Post content & earn content mining yield

placeholder

BitFatty

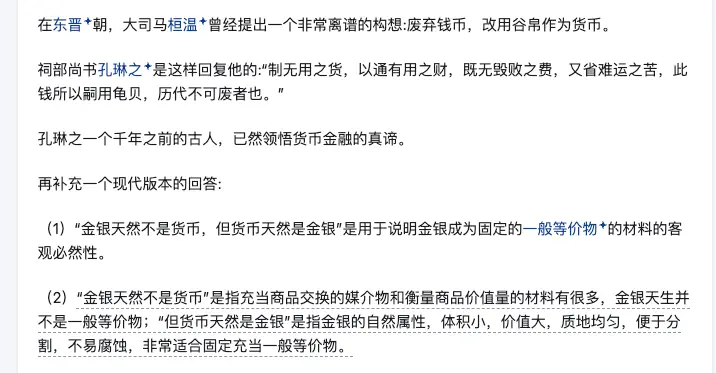

Gold and silver are not inherently currencies, but currencies are inherently gold and silver.

The excess issuance of fiat currency does not flow into Bitcoin.

The excess issuance of fiat currency does not flow into Bitcoin.

BTC0,3%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

AIBT is pioneering a new chapter in AI intelligence (AI Agents) and A2A (Agent-to-Agent) economy. By leveraging blockchain to grant AI agents independent on-chain identities (DID) and wallet permissions, enabling them to autonomously negotiate, procure resources, and exchange value; while AIBT's decentralized architecture provides an immutable audit trail and secure settlement layer for these autonomous actions, building a highly collaborative intelligent financial network between machines and machines. $AIBT #AIBT

View Original

- Reward

- like

- Comment

- Repost

- Share

What if one app gave you better rates, lower fees, crypto flexibility, real security, and zero exchange stress? Is that possible?

Yes, it is, that’s @ClappFinance App

👇

🔹 Top prices, minimal fees, offering high liquidity and low slippage, even for large transactions.

🔹 Fiat + Crypto, made simple.

Easily deposit and withdraw using SEPA or cryptocurrency.

🔹 All-in-one experience

Wallet. Exchange. Portfolio. One place. More features coming.

🔹 Security without stress

Industry-grade protection so you trade with confidence, not caution.

🔹 One KYC. Full access.

Verify once. Trade everywhere. No

Yes, it is, that’s @ClappFinance App

👇

🔹 Top prices, minimal fees, offering high liquidity and low slippage, even for large transactions.

🔹 Fiat + Crypto, made simple.

Easily deposit and withdraw using SEPA or cryptocurrency.

🔹 All-in-one experience

Wallet. Exchange. Portfolio. One place. More features coming.

🔹 Security without stress

Industry-grade protection so you trade with confidence, not caution.

🔹 One KYC. Full access.

Verify once. Trade everywhere. No

DEFI-0,97%

- Reward

- 1

- Comment

- Repost

- Share

Hyperliquid leads perp DEX market with 7x higher open interest than Lighter and lower turnover signaling organic activity despite recent FUD, per CryptoRank.

- Reward

- 4

- Comment

- Repost

- Share

Q1 2026 is coming, buy and hold $GAIA and get ready to become a millionaire

MC:$32.54KHolders:2061

75.05%

- Reward

- like

- 2

- Repost

- Share

GateUser-38e0eb98 :

:

I buy in at 1%View More

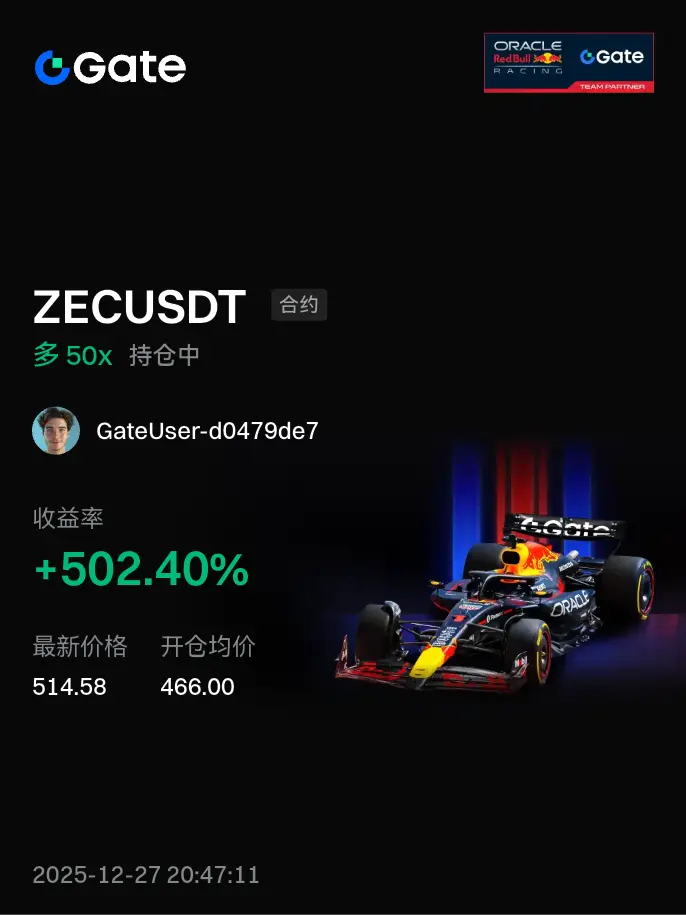

Reflecting on this year's crypto journey—from market surges to bold moves, every step is worth remembering. Check your #2025Gate年度账单 now, and relive your 2025 crypto journey with Gate. Share to receive 20 USDT. https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VLMVBLSOCQ&ref_type=126&shareUid=VlhBUlBaBgIO0O0O

View Original

- Reward

- 6

- 3

- Repost

- Share

ICameToSeeThePictur :

:

Stay strong and HODL💎View More

- Reward

- 1

- Comment

- Repost

- Share

The Casino will open in 2026. Here is why.

Right now, the economy is too tight for a speculative bubble.

Retail is fighting inflation, not chasing shitcoins. That changes next year.

The policy pivot is clear: Rate cuts are here, and 2026 stimulus checks are the political play.

When that fresh capital hits insolvent bank accounts, it won't go into savings bonds. It will go into the fastest horses on the track.

We are waiting for the "Liquidity Overflow" event. Survive the chop.

The mania is being manufactured by the Fed as we speak.

Right now, the economy is too tight for a speculative bubble.

Retail is fighting inflation, not chasing shitcoins. That changes next year.

The policy pivot is clear: Rate cuts are here, and 2026 stimulus checks are the political play.

When that fresh capital hits insolvent bank accounts, it won't go into savings bonds. It will go into the fastest horses on the track.

We are waiting for the "Liquidity Overflow" event. Survive the chop.

The mania is being manufactured by the Fed as we speak.

- Reward

- like

- Comment

- Repost

- Share

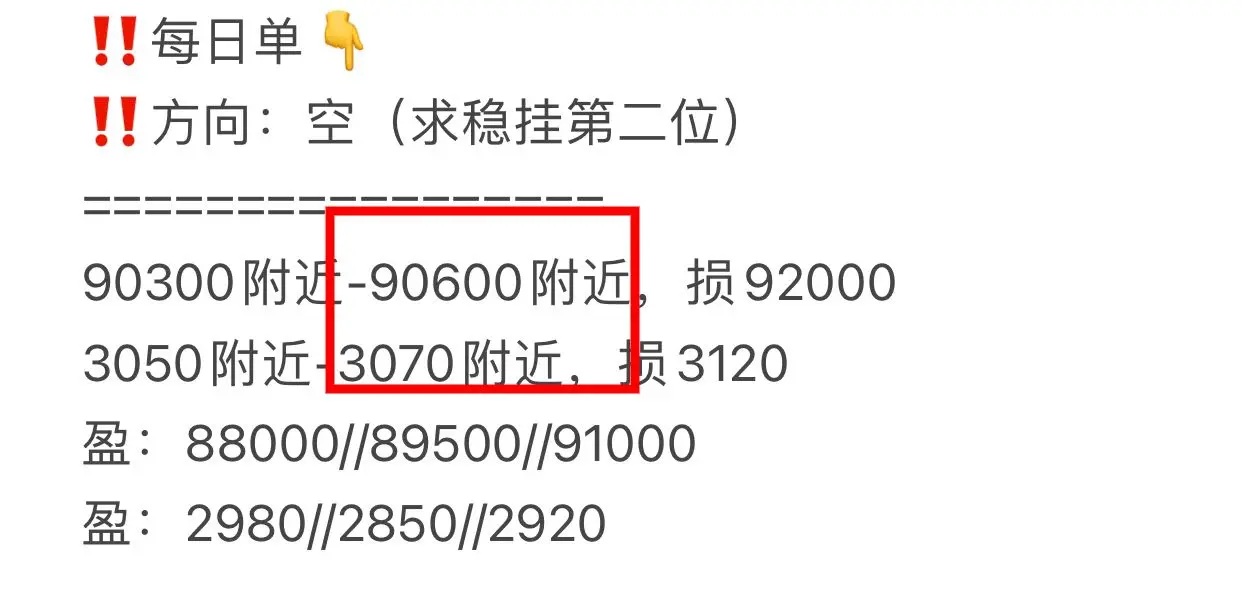

‼️Second order⬇️

‼️Direction: Short

=================

Around 88,900 - 89,200, stop loss at 90,600

Around 3,015 - 3,035, stop loss at 3,085

Profit: 87,300 // 85,500 // 83,800

Profit: 2,950 // 2,890 // 2,820

#2025Gate年度账单

View Original‼️Direction: Short

=================

Around 88,900 - 89,200, stop loss at 90,600

Around 3,015 - 3,035, stop loss at 3,085

Profit: 87,300 // 85,500 // 83,800

Profit: 2,950 // 2,890 // 2,820

#2025Gate年度账单

- Reward

- like

- Comment

- Repost

- Share

$Hype

Finally brokeout from the channel 30$ incoming 🙌

Finally brokeout from the channel 30$ incoming 🙌

HYPE2,65%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

December 26, 2025 BTC Contract Key Level Trading Plan

Core Trading Logic:

The market is in a textbook rectangular consolidation. There is only one high-probability strategy: go long when the price touches the lower boundary of the range (S1), and go short when it touches the upper boundary (P2). Abandon all guesses and operations at intermediate prices. This embodies the principle of “position over direction.”

#BTC行情分析 #今日你看涨还是看跌?

The dividing line between bulls and bears: 88,000 USDT (a psychological level, but not the core of trading. The true dividing line is the range boundary).

Upper res

Core Trading Logic:

The market is in a textbook rectangular consolidation. There is only one high-probability strategy: go long when the price touches the lower boundary of the range (S1), and go short when it touches the upper boundary (P2). Abandon all guesses and operations at intermediate prices. This embodies the principle of “position over direction.”

#BTC行情分析 #今日你看涨还是看跌?

The dividing line between bulls and bears: 88,000 USDT (a psychological level, but not the core of trading. The true dividing line is the range boundary).

Upper res

BTC0,3%

- Reward

- 2

- 1

- Repost

- Share

Ruiling :

:

On Saturday, fluctuations are generally not significant, liquidity is low, and the levels are similar to those on Friday. Updates on levels will be provided tomorrow.💰 $F /USDT

🔼 LONG

✳️ ENTRY (Use DCA STRATEGY) : 954 - 900

🎯 TARGETS - 985, 1015, 1050, 1110, 1200, 1300

🀄️ LEVERAGE - cross 10x

🔴 STOPLOSS - 874

🔼 LONG

✳️ ENTRY (Use DCA STRATEGY) : 954 - 900

🎯 TARGETS - 985, 1015, 1050, 1110, 1200, 1300

🀄️ LEVERAGE - cross 10x

🔴 STOPLOSS - 874

- Reward

- like

- Comment

- 1

- Share

$COPX

Breakout! 💥

Breakout! 💥

- Reward

- like

- Comment

- Repost

- Share

$BTC is squeezing tight, pressure is building. This range won’t stay quiet for long.

Price is still moving inside a descending channel, sellers remain in control but not aggressive. Rejection from here opens the door back to the 80k to 76k demand zone, where buyers previously stepped in hard.

The real shift only comes with a daily close above the channel. Until then, this is patience mode, not chase mode.

Eyes locked on BTC. Big move loading.

Price is still moving inside a descending channel, sellers remain in control but not aggressive. Rejection from here opens the door back to the 80k to 76k demand zone, where buyers previously stepped in hard.

The real shift only comes with a daily close above the channel. Until then, this is patience mode, not chase mode.

Eyes locked on BTC. Big move loading.

BTC0,3%

- Reward

- 1

- 1

- Repost

- Share

EagleEye :

:

Great post, you write really well- Reward

- like

- Comment

- Repost

- Share

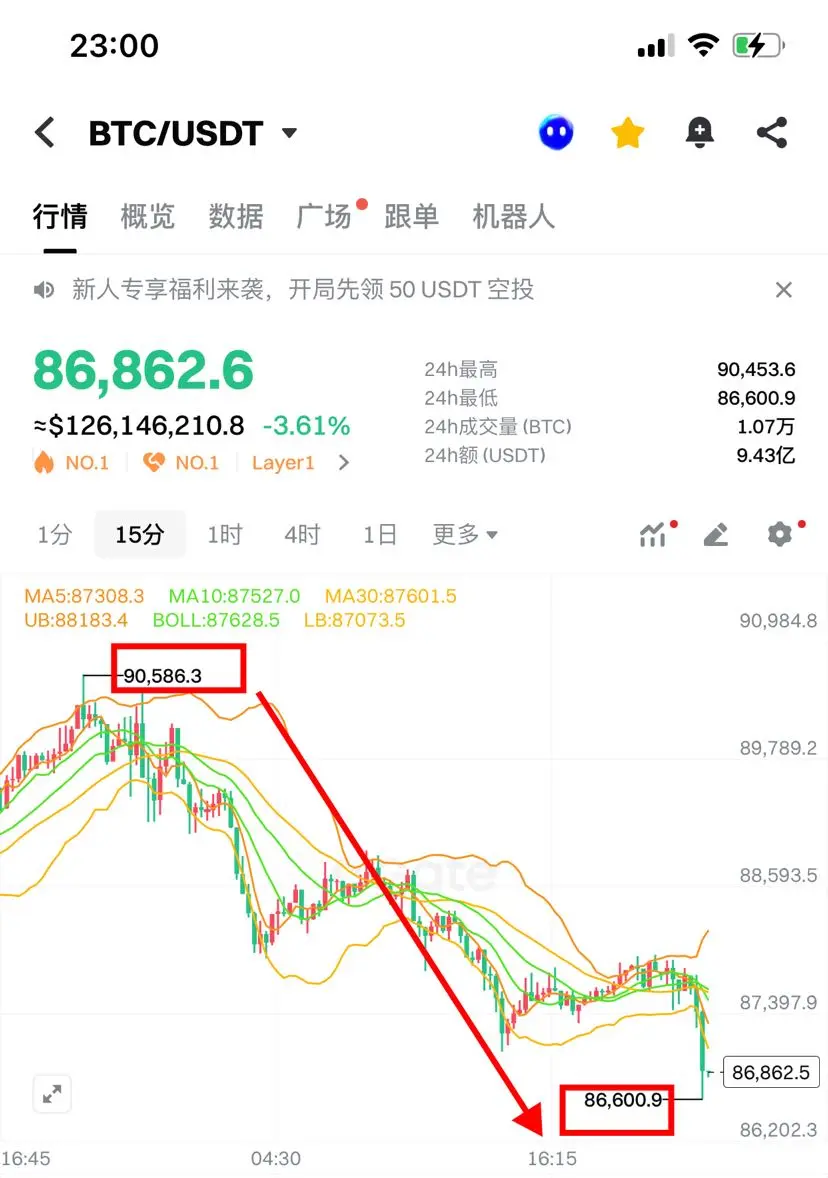

#晒出我的持仓收益#开单建议 跟着我开单的已经吃50点了

- Reward

- like

- Comment

- Repost

- Share

Reflecting on this year's crypto journey—from market surges to bold moves, every step is worth remembering. Check your #2025Gate年度账单 now, and relive your 2025 crypto journey with Gate. Share to receive 20 USDT. https://www.gate.com/zh/competition/your-year-in-review-2025?ref=BlZBA14&ref_type=126&shareUid=UVlBUFxW

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More121.53K Popularity

69.94K Popularity

39.53K Popularity

898 Popularity

13.44K Popularity

Hot Gate Fun

View More- MC:$3.53KHolders:10.00%

- MC:$3.53KHolders:10.00%

- MC:$3.59KHolders:20.04%

- MC:$3.53KHolders:10.00%

- MC:$3.53KHolders:10.00%

News

View MoreETH Breaks Through 2950 USDT

27 m

Next week's macro outlook: FOMC minutes become the focus amid low liquidity

8 h

PlanB: BTC is currently disconnected from the historical correlation with stocks and gold

9 h

Instagram influencer Andrew Tate suspected of involvement in crypto money laundering activities, has deposited $30 million into Railgun over the past two years.

9 h

Flow Foundation is investigating a potential security incident on the Flow network

10 h

Pin