Multicoin Capital: Why are we bullish on Ethena in the long term?

Our Multicoin Liquidity Fund has invested in ENA, the native token of the Ethena protocol. Ethena is the leading issuer of the synthetic dollar USDe.

In our article “The Endgame for Stablecoins,” we highlighted that stablecoins represent the largest potential market in crypto, with yield as the final challenge. While our focus on “yield-bearing stablecoins” proved accurate, we underestimated the market size for synthetic dollars.

We classify stablecoins into two main categories:

- Yield-sharing

- Non-yield-sharing

Yield-sharing stablecoins can be further divided into:

- Fully backed 1:1 by government-supported treasury assets

- Synthetic dollars

Synthetic dollars are not fully backed by government treasuries. Instead, they generate yield and maintain stability by executing market-neutral strategies in financial markets.

Ethena is a decentralized protocol and the largest operator of the synthetic dollar USDe.

Ethena offers a stable alternative to traditional stablecoins like USDC and USDT, whose reserves generally earn short-term U.S. Treasury yields. Ethena’s USDe reserves, however, generate yield and aim for stability through one of traditional finance’s largest and most established strategies: basis trading.

Basis trading in U.S. Treasury futures alone is a multi-hundred-billion, if not trillion-dollar, market. Hedge funds capable of large-scale basis trades restrict access to qualified investors and institutions. Crypto technology is rebuilding finance from scratch, enabling everyone to access these opportunities through tokenization.

We have envisioned a synthetic dollar built on basis trading for years. Back in 2021, we published an article outlining this opportunity and announced our investment in UXD Protocol, the first token fully backed by basis trades.

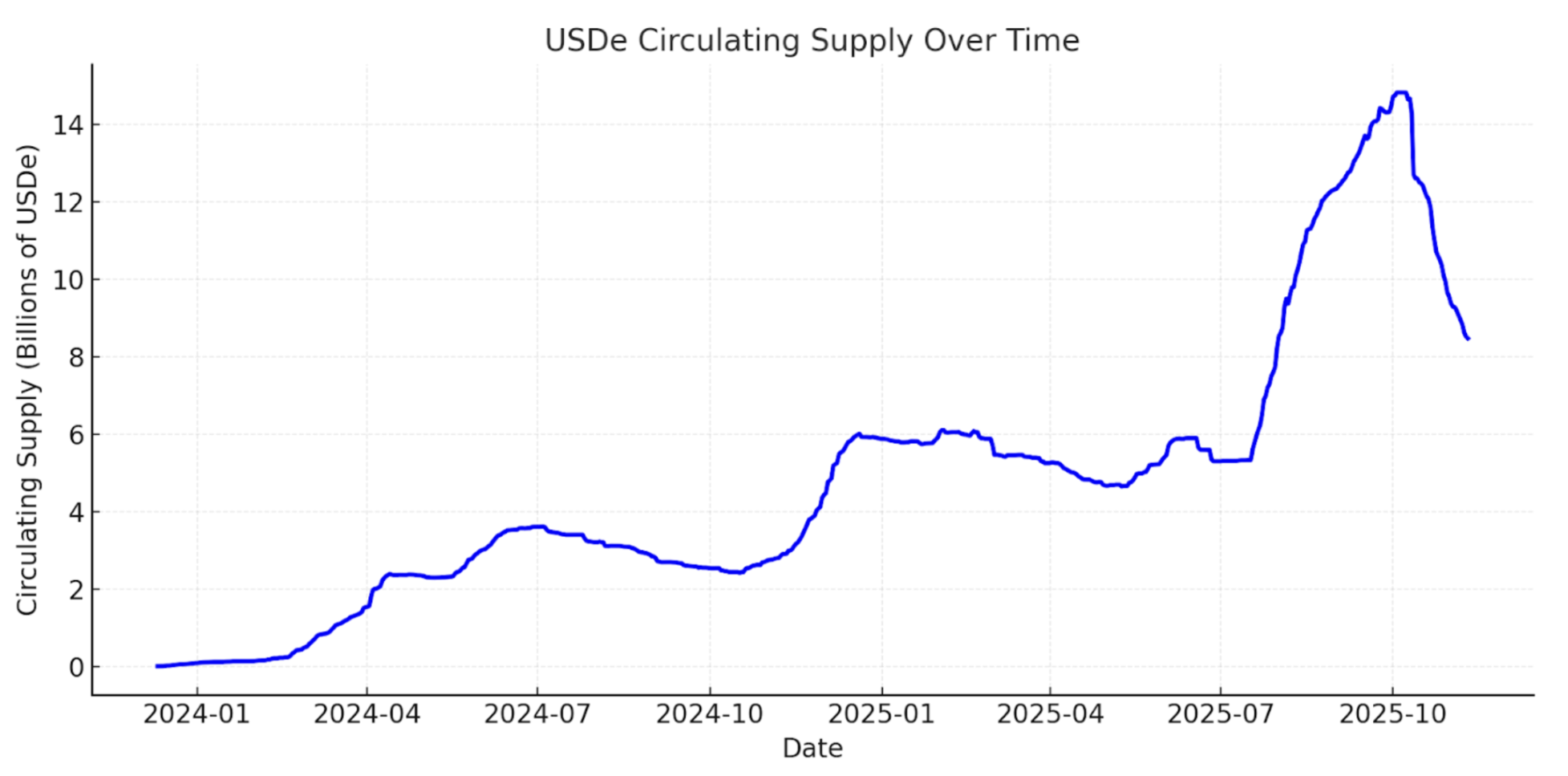

While UXD Protocol was ahead of its time, we believe Ethena Labs’ founder and CEO Guy Young has executed this vision exceptionally well. Today, Ethena is the largest synthetic dollar, with circulation reaching $15 billion within two years of launch, then retracing to about $8 billion after the October 10 market reset. It is the third-largest digital dollar overall, surpassed only by USDC and USDT.

USDe Circulation Over Time - DefiLlama

Structural Tailwinds for Synthetic Dollars

Ethena sits at the convergence of three major trends transforming modern finance: stablecoins, perpetualization, and tokenization.

Stablecoins

More than $300 billion in stablecoins are currently in circulation, and this figure is projected to reach trillions within a decade. For nearly ten years, USDT and USDC have dominated the stablecoin market, together accounting for over 80% of total supply. Neither shares yield directly with holders, but we believe that over time, user yield-sharing will become the standard.

In our view, stablecoins compete and differentiate along three key factors: distribution, liquidity, and yield.

Tether has built an exceptional liquidity base and global distribution network for USDT. It serves as the main quote asset in crypto trading and is the most widely used route for emerging markets to access digital dollars.

Circle, by contrast, has focused on distribution through economic partnerships with players like Coinbase. While this has driven growth, it has pressured Circle’s profit margins. As crypto adoption accelerates, we expect more companies with deep distribution capabilities in finance and technology to issue their own stablecoins, further commoditizing the treasury-backed stablecoin market.

For new entrants, offering higher yields has always been the primary way to stand out in the digital dollar sector. Over the past years, the narrative around yield-bearing stablecoins has gained momentum. However, treasury-backed stablecoins have failed to deliver yields high enough to drive meaningful adoption in crypto, as the opportunity cost for crypto-native capital has historically been higher than U.S. Treasury yields.

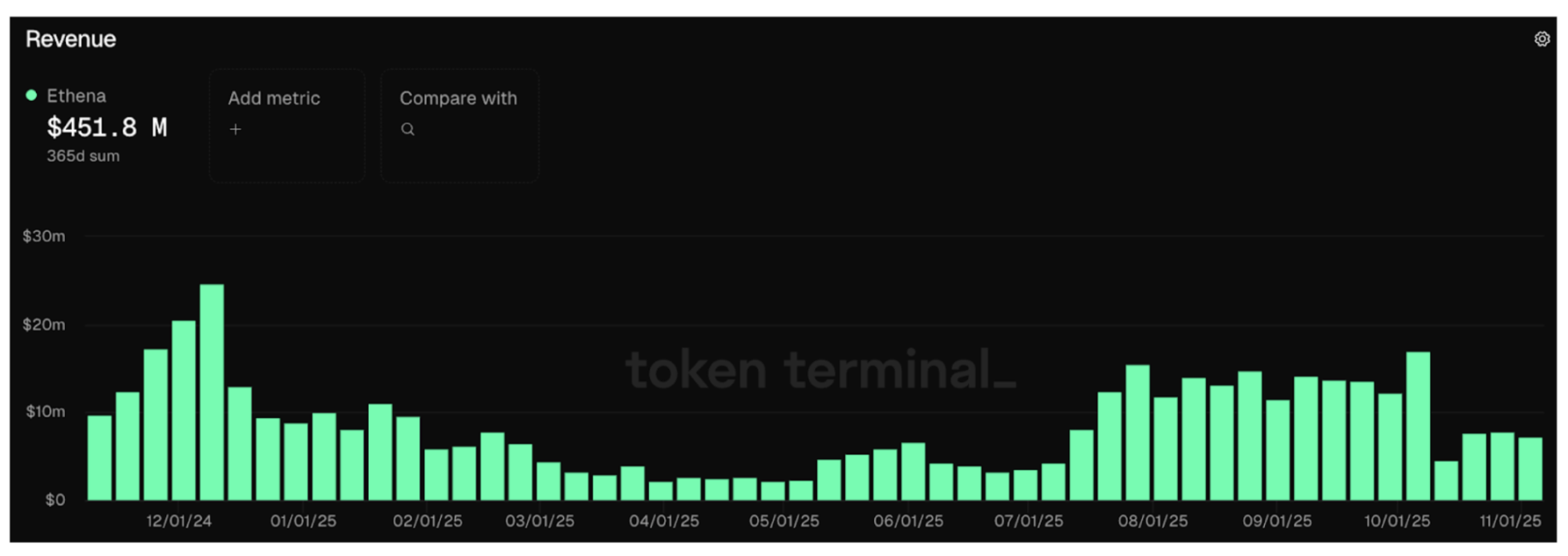

Among the new entrants, Ethena stands out as the only project achieving significant distribution and liquidity, largely due to its higher yield. Based on sUSDe price performance since launch, we estimate its annualized yield slightly exceeds 10%—over double that of treasury-backed stablecoins. This is achieved through basis trading, which monetizes leverage demand in the market. Since launch, the protocol has generated nearly $600 million in revenue, with over $450 million in the last twelve months alone.

Ethena Token Terminal

We believe the true measure of synthetic dollar adoption is acceptance as collateral on major exchanges. Ethena has excelled in integrating USDe as core collateral on leading centralized exchanges such as Binance and Bybit—a key driver of its rapid growth.

Ethena’s strategy also stands out for its slight negative correlation with the federal funds rate. Unlike treasury-backed stablecoins, Ethena tends to benefit as rates fall, since lower rates stimulate economic activity, boost demand for leverage, drive higher funding rates, and reinforce basis trading yields supporting Ethena. We saw this dynamic in 2021 when funding rates exceeded Treasury yields by over 10%.

Of course, as crypto and traditional markets converge, more capital will flow into basis trades and narrow the spread between funding and federal funds rates, but this process will take years.

Treasury Yield vs. Funding Rate

JPMorgan forecasts that yield-bearing stablecoins could account for up to 50% of the stablecoin market in the coming years. As the total stablecoin market is projected to surge into the trillions, we believe Ethena is positioned to be a major player in this transition.

Perpetualization

Perpetual futures have achieved product-market fit in crypto. In the $4 trillion crypto asset class, perpetual contracts see daily trading volumes over $100 billion, with total open interest on CEXs and DEXs also surpassing $100 billion. Perpetuals give investors a streamlined way to access leveraged exposure to underlying asset price movements. We believe more asset classes will adopt perpetuals over time—a trend we call “perpetualization.”

A common question about Ethena concerns the size of its addressable market, since its strategy is capped by open interest in the perpetuals market. While this is a fair short-term constraint, we think it understates the medium- and long-term opportunity.

Perpetuals on Tokenized Equities

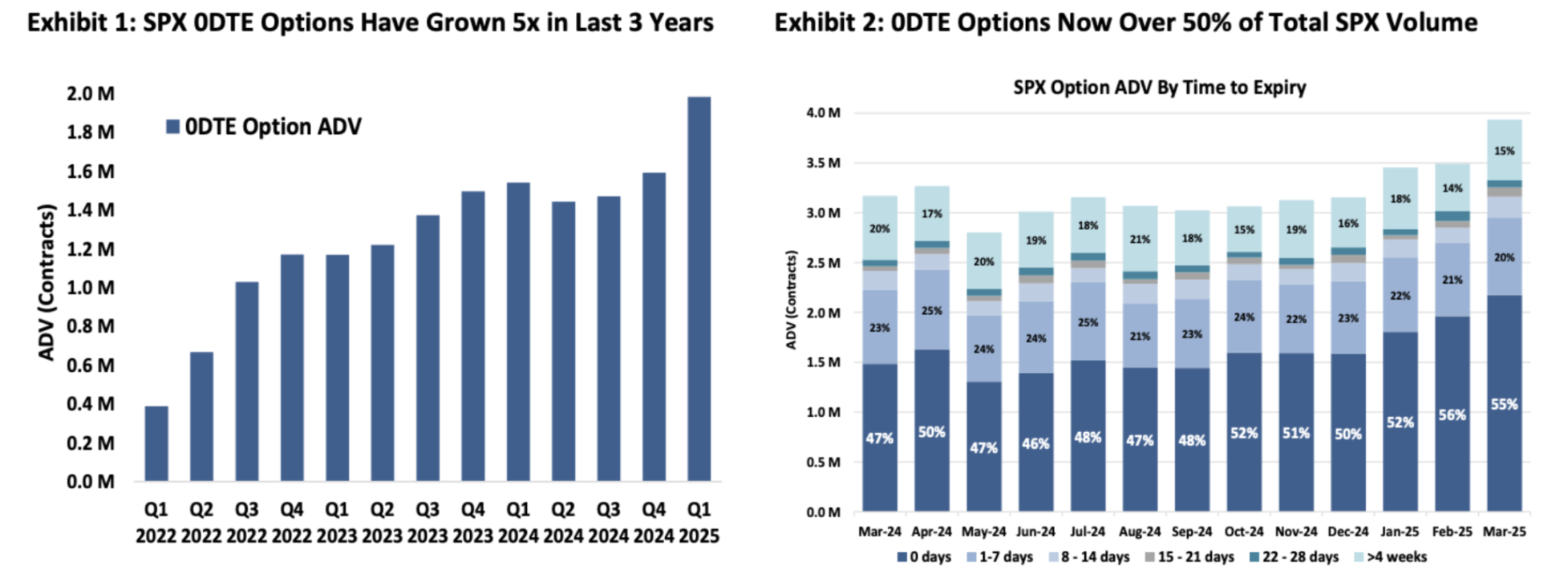

The global equity market is worth about $100 trillion, nearly 25 times the size of the crypto market. The U.S. equity market alone is valued at roughly $60 trillion. As in crypto, equity investors have a strong appetite for leverage. This is reflected in the explosive growth of 0DTE (zero-day-to-expiry) options, which now make up over 50% of SPX options volume—mostly traded by retail investors. Retail clearly wants leveraged exposure to underlying price changes, a demand that tokenized equity perpetuals can directly serve.

SPX ODTE Options

For most investors, perpetuals are simpler than options. A product offering 5x exposure to an underlying asset is easier to grasp than the Theta, Vega, and Delta of options, which require deep knowledge of pricing models. While we don’t expect perpetuals to replace the 0DTE options market, they could capture a significant share.

Translator’s note: In options, Delta measures sensitivity to the underlying asset’s price; Theta measures the rate of time decay; Vega measures sensitivity to volatility.

As equities become tokenized, perpetuals on these assets create a much larger opportunity for Ethena. This positions Ethena as a key liquidity provider for new markets, benefiting both CEXs and DEXs—and potentially enabling Ethena to capture this value internally by establishing a stock perpetual DEX under its own brand. Given the relative size of the equities market, these developments could expand basis trading capacity by orders of magnitude.

Fintech Integration with Decentralized Perpetual DEXs Drives New Distribution Channels

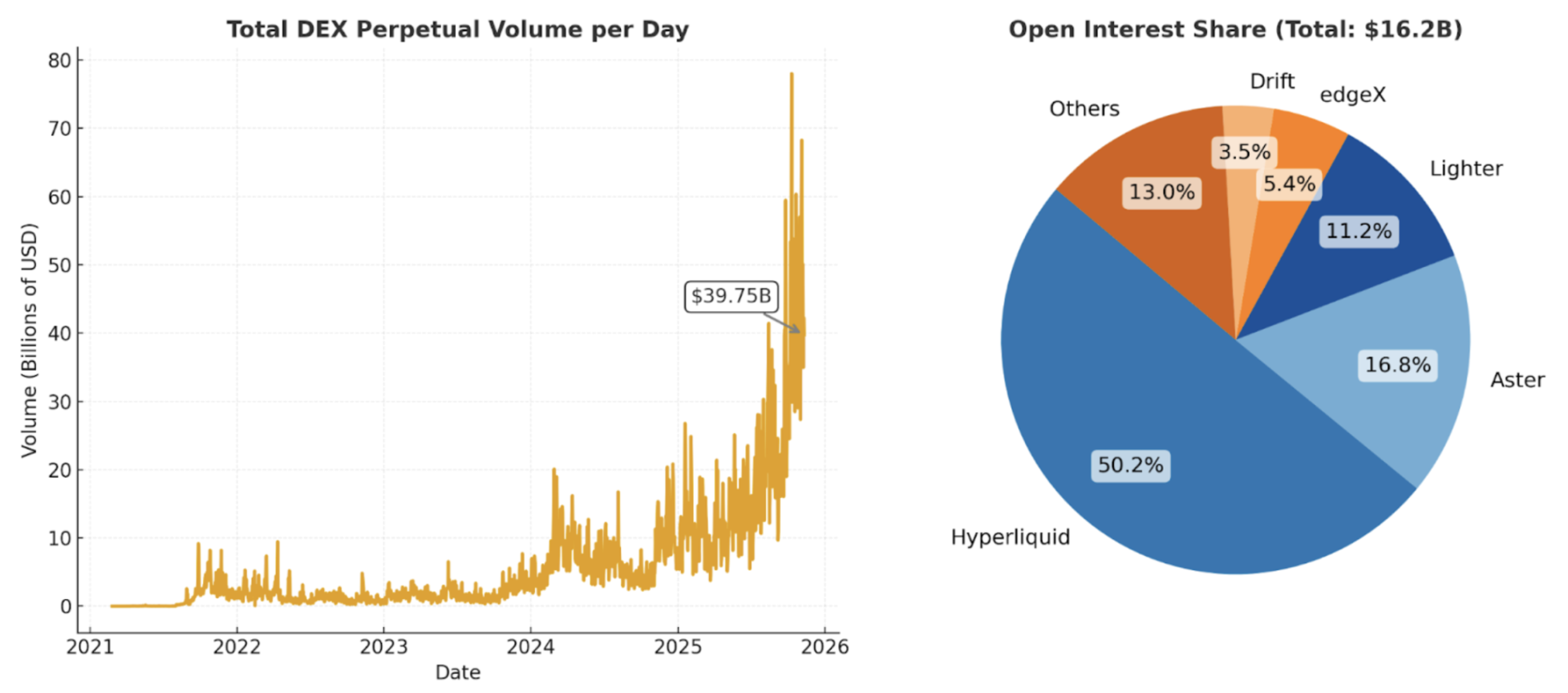

When we first wrote about basis-trade-backed decentralized digital dollars, decentralized derivatives exchanges were nascent, liquidity was thin, and they weren’t ready for mainstream use. Since then, stablecoins have achieved mainstream adoption and high-throughput, low-fee chains have proven themselves. Today, platforms like Hyperliquid facilitate roughly $40 billion in daily decentralized perpetual trading volume, with $15 billion in open interest.

Daily DEX Perpetual Volume

As crypto regulation becomes more favorable, fintech companies worldwide are expected to increasingly adopt crypto. Leading firms like Robinhood and Coinbase have evolved into “all-in-one exchanges.” Many have already integrated with DeFi middleware to support spot trading of long-tail assets not listed on their platforms.

Currently, most non-crypto-native users only have access to a limited range of crypto assets, and typically only in spot markets. We believe this group represents significant untapped demand for leverage. As decentralized perpetual DEXs go mainstream, it’s natural for fintechs to integrate these products directly.

For example, Phantom recently integrated with decentralized perpetual DEX Hyperliquid, enabling users to trade perpetuals directly from their Phantom wallets. This integration has annualized about $30 million in additional revenue. Any fintech founder observing this will likely want to follow suit. Recently, Robinhood announced an investment in the decentralized perpetual DEX Lighter.

We believe fintech adoption of crypto perpetuals will establish a new distribution channel for these products, driving higher volumes and open interest, and expanding the capacity and scalability of basis trades underlying Ethena.

Tokenization

The core strength of crypto is its ability to let anyone seamlessly issue and trade tokens. Tokens can represent any asset—stablecoins, L1 tokens, meme coins, or even tokenized strategies.

In traditional finance, the closest parallel is the ETF. Today, there are more ETFs in the U.S. than individual listed stocks. ETFs package complex strategies into a single tradable ticker, letting investors buy, sell, or hold with ease—without worrying about execution or rebalancing. All operational complexity is handled by the ETF issuer. Unsurprisingly, BlackRock, the world’s largest ETF provider, is fully committed to tokenization.

Tokenization surpasses ETFs by enabling assets to be held and traded faster, cheaper, and at any size, while improving distribution and capital efficiency. Anyone with internet access can instantly buy, sell, send, or receive tokens, or even use them as collateral to unlock extra liquidity. We envision a future where fintech companies worldwide distribute tokenized strategies at scale, delivering institutional-grade products directly to global consumers.

Ethena started by tokenizing basis trades, but nothing prevents it from diversifying its yield sources over time. In fact, it’s already doing so. When basis trades generate lower or negative returns, Ethena can allocate part of its collateral to another product in its ecosystem—USDtb, a stablecoin backed by BlackRock’s tokenized Treasury fund BUIDL—to maintain stability and optimize returns.

Why Invest in ENA

While we’ve discussed the long-term bullish case for Ethena’s market opportunity, understanding the team and protocol features—especially in risk management, value capture, and future growth—is just as important.

Team

“I quit my job a few days after the Luna collapse to build Ethena, and formed the team a few months after the FTX event,” says Ethena founder Guy Young.

From our experience, Guy is one of the sharpest and most strategic thinkers in DeFi, bringing Cerberus Capital Investment experience to a crypto market undergoing rapid financialization.

Guy’s success is backed by a lean, experienced team of about 25 operators. Notable team members include CTO Alex Nimmo, an early BitMEX employee who helped build perpetual futures into crypto’s most important financial instrument, and COO Elliot Parker, who previously worked at Paradigm Markets and Deribit. Elliot’s connections with market makers and exchanges have driven Ethena’s integrations with key counterparties.

The results are clear. In less than two years, Ethena has become the largest synthetic dollar. During this period, the team moved quickly, integrated with top centralized exchanges, and built hedging channels that take most projects years to establish. USDe is now accepted as collateral at major venues like Binance and Bybit. Many of these exchanges are also Ethena investors, demonstrating strong strategic alignment between the protocol and key global crypto players.

Risk Management

My partners Spencer and Kyle wrote in 2021, “DeFi Protocols Don’t Capture Value, DAOs Manage Risk.” The main point: DeFi protocols that don’t manage risk but try to charge get forked—there’s always a free fork. In contrast, protocols that fundamentally manage risk must charge fees, or no one will support the system.

Ethena perfectly demonstrates this principle. The protocol has shown robust risk management, successfully navigating two major stress events this year—each further boosting its credibility, resilience, and brand trust within the crypto ecosystem.

Bybit Hack: Crypto’s Largest Hack to Date

The $1.4 billion Bybit hot wallet hack on February 21, 2025, was a real-world stress test of Ethena’s exchange counterparty model. This triggered massive user withdrawals from Bybit, but Ethena’s strategy was unaffected.

With hedges and collateral diversified across venues and secured in off-exchange custody, Ethena maintained normal operations. Crucially, no Ethena collateral was lost, and no minting or redemption flows were interrupted by the Bybit incident.

October 10 Selloff: The Largest Single-Day Crypto Liquidation

On October 10, 2025, the crypto market underwent extreme deleveraging, with roughly $20 billion in positions liquidated as open interest collapsed across major CEXs and DEXs. During the cascade, due to Binance’s oracle design, USDe briefly traded as low as $0.65 on Binance, sparking criticism. However, USDe maintained near-parity on more liquid on-chain venues like Curve (see chart below), and redemptions continued as normal—demonstrating this was a venue-specific issue, not a systemic depeg. Guy’s X post offers a great breakdown of the October 10 event.

USDe (Curve) vs. USDC (Binance)

In both cases, the Ethena team communicated transparently and lost no user funds. The protocol continued operating normally, processing nine-figure redemptions within hours—all verifiable on-chain. Such events test any protocol’s risk discipline. Successfully handling stress at scale not only boosts trust and credibility but also builds brand value and defensibility—creating a strong moat for DeFi protocols like Ethena.

It’s reasonable to expect that Ethena will face further stress tests in the coming years. We’re not suggesting risk is absent or fully eliminated—rather, that Ethena has proven highly resilient during some of the crypto market’s most significant stress events.

Value Capture

We believe Ethena can command higher fees than stablecoins like USDC. Unlike USDC, Ethena actively manages market risk, shares higher yields with users in most cases, and may have negative rate correlation in the short-to-medium term—all strengthening its long-term value capture abilities.

Currently, the ENA token functions mainly as a governance token, but there’s a clear path for it to accrue value. Ethena generated about $450 million in revenue over the past year, none of which currently flows to ENA holders.

A fee switch proposal introduced in November 2024 outlines milestones required before value can flow to ENA holders. All these were met before the October 10 event. The only remaining target is USDe’s circulating supply, which we expect to exceed $10 billion before activation. The risk committee and community are currently reviewing the fee switch’s implementation details.

We think these developments are likely to be welcomed by public markets, as they reinforce Ethena’s governance, long-term holder base, and reduce token selling pressure.

Long-Term Growth Potential

Ethena is already among the highest-earning protocols in crypto.

Ethena is leveraging its leadership to launch new products built on its strengths in stablecoin issuance and crypto perpetual exchange expertise. These include:

- Ethena Whitelabel: a stablecoin-as-a-service product, building stablecoins for leading chains and apps. Already launched via SUIG in partnership with megaETH, Jupiter, Sui, and others.

- HyENA and Ethereal: two third-party perpetual DEXs built on USDe collateral, driving USDe adoption and returning trading fees to the Ethena ecosystem. Both are built externally but provide direct value to Ethena.

These new product lines could further strengthen Ethena’s leadership in synthetic dollars.

For all new products built on Ethena, the protocol should benefit from these initiatives’ economic gains, adding to its already strong revenue base.

Why We Are Long-Term Bullish on Ethena

Ethena has carved out a unique niche in the stablecoin market long dominated by Tether and Circle, becoming the clear leader in the synthetic dollar space.

With the rise of stablecoins, tokenization of traditional assets, and the growth of perpetual DEXs, we believe Ethena is uniquely positioned to benefit, as global demand for leverage translates into attractive, accessible yields for users and fintechs worldwide.

The protocol’s robust risk management has proven itself in real-world stress events, consistently delivering and building deep trust with users and partners.

Long term, Ethena can leverage its scale, brand, and infrastructure to expand into other products, diversify revenue, and strengthen resilience to market shocks.

As the issuer of the fastest-growing synthetic dollar in the fastest-growing stablecoin segment—yield-bearing stablecoins—Ethena is well positioned to incubate new business lines, boosting the already significant growth potential of its exchange and on/off-ramp businesses, while increasing USDe supply.

The opportunities ahead are significant, and as long-term ENA token holders, we are excited.

Disclosure:

- This article is reprinted from [Foresight News], with copyright belonging to the original author [Vishal Kankani, Multicoin Capital]. If you have any objections to the reprint, please contact the Gate Learn team, who will address the issue promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article without referencing Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?