DappRadar: Another Teardrop of a Fading Era

On the evening of November 17, 2025, DappRadar, a platform that had served the industry for nearly eight years, announced it would gradually shut down its services and stop tracking blockchain and DApp data.

There’s a saying: “A single grain of sand from an era can become a mountain when it falls on an individual.” Nothing could describe DappRadar’s journey better. Born during the widespread “blockchain is dead” narrative, DappRadar grew alongside Web3 from its earliest days to its period of maturity, yet ultimately couldn’t endure the turmoil of industry change. The exit of such era-defining products reminds me of what Nokia’s CEO said at the closing of the Microsoft acquisition press conference 11 years ago:

“We didn’t do anything wrong, but somehow, we lost.”

The Data Platforms We Once Relied On

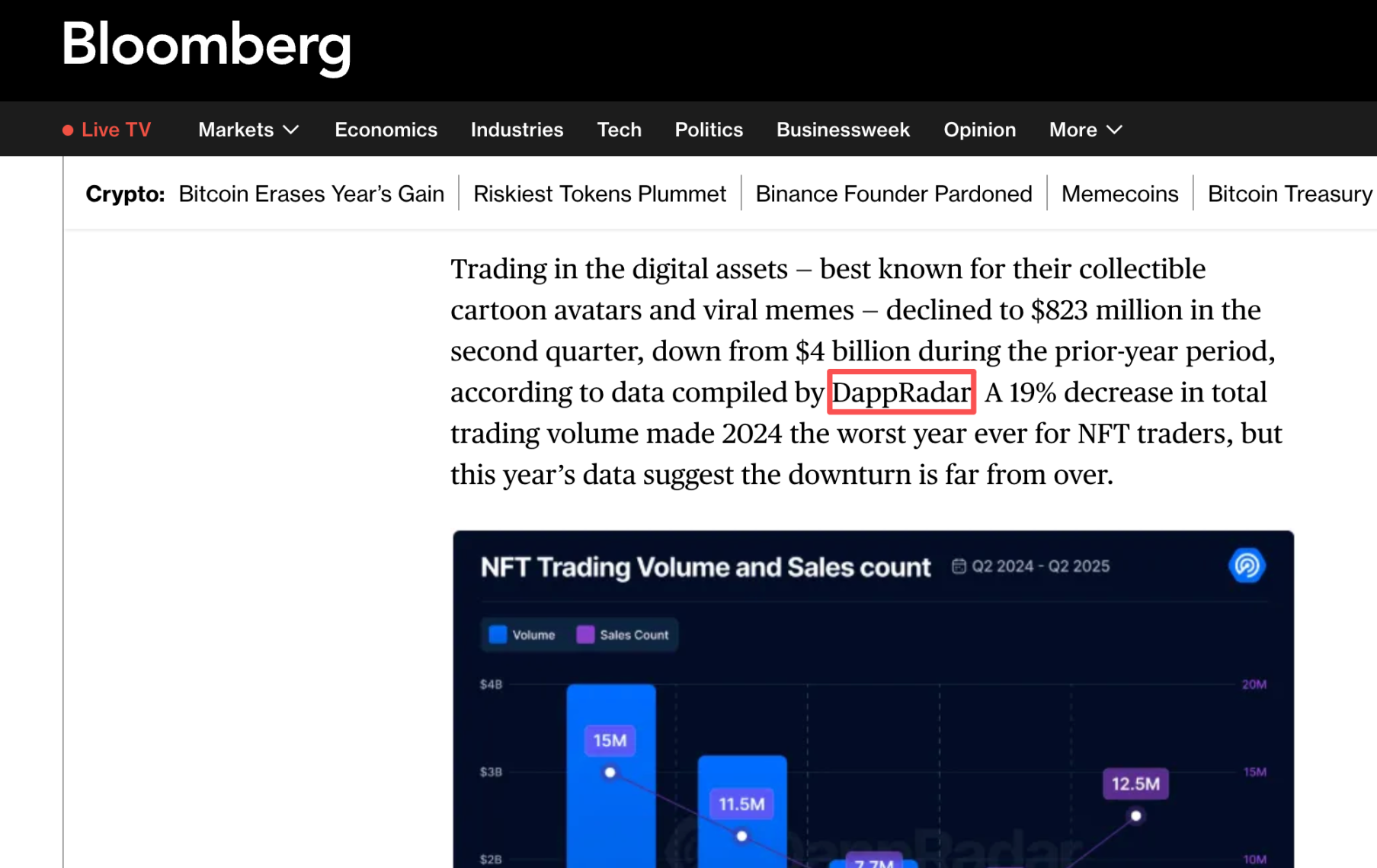

Many newcomers to the Web3 industry might not realize DappRadar was once a crucial and authoritative data source. In addition to being cited by CoinDesk and Chinese Web3 media, top-tier Western media like Bloomberg, Forbes, and the BBC also frequently referenced DappRadar’s data.

DappRadar was widely regarded as an authority because, before specialized data sites like Nansen, Arkham, and DefiLlama or Web3 marketing tools like Cyber and Kaito became mainstream, it served as the primary portal for all DApp projects. The platform’s comprehensive project listings gave its data unmatched completeness and credibility, making it the top choice for anyone seeking quick insights into new projects.

DappRadar co-founder Skirmantas Januskas is from Lithuania. Unlike many industry leaders who wear multiple hats, he has focused exclusively on DappRadar since February 2018. Before that, he had a brief stint as a software developer at NFQ. The other co-founder, Dunica Dragos, previously worked in operations at US gaming giant EA and, after founding DappRadar, also dedicated himself fully to the venture.

DappRadar completed two funding rounds. In its September 2019 seed round, it received $2.23 million from Naspers, Blockchain Ventures, and Angel Invest Berlin. Notably, Naspers is the South African media conglomerate that bought a 46.5% stake in Tencent for $32 million in 2001 from Richard Li, IDG, and others. In May 2021, DappRadar secured $4.94 million in a Series A from Blockchain.com Ventures, Prosus Ventures, and NordicNinja VC.

I found a record of Skirmantas Januskas’s interview following the 2019 fundraising. At the time, the Web3 sector was in its deepest slump, but Skirmantas remained confident, believing that if user experience and demand could be addressed, “centralized applications would become a thing of the past.”

As early as 2019, this passionate industry newcomer shared his perspectives on DeFi and gaming—sectors that would later explode in 2021. While DefiLlama captured most of the DeFi data market, DappRadar’s comprehensive approach and its focus on NFTs, GameFi, and the metaverse helped it reach millions of users at its peak. Even small projects with no visible Twitter presence had their DAU tracked on DappRadar, fluctuating between 0 and 3.

When Professionalism Becomes a Liability

If DappRadar’s failure could be pinned on one thing, it’s being too crypto-native and overlooking commercialization.

Even now, when you visit DappRadar’s homepage, you’ll find categories it’s maintained since the beginning: gaming, DeFi, NFTs, gambling, plus newer sections for AI, RWA, and social. But you won’t see trending topics like meme coins. That’s why Skirmantas earned the industry newcomer label—he kept publishing detailed quarterly reports on NFTs and tracked obscure airdrops, but rarely caught the industry’s hottest trends.

Over the past two years, DappRadar was arguably the only platform covering every long-tail Web3 sector and project. However, its focus seemed stuck on the long-tail itself.

This laser focus on professionalism did provide quality material for Bloomberg and Forbes—but had little commercial value. After the 2021 funding round, DappRadar launched the RADAR token, but aside from Pro subscriptions, staking, and voting, it offered no compelling use cases and effectively blocked the platform’s best subscription revenue stream.

The broad project coverage that built DappRadar’s reputation became a burden. Its DeFi coverage couldn’t match DefiLlama, its token info lagged behind CoinMarketCap, and its research lacked Bankless’s depth. Even its strongest area—NFTs—had stagnated. DappRadar itself recognized these issues and began pursuing commercialization, offering premium data via API and selling ad inventory.

After its 2021 raise, DappRadar survived another four years. While it surely monetized some traffic, revenue couldn’t keep pace with the cost of scaling up data. Since 2023, despite market growth, few projects had substantial budgets, and most spending shifted to influencers, exchanges, and new platforms. DappRadar increasingly struggled to sustain itself as it was left behind.

As noted, its coverage was too long-tail. For many projects, it was nearly impossible to determine which users would consult DappRadar’s data. In the early days, it provided a way to discover new projects. As the industry matured, better channels emerged for researching the select “quality projects.” DappRadar was no longer the obvious choice.

Compared to the clean website of a few years ago, today’s DappRadar is sprawling and fragmented. This is a reflection of over-commercialization and the “leave no stone unturned” ethos in its farewell letter. Without ongoing support or endless funding, DappRadar needed to prioritize content and show restraint with ads. Its relentless focus on professionalism—or “purism”—and the eventual overload of content and ads exposed its operational shortcomings.

Beyond its own issues, running a Web3 data and information platform is fundamentally tough. The explosion of multichain data has driven up indexing and server costs. While demand for quality data is high, willingness to pay is low. Without alternative revenue streams, relying on ads and API sales leads to fierce competition, increased ad clutter, and worsening user experience—a path to decline.

DappRadar’s seven-year journey encapsulates the classic commercialization challenges for such platforms: high value, low monetization, rigid costs, and rapid market shifts. Its closure is a stark lesson for others: if your business model isn’t sustainable from day one, even the most authoritative data can’t prevent eventual decline.

Statement:

- This article is republished from [Foresight News]. Copyright belongs to the original author [Eric, Foresight News]. For any concerns regarding this republication, please contact the Gate Learn team, who will address the issue promptly in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is specifically referenced, translated articles may not be copied, distributed, or plagiarized.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?