DEXed Out, Not Down

Hello

It’s been an interesting year of evolution for both centralised and decentralised exchanges. Over the last 12-18 months, people in crypto have witnessed momentum and liquidity shift from centralised exchanges (CEXs), which rely on trust and compliance, to decentralised exchanges (DEXs) that promise users transparency, composability, and self-custody.

While headlines and reports claim a grand return of centralised trading, a deeper look at the numbers reveals a much more nuanced picture.

In this week’s quant analysis, I explore both DEX and CEX data to better understand how spot and leveraged liquidity are evolving in crypto trading.

On to the story now,

Polymarket: Where Your Predictions Carry Weight.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

The CEX-DEX War

When you zoom out to 2025, it looks like the year when CEXs made their comeback after almost two years of declining confidence and shrinking liquidity. Between January 2021 and May 2022, the monthly volume on CEXs averaged way over $1.5 trillion. However, since June 2022, the monthly volume has crossed the trillion-dollar mark once until November 2023.

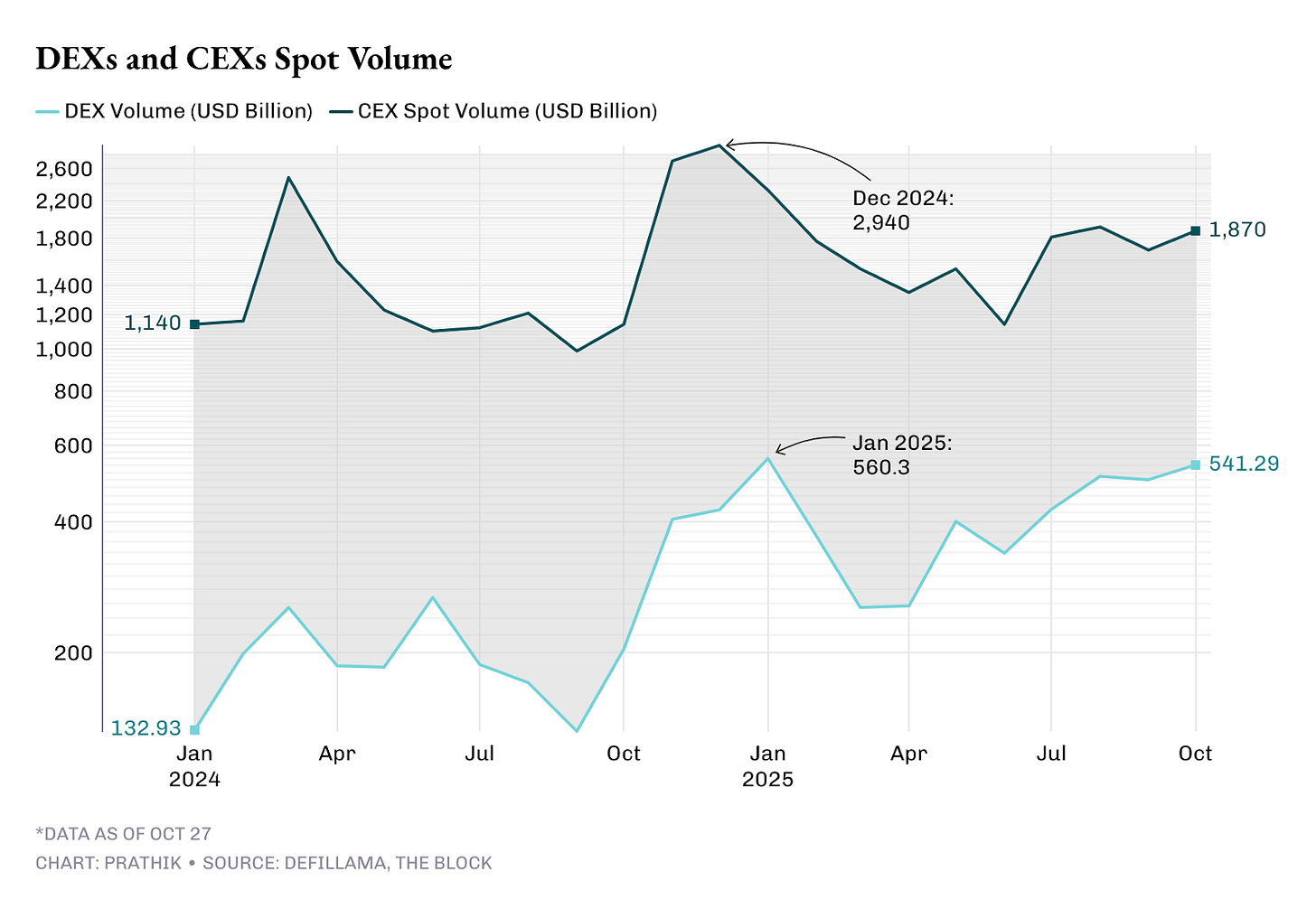

Over the past two years, the volume on CEXs has surged. Thanks to the ETF and macro tailwinds, it has reached record highs. By December 2024, that number had climbed to $2.94 trillion.

The inflection point stands out in Q4 2024. Spot volume on CEXs shot up from $1.14 trillion in October to $2.94 trillion in December 2024, taking the quarter’s average to over $2.25 trillion per month.

The increase coincided with the risk-on sentiment in markets following US President Donald Trump’s re-election and pro-crypto regulatory talks.

The first quarter of 2025 held that momentum, averaging close to $1.8 trillion a month, before dipping about 30% in Q2 2025 to $1.3 trillion. In Q3 2025, though, it recovered all the lost ground and averaged over $1.8 trillion in monthly volume.

While CEXs were recording a strong comeback, DEXs weren’t calm either. In fact, they continued to climb faster than their centralised counterparts.

In January 2024, DEXs processed roughly $133 billion in spot volume. In a little over 18 months, the figure has quadrupled, reaching over $540 billion.

For Q1 2025, DEXs averaged $395 billion in monthly volume, followed by $332 billion in Q2. By Q3 2025, the average had jumped 50% to $480 billion in monthly volume. In October, the volume has already surpassed $540 billion with four days to go.

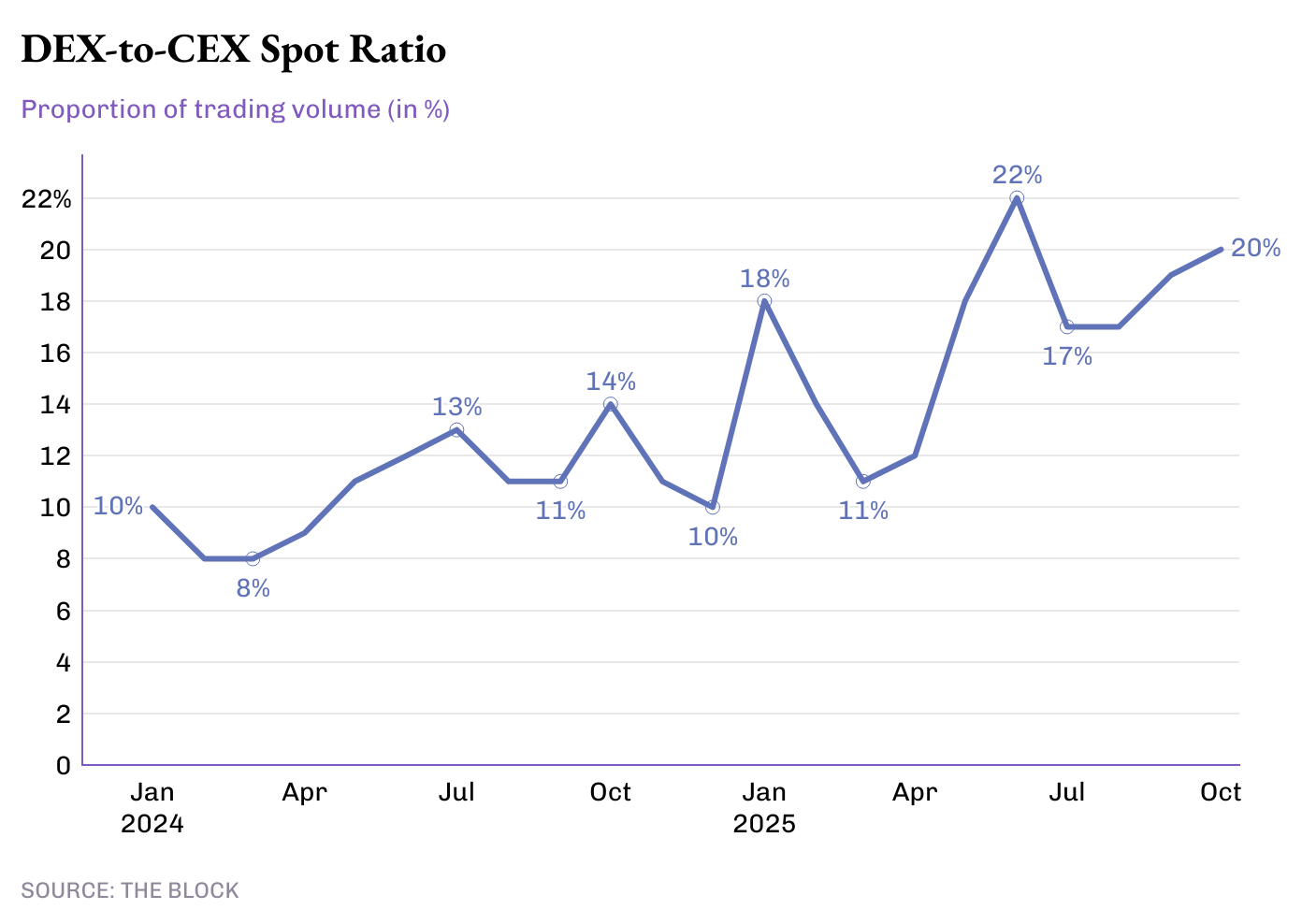

So far this year, DEXs have accounted for nearly 20% all spot volume, up from just over 10% in 2024. While CEXs still dominate the markets due to fiat ramps, DEXs have become the default choice for those seeking speed, composability, anonymity and self-custody.

Better UX, lower gas fees, and tighter spreads on protocols like Uniswap v4, Hyperliquid L1, and Raydium have bridged the experience gap between the two ecosystems.

The Derivatives’ Drive

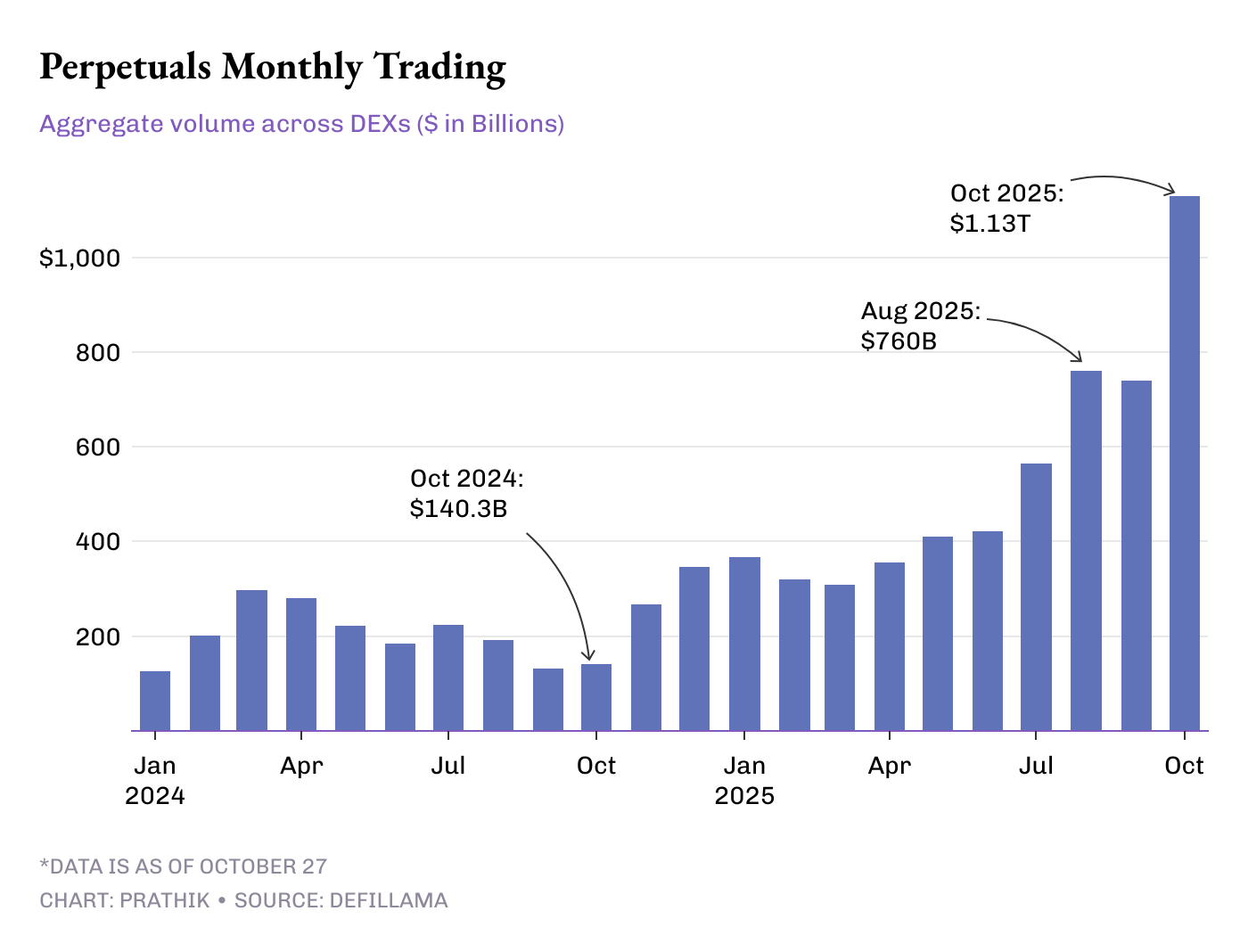

If you ask me, the single most significant boost to DEX activity, I would not look beyond perpetuals. Through 2024, on-chain perps remained a niche product, with a monthly volume of a few hundred billion. This was primarily confined to protocols such as dYdX, GMX, and a few other Arbitrum-based DEXs. However, by the end of 2025, these platforms began to rival the entire DEX Spot market in size.

In January 2024, perpetual DEXs processed $127 billion in monthly volume. By December 2024, that number had almost tripled to $345 billion.

But 2025 changed the tempo. From averaging $332 billion in Q1, the monthly average volume of perpetuals more than doubled to $688 billion in Q3. In October alone, it surpassed $1.13 trillion, the first trillion-dollar month for on-chain derivatives, more than double the size of the DEX Spot market.

These insights show not only more traders entering the on-chain space, but also increased activity per trader. On-chain DEXs offering perpetuals now replicate CEX features such as isolated margin, deep order books, and cross-chain collateral. Additionally, they offer high composability, which CEXs can’t. These advantages have proven enough to retain many high-value traders on-chain.

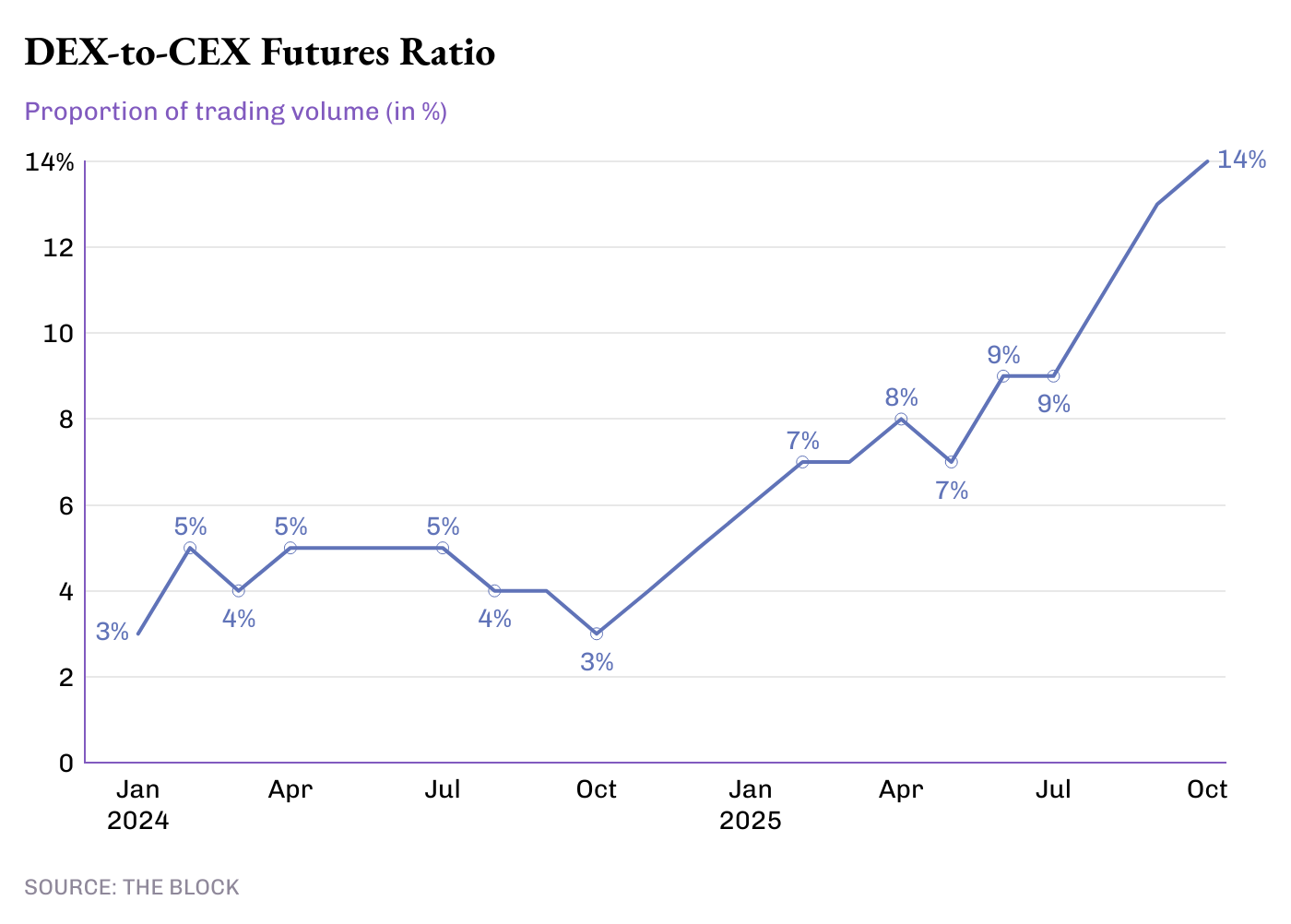

This trend is visible in the stable rise of the DEX-to-CEX ratio for derivatives trading.

In 2024, decentralised perps handled less than 5% of global futures turnover. By mid-2025, that number had doubled to 10%, and by October, it had reached 14.3%, the highest-ever share of on-chain derivatives relative to CEXs.

That’s still a small number when compared to Binance’s scale, but it still tells us where this is headed. While CEX derivatives volume has stayed mostly range-bound this year, DEX perps have grown every quarter since mid-2023.

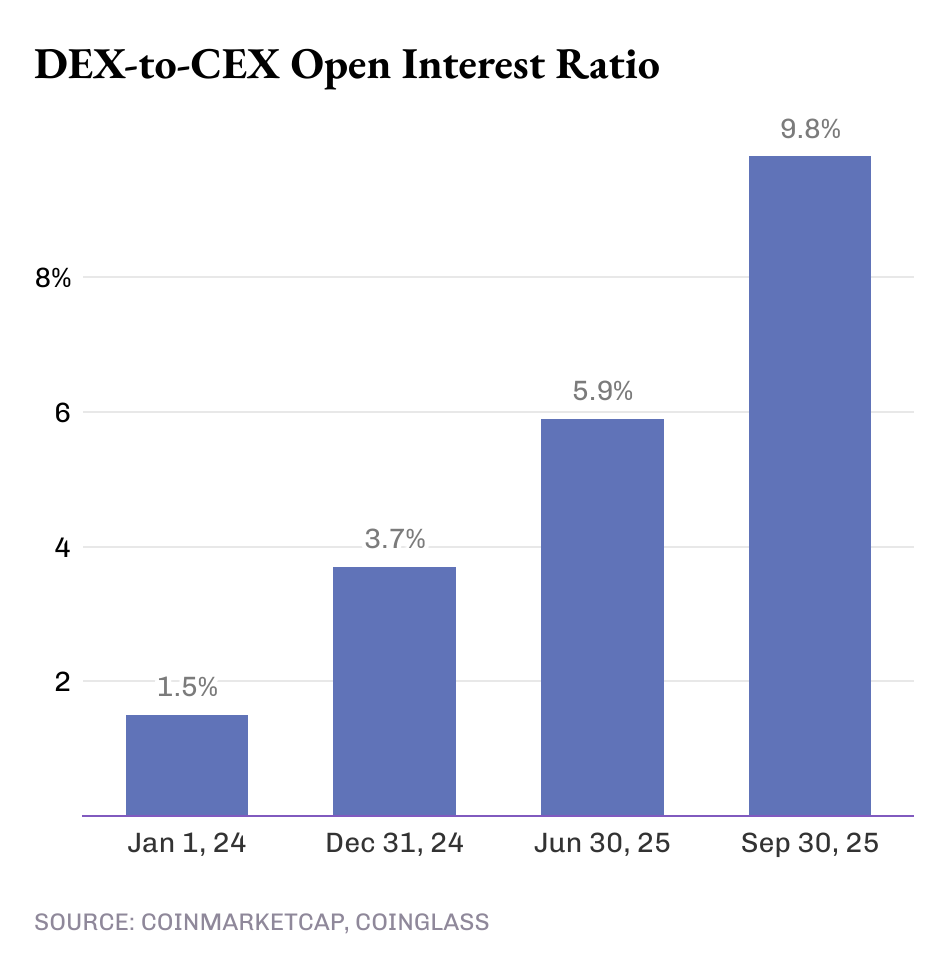

While volumes shows us one part of the story, open interest (OI) gives us further nuance. On January 1, 2024, OI on on-chain exchanges accounted for just 1.5% of the global derivatives. By December 31, 2024, that doubled to 3.7%, and reached 5.9% by June 30. On September 30, 2025, it hit 9.8%. That’s over 6.5x jump in under two years.

Together, these shifts suggest that while CEXs remain liquidity hubs, DEXs are soon becoming the new centres of risk. Where traders choose to trade now depends not just on trust but also on the platform’s additional features.

The growth of DEXs across spot, derivatives, and perps shows that they offer something CEXs can’t replicate, at least not yet. On-chain traders may still be a minority in absolute numbers, but their intent and the features they demand send a clear message to crypto builders about what should be prioritised when developing crypto exchanges.

That’s it for this week’s quants story.

I’ll see you next week.

Until then … stay sharp,

Disclaimer:

- This article is reprinted from [TOKEN DISPATCH]. All copyrights belong to the original author [Prathik Desai]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?