2025 年山寨季分析:非典型牛市中的敘事輪動與資金重構

本文深入分析 2025 年獨特的山寨季格局,闡述市場從傳統 BTC 主導轉向敘事驅動的演變過程。通過解析資金流動模式轉變、板塊輪動加速、政治力量介入等現象,揭示當前「山寨季 2.0」的特徵。文章結合最新數據與研究,展示穩定幣取代 BTC 成爲主要資金來源,以及敘事碎片化對投資策略的影響。針對這種非典型牛市環境,爲投資者提供實用的風險管理建議與機會識別方法,幫助讀者適應並把握新型態的加密貨幣市場。引言:2025 年加密市場格局重塑

在傳統的牛市周期中,加密資金總是循着「BTC → ETH → 主流幣 → 小幣」的經典路線,推動整體市場進入所謂的「山寨季」(Altcoin Season)。然而,這一輪牛市出現在高利率未轉向、總統候選人發幣、迷因幣橫行與敘事爆炸的背景下,市場早已不是熟悉的模樣。

2025 年的山寨季,並未展現過去那種齊飛齊漲的資金狂潮,取而代之的是板塊輪動加快、敘事爆點零散化,以及政治力量與新平台(如 Pump.fun)的劇烈滲透。一場市場內部結構的重塑,催生出一種新的山寨季表現模式,我稱它爲「山寨季 2.0」。

本篇內容我將從歷史演變、敘事輪動、板塊觀察和機構行爲四大面向,全面解析 2025 年山寨季的嶄新格局,並協助投資者掌握敘事驅動下的新型資金節奏與風險因子。

山寨季是什麼?

「山寨季」(Altcoin Season) 這個詞最早在 Reddit、Bitcointalk 等加密社羣中零星出現的時間可追溯至 2017 年 Q2~Q4,當時比特幣價格達到 $3,000 後,投資者發現資金開始從 BTC 流向其他加密貨幣,引發一波山寨幣暴漲潮。這個詞最初只是社羣的口語描述,並非專業術語,後來被逐漸被定型爲一種市場現象。

早期如何判斷山寨季?

山寨季 1.0 時期還未有正式的數據指標,市場主要靠觀察與共識來「粗略預測」山寨季的定義與階段變化。

山寨季 1.0 的定義:

當資金從比特幣(BTC)開始大幅流入其他加密資產(Altcoins),導致山寨幣整體價格快速漲、漲幅明顯超過 BTC,並形成市場普遍參與的投資熱潮,這段期間就被稱爲「山寨季」。

(圖1: 山寨季1.0判斷指標表,制圖Deniz)

山寨季的 3 大核心要素(傳統定義):

1)資金輪動(資金從 BTC 溢出)

- 比特幣在漲一段時間後,漲勢開始放緩甚至橫盤。

- 資金開始尋求更高風險與高報酬的標的,流入 ETH、L1 公鏈、大市值山寨幣,最後擴散至 MEME、小幣。

- BTC.D(比特幣市佔率)會明顯下降,是過去最常用的山寨季啓動判斷指標。

2) 山寨幣漲幅顯著優於比特幣

- 市場進入「只要是幣就會漲」的階段,部分山寨幣在短時間內暴漲數倍甚至十倍。

- 整體山寨幣總市值大幅成長,資金從主流項目流向敘事幣、故事幣、社羣幣。

- MEME 幣、DeFi 幣、GameFi 幣在此階段成爲高爆發板塊。

3)情緒與熱度的 FOMO 爆發

- 社羣熱度極高,Telegram、Discord、X(Twitter)充滿炒幣熱情與尋寶行爲。

- 新手大量進場、網紅出現喊單潮、CEX 爭相上幣,小幣上架即翻倍。

- 各類幣種話題佔據社羣、KOL 談話、媒體報導。

直到後來,爲了解決判斷主觀性, 如 CMC、Blockchain Center 這類平台開始將數據量化,推出「Altcoin Season Index」等量化指標,幫助投資者更客觀地判斷山寨季。

下圖,是最著名的 Blockchain Center Altcoin Season Index,它的定義是:若過去 90 天中,有 75% 的前 50 名山寨幣漲幅優於 BTC,則進入山寨季。

以此圖爲例,在 2024 年 12 月 2 日到 8 日,指標超過 75%,僅維持短暫6天,與 2021 年的山寨季從 3 月到 6 月維持 3 個月相比,天數縮短了15倍,可以說已從「山寨季」變「山寨周」了。

(圖2:截圖自 https://www.blockchaincenter.net/en/altcoin-season-index/)

一、山寨季 2.0 :敘事聚焦資金,輪動節奏快而短

1、數據概覽

就在許多人還在觀望山寨季是否到來時,Crypto Quant 數據平台創始人 Ki Young Ju 在2025年2月時提出一些數據來證實他的觀察,也就是山寨季已經開始,並且山寨季的模式已經改變,具有「選擇性」。

從 Ki Young Ji 的圖表可以看出山寨季的演變:

- 灰線:Altcoin Market Cap(山寨幣總市值,90日移動平均)

- 紫線:Volume Ratio = Altcoin 交易量 / Bitcoin 交易量(中心化交易所)

重點解讀:

- 當紫線上升,代表山寨幣交易量相對於比特幣正在增加,表示「山寨熱」。

- 當紫線下降,表示資金回流比特幣,相對風險偏好減弱。

- 市值灰線顯示整體山寨幣的估值趨勢。

重點觀察:

- 2017 下半年紫線快速上升,年底至 2018 年初山寨幣市值爆發期,灰線也在短時間內快速膨脹,顯示這年的山寨季爲一種資金從 BTC 出逃、流向大量山寨幣的典型 1.0 式行情。

- 2021 牛市中,紫線和灰線同時上升,顯示明顯的山寨季。

- 2022–2023 熊市中,紫線與市值雙雙下滑。

- 2024 年底至今,紫線再次攀升,意味着近期山寨幣再度活躍,資金偏好提升中。

(圖3:截圖自 https://x.com/ki_young_ju/status/1892785881158996173)

進入 2025 年,傳統輪動結構已被徹底顛覆。根據 CryptoQuant 數據,穩定幣交易對現已成爲山寨幣的主要資金來源,而 BTC 報價對在 altcoin 市場的交易量降至歷史最低。這意味着資金不再經由 BTC 流向山寨幣,而是直接從穩定幣湧入特定敘事板塊。

圖例:

- 紫線:Aggregated Altcoin Trading Volume for BTC Quote Pairs(以 BTC 爲報價對的山寨幣交易量)

- 黃區:Altcoin Volume Inceasing Trend(30d > 365d) 交易量是否高於過去 365天平均(= 當前熱度是否高於年平均)

- 灰線:ETH Price(ETH 價格,用來輔助觀察山寨市場整體走勢)

- 綠區:Strong Buy Walls(30d > 365d) = 大戶建倉

《BTC 報價對的山寨幣交易量合計》重點觀察:

左右圖相同,右圖顯示大戶建倉。

- 2017、2021牛市時,BTC 報價對的交易量非常活躍。

- 2023 年之後明顯退潮,顯示市場對「用 BTC 換山寨」的模式熱度下降。

- 最近幾波山寨行情的交易主要以 穩定幣報價 爲主(見圖5)

(圖4:BTC 報價對的山寨幣交易量合計,山寨幣包含ETH、XRP、BNB、SOL,來源:https://cryptoquant.com/community/dashboard/67c85aabdb113415286e82c5 )

CryptoQuant 數據進一步顯示,隨着 BTC 對報價量佔比持續萎縮,USDT 與 USDC 已取代成爲主流交易資金池。 3月份市場熱點板塊如 AI、RWA、PolitiFi、ETF 等題材,皆由穩定幣資金直接引導轉入。

《穩定幣 報價對的山寨幣交易量合計》重點觀察:

左右圖相同,右圖顯示大戶建倉。

- 近兩年明顯成爲主流交易模式,交易量遠高於 BTC 報價。

- 2024–2025 這一波牛市中,穩定幣報價山寨交易量爆炸成長,尤其是黃金區段明顯變多。

- 表示散戶與機構資金皆偏好使用 USDT 等穩定幣進出山寨市場。

(圖5:穩定幣 報價對的山寨幣交易量合計,山寨幣包含ETH、XRP、BNB、SOL,來源:https://cryptoquant.com/community/dashboard/67c85aabdb113415286e82c5)

2、這輪山寨季與以往有何不同?

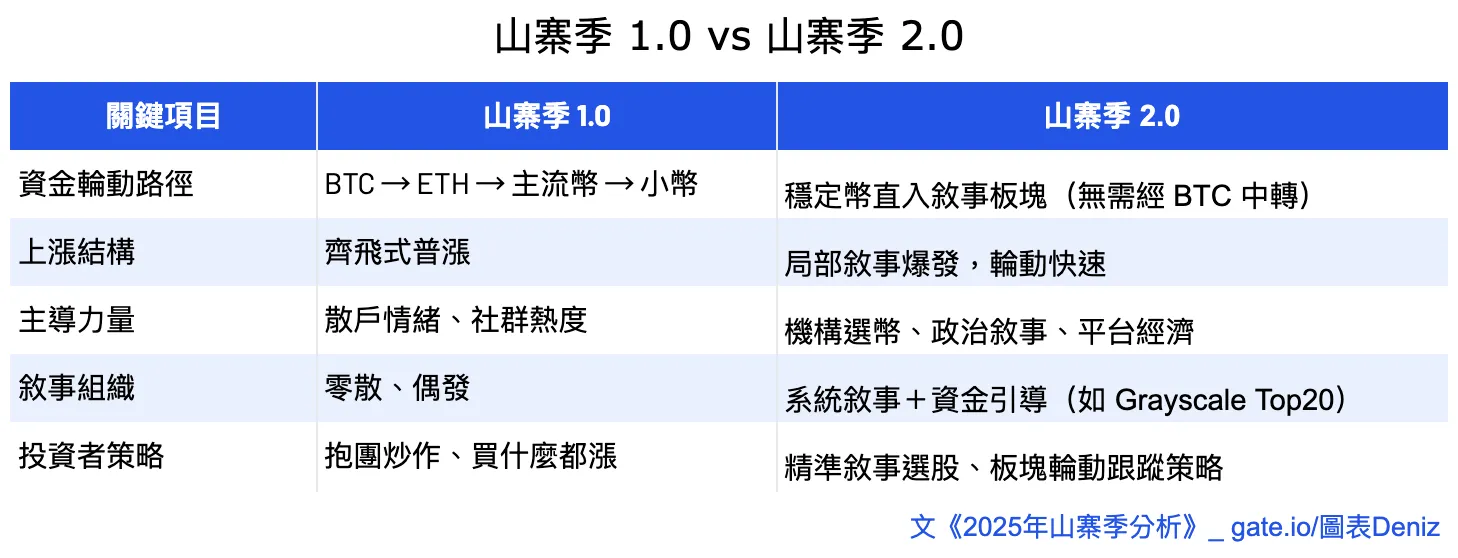

(圖6:山寨季 1.0 v.s 2.0 對比,制圖Deniz)

山寨季 1.0:2017 ~ 2021

這一階段的山寨季特徵爲「資金從 BTC 溢出 → ETH → 山寨幣齊飛」,其共同點是:

- Volume Ratio 飆升與 Altcoin 市值同步膨脹(2017、2021)

- 敘事不重要,凡是山寨幣都能喫到漲幅(只要不是地雷幣,大多都能漲)

- 主導力量是散戶與社羣情緒,FOMO、社羣炒作與 KOL 點火是常態

- 迷因幣、DeFi、GameFi 等都能成爲短期爆點

代表年份與行情:

- 2017–2018:ICO 熱潮、ETH 資金外溢,開啓山寨季

- 2021:DeFi Summer、Layer 1 大戰、NFT 爆發

過渡期:2022 ~ 2023 熊市

- Volume Ratio 下滑、Altcoin 市值縮水,資金退潮明顯

- 各類敘事板塊全面冷卻,DeFi TVL 崩跌,NFT 市場沉寂

- 穩定幣總市值縮水,市場進入機構主導、散戶退場的寒冬期

(圖7:穩定幣總市值,截圖自https://studio.glassnode.com/charts/usd-top4-supplies?s=1513754007&u=1743586205&zoom=)

山寨季 2.0:從 2024 年 Q4 開始

我認爲真正意義上的「山寨季 2.0」是在 2024 年 Q4 開始出現明確跡象,直到現在(2025 年 Q1)正在加速發展。其特徵是:

資金進入方式改變:

- 不再是從 BTC 外溢,而是直接從 穩定幣(如USDT、USDC)流向特定敘事板塊

- 圖片中 Volume Ratio 雖上升,但幅度溫和 → 顯示非全面普漲,而是選擇性輪動

敘事與機構主導:

- Grayscale Research、a16z 等研究報告成爲新敘事源頭

- 政治敘事(如 Trump、WLF)出現,敘事強度超越技術強度

- Pump.fun、Base 等平台催化板塊輪動,快閃式行情頻繁出現

輪動特性:

- 「敘事爆點 → 板塊快閃 → 熄火 → 下一敘事啓動」

- 舉例:AI Agents → SocialFi → Politifi → Restaking → DePIN

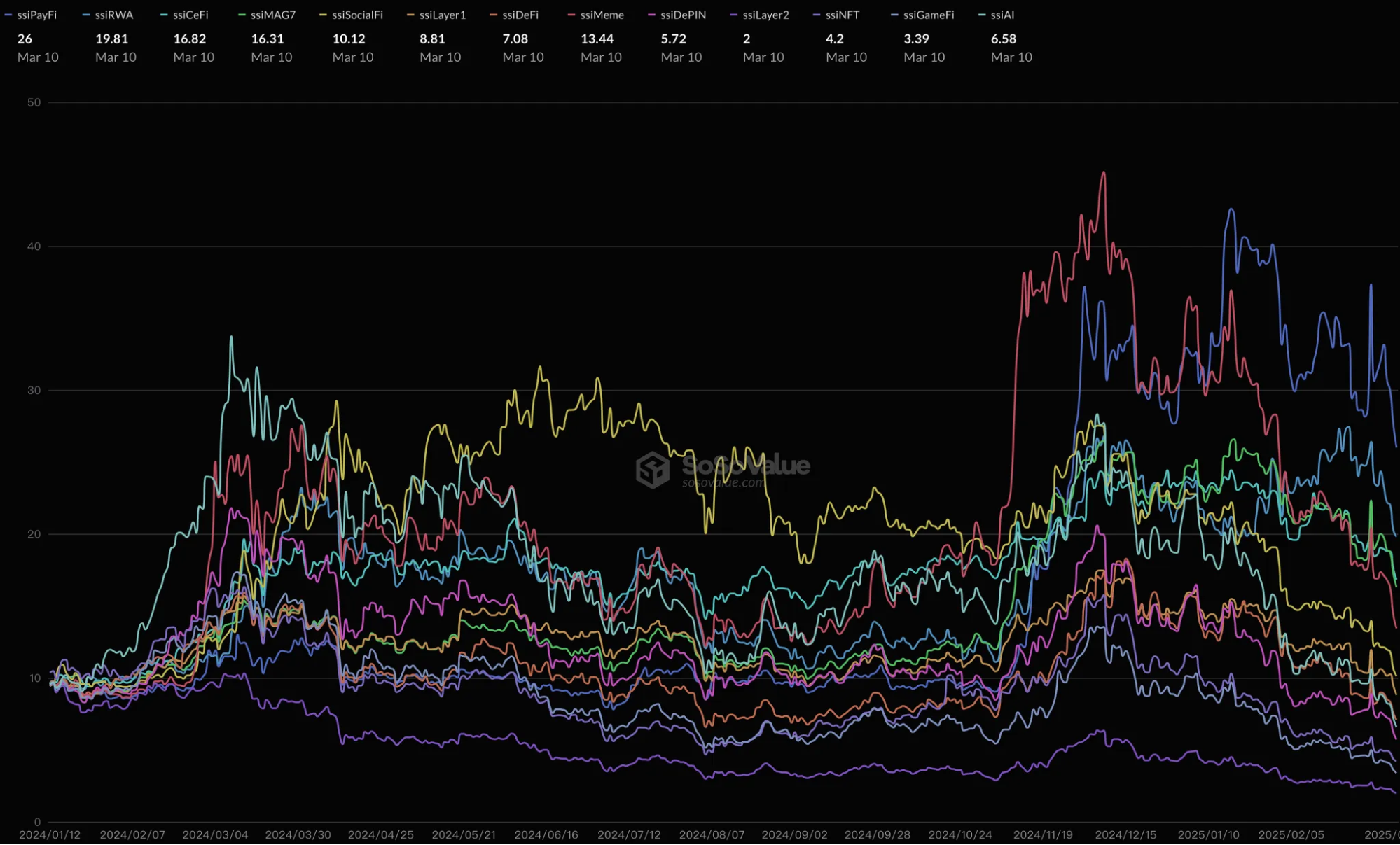

(圖8:板塊指數歷史價格,截圖自https://sosovalue.com/tc/assets/cryptoindex/bigCharts/Historical_Index_Prices_1d )

從以上數據中可以觀察到一個新的山寨季結構正在形成:

- 山寨幣不再齊飛,而是敘事之間爭奪資金焦點

- 板塊周期變短,資金只在熱點敘事間快速流動,爆發期短暫

- 有強機構背書與敘事一致性的幣種,具備持續吸資優勢

綜觀這波山寨季的變化,我們可以看到市場從過去的「全面性漲」轉變爲「選擇性輪動」的模式。在這個新階段中,資金流動更加精準且快速,板塊熱度更迭頻繁,而具有強大機構支持和明確敘事的項目則更容易獲得持續性的資金青睞。這種結構性的轉變不僅改變了投資策略,更預示着加密市場正邁向更成熟的發展階段。

二、敘事滲透、政治加持,加密市場轉向

2025年的山寨季呈現出不同於以往的市場生態,資金不再是全面性漲潮,而是快速在不同板塊間流動。根據SoSoValue數據,3月熱門板塊涵蓋幣安生態、灰度Top20、川普儲備、ETF、DeFAI和AI Agents。

這波行情的特色在於三大力量的融合:政治敘事的深入、機構資金的策略性引導,以及新興平台的催化作用。這些力量重塑了傳統的BTC資金外溢模式,創造出多元的市場熱點,推動各板塊快速發展。

(圖9:3月熱門板塊,截圖自 https://sosovalue.com/tc )

1、政治力量主導市場:從迷因到國家戰略

2024 年底開始,政治因素深刻影響加密市場走向。最具代表性的是川普團隊成立 WLF(World Liberty Financial)平台並發行 $WLFI,隨後提出將加密貨幣納入「美國國家戰略儲備資產」的主張,引發市場轟動。

這股政治力量不僅帶動了 MAGA、TRUMP 等支持性代幣的熱潮,更將加密貨幣推向國家戰略層面的討論。隨着 SEC 主席可能更替的預期,市場對政策友善度的想像持續升溫。根據 DropsTab 數據,WLF 目前已配置超過 8,000 萬美元於 ETH、WBTC 等主流幣種,展現出實質的資本投入力道。

金融敘事的主導權正在發生重大轉變,隨着加密貨幣成爲美國政治舞臺的一部分,市場格局產生了根本性的改變。政治力量不只帶來短期投機機會,更將加密資產納入國家戰略層面,開創了政治與加密市場融合的新局面。

2、金融政治新格局:加密貨幣的國家戰略轉型

2024年底,加密市場迎來重大轉折。川普團隊推出WLF平台及$WLFI代幣,並提議將加密貨幣納入美國國家戰略儲備,徹底改變了市場格局。這項政策不僅帶動MAGA、TRUMP等代幣走強,更將加密資產提升至國家戰略層面。 WLF目前已投入8,000萬美元於主流幣種,展現政策轉向的實質影響力。

這種政治與加密的結合爲市場帶來新氣象,不僅是短期投機熱點,更標志着加密資產正式進入國家政策工具領域。隨着政策環境轉暖,加密貨幣市場正在經歷一場前所未有的制度性變革。

(圖10:WLF 加密投資組合,源自 https://x.com/Dropstab_com/status/1897644913241784519)

3、機構資金重塑市場敘事

機構資金正重塑加密市場格局,以灰度基金爲首的大型機構不再只是被動投資者。灰度最新發布的2025年Q2「Grayscale Research Top 20」名單納入SYRUP、GEOD和IP等實用型代幣,涵蓋實體資產借貸、基礎設施及內容創作領域,顯示機構更重視區塊鏈的實質應用。

機構決策已成爲市場風向標,散戶不僅追隨其投資組合,更提前布局潛在標的。這種現象使Grayscale從純投資機構轉變爲市場趨勢引領者,也形塑了全新的投資邏輯與資金流向模式。

4、平台紅利的新生態:Base 與 Pump.fun 引領潮流

在這波山寨季中,平台不再只是基礎設施,而是演變成敘事催化的重要舞臺。其中,Base 和Pump.fun 兩大平台各自扮演着獨特角色,共同推動市場發展。

Base 作爲 Coinbase 的 Layer網路,憑借其與主流交易所的緊密連結,成功吸引了大量資金流入。從2024年第四季開始,Base 不僅成爲迷因幣和社交代幣的重要發行平台,更逐步發展爲傳統金融與區塊鏈融合的橋梁,特別是在證券型代幣(STO)領域的發展。

另一方面,Pump.fun 則開創了一個全新的敘事模式。透過其創新的 PumpSwap DEX 平台,任何人都能參與代幣發行和敘事創造,徹底改變了過去由風投主導的市場格局。這種去中心化的敘事創造模式,不僅加快了資金流動速度,更爲整個加密市場注入了新的活力。

在山寨季 2.0 時代,Base 專注於合規金融發展,而 Pump.fun 則致力於社羣驅動的創新。這兩個平台的相輔相成,共同打造出一個更具活力和多樣性的加密貨幣生態系統。

三、下一波行情該如何部署?

隨着山寨季 2.0 的輪廓逐漸清晰,加密市場參與者正面臨新的挑戰與機遇。敘事輪動已不再是「幣圈自娛」的內部遊戲,而是融合了政治、平台、機構等多層次力量,使市場行爲與資金節奏更難掌握。

市場走勢三種可能劇本:

根據當前的市場資金結構、敘事活躍度與監管進程,未來數月可能出現以下三種情境:

- 主線敘事持續強勢,輪動延續發酵

AI、RWA、Base、PolitiFi 等主線敘事形成有序接力,市場熱度不減,資金持續流入主題概念。輪動速度維持在每一到兩周一波的節奏,形成可預期的波段行情。 - 輪動過快導致敘事乏力,資金轉向觀望

敘事熱點更替頻繁,但難以形成持續性資金流與社羣關注,導致爆發周期縮短。市場情緒趨於保守,部分資金回流至 BTC、ETH 或穩定幣等待明確趨勢。 - 系統利空引發市場降溫

若美國監管態度驟變、或傳統金融市場出現風險事件(如美元流動性收緊或美股重挫),加密資產將面臨普遍性獲利了結壓力,敘事難以承接資金,導致市場短期失溫。

選擇策略與配置思路

這三種劇本皆有跡可循,關鍵在於掌握敘事周期與資金節奏。

面對敘事碎片化與板塊快閃的山寨季 2.0,市場參與者需要進化其操作邏輯。不同於過去押注整體市場齊飛的策略,現今更需要平衡靈活性與紀律性。一方面,將資金分散至多元敘事板塊(如 AI、Base、生態、公鏈、政治Fi 等)能避免錯過輪動熱點;另一方面,維持適度的穩定幣倉位,可因應頻繁的敘事輪動與快速的行情反轉。

從實務操作來看,監控鏈上交易活躍度與社羣熱度已是不可或缺的基本功。透過市值、FDV、解鎖比例與實際成交量的綜合分析,能有效判斷題材的持續性。當敘事熱度開始降溫,市場往往不會給予第二次機會,因此能否迅速識別「退場訊號」,已成爲山寨季 2.0 的致勝關鍵。

總結而言,2025年的山寨季已不再是「齊頭並進」的行情,而是一場敘事與時間的競賽。比起預測個別幣種的漲幅,更重要的是準確掌握哪一段時間、哪一個敘事正在發酵,並精準控制節奏。

接下來,我們將從整體市場變化的高度,對山寨季 2.0 進行總結與歸納。

四、結語:山寨季2.0的敘事經濟

2025年的山寨季已徹底改寫傳統市場規則。這不再是一場單純的加密資產普漲盛宴,而是演變爲一個以敘事爲核心的動態競技場。政治力量的深度介入、機構資金的策略引導,以及新型平台的催化作用,共同塑造了這場結構性變革。從川普團隊的WLF計畫到Grayscale的投資組合,從Base到Pump.fun的創新生態,每一股力量都在重新定義市場方向。

山寨季2.0 是一種新模型,不只是現象

這場從「幣本位」向「敘事本位」的轉變,標志着山寨季2.0的來臨。在這個新時代,成功已不再取決於簡單的價格預測或幣種選擇,而是需要精準把握敘事脈動與市場節奏。投資者必須提升敘事識別能力,項目方需要專注於共識建構,而市場分析則要超越傳統的技術指標,深入理解敘事張力與社羣互動。

山寨季的本質依舊存在,但已從昔日全民狂歡的盛宴,蛻變爲一場考驗洞察力與執行力的敘事競賽。在這個充滿挑戰的山寨季2.0時代,真正的風險不在於錯過某個代幣的漲勢,而是未能及時捕捉市場敘事的轉折點。唯有掌握敘事變革的核心邏輯,才能在這個快速變化的市場中站穩腳步。

綜上所述,山寨季還在,只是模式改變了,不再遵循一種固定規律,而是更貼近市場律動。

相關文章

3074傳奇後對以太坊治理的思考

區塊鏈盈利能力和發行 - 重要嗎?

比特幣年第二章

Notcoin & UXLINK:鏈上數據比較

什麼是中本聰同步?您需要瞭解的有關 SSNC 的所有資訊