#BitwiseFilesforUNISpotETF

Institutional Crypto Breakthrough & Market Context

Bitwise Asset Management has officially filed with the U.S. Securities and Exchange Commission (SEC) to launch a spot Uniswap (UNI) ETF, marking a historic step toward bringing a regulated DeFi governance‑token product into mainstream financial markets. This is not just another filing — it signals deeper institutional interest in decentralized finance and legitimizes UNI’s role as a foundational protocol asset. ()

📌 What’s Happening?

Bitwise has submitted a Form S‑1 and established a Delaware statutory trust aimed at offering an ETF that directly tracks the value of UNI tokens held in custody. Unlike futures‑based products, a spot ETF holds the actual asset, giving investors regulated exposure without needing to manage wallets or private keys themselves. ()

📊 Deep Institutional Implications

1️⃣ Bridge Between TradFi & DeFi

A spot ETF backed by UNI creates a regulated on‑ramp for institutional capital — such as pension funds, mutual funds, and RIAs — that are traditionally barred from direct crypto investments. This could widen UNI’s investor base and add depth to market liquidity. ()

2️⃣ Regulatory Significance

Filing an S‑1 with the SEC is a formal, transparent step that precedes regulatory review. While approval is not guaranteed, this move reflects a more constructive regulatory environment compared to earlier skepticism toward DeFi tokens. It also follows the end of past enforcement actions against Uniswap Labs, clearing a path for compliance‑based products. ()

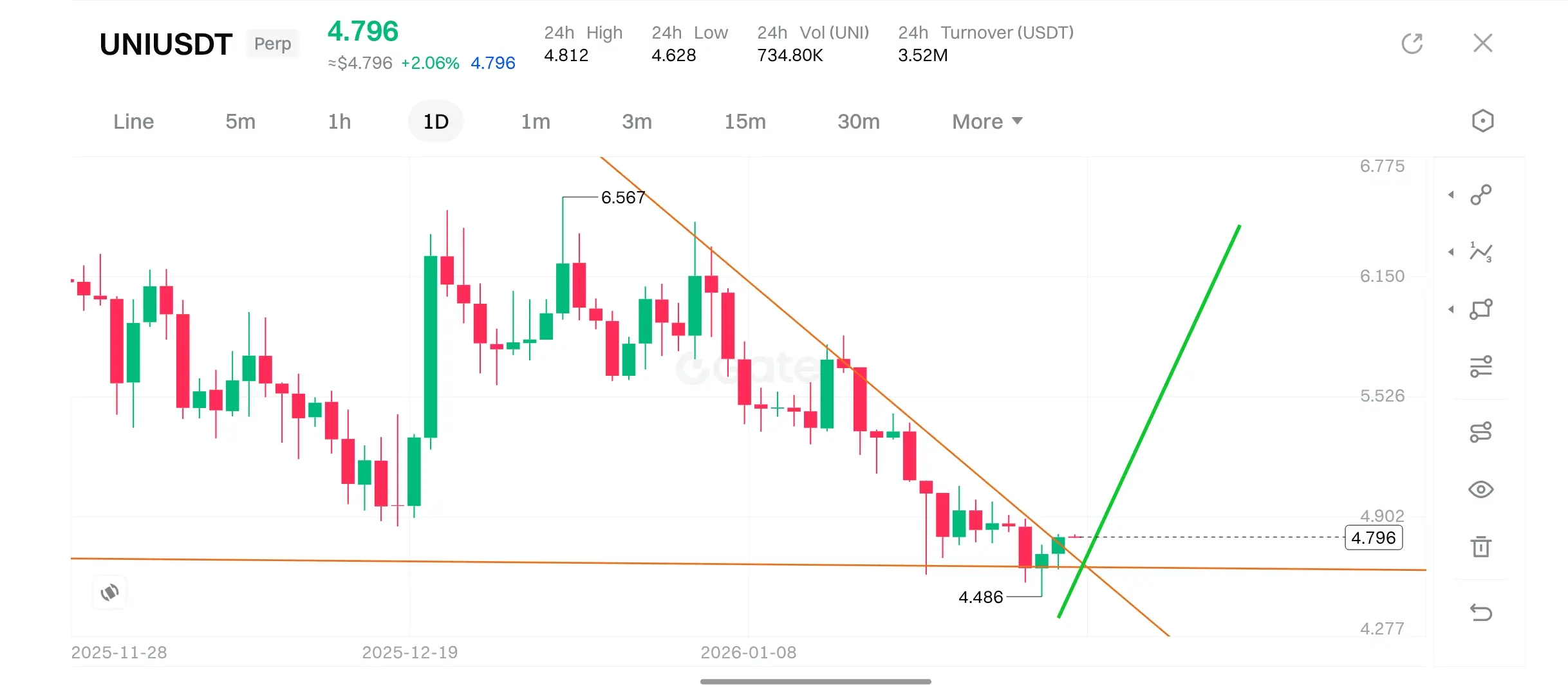

3️⃣ Market Reaction & Price Context

Ironically, despite the institutional milestone, UNI’s price has remained under pressure — trading near multi‑year lows as broader crypto market sentiment weakens and macro risk aversion persists. This divergence highlights that fundamental news doesn’t always produce immediate price rallies, especially when macro volatility dominates. ()

📈 Strategic Outlook for Investors

• Institutional Demand: A spot ETF could eventually attract asset managers and wealth portfolios seeking regulated DeFi exposure.

• Liquidity & Participation: Increased visibility may lead to deeper liquidity and more sophisticated derivatives tied to UNI.

• Long‑Term Adoption: Even if price doesn’t spike immediately, the structural adoption narrative strengthens UNI’s case as a serious protocol asset.

⚠️ Risk Note: Regulatory review timelines and broader market conditions still pose uncertainty. A filing only begins the process — SEC approval is not guaranteed and can be delayed or rejected. ()

Institutional Crypto Breakthrough & Market Context

Bitwise Asset Management has officially filed with the U.S. Securities and Exchange Commission (SEC) to launch a spot Uniswap (UNI) ETF, marking a historic step toward bringing a regulated DeFi governance‑token product into mainstream financial markets. This is not just another filing — it signals deeper institutional interest in decentralized finance and legitimizes UNI’s role as a foundational protocol asset. ()

📌 What’s Happening?

Bitwise has submitted a Form S‑1 and established a Delaware statutory trust aimed at offering an ETF that directly tracks the value of UNI tokens held in custody. Unlike futures‑based products, a spot ETF holds the actual asset, giving investors regulated exposure without needing to manage wallets or private keys themselves. ()

📊 Deep Institutional Implications

1️⃣ Bridge Between TradFi & DeFi

A spot ETF backed by UNI creates a regulated on‑ramp for institutional capital — such as pension funds, mutual funds, and RIAs — that are traditionally barred from direct crypto investments. This could widen UNI’s investor base and add depth to market liquidity. ()

2️⃣ Regulatory Significance

Filing an S‑1 with the SEC is a formal, transparent step that precedes regulatory review. While approval is not guaranteed, this move reflects a more constructive regulatory environment compared to earlier skepticism toward DeFi tokens. It also follows the end of past enforcement actions against Uniswap Labs, clearing a path for compliance‑based products. ()

3️⃣ Market Reaction & Price Context

Ironically, despite the institutional milestone, UNI’s price has remained under pressure — trading near multi‑year lows as broader crypto market sentiment weakens and macro risk aversion persists. This divergence highlights that fundamental news doesn’t always produce immediate price rallies, especially when macro volatility dominates. ()

📈 Strategic Outlook for Investors

• Institutional Demand: A spot ETF could eventually attract asset managers and wealth portfolios seeking regulated DeFi exposure.

• Liquidity & Participation: Increased visibility may lead to deeper liquidity and more sophisticated derivatives tied to UNI.

• Long‑Term Adoption: Even if price doesn’t spike immediately, the structural adoption narrative strengthens UNI’s case as a serious protocol asset.

⚠️ Risk Note: Regulatory review timelines and broader market conditions still pose uncertainty. A filing only begins the process — SEC approval is not guaranteed and can be delayed or rejected. ()