Post content & earn content mining yield

placeholder

MEVictim

- Reward

- like

- Comment

- Repost

- Share

Chainlink price eyes rebound as LINK ETF nears $50m milestone as whales buy

Chainlink's price is stabilizing around $14 after a market rally. A bullish falling wedge pattern and increased ETF inflows signal a potential rise to $20. Supply on exchanges is decreasing, while whale accumulation supports demand for LINK tokens.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

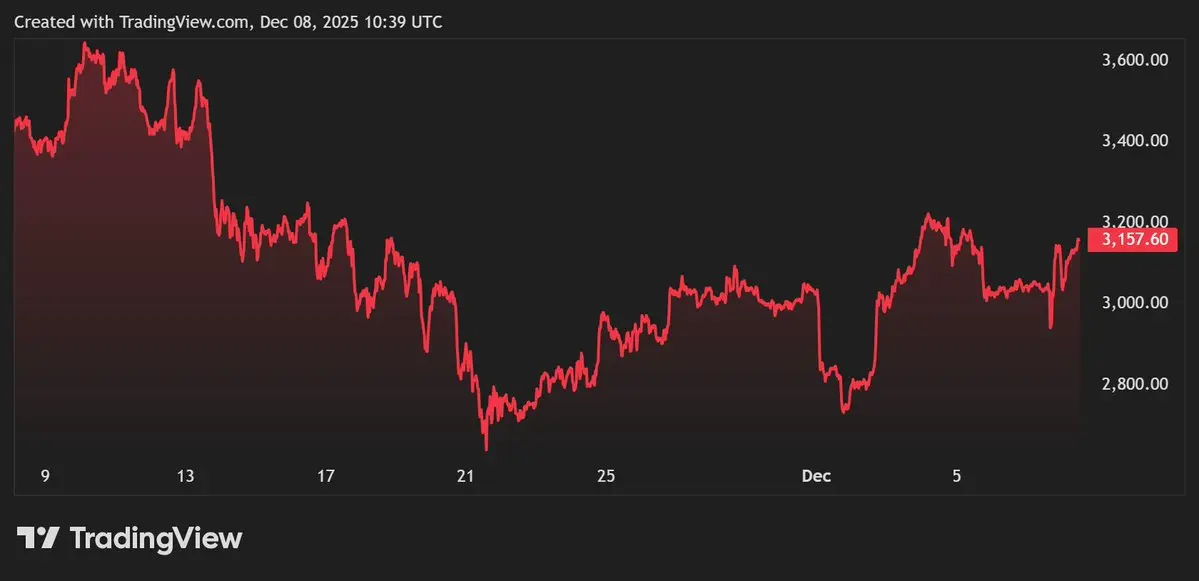

Ethereum whales are making a major bet on a rebound.

On-chain data shows they have opened $426M in new leveraged long positions, with several well-known wallets taking large exposure as ETH holds above the $3,000 level.

These positions include:

- 1011short: $169M long

- Anti-CZ: $194M long

- pension-usdt.eth: $62.5M long

On-chain data shows they have opened $426M in new leveraged long positions, with several well-known wallets taking large exposure as ETH holds above the $3,000 level.

These positions include:

- 1011short: $169M long

- Anti-CZ: $194M long

- pension-usdt.eth: $62.5M long

ETH6.35%

- Reward

- like

- Comment

- Repost

- Share

Solana price could rise by 25% if this resistance is broken

The price of Solana (SOL) has continued to remain in a narrow range for almost a month, ranging from $125 to $145 since mid-November. Both buyers and sellers have not been able to dominate significantly, causing the market to fall into a state of tug-of-war.

The price declines are all strongly supported at $125, in the

The price declines are all strongly supported at $125, in the

SOL4.48%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

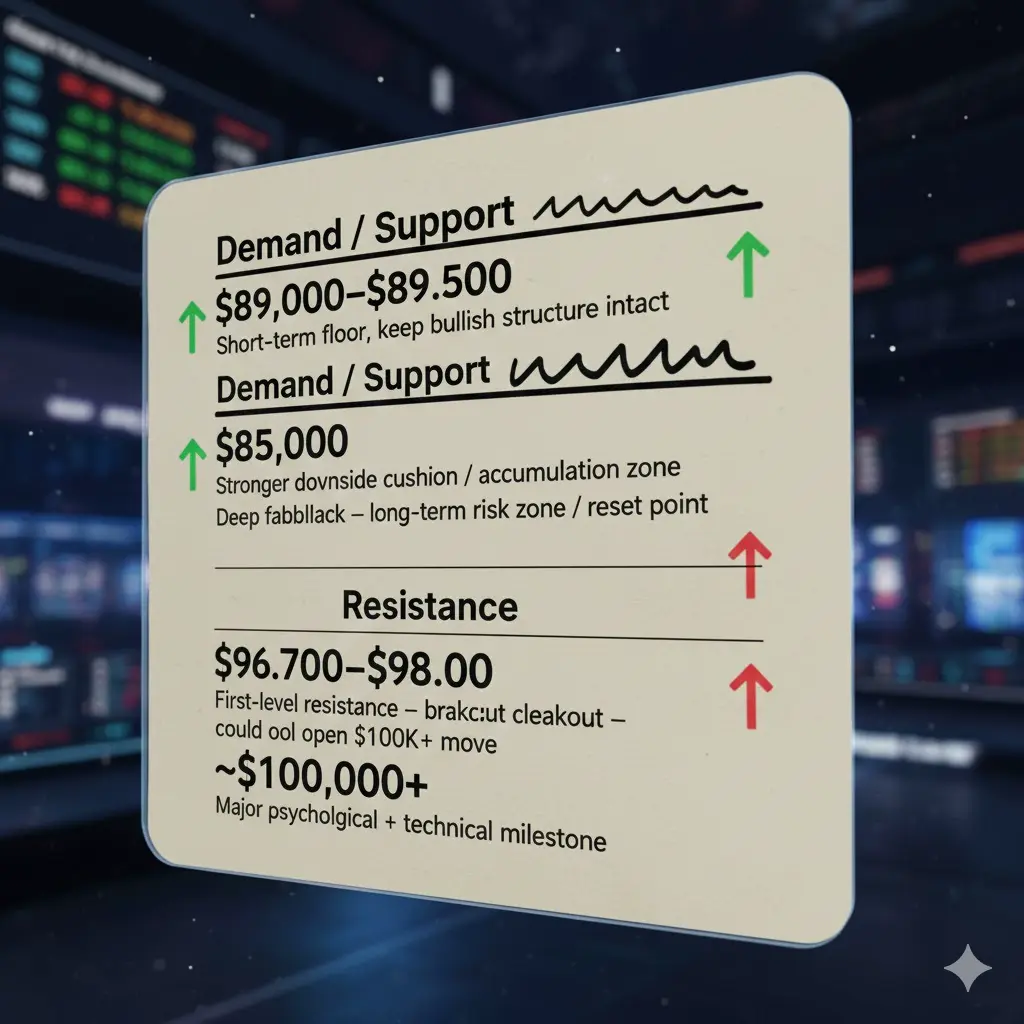

🔥🔥Turning Point🚀🚀

#BitcoinPriceWatch #CryptoMarketWatch #CryptoMarketRebounds #DecemberMarketOutlook

Bitcoin is trading around $89,000, moving within a narrow and high-energy range as the market awaits a decisive breakout. Support zones remain strong, but resistance continues to reject upward momentum, with buyers and sellers battling for control. Bitcoin is primed and the next move could be explosive. For traders, this phase is about patience, clearly defining levels, confirming volume, and disciplined risk management.

Disclaimer: This is for informational and educational purposes only a

View Original#BitcoinPriceWatch #CryptoMarketWatch #CryptoMarketRebounds #DecemberMarketOutlook

Bitcoin is trading around $89,000, moving within a narrow and high-energy range as the market awaits a decisive breakout. Support zones remain strong, but resistance continues to reject upward momentum, with buyers and sellers battling for control. Bitcoin is primed and the next move could be explosive. For traders, this phase is about patience, clearly defining levels, confirming volume, and disciplined risk management.

Disclaimer: This is for informational and educational purposes only a

- Reward

- 2

- 2

- Repost

- Share

Moathalmahdi :

:

Go full throttle 🚀View More

#比特币对比代币化黄金

Bitcoin Versus Tokenized Gold: A Detailed Comparison for Institutional Reserve Assets

The debate surrounding the optimal digital reserve asset has intensified, with institutional attention polarizing around two distinct contenders: Bitcoin (\text{BTC}) and Tokenized Gold (\text{XAUT} or similar digital gold representations). While both assets offer potential benefits for diversifying traditional portfolios, their fundamental properties, risk profiles, and roles within the digital ecosystem are starkly different, making the comparison a matter of utility versus digitization. Bitco

Bitcoin Versus Tokenized Gold: A Detailed Comparison for Institutional Reserve Assets

The debate surrounding the optimal digital reserve asset has intensified, with institutional attention polarizing around two distinct contenders: Bitcoin (\text{BTC}) and Tokenized Gold (\text{XAUT} or similar digital gold representations). While both assets offer potential benefits for diversifying traditional portfolios, their fundamental properties, risk profiles, and roles within the digital ecosystem are starkly different, making the comparison a matter of utility versus digitization. Bitco

- Reward

- 5

- 4

- Repost

- Share

HighAmbition :

:

Ape In 🚀View More

- Reward

- like

- Comment

- Repost

- Share

Japan just signaled a major shift

Authorities are preparing to treat Ethereum as a formal financial instrument

This isn’t a barrier

It’s the kind of regulatory definition that opens the gates for institutional money

Clear rules precede widespread adoption

If you’re already positioned in $ETH, you’re standing in front of the next wave.

Authorities are preparing to treat Ethereum as a formal financial instrument

This isn’t a barrier

It’s the kind of regulatory definition that opens the gates for institutional money

Clear rules precede widespread adoption

If you’re already positioned in $ETH, you’re standing in front of the next wave.

ETH6.35%

- Reward

- like

- Comment

- Repost

- Share

What Is Bittensor (TAO)? The Decentralized AI Network Facing Its First Halving

Bittensor (TAO) is an open-source, blockchain-based protocol that creates a peer-to-peer marketplace for machine intelligence.

- Reward

- like

- Comment

- Repost

- Share

BlackRock officially submits Ethereum staking ETF application—Is Ethereum entering the era of "price + yield" dual engines?

On December 8, 2025, the world’s largest asset management company, BlackRock, officially filed a prospectus for the iShares Staked Ethereum Trust ETF with the U.S. Securities and Exchange Commission. This brand-new product will become BlackRock’s fourth crypto-related ETF, following its spot Bitcoin, spot Ethereum, and “Bitcoin yield” ETFs.

This is not the first time BlackRock has shown interest in Ethereum’s staking capabilities. As early as July this year, the company submitted a rule change request, seeking to add staking functionality to its existing iShares Ethereum Trust (ETHA). Even earlier, in May, the head of BlackRock’s digital assets division stated that current Ethereum ETFs are “not perfect” due to the lack of staking features.

01 Event Focus: From Preparation to Formal Application

According to Bloomberg analysts on social

This is not the first time BlackRock has shown interest in Ethereum’s staking capabilities. As early as July this year, the company submitted a rule change request, seeking to add staking functionality to its existing iShares Ethereum Trust (ETHA). Even earlier, in May, the head of BlackRock’s digital assets division stated that current Ethereum ETFs are “not perfect” due to the lack of staking features.

01 Event Focus: From Preparation to Formal Application

According to Bloomberg analysts on social

- Reward

- like

- Comment

- Repost

- Share

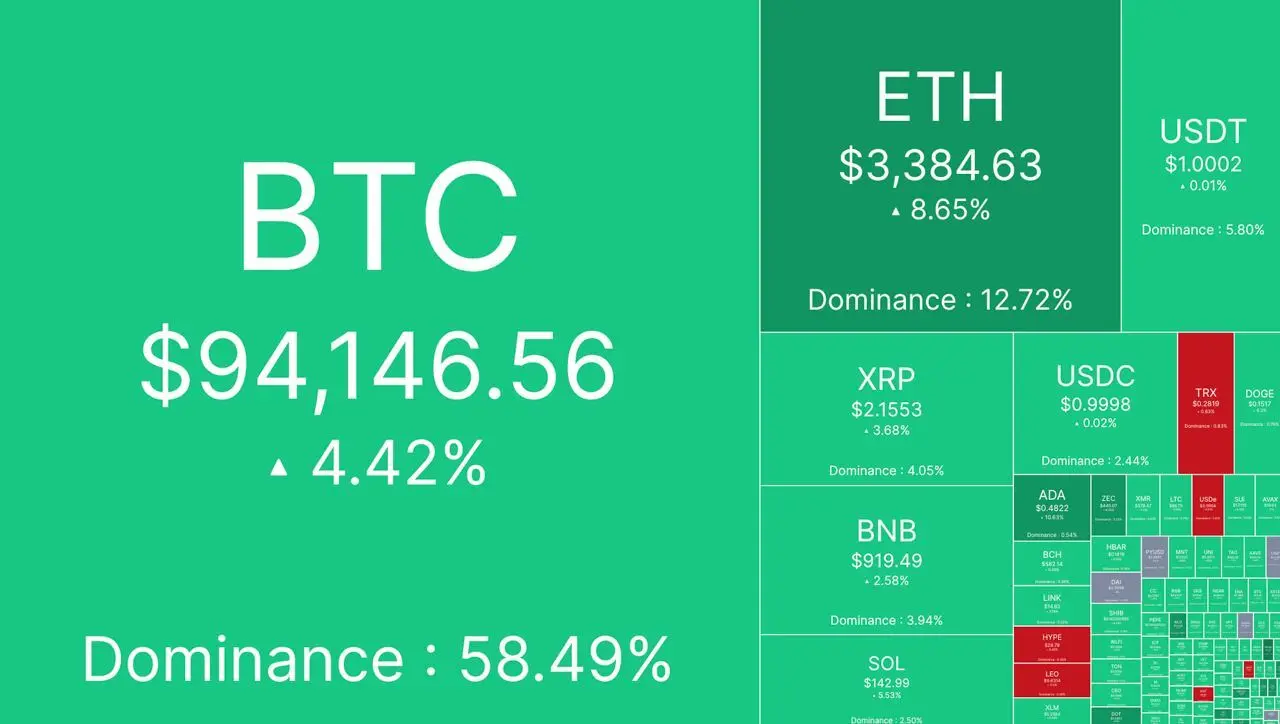

#DecemberMarketOutlook

#FedRateCutPrediction

#CryptoMarketWatch

✨$150 Billion Surge 💪

👉On December 9, 2025, the crypto market made a record jump, adding $150 billion to its total market capitalization in just 90 minutes. Total market capitalization reached $3.2 trillion, while Bitcoin (BTC) surpassed $92,000, marking a 2.2% daily gain. Ethereum (ETH) also approached $3,000, triggering an altcoin rally. This surge was supported by the positive performance of more than 95 top-100 coins.

✨Market enthusiasm was fueled by $54.79 million inflows into US BTC ETFs and signals of quantitative easi

#FedRateCutPrediction

#CryptoMarketWatch

✨$150 Billion Surge 💪

👉On December 9, 2025, the crypto market made a record jump, adding $150 billion to its total market capitalization in just 90 minutes. Total market capitalization reached $3.2 trillion, while Bitcoin (BTC) surpassed $92,000, marking a 2.2% daily gain. Ethereum (ETH) also approached $3,000, triggering an altcoin rally. This surge was supported by the positive performance of more than 95 top-100 coins.

✨Market enthusiasm was fueled by $54.79 million inflows into US BTC ETFs and signals of quantitative easi

- Reward

- 7

- 9

- Repost

- Share

Yusfirah :

:

HODL Tight 💪View More

🚨 BREAKING: JUPITER EXEC ADMITS “ZERO CONTAGION RISK” CLAIM WAS “NOT 100% CORRECT” AFTER BACKLASH.

• Kash Dhanda (COO) acknowledged deleted posts overstated vault isolation.

• Rival Kamino blocked Jupiter’s migration tools, citing rehypothecation risks.

• Critics say assets aren’t truly isolated, warning of cross-contamination.

• Jupiter Lend still boasts $1B+ TVL, but trust concerns remain.

👉 Debate highlights growing scrutiny of risk disclosures in Solana’s DeFi ecosystem.

• Kash Dhanda (COO) acknowledged deleted posts overstated vault isolation.

• Rival Kamino blocked Jupiter’s migration tools, citing rehypothecation risks.

• Critics say assets aren’t truly isolated, warning of cross-contamination.

• Jupiter Lend still boasts $1B+ TVL, but trust concerns remain.

👉 Debate highlights growing scrutiny of risk disclosures in Solana’s DeFi ecosystem.

- Reward

- like

- Comment

- Repost

- Share

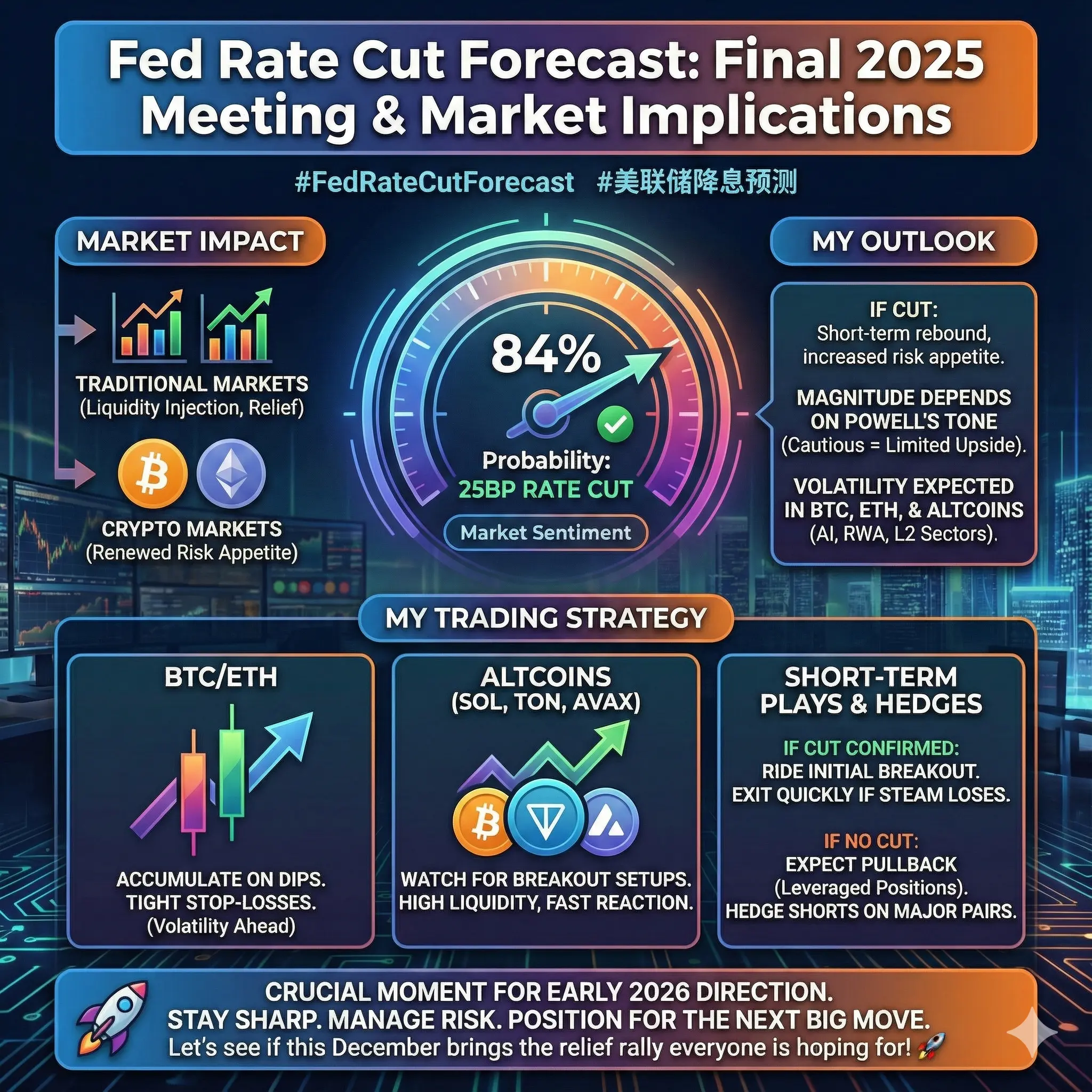

#FedRateCutForecast #美联储降息预测

As we approach the final Fed meeting of 2025, the entire market is holding its breath. With an 84% probability of a 25BP rate cut, traders are bracing for a potential shift in sentiment. A rate cut at this stage—after months of tightening pressure—could inject fresh liquidity and bring relief to both traditional and crypto markets.

📉 My Outlook:

If the Fed cuts rates, we could witness a short-term rebound driven by renewed risk appetite. However, the magnitude of the bounce may depend on Powell’s tone. A cautious or uncertain outlook could limit upside momentum. I

As we approach the final Fed meeting of 2025, the entire market is holding its breath. With an 84% probability of a 25BP rate cut, traders are bracing for a potential shift in sentiment. A rate cut at this stage—after months of tightening pressure—could inject fresh liquidity and bring relief to both traditional and crypto markets.

📉 My Outlook:

If the Fed cuts rates, we could witness a short-term rebound driven by renewed risk appetite. However, the magnitude of the bounce may depend on Powell’s tone. A cautious or uncertain outlook could limit upside momentum. I

- Reward

- 10

- 13

- Repost

- Share

BabaJi :

:

1000x Vibes 🤑View More

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

- Trending TopicsView More

108.63K Popularity

30.1K Popularity

9.62K Popularity

7.26K Popularity

37.13K Popularity

- Hot Gate FunView More

- MC:$3.63KHolders:10.00%

- MC:$3.64KHolders:10.00%

- MC:$3.69KHolders:20.04%

- MC:$3.63KHolders:10.00%

- MC:$3.63KHolders:10.00%

- Pin