Gate ETF Leveraged Tokens Guide: Understanding Risk Boundaries to Truly Amplify Returns

Gate ETF Leveraged Tokens Are Not Low-Risk Products

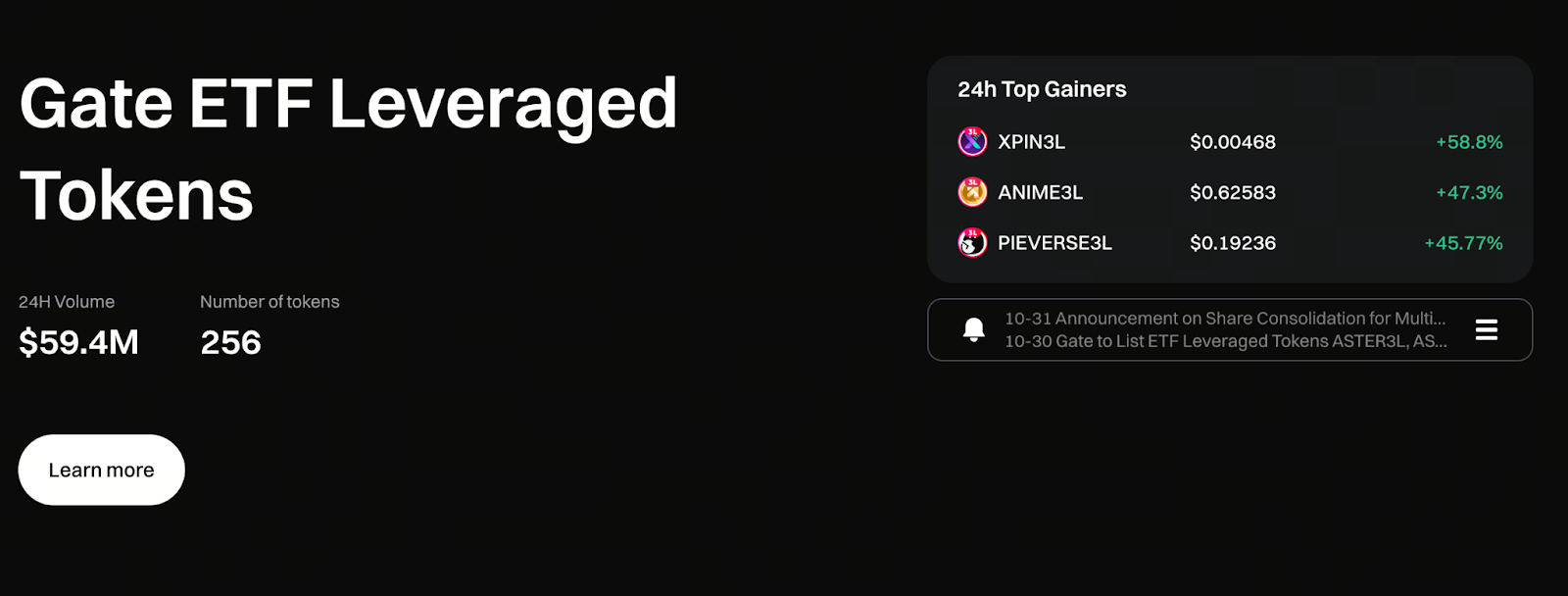

Image source: https://www.gate.com/leveraged-etf

Before we discuss Gate ETF Leveraged Tokens, it’s essential to clarify a key point: “No Forced Liquidation” does not mean low risk.

Gate ETF Leveraged Tokens only change how risk is presented—they do not eliminate risk. Compared to derivatives, these tokens transform “liquidation risk” into “NAV volatility risk,” making losses more linear and predictable. However, the leverage effect still magnifies both gains and losses.

Understanding where the risks lie is the first step to using ETF Leveraged Tokens effectively.

How Do Risks Manifest in Gate ETF Leveraged Tokens?

The main risks of Gate ETF Leveraged Tokens include:

1. Leverage Amplifies Price Movements

When the underlying asset rises or falls, the NAV of the ETF Leveraged Token moves up or down by a fixed multiple.

If you misjudge the market direction, your losses are magnified as well. This is fundamentally the same as with derivatives.

2. NAV Decay in Sideways Markets

In choppy, trendless markets, ETF Leveraged Tokens experience “NAV decay” due to their automatic rebalancing mechanism. Even if the underlying asset returns to its starting price, the token’s value may end up lower than where it began.

This risk is often overlooked, but it has a significant impact on long-term holdings.

3. Management Fees Diminish Long-Term Returns

Gate ETF Leveraged Tokens charge a daily management fee to cover operating costs. This fee is already reflected in the NAV, so users don’t pay it separately. However, the longer you hold, the greater the drag on your returns.

This is why ETF Leveraged Tokens are not intended for long-term holding.

Who Should Use Gate ETF Leveraged Tokens?

In practice, ETF Leveraged Tokens are best suited for:

- Traders who can identify market trends

- Short-term or medium-term swing traders

- Users seeking to avoid liquidation risk

- Traders who want to simplify their trading process

For these users, Gate ETF Leveraged Tokens can significantly boost trading efficiency.

When Should You Avoid ETF Leveraged Tokens?

It is equally important to recognize scenarios where ETF Leveraged Tokens are not appropriate.

1. Long-Term or Value Investing

ETF Leveraged Tokens are not designed for long-term holding. If your objective is long-term investment or asset allocation, spot trading is a better fit.

2. Sideways Markets with No Clear Trend

During sideways or range-bound markets, ETF Leveraged Tokens tend to work against you over time, not in your favor.

3. Emotional or High-Frequency Trading

Frequent trading or chasing price swings can amplify losses and reduce overall returns.

How to Set Reasonable Boundaries for Using Gate ETF Leveraged Tokens

To use ETF Leveraged Tokens rationally, follow these guidelines:

- Define your trading horizon (e.g., 1–3 days, or less than a week)

- Enter positions only after a clear trend emerges

- Set take-profit and stop-loss levels in advance

- Never allocate all your funds to a single leveraged token

ETF Leveraged Tokens should be just one tool in your trading arsenal—not your only tool.

The Right Role for Gate ETF Leveraged Tokens in Your Trading System

In a mature trading system, each tool serves a unique purpose:

- Spot: Long-term holding, low-frequency trading

- Derivatives: High-frequency, advanced strategies

- ETF Leveraged Tokens: Amplifying trends, simplifying execution

The value of Gate ETF Leveraged Tokens is their ability to magnify trends with lower operational complexity.

Why Understanding Product Boundaries Matters More Than Chasing Returns

Many traders focus solely on leverage multiples and ignore the product’s intended purpose.

The primary goal of Gate ETF Leveraged Tokens is not to let users pursue unlimited leverage, but to improve capital efficiency during trending markets while keeping risk manageable.

When you understand what ETF Leveraged Tokens can and cannot do, they become an asset—not a liability.

Conclusion

Gate ETF Leveraged Tokens are clear, user-friendly leveraged trading tools, but they remain high-volatility products. Only by understanding their risk boundaries and respecting market conditions can you truly benefit from their potential to amplify returns.

Always treat them as a tool, not a shortcut. This is a principle every user should remember.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution