Post content & earn content mining yield

placeholder

Aries11111111

Check out Gate and join me in the hottest event! https://www.gate.com/id/campaigns/3959?ref_type=132

- Reward

- like

- Comment

- Repost

- Share

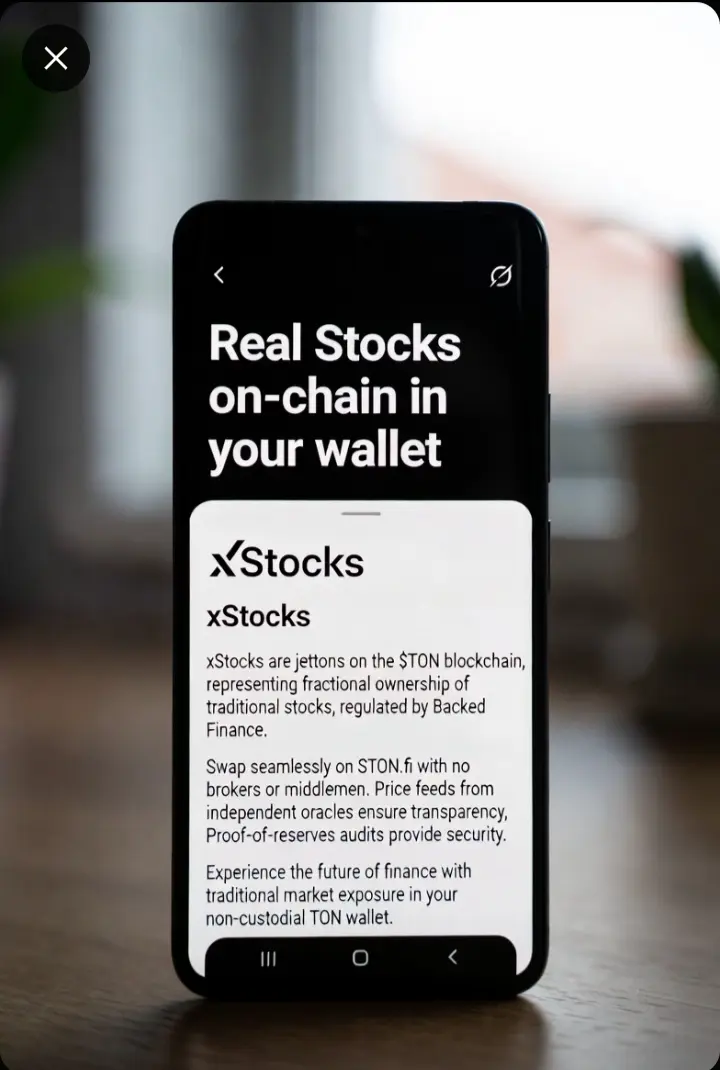

Real Stocks → On‑Chain in Your Wallet: How xStocks Actually Work 💥

For the first time ever, familiar traditional market assets are being brought fully onto the $TON blockchain as xStocks real stock exposure you can hold, trade, and use right alongside your crypto. But how does something like Apple or Tesla become a jetton you see in your wallet? Let’s break it down simply. �

When you swap for an xStock on STONfi, what you’re really doing is accessing an on‑chain representation of a real asset that’s been created through a regulated process. Behind the scenes, a licensed provider like Backed F

For the first time ever, familiar traditional market assets are being brought fully onto the $TON blockchain as xStocks real stock exposure you can hold, trade, and use right alongside your crypto. But how does something like Apple or Tesla become a jetton you see in your wallet? Let’s break it down simply. �

When you swap for an xStock on STONfi, what you’re really doing is accessing an on‑chain representation of a real asset that’s been created through a regulated process. Behind the scenes, a licensed provider like Backed F

TON1,65%

- Reward

- 1

- Comment

- Repost

- Share

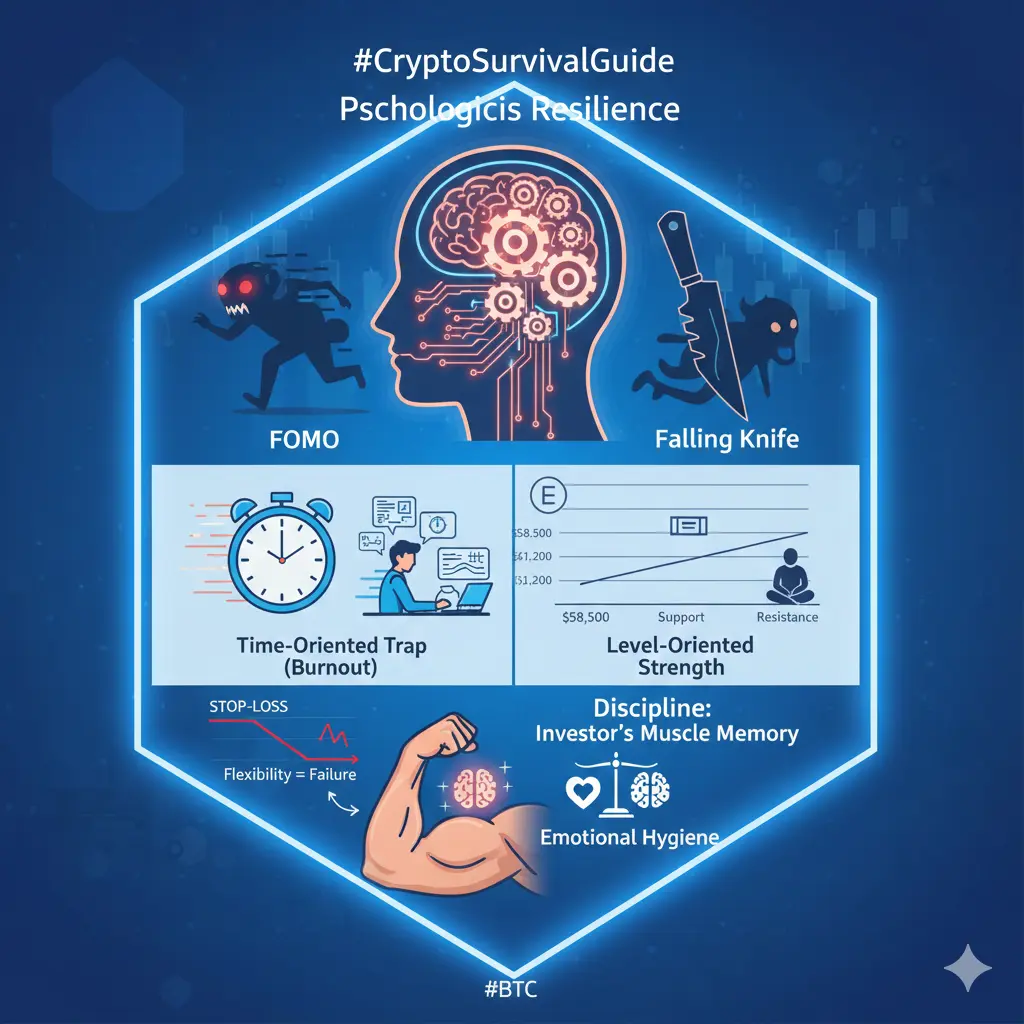

Psychological Resilience: Investing Beyond Emotions

As of February 2026, the high volatility observed in the markets is not just a financial test for investors but also a profound psychological battle. With Bitcoin’s struggle at the $60,000 threshold and the breakdown of its correlation with gold due to urgent liquidity needs (margin calls), mental fortitude has become more critical than ever.

1. Meet Your Inner Enemy: Fear and FOMO

Amidst the red candles dominating the screens, your greatest adversary is not chart patterns, but the primitive defense mechanisms of your brain.

FOMO (Fear of Mis

As of February 2026, the high volatility observed in the markets is not just a financial test for investors but also a profound psychological battle. With Bitcoin’s struggle at the $60,000 threshold and the breakdown of its correlation with gold due to urgent liquidity needs (margin calls), mental fortitude has become more critical than ever.

1. Meet Your Inner Enemy: Fear and FOMO

Amidst the red candles dominating the screens, your greatest adversary is not chart patterns, but the primitive defense mechanisms of your brain.

FOMO (Fear of Mis

BTC-1,41%

- Reward

- 8

- 8

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

BP

剥皮

Created By@EatABubble

Listing Progress

0.00%

MC:

$2.42K

Create My Token

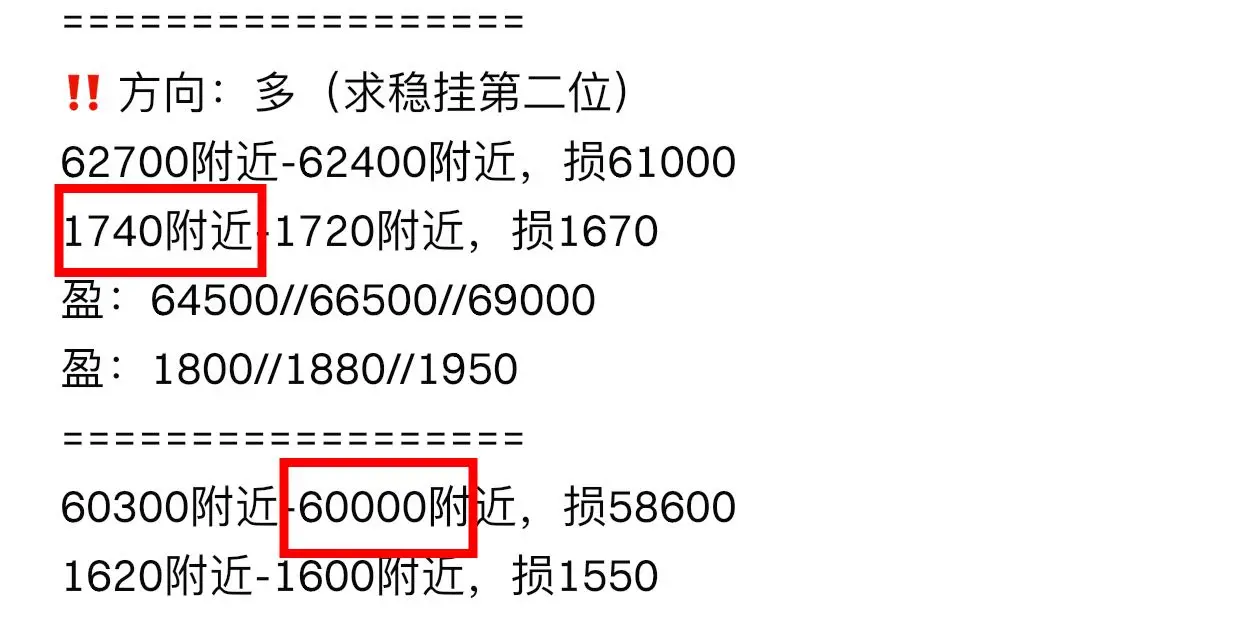

‼️Second order⬇️

‼️Direction: Long (prefer stability, second priority)

Around 67,300 - around 67,000, stop loss at 65,600

Around 2,010 - around 1,990, stop loss at 1,940

Profit: 69,000 // 70,500 // 72,200

Profit: 2,060 // 2,120 // 2,190

#Gate1月透明度报告

View Original‼️Direction: Long (prefer stability, second priority)

Around 67,300 - around 67,000, stop loss at 65,600

Around 2,010 - around 1,990, stop loss at 1,940

Profit: 69,000 // 70,500 // 72,200

Profit: 2,060 // 2,120 // 2,190

#Gate1月透明度报告

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#GlobalTechSell-OffHitsRiskAssets #GlobalTechSell-OffHitsRiskAssets

The global technology sell-off has become one of the most impactful market events of the year, reverberating across nearly every risk asset class. What began as pressure in high growth, valuation-sensitive tech names has widened into a broader re-pricing of risk around the world. This shift is not confined to equity markets alone. It now touches bonds, commodities, cryptocurrencies, emerging market assets, and investor sentiment in ways that are both direct and psychological.

When leading technology companies experience sharp

The global technology sell-off has become one of the most impactful market events of the year, reverberating across nearly every risk asset class. What began as pressure in high growth, valuation-sensitive tech names has widened into a broader re-pricing of risk around the world. This shift is not confined to equity markets alone. It now touches bonds, commodities, cryptocurrencies, emerging market assets, and investor sentiment in ways that are both direct and psychological.

When leading technology companies experience sharp

- Reward

- like

- Comment

- Repost

- Share

I made $3.2M from memecoins in the first 7 days of February.A year ago I was selling pussy.Lock in.

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

【$CRV Signal】Short Position Price drops with stable open interest, beware of main players distributing

$CRV Price drops but open interest remains stable. Combined with persistent negative Taker buy volume and order book sell-side accumulation, this is not simply a long squeeze but more likely an orderly distribution by the main players before a key resistance.

🎯 Direction: Short

Market logic: Price retraced from the high of 0.264, but open interest stayed steady, with no sudden drop caused by a squeeze. The key indicator is the continuous negative Taker buy volume, and the 4H K-line buy/sel

View Original$CRV Price drops but open interest remains stable. Combined with persistent negative Taker buy volume and order book sell-side accumulation, this is not simply a long squeeze but more likely an orderly distribution by the main players before a key resistance.

🎯 Direction: Short

Market logic: Price retraced from the high of 0.264, but open interest stayed steady, with no sudden drop caused by a squeeze. The key indicator is the continuous negative Taker buy volume, and the 4H K-line buy/sel

- Reward

- like

- Comment

- Repost

- Share

MICHAEL SAYOR: "WE CAN BUY MORE BITCOIN THAN SELLERS CAN SELL." OVER 700,000 BTC AND COUNTING. WHAT A LEGEND! 🔥

BTC-1,41%

- Reward

- like

- Comment

- Repost

- Share

Whales are still buying: BitMine-linked addresses scoop up another 20,000 ETH, worth over $40 million

- Reward

- like

- Comment

- Repost

- Share

📊 212,479,300,000 $SHIB : Key Shiba Inu Metric Says Demand Is Back

After multiple days of flashing consistent bearish signals, the Shiba Inu exchange flow is finally seeing demand return to the market as the price makes a massive comeback.

Following the recent volatility faced with the broad crypto market that saw leading cryptocurrencies, including Bitcoin and meme coins like Shiba Inu, plunge significantly in their trading prices, the market has finally regained momentum as Shiba Inu has made a huge comeback in its trading price.

The massive increase in the Shiba Inu price has been accompa

After multiple days of flashing consistent bearish signals, the Shiba Inu exchange flow is finally seeing demand return to the market as the price makes a massive comeback.

Following the recent volatility faced with the broad crypto market that saw leading cryptocurrencies, including Bitcoin and meme coins like Shiba Inu, plunge significantly in their trading prices, the market has finally regained momentum as Shiba Inu has made a huge comeback in its trading price.

The massive increase in the Shiba Inu price has been accompa

SHIB0,51%

- Reward

- like

- Comment

- Repost

- Share

STARX

STARX Token

Created By@CoinShengke

Listing Progress

15.44%

MC:

$4.95K

Create My Token

How can I sleep when this trader turned $0.79 into $860K

- Reward

- 1

- 1

- Repost

- Share

CryptoLoverArtist :

:

wow. that's gambling. lolsGood morning, legends! 🤝🐶

Gm CT 📈 🌐🫡

Happy weekend! ✌️☀️

Dogecoin to the moon! 🚀🌑

Gm CT 📈 🌐🫡

Happy weekend! ✌️☀️

Dogecoin to the moon! 🚀🌑

DOGE-0,04%

- Reward

- 2

- Comment

- Repost

- Share

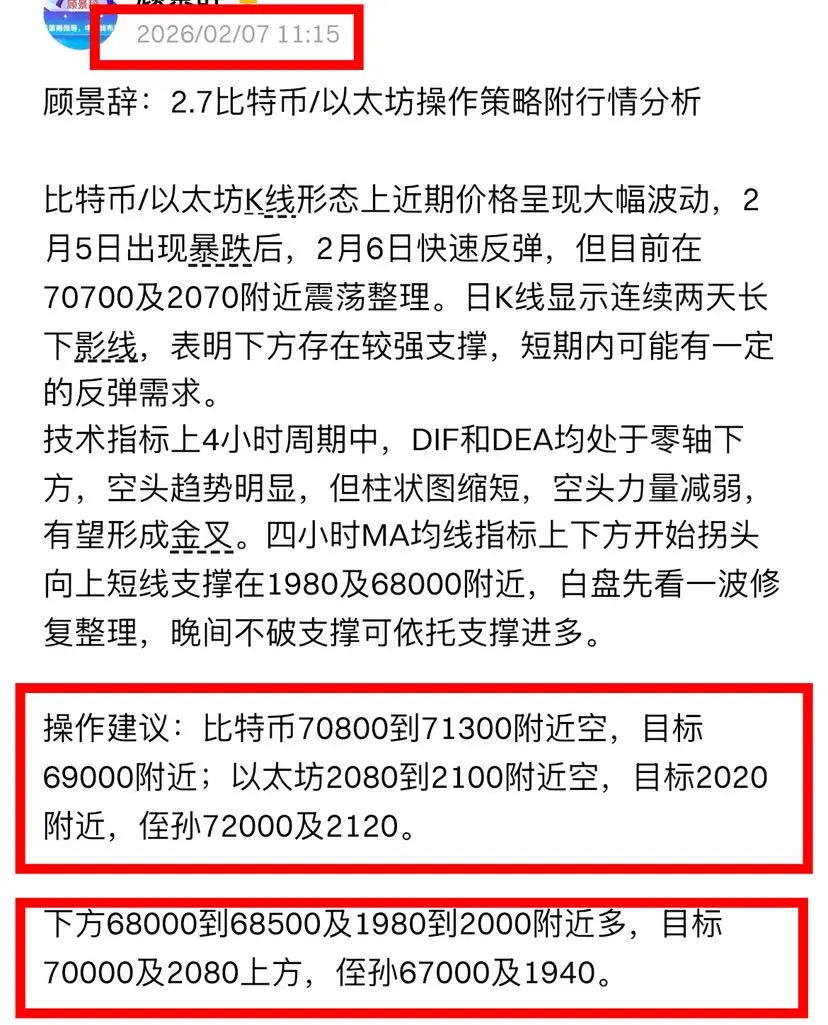

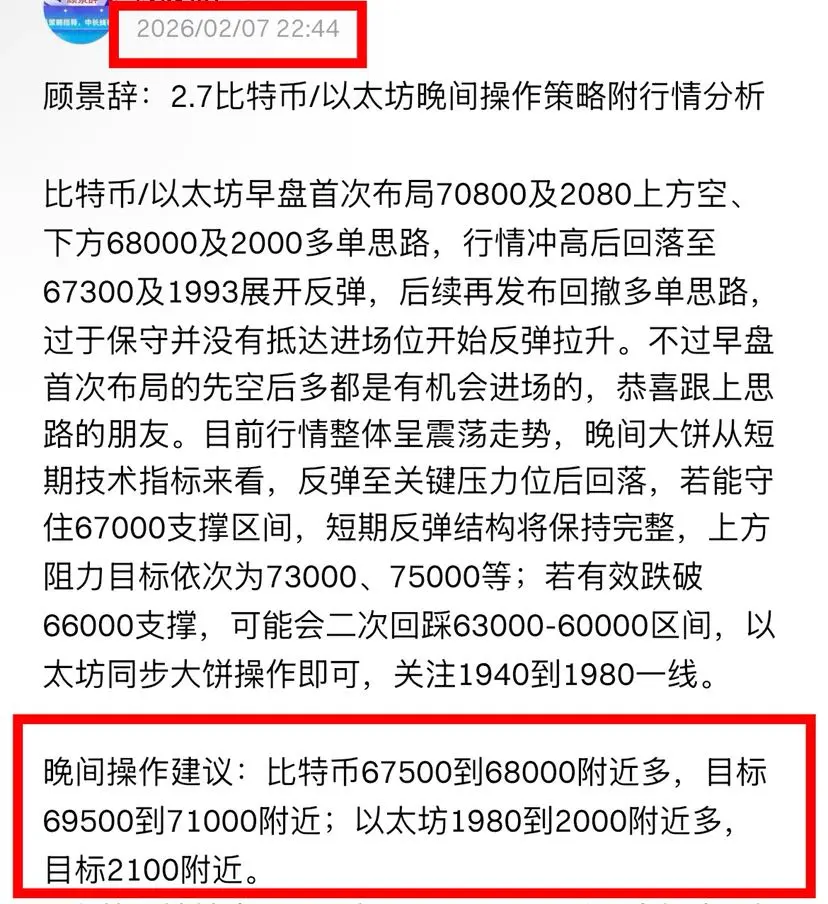

Gu Jingci: Bitcoin/Ethereum yesterday initially shorted then went long, overall space was pretty good

Bitcoin/Ethereum yesterday morning, the strategy was to short above 70800 and 2080. The market surged and then pulled back to 67300 and 1993. Afterwards, went long around 68000 and 2000. In the evening, I again reminded to go long at this level. After a night of consolidation, the price surged to around 70000 and 2130. First shorted then went long, capturing a total of 5500 points and 200 points of space. Congratulations to friends who followed the strategy and successfully made gains.

#当前行情抄底

View OriginalBitcoin/Ethereum yesterday morning, the strategy was to short above 70800 and 2080. The market surged and then pulled back to 67300 and 1993. Afterwards, went long around 68000 and 2000. In the evening, I again reminded to go long at this level. After a night of consolidation, the price surged to around 70000 and 2130. First shorted then went long, capturing a total of 5500 points and 200 points of space. Congratulations to friends who followed the strategy and successfully made gains.

#当前行情抄底

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

The Pi Network Maturity Blueprint

We often talk about launching the mainnet openly, but the real breakthrough lies in data. To enable the Pi ecosystem to support centralized exchanges (CEX) and promote robust global economic development, we need more than just "launching"—we also need liquidity depth. Current statistics show that this model is still in the defensive stage and in early development. To truly mature, we need to see progress toward the following benchmarks:

◆ Migration Rewards (R): Expand the user base by moving beyond 25 billion.

◆ Unlock Rewards: Reach over 10 billion–15 billi

We often talk about launching the mainnet openly, but the real breakthrough lies in data. To enable the Pi ecosystem to support centralized exchanges (CEX) and promote robust global economic development, we need more than just "launching"—we also need liquidity depth. Current statistics show that this model is still in the defensive stage and in early development. To truly mature, we need to see progress toward the following benchmarks:

◆ Migration Rewards (R): Expand the user base by moving beyond 25 billion.

◆ Unlock Rewards: Reach over 10 billion–15 billi

PI-2,04%

- Reward

- 2

- 3

- Repost

- Share

GateUser-40da6f60 :

:

Millions of accounts domestically have no 9 Green 😂, and with each person holding 10,000 coins, it's far greater than the total supply of 100 billion.View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4009?ref=VGDEVLFACA&ref_type=132

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Ape In 🚀View More

[$SIREN Signal] Flat position + Cooling down after extreme volatility

After a 186% surge in a single day, the price formed a high-level, extremely low-volume narrow fluctuation, which is a typical sign of balanced bulls and bears and waning momentum.

🎯 Direction: Flat position

Data reveals the truth: The last 4H candlestick's trading volume plummeted by 99%, and the buy/sell order ratio (0.48) indicates a slight advantage for sellers, with Takers actively selling. Open interest (OI) remains stable, combined with an unusually high positive funding rate of 0.0972%, suggesting that a large numb

View OriginalAfter a 186% surge in a single day, the price formed a high-level, extremely low-volume narrow fluctuation, which is a typical sign of balanced bulls and bears and waning momentum.

🎯 Direction: Flat position

Data reveals the truth: The last 4H candlestick's trading volume plummeted by 99%, and the buy/sell order ratio (0.48) indicates a slight advantage for sellers, with Takers actively selling. Open interest (OI) remains stable, combined with an unusually high positive funding rate of 0.0972%, suggesting that a large numb

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More145.44K Popularity

33.97K Popularity

392.68K Popularity

14.63K Popularity

13.54K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.48KHolders:20.01%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.46KHolders:10.00%

News

View MoreMarket Report: Top 5 Cryptocurrency Gainers on February 8, 2026, led by MemeCore

8 m

Browser cache issues cause abnormal display of Arweave network block data.

14 m

Illinois proposes bill to establish state-level Bitcoin reserve

33 m

Multiple traditional financial assets experience price fluctuations, with gold, silver, and crude oil strengthening.

1 h

South African Reserve Bank Governor warns that the growth in stablecoin usage could impact monetary unity

1 h

Pin