Post content & earn content mining yield

placeholder

Discovery

#WhiteHouseTalksStablecoinYields

The Battle Over Digital Dollar Interest: What’s Happening at the White House?

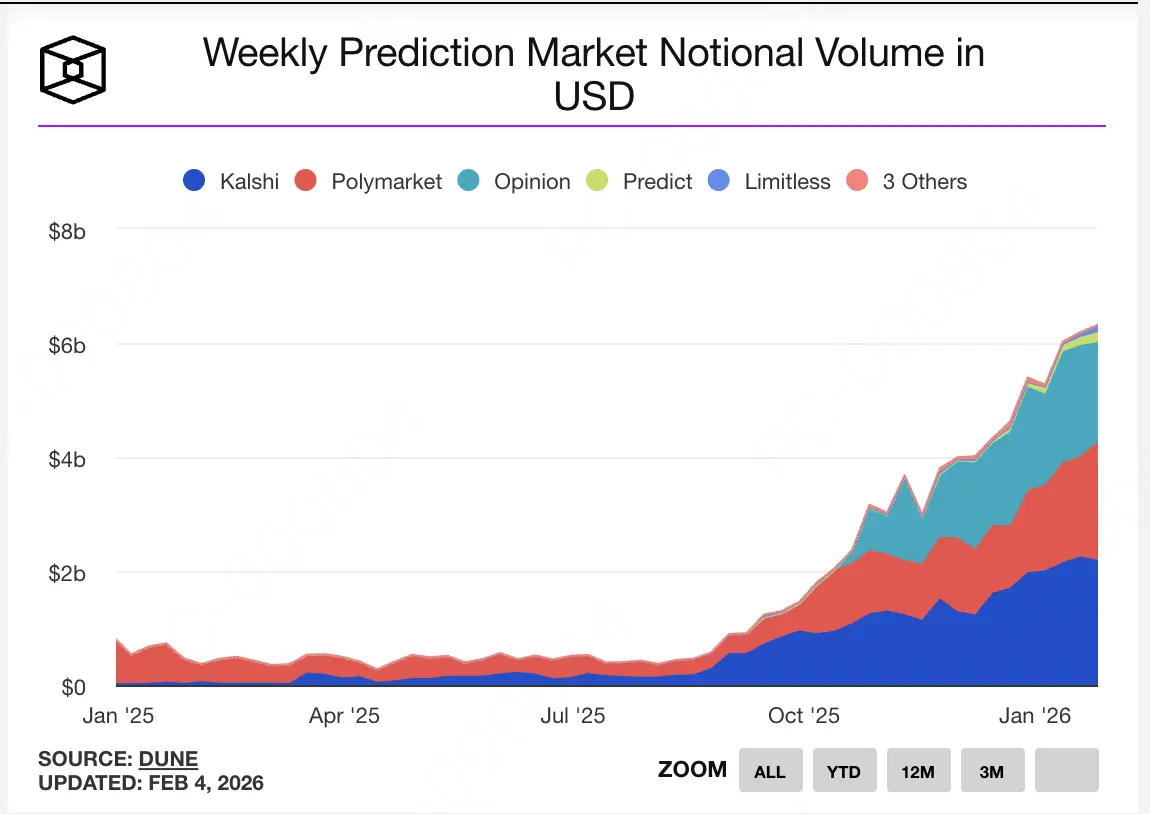

In recent weeks, Washington has been hosting a monumental negotiation that could fundamentally reshape the future of the cryptocurrency sector. High-level meetings at the White House have converged on a single, pivotal question: Can stablecoins offer interest or yield?

This is far more than a technical debate; it is a trillion-dollar war over deposits, pitting the traditional banking system directly against the new generation of Decentralized Finance (DeFi).

The Banks' Fear: A $6

The Battle Over Digital Dollar Interest: What’s Happening at the White House?

In recent weeks, Washington has been hosting a monumental negotiation that could fundamentally reshape the future of the cryptocurrency sector. High-level meetings at the White House have converged on a single, pivotal question: Can stablecoins offer interest or yield?

This is far more than a technical debate; it is a trillion-dollar war over deposits, pitting the traditional banking system directly against the new generation of Decentralized Finance (DeFi).

The Banks' Fear: A $6

DEFI5,47%

- Reward

- 1

- 3

- Repost

- Share

AnnaCryptoWriter :

:

Follow closely 🔍View More

Please promptly adjust your positions and unfilled orders to avoid unnecessary losses. The closing PNL is related to the closing quantity, average position price, and closing price. Adjusting the leverage multiplier will not affect your closing PNL.

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLRCVL8OUG

View Original

- Reward

- like

- Comment

- Repost

- Share

Cyber Guard

no Scam token

Created By@FBL_Fortune

Listing Progress

0.00%

MC:

$2.46K

More Tokens

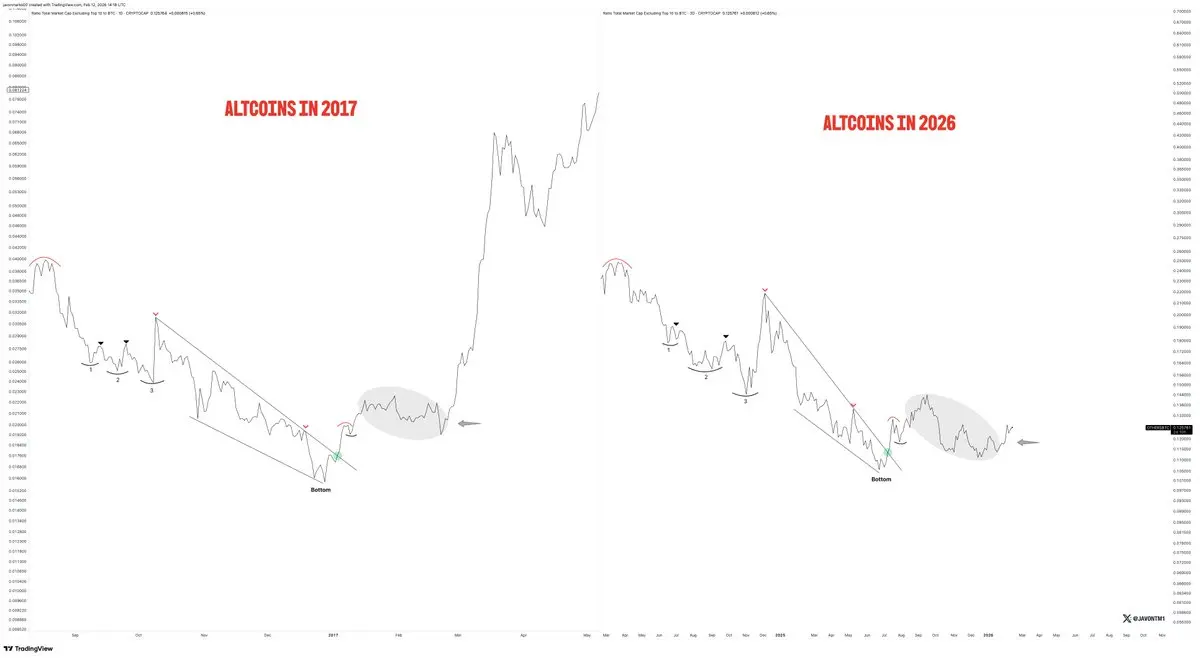

Nih can serve as a reference when opening TradingView.

View Original

- Reward

- 1

- 1

- Repost

- Share

DGBaji :

:

Buy to Generate 💎- Reward

- like

- Comment

- Repost

- Share

Directional bias:Neutral to slightly bearish in the short term

- Reward

- like

- Comment

- Repost

- Share

🚨 4-Year Cycle Buy Signal

Seen it in 2019. Seen it in 2022.

Same script every time:

1. Parabolic top

2. Slow bleed

3. Quiet accumulation

Now 2026’s buy zone is forming.

Are you positioning… or just watching?

Seen it in 2019. Seen it in 2022.

Same script every time:

1. Parabolic top

2. Slow bleed

3. Quiet accumulation

Now 2026’s buy zone is forming.

Are you positioning… or just watching?

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/site-145?ch=7ZxfaPfK&ref=UVhNB1EM&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

This year, the global financial markets are likely to enter a bear market.

Bitcoin is the leading indicator of global risk assets; the crypto market peaks first, followed by the US stock market, and finally the A-shares.

If this logic and order are mistaken, everything will be wrong.

Currently, Bitcoin is crashing, and the logic is simple: 2014, 2018, 2022, 2026—these are four-year cycles, and the bear market has arrived. There's nothing surprising about it.

Additionally, in 2026, the A-shares and US stock markets are very likely to also be in a bear market. Bitcoin's decline is just more sens

Bitcoin is the leading indicator of global risk assets; the crypto market peaks first, followed by the US stock market, and finally the A-shares.

If this logic and order are mistaken, everything will be wrong.

Currently, Bitcoin is crashing, and the logic is simple: 2014, 2018, 2022, 2026—these are four-year cycles, and the bear market has arrived. There's nothing surprising about it.

Additionally, in 2026, the A-shares and US stock markets are very likely to also be in a bear market. Bitcoin's decline is just more sens

BTC-0,73%

- Reward

- like

- Comment

- Repost

- Share

$B

I haven’t given up on #GOLD and #silver. In fact, my multi year rally expectation is still intact. But when a massive hype formed worldwide, they did a shakeout. Short term corrections are possible, but in the long run I expect the uptrend to continue.

strong!

I haven’t given up on #GOLD and #silver. In fact, my multi year rally expectation is still intact. But when a massive hype formed worldwide, they did a shakeout. Short term corrections are possible, but in the long run I expect the uptrend to continue.

strong!

- Reward

- like

- Comment

- Repost

- Share

$WMT

Strong! 🦾

Strong! 🦾

- Reward

- like

- Comment

- Repost

- Share

facetum

facetum

Created By@GateUser-048b85f8

Listing Progress

0.00%

MC:

$2.43K

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=KAIHUCNH

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$NBIS plans to invest CapEx in the range of $16B to $20B in 2026

“We already have about 60% of the capital needed for this range from our balance sheet, existing operations, and commitments.”

I think they should seek debt financing anyway, to improve the IRR profile anyway

“We already have about 60% of the capital needed for this range from our balance sheet, existing operations, and commitments.”

I think they should seek debt financing anyway, to improve the IRR profile anyway

- Reward

- 1

- 1

- Repost

- Share

HarryCrypto :

:

To The Moon 🌕$HWM my no 🥇

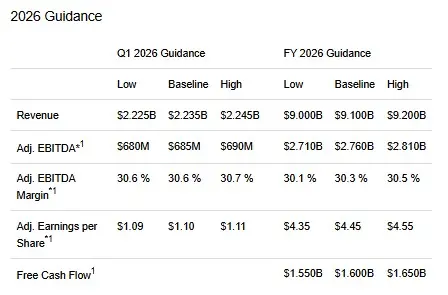

Howmet Aerospace Non-GAAP EPS of $1.05 beats by $0.08, revenue of $2.2B beats by $70M

Feb. 12, 2026

Howmet Aerospace press release (HWM): Q4 Non-GAAP EPS of $1.05 beats by $0.08.

Revenue of $2.2B (+15.8% Y/Y) beats by $70M.

Revenue of $2.2 billion, up 15% year over year (YoY), driven by Commercial Aerospace, up 13%

1Q26 revenue consensus of $2.17B, EPS consensus of $1.02, FY26 revenue consensus of $9.14B, EPS consensus of $4.47

Howmet Aerospace Non-GAAP EPS of $1.05 beats by $0.08, revenue of $2.2B beats by $70M

Feb. 12, 2026

Howmet Aerospace press release (HWM): Q4 Non-GAAP EPS of $1.05 beats by $0.08.

Revenue of $2.2B (+15.8% Y/Y) beats by $70M.

Revenue of $2.2 billion, up 15% year over year (YoY), driven by Commercial Aerospace, up 13%

1Q26 revenue consensus of $2.17B, EPS consensus of $1.02, FY26 revenue consensus of $9.14B, EPS consensus of $4.47

- Reward

- like

- Comment

- Repost

- Share

BTC dominance:Bitcoin maintains strength versus altcoins

- Reward

- like

- Comment

- Repost

- Share

We may only be witnessing the beginning stages of a 2017 like alt run and many of us should be aware of how powerful that run was...

#Altcoins

#Altcoins

- Reward

- like

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=BABDXVld

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More18.3K Popularity

7.77K Popularity

3.36K Popularity

35.36K Popularity

249.37K Popularity

News

View MoreGrok AI under Elon Musk confirms that X Money is considering integrating BTC

6 m

BTC drops below 67,000 USDT

12 m

Nasdaq declines by more than 1%

12 m

Data: 28,054 SOL transferred out from Fireblocks Custody, worth approximately $22,600,000

13 m

A major whale deposited $5 million into Hyperliquid and used 5x leverage to go long on HYPE, ETH, and BTC.

15 m

Pin