Post content & earn content mining yield

placeholder

XiaoZhangWantsToMakeMoney.

Betting small to win big, the principal did not exceed 300

View Original

- Reward

- like

- Comment

- Repost

- Share

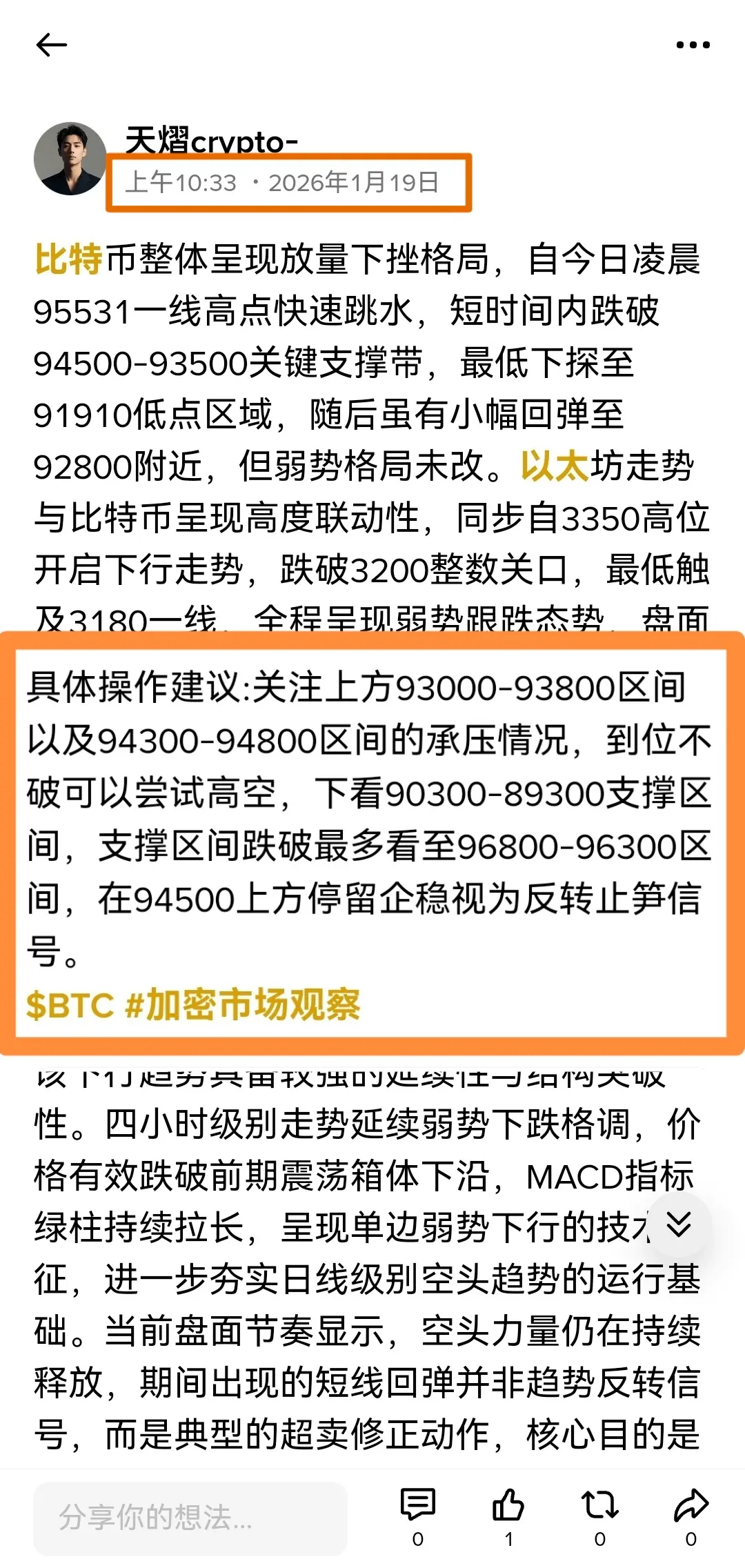

Market Structure: Higher Highs & Lower Lows

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 4

- Repost

- Share

目标5万U :

:

How much have you lost on Pi? I also started playing Pi after losing 30,000.View More

(*)

黑曼巴

Created By@MarketMaker,MarketMaker,IWas

Subscription Progress

0.00%

MC:

$0

Create My Token

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

JUST IN: #Bitcoin falls under $90,000 as $190,000,000 is liquidated from the #crypto market in the past 60 minutes. #CryptoScam

$BTC

$BTC

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

It's just a normal dip. Yesterday, I reduced my position at 93,300 but didn't sell everything, thinking of keeping a core position to play around. Although this morning I was down 25% and broke even!

But I still held on! A 2x unrealized loss, which is only 2% of the principal!

If you can't withstand a 2% unrealized loss, can you really adapt to the rhythm of futures trading?

The premise of staying calm and steady is good position control!

If you don't control it well, there won't be a second chance!

FOMO mentality that thinks a drop is the end of the world and a rise is a bull run!

But I still held on! A 2x unrealized loss, which is only 2% of the principal!

If you can't withstand a 2% unrealized loss, can you really adapt to the rhythm of futures trading?

The premise of staying calm and steady is good position control!

If you don't control it well, there won't be a second chance!

FOMO mentality that thinks a drop is the end of the world and a rise is a bull run!

BTC-2,61%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

萝卜纸巾猫

萝卜纸巾猫

Created By@It_sLolitaGogo

Listing Progress

0.00%

MC:

$3.4K

Create My Token

In this market that has already retreated to a low level, from a technical perspective, support levels, indicator divergences, and trend reversal points may all signal a buy opportunity. Opportunities can be seen everywhere.

But in the same market, some can catch the main upward wave, while others are repeatedly shaken out in oscillations. The problem is often not about "whether there is an opportunity," but whether you have the ability to identify high-probability opportunities, whether you have strict position management and stop-loss/take-profit discipline, and whether you can stick to your

View OriginalBut in the same market, some can catch the main upward wave, while others are repeatedly shaken out in oscillations. The problem is often not about "whether there is an opportunity," but whether you have the ability to identify high-probability opportunities, whether you have strict position management and stop-loss/take-profit discipline, and whether you can stick to your

- Reward

- like

- Comment

- Repost

- Share

Positive news realized, looking for downward space.

- Reward

- like

- Comment

- Repost

- Share

0xfF72205628532245149f0DEEe1219504451B7407

- Reward

- like

- Comment

- Repost

- Share

CPS Chaps X Selvedgework ผ้า 15oz limited edition 350 ตัว

- Reward

- like

- Comment

- Repost

- Share

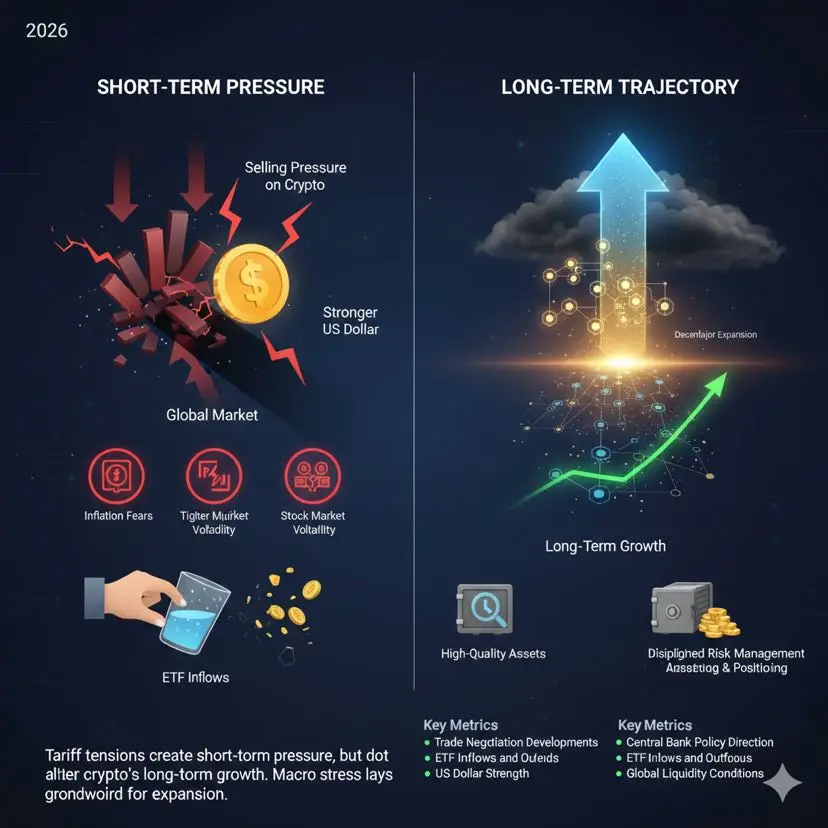

#FutureOutlook2026

Future Outlook & Market Impact (2026)

Rising global tariff tensions and renewed trade restrictions have become a powerful macro force shaping financial markets in 2026. As geopolitical pressure increases, cryptocurrencies—highly sensitive to liquidity conditions and investor psychology—are once again responding to uncertainty on a global scale.

When tariff conflicts escalate, markets typically shift into a risk-off environment. Investors reduce exposure to volatile assets and move capital toward perceived safety. This transition often creates immediate selling pressure acros

Future Outlook & Market Impact (2026)

Rising global tariff tensions and renewed trade restrictions have become a powerful macro force shaping financial markets in 2026. As geopolitical pressure increases, cryptocurrencies—highly sensitive to liquidity conditions and investor psychology—are once again responding to uncertainty on a global scale.

When tariff conflicts escalate, markets typically shift into a risk-off environment. Investors reduce exposure to volatile assets and move capital toward perceived safety. This transition often creates immediate selling pressure acros

BTC-2,61%

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

The Year of the Horse Usachi is not here to explain the market, but to mock it. While others are still waiting for confirmation and drawing trend lines, this rabbit has already been rushing around wildly, riding the inertia of the Year of the Horse. It represents retail investor sentiment, community playfulness, and irrational consensus—no roadmap, no promises, only constantly shared memes and increasingly noisy chat rooms. Here, we don't sell rationality, only amplify emotions; we don't guarantee success, only guarantee participation. This is not an investment plan, but a meme conspiracy expe

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$53.33KHolders:49

100.00%

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3817?ref=VLBNVAHDVQ&ref_type=132

- Reward

- 2

- 1

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More6.97K Popularity

35.51K Popularity

49.63K Popularity

11.67K Popularity

8.91K Popularity

News

View MoreMask Network takes over Lens Protocol, aiming to create a "truly user-driven product"

1 m

Solana Labs Co-Founder: SKR at low prices benefits early builders; ecosystem maturity takes 10 years

13 m

The Dogecoin Foundation-supported House of Doge project launches DOGE payment app "Such"

15 m

After launching on NPM, Alpha increased by 4218.95%, current price 0.0024421 USDT

18 m

In the past 4 hours, the entire network has been liquidated for $236 million, mainly long positions.

22 m

Pin