Post content & earn content mining yield

placeholder

CEO

BREAKING: 🇺🇸 President Trump says Vladimir Putin has agreed to stop attacking Ukraine.

- Reward

- 1

- Comment

- Repost

- Share

$SOL signal: short position + open interest divergence decline

$SOL price decline is accompanied by high trading volume and open interest, and market logic suggests that we need to be wary of the main shipments. At present, there is no clear support structure on the market, and the downward momentum has not been exhausted, so it is not appropriate to go against the trend.

🎯 Direction: Short position

Wait for a clear stop or absorption signal for price action. The current strategy is to protect capital and observe whether selling pressure is effectively absorbed and changes in open interest.

$SOL price decline is accompanied by high trading volume and open interest, and market logic suggests that we need to be wary of the main shipments. At present, there is no clear support structure on the market, and the downward momentum has not been exhausted, so it is not appropriate to go against the trend.

🎯 Direction: Short position

Wait for a clear stop or absorption signal for price action. The current strategy is to protect capital and observe whether selling pressure is effectively absorbed and changes in open interest.

SOL-6,98%

- Reward

- like

- 1

- Repost

- Share

ContractsBringWealth :

:

I have already lost a few hundred dollarsTechnical Analysis Basics: Trend, Support & Resistance

- Reward

- like

- Comment

- Repost

- Share

167994487976

彩票基金

Created By@先赚100万

Listing Progress

0.00%

MC:

$3.28K

Create My Token

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3867?ref=BVVEVQ9c&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Securitize is a leader in tokenizing real-world assets.

Securitize has minted ~$3.13B in assets, >50% of which are on Ethereum mainnet or L2s, reflecting Ethereum’s growing role in onchain capital markets.

Securitize has minted ~$3.13B in assets, >50% of which are on Ethereum mainnet or L2s, reflecting Ethereum’s growing role in onchain capital markets.

ETH-7,44%

- Reward

- 1

- Comment

- Repost

- Share

live trading - Analysis Hot crypto coin

- Reward

- 1

- 1

- Repost

- Share

MingDragonX :

:

2026 GOGOGO 👊🚨 JUST IN: No Democrats voted to advance the crypto market structure bill today.

- Reward

- like

- Comment

- Repost

- Share

Gate annual bill is out! Let's take a look at my annual performance

Click the link to view your exclusive #2025Gate年度账单 to claim a 20 USDT position voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQUQUQPAAG&ref_type=126&shareUid=U1lEUF5bAgUO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 to claim a 20 USDT position voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQUQUQPAAG&ref_type=126&shareUid=U1lEUF5bAgUO0O0O

- Reward

- 1

- Comment

- Repost

- Share

Gate annual bill is out! Let's take a look at my annual performance

Click the link to view your exclusive #2025Gate年度账单 to claim a 20 USDT position voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQIQVWTXUG&ref_type=126&shareUid=U1ZEVVlbBQoO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 to claim a 20 USDT position voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQIQVWTXUG&ref_type=126&shareUid=U1ZEVVlbBQoO0O0O

- Reward

- like

- Comment

- Repost

- Share

BBM猫

宝贝猫

Created By@AFollowsTheTrend

Listing Progress

0.00%

MC:

$3.27K

Create My Token

Gate annual bill is out! Let's take a look at my annual performance

Click the link to view your exclusive #2025Gate年度账单 to claim a 20 USDT position voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQRHV1XECA&ref_type=126&shareUid=U1lAUVlZAAMO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 to claim a 20 USDT position voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQRHV1XECA&ref_type=126&shareUid=U1lAUVlZAAMO0O0O

- Reward

- like

- 1

- Repost

- Share

GateUser-94906286 :

:

2026 Go Go Go 👊🚨 BREAKING NEWS.🇺🇲 The U.S. Senate has voted 45–55 against the latest funding bill, leaving the government just two days away from a shutdown. Not again.

- Reward

- like

- Comment

- Repost

- Share

Gate annual bill is out! Let's take a look at my annual performance

Click the link to view your exclusive #2025Gate年度账单 to claim a 20 USDT position voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=BFJHXQ9Z&ref_type=126&shareUid=VlNDXF1eAAEO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 to claim a 20 USDT position voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=BFJHXQ9Z&ref_type=126&shareUid=VlNDXF1eAAEO0O0O

- Reward

- 2

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3902?ref=BVVEVQ9c&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

1 more follower to get to 2700Who will give me that honour?

- Reward

- like

- Comment

- Repost

- Share

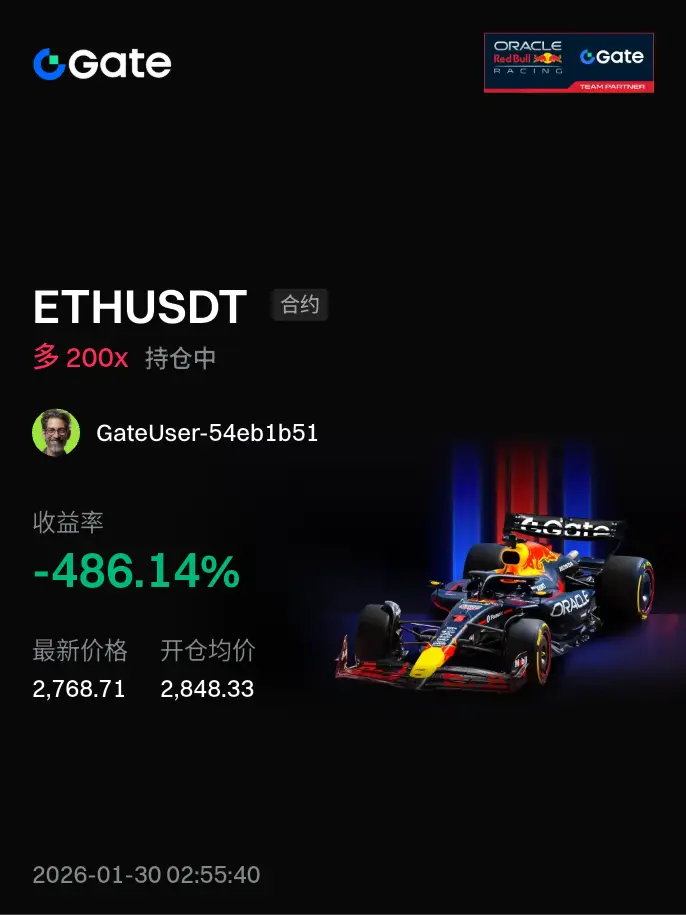

#晒出我的持仓收益# You win, 2730 liquidates, then smash it, and quit

View Original

- Reward

- like

- Comment

- Repost

- Share

If you’re between 18 and 48 years old,

You need to read this urgently.

Why?

Because you're going to make disgusting sums of money in the next 3-6 months.

You're going to make so much you will be embarrassed to tell anyone irl (keep it to yourself).

You’ll have so much money that saying it out loud might feel like confessing a crime.

The next 3 to 6 months will create a record number of MILLIONAIRES.

The stock market will go on a crazy rally with a final blow off top.

The crypto market will begin a terrifying rally right before the largest recession in history.

DON’T WASTE TIME.

This kind of o

You need to read this urgently.

Why?

Because you're going to make disgusting sums of money in the next 3-6 months.

You're going to make so much you will be embarrassed to tell anyone irl (keep it to yourself).

You’ll have so much money that saying it out loud might feel like confessing a crime.

The next 3 to 6 months will create a record number of MILLIONAIRES.

The stock market will go on a crazy rally with a final blow off top.

The crypto market will begin a terrifying rally right before the largest recession in history.

DON’T WASTE TIME.

This kind of o

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More13.46K Popularity

11.34K Popularity

9.37K Popularity

4.03K Popularity

45.46K Popularity

Hot Gate Fun

View More- MC:$3.24KHolders:10.00%

- MC:$3.22KHolders:10.00%

- MC:$3.27KHolders:20.00%

- MC:$3.27KHolders:10.00%

- MC:$3.26KHolders:10.00%

News

View MoreData: If ETH breaks through $2,932, the cumulative liquidation strength of short orders on mainstream CEXs will reach US$963 million

1 h

Data: If BTC breaks through $87,889, the cumulative short liquidation intensity of mainstream CEXs will reach $2.047 billion

2 h

BTC 跌破 84000 USDT

2 h

Data: 43 BTC transferred out of Cumberland DRW, worth approximately $2.8 million

2 h

数据:2000 枚 XAUt 从 Tether 转入 Abraxas Capital Mgmt (Heka Funds),价值约 1059 万美元

3 h

Pin