# FedWatch

7.63K

MissCrypto

#FedRateDecisionApproaches 🚨

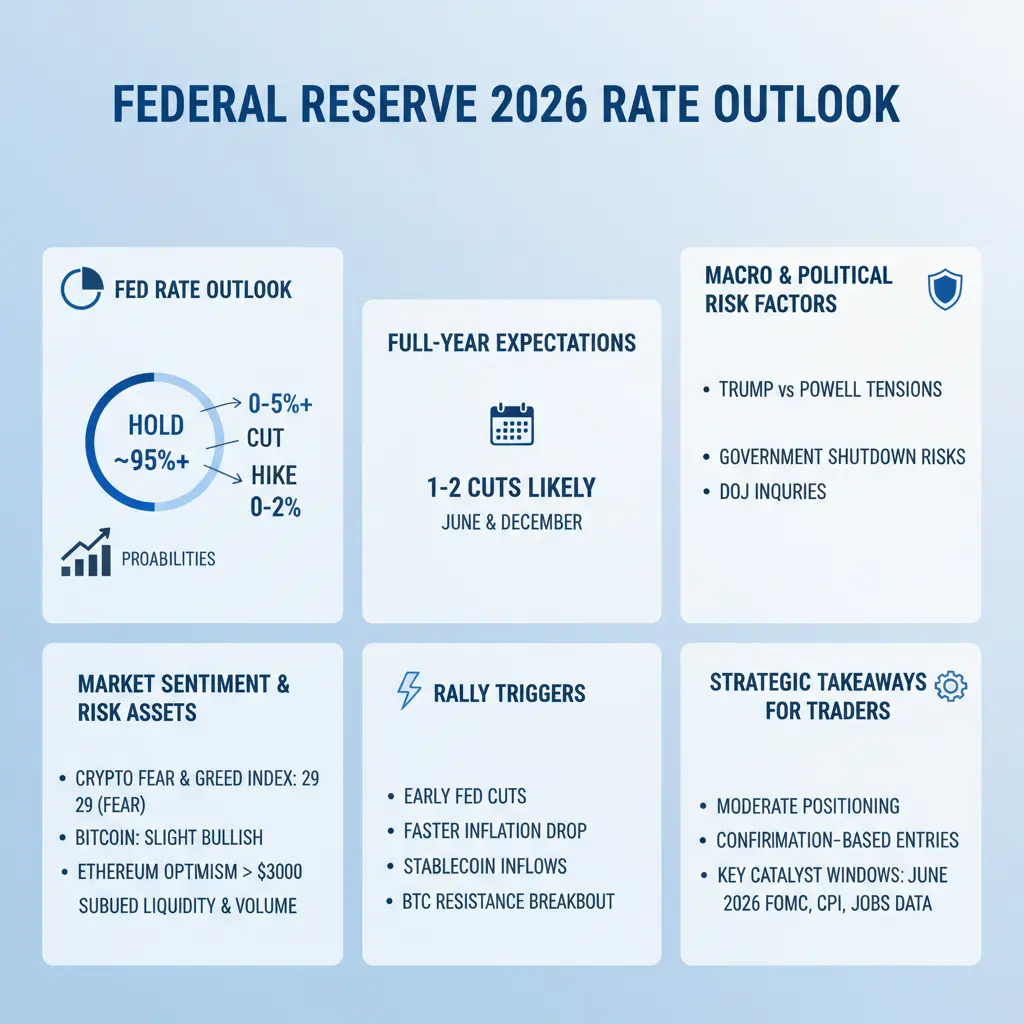

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

- Reward

- 5

- 8

- Repost

- Share

CryptoChampion :

:

DYOR 🤓View More

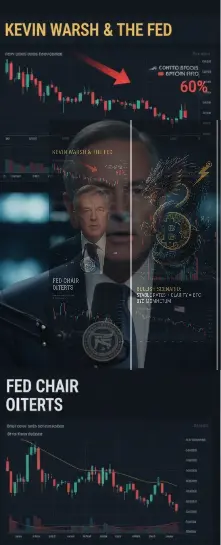

#WarshLeadsFedChairRace

🏛️ Kevin Warsh & the Fed — What It Means for Crypto!

Kevin Warsh’s odds of becoming Fed Chair have risen to 60%, with rates expected to stay unchanged in January. The big question: Bullish or bearish for crypto? 🤔

🔍 Key Points

1️⃣ Policy stance: Warsh is moderately hawkish → could weigh on crypto if tightening signals appear.

2️⃣ Rate expectations: No immediate hikes → may support BTC and risk assets if stability continues.

3️⃣ Market psychology: Crypto loves clarity; consistent guidance could reduce volatility.

📊 Possible Scenarios

Bullish: Stable rates + clear co

🏛️ Kevin Warsh & the Fed — What It Means for Crypto!

Kevin Warsh’s odds of becoming Fed Chair have risen to 60%, with rates expected to stay unchanged in January. The big question: Bullish or bearish for crypto? 🤔

🔍 Key Points

1️⃣ Policy stance: Warsh is moderately hawkish → could weigh on crypto if tightening signals appear.

2️⃣ Rate expectations: No immediate hikes → may support BTC and risk assets if stability continues.

3️⃣ Market psychology: Crypto loves clarity; consistent guidance could reduce volatility.

📊 Possible Scenarios

Bullish: Stable rates + clear co

- Reward

- 18

- 11

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

#WarshLeadsFedChairRace

A Hawk at the Helm: What a Warsh-Led Fed Could Mean for Crypto’s Next Phase

Markets are already looking ahead. With prediction platforms signaling a strong probability that Kevin Warsh could become the next U.S. Federal Reserve Chair, investors are beginning to price in not just a name — but a policy mindset.

Warsh is widely viewed as inflation-focused and policy-disciplined. That matters.

🔍 Why This Shift Is Important

A new Fed Chair often marks a change in tempo, not just direction. Under a Warsh-style framework:

• Aggressive rate cuts become less likely

• Inflation

A Hawk at the Helm: What a Warsh-Led Fed Could Mean for Crypto’s Next Phase

Markets are already looking ahead. With prediction platforms signaling a strong probability that Kevin Warsh could become the next U.S. Federal Reserve Chair, investors are beginning to price in not just a name — but a policy mindset.

Warsh is widely viewed as inflation-focused and policy-disciplined. That matters.

🔍 Why This Shift Is Important

A new Fed Chair often marks a change in tempo, not just direction. Under a Warsh-style framework:

• Aggressive rate cuts become less likely

• Inflation

- Reward

- 2

- Comment

- Repost

- Share

#WeekendMarketAnalysis 📊 Market Prediction | When One Sentence Moves Global Markets

A single remark from Trump was enough to shift market expectations — and suddenly, Kevin Warsh is being priced in as the frontrunner for the next Fed Chair.

This isn’t about politics alone. It’s about how markets trade probability, not announcements.

Warsh is widely seen as more disciplined on monetary policy, less tolerant of prolonged easing, and more focused on financial stability. That changes everything — from bond yields and the US dollar to equities and crypto.

For crypto traders, this matters deeply. H

A single remark from Trump was enough to shift market expectations — and suddenly, Kevin Warsh is being priced in as the frontrunner for the next Fed Chair.

This isn’t about politics alone. It’s about how markets trade probability, not announcements.

Warsh is widely seen as more disciplined on monetary policy, less tolerant of prolonged easing, and more focused on financial stability. That changes everything — from bond yields and the US dollar to equities and crypto.

For crypto traders, this matters deeply. H

BTC2,19%

- Reward

- 5

- 8

- Repost

- Share

MissCrypto :

:

2026 GOGOGO 👊View More

🚨 Powell Under Investigation? Markets on Alert

#FedWatch #MacroRisk #CryptoVolatility

Recent reports have sparked headlines around U.S. Fed Chair Jerome Powell and an alleged investigation tied to Fed HQ renovation spending.

⚠️ No verdict, no confirmation yet — but markets don’t wait for outcomes, they react to uncertainty.

📉 Why Markets Care The Federal Reserve runs on credibility and trust.

Even perceived governance risk can: • Shake investor confidence

• Increase volatility

• Delay risk-taking across markets

📊 Immediate Market Reaction 🔹 Stocks & Crypto: Sensitive to policy clarity → ch

#FedWatch #MacroRisk #CryptoVolatility

Recent reports have sparked headlines around U.S. Fed Chair Jerome Powell and an alleged investigation tied to Fed HQ renovation spending.

⚠️ No verdict, no confirmation yet — but markets don’t wait for outcomes, they react to uncertainty.

📉 Why Markets Care The Federal Reserve runs on credibility and trust.

Even perceived governance risk can: • Shake investor confidence

• Increase volatility

• Delay risk-taking across markets

📊 Immediate Market Reaction 🔹 Stocks & Crypto: Sensitive to policy clarity → ch

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

🏦 #FedRateCutComing | Macro Market Alert 📉✨

Markets are anticipating a potential Federal Reserve rate cut, a move that could impact global liquidity, risk sentiment, and crypto market momentum. Traders are watching closely to adjust strategies and manage risk. 🌍💹

🔍 Key Points to Monitor:

Potential boost to risk assets, including crypto 🚀

Impact on USD strength and global trading sentiment 💱

Volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWatch #InterestRates #CryptoMarket 🚀✨

Markets are anticipating a potential Federal Reserve rate cut, a move that could impact global liquidity, risk sentiment, and crypto market momentum. Traders are watching closely to adjust strategies and manage risk. 🌍💹

🔍 Key Points to Monitor:

Potential boost to risk assets, including crypto 🚀

Impact on USD strength and global trading sentiment 💱

Volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWatch #InterestRates #CryptoMarket 🚀✨

- Reward

- 3

- Comment

- Repost

- Share

🏦 #FedRateCutComing | Macro Market Update 📉✨

Markets are anticipating a potential Federal Reserve rate cut, which could influence global liquidity, risk appetite, and crypto market momentum. Traders are closely watching developments to adjust strategies and manage risk effectively. 🌍💹

🔍 What to Watch:

Potential boost to risk assets, including BTC and major altcoins 🚀

Impact on USD strength and global trading sentiment 💱

Increased volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWa

Markets are anticipating a potential Federal Reserve rate cut, which could influence global liquidity, risk appetite, and crypto market momentum. Traders are closely watching developments to adjust strategies and manage risk effectively. 🌍💹

🔍 What to Watch:

Potential boost to risk assets, including BTC and major altcoins 🚀

Impact on USD strength and global trading sentiment 💱

Increased volatility around macroeconomic announcements ⚠️

Stay informed and trade smart with Gate.io’s real-time market insights and advanced tools. ⚡💼

#Gateio #FedWa

BTC2,19%

- Reward

- 3

- Comment

- Repost

- Share

🚨 BREAKING: S&P PMI DROP ALERT🚨

🇺🇸 The Fed releases the *first key economic data of 2026* today — *9:45 AM ET*!

📊 *How markets may react:*

🚀 *PMI > 52.5* → Bullish surge incoming

⚖️ *PMI 51.5–52.5* → Neutral, likely priced in

📉 *PMI < 51.5* → Bearish momentum expected

👀 All eyes on the Fed — this drop could shake the markets!

Trade the reaction live on *Gate.io*

#SPPMI #FedWatch #Gateio #MarketMoves

🇺🇸 The Fed releases the *first key economic data of 2026* today — *9:45 AM ET*!

📊 *How markets may react:*

🚀 *PMI > 52.5* → Bullish surge incoming

⚖️ *PMI 51.5–52.5* → Neutral, likely priced in

📉 *PMI < 51.5* → Bearish momentum expected

👀 All eyes on the Fed — this drop could shake the markets!

Trade the reaction live on *Gate.io*

#SPPMI #FedWatch #Gateio #MarketMoves

- Reward

- like

- Comment

- Repost

- Share

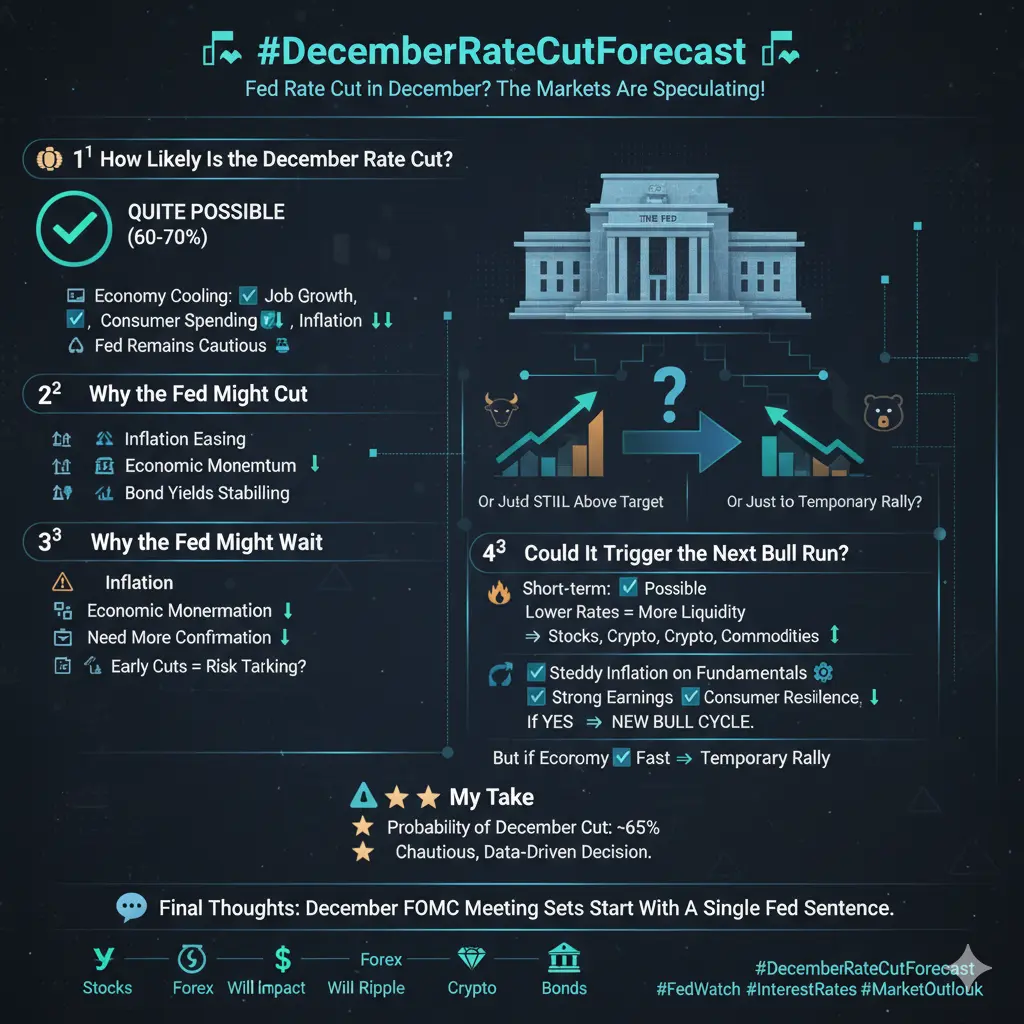

📉 #DecemberRateCutForecast 📉

The Fed may cut rates again this December, and the markets are heating up with speculation.

But the real question is 👇

💭 How likely is the rate cut?

💭 Could it ignite the next bull run?

Let’s break it down 🔍

💰 1️⃣ How Likely Is the December Rate Cut?

✅ Quite possible — but not guaranteed.

The economy is cooling down — job growth is slowing, consumer spending is softening, and inflation is gradually coming under control. These are exactly the conditions that could push the Fed to ease rates to prevent a sharper slowdown.

However… the Fed remains cautious ⚖️

O

The Fed may cut rates again this December, and the markets are heating up with speculation.

But the real question is 👇

💭 How likely is the rate cut?

💭 Could it ignite the next bull run?

Let’s break it down 🔍

💰 1️⃣ How Likely Is the December Rate Cut?

✅ Quite possible — but not guaranteed.

The economy is cooling down — job growth is slowing, consumer spending is softening, and inflation is gradually coming under control. These are exactly the conditions that could push the Fed to ease rates to prevent a sharper slowdown.

However… the Fed remains cautious ⚖️

O

- Reward

- 4

- 2

- Repost

- Share

TheRealKing :

:

niceView More

#FederalReserve #RateCut

#FedWatch | Federal Reserve Governor Lisa Cook Hints at Possible December Rate Cut But the Data Will Tell the Story

The financial world is on high alert after Federal Reserve Governor Lisa Cook suggested that a December interest rate cut remains on the table, but only if upcoming economic data confirms that inflation is cooling and growth is slowing. Speaking at the Brookings Institution, Cook emphasized the Fed’s continued data-driven approach, reinforcing that every decision from here will be based on evidence not assumptions.

📊 A “Live” December Meeting Policy Fle

#FedWatch | Federal Reserve Governor Lisa Cook Hints at Possible December Rate Cut But the Data Will Tell the Story

The financial world is on high alert after Federal Reserve Governor Lisa Cook suggested that a December interest rate cut remains on the table, but only if upcoming economic data confirms that inflation is cooling and growth is slowing. Speaking at the Brookings Institution, Cook emphasized the Fed’s continued data-driven approach, reinforcing that every decision from here will be based on evidence not assumptions.

📊 A “Live” December Meeting Policy Fle

- Reward

- 2

- 4

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

12.69K Popularity

74.94K Popularity

30.06K Popularity

10.3K Popularity

10.71K Popularity

9.62K Popularity

8.48K Popularity

8.46K Popularity

74.47K Popularity

21.5K Popularity

82.53K Popularity

23.54K Popularity

50.38K Popularity

43.93K Popularity

197.47K Popularity

News

View MoreBessent: We have implemented favorable policies that promote growth.

4 m

Tom Lee: Agentic AI Will Face Security Issues; Ethereum Blockchain May Be the Solution

7 m

Bitcoin and Ethereum ETFs Record Significant Outflows While Solana ETFs See Inflows

9 m

Data: 16,000 SOL transferred to FixedFloat, worth approximately $2.03 million

13 m

Circle: CCTP mainnet cross-chain forwarding feature is now live

13 m

Pin