How On-Chain TCGs Could Unlock the Next $2 Billion Market: Landscape Overview and Valuation Outlook

Source: zionmarketresearch, pokebeach, Gate Ventures

Pokémon TCG stands as the clear leader among trading card game (TCG) brands. By 2023, more than 52.9 billion Pokémon cards had been produced worldwide, spanning 14 languages and nearly 90 countries and regions. This surpasses all competitors in both reach and revenue. This dominance is driven by the powerful Pokémon IP across games, animation, and movies, alongside a product design balancing playability and collectibility. (1)

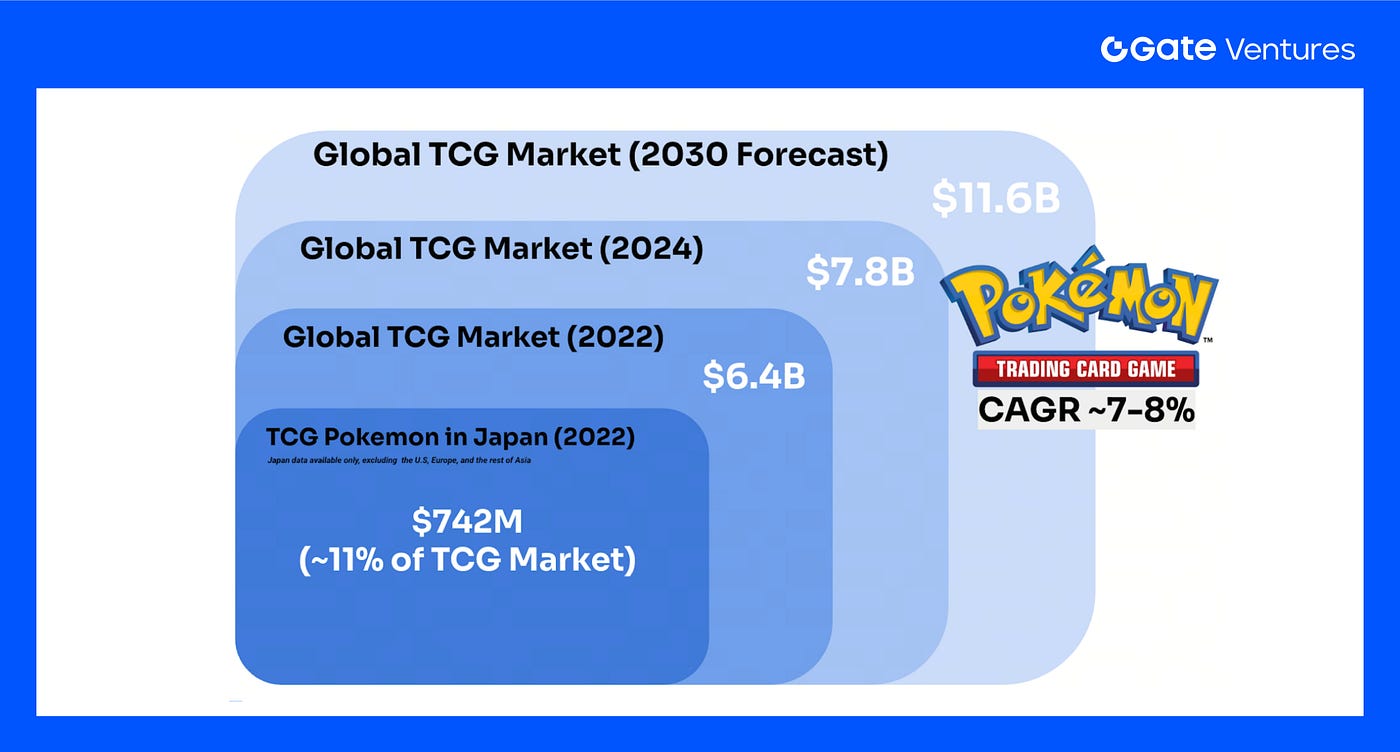

Publicly available data confirms Pokémon TCG’s extraordinary global status. In 2022, revenue from Japan alone accounted for 11% of the global TCG market. Industry forecasts estimate the global TCG market will hit $11.6 billion by 2030, with a compound annual growth rate of approximately 8%. This expansion is fueled by a surge in collector culture, and the ongoing growth of digital channels and the secondary market. (2)

Source: pokebeach, Gate Ventures

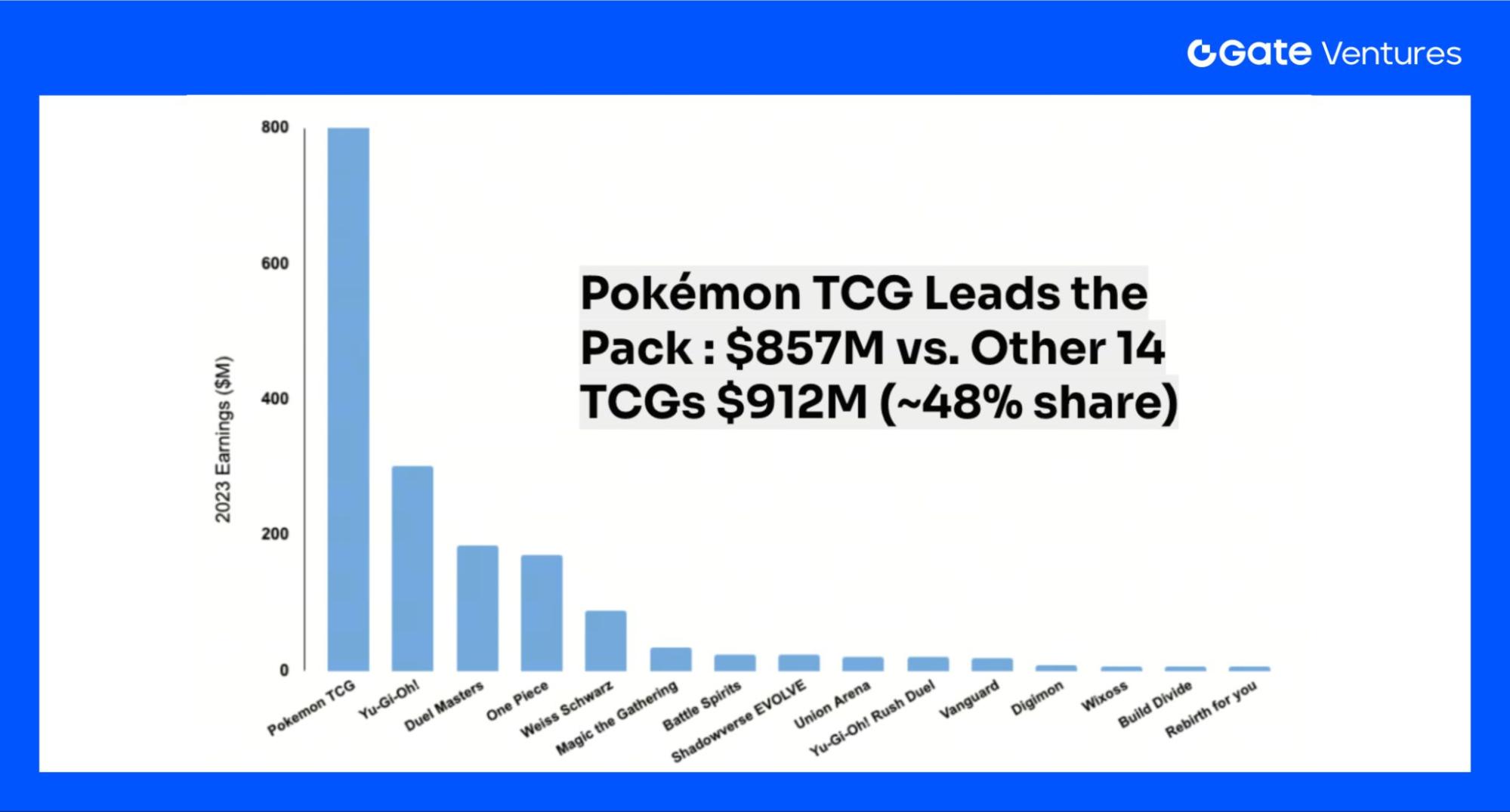

Regionally, North America and Europe are the most mature markets, featuring robust player communities and tournament infrastructure. Japan, home of Pokémon, continues to show strong demand—in 2023, Pokémon TCG’s revenue in Japan matched that of 14 other TCGs combined, reaching nearly 50% market share. Meanwhile, Southeast Asia and Latin America are rapidly developing, showing significant growth potential. (2)

Source: Wall Street Journal

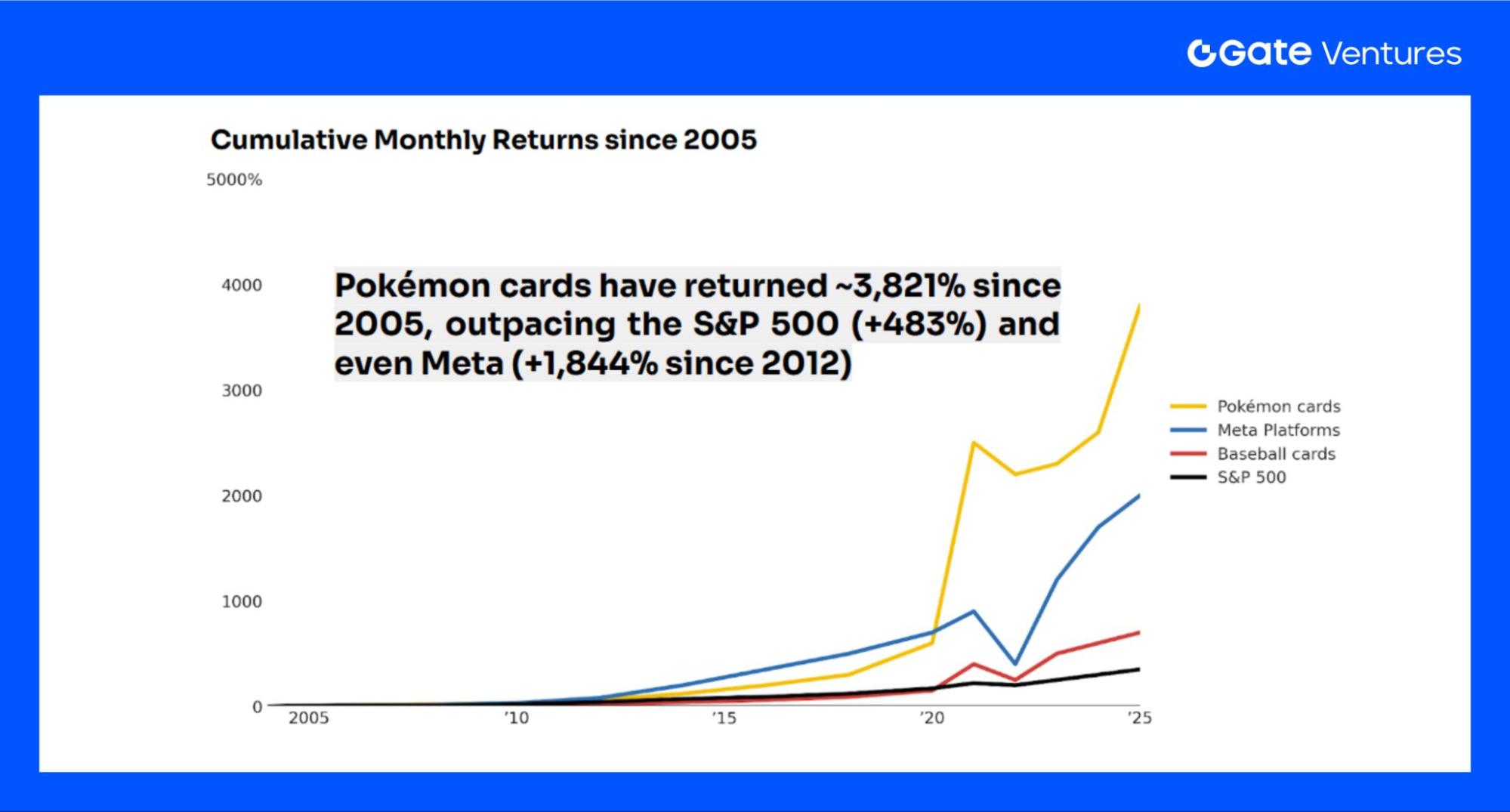

Driven by the rise of online trading platforms, social media, and a global fanbase, Pokémon cards have evolved from simple entertainment merchandise into a worldwide asset class with investment and collectible attributes—reinforcing their central role in the TCG ecosystem. Historically undervalued as investments, Pokémon cards have demonstrated returns over the past 20 years that exceed those of the S&P 500 and Meta, underscoring their unique investment proposition.

Pokémon TCG Ecosystem

To analyze the on-chain Pokémon TCG market, one must first understand its operating model.

Source: Gate Ventures

Vault Custody: Physical cards are sent to secure vaults (or direct from grading agencies); on-chain registration, photography, and certificate verification are performed; assets are stored in temperature- and humidity-controlled, insured facilities.

Authentication/Grading: The vault forwards cards to agencies like PSA, CGC, or BGS for grading; upon completion, cards return to the vault with updated certificate numbers and documentation.

Marketplace Listing: Cards can be listed for sale on exchange platforms or auction houses linked to the vault. Sellers set fixed or reserve prices. The system pulls certified images and data directly from vault records.

Trade & Settlement: Buyer submits payment → platform escrows funds → vault transfers ledger ownership to the buyer.

Delivery Options (select one):

- Vault-to-vault transfer: Buyer retains storage; ownership changes on the vault’s records.

- Physical withdrawal: Buyer requests shipping, vault arranges insured delivery, buyer pays shipping costs.

After-Sale/Asset Management: Users may resell, consign cards for auction, or fractionalize them (if compliant); vault statements and on-chain records provide full provenance and traceability.

Pokémon TCG and Web3 Synergy

Pokémon TCG boasts a robust ecosystem and commercial model, laying the technical foundation for on-chain applications. The next consideration is where synergy between Pokémon TCG and Web3 manifests.

Source: SolScan

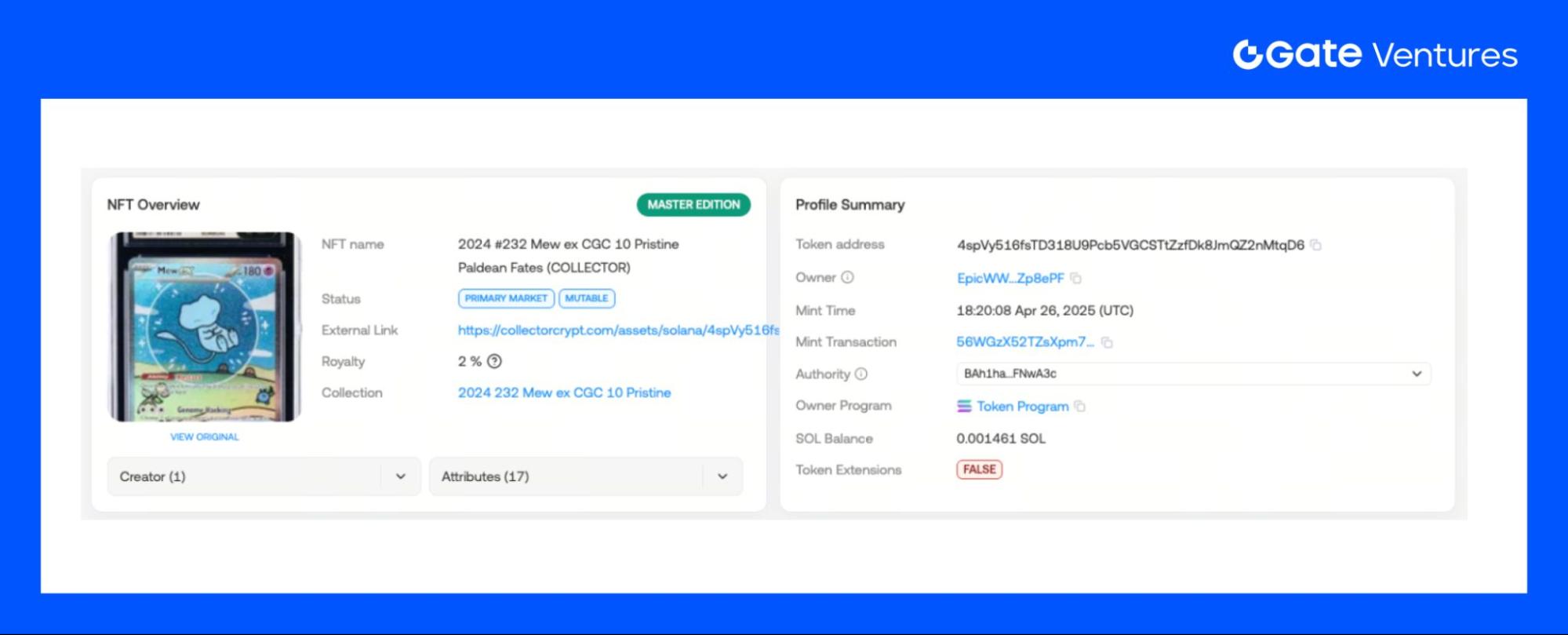

True Rarity and Verifiable Authenticity: When cards are minted as NFTs, the blockchain permanently records rarity and authenticity, enabling global ownership verification and free circulation. NFTs serve as digital title certificates, tied to unique token addresses, mint timestamps, and full transaction histories for verifiable provenance.

Cross-Platform Trading & Liquidity: NFT cards, as blockchain assets, are tradable worldwide and around the clock, greatly increasing liquidity. Platforms like Collector_Crypt and Courtyard.io enable 24/7 trading, overcoming the limitations of legacy channels and slashing barriers and costs.

Lower Fees: Legacy marketplaces like eBay charge 13%+ in seller fees, whereas blockchain platforms such as Courtyard and Collector_Crypt charge as little as 6% and 2%, respectively, driving users toward on-chain trading due to clear cost advantages.

Source: DexScreener

Pokémon TCG’s on-chain beta effect: Pokémon cards are high-value investments, but unfamiliarity with its ecosystem can be a barrier for new investors. Web3 enables rapid value realization and tokenization of premium assets, giving rise to Pokémon TCG’s on-chain beta effect. High-profile projects like $CARD (with a 10x price surge) and airdrop-driven Phygital initiatives ($PKMN) offer alternative investment opportunities tied to Pokémon premiums.

On-Chain TCG Market Overview

Source: Gate Ventures

Core on-chain TCG platform features fall into two categories:

- Pack Opening (Gacha mechanic): Users open digital card packs or blind boxes to receive randomized cards, enhancing gamification and engagement. Courtyard’s system ensures each digital card corresponds to a professionally vaulted physical asset.

- Secondary Marketplace: Users may trade cards freely or sell them back to the platform; some platforms guarantee buybacks (e.g., Courtyard offers 85–90% original price buybacks) to ensure liquidity and mitigate user risk.

Source: Dune Analytics

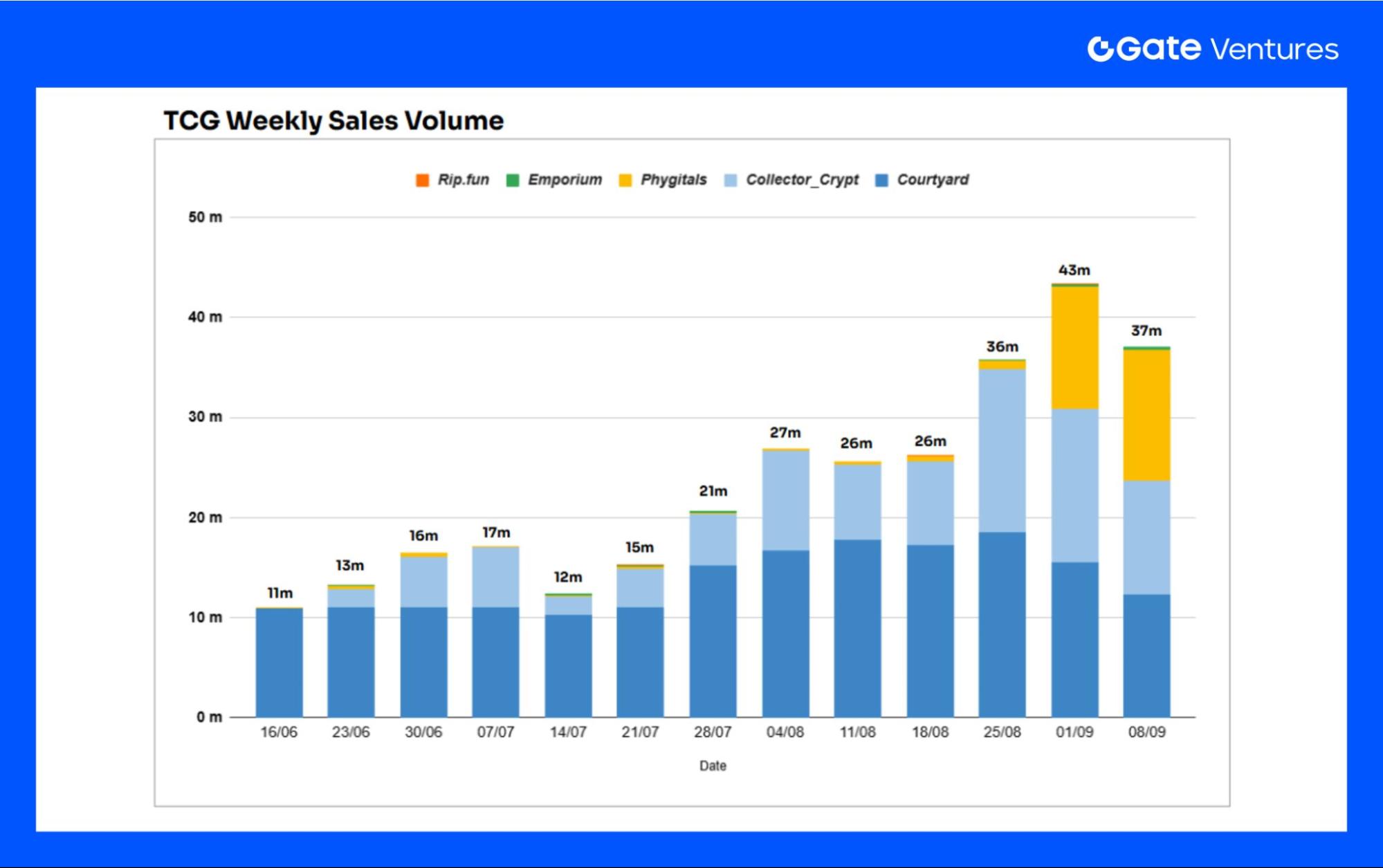

Recent months saw a surge in TCG market volume—from roughly $10 million in mid-June to $40 million by September (a fourfold increase). Courtyard.io initially held the bulk of market share, but new entrants like Collector_Crypt and Phygitals, plus airdrop activity, are diversifying and expanding the sector.

Source: Dune Analytics

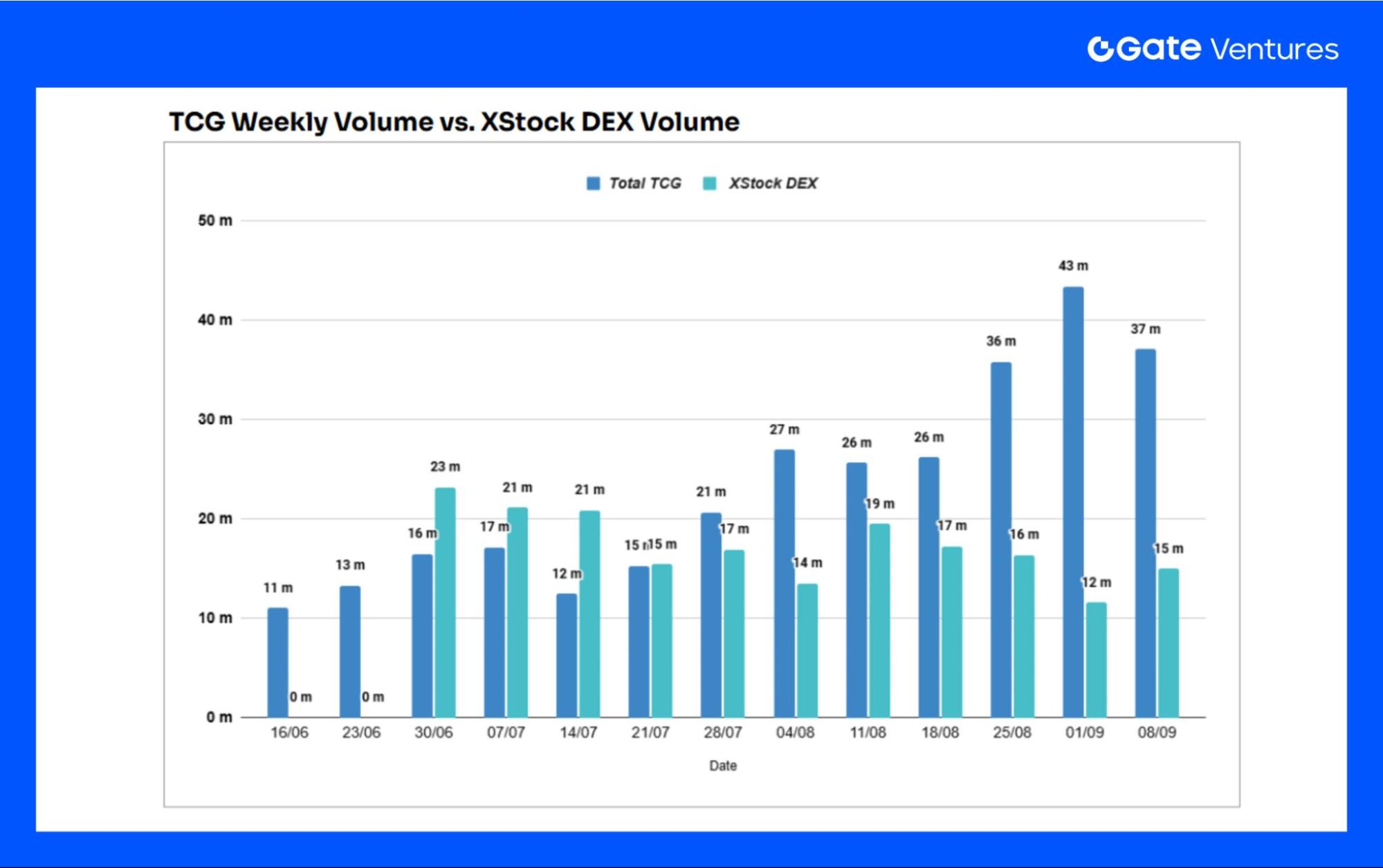

Relative to other on-chain real-world asset (RWA) tracks, TCG volumes have dramatically outpaced competitors like xStock since early August, tripling market size by September. TCG’s fit for blockchain and popularity highlight its greater appeal compared to on-chain equities, confirming a strong sector alignment with blockchain innovation.

Source: Documentations from each platform

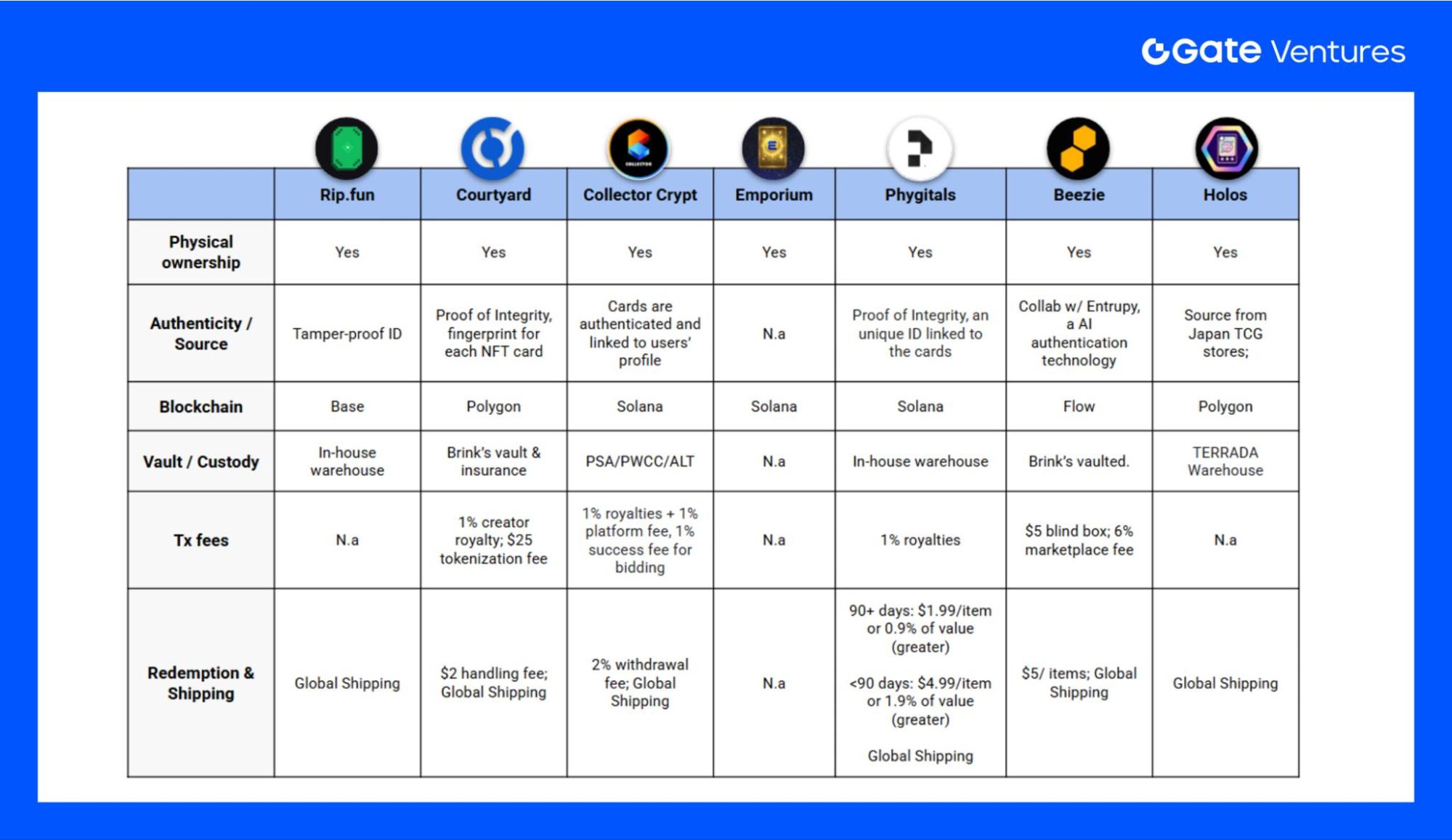

Key Takeaways — On-Chain TCG Platforms

- Most NFT cards represent physical ownership and employ varied authentication protocols.

- Platforms utilize chains such as Base, Solana, Polygon, and Flow, offering low fees and high transaction speed—clear advantages over legacy platforms.

- Fees are lower than eBay and similar platforms; royalty sharing incentivizes creators and holders.

- Global shipping supported (with local taxes); some platforms charge withdrawal or storage fees.

Case Study — Collector_Crypt

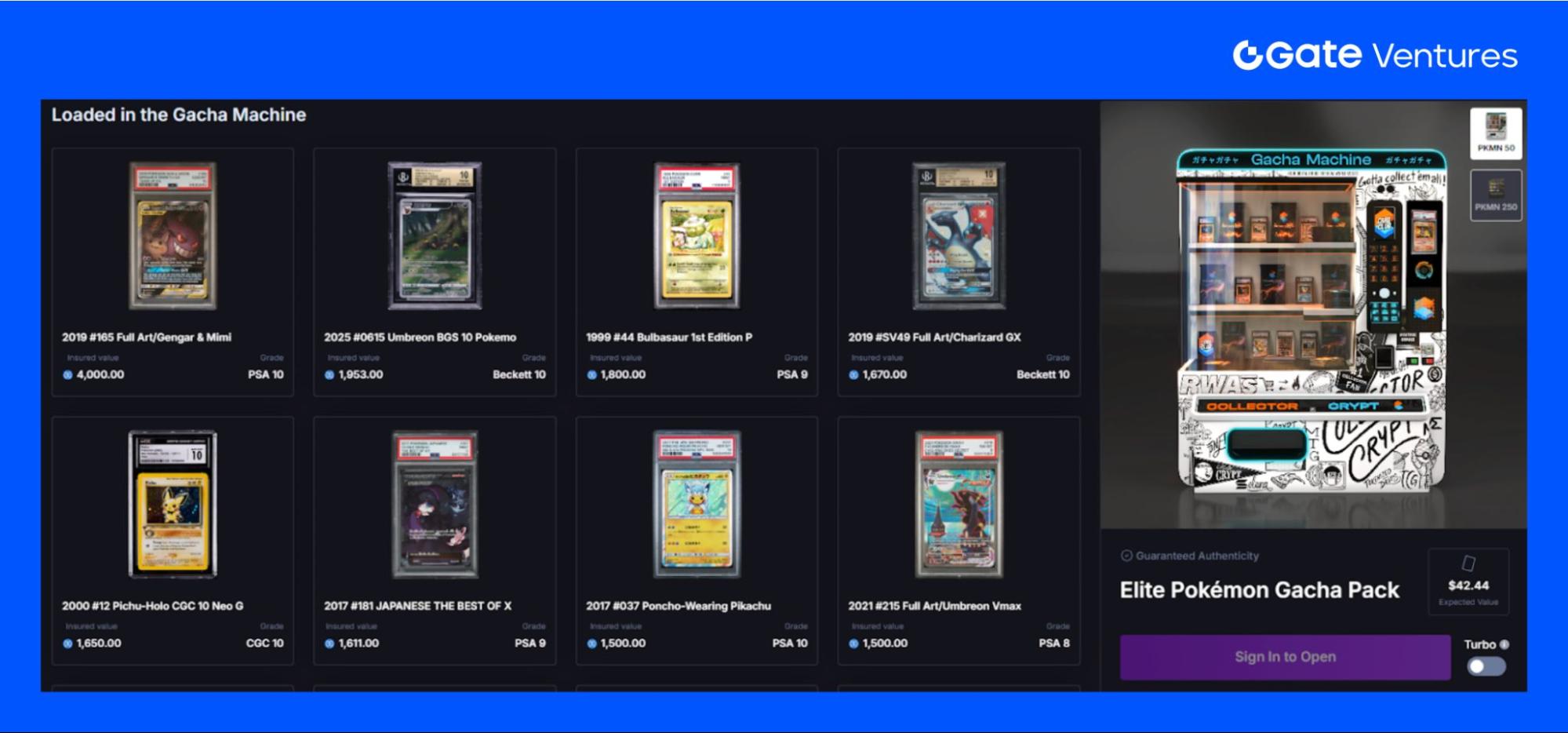

Collector_Crypt is the leading TCG collectible platform, focusing on Solana-based card asset trading. The standard workflow is:

Physical Card Deposited → Minted as Redeemable NFT → Users Open Packs or Trade on Marketplace.

Source: Collector_Crypt

The Gacha pack-opening mechanism delivers an authentic experience and is the platform’s key revenue source, with packs priced at 50 USDC and 250 USDC.

Source: Collector_Crypt

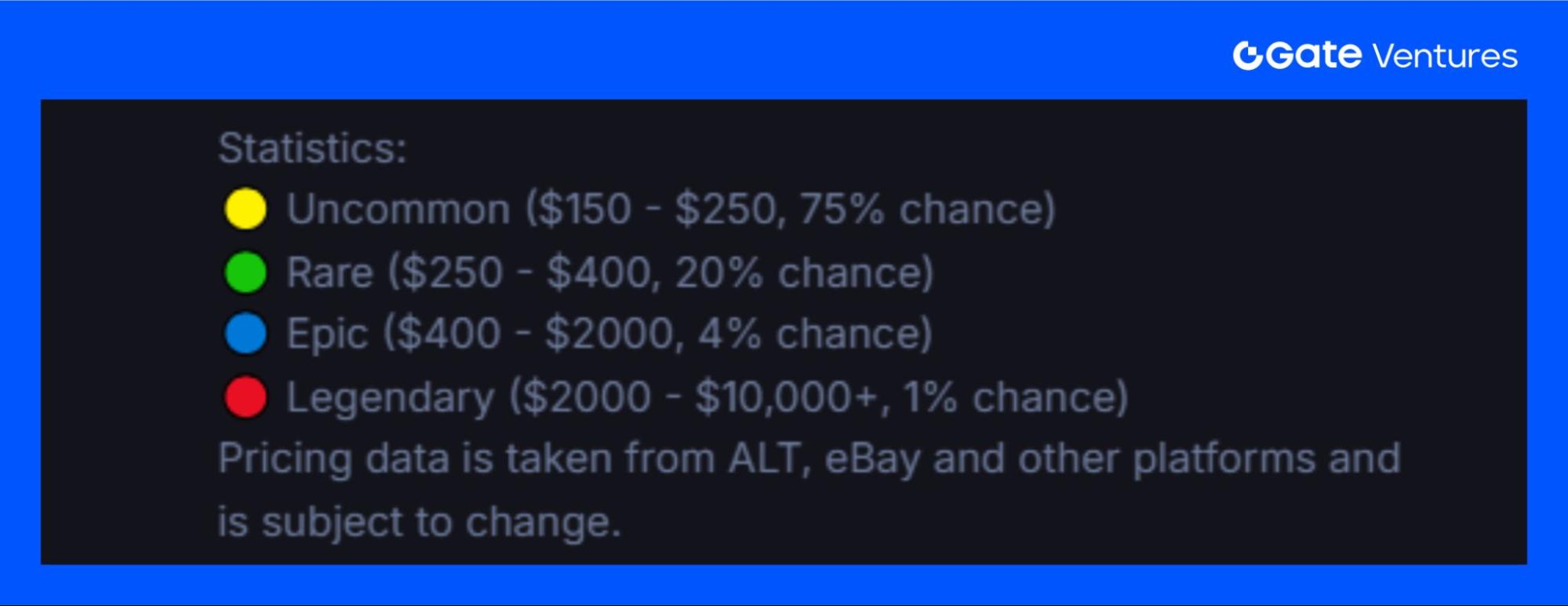

Official odds and pricing imply a positive expectancy: the expected value per card draw ($258.89) exceeds the cost ($250). This results in a favorable long-term payout profile for participants. Most users draw cards close to pack cost, minimizing downside risk, while rare Epic or Legendary draws offer outsized returns. Coupled with instant settlement and buyback, Collector_Crypt positions card opening as a statistically positive investment.

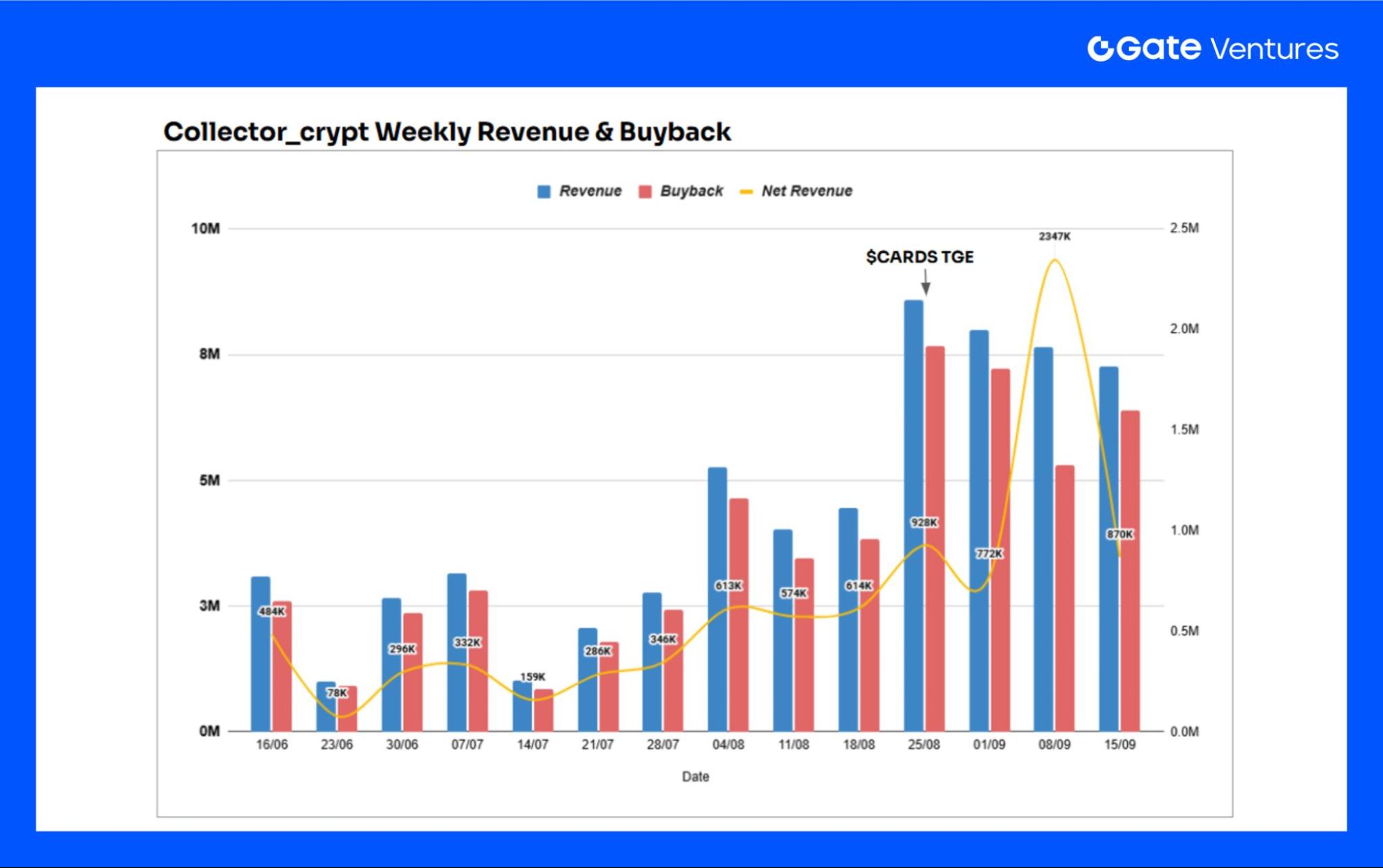

Platform Revenue

Source: Dune Analytics

Core revenue sources are a 2% Gacha and secondary market fee, plus a 2% withdrawal fee; the main expense is buying back cards at 85–90% of original value. August saw explosive growth on the back of $CARDS airdrop speculation, with net income nearly doubling month-over-month. Post-TGE, revenue peaked at $2.3 million for the top week, with over 120,000 packs opened.

To date, Collector_Crypt users have opened nearly 1.5 million packs, with total volume exceeding $180 million.

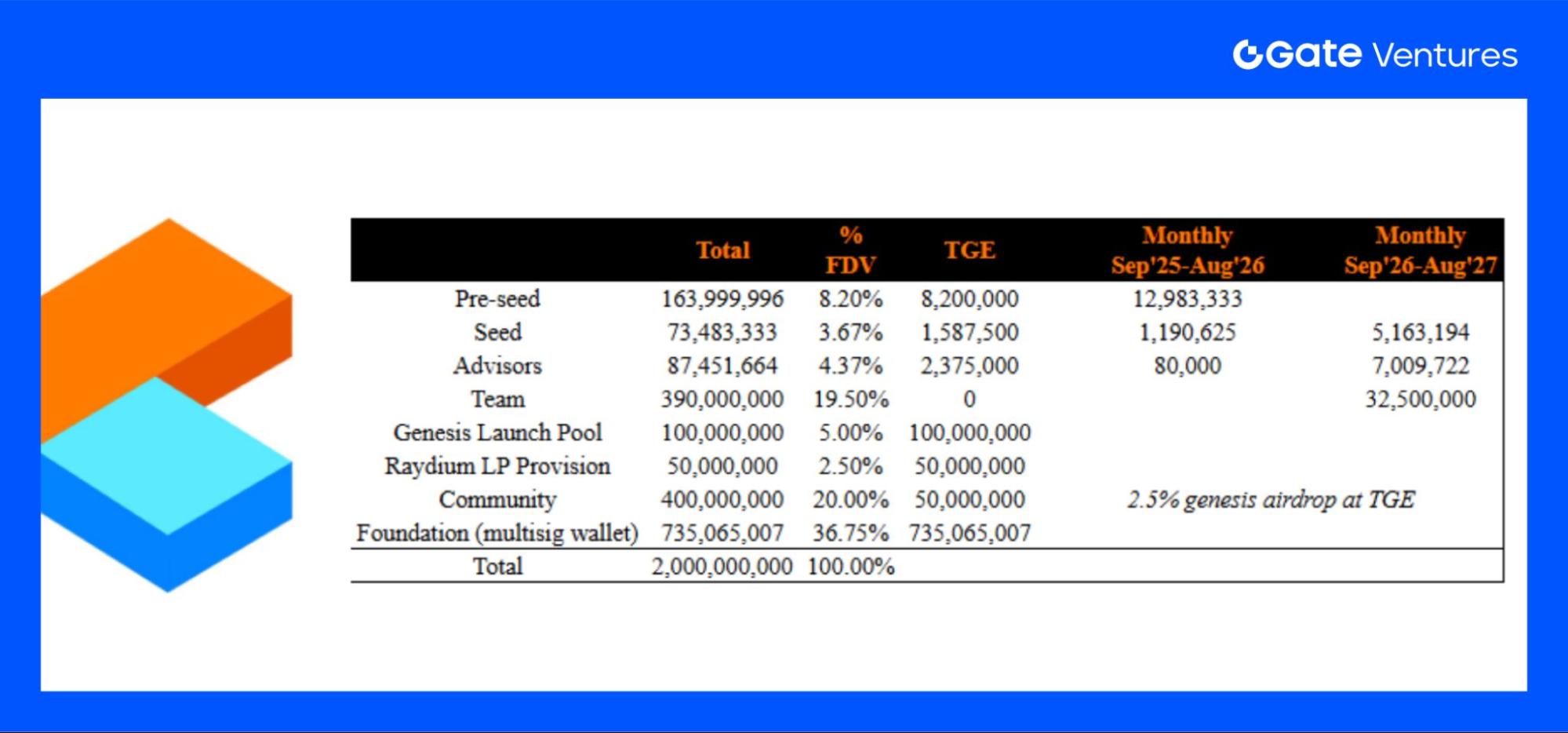

Tokenomics

Source: Collector_Crypt

$CARDS allocation: 16% to early investors, 5% to Launchpool, 50%+ to team and foundation, remainder for liquidity and expansion.

All Launchpool-raised funds (after costs) are used to purchase Pokémon cards, forming the platform’s core inventory. Further token utility details will follow after TGE. Currently, $CARDS lacks formal use cases (payments, staking, discounting, etc.).

Given Collector_Crypt’s strong cash flow, future profit-driven $CARDS buybacks or continued rare Pokémon card acquisitions may serve as significant price drivers.

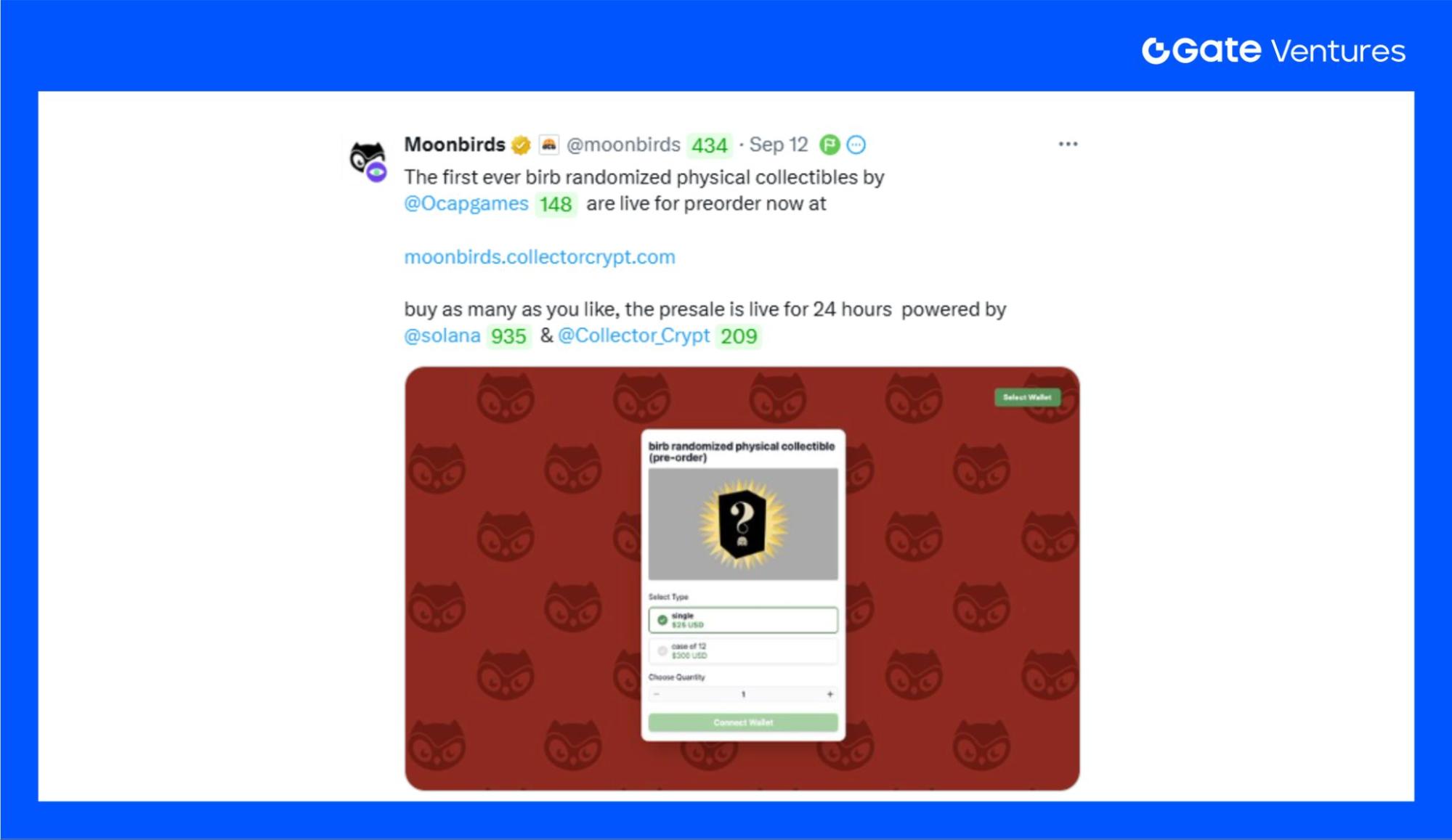

Source: X @ Moonbirds

While Pokémon TCG is currently Collector_Crypt’s main focus, the platform’s model can be extended—sports, anime, and movie IPs can similarly be tokenized. A new partnership with Moonbirds will bring physical collectibles to market. Each collectible will be paired with an on-chain certificate.

This “physical asset + on-chain token” strategy leverages blockchain’s strengths in transaction efficiency and authentication. It is well-positioned to become the next major trend in collectibles, accelerating Collector_Crypt’s growth.

Case Study — Phygitals

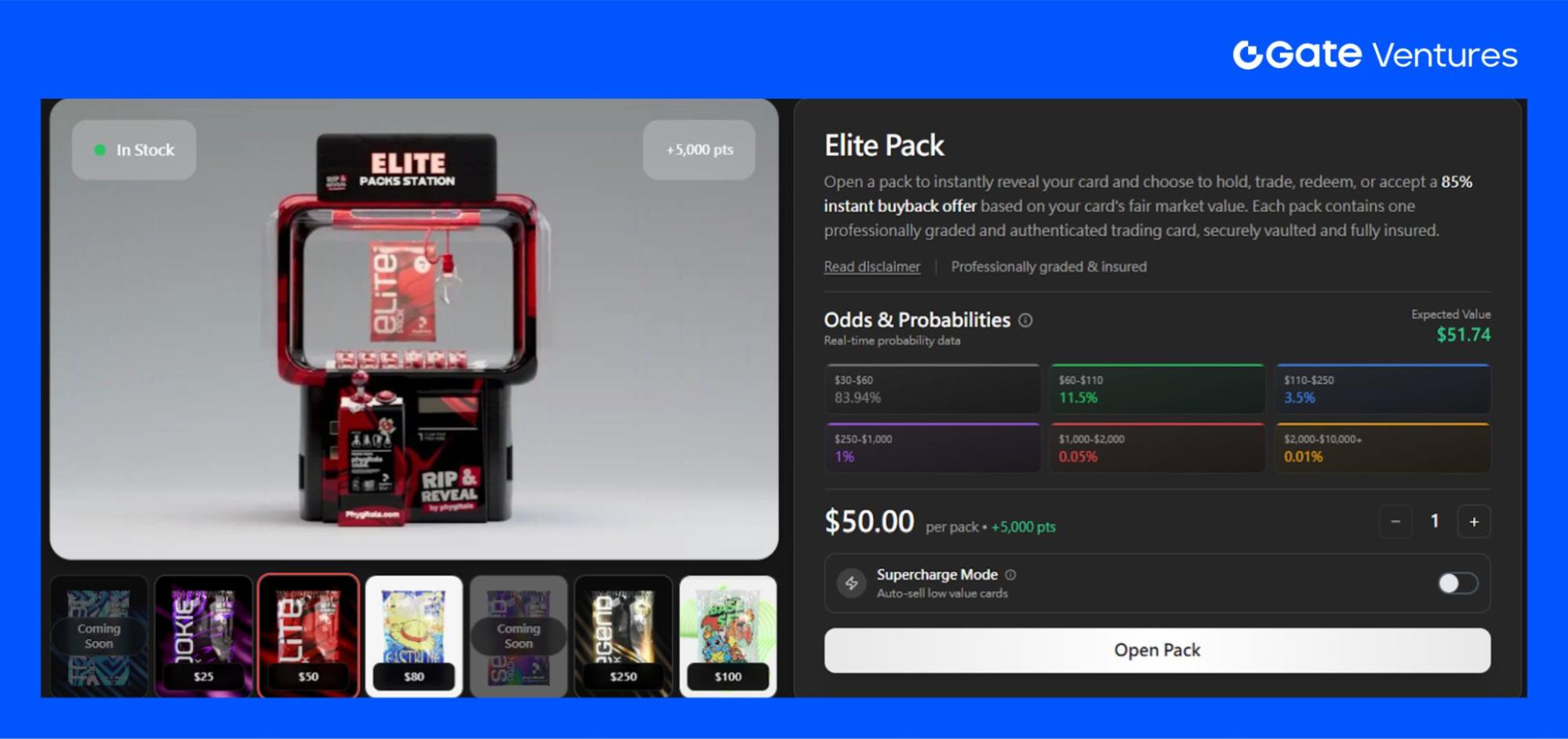

Phygitals uses a model similar to Collector_Crypt; users buy card packs at different price points ($25, $50, $80, $250, $500), each with varying rarity profiles. Cards can be held, traded, or sold back to the platform (at roughly 85% market value). Pokémon and other top IPs, such as One Piece, are included to diversify the audience.

Source: X @ phygitals

Phygitals will soon launch live pack-opening features, inspired by pump.fun’s live token releases, to create a youth-driven pop culture phenomenon. This interactive, entertainment-oriented approach fosters higher engagement and market buzz.

Free custody/withdrawal (excluding shipping) is coming soon, enabled by integration with a single vault partner and competitive pricing.

Platform Revenue

Source: Dune Analytics

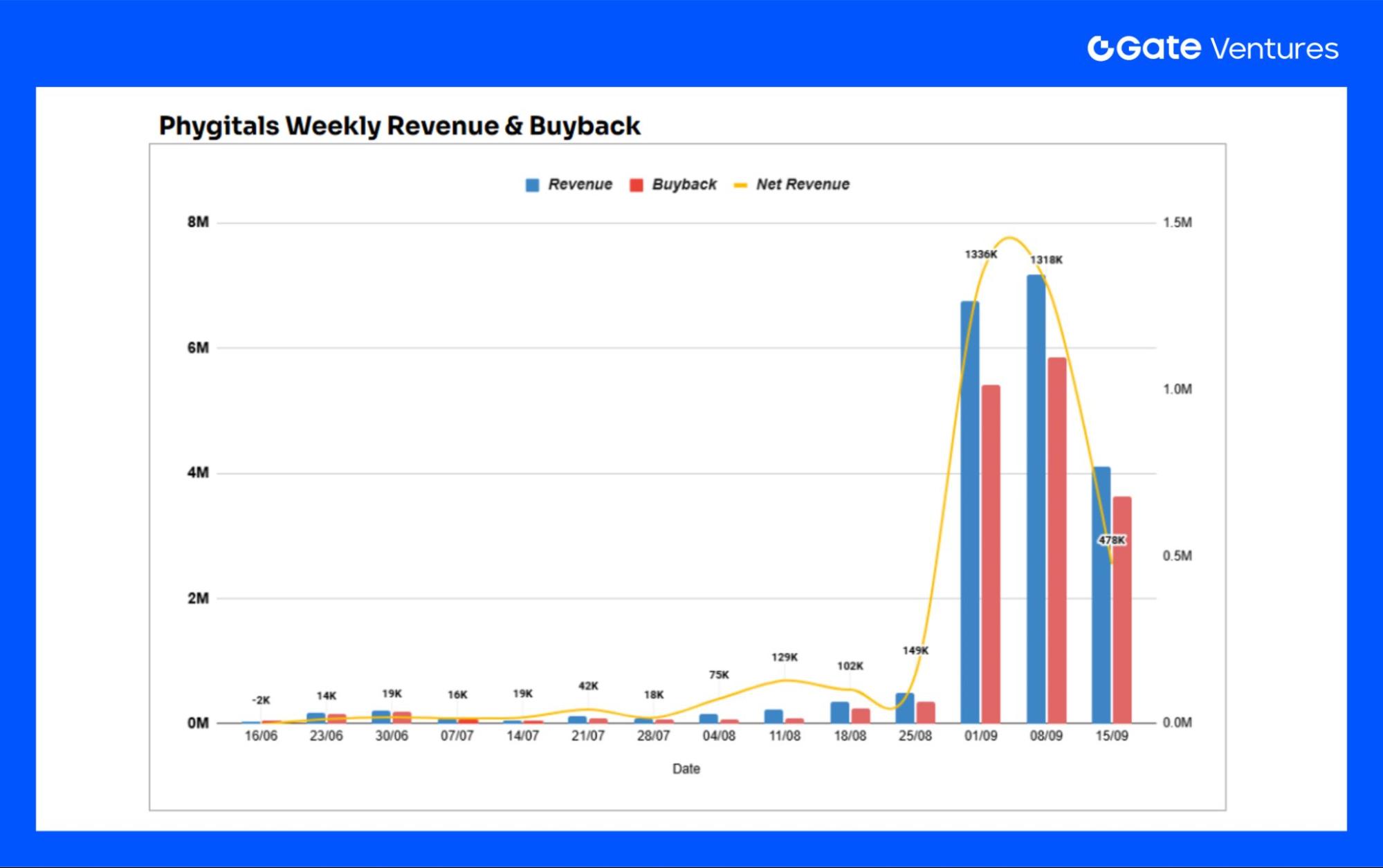

Before the TCG surge, Phygitals’ volume was flat. The $CARDS boom turned focus to “second-best” platforms, fueling speculation around upcoming token airdrops.

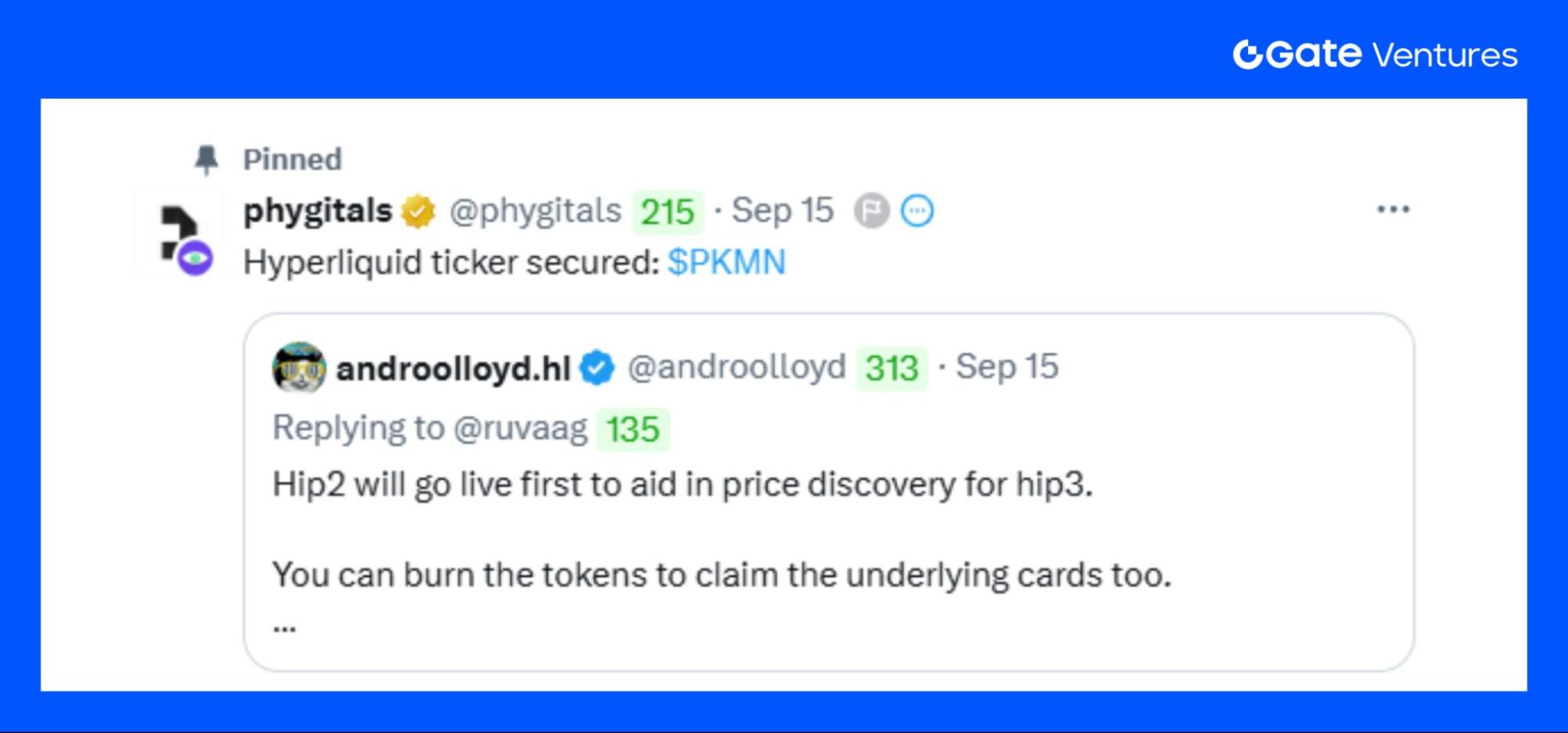

Source: X @ phygitals

Phygitals announced a Hyperliquid token auction ($PKMN), sparking a flood of airdrop participants and pushing weekly net revenue to $1.3 million on 170,000 packs opened.

Source: X @ phygitals

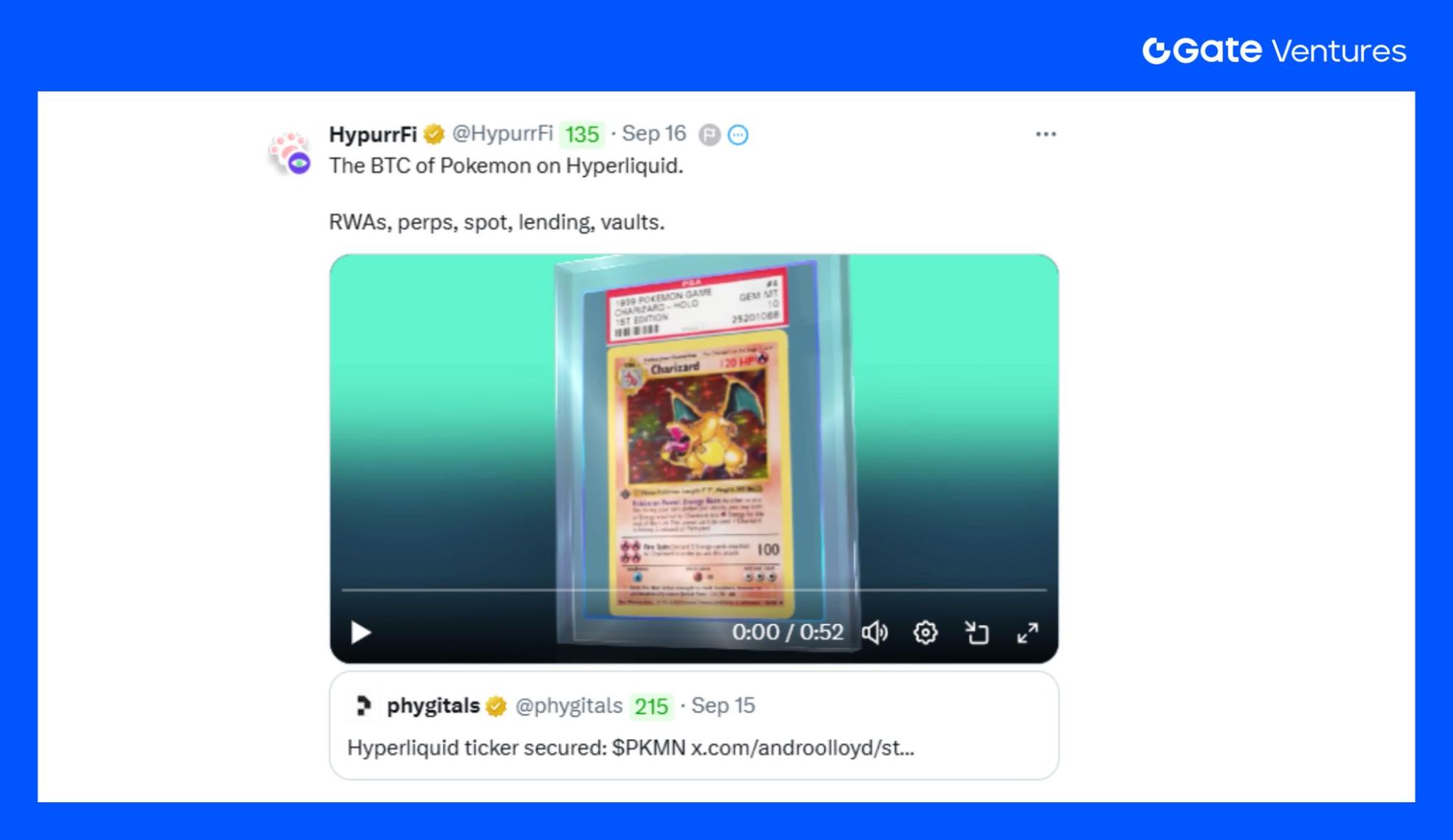

Partnerships with HypurrFi (HL’s DeFi protocol) suggest future lending and perpetual contract services for Pokémon cards—expanding the utility and integration of RWAs with DeFi.

Track Scale Forecast

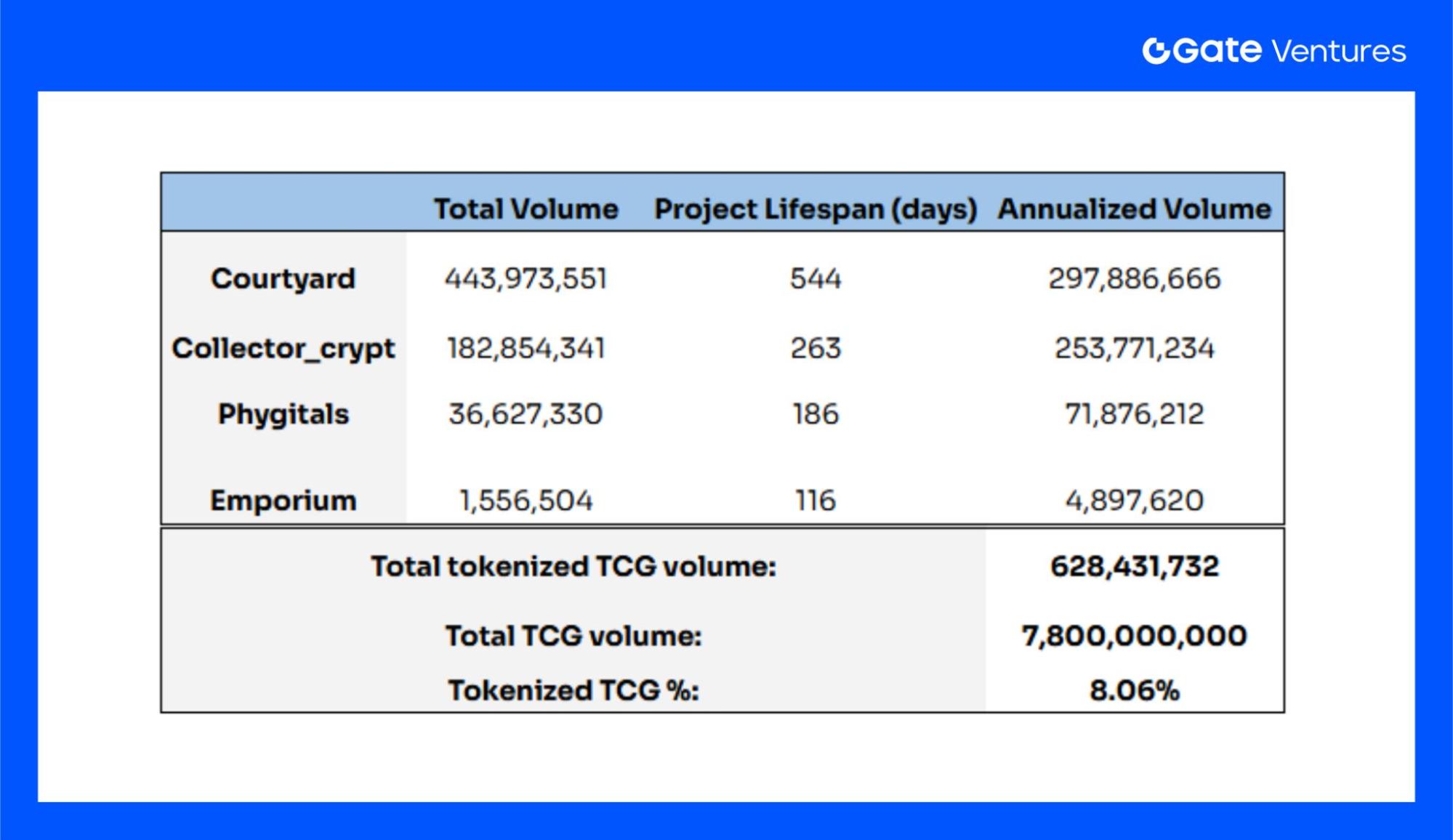

Source: Dune Analytics, zionmarketresearch

Current on-chain TCG markets transact around $630 million annually, representing 8% of the global market. As tokenized cards gain traction for their liquidity and efficiency, this share is set to rise.

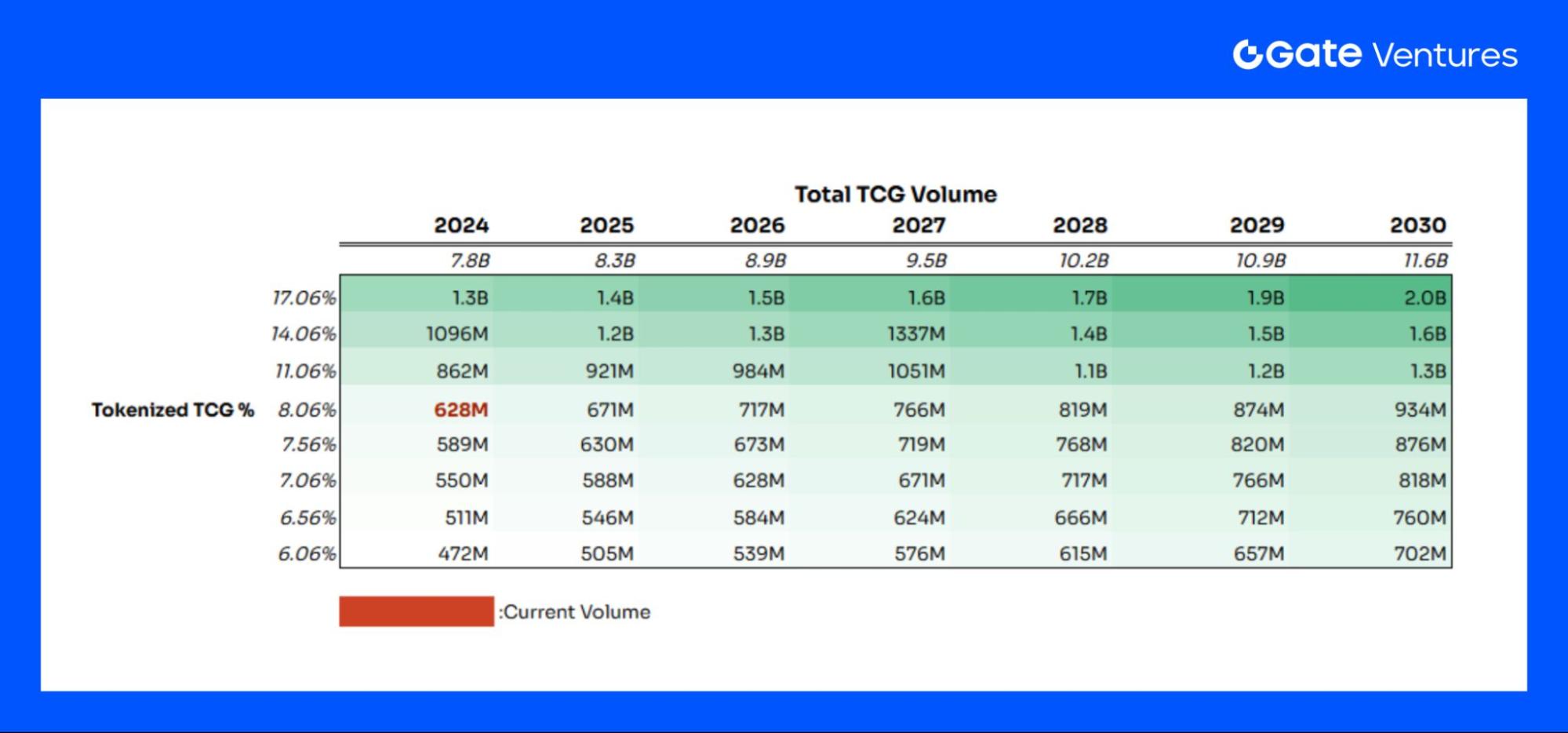

Source: Gate Ventures

Sensitivity analysis, based on industry forecasts, projects $11.6 billion in global TCG volume by 2030. Assuming a tokenized share between +3% (optimistic) and -0.5% (conservative), tokenized TCG could capture 17% of the market ($2 billion), a threefold increase from present levels.

Catalysts

1. Strong IP Power

Pokémon is the highest-earning entertainment IP globally, with nearly $100 billion in total revenue from games, animation, cards, movies, and merchandise. Its card ecosystem supports a massive player, collector, and investor base, creating strong emotional and monetary attachment to rare cards. The IP’s brand recognition lowers onboarding hurdles—users enter for the brand, not the blockchain. (3)

Pokémon cards have established transparent valuation across eBay, TCGPlayer, and Heritage Auction. On-chain tokenization leverages this price history, enabling NFTs to inherit real-world consensus. User trust is anchored by the established offline marketplace.

Pokémon is just a starting point; the tokenization model is extensible to:

- Sports cards (post-NBA Top Shot)

- Other anime/manga IPs (One Piece, Naruto, etc.)

- Movie/game IP (Star Wars, Marvel, Nintendo)

These verticals also feature active trading and collecting cultures and substantial Web3 audience overlap.

IP-driven culture and network effects increase reach beyond crypto-native circles, creating viral growth and capital inflows. The IP lever is key for rapid adoption and market penetration in on-chain TCG.

2. New Narrative and Compatibility in On-Chain Assetization

On-chain NFTs map 1:1 to physical cards with full transparency and provenance, resolving authenticity and trust gaps. Users access detailed card origin and transaction history.

Liquidity and speed are enhanced by instant buybacks (85–90%) and real-time settlement, versus legacy platforms’ longer cycles and opaque dispute resolution. On-chain enables faster, lower-friction trades.

Cost advantages are pronounced—legacy platforms like eBay charge 14%+ in fees, while on-chain platforms such as Collector_Crypt and Courtyard offer lower, transparent fees and permanent royalties for initial owners. This means:

- Users pay less in fees

- Original holders share in future trading value

Users recognizing these incentives are likely to transition from legacy platforms to on-chain TCG trading.

3. New Financialization Models

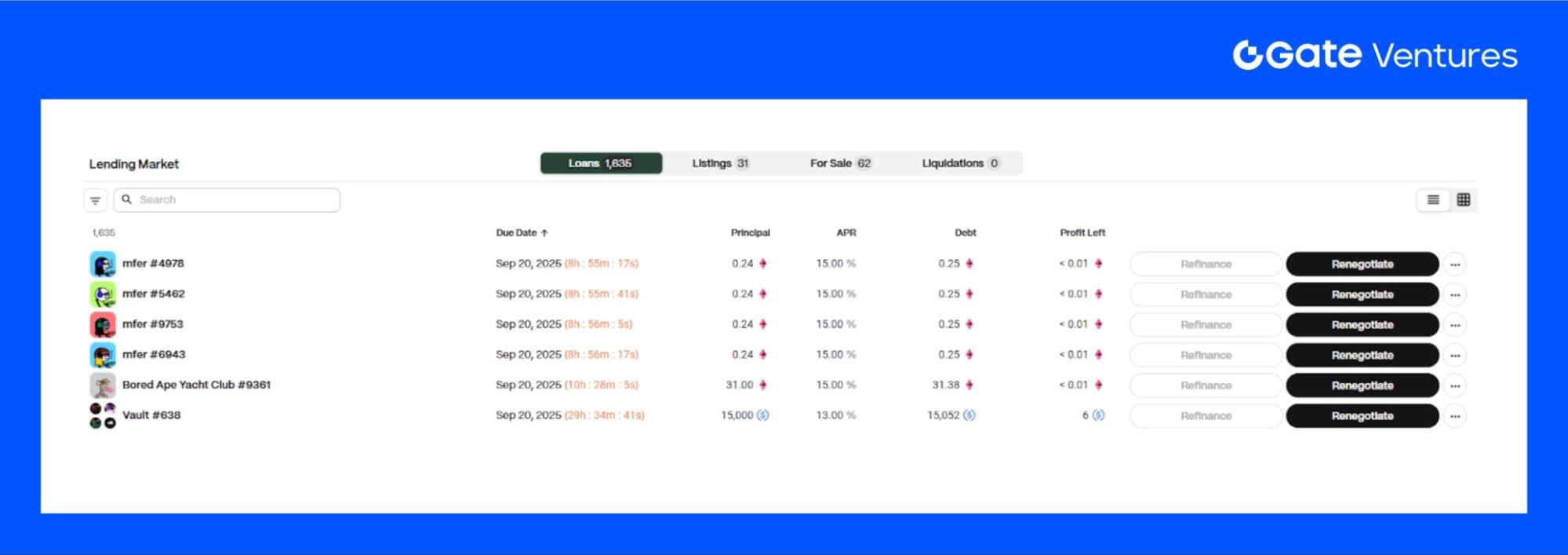

Developers are exploring NFT-collateralized lending, derivatives, staking, and DeFi services for high-value TCG cards, establishing the “Collectibles-Fi” narrative—cards evolve from mere collectibles to capital-efficient real-world assets (RWAs).

Web3’s strengths in value transfer foster new opportunities for token-based investment, with TCG-related tokens serving as sector beta assets, offering broader investment access.

Source: GONDI

TCG–DeFi integration is not new. NFT lending protocols (e.g., Blur Lending, Gondi) once achieved substantial TVLs, but suffered from unstable asset foundations—blue-chip NFT price collapses destroyed liquidity.

TCG cards face similar systemic risk, but their underlying strength is greater:

- 30-year market history, mature price mechanisms

- Deep emotional/cultural and aggregate user loyalty

Thus, TCG asset stability and cultural stickiness may better support DeFi integration, positioning TCGs for durable sector growth and ecosystem development.

Risk

It is necessary to pay close attention to the sustainability of card supply. For example, in the Pokémon TCG, certain booster series have long been in short supply and were consequently hyped in the secondary market. For on-chain TCG platforms, ensuring a continuous and stable supply will be a long-term challenge. Taking Collector_Crypt’s Legendary Gacha series as an example, signs of supply shortages have already emerged. If replenishment is delayed, it will significantly weaken user stickiness and spending habits. Therefore, this issue warrants ongoing attention.

Conclusion & Outlook

On-chain TCGs validate the thesis: tokenized collectibles are tradable, liquid financial assets. While Pokémon leads, it is just the gateway.

Sports cards represent a market almost twice Pokémon’s scale, with global fandom and investment appeal. Other major IPs—One Piece, Yu-Gi-Oh!—bring large collector bases and well-developed secondary markets.

As these IPs move on-chain, the “Exotic RWA” ecosystem will expand to encompass sports, anime, and entertainment culture, forging a diverse market and powering new connections between fandom economies and DeFi.

About Gate Ventures

Gate Ventures is the venture capital arm of Gate, focused on decentralized infrastructure, ecosystems, and applications that will shape the Web 3.0 era. Gate Ventures partners with innovators and global leaders to empower teams and startups to redefine financial and social interaction.

Disclaimer:

This content does not constitute an offer, solicitation, or recommendation. You should seek independent professional advice before making investment decisions. Gate and/or Gate Ventures may restrict or prohibit services in certain regions—please consult the relevant user agreements.

References

- https://www.gamedeveloper.com/business/pok-mon-series-has-sold-480-million-units-made-52-9-billion-cards?utm_source=chatgpt.com

- https://www.zionmarketresearch.com/report/trading-card-game-market

- https://www.vice.com/en/article/pokemon-has-become-the-highest-grossing-media-franchise-of-all-time/?utm_source=chatgpt.com

- https://dune.com/zkayape/pokemontcgsol

- https://dune.com/socialgraphventures/ripfun-kpis

- https://dune.com/hashed_official/xstocks-metrics

Related Articles

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)

Gate Ventures Weekly Crypto Recap (September 22, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

Gate Ventures Weekly Crypto Recap (September 15, 2025)