XRP News Prediction: Key Support and Resistance Levels

XRP Short-Term Market Overview

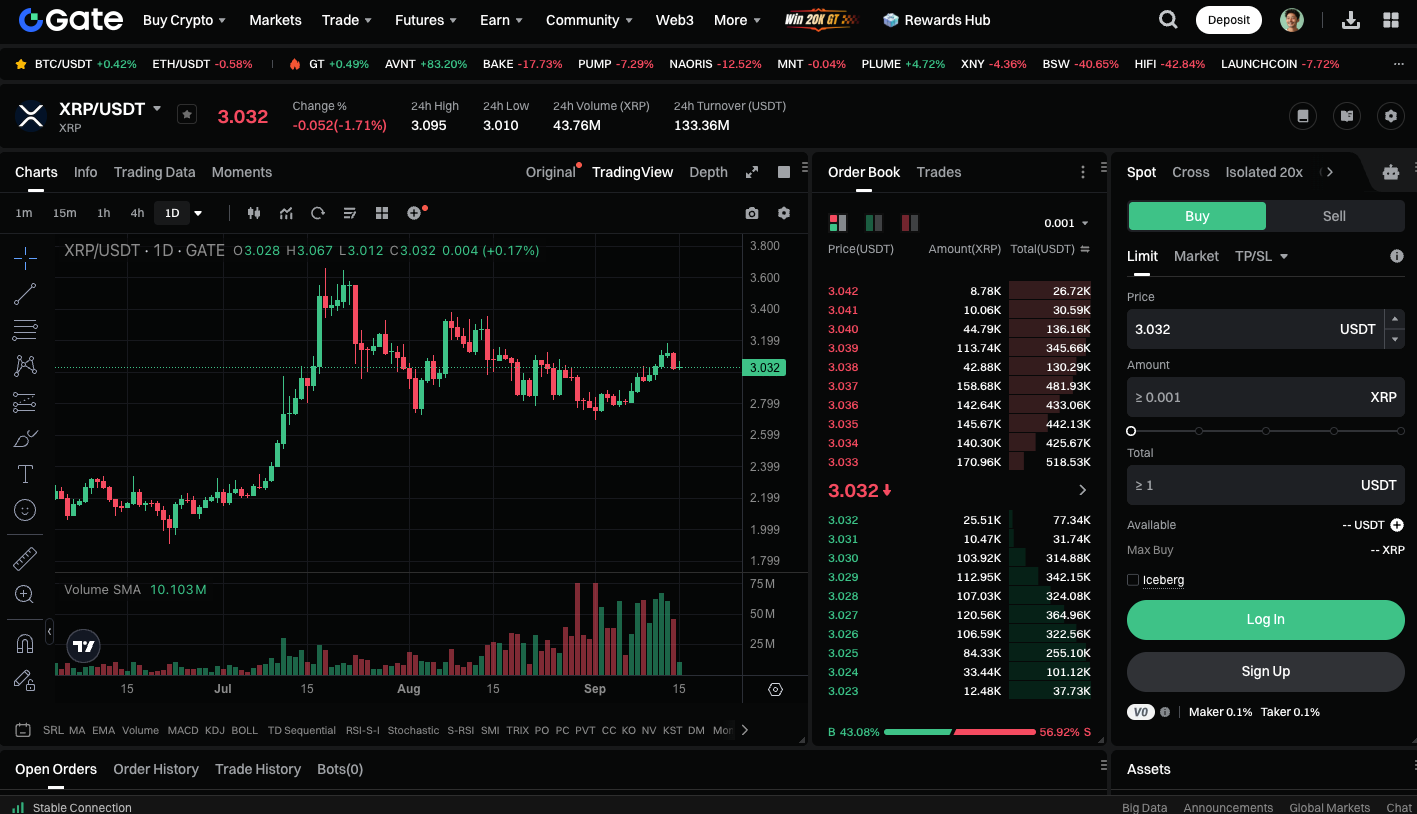

Recently, XRP saw a breakout event with bulls successfully driving prices above the descending trendline. However, this breakout lacked sustained momentum, and overall market sentiment remains cautious. In the near term, investors should closely watch whether XRP can maintain stability above the breakout level—otherwise, this move could turn out to be a false breakout.

Support Level Insights

On the technical front, if XRP retreats and falls below the 20-day EMA (around $2.93), this would indicate that the earlier breakout failed. In this scenario, bears may push the price down toward the strong support zone at $2.73. For short-term traders, this range is a key gauge of the prevailing balance between bulls and bears.

Resistance Levels and Bullish Momentum

If XRP finds support near the 20-day EMA and rebounds, and then surpasses the $3.15 resistance mark, this shift signals a move from selling on strength to buying on weakness. This could drive XRP higher in the short term, potentially targeting the $3.40 level. Bulls should aim to increase trading volume in this range to reinforce upward momentum.

Market Strategies and Risk Alerts

Investors should keep the following in mind when trading:

- High short-term volatility: XRP may still retest support after a breakout—set your stop-loss levels accordingly.

- Volume validation: For a breakout to be valid, it must be accompanied by a notable rise in trading volume—remain vigilant for false breakouts.

- Trend reversal signals: If the price lingers below resistance, prepare for choppy short-term trading.

You can start trading XRP spot now at: https://www.gate.com/trade/XRP_USDT

Conclusion

XRP’s short-term trend remains range-bound. The breakout above the descending trendline signals a bullish outlook, but investors should watch how XRP behaves around the 20-day EMA support and $3.15 resistance to gauge future direction. For those trading XRP, it is crucial to follow the trend and closely monitor trading volume.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution