Post content & earn content mining yield

placeholder

Crypto_Crown

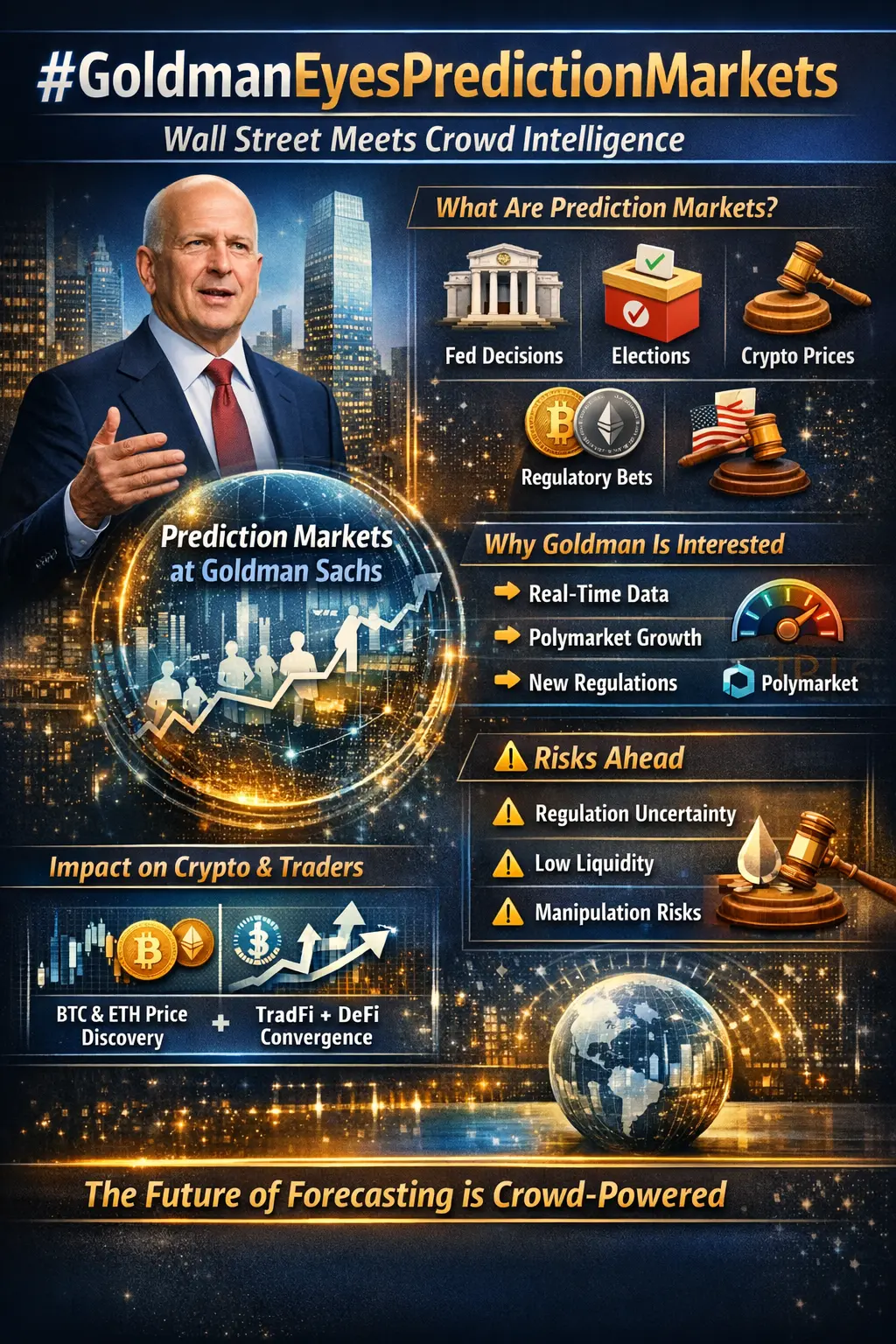

🔥 #GoldmanEyesPredictionMarkets

Wall Street Meets Crowd Intelligence

Goldman Sachs CEO David Solomon has confirmed that the firm is actively exploring prediction markets, calling them “super interesting” during the Q4 2025 earnings call.

Meetings have reportedly taken place with major platforms like Polymarket and Kalshi, and internal teams are already studying integration ideas.

This signals a big shift: crowd-sourced forecasting is moving into mainstream finance.

📊 What Are Prediction Markets?

Prediction markets allow users to trade on real-world outcomes like:

Fed rate decisions

Elections

Wall Street Meets Crowd Intelligence

Goldman Sachs CEO David Solomon has confirmed that the firm is actively exploring prediction markets, calling them “super interesting” during the Q4 2025 earnings call.

Meetings have reportedly taken place with major platforms like Polymarket and Kalshi, and internal teams are already studying integration ideas.

This signals a big shift: crowd-sourced forecasting is moving into mainstream finance.

📊 What Are Prediction Markets?

Prediction markets allow users to trade on real-world outcomes like:

Fed rate decisions

Elections

- Reward

- like

- Comment

- Repost

- Share

Everyone, please be careful. There are a few scammers who often use this trick to deceive people into buying newly launched coins. Once they reach a certain level, they run away, leaving you stuck inside. Be extremely cautious.

View Original- Reward

- like

- Comment

- Repost

- Share

无敌推土机

无敌推土机

Created By@ChineseMemeHeartTransmitter

Listing Progress

0.00%

MC:

$3.45K

Create My Token

The People's Bank of China announces the USD/CNY reference rate at 7.0019 - - #cryptocurrency #bitcoin #altcoins

BTC0,79%

- Reward

- like

- Comment

- Repost

- Share

📊 SOL/USDT 1H Technical Deep Dive

1. Trend Structure and Moving Average Patterns

After a unilateral decline from the previous high of 143.16 USDT, the price found key support at 124.59 USDT and began to rebound, currently reclaiming the 130 USDT psychological level. The short-term MA5 and MA10 have formed a golden cross upward, and the price has moved above the short-term moving averages, indicating that short-term bullish momentum is temporarily dominant; however, MA20, MA30, MA50, and MA100 remain in a bearish alignment, with the price being suppressed by the MA100 (132.78 USDT). The medium

1. Trend Structure and Moving Average Patterns

After a unilateral decline from the previous high of 143.16 USDT, the price found key support at 124.59 USDT and began to rebound, currently reclaiming the 130 USDT psychological level. The short-term MA5 and MA10 have formed a golden cross upward, and the price has moved above the short-term moving averages, indicating that short-term bullish momentum is temporarily dominant; however, MA20, MA30, MA50, and MA100 remain in a bearish alignment, with the price being suppressed by the MA100 (132.78 USDT). The medium

SOL1,86%

- Reward

- like

- Comment

- Repost

- Share

Technical Analysis Basics: Trend, Support & Resistance

- Reward

- like

- Comment

- Repost

- Share

The "On-Chain Gold Largest Long" fully closed its PAXG long position at an average price of $4,865, previously opened at approximately $4,415.

On January 22, according to Coinbob's popular address monitoring, influenced by the decline in gold price per ounce overnight and this morning, dropping below $4,800 briefly, the "On-Chain Gold Largest Long" whale on Hyperliquid completely closed its 5x leveraged PAXG long position. The position recorded a profit of $675,000, with an initial size of about $7.3 million and an average price of $4,415. After closing, the address increased its holdings in X

On January 22, according to Coinbob's popular address monitoring, influenced by the decline in gold price per ounce overnight and this morning, dropping below $4,800 briefly, the "On-Chain Gold Largest Long" whale on Hyperliquid completely closed its 5x leveraged PAXG long position. The position recorded a profit of $675,000, with an initial size of about $7.3 million and an average price of $4,415. After closing, the address increased its holdings in X

PAXG-0,62%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3900?ref=VLBNBL5DBQ&ref_type=132&utm_cmp=OWgqUmPM

- Reward

- 1

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

Good news: SOL mobile token SKR surges, if you get the highest level airdrop on a single phone, you can directly get over 3WU\n\nBad news: I sold too early and only got 1WU, but this is also the biggest airdrop I've ever received as a non-crypto enthusiast\n\nBy the way, now with AI, writing crypto farming scripts is easy, and I even want to become a professional crypto farmer to recover my losses😂\n\nFor the SOL mobile this thing, one step is to刷交易, I previously used CC to quickly write a transaction spamming script😜

View Original

- Reward

- like

- Comment

- Repost

- Share

For users interested in on-chain fairness mechanisms, this event is worth paying close attention to.\n🔍 On-Chain Trading Competition #111 uses a pure trading volume ranking system, no luck involved, no lotteries, only on-chain data.\n\nAll valid trading activities on the BSC chain will be recorded by the system and ranked collectively based on total trading volume.\n\n💰 The reward structure is clear and transparent, with a total prize pool of 150,000 USDT and a maximum reward of 6,000 USDT for a single individual.\nThe event duration is well-defined, the rules are simple, making it very suit

View Original

- Reward

- like

- Comment

- Repost

- Share

#GateTradFi1gGoldGiveaway 💡 Key Insights for Today

The "ETF Absorption" Effect: While retail sentiment is shaken, the data tells a different story. U.S. Spot ETFs (led by BlackRock) saw a massive reversal with $1.7 billion in inflows last week. Institutions are treating this $90k region as a "value zone" rather than a exit point.

Macro Headwinds: The "Trump Tariff" rhetoric has introduced a risk-off sentiment across global equities, which BTC is currently mirroring. However, the creation of the U.S. Bitcoin Strategic Reserve continues to act as a massive long-term psychological floor for the

The "ETF Absorption" Effect: While retail sentiment is shaken, the data tells a different story. U.S. Spot ETFs (led by BlackRock) saw a massive reversal with $1.7 billion in inflows last week. Institutions are treating this $90k region as a "value zone" rather than a exit point.

Macro Headwinds: The "Trump Tariff" rhetoric has introduced a risk-off sentiment across global equities, which BTC is currently mirroring. However, the creation of the U.S. Bitcoin Strategic Reserve continues to act as a massive long-term psychological floor for the

BTC0,79%

- Reward

- 4

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

📊 BTC/USDT 1H Technical Deep Dive

1. Trend Structure and Moving Average Patterns

After a unilateral decline from the previous high of 95,481.0 USDT, the price found key support at 87,210.5 USDT and began to rebound. Currently, the price has stabilized above the 89,000 USDT integer level. The short-term MA5 and MA10 have formed a golden cross upward, and the price is above the short-term moving averages, indicating that short-term bullish momentum is temporarily dominant; however, the MA20, MA30, MA50, and MA100 are still in a bearish arrangement, with the price being suppressed by the MA50 (8

1. Trend Structure and Moving Average Patterns

After a unilateral decline from the previous high of 95,481.0 USDT, the price found key support at 87,210.5 USDT and began to rebound. Currently, the price has stabilized above the 89,000 USDT integer level. The short-term MA5 and MA10 have formed a golden cross upward, and the price is above the short-term moving averages, indicating that short-term bullish momentum is temporarily dominant; however, the MA20, MA30, MA50, and MA100 are still in a bearish arrangement, with the price being suppressed by the MA50 (8

BTC0,79%

- Reward

- like

- Comment

- Repost

- Share

BBF

BudeBitsfak

Created By@HousakuHojo39

Subscription Progress

0.00%

MC:

$0

Create My Token

#SpotGoldHitsaNewHigh 🔍 Current Market Dynamics

The "Greenland" Macro Hedge: Geopolitical tensions (specifically the Greenland standoff and tariff threats) have introduced a "risk-off" sentiment. While gold has surged toward $5,000, crypto is undergoing a stress test to see if it can hold its ground as a digital alternative.

Key Support Floors: Bitcoin is currently hunting for stability in the $84,000–$88,000 zone. This area is critical; as long as we hold above the $80,000 "lifeline," the macro-uptrend remains structurally sound.

Relative Strength: While high-beta assets like XRP and certain

The "Greenland" Macro Hedge: Geopolitical tensions (specifically the Greenland standoff and tariff threats) have introduced a "risk-off" sentiment. While gold has surged toward $5,000, crypto is undergoing a stress test to see if it can hold its ground as a digital alternative.

Key Support Floors: Bitcoin is currently hunting for stability in the $84,000–$88,000 zone. This area is critical; as long as we hold above the $80,000 "lifeline," the macro-uptrend remains structurally sound.

Relative Strength: While high-beta assets like XRP and certain

- Reward

- 2

- 3

- Repost

- Share

Srputra17 :

:

gogo gogo gogo gogo gogogogoogogogkdjjdjsiiskekeiididjejjeidView More

Ruan Chang Homestay and Cafe, so awesome!

View Original

- Reward

- like

- Comment

- Repost

- Share

Live broadcast summary on 2026.1.21, please listen to the replay for details

View Original

- Reward

- like

- Comment

- Repost

- Share

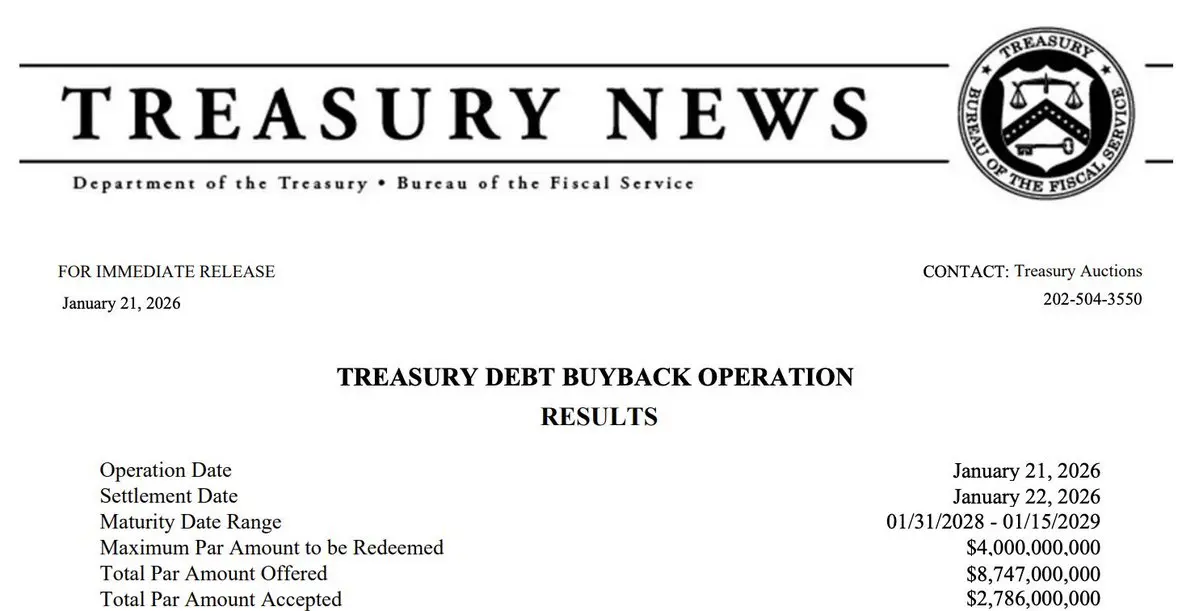

🚨 DEBT REPAYMENT: The US Treasury has bought back $2.78 Billion of its own debt to ensure market stability! #USDebt #Finance

- Reward

- 1

- Comment

- Repost

- Share

🚨 LATEST: BitGo raises $212.8 million in US IPO, valuing the #crypto custody firm at $2.08 billion, marking the first digital asset company IPO of 2026, per Reuters. #crypto

- Reward

- 1

- Comment

- Repost

- Share

Which #Memecoin Do You Think Will Dominate this Bullrun ?🤔\n\n$DROVER\n$CKOM\n#HYDRACHAIN \n$BOSS\n$SHIB\n$PEPE\n$BRETT\n$BONK\n$WKC\n$FLOKI\n$PNUT\n$DOGE\n$TURBO\n\n👇 Any Other 🎯

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More48.88K Popularity

30.92K Popularity

16.31K Popularity

60.17K Popularity

345.57K Popularity

Hot Gate Fun

View More- MC:$3.43KHolders:10.00%

- MC:$3.43KHolders:10.00%

- MC:$3.43KHolders:10.00%

- MC:$3.5KHolders:20.19%

- MC:$3.96KHolders:22.66%

News

View MoreBitcoin returns to $90,000 but BTC ETF experiences significant outflows, market bulls and bears intensify their battle

1 m

A certain whale shorted 2,735,000 XRP with 20x leverage, with an average entry price of $1.95

1 m

Trump pushes for Greenland framework agreement implementation, Denmark signals negotiations on "Golden Dome" missile defense plan

3 m

Messari warns of the decentralized social shift: Farcaster acquired, Lens changes ownership, DeSoc enters restructuring cycle

4 m

USDC Treasury burns $50 million USDC on the Ethereum chain

7 m

Pin