTR amplified downside (~8–10%), but no structural crisis occurred. This is normal cycle volatility, not market collapse — presenting opportunities for conviction plays while advising caution with leveraged exposure.

Strategy Bitcoin Position Turns Red – Comprehensive Market Analysis (Feb 3, 2026)

The recent event of Strategy Inc. (formerly MicroStrategy, ticker: MSTR) temporarily seeing its massive BTC holdings move into unrealized losses (“red” on paper) has become a significant milestone in the Bitcoin and institutional investing landscape. Led by Executive Chairman Michael Saylor, this occurrence triggered sharp sentiment swings, debates, and FUD across crypto communities, X, finance forums, and trading desks.

1️⃣ Exact Trigger & Current Status

BTC Holdings: 713,502 BTC (latest 8-K filings, Feb 2, 2026).

Average Acquisition Cost: $76,052/BTC (blended, including fees; total cost basis ~$54.26B).

Recent Buys:

855 BTC at ~$87,974 each (Jan 26–Feb 1, 2026)

Prior week: 2,932 BTC at $90,061 average

Trigger Event: BTC briefly fell below $76,000 (lows ~$74,500–$75,500 during Feb 1–2 Asian session), dipping below Strategy’s cost basis and turning the position red.

Unrealized Loss Peak: ~$900M–$1B at the low (~1.3–1.5% underwater on average cost).

Recovery (Feb 3, 2026): BTC rebounded to ~$78,400–$78,900 (+3–5% from weekend lows), restoring slight unrealized gains (2.5–3% above cost). Treasury value: ~$55.8–$56.2B.

Takeaway: While brief, the red flip was a psychological milestone highlighting the inherent volatility of leveraged BTC proxies.

2️⃣ Price Action & Percentage Analysis

BTC Cycle Drawdown: Late-2025 ATH $126,000 → current $78,500 ≈ 37–38% correction

Recent Dip: $85,000–$90,000 → $74,500 ≈ 17–20% drop in days

Red Trigger: Breach below $76,052 (~1–2% further downside)

MSTR Amplification:

BTC proxy with 2–3x beta → $MSTR dropped 8–10%+ pre-market on red news

6-month drawdown ~55–61% from peaks

Post-dip, MSTR trades below NAV (<1x BTC value), vs. prior ~1.15x premium at $90k BTC

Recovery Bounce: BTC +4–6% intraday (Feb 2–3); MSTR likely +10–15% on green flip

3️⃣ Volume, Liquidity & Market Dynamics

Spot Volume: 30–40% below recent averages during dip → traders stepped back

Derivatives: Futures open interest declined; funding rates negative → classic deleveraging (~20–30% reduction in system leverage)

Liquidity Shifts:

BTC spot depth thinned 10–15%

Altcoins/mid-caps liquidity drained 30–50%

Defensive rotation favored BTC/large-caps

MSTR Equity Liquidity: Premium-to-NAV erosion makes future capital raises less efficient → slows aggressive BTC accumulation

Broader Crypto Impact: Total market cap fell 10–15% in the weekend leg; ~$590M longs liquidated, ~$230M shorts wiped out

4️⃣ Why It Matters: Psychological & Structural Angles

Sentiment Shock: “Even Saylor is red” narrative → extreme fear spike, amplified FUD

No Forced Selling: Strategy holds BTC without collateral calls; structure absorbs volatility

Historical Echo: Similar “reds” survived in 2022 bear market; BTC later multiplied in bull phases

ETF Comparison: Spot BTC ETFs (IBIT avg entry ~$85,360) also in unrealized losses → broader institutional pain

5️⃣ Macro & Fundamental Drivers

Hawkish Macro: USD strength, higher real yields, Fed chair uncertainty pressured risk assets

Cycle Timing: Post-halving volatility is normal; healthy correction/deleveraging, not end-of-bull

Adoption Tailwind: Corporate treasuries holding BTC through dips validate maturity & adoption narrative

6️⃣ Risks Amplified

Leverage Amplification: MSTR magnifies BTC moves → sharper equity drops

Dilution Trap: NAV discount slows aggressive buying; prolonged red could pressure asset sales (low probability)

Contagion: No immediate systemic threat, but sentiment fragile if BTC retests $70k–$72k

Persistent Volatility: Thin liquidity + headline sensitivity → choppy trading ranges

7️⃣ Opportunities & Bullish Case

Classic Dip-Buy Setup: Fear peaks often precede strong recoveries (2022 reds → 2023–2025 gains)

Saylor Conviction: Recent buys at highs signal long-term belief; “buy more” playbook

Reclaim Catalyst: BTC above $78k–$80k → rapid green flip, NAV premium return, sentiment reversal

Long-Term Validation: Corporate BTC holdings through drawdowns strengthen mainstream adoption

8️⃣ Tactical Takeaways for Traders/Investors

Short-Term: Expect high volatility; use stops below $74k–$75k for longs

Key Levels: BTC reclaim $80k = bullish; break below $72k = deeper 10–15% risk

Position Sizing: Small, measured bets; avoid blindly mirroring leveraged proxies

Broader Lesson: Paper losses ≠ realized pain; focus on fundamentals over viral headlines

✅ Bottom Line (Feb 3, 2026)

Strategy Inc.’s brief red position was a temporary but significant sentiment event. BTC’s 17–20% macro leg breached the company’s $76,052 cost basis, peaking at ~$1B unrealized loss, before rebounding to ~$78,500+. Volume compressed (~30–40%), liquidity rotated defensively, and MSTR amplified downside (~8–10%), but no structural crisis occurred. This is normal cycle volatility, not market collapse — presenting opportunities for conviction plays while advising caution with leveraged exposure.