XRP Price Prediction: Could Ripple Surge to $15 by 2025 with a 5x Gain?

Introduction

As the cryptocurrency market shifts into the end-of-year period, investor optimism is rising, with meme coins and altcoins once again capturing attention. According to Perplexity AI’s latest analysis, XRP stands out as a potential leader in this emerging trend.

Market Overview

Bitcoin set a new all-time high of $124,128 at the end of last month, eclipsing the previous record of $122,838 established just weeks earlier. However, the rally lost momentum after U.S. July inflation numbers surpassed market forecasts. As a result, sentiment remains upbeat, and investors are gradually reallocating capital to altcoins and meme coins.

Policy Drivers

Recently, the U.S. regulatory landscape has evolved rapidly. President Trump signed the landmark GENIUS Act—the first dedicated stablecoin legislation—mandating full reserve backing to boost market transparency. At the same time, the Securities and Exchange Commission (SEC) launched a new initiative to provide more detailed compliance guidance for blockchain enterprises, signaling a maturing regulatory environment.

XRP Highlights and Global Expansion

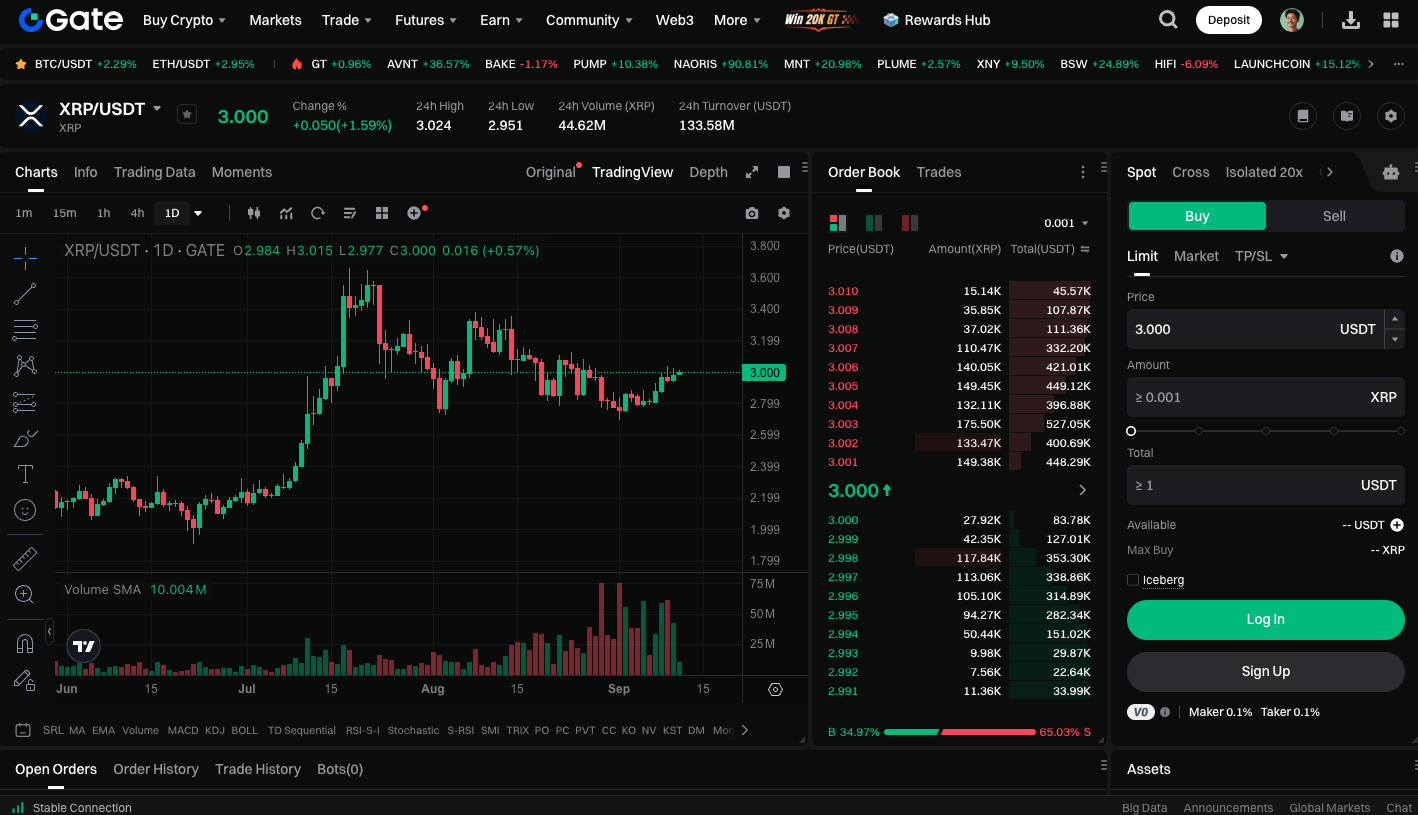

XRP has proven its resilience in the market, reaching $3.65 in July—surpassing its 2018 historical peak of $3.40. Although the price later dipped to around $3, the outlook remains bullish overall. Ripple continues to expand its international payments footprint. In 2024, the United Nations Capital Development Fund recognized it as a key cross-border solution for emerging markets. The long-standing SEC lawsuit concluded with a ruling that retail XRP transactions do not constitute sales of securities, clearing a major hurdle for future growth.

Trade XRP spot instantly: https://www.gate.com/trade/XRP_USDT

Price Forecast

Perplexity AI projects that if the market maintains its current momentum, XRP could challenge the $10 to $15 range by year-end 2025—representing a potential fivefold increase from current prices. The short-term benchmark is projected between $3.30 and $5.50.

If the Trump administration enacts clarity-focused regulations and the SEC approves an XRP spot ETF, these catalysts could trigger the next wave of price increases.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution