STBL: Yield-Splitting Stablecoin Architecture - What You Need to Know

Stablecoins have become essential for DeFi, but they come with trade‑offs.

Overcollateralized crypto‑backed stables like DAI suffer from volatility risk, centralized stables like USDC and USDT little to no transparency into reserves, and algorithmic stables such as UST or FRAX have proven unsustainable. Additionally, issuers capture the yield from backing assets, while users receive nothing in return.

STBL proposes a fourth path where users mint fully RWA-collateralized stablecoins and keep the yield for themselves. STBL splits your deposit into a spendable stablecoin and a yield‑bearing NFT position, giving holders both liquidity and predictable yields.

In this edition, we’ll explore STBL’s architecture, the market context it addresses, and how its products work.

Stay informed in the markets ⬇️

What is $STBL

$STBL is a non-custodial stablecoin backed by U.S. Treasury bills or private credit. The key difference with other solutions is its 3-token design ($STBL, $USST, and $YLD), with $STBL as the governance token and the 2 primary stablecoin instruments being:

- USST: A fully collateralized stablecoin pegged 1:1 to the U.S. dollar issued as an ERC‑20/4626 token and used for on‑chain payments, swaps and lending. USST can be used for on‑chain payments, liquidity provision, lending, or staking into the protocol’s Liquidity and Minting Pool (LAMP). You can redeem the underlying collateral at any time without penalties.

- YLD: An ERC-721 NFT representing your right to the yield generated by the deposited asset. Each YLD token accrues real‑time interest based on coupon payments from tokenized T‑bills, private credit or other fixed‑income instruments. The NFT design allows yield isolation and transferability via OTC while preventing retail speculation.

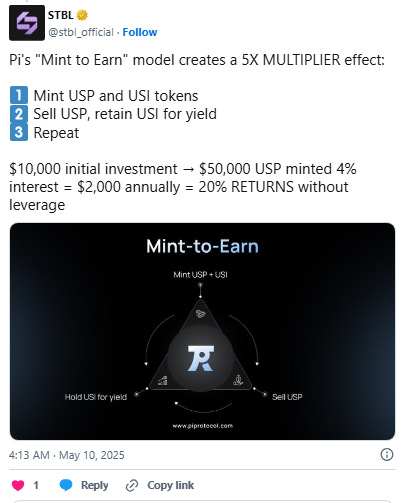

(STBL was previouisly called Pi. USI = YLD, USP = USST)

STBL uses a Mint-to-Earn model with incentives rewards early adopters with STBL governance tokens proportional to their minting activity, helping bootstrap liquidity. This model allows users to earn passive yields by simply holding YLD tokens with the underlying yields coming from RWAs rather than inflationary emissions or leverage. They can choose from multiple vaults including T-Bill vaults for low risk and predictable 4–5 % APY, or private credit vaults for higher returns of 10–12 % APY.

STBL also maintains a transparent fee structure of 20 % of all yield to ensure sustainability. These fees are allocated to a Treasury Reserve for development, a Loss Reserve Pool to absorb defaults, USST rewards for stakers, and boosts for long-term lockers (sUSST).

Stablecoin Landscape and RWA Adoption

Stablecoins are among the most used assets in digital finance, with over $290 billion in circulation in 2025. Yet the yields on their reserves remain captured by issuers.

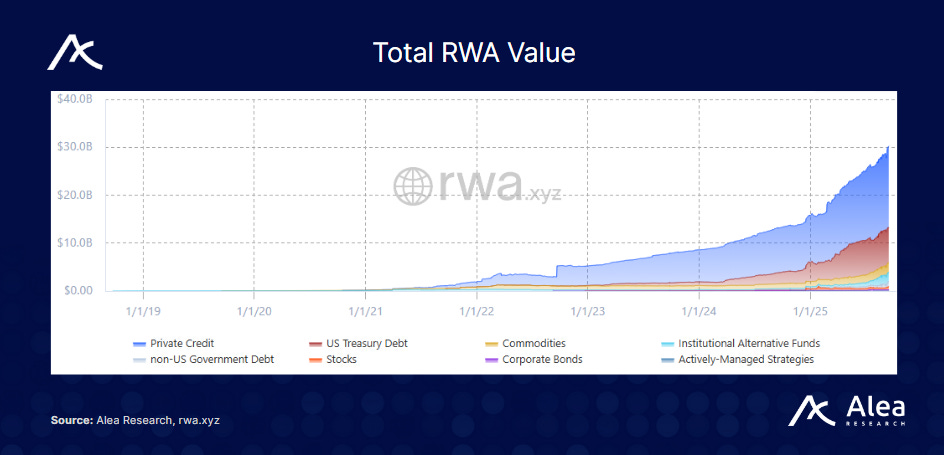

At the same time, tokenized treasuries and other RWAs have surpassed $30 billion in total value locked, reflecting growing demand for regulated, yield‑bearing instruments on‑chain. STBL channels the predictable cash flows from RWAs directly to stablecoin users, creating a sustainable alternative to unstable algorithmic coins and opaque custodial models.

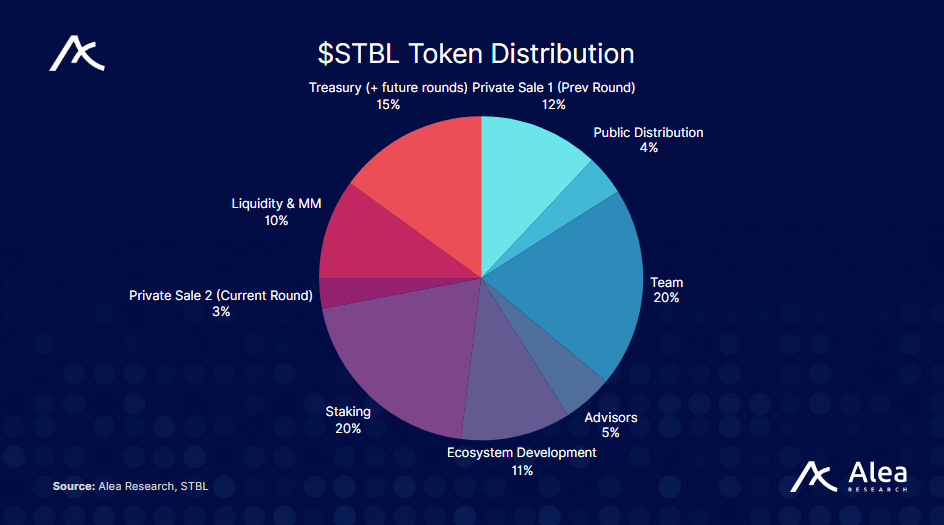

$STBL Tokenomics

$STBL is the governance/fee token for a three-asset system that separates money ($USST) from yield ($YLD). In principle, protocol fees (e.g., mint/redeem, yield routing, or auctions) and parameter changes (oracle, collateral, emissions) sit under STBL governance.

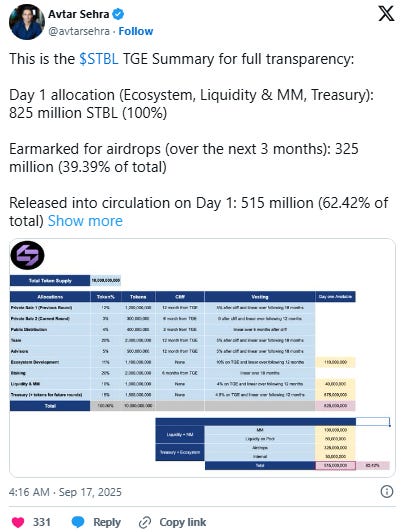

$STBL has a total supply of 10 billion with a day one unlock of 825 million (8.25% of supply).

The vesting schedules are as follows:

- Private 1 / Team / Advisors: 12-month cliff (5% immediate at cliff,18-month linear thereafter)

- Private 2: 6-month cliff → 12-month linear.

- Public: 3-month cliff → 6-month linear.

- Staking: 6-month cliff → 18-month linear.

- Ecosystem: 10% at TGE, then 12-month linear.

- Liquidity & MM: 4% at TGE, then 12-month linear.

- Treasury: 45% at TGE, then 12-month linear.

Disclaimer:

- This article is reprinted from [Alea Research Daily Newsletter]. All copyrights belong to the original author [Alea Research Daily Newsletter]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?