BTC: Onchain Data Update

Hello readers,

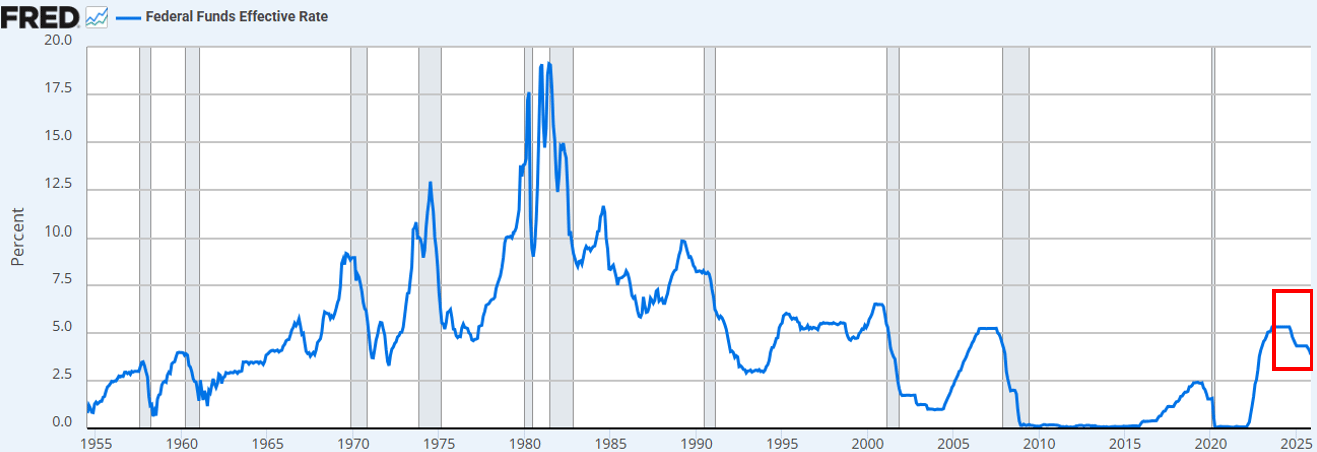

The Fed cut rates to a target range of 3.50%–3.75% last week — a move fully priced by markets and largely unsurprising.

What did surprise markets was the Fed’s announcement of $40B per month in Treasury bill purchases, quickly labeled by some as “QE-lite.”

In today’s report, we break down what this policy changes. What it doesn’t change. And why we think that distinction matters for risk assets. We also share an update on key BTC onchain indicators and what they’re signaling in the current environment.

Let’s go.

Monetary Policy Changes

The “Near-Term” Setup

The Fed cut rates, as expected. That’s now the third rate cut this year, and the 6th rate cut since September of 2024. Altogether, rates have now been cut by 175 basis points, reducing the Fed Fund Rate to the lowest level in roughly three years.

Data: FRED

In addition to cutting rates, Powell announced that the Fed would commence “Reserve Management Purchases” of T-Bills at a clip of $40b/month starting in December.

Given ongoing tensions in the repo market and banking sector liquidity, this is something we’ve been anticipating.

The consensus view (on X and even more so on CNBC) was that this was a “dovish” shift in policy.

via X

Discussion over whether the Fed’s announcement amounted to “money printing,” “QE,” or “QE-lite” immediately appeared across our timeline.

via X

Of course. We’re “market participants.” But we always want to view events as “market observers.”

The takeaway?

Market psychology is still leaning risk-on. In this state, we expect investors to overfit bullish narratives to policy headlines — and underfit the actual mechanism by which policy is transmitted into financial conditions.

It’s our view that the Fed’s new policy is bullish for “financial market plumbing.” It is not bullish for risk assets.

Where do we differ? We think the market is confusing balance‑sheet expansion with easing financial conditions or “QE”.

Our View:

- T-bill purchases do not remove duration from the market. The Fed is buying short-dated bills, not coupons.

- There is no suppression of long-end yields. While bill purchases may marginally reduce long‑end issuance, this does nothing to compress the term premium. Roughly 84% of Treasury issuance is already bills, so the policy does not meaningfully alter the duration profile facing investors.

- Financial conditions are not broadly eased. Reserve Management Purchases stabilize repo markets and bank liquidity, but they do not lower real rates, corporate borrowing costs, mortgage rates, or equity discount rates.

So, no. This is not QE. It is not financial repression. And to be clear, the acronym doesn’t matter. You can call this money printing if you want. But it does not intentionally suppress long-term yields via duration removal, which tends to force investors out the risk curve.

This is not happening right now. The price action from BTC and the Nasdaq since last Wednesday serves as confirmation.

What would change our view?

We believe BTC (and risk assets more broadly) will have their moment in the sun. But that will come after QE (or whatever the Fed calls the next phase of financial repression).

That moment arrives when:

- The Fed artificially suppresses the long end of the yield curve (or signals the move to markets)

- Real rates fall (due to rising inflation expectations)

- Corporate borrowing costs decline (fueling tech/Nasdaq)

- The term premium compresses (long rates drop)

- Equity discount rates fall (forcing investors into longer duration risk assets)

- Mortgage rates fall (due to suppression of long-end rates, which drive mortgage rates)

That’s when investors sniff out financial repression. And rebalance portfolios in response.

We’re not in this environment yet. But we do believe it’s coming. Timing is always tricky, but our base case is that volatility will pick up significantly in the first quarter of next year.

That’s the “near-term” setup, in our opinion.

The “Big Picture” Setup

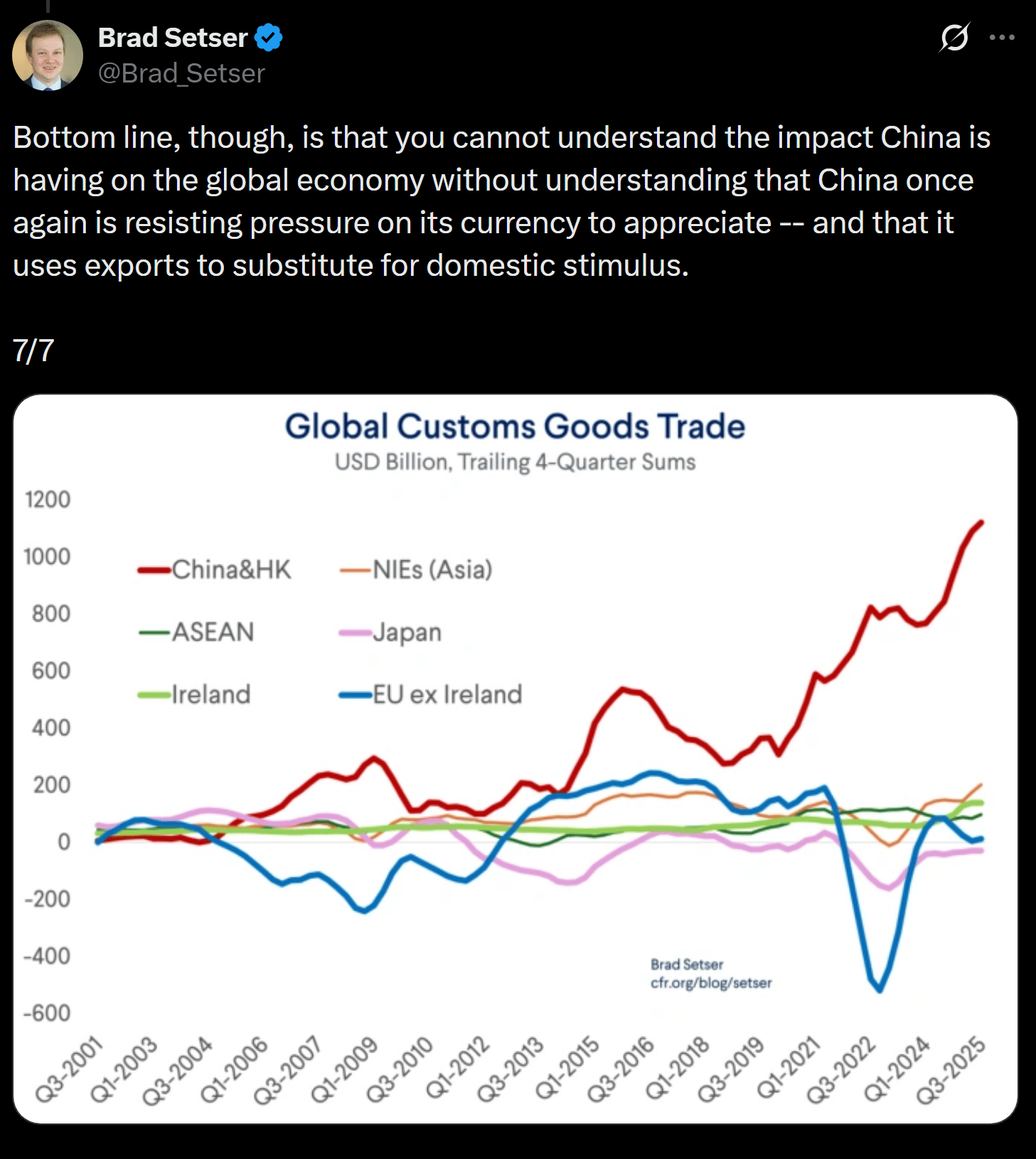

The deeper issue is not near-term Fed policy. It’s the global trade war (currency war) — and the tension it creates at the core of the dollar system.

Why?

The U.S. is moving toward the next phase of its strategy: Reshoring manufacturing. Rebalancing global trade. And competing in strategically essential industries, such as AI.

That objective conflicts directly with the dollar’s role as the world’s reserve currency.

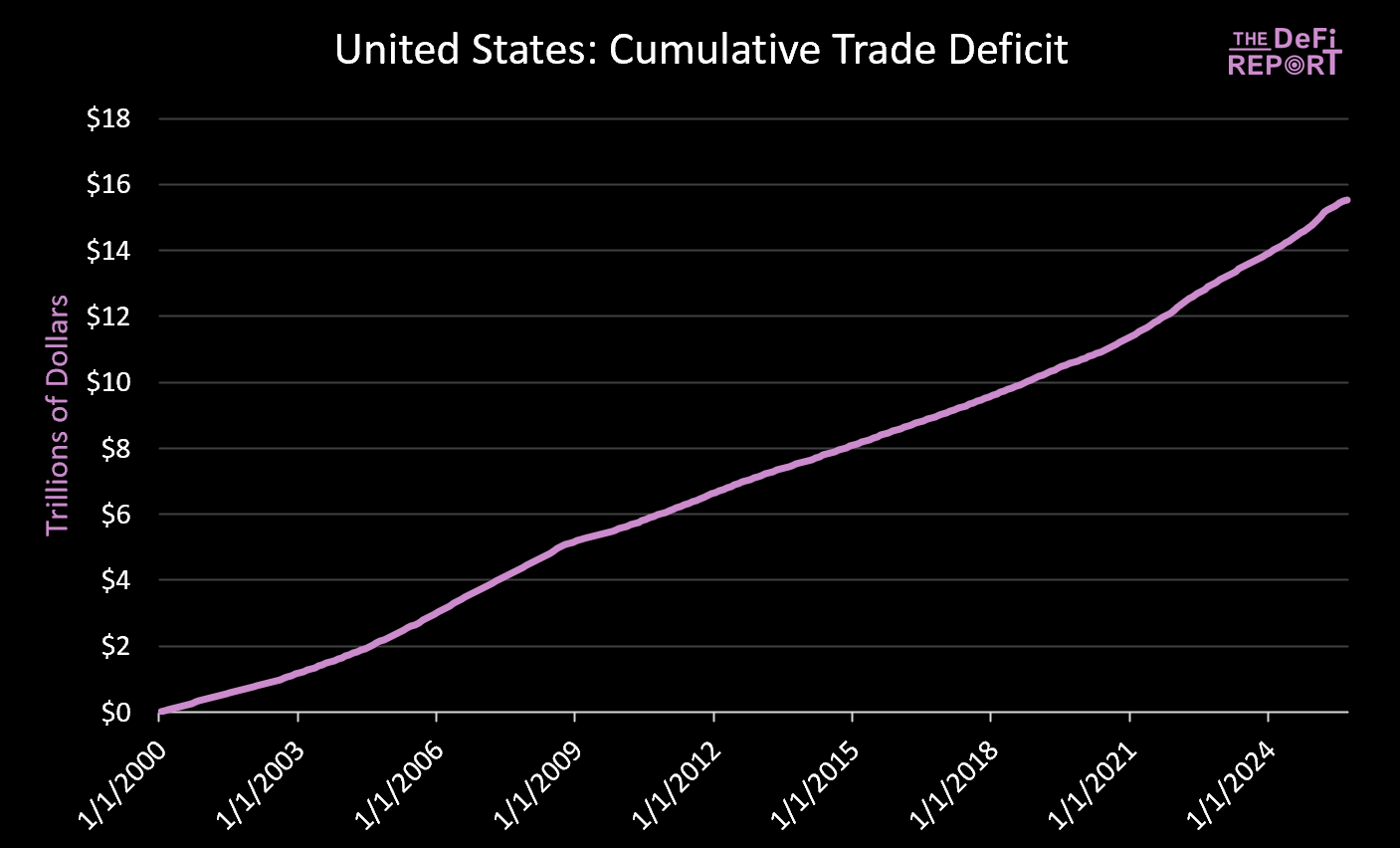

Reserve-currency status only works if the U.S. runs persistent trade deficits. In the current system, dollars are sent abroad for goods, then recycled back into U.S. capital markets via Treasuries and risk assets. This is the essence of Triffin’s Dilemma.

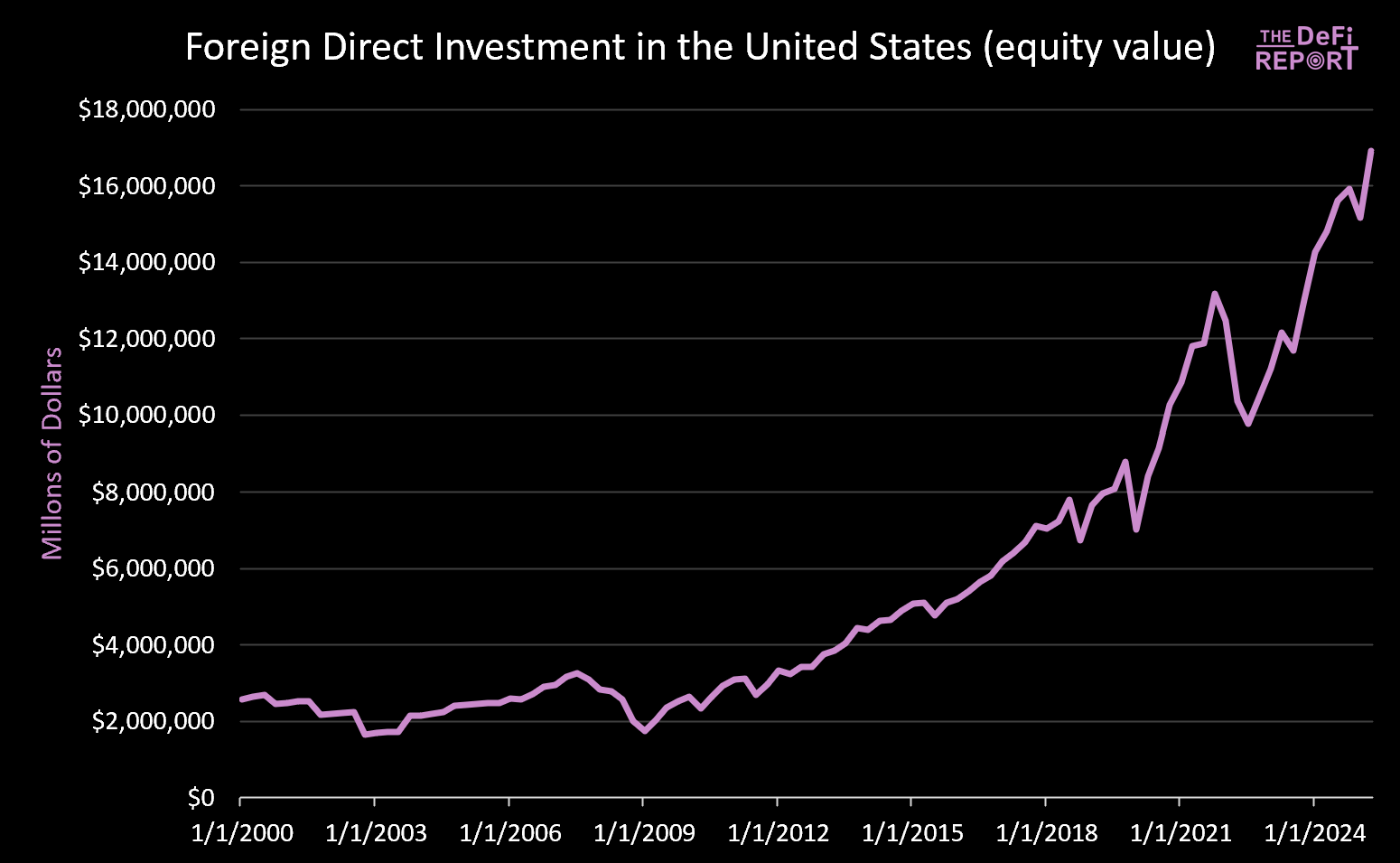

This chart:

Data: FRED

Is the mirror image of this chart:

Data: U.S. Bureau of Economic Analysis

Since 1/1/2000: $14 trillion + rise in equity value (not including $9 trillion of current foreign bond holdings). Nearly $16 trillion out (to pay for goods).

Efforts to reduce trade deficits necessarily reduce the flow of recycled capital back into U.S. markets. While Trump touts commitments from places like Japan for “$550b of investment into US industry” he fails to share that Japan’s (and others) capital cannot be in both our manufacturing and capital markets. It’s our view that this tension will not resolve cleanly. Rather, we expect higher volatility, asset repricing, and eventually currency adjustments (a declining dollar and real value of U.S. treasuries).

It’s our opinion that this period of transition will require the “big devaluation” (of the dollar).

The timing and execution are uncertain. But the direction is not. The more aggressively the U.S. pursues reshoring and trade rebalancing, the greater the pressure on the dollar, real rates, and asset prices to adjust.

The bottom line: China is artificially suppressing the Yuan (making its exports artificially cheap). Meanwhile, the dollar is artificially overvalued due to foreign capital investment (making imports artificially cheap).

We think a forced dollar devaluation is on the horizon to solve this issue. It’s the only way that global trade imbalances can be solved, in our opinion.

The market will ultimately decide which assets/markets are worthy of “storing value” in this new regime of financial repression.

The key question is whether the U.S. Treasury will continue to serve as the global reserve asset when it’s all said and done.

We believe BTC and other global, non-sovereign stores of value, such as gold, will serve a far greater role. Why? They are scarce and don’t rely on policy credibility.

That’s the “big picture” setup in our view.

BTC Onchain Data Update

What is the onchain data telling us about the current environment?

Disclaimer:

- This article is reprinted from [thedefireport]. All copyrights belong to the original author [thedefireport]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

NFTs and Memecoins in Last vs Current Bull Markets