什麼是 TrendX?

了解TrendX是什麼、它如何運作以及爲什麼它在Web3領域引起關注。探索其AI驅動的交易工具、雙代幣系統(TTA和XTTA)、關鍵功能和完整的路線圖。簡介

TrendX 是一個Web3投資平台,結合了人工智能(AI)、大數據和區塊鏈技術,幫助用戶做出更好的交易和投資決策。它爲希望提前識別市場趨勢並根據實時洞察採取行動的初學者和高級加密用戶打造。

該平台使用AI代理分析鏈上和鏈下數據,旨在提高投資策略的速度和準確性。TrendX還運行在去中心化計算網絡上,支持更高效、低成本地訓練和運行這些AI模型。

TrendX的獨特之處在於其專注於自動化、數據透明性和易於使用的工具,這些工具無需技術技能即可操作。它提供趨勢預測、智能資金追蹤和影響者支持的洞察,所有功能都集中在一個平台上。

什麼是TrendX

TrendX 是一個AI驅動的Web3投資與交易策略平台。它提供自動化工具,幫助用戶發現有利可圖的加密趨勢,做出明智的投資決策,並以最小的人工輸入執行策略。該平台專注於通過AI、大數據和去中心化基礎設施改善智能交易策略的可訪問性。

TrendX利用人工智能處理大量鏈上和鏈下數據,包括區塊鏈活動、市場行爲和社交信號。基於這些分析,它實時提供趨勢預測、策略建議和警報。

與傳統交易平台不同,TrendX建立在一個去中心化的物理基礎設施網絡(DePIN)——Owlbot上。TrendX完全依賴全球零售用戶貢獻的空閒計算資源,而不是出售專有硬件節點。

用戶可以通過在現有設備上運行節點軟件參與Owlbot網絡,並通過提供計算能力獲得XTTA代幣獎勵。這種模式降低了AI處理的運營成本,並在不需要集中式基礎設施或專用硬件的情況下增加了可擴展性。

TrendX還設計得易於使用,提供一鍵策略和可定制工具,適用於不同用戶層級——從初學者到經驗豐富的交易者。其雙代幣系統(TTA和XTTA)支持平台功能、服務訪問和去中心化計算獎勵。

TrendX的歷史、起源和關鍵人物

TrendX於2022年推出,最初作爲veDAO,一個去中心化社區平台,用於資助早期Web3項目。該項目後來重新品牌化爲TrendX,更多地聚焦於AI驅動的交易策略和Web3投資工具。

重新品牌化後,項目從基於DAO的資助模式轉向了一個以數據驅動的平台,提供AI引導的投資策略。這一轉變還引入了Owlbot去中心化計算網絡和雙代幣系統(TTA和XTTA),這些現在構成了TrendX生態系統的核心。

TrendX的關鍵團隊成員包括在區塊鏈、AI和DePIN網絡方面具有經驗的專業人士。值得注意的是,Abderrahmane Delliou擔任首席執行官,他爲項目帶來了技術和運營方面的專業知識,指導其發展和市場方向。

TrendX已通過兩輪主要融資獲得資金支持:

- 種子輪:2024年1月8日籌集了100萬美元,投資者包括CatcherVC、Coresky和Web3Link。

- A輪:2024年9月2日籌集了500萬美元,參與者包括Coresky、Tido Capital、BullPerks等。

這筆資金支持了平台的成長,包括產品開發、AI基礎設施建設和原生代幣的交易所上市。來自知名投資者的支持以及從veDAO到TrendX的轉變,展示了該項目朝着一個以功能爲主、可擴展的加密投資平台的清晰演變。

TrendX是如何運作的?

TrendX結合了人工智能(AI)、區塊鏈數據和去中心化計算,爲用戶提供交易信號和投資策略。

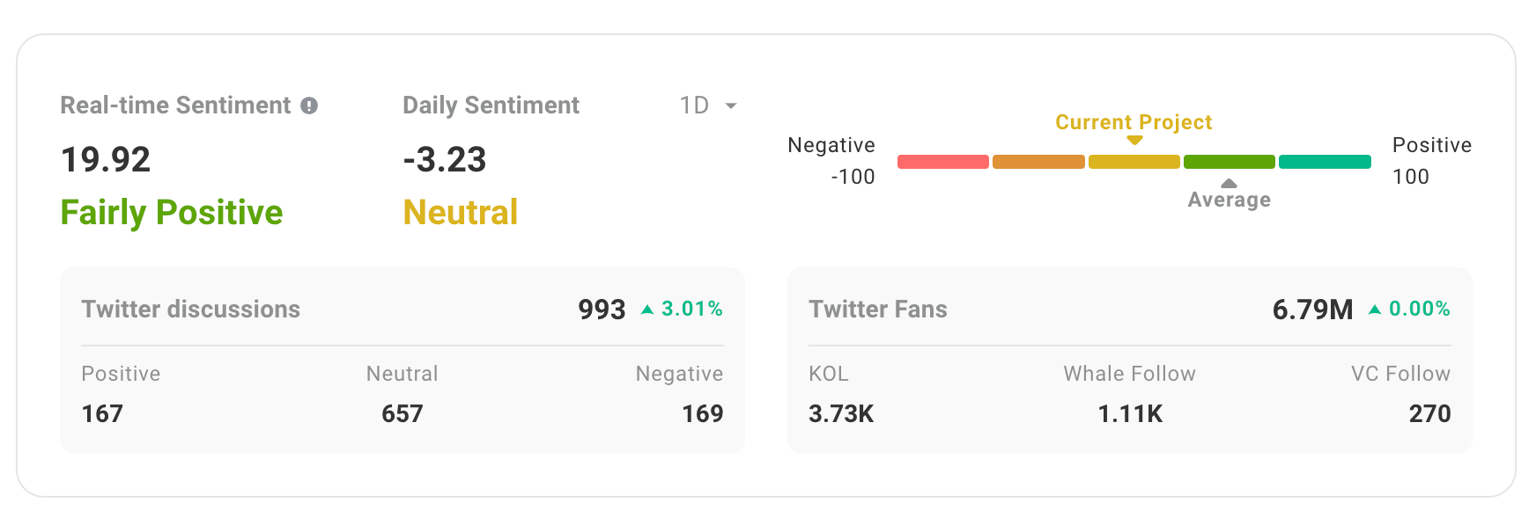

平台的核心是一個AI引擎,處理鏈上數據(如代幣流動、錢包活動和智能合約互動)和鏈下數據(包括市場趨勢、新聞和社交情緒)。該引擎識別市場模式、預測趨勢,並建議可操作的策略。

TrendX使用模塊化策略系統。AI代理不斷從數據中學習,並根據實時情況更新策略。用戶可以通過單擊應用這些策略,省去了手動研究或技術分析的需求。

TrendX通過一個名爲Owlbot的去中心化計算網絡來支持AI處理。Owlbot網絡並不依賴集中式服務器,而是利用來自全球用戶的空閒計算資源。這降低了運行AI模型的成本,並允許任何人通過提供計算能力來參與,作爲回報獲得XTTA代幣獎勵。

用戶可以通過一個簡單的界面與TrendX互動,操作包括:

- 查看趨勢預測

- 監控智能資金活動

- 跟蹤關鍵意見領袖(KOL)洞察

- 訪問自定義或預設交易策略

所有平台服務都由其代幣系統提供支持,其中TTA用於訂閱和訪問,XTTA與計算網絡和挖礦相關聯。

TrendX的關鍵功能

TrendX提供集成的功能,旨在幫助用戶通過AI和區塊鏈數據識別、評估和採取加密投資機會。這些功能旨在服務於初學者和經驗豐富的交易者。

AI策略引擎

TrendX的核心是其AI策略引擎,利用機器學習算法分析大量鏈上和鏈下數據,包括區塊鏈交易、市場趨勢和社交情緒。該引擎識別模式並生成實時交易策略,使用戶能夠在無需廣泛手動研究的情況下做出明智決策。這種自動化簡化了投資過程,使復雜策略對所有用戶都可訪問。

Owlbot網絡(DePIN)

TrendX運行在Owlbot網絡上,這是一個去中心化物理基礎設施網絡(DePIN),利用全球用戶貢獻的空閒計算資源。這種去中心化的方法降低了與AI計算相關的成本,並增強了平台的可擴展性。參與者通過提供計算能力獲得XTTA代幣獎勵,促進了一個協作生態系統,在該生態系統中,用戶支持平台基礎設施並獲得獎勵。

KOL廣場

KOL廣場是TrendX中的一個專屬功能,連接用戶與加密領域超過50,000個關鍵意見領袖(KOL)。它充當Web2和Web3之間的橋梁,提供快速融入Web3社區的機會。用戶可以訪問有價值的洞察,監控KOL活動,及時了解新興趨勢和潛在的高回報投資。TrendX採用專有算法分析KOL推文情緒和投資趨勢,爲用戶提供及時和相關的信息。

Alpha廣場

Alpha廣場提供先進的工具來識別早期投資機會。通過捕捉和分析來自多個維度的關鍵因素,包括鏈上和鏈下數據,它形成了多偏好趨勢策略,幫助用戶及時抓住市場機會。用戶可以通過TrendX功能自定義策略,並通過在智能幣推薦平台上發布這些策略來賺取利潤。

智能資金追蹤

TrendX的智能資金追蹤功能是一個專業的追蹤模塊,探索大量鯨魚和超智能資金地址的最新動態。它揭示了這些大型投資者操作的共性和交易趨勢。智能資金信號功能爲用戶提供有價值的參考指標,包括代幣趨勢、交易量和淨購買量。結合用戶對項目的理解,他們可以選擇投資目標。

一鍵策略訪問

TrendX通過一鍵策略訪問功能簡化了交易策略的執行。用戶可以直接將AI生成的策略應用到他們的投資組合中,無需復雜的配置或編碼。這一功能降低了初學者的入門門檻,並提高了經驗豐富的交易者的效率,使他們能夠迅速應對市場變化。

Web3集成

TrendX強調無縫連接,支持與主要Web3錢包的集成。用戶可以將他們的錢包連接到平台,應用策略並直接從TrendX儀表板上監控表現。這一集成確保了一個連貫且用戶友好的體驗,使用戶能夠高效管理Web3生態系統中的數字資產。

TrendX值得投資嗎?

投資TrendX需要考慮多個因素,包括平台的創新方法、市場採用情況以及加密市場的固有波動性。TrendX將AI和區塊鏈技術結合在一起,使其在加密領域中處於獨特位置,可能提供競爭優勢。然而,像任何投資一樣,在投入資金之前,進行徹底的研究並評估個人的風險承受能力是至關重要的。

如何擁有TrendX?

通過參與其代幣生態系統,可以擁有TrendX。平台採用雙代幣系統:

- TTA代幣:作爲本地實用代幣,用於交易費用、進階策略訂閱和訪問平台的OpenAPI。

- XTTA代幣:作爲計算能力代幣,支持Owlbot網絡,並允許用戶升級他們的挖礦能力。

用戶可以通過參與平台活動(如提供計算能力)或在支持的加密貨幣交易所(如Gate.com)購買這些代幣。

TrendX代幣經濟模型

TrendX採用雙代幣系統——TTA和XTTA——每個代幣在平台生態系統中扮演不同的角色。兩種代幣都建立在Basechain上,支持TrendX基礎設施的不同部分。

TTA代幣

- 總供應量:10億

- 目的:平台服務的實用代幣

使用案例

- 交換交易費用:用戶可以使用TTA支付費用,並獲得折扣。

- 高級策略訂閱:TTA用於解鎖高級功能,如機構Twitter監控、互動分析、智能資金策略和KOL過濾工具。

- OpenAPI訪問:用戶可以支付TTA以訪問TrendX的API,提供動態KOL數據、情緒指標、項目圖譜和智能資金交易。OKX已經是此API的客戶。

- 廣告競標:用戶可以使用TTA競標平台上的廣告位。

代幣分配

- 40% – 交易激勵

- 22% – 投資者

- 20% – TrendX生態系統

- 8% – 團隊

- 4% – 流動性

- 4% – 空投

- 2% – 顧問

XTTA代幣

- 總供應量:4億

- 目的:支持Owlbot網絡的計算能力代幣

使用案例

- 購買Owlbot蛋:XTTA可用於購買Owlbot蛋,提升用戶計算能力並幫助控制代幣賣壓。

- 購買計算盒:用戶可使用XTTA升級Owlbot的計算能力。

- 交換交易費用:XTTA與TTA類似,也可用於降低TrendX Swap的交易成本。

- 高級策略訂閱:XTTA也可以訪問平台的高級功能,類似TTA。

發行計劃

XTTA採用長期發行模型,以管理供應並激勵參與:

- 第一年:50%(2億XTTA)

- 第二年:25%

- 第三年:12.5%

- 第四年及以後:每年減半

代幣鎖倉規則

用戶通過提供計算能力獲得XTTA積分。這些積分必須先鎖倉才能轉換爲XTTA代幣:

- 30天鎖倉:釋放25%;75%用於明年的挖礦

- 60天鎖倉:釋放50%;50%用於明年

- 120天鎖倉:立即釋放100%

TTA與XTTA的關系

TTA是核心實用代幣,用於交易、訂閱、OpenAPI訪問和平台服務。XTTA支持計算基礎設施,獎勵貢獻者並推動AI處理。兩種代幣都可以用於折扣交易費用,使用戶能夠在TrendX生態系統中享受不同的訪問權限和功能。

這種雙代幣模型將用戶活動與系統資源激勵分離,允許平台高效擴展,同時將實用性與網絡貢獻對接。

TrendX路線圖

TrendX的發展採用了結構化的階段性方法,從DAO治理、空投系統和人才挖掘工具的推出開始。隨着平台的成熟,它整合了社交數據功能,如Twitter情緒追蹤、影響力圖譜和項目評論,以支持早期趨勢檢測。這一基礎促成了Alpha Square和策略訂閱服務的推出,使用戶能夠獲取AI生成的交易洞察。

與此同時,TrendX推出了智能資金追蹤和AI助手,以增強數據解讀能力。平台隨後通過推出Owlbot(去中心化計算網絡)和TrendX OpenAPI(支持第三方集成)擴大了生態系統。

之後,像KOL Square、跨鏈交易和移動可訪問性等功能相繼添加,以提升可用性和可擴展性。所有這些階段反映了TrendX從數據收集工具到全面AI驅動、多鏈交易平台的轉型。

結論

TrendX將自己定位爲Web3投資領域的前瞻性解決方案。結合人工智能、大數據和去中心化計算,使用戶能夠訪問自動化交易策略、追蹤市場信號,並受益於智能基礎設施。其雙代幣模型——TTA用於平台訪問,XTTA用於計算能力——確保了使用和貢獻都能獲得獎勵。

憑借清晰的發展路線圖、不斷增長的投資者支持以及智能資金追蹤、Alpha Square和KOL洞察等擴展功能,TrendX不斷發展成爲一個完整的AI驅動交易平台。無論你是尋求簡化工具的初學者,還是探索市場信號的高級交易者,TrendX都爲加密投資中的可擴展、數據驅動決策提供了一個完善的生態系統。

相關文章

Solana需要 L2 和應用程式鏈?

Sui:使用者如何利用其速度、安全性和可擴充性?

Arweave:用AO電腦捕捉市場機會

即將到來的AO代幣:可能是鏈上AI代理的終極解決方案

什麼是中本聰同步?您需要瞭解的有關 SSNC 的所有資訊